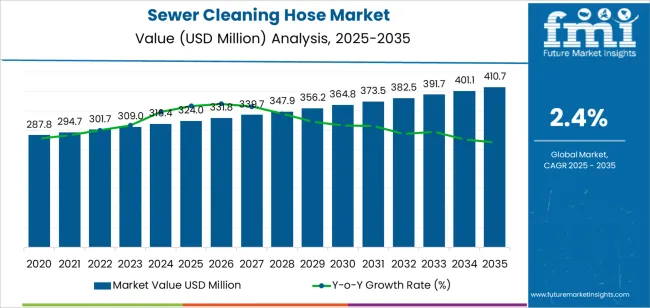

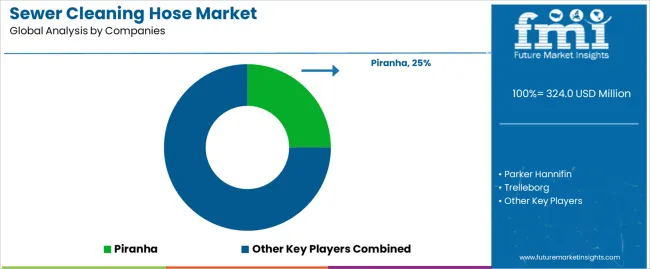

The sewer cleaning hose market is valued at USD 324.0 million in 2025 and is expected to reach USD 410.7 million by 2035, reflecting a sustained emphasis on preventive wastewater system maintenance, urban sanitation improvement, and residential drainage upkeep. Demand growth is closely linked to aging municipal sewage networks, expansion of urban settlement zones, and stricter public hygiene standards. Sewer cleaning hoses play a central role in high-pressure flushing operations, pipeline blockage removal, and scheduled maintenance procedures that prevent system failures and environmental contamination. Increased outsourcing of municipal cleaning contracts to private service providers and rising investment in fleet-based maintenance equipment strengthen market continuity.

During the first half of the forecast period, from 2025 to 2030, the market will rise from USD 324.0 million to approximately USD 364.8 million, adding USD 40.8 million in value, which accounts for 47 percent of total decade growth. This phase is marked by widespread adoption of reinforced high-pressure hose systems capable of withstanding abrasive debris, fluctuating pressure output, and continuous field use. Procurement decisions center on durability performance, kink resistance, and compatibility with various sewer jetting equipment types. Operational reliability, ease of replacement, and system-level efficiency become standardized expectations. Manufacturers offering multi-layer hose constructions, corrosion-resistant fittings, and pressure response stability gain competitive advantage as maintenance planning becomes more preventive and data-driven across municipal and commercial service environments.

The latter half (2030-2035) will witness continued growth from USD 364.8 million to USD 410.7 million, representing an addition of USD 45.9 million or 53% of the decade's expansion. This period will be defined by mass market penetration of specialized cleaning technologies, integration with comprehensive maintenance management platforms, and seamless compatibility with existing infrastructure equipment. The market trajectory signals fundamental shifts in how municipal facilities approach wastewater system maintenance and cleaning operations, with participants positioned to benefit from growing demand across multiple hose types and application segments.

| Period | Primary Revenue Buckets | Share | Notes |

|---|---|---|---|

| Today | New hose sales (lateral line, mainline) | 52% | Replacement-driven, infrastructure maintenance purchases |

| Repair kits & accessories | 22% | Couplings, nozzles, fittings for operations | |

| Service & maintenance support | 16% | Equipment inspection, pressure testing | |

| Custom fabrication | 10% | Specialized lengths, pressure ratings | |

| Future (3-5 yrs) | High-pressure hose systems | 45-50% | Advanced materials, extended durability |

| Accessories & nozzles | 18-22% | Specialized cleaning attachments, rotary tools | |

| Service-as-a-subscription | 12-16% | Performance guarantees, scheduled replacement programs | |

| Custom solutions | 10-14% | Application-specific designs, specialized coatings | |

| Training & safety services | 6-9% | Operator certification, safety compliance programs | |

| Digital tracking solutions | 3-5% | Usage monitoring, predictive replacement analytics |

| Metric | Value |

|---|---|

| Market Value (2025) | USD 324.0 million |

| Market Forecast (2035) | USD 410.7 million |

| Growth Rate | 2.4% CAGR |

| Leading Technology | Lateral Line Hose |

| Primary Application | Commercial Segment |

The market demonstrates strong fundamentals with lateral line hose systems capturing a dominant share through advanced cleaning capabilities and infrastructure maintenance optimization. Commercial applications drive primary demand, supported by increasing facility maintenance and wastewater system cleaning requirements. Geographic expansion remains concentrated in developed markets with established municipal infrastructure, while emerging economies show accelerating adoption rates driven by urbanization initiatives and rising sanitation standards.

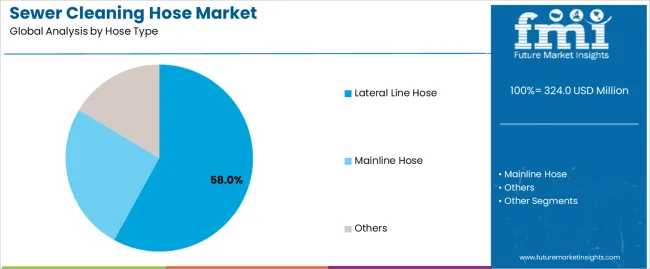

Primary Classification: The market segments by hose type into lateral line hose, mainline hose, and other specialized cleaning hoses, representing the evolution from basic cleaning equipment to sophisticated maintenance solutions for comprehensive infrastructure cleaning optimization.

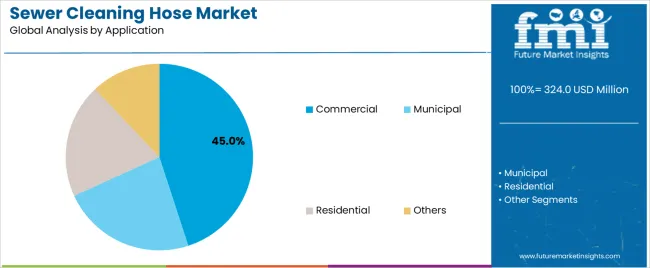

Secondary Classification: Application segmentation divides the market into commercial, municipal, residential, and other sectors, reflecting distinct requirements for cleaning capacity, operational pressure, and infrastructure maintenance standards.

Regional Classification: Geographic distribution covers North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East & Africa, with developed markets leading adoption while emerging economies show accelerating growth patterns driven by infrastructure development expansion programs.

The segmentation structure reveals technology progression from standard cleaning equipment toward sophisticated maintenance systems with enhanced durability and pressure capabilities, while application diversity spans from municipal facilities to commercial operations requiring precise wastewater system cleaning solutions.

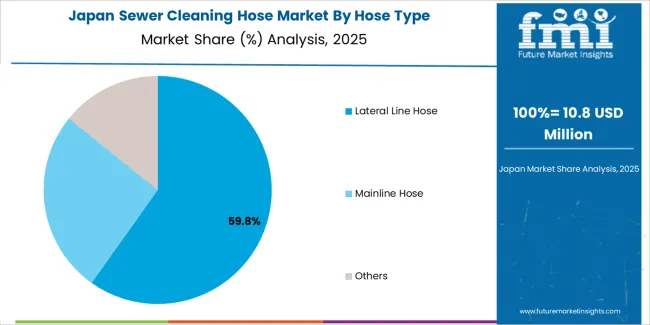

Market Position: Lateral Line Hose systems command the leading position in the sewer cleaning hose market with 58% market share through advanced cleaning features, including superior pressure handling, operational flexibility, and infrastructure maintenance optimization that enable service facilities to achieve optimal cleaning consistency across diverse municipal and commercial environments.

Value Drivers: The segment benefits from service operator preference for reliable cleaning systems that provide consistent performance, reduced downtime, and operational efficiency optimization without requiring significant equipment modifications. Advanced design features enable flexible maneuvering capabilities, pressure consistency, and integration with existing cleaning equipment, where operational performance and durability represent critical service requirements.

Competitive Advantages: Lateral Line Hose systems differentiate through proven operational reliability, consistent cleaning characteristics, and integration with various nozzle systems that enhance service effectiveness while maintaining optimal pressure standards suitable for diverse municipal and commercial applications.

Key market characteristics:

Mainline Hose systems maintain a 34% market position in the sewer cleaning hose market due to their high-pressure properties and heavy-duty construction advantages. These systems appeal to facilities requiring maximum cleaning power with competitive pricing for large-diameter applications. Market growth is driven by municipal expansion, emphasizing reliable cleaning solutions and operational efficiency through reinforced system designs.

Other Specialized Cleaning Hose systems capture 8% market share through specialized cleaning requirements in industrial facilities, specialized applications, and custom maintenance operations. These facilities demand adaptable cleaning systems capable of handling unique infrastructure while providing effective cleaning capabilities and operational reliability.

Market Context: Commercial applications demonstrate the highest growth rate in the sewer cleaning hose market with 2.8% CAGR due to widespread adoption of professional cleaning systems and increasing focus on facility maintenance optimization, operational efficiency, and infrastructure care applications that maximize system performance while maintaining sanitation standards.

Appeal Factors: Commercial facility operators prioritize system reliability, cleaning effectiveness, and integration with existing maintenance equipment that enables coordinated cleaning operations across multiple properties. The segment benefits from substantial facility management investment and modernization programs that emphasize the acquisition of professional cleaning systems for maintenance optimization and infrastructure care applications.

Growth Drivers: Facility management expansion programs incorporate sewer cleaning hoses as standard equipment for maintenance operations, while commercial property growth increases demand for reliable cleaning capabilities that comply with sanitation standards and minimize operational disruption.

Market Challenges: Varying facility requirements and infrastructure complexity may limit system standardization across different properties or service scenarios.

Application dynamics include:

Municipal applications capture market share through comprehensive cleaning requirements in public wastewater systems, storm drain maintenance, and municipal infrastructure operations. These facilities demand heavy-duty cleaning systems capable of operating with large-diameter pipes while providing effective cleaning access and operational reliability capabilities.

Residential applications account for market share, including plumbing service providers, residential maintenance, and property care requiring accessible cleaning capabilities for operational efficiency and homeowner service.

| Category | Factor | Impact | Why It Matters |

|---|---|---|---|

| Driver | Aging infrastructure & increasing maintenance needs (legacy pipe systems, deterioration) | ★★★★★ | Growing infrastructure maintenance requirements drive consistent demand for cleaning equipment; regular maintenance becomes essential for system operation and compliance. |

| Driver | Urbanization & wastewater system expansion (population growth, city development) | ★★★★☆ | Expanding municipal networks require new cleaning equipment; urban growth and infrastructure development create sustained market opportunities. |

| Driver | Environmental regulations & sanitation standards (EPA requirements, discharge compliance) | ★★★★☆ | Stricter maintenance requirements turn professional cleaning from optional to mandatory; compliance documentation and regular cleaning become operational necessities. |

| Restraint | Price sensitivity & replacement cycle timing (budget constraints, equipment longevity) | ★★★★☆ | Municipal budget limitations defer purchases; extended hose life and delayed replacement slow market turnover in established operations. |

| Restraint | Competition from alternative cleaning methods (chemical treatments, mechanical tools) | ★★★☆☆ | Alternative maintenance approaches compete for budget; technological diversification limits exclusive dependence on traditional hose cleaning systems. |

| Trend | Advanced materials & extended durability | ★★★★★ | New polymer compounds and reinforcement technologies extend service life; material innovation drives premium segment growth and reduces total ownership costs. |

| Trend | Integrated cleaning systems & equipment packages | ★★★★☆ | Comprehensive solutions combining hoses, nozzles, and accessories; bundled offerings and system compatibility become competitive differentiators. |

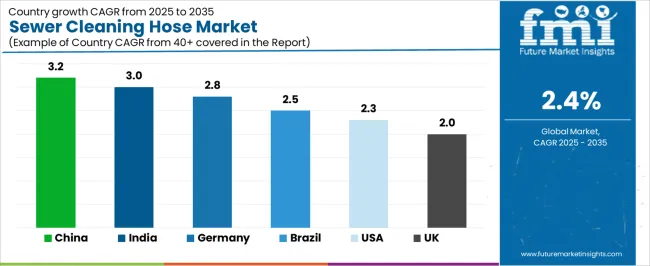

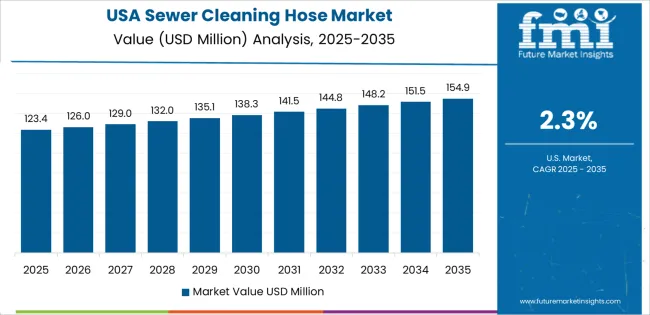

The sewer cleaning hose market demonstrates varied regional dynamics with Growth Leaders including China (3.2% growth rate) and India (3.0% growth rate) driving expansion through infrastructure development initiatives and urbanization capacity programs. Steady Performers encompass Germany (2.8% growth rate), Brazil (2.5% growth rate), and developed regions, benefiting from established municipal systems and maintenance technology adoption. Emerging Markets feature United States (2.3% growth rate) and developed regions, where infrastructure replacement and maintenance modernization support consistent growth patterns.

Regional synthesis reveals East Asian markets leading adoption through urbanization expansion and infrastructure development, while South Asian countries maintain rapid expansion supported by sanitation modernization and municipal system requirements. Western European markets show moderate growth driven by infrastructure maintenance applications and quality system trends.

| Region/Country | 2025-2035 Growth | How to win | What to watch out |

|---|---|---|---|

| China | 3.2% | Focus on cost-effective durability | Localization requirements; price competition |

| India | 3.0% | Lead with value systems | Infrastructure gaps; municipal budget constraints |

| Germany | 2.8% | Offer premium materials | Over-specification; lengthy procurement cycles |

| Brazil | 2.5% | Value-oriented solutions | Currency fluctuations; import duties |

| USA | 2.3% | Provide comprehensive support | Market maturity; replacement cycle timing |

| UK | 2.0% | Push system integration | Budget pressures; procurement complexity |

China establishes fastest market growth through aggressive urbanization programs and comprehensive municipal infrastructure development, integrating advanced sewer cleaning hoses as standard components in wastewater system maintenance and municipal service installations. The country's 3.2% growth rate reflects government initiatives promoting sanitation infrastructure and urban development that mandate the use of professional cleaning systems in municipal and commercial facilities. Growth concentrates in major urban centers, including Beijing, Shanghai, and Guangzhou, where infrastructure development showcases integrated cleaning systems that appeal to municipal operators seeking advanced maintenance optimization capabilities and infrastructure care applications.

Chinese manufacturers are developing cost-effective cleaning solutions that combine domestic production advantages with advanced operational features, including high-pressure capabilities and enhanced durability characteristics. Distribution channels through municipal equipment suppliers and maintenance service distributors expand market access, while government support for infrastructure development supports adoption across diverse municipal and commercial segments.

Strategic Market Indicators:

In Delhi, Mumbai, and Bangalore, municipal facilities and commercial properties are implementing advanced sewer cleaning hoses as standard equipment for infrastructure maintenance and sanitation applications, driven by increasing government urbanization investment and municipal modernization programs that emphasize the importance of professional cleaning capabilities. The market holds a 3.0% growth rate, supported by government sanitation initiatives and infrastructure development programs that promote professional cleaning systems for municipal and commercial facilities. Indian operators are adopting cleaning systems that provide consistent operational performance and durability features, particularly appealing in urban regions where maintenance effectiveness and system reliability represent critical operational requirements.

Market expansion benefits from growing municipal infrastructure capabilities and technology adoption programs that enable local production of cleaning equipment for municipal and commercial applications. Technology adoption follows patterns established in municipal equipment, where reliability and durability drive procurement decisions and operational deployment.

Market Intelligence Brief:

Germany establishes technology leadership through comprehensive municipal programs and advanced infrastructure maintenance development, integrating sewer cleaning hoses across municipal and commercial applications. The country's 2.8% growth rate reflects established municipal system relationships and mature cleaning technology adoption that supports widespread use of professional cleaning systems in municipal and facility maintenance operations. Growth concentrates in major urban centers, including Baden-Württemberg, Bavaria, and North Rhine-Westphalia, where municipal technology showcases advanced cleaning deployment that appeals to municipal operators seeking proven maintenance capabilities and operational efficiency applications.

German equipment providers leverage established distribution networks and comprehensive service capabilities, including training programs and maintenance support that create customer relationships and operational advantages. The market benefits from mature municipal standards and sanitation requirements that mandate cleaning system use while supporting technology advancement and operational optimization.

Market Intelligence Brief:

Brazil's market expansion benefits from diverse municipal demand, including infrastructure modernization in São Paulo and Rio de Janeiro, municipal facility upgrades, and government sanitation programs that increasingly incorporate cleaning solutions for maintenance optimization applications. The country maintains a 2.5% growth rate, driven by rising urbanization activity and increasing recognition of professional cleaning benefits, including infrastructure longevity and enhanced sanitation effectiveness.

Market dynamics focus on cost-effective cleaning solutions that balance advanced operational performance with affordability considerations important to Brazilian municipal operators. Growing urban infrastructure creates continued demand for modern cleaning systems in new facility infrastructure and maintenance modernization projects.

Strategic Market Considerations:

United States establishes established market position through comprehensive municipal programs and advanced infrastructure maintenance development, integrating sewer cleaning hoses across municipal and commercial applications. The country's 2.3% growth rate reflects mature municipal system relationships and established cleaning technology adoption that supports widespread use of professional cleaning systems in municipal and facility maintenance operations. Growth concentrates in major metropolitan centers, including the Northeast, Midwest, and West Coast regions, where municipal technology showcases mature cleaning deployment that appeals to municipal operators seeking proven maintenance capabilities and operational efficiency applications.

American equipment providers leverage established distribution networks and comprehensive service capabilities, including safety training and compliance support that create customer relationships and operational advantages. The market benefits from mature sanitation standards and maintenance requirements that mandate cleaning system use while supporting technology advancement and infrastructure care.

Market Intelligence Brief:

United Kingdom's municipal technology market demonstrates sewer cleaning hose deployment with documented operational effectiveness in municipal applications and commercial facilities through integration with existing maintenance systems and infrastructure equipment. The country leverages maintenance expertise in municipal technology and equipment integration to maintain a 2.0% growth rate. Urban centers, including London, Manchester, and Birmingham, showcase installations where cleaning systems integrate with comprehensive maintenance platforms and facility management systems to optimize infrastructure operations and sanitation effectiveness.

British municipal providers prioritize system durability and compliance in cleaning equipment procurement, creating demand for reliable systems with advanced features, including facility monitoring integration and operational safety systems. The market benefits from established municipal technology infrastructure and a commitment to invest in maintenance technologies that provide operational benefits and compliance with national sanitation standards.

Market Intelligence Brief:

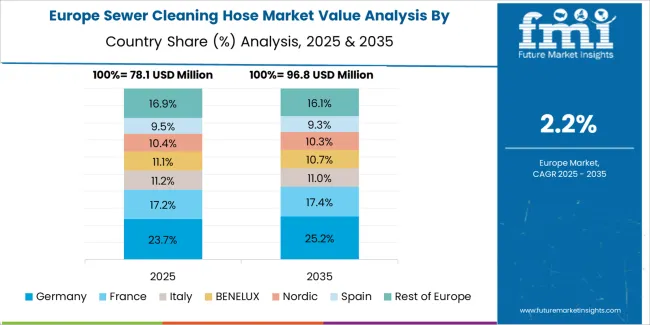

The European sewer cleaning hose market is projected to grow from USD 116.8 million in 2025 to USD 155.2 million by 2035, registering a CAGR of 2.9% over the forecast period. Germany is expected to maintain its leadership position with a 32.4% market share in 2025, supported by its advanced municipal infrastructure and comprehensive maintenance technology adoption.

France follows with a 23.6% share in 2025, driven by municipal modernization initiatives and infrastructure maintenance requirements. The United Kingdom holds a 18.9% share through established municipal networks and sanitation standards. Italy commands a 13.7% share, while Spain accounts for 8.2% in 2025. The rest of Europe region is anticipated to gain momentum, expanding its collective share from 3.2% to 4.1% by 2035, attributed to increasing municipal adoption in Nordic countries and emerging Eastern European facilities implementing infrastructure modernization programs.

Japan demonstrates advanced infrastructure maintenance in sewer cleaning hoses with comprehensive deployment across municipal facilities and commercial properties. The country maintains steady growth through infrastructure quality emphasis and maintenance precision requirements that support adoption of professional cleaning systems. Japanese municipal facilities prioritize durability and reliability in cleaning equipment procurement, creating consistent demand for premium systems with advanced material capabilities. Market characteristics include high adoption rates in urban municipal centers, established maintenance standards, and integration with comprehensive infrastructure management systems that optimize cleaning workflows and sanitation programs.

South Korea establishes municipal innovation leadership through rapid adoption of advanced maintenance technologies and comprehensive infrastructure modernization programs. The country leverages technology infrastructure and urban development initiatives to support sewer cleaning hose deployment across major municipal networks and commercial facilities. Korean municipal facilities emphasize operational efficiency and system durability, driving demand for high-performance systems with advanced material construction. Market growth benefits from government infrastructure investment, technology-focused procurement standards, and increasing emphasis on sanitation maintenance that position South Korea as a leading market for advanced cleaning solutions.

The sewer cleaning hose market maintains a moderately fragmented structure with 15-22 credible players, where the top 4-5 companies hold approximately 55-62% market share by revenue. Leadership is maintained through comprehensive product portfolios spanning multiple pressure ratings and hose configurations, established distributor relationships, and regional service networks that provide technical support, custom fabrication, and replacement programs. Market leaders differentiate through material innovation combining advanced polymer technologies with reinforced construction methods, while also offering integrated solutions that include couplings, nozzles, and cleaning accessories for complete system compatibility.

Basic hose construction and standard pressure ratings are commoditizing, shifting competitive advantage toward value-added services including custom length fabrication, specialized coating applications, and comprehensive maintenance programs. Margin opportunities concentrate in premium material segments with extended durability characteristics, specialized applications requiring custom engineering, and service contracts that provide scheduled replacement and inspection support. Companies investing in advanced polymer research and abrasion-resistant technologies position themselves for premium market segments, while those focusing on cost-effective manufacturing and efficient distribution capture growth in price-sensitive municipal and commercial applications.

Strategic partnerships between hose manufacturers and cleaning equipment providers create integrated offerings that simplify procurement and ensure compatibility. The competitive landscape reveals increasing emphasis on total system solutions rather than standalone hose products, with successful players offering comprehensive packages that address diverse cleaning needs across municipal, commercial, and residential applications. Material advancement in thermoplastic and rubber compounds creates differentiation opportunities, while established distribution networks and technical support capabilities remain fundamental requirements for market participation across developed municipal systems.

| Stakeholder | What they actually control | Typical strengths | Typical blind spots |

|---|---|---|---|

| Global platforms | Distribution reach, comprehensive product catalogs, service networks | Broad availability, proven reliability, multi-region support | Innovation speed; emerging market pricing flexibility |

| Technology innovators | Material R&D; advanced polymers; specialized coatings | Latest material technologies; attractive durability and performance | Distribution density outside core regions; price competitiveness |

| Regional specialists | Local compliance, rapid delivery, custom fabrication | Close customer relationships; pragmatic pricing; local standards | Technology gaps; scaling limitations |

| Service-focused ecosystems | Maintenance programs, inspection support, replacement services | Lowest operational disruption; comprehensive support | Service costs if overpromised; technology advancement |

| Niche specialists | Specialized applications, custom solutions, industrial cleaning | Win specialized and custom applications; flexible configurations | Scalability limitations; narrow market focus |

| Item | Value |

|---|---|

| Quantitative Units | USD 324 million |

| Hose Type | Lateral Line Hose, Mainline Hose, Others |

| Application | Commercial, Municipal, Residential, Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East & Africa |

| Countries Covered | United States, China, Germany, India, United Kingdom, Japan, Brazil, France, South Korea, Canada, and 25+ additional countries |

| Key Companies Profiled | Piranha, Parker Hannifin, Trelleborg, Unisource Manufacturing, Harben, SHPI, Poly-Flow, Integraflex, Jet-Vac Equipment Company, Sinopulse Hose Factory, Dultmeier Sales, Benz Hydraulics |

| Additional Attributes | Dollar sales by hose type and application categories, regional adoption trends across East Asia, South Asia Pacific, and Western Europe, competitive landscape with municipal equipment manufacturers and commercial cleaning suppliers, municipal operator preferences for durability and pressure performance, integration with cleaning equipment and maintenance systems, innovations in material technology and reinforcement enhancement, and development of advanced cleaning solutions with enhanced performance and infrastructure maintenance optimization capabilities. |

The global sewer cleaning hose market is estimated to be valued at USD 324.0 million in 2025.

The market size for the sewer cleaning hose market is projected to reach USD 410.7 million by 2035.

The sewer cleaning hose market is expected to grow at a 2.4% CAGR between 2025 and 2035.

The key product types in sewer cleaning hose market are lateral line hose, mainline hose and others.

In terms of application, commercial segment to command 45.0% share in the sewer cleaning hose market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cleaning Robot Market Size and Share Forecast Outlook 2025 to 2035

Cleaning In Place Market Growth - Trends & Forecast 2025 to 2035

Cleaning and Hygiene Product Market Report – Demand & Trends 2024-2034

Wet Cleaning Ozone Water System Market Size and Share Forecast Outlook 2025 to 2035

Dry Cleaning Solvents Market Size and Share Forecast Outlook 2025 to 2035

GMP Cleaning Services Market Analysis Size and Share Forecast Outlook 2025 to 2035

Dry-Cleaning and Laundry Services Market Growth, Trends and Forecast from 2025 to 2035

Self-Cleaning Bottle Market Analysis - Trends, Growth & Forecast 2025 to 2035

Hand Cleaning Accessories Market

Floor Cleaning and Mopping Machine Market Size and Share Forecast Outlook 2025 to 2035

Cable Cleaning Solutions Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cable Cleaning Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Wafer Cleaning Equipment Market Growth - Trends & Forecast 2025 to 2035

Drain Cleaning Equipment Market Growth - Trends & Forecast 2025 to 2035

Medical Cleaning Devices Market Overview - Trends & Forecast 2025 to 2035

Thermal Cleaning System Market Growth - Trends & Forecast 2025 to 2035

Document Cleaning Powder Market Size and Share Forecast Outlook 2025 to 2035

Air Duct Cleaning Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cleaning Chemicals Market 2025-2035

Wellbore Cleaning Tool Market Size, Share, Trend & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA