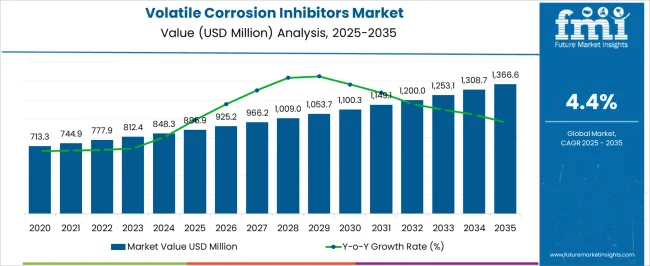

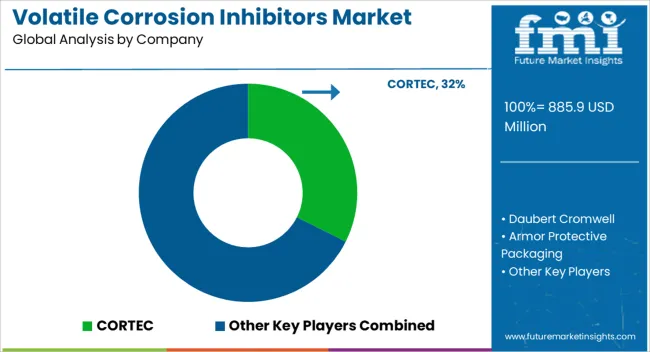

The Volatile Corrosion Inhibitors Market is estimated to be valued at USD 885.9 million in 2025 and is projected to reach USD 1366.6 million by 2035, registering a compound annual growth rate (CAGR) of 4.4% over the forecast period.

| Metric | Value |

|---|---|

| Volatile Corrosion Inhibitors Market Estimated Value in (2025 E) | USD 885.9 million |

| Volatile Corrosion Inhibitors Market Forecast Value in (2035 F) | USD 1366.6 million |

| Forecast CAGR (2025 to 2035) | 4.4% |

The Volatile Corrosion Inhibitors market is being driven by the growing demand for corrosion protection solutions across various industries, particularly in sectors where metal assets are exposed to moisture, salts, and other corrosive elements. The current market scenario is shaped by the rising awareness of asset longevity, cost-saving maintenance, and regulatory requirements focused on reducing environmental impact. Increasing investments in automotive, aerospace, and heavy machinery industries are supporting the adoption of corrosion inhibitors as essential components for preventive maintenance strategies.

The future outlook for the market is expected to be shaped by innovations in inhibitor formulations that provide extended protection and lower toxicity. Furthermore, growing concerns over equipment downtime, safety risks, and repair costs are encouraging industries to integrate advanced corrosion control systems.

Sustainable formulations that reduce hazardous waste and enhance operational efficiency are also being prioritized With the rapid expansion of infrastructure projects and increased production capacity in emerging markets, the Volatile Corrosion Inhibitors market is poised for sustained growth, driven by the need for reliable, efficient, and environmentally friendly corrosion management solutions.

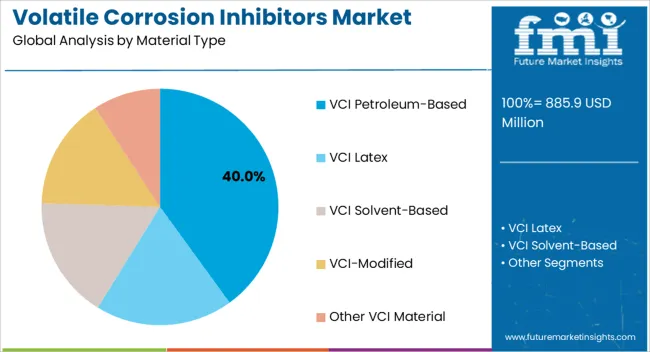

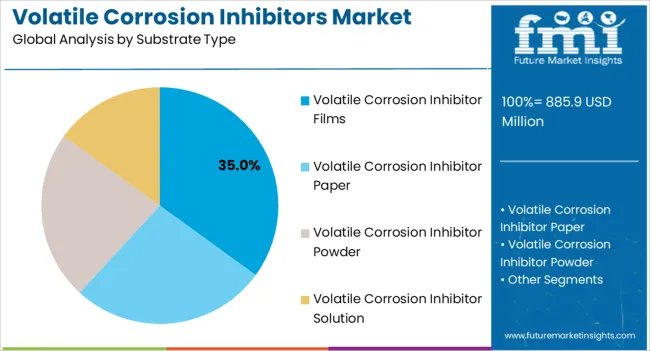

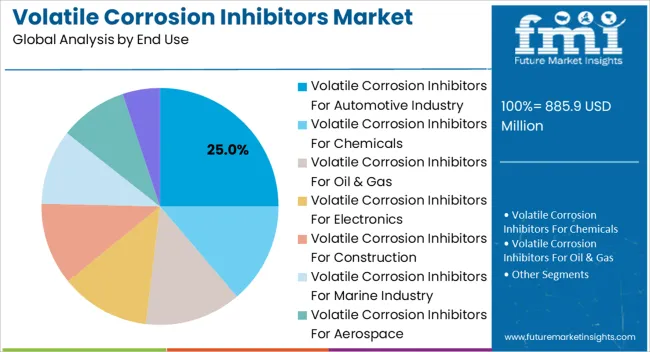

The volatile corrosion inhibitors market is segmented by material type, substrate type, end use, and geographic regions. By material type, volatile corrosion inhibitors market is divided into VCI Petroleum-Based, VCI Latex, VCI Solvent-Based, VCI-Modified, and Other VCI Material. In terms of substrate type, volatile corrosion inhibitors market is classified into Volatile Corrosion Inhibitor Films, Volatile Corrosion Inhibitor Paper, Volatile Corrosion Inhibitor Powder, and Volatile Corrosion Inhibitor Solution. Based on end use, volatile corrosion inhibitors market is segmented into Volatile Corrosion Inhibitors For Automotive Industry, Volatile Corrosion Inhibitors For Chemicals, Volatile Corrosion Inhibitors For Oil & Gas, Volatile Corrosion Inhibitors For Electronics, Volatile Corrosion Inhibitors For Construction, Volatile Corrosion Inhibitors For Marine Industry, Volatile Corrosion Inhibitors For Aerospace, and Volatile Corrosion Inhibitors For Mining & Metallurgy. Regionally, the volatile corrosion inhibitors industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The VCI petroleum-based material type is expected to hold 40.00% of the Volatile Corrosion Inhibitors market revenue share in 2025, making it the largest segment by material type. This leading position has been attributed to its proven efficiency in providing long-term corrosion protection, especially in harsh environmental conditions. The petroleum-based formulations have been widely used because of their ability to form stable vapor-phase barriers that prevent moisture and corrosive agents from reaching metal surfaces.

These inhibitors are considered cost-effective and are easily integrated into existing manufacturing processes without the need for significant modifications. The growth of this segment has been supported by increasing adoption in industries that rely on heavy equipment and metal assets, such as automotive, aerospace, and defense.

Additionally, regulatory frameworks encouraging preventive maintenance and reduced repair costs have further bolstered the use of petroleum-based corrosion inhibitors The ability to provide consistent performance under fluctuating conditions has made this segment highly preferred, and future growth is expected as industries continue to focus on extending the life span of their assets while controlling maintenance expenses.

The Volatile Corrosion Inhibitor films substrate type is projected to account for 35.00% of the Volatile Corrosion Inhibitors market revenue share in 2025, establishing it as the dominant substrate type. This position has been attributed to the growing need for packaging solutions that provide passive corrosion protection without direct contact with metal surfaces. The films are increasingly being utilized in sectors such as automotive, electronics, and industrial equipment, where sensitive metal parts require protection during storage and transit.

The growth of this segment has been supported by the ability of these films to release protective vapors in enclosed spaces, effectively preventing corrosion even in environments with high humidity or temperature fluctuations. The adoption of such films is also being driven by the shift toward environmentally friendly and user-safe formulations that reduce the need for liquid-based coatings.

The ease of application, compatibility with automated packaging systems, and minimal maintenance requirements have further encouraged their integration As global supply chains expand and asset protection becomes a key concern, the volatile corrosion inhibitor films segment is expected to maintain its leadership by offering efficient, low-cost, and sustainable corrosion prevention solutions.

The Volatile Corrosion Inhibitors for the automotive industry segment is anticipated to hold 25.00% of the Volatile Corrosion Inhibitors market revenue share in 2025, marking it as the largest end-use segment. This leadership has been supported by the growing need for corrosion protection in automotive manufacturing, where metal components are exposed to moisture, road salts, and varying climatic conditions. The segment’s growth has been further encouraged by the increasing production of electric and hybrid vehicles, which require advanced corrosion management solutions for battery enclosures and lightweight metal structures.

Automotive manufacturers are being compelled to reduce maintenance and warranty costs while improving product longevity, making corrosion inhibitors an essential part of design and supply chain strategies. The adoption of inhibitors that can be seamlessly integrated into packaging and assembly lines has provided added value by reducing downtime and enhancing operational efficiency.

Furthermore, industry focus on sustainability and regulatory compliance has prompted manufacturers to select formulations that are both effective and environmentally responsible The combination of rising vehicle production, stricter safety standards, and the pursuit of durable and lightweight designs is expected to sustain the growth of this segment in the coming years.

“Corrosion is an irreversible phenomenon of metals with its environment that results in consumption of the metal or its dissolution into the material of a component of the environment," according to the International Union of Pure and Applied Chemistry. Corrosion of metals can be defined as the surface disintegration of metals or alloys within a specific environment. Some metals have a high corrosion resistance due to a variety of factors such as the nature of the chemical reaction, chemical constituents, and others.

Corrosion is a critical industrial issue that affects metals and causes direct and indirect economic loss. There are several methods for preventing corrosion, including protective coating, galvanization, cathodic protection, and corrosion inhibitors. Among all of these methods, volatile corrosion inhibitors are the most commonly used for temporary metal protection. Volatile corrosion inhibitors are corrosion inhibitors that are applied to ferrous or non-ferrous metals. Volatile corrosion inhibitors are a novel corrosion protection method in which the organic or inorganic chemical compounds that protect the metal surface disperse and condense on the metal surface, making it less corrosive. In general, volatile corrosion inhibitors are used when surface protective treatment appears ineffective. Volatile corrosion inhibitors are preferred in industries such as offshore drilling, storage tanks, automotive underbodies, and naval vessels, petrochemical and chemical.

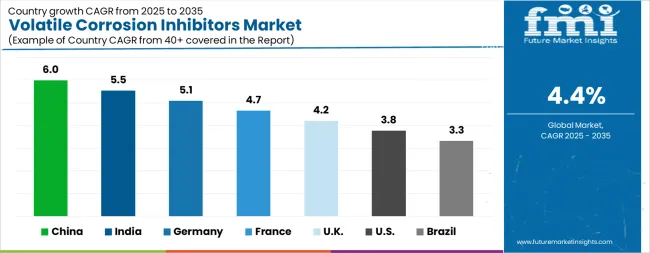

| Country | CAGR |

|---|---|

| China | 6.0% |

| India | 5.5% |

| Germany | 5.1% |

| France | 4.7% |

| UK | 4.2% |

| USA | 3.8% |

| Brazil | 3.3% |

The Volatile Corrosion Inhibitors Market is expected to register a CAGR of 4.4% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 6.0%, followed by India at 5.5%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 3.3%, yet still underscores a broadly positive trajectory for the global Volatile Corrosion Inhibitors Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 5.1%. The USA Volatile Corrosion Inhibitors Market is estimated to be valued at USD 308.9 million in 2025 and is anticipated to reach a valuation of USD 447.1 million by 2035. Sales are projected to rise at a CAGR of 3.8% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 41.8 million and USD 25.0 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 885.9 Million |

| Material Type | VCI Petroleum-Based, VCI Latex, VCI Solvent-Based, VCI-Modified, and Other VCI Material |

| Substrate Type | Volatile Corrosion Inhibitor Films, Volatile Corrosion Inhibitor Paper, Volatile Corrosion Inhibitor Powder, and Volatile Corrosion Inhibitor Solution |

| End Use | Volatile Corrosion Inhibitors For Automotive Industry, Volatile Corrosion Inhibitors For Chemicals, Volatile Corrosion Inhibitors For Oil & Gas, Volatile Corrosion Inhibitors For Electronics, Volatile Corrosion Inhibitors For Construction, Volatile Corrosion Inhibitors For Marine Industry, Volatile Corrosion Inhibitors For Aerospace, and Volatile Corrosion Inhibitors For Mining & Metallurgy |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | CORTEC, Daubert Cromwell, Armor Protective Packaging, Oji F-Tex, Branopac, Protective Packaging Corporation, Zerust, and Transilwrap (Metpro) |

The global volatile corrosion inhibitors market is estimated to be valued at USD 885.9 million in 2025.

The market size for the volatile corrosion inhibitors market is projected to reach USD 1,366.6 million by 2035.

The volatile corrosion inhibitors market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in volatile corrosion inhibitors market are vci petroleum-based, vci latex, vci solvent-based, vci-modified and other vci material.

In terms of substrate type, volatile corrosion inhibitor films segment to command 35.0% share in the volatile corrosion inhibitors market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Volatile Corrosion Inhibitors (VCI) Packaging Market Insights - Growth & Demand 2025 to 2035

Volatile Corrosion Inhibitor Bags Market Analysis by Zipper Bags, Gusset Bags and Flat Bags Through 2035

Corrosion Inhibitors Market Growth - Trends & Forecast 2025 to 2035

Ballast Tank Corrosion Inhibitors Market

Corrosion Resistant Resin Market Size and Share Forecast Outlook 2025 to 2035

Volatile Organic Compound Gas Sensor Market Size and Share Forecast Outlook 2025 to 2035

Volatile Organic Compound (VOC) Detector Market Size and Share Forecast Outlook 2025 to 2035

Corrosion Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Corrosion Protection Coatings & Acid Proof Lining Market Growth - Trends & Forecast 2025 to 2035

Corrosion Protection Tape Market Growth – Forecast 2024-2034

CUI & SOI Coating Market Growth – Trends & Forecast 2024-2034

Corrosion Protection Polymer Coating Market 2022 to 2032

Corrosion Protection Rubber Linings Market 2022 to 2032

Non-volatile Dual In-line Memory Module (NVDIMM) Market Analysis - Growth & Forecast 2025 to 2035

FcRn Inhibitors Market Size and Share Forecast Outlook 2025 to 2035

Anti-corrosion Bags Market Size and Share Forecast Outlook 2025 to 2035

Anti-corrosion Coatings Market Size and Share Forecast Outlook 2025 to 2035

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

SGLT2 Inhibitors Market Size and Share Forecast Outlook 2025 to 2035

SGLT2 Inhibitors Treatment Market Overview – Trends & Growth 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA