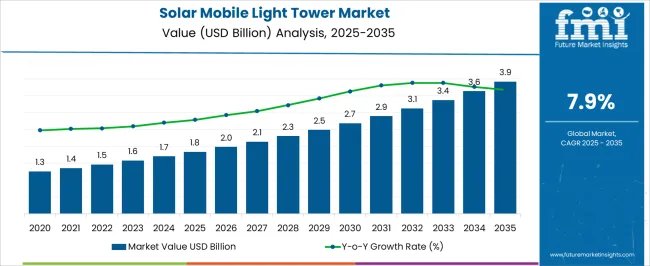

The solar mobile light tower market is expected to reach USD 1.8 billion in 2025 and 3.9 billion in 2035, growing at a CAGR of 7.9%. Early adoption from 2020 to 2024 was driven by pilot projects and limited deployments, with companies testing product performance and reliability. Moving into 2025, scaling accelerates as larger fleets and commercial users increase adoption, distribution networks expand, and production efficiencies improve.

Market players focus on expanding reach, improving service models, and capturing emerging demand across construction, events, and emergency response sectors, laying the groundwork for a period of steady growth and stronger market presence. From 2030 to 2035, the market is projected to reach USD 3.9 billion, with growth moderating at a CAGR of 7.9%. Consolidation dominates as leading suppliers strengthen positions through strategic partnerships, regional expansion, and acquisitions. Smaller vendors either specialize in niche applications or exit, while competition shifts from new entrants to optimizing cost, reliability, and customer service. Market adoption stabilizes as most potential users are engaged, driving companies to focus on maximizing efficiency, fleet management, and long-term contracts, establishing a mature, predictable market environment.

| Metric | Value |

|---|---|

| Solar Mobile Light Tower Market Estimated Value in (2025 E) | USD 1.8 billion |

| Solar Mobile Light Tower Market Forecast Value in (2035 F) | USD 3.9 billion |

| Forecast CAGR (2025 to 2035) | 7.9% |

Mining & Quarrying contributes around 20%, where off-grid lighting solutions are critical for safety and productivity. Oil & Gas accounts for 12%, particularly in exploration and maintenance sites requiring portable illumination. Events & Entertainment represents roughly 10%, as outdoor concerts, festivals, and sports venues increasingly deploy mobile lighting solutions. Emergency & Disaster Response contributes about 8%, where rapid deployment and reliability are essential during relief operations.

Transportation & Logistics holds 7%, supporting night-time operations in ports, rail yards, and highways. Telecom & Utility Maintenance represents 5%, leveraging mobile lighting for infrastructure inspection and repair. Smaller sectors, including Agriculture and Military Applications, together form the remaining 3%, typically deploying specialized or small-scale units.

The solar mobile light tower market is experiencing steady growth driven by increasing adoption of renewable energy solutions for off grid and temporary lighting applications. Rising fuel costs and stringent environmental regulations are encouraging the shift from diesel powered units to solar powered alternatives.

Advancements in photovoltaic efficiency, battery storage capacity, and LED integration are improving performance and reducing operational costs. The growing need for sustainable and portable lighting solutions in remote work sites, emergency response operations, and infrastructure development projects is further supporting market expansion.

Government incentives promoting clean energy technologies are also influencing procurement decisions. With the added benefits of lower maintenance requirements and reduced noise pollution, solar mobile light towers are positioned to play a pivotal role in meeting the lighting demands of construction, mining, and public event sectors while aligning with global sustainability goals.

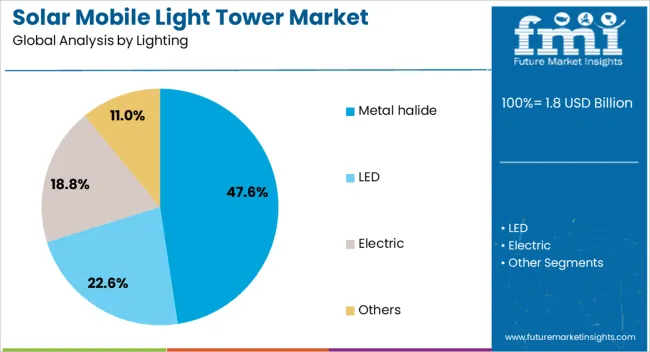

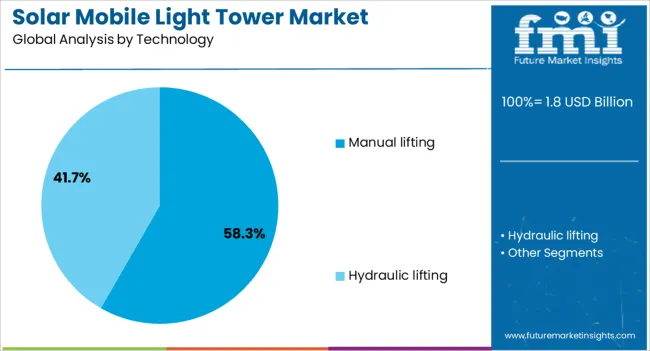

The solar mobile light tower market is segmented by lighting, technology, application, and geographic regions. By lighting, solar mobile light tower market is divided into Metal halide, LED, Electric, and Others. In terms of technology, solar mobile light tower market is classified into Manual lifting and Hydraulic lifting.

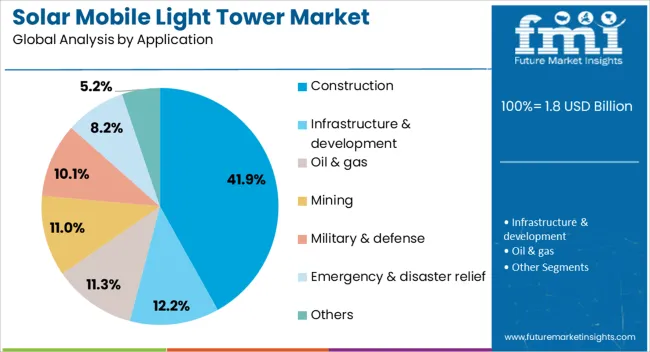

Based on application, solar mobile light tower market is segmented into Construction, Infrastructure & development, Oil & gas, Mining, Military & defense, Emergency & disaster relief, and Others. Regionally, the solar mobile light tower industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The metal halide segment is expected to account for 47.60% of total market revenue by 2025 within the lighting category, positioning it as a leading segment. This dominance is due to its high intensity illumination, wide coverage capability, and proven performance in large scale outdoor applications.

Despite the rise of LED technology, metal halide continues to be preferred in certain environments where broad area lighting and high lumen output are critical.

The reliability of this lighting type in extreme weather conditions and its suitability for long duration operations have reinforced its market position.

The manual lifting segment is projected to hold 58.30% of market revenue by 2025 in the technology category, making it the most significant segment. Its popularity is attributed to its cost effectiveness, ease of deployment, and minimal maintenance requirements.

Manual lifting systems are often favored in remote or rugged environments where simple operation and mechanical reliability are prioritized over automation.

Their durability and lower initial investment costs make them a practical choice for construction and industrial users seeking efficient height adjustment capabilities without complex equipment.

The construction segment is anticipated to represent 41.90% of total market revenue by 2025 within the application category, establishing it as the leading segment. Growth in this segment is being driven by the increasing demand for reliable, mobile, and eco-friendly lighting in large-scale building and infrastructure projects.

Solar mobile light towers are widely used to extend working hours, enhance site safety, and meet environmental compliance requirements.

The portability and rapid deployment capability of these units make them well-suited for dynamic construction site layouts and evolving project needs.

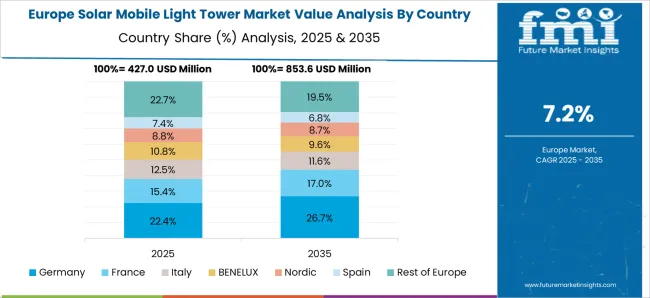

The solar mobile light tower market is expanding due to increasing demand for sustainable, off-grid lighting in construction sites, outdoor events, and emergency applications. North America and Europe lead with technologically advanced, high-lumen, and energy-efficient towers, while Asia-Pacific shows rapid growth fueled by infrastructure development, mining, and disaster relief operations. Manufacturers differentiate through battery capacity, solar panel efficiency, portability, and remote monitoring. Regional variations in renewable adoption, energy costs, and project types strongly influence deployment, market acceptance, and competitiveness globally.

Adoption of solar mobile light towers is driven by the need for renewable, off-grid power solutions. North America and Europe prioritize towers with high-efficiency solar panels and integrated energy storage to reduce diesel generator reliance and minimize emissions. Asia-Pacific markets emphasize cost-effective solutions for construction, mining, and rural electrification projects, balancing performance with affordability. Differences in renewable energy adoption, solar irradiance, and storage technology affect runtime, lighting capacity, and operational efficiency. Leading suppliers provide smart energy management, rapid charging, and long-lasting batteries, while regional manufacturers focus on affordable, functional systems. Renewable integration contrasts with shape adoption, operational sustainability, and market competitiveness globally.

Portability, compact design, and ease of deployment are critical factors influencing adoption. North America and Europe prioritize lightweight, modular, and foldable towers for rapid relocation across construction sites, events, and emergency zones. Asia-Pacific markets adopt robust, easy-to-assemble towers suitable for harsh environments and mass deployment in mining or disaster relief. Differences in portability and deployment flexibility affect installation speed, labor costs, and operational convenience. Leading suppliers offer telescopic masts, foldable panels, and multi-unit mobility, while regional manufacturers provide durable, practical designs. Design and deployment contrasts shape adoption, logistical efficiency, and competitive positioning in the solar mobile light tower market.

Battery capacity and energy storage efficiency are critical for ensuring uninterrupted lighting. North America and Europe focus on towers with high-capacity lithium-ion batteries, advanced charge controllers, and smart discharge management to ensure reliability during long night operations. Asia-Pacific markets adopt cost-effective lead-acid or hybrid battery systems for extended runtime, balancing investment and performance. Differences in storage technology and reliability influence operational uptime, maintenance frequency, and end-user confidence. Suppliers providing high-performance batteries, optimized solar charging, and remote monitoring gain premium adoption, while regional manufacturers emphasize cost-effective, durable storage solutions. Storage and runtime contrasts drive adoption, reliability, and competitiveness across global solar mobile light tower markets.

Compliance with lighting, electrical safety, and environmental standards significantly affects market adoption. North America and Europe enforce strict standards for luminous intensity, battery safety, and solar efficiency to ensure operational reliability and user protection. Asia-Pacific regulations vary; developed regions follow international norms, while emerging markets adopt locally enforced guidelines prioritizing affordability.

Differences in regulatory compliance affect product approval, deployment timelines, and investor confidence. Suppliers offering certified, compliant solar towers gain higher adoption, while regional manufacturers focus on practical, regulation-compliant, and cost-effective models. Standards and compliance contrasts shape adoption, market credibility, and competitive positioning globally.

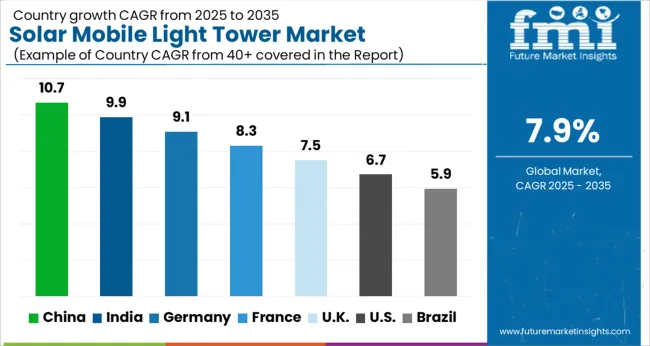

| Country | CAGR |

|---|---|

| China | 10.7% |

| India | 9.9% |

| Germany | 9.1% |

| France | 8.3% |

| UK | 7.5% |

| USA | 6.7% |

| Brazil | 5.9% |

The global solar mobile light tower market is projected to grow at a 7.9% CAGR through 2035, driven by applications in construction, emergency services, and outdoor events. Among BRICS nations, China led with 10.7% growth as large-scale production and deployment facilities were commissioned and compliance with safety and electrical standards was enforced, while India at 9.9% growth expanded manufacturing capacity to meet increasing regional demand. In the OECD region, Germany at 9.1% maintained consistent output under stringent industrial and regulatory frameworks, while the United Kingdom at 7.5% operated mid-scale facilities for commercial and municipal applications. The USA, growing at 6.7%, supported steady adoption across construction, utility, and event-based deployments, adhering to federal and state-level quality and safety benchmarks. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The solar mobile light tower market in China is projected to grow at a CAGR of 10.7% due to rising demand for portable, energy efficient lighting solutions in construction, mining, and outdoor events. The market is being supported by adoption of solar powered towers that reduce fuel costs, ensure continuous illumination, and provide environmentally friendly alternatives to diesel generators. Manufacturers are being encouraged to deliver durable, high performance, and cost effective units. Distribution through industrial suppliers, event organizers, and authorized dealers is being strengthened. Research in improved solar panels, battery storage, and automated light controls is being conducted. Growing construction activity, expansion of mining operations, and increase in outdoor event hosting are considered key factors driving growth of the solar mobile light tower market in China.

The solar mobile light tower market in India is expected to grow at a CAGR of 9.9% due to increasing adoption in infrastructure projects, outdoor events, and temporary emergency lighting. The market is being supported by use of solar powered towers that provide reliable illumination while reducing operational costs and emissions. Manufacturers are being encouraged to supply cost effective, durable, and efficient units. Distribution through industrial suppliers, utility providers, and event management companies is being strengthened. Technical workshops and demonstrations are being conducted to increase awareness of proper installation and maintenance. Expansion of construction projects, outdoor event activities, and remote site operations are recognized as primary drivers for the solar mobile light tower market in India.

Germany is experiencing growth in the solar mobile light tower market at a CAGR of 9.1%, driven by industrial, construction, and event lighting applications. Adoption is being supported by solar powered solutions that provide sustainable, low maintenance, and reliable lighting. Manufacturers are being encouraged to provide durable, technologically advanced, and efficient units. Distribution through industrial suppliers, utility companies, and authorized dealers is being maintained. Research in higher efficiency solar panels, extended battery life, and automated controls is being pursued. Growth in construction, outdoor recreational events, and renewable energy initiatives is considered a key factor for the solar mobile light tower market in Germany.

Increasing use of portable and energy efficient lighting solutions is driving the solar mobile light tower market in the United Kingdom, expected to grow at a CAGR of 7.5%. Adoption is being emphasized in construction sites, outdoor events, and emergency operations where reliable and low maintenance lighting is required. Manufacturers are being focused on providing durable, high performance, and cost effective towers. Distribution through authorized dealers, industrial suppliers, and event management firms is being strengthened. Awareness programs and technical demonstrations are being conducted to promote correct usage and installation. Expansion of construction activities, temporary event setups, and emergency response operations are recognized as major contributors to market growth.

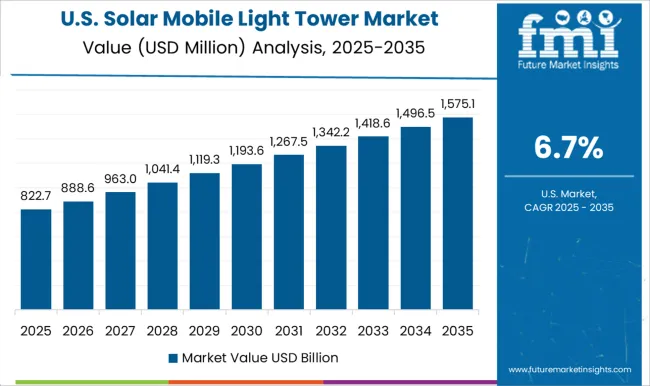

The solar mobile light tower market in the United States is expected to grow at a CAGR of 6.7%, supported by demand for renewable energy powered lighting solutions in construction, mining, and emergency applications. Adoption is being strengthened by portable, cost effective, and environmentally friendly towers. Manufacturers are being encouraged to provide efficient, durable, and high performance units. Distribution through industrial suppliers, utility companies, and event organizers is being maintained. Research into advanced solar panels, longer lasting batteries, and automated lighting controls is being conducted. Growth of infrastructure projects, mining operations, and temporary outdoor events are considered important factors supporting the solar mobile light tower market in the United States.

The solar mobile light tower market has experienced substantial growth in recent years, driven by increasing demand for sustainable and off-grid lighting solutions across construction sites, outdoor events, emergency response scenarios, and mining operations. These towers provide environmentally friendly, energy-efficient lighting powered by solar panels, often integrated with battery storage and smart control systems. Rising awareness of carbon footprint reduction, stringent environmental regulations, and the high operational cost of diesel-powered alternatives are encouraging end-users to adopt solar-powered mobile light towers. Additionally, the mobility, ease of deployment, and low maintenance requirements of these towers further support their widespread adoption in remote and temporary locations.

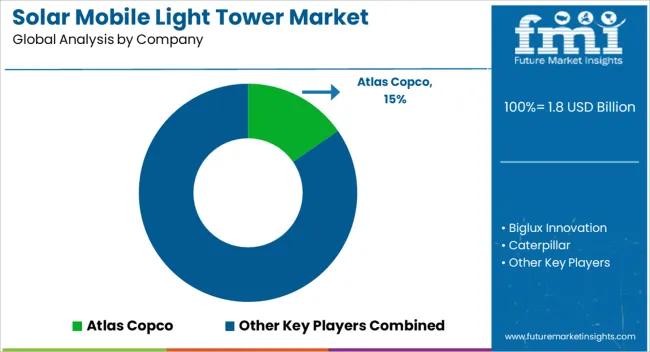

Key players dominating the solar mobile light tower market include Atlas Copco, Biglux Innovation, Caterpillar, CleanLight, Colorado Standby, Generac Mobile Products, Greensky Mobile Power & Light, Herc Rentals, Larson Electronics, National Signal, Progress Solar Solutions, Sunbelt Rentals, Trime, United Rentals, Vermac, Wacker Neuson, and Wanco. These companies focus on product innovation, energy efficiency, and durability while providing tailored solutions for diverse sectors such as construction, mining, emergency services, and outdoor recreational activities. Their strategies emphasize global distribution, after-sales support, and technological enhancements to meet evolving market needs.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.8 Billion |

| Lighting | Metal halide, LED, Electric, and Others |

| Technology | Manual lifting and Hydraulic lifting |

| Application | Construction, Infrastructure & development, Oil & gas, Mining, Military & defense, Emergency & disaster relief, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Atlas Copco, Biglux Innovation, Caterpillar, CleanLight, Colorado Standby, Generac Mobile Products, Greensky Mobile Power & Light, Herc Rentals, Larson Electronics, National Signal, Progress Solar Solutions, Sunbelt Rentals, Trime, United Rentals, Vermac, Wacker Neuson, and Wanco |

| Additional Attributes | Dollar sales vary by product type, including hybrid and fully solar light towers; by application, such as construction sites, mining operations, emergency response, and outdoor events; by end-use, spanning construction companies, mining firms, government agencies, and event organizers; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising demand for sustainable lighting solutions, renewable energy adoption, and off-grid illumination needs. |

The global solar mobile light tower market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the solar mobile light tower market is projected to reach USD 3.9 billion by 2035.

The solar mobile light tower market is expected to grow at a 7.9% CAGR between 2025 and 2035.

The key product types in solar mobile light tower market are metal halide, led, electric and others.

In terms of technology, manual lifting segment to command 58.3% share in the solar mobile light tower market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Solar Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Solar Aluminum Alloy Frame Market Size and Share Forecast Outlook 2025 to 2035

Solar Grade Monocrystalline Silicon Rods Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Solar Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Solar PV Module Market Size and Share Forecast Outlook 2025 to 2035

Solar Encapsulation Market Size and Share Forecast Outlook 2025 to 2035

Solar Pumps Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Solar PV Recycling Market Size and Share Forecast Outlook 2025 to 2035

Solar Tracker for Power Generation Market Size and Share Forecast Outlook 2025 to 2035

Solar Panel Market Size and Share Forecast Outlook 2025 to 2035

Solar-Powered Active Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Solar Panel Recycling Management Market Size and Share Forecast Outlook 2025 to 2035

Solar Photovoltaic (PV) Market Size and Share Forecast Outlook 2025 to 2035

Solar EPC Market Size and Share Forecast Outlook 2025 to 2035

Solar-Powered UAV Market Size and Share Forecast Outlook 2025 to 2035

Solar Panel Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Solar Salt Market Size and Share Forecast Outlook 2025 to 2035

Solar Control Window Films Market Size and Share Forecast Outlook 2025 to 2035

Solar Reflective Glass Market Size and Share Forecast Outlook 2025 to 2035

Solar Water Desalination Plant Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA