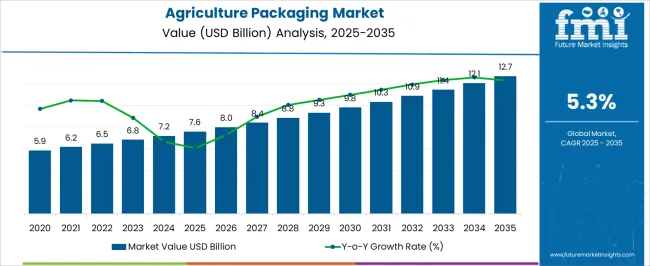

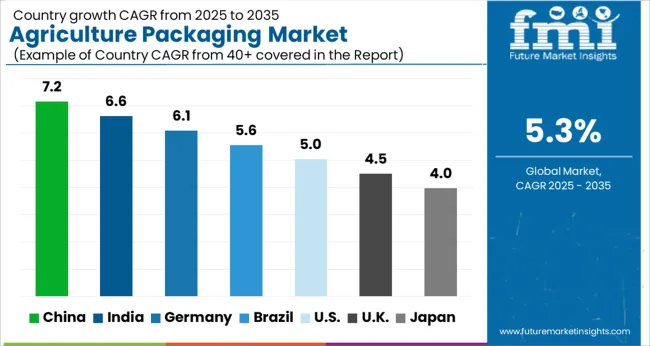

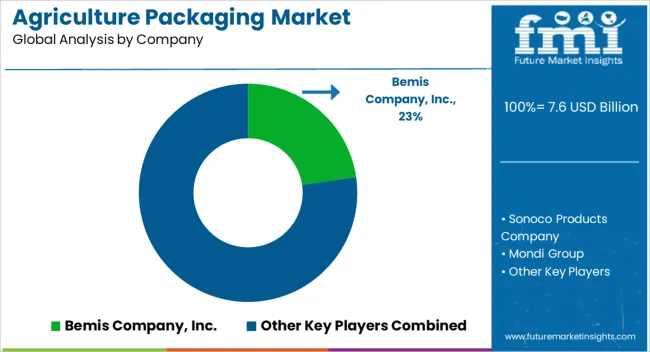

The Agriculture Packaging Market is estimated to be valued at USD 7.6 billion in 2025 and is projected to reach USD 12.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period.

| Metric | Value |

|---|---|

| Agriculture Packaging Market Estimated Value in (2025 E) | USD 7.6 billion |

| Agriculture Packaging Market Forecast Value in (2035 F) | USD 12.7 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

The agriculture packaging market is experiencing notable growth as rising global demand for fresh produce, seeds, and agrochemicals drives the adoption of durable and sustainable packaging solutions. Increasing focus on minimizing post harvest losses, ensuring product integrity, and extending shelf life is fueling investment in innovative packaging formats.

The sector is also witnessing regulatory pressure to reduce single use plastics, which is encouraging manufacturers to explore recyclable and biodegradable materials. Advances in barrier technologies and packaging designs that enhance resistance to moisture, oxygen, and light are further supporting market expansion.

Moreover, branding opportunities through customized packaging and traceability features are adding value to the supply chain. The outlook remains positive as sustainability mandates and the need for efficient logistics converge with the growing agricultural output worldwide.

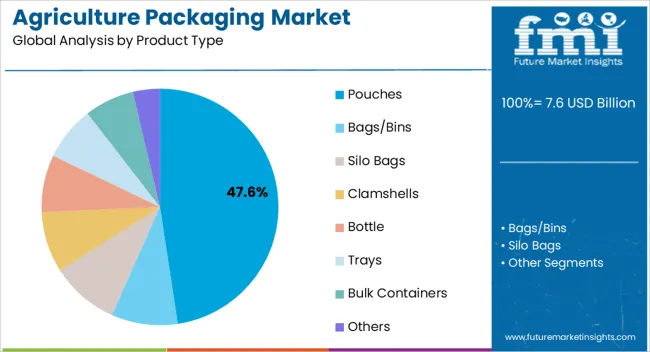

The pouches segment is projected to account for 47.60% of total revenue by 2025 within the product type category, making it the most significant segment. This growth is being driven by their lightweight structure, cost effectiveness, and flexibility in storing and transporting agricultural inputs.

Pouches also offer easy handling, resealability, and customization options, which align with the operational and marketing needs of agricultural producers and distributors. Their ability to reduce transportation costs and improve storage efficiency has further supported their adoption across various applications.

As a result, pouches continue to hold a leading position in the product type category.

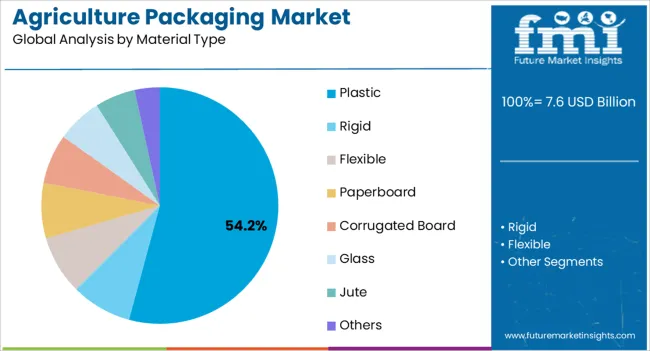

The plastic segment is expected to contribute 54.20% of total market revenue by 2025 within the material type category, positioning it as the dominant choice. This prominence is attributed to the durability, affordability, and versatility of plastics in meeting diverse agricultural packaging needs.

Plastics provide high resistance to external factors such as moisture and contamination while supporting large scale production at lower costs. Their compatibility with modern barrier technologies and ability to extend the shelf life of packaged goods have further reinforced their preference.

Despite sustainability concerns, the recyclability of advanced plastics is sustaining their demand, ensuring their dominance in the material type segment.

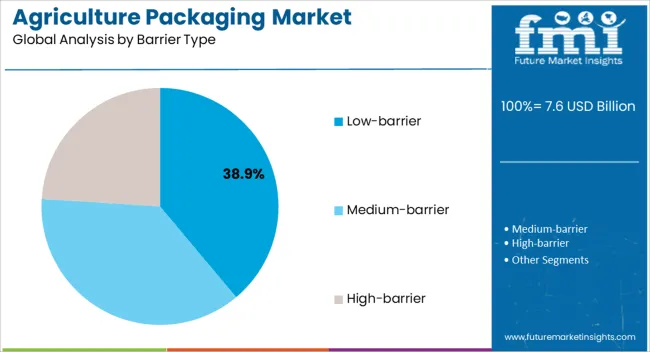

The low barrier category is projected to represent 38.90% of total revenue by 2025 within the barrier type segment, highlighting its leading role. This is due to its suitability for applications that require protection from basic environmental factors without incurring the higher costs of advanced barriers.

Low barrier packaging is widely used for bulk agricultural commodities and short duration storage, offering a cost efficient solution that meets industry needs. Its scalability and affordability have made it highly favorable for producers managing high volume packaging operations.

Consequently, the low barrier segment maintains its leadership by providing a balance between performance and cost effectiveness.

The market for agriculture packaging was worth USD 5,315.8 million in 2020. It accumulated a market value of USD 6,478.3 million in 2025 while growing at a CAGR of 4.8% during the historical period. The consistent increase in the global population is driving the demand for food.

This is fueling the expansion of agricultural industry and, in turn, the agriculture packaging market.

The rising trend of automation is further driving growth in the agricultural industry. This is expected to drive the need for new packaging solutions that are compatible with automated systems.

According to an article published in the Environmental Science and Technology journal, food travels an average of 4,100 miles, until it reaches the end-user. This is expected to fuel the demand for innovative packaging solutions to meet the requirement of farmers, processors, and distributors who sell in the international and national markets.

Agriculture packaging solutions are going through horizontal integration approaches. This is bringing easy packaging solutions, printing capabilities, and additional value-adding solutions to packaging closer to the packaging manufacturers. This will most likely keep the product demand afloat in the coming years.

Innovations in technology, sustainability concerns, and attractive economics are expected to drive the demand for innovative agriculture packaging solutions. Nowadays, there is a massive demand for agricultural packages that are integrated with monitoring instruments.

Advanced packaging styles, like bag-in-box and pouches, are accelerating the usage of flexible packaging in combination with rigid packaging formats. According to the Flexible Packaging Association, flexible packaging is majorly used for food.

This contributes to over 60% of the total food packaging market. Also, the consolidation of e-commerce is expected to make flexible packaging one of the rapidly growing packaging approaches during the forecast period.

Growing Demand for Agro Chemicals to Fuel Market Expansion

A rise in pest attacks is driving the demand for crop protection chemicals, such as fertilizers and pesticides, which are toxic. The packaging of these chemicals requires advanced packaging materials so as to minimize the risk while storing, handling, and transporting these agrochemicals.

This is expected to drive the demand for agricultural packaging solutions for agrochemicals.

Increasing awareness regarding eco-friendly packaging in developed countries is leading to increased adoption of agriculture packaging in various companies. These companies are utilizing paper and jute-based agriculture packaging bags and pouches to retain their customer base. This is helping the market to sustain its market footprint.

The use of bulk bags which are suitable for local and international transportation is further helping in the market expansion. These bags have become an industry standard for more than a hundred years.

These flexible bags are reliable affordable and durable. The agriculture products arrive in the best possible condition by utilizing these bags with minimal damages. Furthermore, the rising use of these bags for farm and warehouses are expected to positively influence market growth.

High Costs of Raw Materials to Restrict Market Growth

High costs of raw materials and the rising use of outdated and discarded packaging materials are expected to hold back the agriculture packaging market's growth over the forecast period. Rising concerns for the environment and recyclability are estimated to become growth hurdles during the forecast period.

North America driving growth with a significant market share

North America accounted for 22.8% of the revenue share in 2025, in the agriculture packaging market. The region is expected to accumulate a 24.1% market share by end of 2025. The market in this region is projected to grow with a CAGR of 5.2% during the forecast period.

The growth is attributed to the region's growing use of packaging for solid grains and silage, liquid insecticides, and storage of seeds.

The United States alone accounted for 20.8% of global market share in 2025. The region is expected to continue its regional dominance by accumulating a 22.5% market share by end of 2025.

The high adoption of sophisticated packaging technologies and the strong presence of key players are anticipated to drive the wheels of growth in the region. Moreover, rising demand for sustainable packaging solutions is further expected to generate new opportunities for market expansion.

China Driving Growth with Significant CAGR

China is expected to dominate the agriculture packaging market in the Asia Pacific region. The market in this region is anticipated to grow with an impressive CAGR of 6.7% during the forecast period.

China is witnessing investments and technological advancements, like Artificial Intelligence-based technologies in agriculture. The region is rapidly adopting smart technologies across the agriculture sector.

?Increasing adoption of precision farming in the region is fuelled by various factors, such as consistent advancements in technology, reduced equipment price, social media use, and prevalence of online publications that help create awareness. ? These factors are expected to generate growth in the region.

Alibaba, a Chinese e-commerce giant has recently taken its first step into the agriculture sector by utilizing artificial intelligence in agriculture to assist farmers in increasing crop yield and simultaneously reducing the cost of production.

Farmers accessed digitally recorded information on their smartphones provided by Alibaba. This allowed them to monitor whether fruits are ready to be harvested or if there is any chance of pest attack on their standing crops. This adoption is expected to drive growth in the market in the coming years as well.

Bags/Bins to Dominate the Market with a Sizable Share

Bags/Bins accounted for a revenue share of 42% in 2025 on the basis of product type. This segment is expected to continue its trend of dominance by accumulating a 43.6% market share by end of 2025. The segment is expected to generate a CAGR of 6.2% during the forecast period.

Bags/Bins provide superior safety against transportation losses in a sustainable manner that is helping to drive growth in the segment. Also, rising product launches in solid/dry formulations of agrochemical products by key players are expected to drive segment growth.

Attractive color and high-resolution image graphics are offered with Biaxially-Oriented Polypropylene (BOPP) agriculture bags. Two material layers, woven polypropylene, and a moisture-resistant film make this agriculture bag tough and durable. These bags are ideal for various different applications from animal feed bags to cement.?

The rising adoption of these bags in agricultural practices is expected to drive growth in the segment. Supreme print quality provides a unique advertising and marketing opportunity. ?

Silage Expected to Dominate the Market with a Significant Market Share

Silage accounted for a 44.6% market share in 2025. This segment is estimated to accumulate over 46% market share by end of 2025. It is expected to grow with a CAGR of 6.1% until 2035.

Livestock is the main source of livelihood for the majority of rural population, especially in countries like India and China. Over 75 % of Indian farmers are small and marginal landholders.

They are the backbone of Indian Agriculture contributing more than 7% to the national gross domestic product. With the highest livestock population, the demand for silage is expected to rise significantly.

Long-term preservation of fodder in the form of silage is practiced which is driving the growth of the segment. These are widely used in the pit method in various government /private grain storage warehouses.

Start-ups help in predicting future growth opportunities in any market. New entities have the potential to generate high returns which directly benefits the expansion of any industry.

These start-ups are generally more productive at transforming inputs into outputs with more flexibility and adaptability, ability to adopt volatile market conditions. Some of the start-ups that will propel the expansion of agriculture packaging market are

The agriculture packaging market is extremely competitive and consists of various key industry players. These players are heavily investing in manufacturing agriculture packaging solutions.

The key industry players are: Bemis Company, Inc., Sonoco Products Company, Mondi Group, LC Packaging International BV, Packaging Corporation of America, H.B. Fuller Company, Atlantic Packaging, NNZ Group, Parakh Agro Industries Ltd, International Paper Company, DS Smith Plc, Smurfit Kappa Group Plc, KapStone Paper, and Packaging Corp.

Some recent developments in the market are

Key market players are leveraging on inorganic growth strategies like acquisition, mergers, partnerships, and collaboration in order to enhance their product portfolio. This is expected to fuel the global agriculture packaging market.

In May 2024, a paper-based high-strength packaging was developed for the Irish farm potato company Meade Farm Group, by a partnership between packaging and paper giant Mondi and the Polish biodegradable packaging firm SILBO.

These new bags, which are claimed as compostable and possess a bio-based covering on the inside, are said to replace non-biodegradable plastic bags with paper ones.

| Report Attribute | Details |

|---|---|

| Market Value in 2025 | USD 7.6 billion |

| Market Value in 2035 | USD 12.7 billion |

| Growth Rate | CAGR of 5.3% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Product Type, Material Type, Barrier Type, Application, Region |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East and Africa |

| Key Countries Profiled | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, China, Japan, South Korea, Singapore, Thailand, Indonesia, Australia, New Zealand, GCC Countries, South Africa, Israel |

| Key Companies Profiled | Bemis Company, Inc.; Sonoco Products Company; Mondi Group; LC Packaging International BV; Packaging Corporation of America; H.B. Fuller Company; Atlantic Packaging; NNZ Group; Parakh Agro Industries Ltd; International Paper Company; DS Smith Plc; Smurfit Kappa Group Plc; KapStone Paper and Packaging Corp. |

| Customization | Available upon Request |

The global agriculture packaging market is estimated to be valued at USD 7.6 billion in 2025.

The market size for the agriculture packaging market is projected to reach USD 12.7 billion by 2035.

The agriculture packaging market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in agriculture packaging market are pouches, bags/bins, silo bags, clamshells, bottle, trays, bulk containers and others.

In terms of material type, plastic segment to command 54.2% share in the agriculture packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Breakdown of Agriculture Packaging Solutions

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Agriculture Gateway Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Agriculture Solar Water Pumps Market Size and Share Forecast Outlook 2025 to 2035

Agriculture Fertilizer Spreader Market Size and Share Forecast Outlook 2025 to 2035

Agriculture Analytics Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA