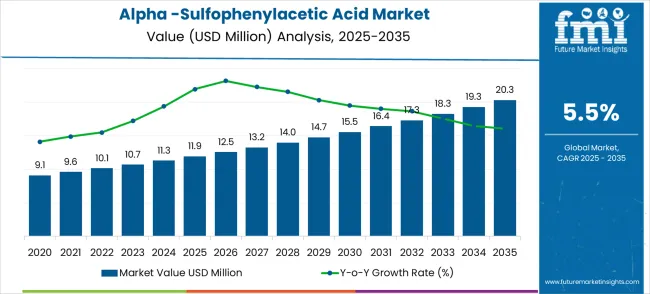

The alpha-sulfophenylacetic acid market is expected to grow from USD 11.9 million in 2025 to USD 20.3 million by 2035, reflecting a CAGR of 5.5%. Peak-to-trough analysis highlights fluctuations in growth intensity and revenue accumulation across the decade, offering insight into periods of accelerated adoption versus slower expansion. From 2025 to 2028, the market experiences an early peak phase, driven by rising industrial demand in the pharmaceutical and chemical sectors. During this period, increasing adoption for use in drug formulations, synthesis processes, and specialty chemical applications contributes to relatively higher growth rates, establishing a strong revenue base.

Following the initial peak, the market enters a trough period from 2028 to 2031, characterized by moderate growth due to market stabilization and slower adoption in regions where regulatory approvals and production scaling create temporary limitations. During this phase, companies focus on process optimization, cost efficiency, and incremental product improvements, which sustain steady but slower revenue growth. From 2031 to 2035, the market rebounds toward a second peak as broader adoption, enhanced production techniques, and expansion into emerging markets accelerate growth once again. This cyclical pattern of peaks and troughs provides stakeholders with actionable insights for strategic planning, including timing for capacity expansion, R&D investment, and market entry initiatives to maximize returns and maintain competitive positioning across the decade.

The market is segmented across pharmaceutical manufacturing (38%), cosmetic and personal care formulations (25%), chemical research and laboratories (16%), agrochemical production (12%), and specialty applications including food additives and analytical reagents (9%). Pharmaceutical manufacturing dominates adoption due to α-SPA’s role as an intermediate in drug synthesis and enzyme inhibitors. Cosmetic and personal care applications leverage it for mild surfactants and pH stabilization. Chemical research facilities utilize α-SPA in experimental reactions and as a standard reference compound. Agrochemical manufacturers incorporate it in herbicides, insecticides, and plant growth regulators. Specialty applications focus on functional ingredients and analytical assays where precision and consistency are critical.

Recent trends include high-purity synthesis techniques, improved solubility, and eco-friendly production processes. Manufacturers are innovating with customized derivatives and multi-functional intermediates for targeted applications. Expansion is driven by growing pharmaceutical pipelines, cosmetic formulation demands, and agrochemical innovations. Partnerships between chemical suppliers and end-use industries enable tailored solutions for performance, consistency, and regulatory compliance, promoting steady global market growth.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 11.9 million |

| Market Forecast Value (2035) | USD 20.3 million |

| Forecast CAGR (2025-2035) | 5.5% |

The Alpha-Sulfophenylacetic Acid market grows by enabling pharmaceutical manufacturers to produce essential antibiotic intermediates required for beta-lactam antibiotic synthesis. The pharmaceutical industry faces increasing demand for generic antibiotics, with global antibiotic consumption projected to increase by 200% through 2030, creating sustained demand for high-quality chemical intermediates. The expansion of pharmaceutical manufacturing in emerging markets, particularly India and China, drives the adoption of cost-effective intermediate chemicals that meet international quality standards. Growing emphasis on antibiotic resistance management creates demand for specialized antibiotic formulations requiring specific intermediate compounds.

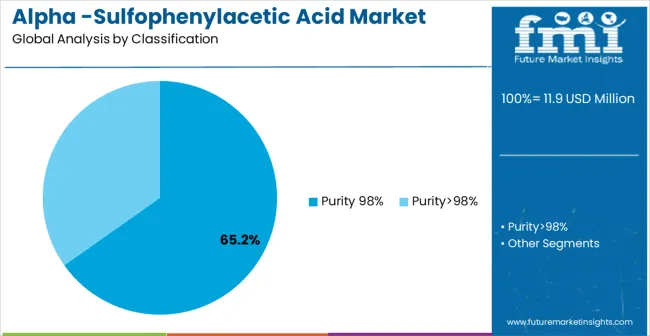

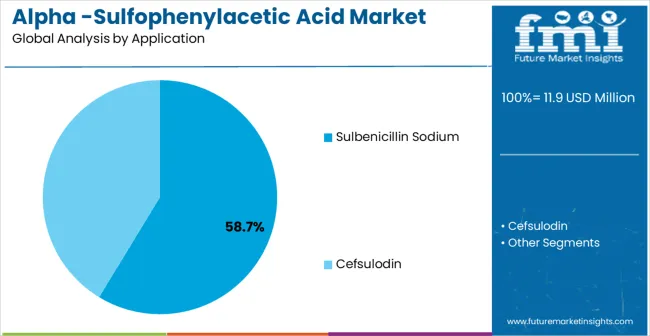

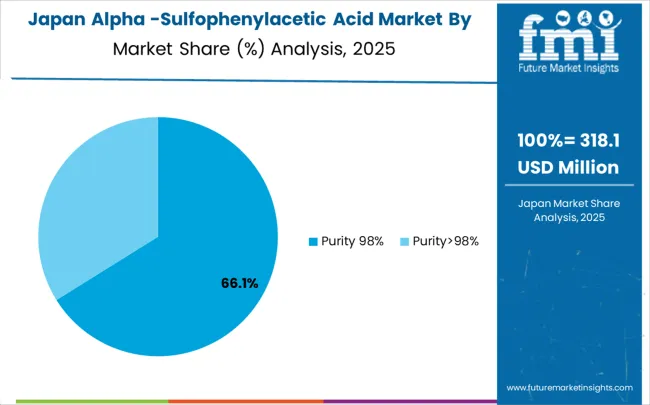

The market is segmented by Purity Level, Application, and region. By Purity Level, the market is divided into Purity 98% and Purity>98%. Based on the Application, the market is categorized into Sulbenicillin Sodium and Cefsulodin. Regionally, the market is divided into North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa.

Purity 98% grade is projected to account for the largest share of the Alpha-Sulfophenylacetic Acid market in 2025, commanding approximately 65.2% market share. This dominant position is supported by the grade's optimal balance between quality requirements and cost-effectiveness for pharmaceutical intermediate applications. The segment allows for stakeholders to benefit from consistent quality standards that meet most pharmaceutical manufacturing requirements while maintaining competitive pricing for large-volume production runs.

Key advantages include:

Sulbenicillin Sodium applications are expected to represent the dominant share of Alpha-Sulfophenylacetic Acid applications in 2025, holding approximately 58.7% market share. This leading position reflects the critical role of alpha-sulfophenylacetic acid as a key intermediate in sulbenicillin sodium synthesis, a beta-lactam antibiotic used for treating bacterial infections. The segment provides essential raw material support for antibiotic manufacturing, where precise chemical composition directly impacts drug efficacy and safety profiles. Growth drivers include increasing global demand for generic antibiotics, expanding pharmaceutical manufacturing capacity in emerging markets, and the need for reliable intermediate supply chains.

Key market dynamics include:

The market is driven by three concrete demand factors tied to pharmaceutical production requirements. The generic drug manufacturing expansion creates sustained demand for cost-effective pharmaceutical intermediates, with global generic drug market growth of 7.2% annually driving intermediate chemical consumption. The antibiotic production requirements in emerging markets, particularly India and China, generate volume demand for specialized chemical intermediates supporting local pharmaceutical manufacturing capabilities. The regulatory compliance standards for pharmaceutical intermediates create a preference for established suppliers with proven quality management systems and regulatory track records.

Market restraints include stringent quality requirements that demand significant investment in manufacturing infrastructure and quality control systems, potentially limiting market entry for smaller chemical manufacturers. Regulatory compliance complexity poses another important challenge, as pharmaceutical intermediate manufacturing requires extensive documentation, validation, and ongoing monitoring to meet international pharmaceutical standards. Raw material availability and pricing volatility create potential supply chain disruptions, particularly for specialized chemical precursors required for alpha-sulfophenylacetic acid synthesis.

Key trends indicate accelerated adoption in Asia-Pacific markets, particularly China and India, where pharmaceutical manufacturing expansion and cost-competitive production capabilities drive market growth. Manufacturing shifts toward improved synthesis methods, enhanced purification processes, and automated quality control systems enable producers to meet evolving pharmaceutical industry requirements while maintaining cost competitiveness. The market thesis could face disruption if alternative synthetic routes or innovative manufacturing processes significantly reduce production costs or improve the quality characteristics of competing pharmaceutical intermediates.

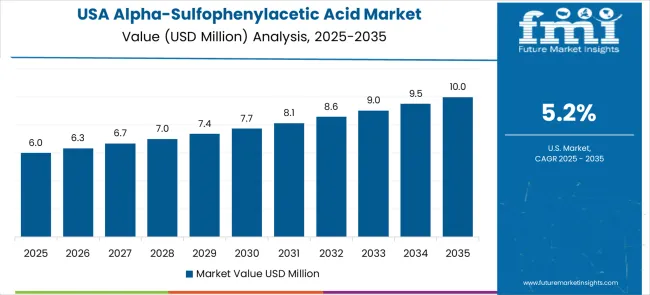

| Country | CAGR (2025-2035) |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| Brazil | 5.8% |

| USA | 5.2% |

| UK | 4.7% |

| Japan | 4.1% |

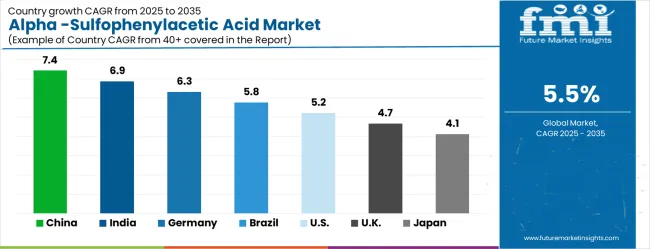

The alpha-sulfophenylacetic acid market is experiencing steady expansion worldwide, with China leading the growth trajectory through pharmaceutical manufacturing expansion and cost-competitive production capabilities. India follows closely, benefiting from generic drug manufacturing growth and established chemical intermediate production infrastructure. Germany demonstrates solid growth potential through its advanced pharmaceutical industry and stringent quality standards. Brazil shows promising development in pharmaceutical manufacturing and chemical production capabilities. The USA maintains moderate growth through established pharmaceutical manufacturing and regulatory compliance requirements, while the UK and Japan continue to record consistent progress in specialized pharmaceutical applications. Together, China and India anchor the global expansion story, while developed markets provide stability and quality leadership.

The report covers an in-depth analysis of 40+ countries, Top-performing countries are highlighted below.

The alpha-sulfophenylacetic acid market in China is growing at a CAGR of 7.4%, above the global average of 5.7%. Growth is driven by the chemical, pharmaceutical, and agricultural sectors, which use it for herbicides, intermediates, and specialty chemicals. Industrial clusters integrate advanced production systems to improve purity, yield, and consistency. Pilot programs demonstrate optimized reaction times and reduced waste. Suppliers focus on scalable and energy-efficient processes to meet growing domestic and export demand. Regulatory frameworks promoting high-quality chemical production support market expansion. Rising research initiatives in fine chemicals and agrochemicals further accelerate adoption.

India is projected to grow at a CAGR of 6.9%, above the global average. Expansion is supported by pharmaceutical, agrochemical, and specialty chemical industries seeking high-purity intermediates. Alpha-sulfophenylacetic acid is used to enhance product efficacy and consistency. Industrial clusters implement optimized production processes to improve efficiency and reduce operational costs. Pilot programs demonstrate better yield and faster reaction cycles. Suppliers provide cost-effective and reliable systems suitable for medium and large-scale operations. Increasing domestic demand for pharmaceuticals and agrochemicals drives market growth.

Germany grows at a CAGR of 6.3%, above the global average. Growth is driven by specialty chemical, pharmaceutical, and agrochemical sectors requiring high-quality intermediates. Alpha-sulfophenylacetic acid is used in fine chemicals, herbicides, and research applications. Suppliers provide energy-efficient and environmentally compliant production processes. Pilot installations demonstrate reduced chemical waste and optimized yields. Industrial clusters implement automated systems for precision chemical manufacturing. Research initiatives focus on improving reaction efficiency and reducing energy consumption. Strict quality and environmental standards support the adoption of advanced production technologies.

The Brazilian market grows at a CAGR of 5.8%, slightly above the global average. Growth is fueled by the agrochemical and chemical manufacturing sectors requiring high-purity intermediates for herbicides and specialty chemicals. Industrial clusters integrate optimized production systems to improve efficiency and maintain product quality. Pilot programs demonstrate improved yield and reduced operational costs. Suppliers provide durable and scalable equipment suitable for medium to large operations. Expansion in agriculture and chemical research initiatives drives gradual market adoption. Local distributors offer technical support to ensure effective utilization in diverse production environments.

The United States grows at a CAGR of 5.2%, slightly below the global average. Slower growth is influenced by a mature chemical industry with existing high-efficiency production systems. Alpha-sulfophenylacetic acid is applied in pharmaceuticals, specialty chemicals, and agrochemical research to improve product consistency. Suppliers provide reliable and precise production systems for small to large-scale operations. Pilot programs demonstrate optimized reaction times and reduced material loss. Industrial hubs integrate chemical intermediates into automated production lines. Research initiatives focus on improving energy efficiency and process safety.

The UK market grows at a CAGR of 4.7%, below the global average. Growth is moderated by a mature chemical sector with established production methods. Alpha-sulfophenylacetic acid is used in pharmaceuticals, specialty chemicals, and agrochemical formulations. Suppliers provide compact and precise production systems for small and medium-scale operations. Pilot programs demonstrate improved yields and reduced chemical waste. Industrial clusters adopt automated systems to maintain consistency. Adoption is increasing in research and specialized production facilities. Quality and environmental compliance standards drive careful integration of new processes.

Japan grows at a CAGR of 4.1%, below the global average. Slower growth is influenced by a mature chemical industry with established high-purity production methods. Alpha-sulfophenylacetic acid is applied in pharmaceutical intermediates, specialty chemicals, and herbicides. Suppliers provide precise, durable, and energy-efficient systems. Pilot programs demonstrate optimized reaction efficiency and reduced waste. Industrial clusters integrate intermediates into automated chemical processes. R&D initiatives focus on minimizing energy consumption and improving process control for high-value applications.

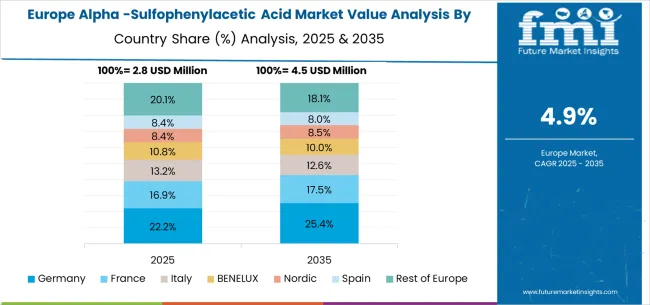

The European Alpha-Sulfophenylacetic Acid market is projected to grow from USD 2.8 million in 2025 to USD 4.6 million by 2035, registering a CAGR of 5.1% over the forecast period. Germany is expected to maintain its leadership position with a 28.6% market share in 2025, projected to reach 29.2% by 2035, supported by its advanced pharmaceutical manufacturing infrastructure and stringent quality standards.

France follows with a 21.4% share in 2025, expected to reach 21.8% by 2035, driven by pharmaceutical manufacturing capabilities and established chemical intermediate supply chains. The United Kingdom holds a 19.3% share in 2025, projected to maintain 19.1% by 2035 due to stable pharmaceutical production requirements. Italy commands a 14.7% share, while Spain accounts for 10.2% in 2025. The Rest of Europe region is anticipated to maintain a steady contribution, holding its collective share at approximately 6.4% through 2035, attributed to consistent pharmaceutical manufacturing activities in Nordic countries and Eastern European chemical production capabilities.

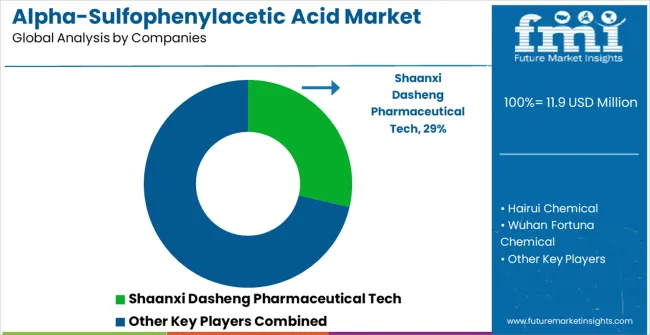

The Alpha-Sulfophenylacetic Acid market features approximately 10-15 meaningful players with moderate concentration, where the top four companies control roughly 60-65% of global market share through established manufacturing capabilities, quality certifications, and pharmaceutical industry relationships. Competition centers on quality consistency, regulatory compliance, and reliable supply chain management rather than price competition alone.

Market leaders include Shaanxi Dasheng Pharmaceutical Tech and Hairui Chemical, which maintain competitive advantages through comprehensive quality management systems, pharmaceutical-grade manufacturing facilities, and established customer relationships with pharmaceutical manufacturers. These companies leverage proven manufacturing processes and regulatory compliance records to defend market positions while expanding into emerging pharmaceutical markets.

Challengers encompass Wuhan Fortuna Chemical and Dingxing Tong, which compete through specialized manufacturing capabilities and focus on specific pharmaceutical intermediate applications. These companies offer differentiated value propositions through customized synthesis services, flexible production capabilities, and regional market expertise in key pharmaceutical manufacturing centers.

Regional players and emerging chemical manufacturers create competitive pressure through cost-effective production methods and rapid response capabilities, particularly in high-growth markets including China and India, where local manufacturing provides advantages in customer service and logistics efficiency. Market dynamics favor companies that combine advanced chemical synthesis capabilities with comprehensive quality assurance systems and established pharmaceutical industry relationships, addressing the complete supply chain from raw materials through pharmaceutical-grade intermediate delivery.

Alpha-sulfophenylacetic acid (ASPA) represents a critical pharmaceutical intermediate in the global antibiotic manufacturing ecosystem, primarily serving as a key building block for beta-lactam antibiotics, including sulbenicillin sodium and cefsulodin. With the market projected to grow from USD 11.9 million in 2025 to USD 20.3 million by 2035 at a 5.5% CAGR, scaling commercial viability requires coordinated action across regulatory bodies, chemical manufacturers, pharmaceutical companies, quality assurance organizations, and financial institutions to address the complex interplay of purity requirements, regulatory compliance, and supply chain reliability.

How Governments Could Accelerate Market Development?

Regulatory Harmonization: Establish streamlined approval pathways for pharmaceutical-grade chemical intermediates across major markets, reducing regulatory complexity for manufacturers seeking multi-jurisdictional compliance. Create mutual recognition agreements between the FDA, EMA, and other regulatory bodies to facilitate cross-border trade.

Manufacturing Incentives: Provide targeted tax credits and production-linked incentives for establishing pharmaceutical intermediate manufacturing facilities, particularly in strategic locations that reduce supply chain dependencies. Offer fast-track environmental clearances for facilities meeting pharmaceutical-grade quality standards.

R&D Support: Fund collaborative research programs between chemical manufacturers and pharmaceutical companies to develop improved synthesis methods, enhance purity levels beyond 98%, and reduce manufacturing costs. Support technology transfer initiatives that bring advanced chemical synthesis capabilities to emerging markets.

Quality Infrastructure: Invest in national testing and certification laboratories capable of validating pharmaceutical intermediate quality, ensuring domestic manufacturers can meet international standards. Establish centers of excellence for pharmaceutical chemistry that support both industry needs and regulatory oversight.

Strategic Stockpiling: Include critical pharmaceutical intermediates like ASPA in national strategic reserves to ensure antibiotic manufacturing continuity during supply chain disruptions, particularly given the concentration of production in China and India.

How Industry Bodies Could Strengthen Market Foundation?

Quality Standardization: Develop comprehensive analytical methods and specifications for ASPA purity grades, establishing industry-wide benchmarks for the critical 98% and >98% purity segments. Create standardized testing protocols for anti-nutritional factors, impurity profiles, and stability characteristics.

Supply Chain Transparency: Implement blockchain-based traceability systems that document ASPA from raw material sourcing through pharmaceutical manufacturing, enabling buyers to verify quality, provenance and regulatory compliance throughout the supply chain.

Technical Education: Establish training programs for pharmaceutical formulators on optimal ASPA integration in antibiotic synthesis, including dosing protocols, handling procedures, and quality control requirements specific to sulbenicillin sodium and cefsulodin production.

Market Intelligence: Develop real-time pricing indices and supply-demand forecasting tools that help pharmaceutical manufacturers optimize procurement strategies and chemical producers plan capacity investments based on antibiotic market trends.

Regulatory Advocacy: Coordinate industry positions on emerging pharmaceutical intermediate regulations, ensuring that quality requirements balance patient safety with commercial feasibility for the diverse range of global manufacturers.

How Chemical Manufacturers and Technology Providers Could Optimize the Ecosystem?

Advanced Synthesis Technologies: Deploy continuous flow chemistry and automated synthesis systems that achieve consistent >98% purity levels while reducing production costs. Develop modular manufacturing platforms that allow rapid scaling based on pharmaceutical demand fluctuations.

Quality Control Innovation: Implement real-time analytical monitoring systems using advanced spectroscopy and chromatography that ensure batch-to-batch consistency and detect impurities at sub-ppm levels required for pharmaceutical applications.

Supply Chain Integration: Create digital platforms that connect ASPA producers with pharmaceutical manufacturers, enabling just-in-time delivery, quality documentation sharing, and integrated inventory management across the antibiotic supply chain.

Sustainable Manufacturing: Develop green chemistry approaches that reduce solvent usage, minimize waste generation, and improve energy efficiency in ASPA synthesis, addressing pharmaceutical industry sustainability requirements while maintaining cost competitiveness.

Technical Support Services: Provide comprehensive application support, including stability studies, compatibility testing, and regulatory documentation assistance that accelerates ASPA adoption in new antibiotic formulations and manufacturing processes.

How Pharmaceutical Companies Could Navigate Supply Chain Optimization?

Strategic Sourcing: Develop multi-supplier strategies that balance cost optimization with quality assurance, establishing long-term partnerships with certified ASPA manufacturers in different geographic regions to mitigate supply chain risks.

Backward Integration: Evaluate opportunities for captive ASPA manufacturing or joint ventures with chemical producers, particularly for high-volume antibiotic production, where supply security and cost control provide competitive advantages.

Quality Partnerships: Implement vendor development programs that help ASPA suppliers achieve pharmaceutical-grade certifications and maintain continuous quality improvements aligned with evolving regulatory requirements.

Innovation Collaboration: Partner with chemical manufacturers on next-generation synthesis methods that improve ASPA functionality in antibiotic applications, reduce manufacturing costs, and enhance the therapeutic efficacy of final pharmaceutical products.

Regulatory Strategy: Develop comprehensive supplier qualification protocols that ensure ASPA sources meet FDA, EMA, and other regulatory requirements, including detailed documentation for drug master files and manufacturing change controls.

How Investors and Financial Enablers Could Unlock Market Value?

Manufacturing Infrastructure: Finance purpose-built pharmaceutical intermediate facilities with advanced quality control systems, particularly in regions with strong pharmaceutical manufacturing presence but limited chemical intermediate capacity.

Technology Ventures: Support startups developing breakthrough synthesis technologies, continuous manufacturing systems, and quality assurance innovations that could significantly improve ASPA production economics and quality characteristics.

Supply Chain Financing: Provide working capital solutions that enable pharmaceutical manufacturers to optimize inventory management while ensuring adequate ASPA availability for continuous antibiotic production requirements.

Market Consolidation: Back strategic acquisitions that create integrated ASPA-to-antibiotic manufacturing platforms, capturing value across the pharmaceutical supply chain while improving quality control and regulatory compliance.

Risk Mitigation Instruments: Develop specialized insurance products and hedging mechanisms that protect against ASPA price volatility, supply disruptions, and regulatory changes that could impact pharmaceutical manufacturing operations.

Asia-Pacific Focus: Leverage the region's 7.4% CAGR in China and 6.9% in India by supporting technology transfer initiatives, quality upgrade programs, and regulatory harmonization efforts that maintain cost advantages while meeting international pharmaceutical standards.

European Excellence: Capitalize on Germany's 6.3% growth and established pharmaceutical infrastructure by promoting advanced manufacturing technologies and regulatory leadership that set global quality benchmarks for pharmaceutical intermediates.

Americas Integration: Support Brazil's 5.8% growth potential and USA regulatory excellence by facilitating technology partnerships, supply chain integration, and manufacturing capability development that strengthens pharmaceutical supply chain resilience across both North and South America.

| Item | Value |

|---|---|

| Quantitative Units | USD 11.9 million |

| Purity Level | Purity 98%, Purity>98% |

| Application | Sulbenicillin Sodium, Cefsulodin |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, the USA, the UK, Japan, and 40+ countries |

| Key Companies Profiled | Shaanxi Dasheng Pharmaceutical Tech, Hairui Chemical, Wuhan Fortuna Chemical, Dingxing Tong |

| Additional Attributes | Dollar sales by purity level and application categories, regional adoption trends across Asia Pacific, North America, and Europe, competitive landscape with chemical manufacturers and pharmaceutical intermediates suppliers, customer preferences and quality requirements, integration with pharmaceutical manufacturing processes and supply chains, innovations in chemical synthesis and purification technologies, and development of specialized applications with antibiotic manufacturing capabilities. |

The global alpha -sulfophenylacetic acid market is estimated to be valued at USD 11.9 million in 2025.

The market size for the alpha -sulfophenylacetic acid market is projected to reach USD 20.3 million by 2035.

The alpha -sulfophenylacetic acid market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in alpha -sulfophenylacetic acid market are purity 98% and purity>98%.

In terms of application, sulbenicillin sodium segment to command 58.7% share in the alpha -sulfophenylacetic acid market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Acid Resistant Pipe Market Forecast and Outlook 2025 to 2035

Acid Coil Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Acid Filling and Leveling Machine Market Size and Share Forecast Outlook 2025 to 2035

Acid Chlorides Market Size and Share Forecast Outlook 2025 to 2035

Acid-Sensitive APIs Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Acidified Whey Protein Market Analysis - Size, Share & Trends 2025 to 2035

Acid Dyes Market Growth - Trends & Forecast 2025 to 2035

Acidity Regulator Market Growth - Trends & Forecast 2025 to 2035

Acid Proof Lining Market Trends 2025 to 2035

Acid Citrate Dextrose Tube Market Trends – Growth & Industry Outlook 2024-2034

Acid Orange Market

Antacids Market Analysis – Size, Trends & Forecast 2025 to 2035

Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Lead Acid Battery Recycling Market Size and Share Forecast Outlook 2025 to 2035

Feed Acidifier Market Analysis Size Share and Forecast Outlook 2025 to 2035

Food Acidulants Market Growth - Key Trends, Size & Forecast 2024 to 2034

Nylon Acid Dye Fixing Agent Market Size and Share Forecast Outlook 2025 to 2035

Boric Acid Market Forecast and Outlook 2025 to 2035

Folic Acid Market Size and Share Forecast Outlook 2025 to 2035

Oleic Acid Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA