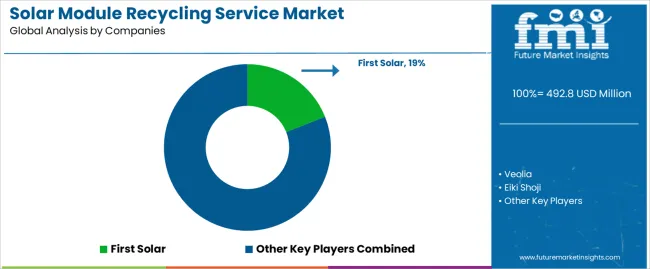

The global solar module recycling service market is forecasted to grow from USD 492.8 million in 2025 to approximately USD 1,437.6 million by 2035, recording an absolute increase of USD 944.8 million over the forecast period. This translates into a total growth of 191.7%, with the market forecast to expand at a CAGR of 11.3% between 2025 and 2035. The overall market size is expected to grow by nearly 2.9X during the same period, supported by increasing end-of-life photovoltaic module volumes from first-generation solar installations, growing regulatory requirements mandating producer responsibility for renewable energy waste, and rising environmental consciousness driving circular economy adoption across solar energy infrastructure decommissioning operations.

The market exhibits distinct regional dynamics with Asia Pacific emerging as the fastest-growing region, led by China's massive solar installation base reaching decommissioning age and India's expanding renewable energy infrastructure requiring waste management solutions. Europe maintains substantial market presence through established Extended Producer Responsibility regulations and comprehensive waste management frameworks. North America demonstrates growing adoption driven by utility-scale solar farm retirements and state-level recycling mandates. The solar module recycling segment demonstrates particular strength in recovering valuable materials including silicon, silver, copper, and aluminum, with technology evolution toward high-purity material recovery enabling economic viability. Market participants increasingly focus on establishing regional processing facilities, developing automated disassembly technologies, and securing long-term contracts with solar farm operators and photovoltaic manufacturers to ensure feedstock supply as decommissioning volumes accelerate through 2030.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 492.8 million |

| Market Forecast Value (2035) | USD 1,437.6 million |

| Forecast CAGR (2025-2035) | 11.3% |

| REGULATORY & ENVIRONMENTAL DRIVERS | SOLAR INSTALLATION LIFECYCLE FACTORS | RESOURCE RECOVERY ECONOMICS |

|---|---|---|

| Extended Producer Responsibility Expansion Regulatory frameworks establishing manufacturer obligations for end-of-life photovoltaic module management across European Union and emerging Asian markets. Landfill Restriction Policies Government mandates prohibiting solar waste disposal in standard landfills due to hazardous material content and resource recovery requirements. Circular Economy Initiatives Policy frameworks incentivizing material recovery and green waste management practices in renewable energy sectors. | First Generation Module Retirement Wave Solar installations from 2010-2015 deployment period reaching 25-30 year operational life requiring systematic decommissioning and material recovery services. Manufacturing Defect Returns Warranty claims and premature failures generating immediate recycling demand independent of lifecycle timeline expectations. Repowering Project Acceleration Utility-scale solar farms replacing functional but less efficient older modules with advanced technology, creating operational equipment recycling streams. | Critical Material Value Recovery Silicon, silver, copper, and aluminum content in photovoltaic modules providing economic justification for specialized recycling processing operations. Processing Technology Advancement Automated disassembly systems and chemical separation techniques improving material purity and recovery rates enhancing operational profitability. Secondary Material Market Development Established commodity markets for recovered materials reducing price volatility and improving revenue predictability for recycling operations. Avoided Disposal Cost Structures Landfill fees and hazardous waste management costs making recycling economically competitive alternative for solar asset owners. |

| Category | Segments Covered |

|---|---|

| By Module Type | Monocrystalline Photovoltaic Modules, Polycrystalline Photovoltaic Modules, Thin-film Modules |

| By Application | Resource Recovery Companies, Photovoltaic Module Manufacturers, Other |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Segment | 2025 to 2035 Outlook |

|---|---|

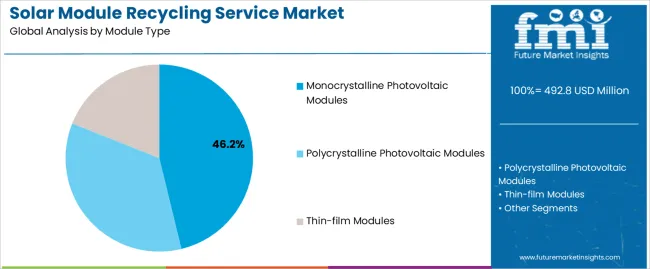

| Monocrystalline Photovoltaic Modules | Leader in 2025 with 46.2% market share; maintains leadership through 2035. Dominant technology in residential and commercial installations, high silicon content supporting recovery economics, established processing protocols for crystalline technology. Momentum: strong growth driven by market share dominance in new installations and accumulating retirement volumes. Watchouts: processing complexity for PERC cell architectures, lamination material variations affecting separation efficiency. |

| Polycrystalline Photovoltaic Modules | Substantial segment representing legacy utility-scale installations and early residential deployments. Lower silicon purity compared to monocrystalline but simpler cell structures facilitating mechanical separation. Established recycling infrastructure and processing experience. Momentum: moderate growth peaking mid-decade as first-generation utility projects reach retirement age, declining thereafter as market share of new installations diminishes. Technology transition reducing future feedstock volumes. |

| Thin-film Modules | Specialized recycling requirements due to cadmium telluride and CIGS material compositions. Limited volume compared to crystalline technologies but higher complexity requiring dedicated processing capabilities. Regulatory scrutiny due to hazardous material content mandating specialized handling. Momentum: steady growth from commercial rooftop and utility projects, particularly First Solar installation retirements. Watchouts: geographic concentration of manufacturing creates regional processing requirements, evolving environmental regulations affecting disposal protocols. |

| Segment | 2025 to 2035 Outlook |

|---|---|

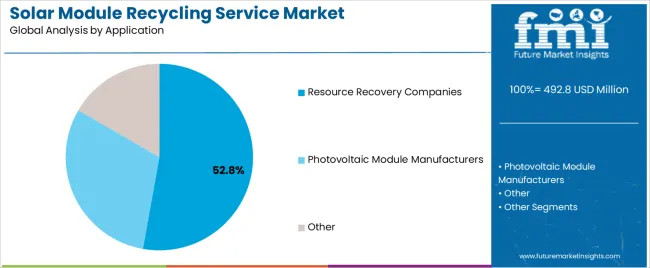

| Resource Recovery Companies | At 52.8%, largest application segment in 2025 with established waste management infrastructure and material processing capabilities. Specialized recyclers developing photovoltaic-specific processing lines, investment in automated disassembly equipment, strategic positioning near decommissioning activity concentrations. Mature operational protocols for hazardous material handling and commodity material marketing. Momentum: strong growth driven by increasing decommissioning volumes and favorable recycling economics. Contract structures with solar farm operators and EPCs securing long-term feedstock supply. Watchouts: processing capacity requirements straining regional infrastructure, technology variations requiring flexible processing capabilities. |

| Photovoltaic Module Manufacturers | Growing segment as Extended Producer Responsibility regulations require manufacturers to establish take-back programs and recycling capabilities. Vertical integration strategies capturing material value and ensuring regulatory compliance. Closed-loop manufacturing approaches incorporating recovered materials into new module production. Momentum: accelerating growth through 2030 as regulatory requirements expand globally and manufacturers develop processing expertise. Strategic partnerships with specialized recyclers common during capability development phase. Watchouts: capital investment requirements for processing infrastructure, logistics complexity managing reverse supply chains across distributed installation base. |

| Other | Diverse segment including utility companies managing solar farm decommissioning, engineering firms providing comprehensive project closure services, and environmental consultants coordinating waste management compliance. Project-based service delivery model, regulatory compliance focus, coordination across multiple stakeholders. Momentum: moderate growth as utility-scale decommissioning volumes increase and project complexity requires specialized coordination. Fragmented market structure with regional service providers dominating local markets. Limited processing capabilities necessitating partnerships with resource recovery companies for actual recycling operations. |

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

| Regulatory Mandate Expansion Extended Producer Responsibility frameworks requiring manufacturers to finance and manage end-of-life photovoltaic module recycling across expanding jurisdictions. Decommissioning Volume Acceleration First-generation solar installations from global deployment surge reaching operational life completion requiring systematic material recovery. Material Recovery Economics Valuable material content including silicon, silver, copper, aluminum justifying processing investment and supporting operational profitability. | Processing Infrastructure Limitations Insufficient regional recycling capacity relative to projected decommissioning volumes requiring substantial capital investment in processing facilities. Collection Logistics Complexity Distributed installation locations complicating reverse logistics and increasing transportation costs affecting processing economics. Technology Standardization Absence Diverse module construction methods and material compositions requiring flexible processing capabilities and complicating standardized recycling protocols. | Automated Disassembly Systems Mechanical and thermal separation technologies enabling efficient frame removal, junction box extraction, and laminate processing at industrial scale. High-Purity Material Recovery Advanced chemical and thermal processes achieving semiconductor-grade silicon recovery enabling closed-loop manufacturing integration. Regional Processing Hub Development Strategic facility location near decommissioning activity concentrations optimizing logistics costs and enabling rapid service delivery. Manufacturer Take-Back Programs Vertical integration of recycling capabilities by photovoltaic producers ensuring compliance and capturing material value in circular economy models. |

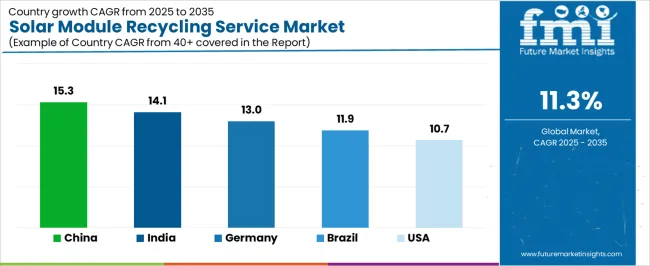

| Country | CAGR (2025-2035) |

|---|---|

| China | 15.3% |

| India | 14.1% |

| Germany | 13.0% |

| Brazil | 11.9% |

| United States | 10.7% |

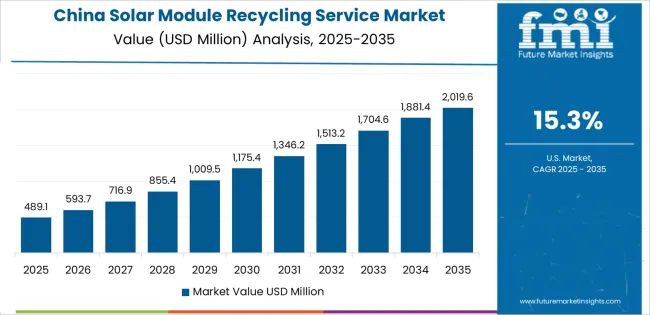

Solar module recycling services market in China is projected to grow at a CAGR of 15.3% from 2025 to 2035. Revenue from solar module recycling services in China is expected to exhibit exceptional growth, with market value reaching significant levels by 2035, driven by a massive photovoltaic installation base from government-subsidized deployment programs reaching decommissioning age and comprehensive circular economy policy frameworks creating substantial opportunities for material recovery companies across utility-scale solar farm retirement operations, distributed generation system replacement programs, and manufacturing warranty return processing. The country's established photovoltaic manufacturing ecosystem and expanding environmental compliance requirements are creating significant demand for both domestic processing capabilities and technology development.

Major recycling operations and material recovery companies, including specialized solar waste processors, are establishing comprehensive regional facilities to support large-scale decommissioning operations and meet growing demand for recovered material solutions. Renewable energy waste management regulations are supporting widespread adoption of solar module recycling across decommissioning operations, driving demand for processing infrastructure and material recovery capabilities. Utility-scale solar farm retirement programs and distributed generation system upgrades are creating substantial opportunities for recycling service providers requiring efficient logistics and cost-effective processing solutions. Manufacturing center proximity and established reverse logistics networks are facilitating adoption of comprehensive recycling services throughout major solar deployment regions.

Solar module recycling services market in India is expected to expand at a CAGR of 14.1% from 2025 to 2035. Revenue from solar module recycling services in India is expanding substantially by 2035, supported by extensive solar capacity additions from government renewable energy targets reaching operational maturity and comprehensive Extended Producer Responsibility regulations creating continued demand for recycling solutions across diverse installation categories and manufacturer compliance segments. The country's aggressive solar deployment trajectory and expanding regulatory attention are driving demand for recycling services that provide systematic decommissioning management while supporting environmental compliance requirements.

International recycling companies and domestic waste management providers are investing in processing capabilities to support growing decommissioning volumes and regulatory obligations. Renewable energy expansion programs and manufacturing localization initiatives are creating opportunities for recycling services across utility and distributed generation segments requiring reliable processing and regulatory compliance support. Government policy frameworks and producer responsibility regulations are driving investments in domestic processing infrastructure supporting material recovery requirements throughout major solar deployment states. Installation base maturation and warranty return volumes are enhancing demand for comprehensive recycling capabilities throughout primary solar markets.

Solar module recycling services market in Germany is forecasted to grow at a CAGR of 13.0% from 2025 to 2035. Demand for solar module recycling services in Germany is expected to reach substantial levels by 2035, supported by the country's leadership in Extended Producer Responsibility regulation and advanced waste management infrastructure requiring comprehensive photovoltaic module processing systems for utility decommissioning and residential system retirement applications. German waste management companies are implementing sophisticated processing systems that support high material recovery rates, operational efficiency, and comprehensive regulatory compliance protocols. The market is characterized by focus on operational excellence, environmental performance, and adherence to stringent waste management and material recovery standards. Renewable energy industry investments are prioritizing advanced recycling technologies that demonstrate superior material separation and recovery performance while meeting German environmental protection and circular economy standards. WEEE Directive implementation and waste hierarchy compliance are driving adoption of specialized processing facilities that support comprehensive material recovery and environmental protection. Research and development programs for recycling technology enhancement are facilitating adoption of innovative separation techniques throughout major processing centers.

Demand for solar module recycling services in the United States is growing at a CAGR of 10.7% from 2025 to 2035. Revenue from solar module recycling services in the United States is growing to reach substantial levels by 2035, driven by utility-scale solar farm decommissioning programs and increasing state-level recycling mandates creating persistent opportunities for waste management providers serving both utility operators and residential system decommissioning contractors. The country's extensive solar installation base and expanding regulatory attention are creating demand for recycling services that support diverse compliance requirements while maintaining processing cost competitiveness.

Waste management companies and specialized solar recyclers are developing regional capabilities to support operational efficiency and state regulatory compliance. Utility decommissioning projects and state legislative mandates are facilitating adoption of recycling services capable of supporting varied regulatory requirements and operational performance standards. Renewable energy project closure programs and Extended Producer Responsibility framework development are enhancing demand for comprehensive processing capabilities that support material recovery and environmental compliance. Solar farm repowering initiatives and residential system replacement programs are creating opportunities for integrated decommissioning and recycling services across American solar markets.

Solar module recycling services market in Brazil is anticipated to increase at a CAGR of 11.9% from 2025 to 2035. Demand for solar module recycling services in Brazil is expected to reach meaningful levels by 2035, driven by expanding solar capacity installations and environmental awareness programs supporting waste management infrastructure development and regulatory framework evolution. The country's growing renewable energy sector and emerging environmental compliance requirements are creating demand for recycling capabilities that support future decommissioning needs and eco-friendly energy system development. International waste management providers and domestic recycling companies are maintaining development strategies to support anticipated processing requirements.

Renewable energy expansion and environmental policy development programs are supporting future demand for solar module recycling that meets emerging performance and compliance standards. Installation base growth and manufacturing sector development are creating opportunities for processing infrastructure that provides operational support and material recovery capabilities. Eco-friendly initiatives and circular economy awareness programs are facilitating adoption of recycling planning throughout solar project development and operation phases.

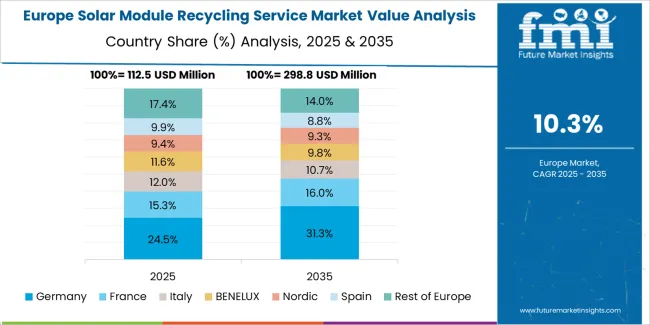

The solar module recycling service market in Europe is projected to grow from USD 167.8 million in 2025 to USD 817.1 million by 2035, registering a CAGR of 17.1% over the forecast period. Germany is expected to maintain its leadership position with a 34.7% market share in 2025, declining slightly to 32.3% by 2035, supported by its comprehensive WEEE Directive implementation and advanced recycling infrastructure serving extensive solar installation base decommissioning.

France follows with a 21.5% share in 2025, projected to reach 22.8% by 2035, driven by expanding Extended Producer Responsibility frameworks and utility-scale solar farm retirement programs. The United Kingdom holds a 14.9% share in 2025, expected to maintain 14.6% by 2035 despite post-Brexit regulatory adjustments. Italy commands a 13.2% share, while Spain accounts for 10.4% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 5.3% to 7.0% by 2035, attributed to increasing recycling infrastructure development in Nordic countries and emerging Eastern European nations implementing EU waste management directives for renewable energy installations.

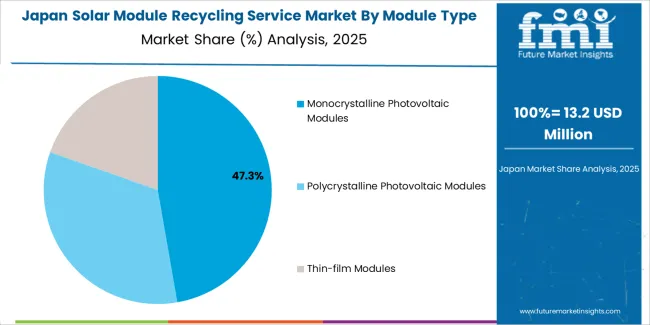

Japanese solar module recycling operations reflect the country's comprehensive environmental regulations and sophisticated waste management infrastructure. Major photovoltaic manufacturers including Sharp, Panasonic, and Kyocera maintain extensive take-back programs under Japan's renewable energy equipment recycling guidelines, with stringent material recovery rate targets and hazardous substance management protocols. This creates structured market conditions favoring established relationships between manufacturers and certified recycling facilities.

The Japanese market demonstrates advanced processing technology adoption, with significant investment in automated disassembly systems and high-purity material recovery processes tailored to domestic module specifications. Companies require detailed material composition documentation and processing verification protocols that align with Japanese environmental standards, driving demand for sophisticated tracking and quality control capabilities.

Regulatory oversight through the Ministry of Environment emphasizes comprehensive traceability and material accountability throughout recycling processes. The waste management framework requires detailed reporting on recovered material disposition and environmental impact metrics, creating advantages for recyclers with established documentation systems and transparent operations.

Supply chain coordination focuses on regional processing hub development near major installation concentrations, minimizing transportation costs while maintaining rapid response capabilities for decommissioning projects. Japanese companies typically establish long-term processing agreements with certified recyclers, emphasizing operational reliability and consistent compliance rather than competitive bidding processes. This stability supports specialized infrastructure investment tailored to Japanese photovoltaic technology specifications.

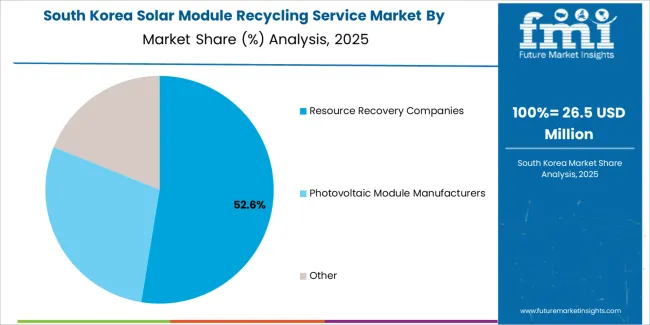

South Korean solar module recycling operations reflect the country's advanced manufacturing sector and export-oriented renewable energy industry. Major photovoltaic manufacturers including Hanwha Q CELLS, LG Electronics, and Hyundai Energy Solutions drive comprehensive end-of-life management strategies, establishing processing partnerships globally to support warranty returns and Extended Producer Responsibility compliance for international sales while developing domestic capabilities for local installation retirement.

The Korean market demonstrates particular strength in applying advanced separation technologies to recover high-purity materials suitable for semiconductor and solar manufacturing applications. Companies integrate chemical processing expertise from electronics recycling operations into photovoltaic module processing, achieving superior material quality compared to mechanical-only separation approaches.

Regulatory frameworks through Ministry of Environment and Ministry of Trade, Industry and Energy emphasize producer responsibility and circular economy principles, with photovoltaic manufacturers required to establish financial reserves and processing capacity commitments for future module retirement volumes. This creates structured market development favoring manufacturer-led initiatives and strategic recycling partnerships.

Processing technology development focuses on closed-loop manufacturing integration, with recovered silicon and metals reintroduced into production processes. Korean manufacturers invest in proprietary recycling technologies supporting competitive advantage through vertical integration and material cost optimization. Innovation emphasis on automation and artificial intelligence applications in sorting and separation processes positions Korean facilities for processing efficiency leadership as global decommissioning volumes accelerate.

Profit pools consolidate around operators demonstrating processing scale economics and strategic positioning near decommissioning activity concentrations. Value migrates from manual disassembly operations toward automated processing facilities where material recovery efficiency, throughput capacity, and environmental compliance capabilities command premiums. Several operational models define competitive positioning: established waste management conglomerates leveraging existing hazardous material handling infrastructure and customer relationships; photovoltaic manufacturers developing vertical integration capabilities to capture material value and ensure Extended Producer Responsibility compliance; specialized solar recyclers focusing on proprietary processing technologies and high-purity material recovery; and regional service providers establishing local collection networks and processing partnerships.

Switching costs remain moderate for solar farm operators selecting recycling service providers, driven primarily by logistics optimization and regulatory compliance verification rather than technical integration requirements. Long-term decommissioning service agreements create relationship stability once established, particularly for utility-scale projects where systematic retirement planning and regulatory oversight favor proven operators. Competitive advantages accrue to recyclers maintaining geographic proximity to major solar deployment regions, reducing transportation costs while enabling responsive service delivery. Processing technology capabilities increasingly differentiate operators, with advanced separation systems achieving higher material purity and recovery rates supporting superior economics.

Market consolidation accelerates as established waste management companies acquire specialized solar recycling operations to expand service offerings while photovoltaic manufacturers evaluate build-versus-buy decisions for recycling capabilities. Regional processing hub development intensifies with companies securing strategic facility locations and establishing collection networks before decommissioning volumes surge post-2028. Technology licensing and processing partnerships proliferate as intellectual property holders monetize proprietary separation techniques while recyclers access advanced capabilities without full capital investment. Contract structures evolve toward long-term service agreements with solar farm operators and manufacturers, providing volume visibility supporting infrastructure investment while securing competitive positioning before market maturity.

| Items | Values |

|---|---|

| Quantitative Units | USD 492.8 million |

| Module Type | Monocrystalline Photovoltaic Modules, Polycrystalline Photovoltaic Modules, Thin-film Modules |

| Application | Resource Recovery Companies, Photovoltaic Module Manufacturers, Other |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Key Countries Covered | United States, Germany, China, India, Brazil, Japan, South Korea, and other countries |

| Key Companies Profiled | First Solar, Veolia, Eiki Shoji, Echo Environmental, Reiling Unternehmensgruppe, ERI, Green Clean Solar, NPC Group, Rinovasol, Solarcycle, SPRW, We Recycle Solar, Solar Recycling Solutions, ROSI, PV Circonomy, Retrofit Environmental, Waste Experts, PV Industries, Cleanlites, Powerhouse Recycling, Sircel, EKG, Phoenix Recycling Group, KGS |

| Additional Attributes | Revenue analysis by module type and application segment, regional market dynamics, competitive landscape assessment, processing technology evolution, regulatory framework development, and material recovery innovations driving circular economy advancement, environmental responsibility, and resource optimization |

The global solar module recycling service market is estimated to be valued at USD 492.8 million in 2025.

The market size for the solar module recycling service market is projected to reach USD 1,437.5 million by 2035.

The solar module recycling service market is expected to grow at a 11.3% CAGR between 2025 and 2035.

The key product types in solar module recycling service market are monocrystalline photovoltaic modules, polycrystalline photovoltaic modules and thin-film modules.

In terms of application, resource recovery companies segment to command 52.8% share in the solar module recycling service market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Solar Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Solar Aluminum Alloy Frame Market Size and Share Forecast Outlook 2025 to 2035

Solar Grade Monocrystalline Silicon Rods Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Solar Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Solar Encapsulation Market Size and Share Forecast Outlook 2025 to 2035

Solar Pumps Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Solar Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Solar Tracker for Power Generation Market Size and Share Forecast Outlook 2025 to 2035

Solar Panel Market Size and Share Forecast Outlook 2025 to 2035

Solar-Powered Active Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Solar Photovoltaic (PV) Market Size and Share Forecast Outlook 2025 to 2035

Solar EPC Market Size and Share Forecast Outlook 2025 to 2035

Solar-Powered UAV Market Size and Share Forecast Outlook 2025 to 2035

Solar Panel Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Solar Salt Market Size and Share Forecast Outlook 2025 to 2035

Solar Control Window Films Market Size and Share Forecast Outlook 2025 to 2035

Solar Street Lighting Market Size and Share Forecast Outlook 2025 to 2035

Solar Reflective Glass Market Size and Share Forecast Outlook 2025 to 2035

Solar Water Desalination Plant Market Size and Share Forecast Outlook 2025 to 2035

Solar Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA