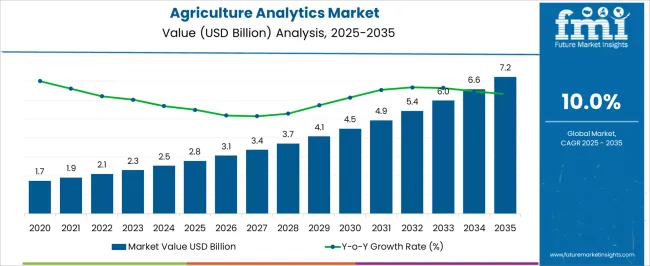

The agriculture analytics market is valued at USD 2.8 billion in 2025 and is expected to reach USD 7.2 billion by 2035, registering a CAGR of 10.0%. A compound absolute growth analysis highlights the incremental value additions across the forecast period, providing insights into the pace and drivers of market expansion. From 2021 to 2025, the market rises from USD 1.7 billion to 2.8 billion, passing through intermediate values of USD 1.9 billion, 2.1 billion, 2.3 billion, and 2.5 billion.

This early phase demonstrates steady absolute growth, fueled by adoption of data-driven farming techniques, precision agriculture, and initial implementation of IoT-based monitoring and predictive analytics.

Between 2026 and 2030, values expand from USD 2.8 billion to 4.5 billion, with incremental steps at USD 3.1 billion, 3.4 billion, 3.7 billion, and 4.1 billion. This phase shows accelerated absolute growth as farm management software, cloud-based platforms, and AI-powered insights gain traction, improving crop yields, reducing input costs, and enhancing decision-making efficiency.

From 2031 to 2035, the market progresses from USD 4.9 billion to 7.2 billion, moving through USD 5.4 billion, 6.0 billion, and 6.6 billion. The latter phase reflects the highest absolute growth contribution, supported by widespread integration of remote sensing, advanced analytics, and automated data collection systems.

| Metric | Value |

|---|---|

| Agriculture Analytics Market Estimated Value in (2025 E) | USD 2.8 billion |

| Agriculture Analytics Market Forecast Value in (2035 F) | USD 7.2 billion |

| Forecast CAGR (2025 to 2035) | 10.0% |

The precision agriculture and smart farming market contributes the largest share, about 25-30%, as analytics platforms enable crop monitoring, yield prediction, irrigation management, and input optimization for enhanced productivity and efficiency. The agricultural machinery and equipment market adds approximately 20-24%, where tractors, harvesters, drones, and sensors generate real-time data that feed analytics platforms to support operational decision-making and equipment utilization.

The seed and crop management market contributes around 15-18%, leveraging analytics for selecting optimal seed varieties, monitoring growth conditions, and improving pest and disease management strategies. The agribusiness and supply chain market accounts for roughly 12-15%, as analytics help track crop quality, storage conditions, logistics, and market pricing to reduce losses and enhance profitability. Finally, the environmental and climate monitoring market represents about 8-10%, where data on soil health, weather patterns, and water resources inform predictive modeling and sustainable farm management.

The agriculture analytics market is experiencing steady growth, supported by the increasing adoption of data-driven decision-making tools in farming practices. Advances in technologies such as satellite imaging, IoT-enabled sensors, and predictive modeling have enabled farmers to optimize crop yields, manage resources efficiently, and reduce operational costs.

Industry announcements and government initiatives promoting smart farming solutions have further boosted adoption rates, especially in regions investing heavily in agricultural modernization. Strategic collaborations between agri-tech companies and farming cooperatives have facilitated the integration of analytics platforms across varied agricultural landscapes.

The growing need for sustainable farming practices to address climate challenges has also accelerated the use of analytics for precision irrigation, soil health monitoring, and yield forecasting. Looking ahead, the market is expected to benefit from AI-powered agricultural solutions, broader access to cloud-based analytics, and the expansion of subscription-based software models.

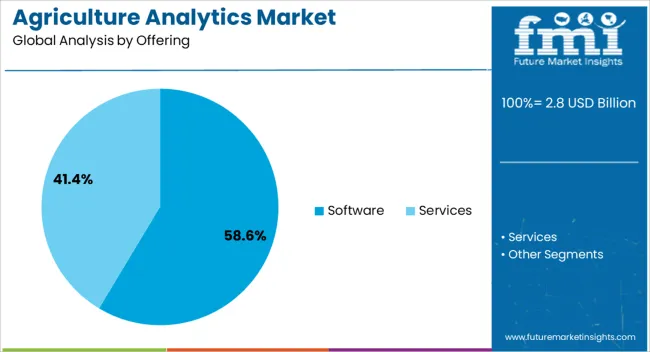

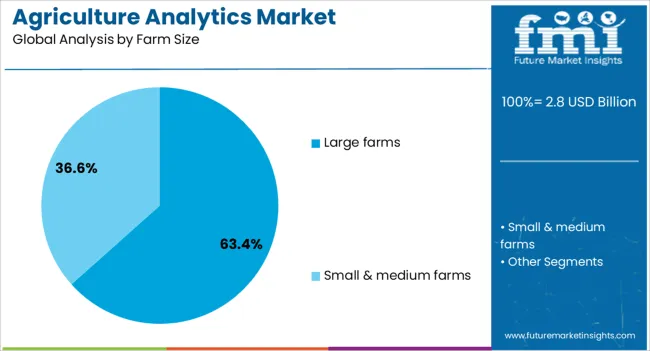

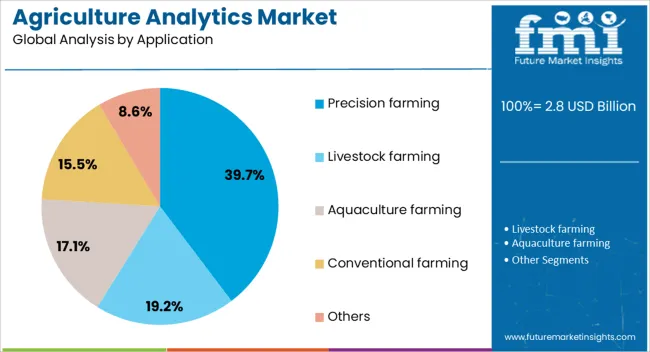

The agriculture analytics market is segmented by offering, farm size, application, technology, and geographic regions. By offering, the agriculture analytics market is divided into Software and Services. In terms of farm size, the agriculture analytics market is classified into large farms and small and medium farms. Based on application, the agriculture analytics market is segmented into Precision farming, Livestock farming, Aquaculture farming, Conventional farming, and Others.

By technology, agriculture analytics market is segmented into Farm analytics, Livestock analytics, Supply chain analytics, and Others. Regionally, the agriculture analytics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Software segment is projected to account for 58.6% of the agriculture analytics market revenue in 2025, making it the dominant offering category. Growth in this segment is being driven by the shift from manual to automated farming processes, where centralized platforms integrate data from various sources to deliver actionable insights.

Farmers and agribusinesses have increasingly invested in software solutions that provide predictive analytics, farm management dashboards, and automated alerts for weather, pest, and disease risks. Cloud-based platforms have enhanced accessibility, enabling users to analyze and act on data in real time from remote locations.

Continuous updates and feature enhancements by agri-tech firms have improved user experience and decision-making accuracy. With the scalability and flexibility offered by subscription models, the Software segment is positioned to remain the preferred choice for agricultural data analytics.

The Large Farms segment is estimated to hold 63.4% of the agriculture analytics market revenue in 2025, maintaining its lead among farm size categories. This dominance is attributed to the higher capital resources and technological readiness of large-scale farming operations, which allow for significant investment in advanced analytics solutions.

Large farms benefit from economies of scale when implementing data-driven tools for crop monitoring, irrigation scheduling, and equipment management. These farms often operate across multiple locations, making centralized data platforms critical for operational efficiency.

Additionally, large-scale agricultural enterprises are more likely to participate in research partnerships with agri-tech companies, facilitating early adoption of new analytical capabilities. As global agricultural trade demands consistent quality and output, large farms are expected to continue leveraging analytics to optimize productivity and maintain a competitive advantage.

The Precision Farming segment is forecasted to contribute 39.7% of the agriculture analytics market revenue in 2025, reflecting its pivotal role in modern agriculture. Adoption of precision farming techniques has been accelerated by the need to maximize yield while minimizing resource waste.

Analytics tools have enabled farmers to make informed decisions regarding seed selection, planting schedules, fertilizer application, and irrigation management. Precision farming integrates data from GPS-enabled equipment, drones, and field sensors to provide detailed field maps and predictive yield models.

These insights have helped in reducing input costs, improving soil health, and enhancing sustainability practices. Government-backed subsidy programs for precision agriculture technologies have also supported segment growth. As climate change and resource scarcity continue to influence agricultural strategies, precision farming is expected to remain at the forefront of analytics-driven farming solutions.

The agriculture analytics market is growing due to rising adoption of data-driven tools for precision farming, crop health monitoring, irrigation optimization, and supply chain efficiency. Solutions integrate IoT sensors, AI, remote sensing, and predictive analytics to improve yields and reduce operational costs. Challenges include high implementation costs, technical complexity, data integration, and regulatory compliance. Opportunities exist in precision agriculture, automated irrigation, yield prediction, and farm management optimization. Manufacturers providing scalable, user-friendly, AI-enabled, and actionable analytics solutions are best positioned to capture global growth.

Analytics solutions collect and process data from IoT sensors, drones, satellite imagery, and weather monitoring systems to support precision farming. Growth is driven by rising demand for increased crop productivity, efficient irrigation, soil monitoring, and pest management across Asia-Pacific, North America, and Europe. Companies such as John Deere, Trimble, and IBM are providing integrated platforms that combine predictive analytics, farm management software, and decision support systems. Adoption of digital farming techniques enhances operational efficiency, reduces crop losses, and improves profitability. Providers offering scalable, user-friendly, and predictive analytics solutions are well-positioned to capture market growth globally.

Despite rising adoption, the agriculture analytics market faces challenges from high initial investment, data integration complexity, and technical expertise requirements. Implementation of sensor networks, cloud platforms, and advanced analytics involves substantial capital expenditure for hardware, software, and connectivity. Data privacy, regulatory compliance, and interoperability with legacy farm systems add operational complexity. Variability in soil types, weather conditions, and crop cycles can affect accuracy and reliability of predictive models. Farmers increasingly demand actionable insights, real-time monitoring, and user-friendly dashboards. Companies investing in simplified deployment, data standardization, and local technical support can overcome operational and technical barriers. Ensuring compliance, reliability, and cost-effectiveness is critical for adoption in diverse agricultural environments globally.

Analytics solutions enable farmers to apply fertilizers and pesticides efficiently, reduce water usage, and predict yield outcomes. Integration with farm machinery and logistics systems allows data-driven harvesting, storage, and transportation decisions. Asia-Pacific, North America, and Europe are witnessing strong growth due to increasing investment in smart agriculture and IoT-based solutions. Manufacturers providing tailored analytics, predictive modeling, and actionable insights gain a competitive advantage. Expansion in emerging markets, government support for digital agriculture, and collaborations with agritech startups further enhance adoption, positioning agriculture analytics as essential for modern farming operations.

Data visualization dashboards, cloud-based platforms, and mobile applications enable real-time monitoring, performance evaluation, and proactive decision-making. Integration with precision machinery ensures optimized input application, automated irrigation, and efficient resource management. Companies are also leveraging AI for crop disease detection, soil fertility analysis, and climate-based predictive analytics. Providers offering end-to-end, scalable, and technologically advanced solutions are positioned to meet rising global demand. Adoption of smart farming practices enhances productivity, reduces operational costs, and improves sustainability across commercial and smallholder farming operations worldwide.

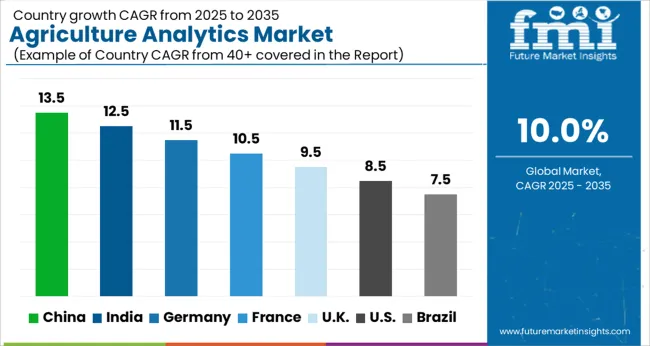

| Country | CAGR |

|---|---|

| China | 13.5% |

| India | 12.5% |

| Germany | 11.5% |

| France | 10.5% |

| U.K. | 9.5% |

| U.S. | 8.5% |

| Brazil | 7.5% |

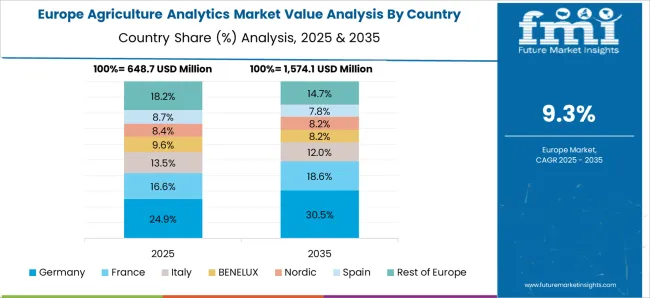

The global agriculture analytics market is projected to grow at a CAGR of 10% from 2025 to 2035. China leads with 13.5%, followed by India at 12.5%, France at 10.5%, the U.K. at 9.5%, and the U.S. at 8.5%. Market expansion is fueled by precision agriculture, AI-driven analytics, IoT sensors, drones, and cloud-based farm management platforms. Government initiatives, private-sector investment, and agri-tech startups are accelerating adoption. Farmers and agribusinesses are increasingly leveraging real-time monitoring, predictive insights, and data-driven decision-making for crop, soil, and irrigation management, while enhancing operational efficiency and supply chain performance globally. The analysis spans over 40+ countries, with the leading markets shown below

The agriculture analytics market in China is projected to grow at a CAGR of 13.5% from 2025 to 2035, driven by large-scale adoption of precision farming technologies, government initiatives for smart agriculture, and increasing demand for data-driven crop management. Advanced sensors, IoT devices, drones, and AI-powered analytics are being used to optimize irrigation, fertilizer application, and yield prediction. Farmers and agribusinesses are integrating real-time soil, weather, and crop health monitoring solutions. Large-scale farms and agro-industrial enterprises are increasingly adopting cloud-based platforms for predictive analytics and resource optimization. The rise of e-commerce platforms for agri-products also boosts analytics adoption for supply chain efficiency.

The agriculture analytics market in China is expected to grow at a CAGR of 12.5%, supported by the government’s digital agriculture programs and expanding adoption of smart farming practices among medium and large farms. Remote sensing, soil monitoring, and AI-powered crop recommendations are being widely implemented. Smallholder farmers are increasingly accessing mobile-based platforms for farm management, pest alerts, and market pricing intelligence. Private sector investment in agri-tech startups is driving innovation in farm management systems. Weather forecasting, irrigation scheduling, and predictive crop modeling are enhancing yield and reducing resource waste. Partnerships with fintech and insurance companies are enabling data-driven crop insurance and lending solutions.

The agriculture analytics market in France is projected to grow at a CAGR of 10.5%, driven by large-scale adoption of smart farming and precision viticulture practices. Advanced analytics solutions for soil management, nutrient optimization, and pest monitoring are widely deployed in vineyards and large-scale cereal farms. Cloud-based and AI-powered analytics platforms are integrated with automated irrigation systems and smart tractors. Government subsidies and EU initiatives are supporting digital agriculture adoption. Data-driven insights are increasingly used to enhance operational efficiency, reduce input costs, and improve sustainability in crop production.

The U.K. market is expected to grow at a CAGR of 9.5% from 2025 to 2035, with adoption concentrated in arable farming, livestock management, and commercial horticulture. Farmers increasingly use IoT-enabled sensors, AI analytics, and drones for soil health monitoring, disease prediction, and irrigation optimization. Data integration across platforms allows predictive maintenance, resource planning, and yield forecasting. Government programs supporting digital agriculture, coupled with private-sector agri-tech initiatives, are accelerating adoption among large farms. Drones and satellite imagery are widely applied for crop health assessment, pest detection, and precision spraying. Agribusinesses are leveraging analytics for supply chain efficiency, market forecasting, and logistical optimization. Leasing models and subscription-based analytics services are expanding accessibility for small and medium-sized farms.

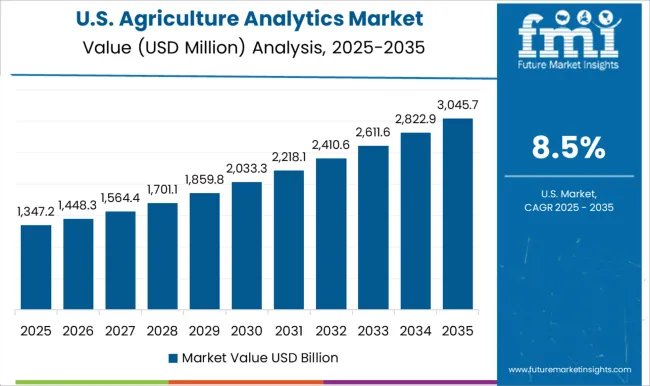

The U.S. agriculture analytics market is projected to expand at a CAGR of 8.5% from 2025 to 2035, driven by large-scale adoption of precision agriculture, AI analytics, and remote sensing technologies. Farmers deploy soil sensors, satellite imagery, and AI-powered platforms to optimize irrigation, fertilization, and crop yield. Industrial farms and agribusinesses are increasingly adopting cloud-based platforms for real-time monitoring, predictive analytics, and supply chain management. Drones and autonomous equipment enhance efficiency in crop surveillance, pest detection, and field operations. Investment from agri-tech startups, partnerships with equipment manufacturers, and government support for digital agriculture solutions are accelerating market penetration. Data-driven insights are being applied for crop rotation planning, risk assessment, and resource allocation.

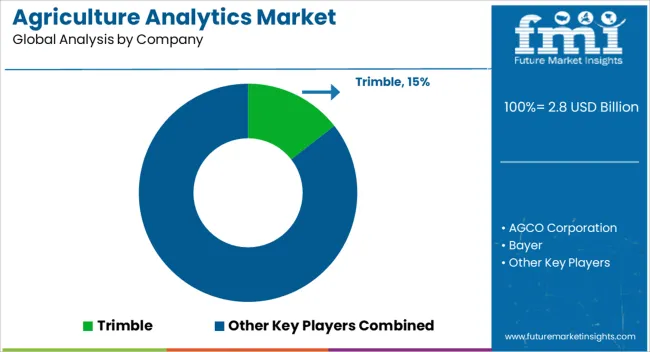

Competition in the agriculture analytics market is driven by precision, data integration, and technological innovation. Trimble leads with a comprehensive suite of precision agriculture tools, combining GNSS guidance, field analytics, and cloud-based data management to optimize farm operations. The company focuses on providing actionable insights for crop health, soil management, and equipment efficiency, enabling farmers to maximize yield and reduce operational costs. AGCO Corporation, known for brands like Fendt and Massey Ferguson, competes through advanced farm machinery integrated with analytics platforms, offering solutions for planting, harvesting, and field monitoring. A strategic collaboration with Trimble enhances AGCO’s data capabilities and strengthens its market positioning. Bayer leverages its digital farming solutions through Climate LLC, providing analytics for crop protection, nutrient management, and predictive insights to improve productivity. Corteva Agriscience focuses on its Granular platform, offering farm management software that streamlines decision-making, operational efficiency, and resource allocation. DeLaval addresses livestock operations, providing dairy farm management solutions that integrate data analytics to monitor animal health, optimize feeding schedules, and enhance milk production.

SAP SE offers enterprise resource planning tools tailored for agriculture, combining supply chain management, operational analytics, and predictive modeling for strategic farm planning. Emerging players like Taranis utilize aerial imagery, AI, and machine learning to detect crop stress, pest infestations, and disease outbreaks at an early stage. By combining real-time monitoring with predictive insights, Taranis enables precise interventions that minimize crop losses and enhance sustainability. Across the market, strategies focus on partnerships, AI and IoT integration, and expansion of solution portfolios to cater to crop farming, livestock management, and large-scale agricultural operations. Product offerings emphasize actionable insights, predictive modeling, automated reporting, and remote monitoring capabilities.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.8 Billion |

| Offering | Software and Services |

| Farm Size | Large farms and Small & medium farms |

| Application | Precision farming, Livestock farming, Aquaculture farming, Conventional farming, and Others |

| Technology | Farm analytics, Livestock analytics, Supply chain analytics, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Trimble, AGCO Corporation, Bayer, Corteva Agriscience, DeLaval, SAP SE, and Taranis |

| Additional Attributes | Dollar sales by solution type (field analytics, livestock analytics, crop management software), data source (satellite imagery, IoT sensors, drones), and end user (large-scale farms, SMEs, cooperatives). Demand is fueled by precision agriculture adoption, sustainability initiatives, and the need for higher crop yields. Regional trends show strong growth in North America, Europe, and Asia-Pacific, supported by smart farming initiatives, government incentives, and increasing agri-tech investment. |

The global agriculture analytics market is estimated to be valued at USD 2.8 billion in 2025.

The market size for the agriculture analytics market is projected to reach USD 7.2 billion by 2035.

The agriculture analytics market is expected to grow at a 10.0% CAGR between 2025 and 2035.

The key product types in agriculture analytics market are software, services, professional and managed.

In terms of farm size, large farms segment to command 63.4% share in the agriculture analytics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Agriculture Gateway Market Size and Share Forecast Outlook 2025 to 2035

Agriculture Solar Water Pumps Market Size and Share Forecast Outlook 2025 to 2035

Agriculture Fertilizer Spreader Market Size and Share Forecast Outlook 2025 to 2035

Agriculture Packaging Market Size and Share Forecast Outlook 2025 to 2035

Agriculture IoT Market Size and Share Forecast Outlook 2025 to 2035

Agriculture Enzyme Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Market Share Breakdown of Agriculture Packaging Solutions

Agriculture Bags Market

Agriculture Testing Services Market Growth – Trends & Forecast 2018-2028

Non-Agriculture Smart Irrigation Controllers Market Size and Share Forecast Outlook 2025 to 2035

Smart Agriculture Market Size and Share Forecast Outlook 2025 to 2035

Ai In Agriculture Market Size and Share Forecast Outlook 2025 to 2035

Smart Agriculture Solution Market Analysis by Component Type, Application, and Region Through 2035

Precision Agriculture Market

Regenerative Agriculture Market Size and Share Forecast Outlook 2025 to 2035

Blockchain in Agriculture and Food Supply Chain Market Size and Share Forecast Outlook 2025 to 2035

Blockchain in Agriculture Market Analysis – Size, Share & Forecast 2024-2034

Controlled Environment Agriculture (CEA) Market Size and Share Forecast Outlook 2025 to 2035

Analytics Of Things Market Size and Share Forecast Outlook 2025 to 2035

Analytics as a Service (AaaS) Market - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA