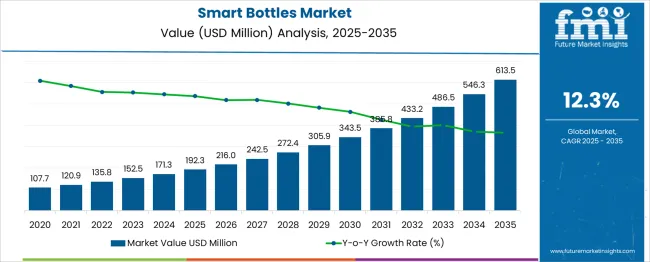

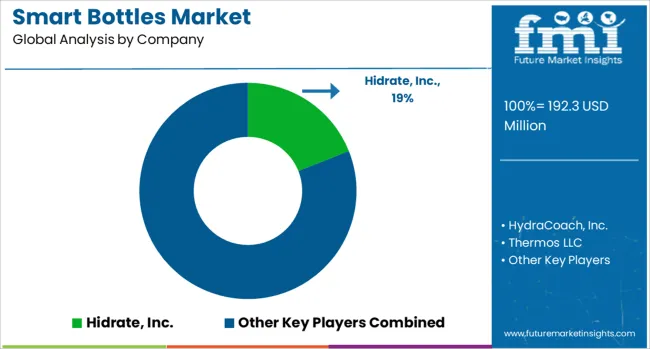

The Smart Bottles Market is estimated to be valued at USD 192.3 million in 2025 and is projected to reach USD 613.5 million by 2035, registering a compound annual growth rate (CAGR) of 12.3% over the forecast period. Analysis of rolling CAGR over the decade reveals a dynamic growth pattern characterized by gradual acceleration and sustained momentum throughout the period. Between 2025 and 2030, the market increases from USD 192.3 million to USD 343.5 million.

The compound annual growth rate during these initial five years averages approximately 12.8%, reflecting early adoption phases and expanding consumer interest in connected packaging solutions. Yearly increments steadily rise from USD 23.7 million in 2026 to USD 38.6 million by 2030, showing consistent market acceptance and gradual penetration in the health, beverage, and consumer goods sectors. From 2030 to 2035, the market advances from USD 343.5 million to USD 613.5 million.

The rolling CAGR for this latter half is around 11.7%, slightly lower than the earlier phase but still indicative of strong and stable growth. Annual value gains increase from USD 43.7 million in 2031 to USD 67.2 million in 2035. This period reflects broader market expansion driven by technological innovation, integration with IoT platforms, and growing consumer demand for smart packaging.

The rolling CAGR analysis highlights a robust market with strong growth momentum maintained throughout the forecast period, underscoring the evolving role of smart bottle technology across various end-use applications.

| Metric | Value |

|---|---|

| Smart Bottles Market Estimated Value in (2025 E) | USD 192.3 million |

| Smart Bottles Market Forecast Value in (2035 F) | USD 613.5 million |

| Forecast CAGR (2025 to 2035) | 12.3% |

The smart bottles market is viewed as a specialized yet steadily expanding category within its parent industries. It is estimated to account for about 1.9% of the global reusable bottles and drinkware market, driven by rising consumer interest in hydration tracking and health monitoring. Within the connected devices and Internet of Things (IoT) sector, a share of approximately 2.7% is assessed due to integration of sensors and mobile app connectivity.

In the sports and fitness equipment industry, around 2.4% is observed reflecting demand from active and health-conscious consumers. Within the smart home and personal wellness market, about 2.1% is evaluated as smart bottles become part of broader lifestyle technology ecosystems. In the environmental and sustainability product segment, a contribution of roughly 1.5% is calculated supported by reusable and eco-friendly materials.

Market growth has been influenced by consumer demand for personalized hydration data and convenience features. Innovations have focused on development of bottles with embedded sensors measuring water intake, temperature, and purity, along with app integration for reminders and tracking.

Interest has increased in designs offering modular components, wireless charging, and compatibility with fitness platforms. The North America region has been observed to lead adoption while Asia Pacific shows rapid growth due to expanding health awareness and wearable technology use. Strategic initiatives have included partnerships between smart device manufacturers and beverage companies to create co-branded products and integrated wellness solutions.

The smart bottles market is witnessing accelerating adoption driven by rising consumer focus on health tracking, hydration monitoring, and connected wellness devices. Growth is being enabled by the integration of sensors, mobile app connectivity, and real-time consumption data, which collectively enhance user experience and engagement.

Increasing penetration of fitness technology and smart wearables has fueled demand for auxiliary devices that support data-driven health management. In parallel, heightened environmental concerns and awareness campaigns around hydration benefits are encouraging users to shift from conventional to intelligent hydration solutions.

Tech-enabled product innovations and expanded retail visibility are further accelerating smart bottle adoption, especially across urban and fitness-centric demographics. Over the coming years, enhancements in battery life, modularity, and cross-device compatibility are expected to fuel next-generation product cycles and solidify the segment’s presence in the broader wellness and consumer electronics ecosystems.

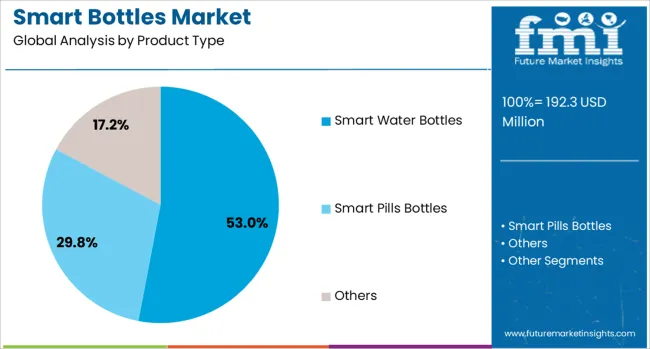

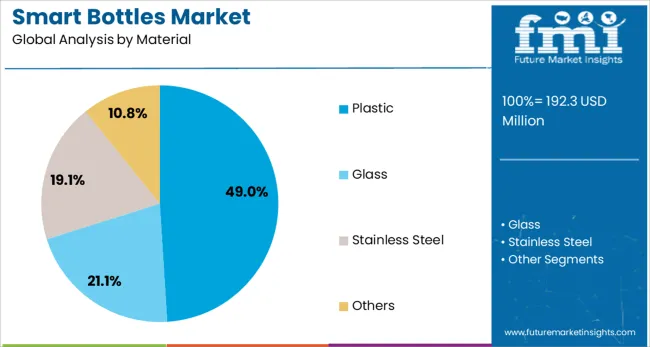

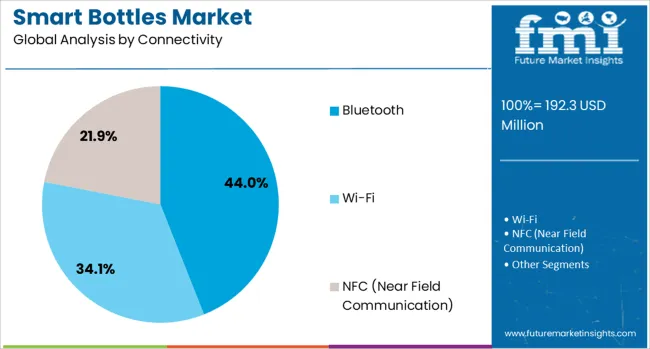

The smart bottles market is segmented by product type, material, connectivity, capacity, price, end use, and geographic regions. The smart bottles market is divided by product type into Smart Water Bottles, Smart Pill Bottles, and Others. The smart bottles market is classified by material into Plastic, Glass, Stainless Steel, and Others. The smart bottles market is segmented based on connectivity into Bluetooth, Wi-Fi, and NFC (Near Field Communication).

The smart bottles market is segmented by capacity into 500–1000 ml, 500 ml, and >1000 ml. The smart bottles market is segmented by price into Medium, Low, and High. The end use of the smart bottles market is segmented into Homecare Settings, Senior Care & Assisted Living Centers, and Others.

Regionally, the smart bottles industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Smart water bottles are projected to hold 53.0% of the overall market share by 2025, positioning them as the dominant product type. Their leadership is being supported by rising demand for hydration reminders, fluid intake tracking, and integration with health-monitoring platforms.

These bottles have found strong traction among athletes, office workers, and tech-savvy consumers who prioritize wellness data and goal-driven hydration. Enhanced features such as LED indicators, voice assistance, and real-time alerts have contributed to their mass-market viability.

Moreover, their compatibility with major fitness ecosystems has enabled strong ecosystem stickiness, driving repurchase behavior and platform engagement. As health personalization becomes more mainstream, smart water bottles are expected to remain the anchor of the smart hydration category.

Plastic smart bottles are expected to account for 49.0% of total market revenue by 2025, making them the leading material segment. Their dominance is attributed to their affordability, design flexibility, and lightweight properties that support everyday usability.

Plastic options allow for easier sensor embedding, transparency in design, and a wide range of shape configurations, which collectively enhance product versatility. Additionally, the material’s durability under varied environmental conditions and its cost-effectiveness for mass production make it ideal for broader consumer penetration.

Sustainable variants of plastics, including BPA-free and recycled options, have further aligned with evolving environmental preferences, strengthening demand among value-conscious yet eco-aware consumers.

Bluetooth-enabled smart bottles are projected to contribute 44.0% of market share in 2025, making them the leading connectivity segment. This dominance is driven by the protocol’s compatibility with smartphones, wearables, and fitness apps, enabling real-time hydration tracking without constant internet access.

Bluetooth integration allows seamless syncing, battery efficiency, and local data storage, features that align well with user expectations for non-intrusive smart accessories. The protocol also facilitates firmware updates and user customization through dedicated apps, increasing consumer engagement and satisfaction.

As privacy and offline functionality gain importance, Bluetooth-enabled models are expected to retain their lead over Wi-Fi or cellular-connected alternatives in the consumer space.

The smart bottles market has been expanding steadily due to growing consumer interest in health monitoring and personalized hydration. The integration of sensors that track water consumption, temperature, and quality has been widely adopted to enhance user engagement. Connectivity features, including Bluetooth and IoT technology, have been embedded to allow real-time data synchronization with mobile applications. Growth has also been supported by rising awareness of the importance of hydration in maintaining overall wellness. Collaborations between technology developers and traditional bottle manufacturers have accelerated product innovation. Market penetration has been facilitated by expanding distribution channels and rising digital literacy across various regions.

Significant technological advancements have been made in sensor integration, enabling precise monitoring of fluid intake and environmental factors. Capacitive and optical sensors are commonly used for accurate detection of liquid levels and contamination. Temperature regulation features have been enhanced to maintain beverage freshness over extended periods. AI-powered applications have been developed to provide personalized hydration reminders based on user activity and environmental conditions. Eco-friendly, BPA-free materials have been utilized to meet consumer demand for sustainable products. These innovations have contributed to improved user experience and increased adoption across fitness, healthcare, and lifestyle markets globally.

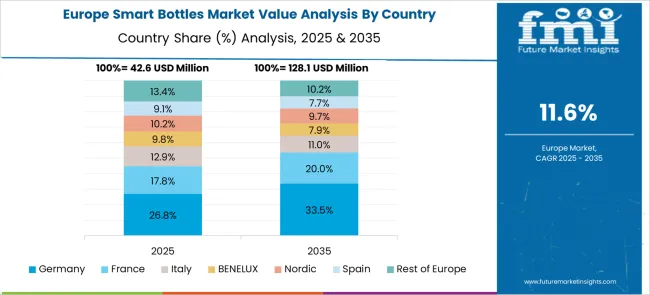

The adoption of smart bottles has been observed across diverse consumer segments, including athletes, office professionals, and older adults, with a focus on wellness maintenance. North America and Europe have emerged as key markets due to high digital penetration and health awareness. Rapid urbanization and increased health consciousness in the Asia-Pacific have driven significant market growth in countries such as China and India. Expansion into corporate wellness programs and healthcare sectors has diversified application areas. Strategic partnerships with wellness platforms and enhanced e-commerce availability have further broadened market accessibility. Regional product adaptations addressing local preferences have supported sustained growth in emerging economies.

Innovative marketing campaigns and consumer engagement initiatives have supported the market growth. Social media platforms and influencer collaborations have been leveraged to enhance brand visibility and communicate product benefits effectively. Personalized customer experiences have been created through interactive mobile applications and loyalty programs. Retailers have adopted omnichannel approaches combining online and offline sales channels to increase consumer touchpoints. Educational campaigns focusing on the role of hydration in health have been deployed to increase product acceptance. These strategies have facilitated stronger brand-consumer relationships and have driven repeat purchases and customer retention.

Challenges, including high product costs and technological complexity have moderated the market growth. Price sensitivity among consumers, especially in developing regions, has limited widespread adoption. The incorporation of multiple sensors and connectivity features has increased manufacturing expenses and device weight, impacting user convenience. Data privacy concerns have emerged due to the collection and transmission of personal hydration information. Technical limitations such as battery life and device durability under varying conditions have been reported. Fragmentation in platform compatibility has posed challenges to seamless integration. Manufacturers have been required to focus on cost optimization, cybersecurity, and cross-platform support to address these issues effectively.

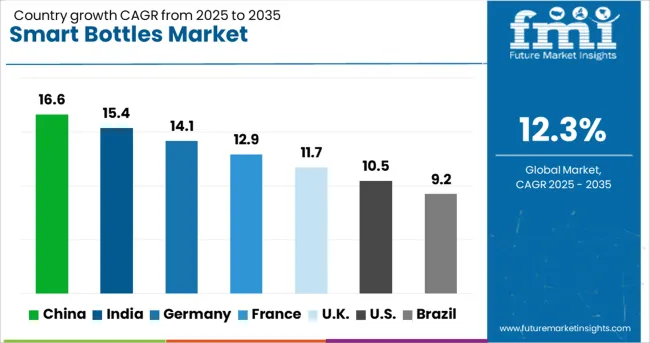

| Country | CAGR |

|---|---|

| China | 16.6% |

| India | 15.4% |

| Germany | 14.1% |

| France | 12.9% |

| UK | 11.7% |

| USA | 10.5% |

| Brazil | 9.2% |

The smart bottles market is expected to grow at a global CAGR of 12.3% between 2025 and 2035, driven by rising consumer interest in health monitoring, increasing adoption of IoT-enabled devices, and growth in fitness and wellness sectors. China leads with a 16.6% CAGR, supported by large-scale electronics manufacturing and expanding health-conscious population. India follows at 15.4%, fueled by growing fitness awareness and rising smart device penetration. Germany, at 14.1%, benefits from advanced sensor technologies and strong consumer electronics markets. The UK, projected at 11.7%, sees growth from health-focused consumers and wearable tech integration. The USA, at 10.5%, reflects steady adoption in fitness, healthcare, and lifestyle segments. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is forecasted to expand at a CAGR of 16.6% from 2025 to 2035 due to increasing consumer focus on hydration monitoring and health awareness. Local brands like Xiaomi and Huawei are integrating sensors and connectivity features into smart bottles, enhancing user interaction with mobile apps. The growing fitness culture in urban centers and partnerships with health platforms accelerate adoption. Production costs remain competitive due to domestic manufacturing capabilities. The rising demand from younger, tech-savvy consumers is a key growth driver.

India is expected to witness a CAGR of 15.4% from 2025 to 2035, supported by growing health consciousness and expanding digital retail platforms. Companies such as Havells and Noise have launched smart bottles with temperature control and hydration alert systems. Increased smartphone penetration and rising fitness trends among urban populations stimulate demand. Affordability and localized product features remain essential to capturing the market. Rapid growth in e-commerce channels has enabled broader access to innovative smart hydration solutions.

Germany is poised for a CAGR of 14.1% between 2025 and 2035, with consumers prioritizing sustainability alongside technology. Brands such as VIVREAL emphasize smart bottles made from recyclable materials equipped with precise hydration sensors. Integration with health tracking and smart home systems further enhances appeal. The market targets environmentally conscious and tech-savvy customers willing to invest in durable and premium products. Strong distribution through health stores and specialty retailers supports market penetration.

The United Kingdom is expected to see a CAGR of 11.7% from 2025 to 2035, driven by wellness trends and the popularity of connected lifestyle devices. Leading players like Equa and HidrateSpark focus on app-enabled smart bottles that offer customizable hydration plans. Corporate wellness initiatives and an aging population increase demand. Emphasis on sustainable materials and product design aesthetics influences purchase decisions. Retail strategies blend online platforms and experiential stores to enhance consumer engagement.

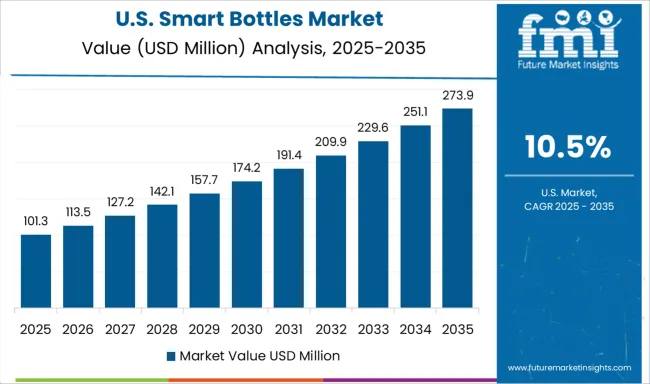

The United States is anticipated to grow at a CAGR of 10.5% from 2025 to 2035, fueled by high consumer adoption of fitness and wellness technologies. Brands like Hidrate and Thermos lead with smart bottles featuring temperature regulation and hydration reminders synced with mobile applications. Distribution through specialty retailers and online channels widens market reach. Social media marketing and influencer endorsements play a vital role in brand visibility. Demand is primarily driven by active lifestyle consumers focused on health optimization.

The smart bottles market is driven by technology-focused companies and consumer goods brands developing hydration products with integrated sensors, Bluetooth connectivity, and app-based tracking features. Hidrate, Inc. and HydraCoach, Inc. are pioneers offering bottles that monitor water intake and provide real-time reminders to improve hydration habits.

Thermos LLC combines traditional insulated bottle expertise with smart technology, targeting health-conscious consumers. Koninklijke Philips NV extends its wellness portfolio with smart hydration solutions designed for seamless integration with personal health ecosystems.

Trago, Inc. and Myhydrate, Inc. develop connected bottles with customizable LED reminders and smartphone apps for hydration tracking. Gululu targets younger demographics by combining smart bottles with gamified hydration encouragement features. LifeFuels, Inc. offers modular bottles that track hydration and provide nutrient delivery options through custom fuel pods. Moikit, Inc., Sippo (WaterH), and Equa focus on sleek design and usability, emphasizing durability and battery life.

Noerden and Ecomo deliver eco-friendly smart bottles with health monitoring sensors, while ionBottles Corporation and AQUAMINDER integrate UV-C sterilization with smart features for enhanced water safety. Key strategies include continuous innovation in sensor accuracy, expanding app functionality for health data integration, and broadening distribution channels through e-commerce and retail partnerships. Entry barriers include technology development costs, user privacy considerations, and the need for seamless hardware-software integration to ensure reliable consumer experience.

| Item | Value |

|---|---|

| Quantitative Units | USD 192.3 Million |

| Product Type | Smart Water Bottles, Smart Pills Bottles, and Others |

| Material | Plastic, Glass, Stainless Steel, and Others |

| Connectivity | Bluetooth, Wi-Fi, and NFC (Near Field Communication) |

| Capacity | 500–1000 ml, 500 ml, and >1000 ml |

| Price | Medium, Low, and High |

| End Use | Homecare Settings, Senior Care & Assisted Living Centers, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Hidrate, Inc., HydraCoach, Inc., Thermos LLC, Koninklijke Philips NV, Trago, Inc., Myhydrate, Inc., Gululu, LifeFuels, Inc., Moikit, Inc., Sippo (WaterH), Equa, Noerden, Ecomo, ionBottles Corporation, and AQUAMINDER |

| Additional Attributes | Dollar sales by material type and distribution channel, demand dynamics across hydration tracking, temperature control, and connected fitness integration, regional trends in adoption across North America, Europe, and Asia-Pacific, innovation in IoT-enabled sensors, mobile app connectivity, and self-cleaning technologies, environmental impact of production materials and end-of-life disposal, and emerging use cases in personalized hydration plans, corporate wellness programs, and athletic performance monitoring. |

The global smart bottles market is estimated to be valued at USD 192.3 million in 2025.

The market size for the smart bottles market is projected to reach USD 613.5 million by 2035.

The smart bottles market is expected to grow at a 12.3% CAGR between 2025 and 2035.

The key product types in smart bottles market are smart water bottles, smart pills bottles and others.

In terms of material, plastic segment to command 49.0% share in the smart bottles market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Pill Boxes & Bottles Market Size, Growth, and Forecast for 2025 to 2035

Smart Meeting Pod Market Size and Share Forecast Outlook 2025 to 2035

Smart Electrogastrogram Recorder Market Size and Share Forecast Outlook 2025 to 2035

Smart Aerial Work Robots Market Size and Share Forecast Outlook 2025 to 2035

Smart Bladder Scanner Market Size and Share Forecast Outlook 2025 to 2035

Smart School Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Wireless Smoke Detector Market Size and Share Forecast Outlook 2025 to 2035

Smart Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Vision Processing Chips Market Size and Share Forecast Outlook 2025 to 2035

Smart Touch Screen Scale Market Size and Share Forecast Outlook 2025 to 2035

Smart Magnetic Drive Conveyor System Market Size and Share Forecast Outlook 2025 to 2035

Smart Wheelchair market Size and Share Forecast Outlook 2025 to 2035

Smart Mining Technologies Market Size and Share Forecast Outlook 2025 to 2035

Smart Parking Market Size and Share Forecast Outlook 2025 to 2035

Smart Digital Valve Positioner Market Forecast and Outlook 2025 to 2035

Smart Card IC Market Size and Share Forecast Outlook 2025 to 2035

Smart-Tag Inlay Inserters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA