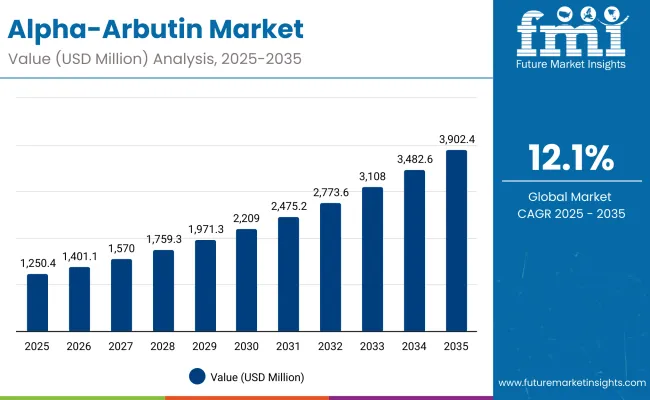

The Alpha-Arbutin Market is expected to record a valuation of USD 1,250.4 million in 2025 and USD 3,902.4 million in 2035, with an increase of USD 2,652.0 million, which equals a growth of 193% over the decade. The overall expansion represents a CAGR of 12.1% and more than a 2X increase in market size.

Alpha-Arbutin Market Key Takeaways

| Metric | Value |

|---|---|

| Alpha-Arbutin Market Estimated Value in (2025E) | USD 1,250.4 million |

| Alpha-Arbutin Market Forecast Value in (2035F) | USD 3,902.4 million |

| Forecast CAGR (2025 to 2035) | 12.1% |

During the first five-year period from 2025 to 2030, the market increases from USD 1,250.4 million to USD 1,971.3 million, adding USD 720.9 million, which accounts for 27.2% of the total decade growth. This phase records steady adoption of alpha-arbutin in daily-use water-based serums, essences, and emulsion formulations, with strong demand for hyperpigmentation and spot-fading solutions. The unisex segment dominates this period, reflecting universal consumer acceptance, while standard 2% concentration formulas remain the preferred choice.

The second half from 2030 to 2035 contributes USD 1,931.1 million, equal to 72.8% of total growth, as the market jumps from USD 1,971.3 million to USD 3,902.4 million. This acceleration is powered by rapid premiumization, expansion of clean-label and vegan-certified products, and higher adoption in emerging markets such as India and China. Hybrid formulations blending alpha-arbutin with peptides and hyaluronic acid become mainstream, enabling brands to capture higher margins. E-commerce and specialty beauty retail solidify their role as leading distribution channels, driving long-term scale.

From 2020 to 2024, the Alpha-Arbutin Market experienced robust growth as consumer demand for safe alternatives to hydroquinone rose sharply. Brands such as The Ordinary, Paula’s Choice, and SkinCeuticals capitalized on the shift toward dermatologist-recommended brightening actives, while e-commerce platforms fueled mass awareness. Product differentiation during this period relied on concentration levels (notably 2%) and delivery formats such as serums, ampoules, and toners. Clean-label and vegan claims began gaining traction but represented a niche share.

By 2025, the market value will reach USD 1,250.4 million, and the revenue mix is shifting rapidly toward premium, multifunctional skincare. Established leaders face growing competition from digital-first brands like Good Molecules and COSRX, which emphasize affordability, transparency, and community-driven marketing. The competitive advantage is moving away from concentration level alone toward ecosystem strategies that combine sustainability, clinical validation, and digital engagement. Brands that successfully align with these attributes are expected to capture disproportionate growth through 2035.

The tightening of cosmetic regulations on hydroquinone in regions such as Europe and North America has accelerated the transition to alpha-arbutin as a safer and clinically validated brightening ingredient. Consumers seeking solutions for hyperpigmentation and uneven skin tone are increasingly choosing alpha-arbutin-based serums and toners, which deliver comparable efficacy without the harsh side effects. This regulatory-driven substitution effect is a key driver expanding alpha-arbutin’s presence across mainstream and premium skincare portfolios.

The proliferation of digital beauty platforms and influencer-driven skincare education is fueling demand for alpha-arbutin. Unlike generic moisturizers, alpha-arbutin products are promoted in detailed ingredient-centric content highlighting benefits for spot fading, tone evening, and post-acne care. Online-first brands are leveraging transparency in formulations and affordable pricing to reach a younger, ingredient-savvy audience. This direct-to-consumer education model has significantly accelerated adoption, particularly in fast-growing markets such as China and India where digital retail dominates skincare sales.

The Alpha-Arbutin Market is segmented by function, format, concentration, claim, end user, channel, and region. Functions include hyperpigmentation/spot fading, tone evening/brightening, and post-inflammation marks care, which highlight the ingredient’s role in targeted skin correction. Format classification spans water-based serums, emulsion serums, ampoules, and essence/toners to cater to different skincare routines.

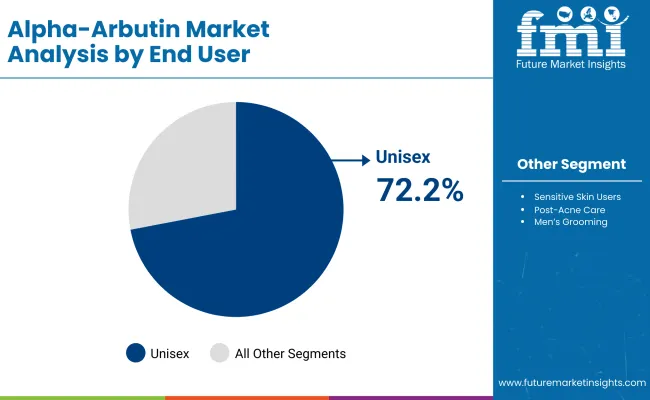

Concentration is split between standard 2% formulations and higher or customized blends, while claims encompass clean-label, vegan, dermatologist-tested, and fragrance-free. End-user categories cover unisex, sensitive skin users, post-acne care, and men’s grooming. Distribution is led by e-commerce, supported by pharmacies, specialty beauty retail, and mass retail. Regionally, the market scope includes North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

| End User | Value Share % 2025 |

|---|---|

| Unisex | 72.7% |

| Others | 27.3% |

The unisex segment is projected to contribute 72.7% of Alpha-Arbutin Market revenue in 2025, maintaining its lead as the dominant end-user category. This is driven by the universal appeal of alpha-arbutin as a safe and effective brightening agent suitable for all skin types, cutting across traditional gender-specific boundaries. Rising demand for tone-evening and hyperpigmentation treatments has positioned unisex products as mainstream, particularly in serum and toner formats.

The segment’s growth is further supported by digital-first marketing strategies, where global brands highlight alpha-arbutin as an inclusive ingredient in everyday skincare. As consumer preferences continue to shift toward ingredient transparency and multifunctional solutions, unisex formulations are expected to remain the backbone of alpha-arbutin adoption worldwide.

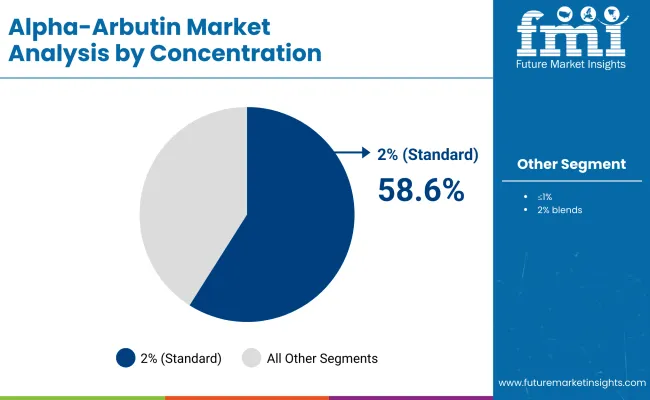

| Concentration | Value Share % 2025 |

|---|---|

| 2% (standard) | 58.6% |

| Others | 41.4% |

The 2% standard concentration segment is forecasted to hold 58.6% of the Alpha-Arbutin Market share in 2025, led by its proven efficacy as the industry benchmark for safe and effective skin brightening. This concentration level is favored for its balance of visible results in reducing hyperpigmentation and tone unevenness, while minimizing irritation risk across sensitive skin types. It has become the preferred formulation for water-based serums, toners, and ampoules that appeal to mass and premium consumers alike.

Growth in this segment is further supported by dermatologists and regulatory bodies endorsing 2% alpha-arbutin as a safe alternative to hydroquinone. As global consumer awareness of skin health rises, the standard concentration is expected to remain dominant, particularly in unisex and sensitive skin care lines, reinforcing its role as the backbone of alpha-arbutin adoption worldwide.

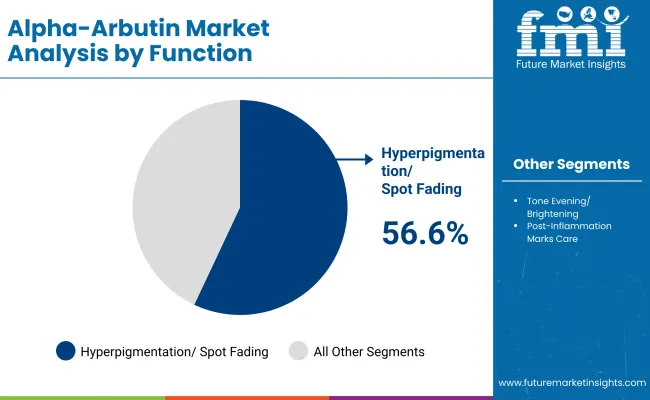

| Function | Value Share % 2025 |

|---|---|

| Hyperpigmentation/spot fading | 56.6% |

| Others | 43.4% |

The hyperpigmentation and spot fading segment is projected to account for 56.6% of the Alpha-Arbutin Market revenue in 2025, establishing it as the leading functional category. Alpha-arbutin’s clinical efficacy in inhibiting melanin production has made it the preferred choice for treating dark spots, sun damage, and age-related pigmentation issues.

This function is highly compatible with serum, ampoule, and toner formulations, which are the most popular delivery systems in global skincare routines. Rising consumer demand for safe and non-irritating alternatives to hydroquinone further strengthens this segment’s dominance. As skin tone correction and brightening continue to gain mainstream appeal across both developed and emerging markets, the hyperpigmentation/spot fading function is expected to maintain its leading role in the Alpha-Arbutin Market through the forecast period.

Rising Demand for Safe Skin Brightening Alternatives

Growing restrictions on hydroquinone in Europe, North America, and parts of Asia have accelerated the adoption of alpha-arbutin as a safe, dermatologist-endorsed ingredient for brightening and pigmentation control. Consumers are increasingly aware of the side effects of harsher actives and are shifting to alpha-arbutin, which delivers comparable results with minimal irritation. This shift has expanded its use across mass-market and premium skincare, reinforcing alpha-arbutin’s role as the preferred active for hyperpigmentation and tone-evening products globally.

Expansion of E-commerce and Ingredient-Centric Marketing

Digital-first retail platforms and social media influencers are fueling consumer education around alpha-arbutin’s efficacy in fading spots and evening skin tone. Ingredient-focused branding strategies by companies like The Ordinary and Paula’s Choice resonate strongly with younger demographics, especially in Asia and North America. The convenience of online purchasing combined with transparent formulations and user testimonials accelerates adoption. This driver is particularly evident in India and China, where e-commerce penetration and consumer willingness to try clinically proven actives are at their peak.

Price Sensitivity and Limited Awareness in Emerging Markets

Despite its rising global popularity, alpha-arbutin remains relatively expensive compared to basic moisturizers and plant-based brightening agents. In emerging markets, this cost barrier limits adoption among price-conscious consumers outside urban centers. Additionally, awareness about alpha-arbutin’s benefits is still limited in regions where traditional herbal remedies dominate skincare routines. Without targeted marketing and affordable product launches, penetration in these markets will remain uneven, constraining overall growth potential despite the ingredient’s established reputation in developed regions.

Clean-Label and Multi-Functional Skincare Adoption

The market is witnessing a strong trend toward clean-label and multi-functional skincare products where alpha-arbutin is blended with actives such as hyaluronic acid, niacinamide, and peptides. Consumers are increasingly seeking all-in-one solutions that address pigmentation, hydration, and anti-aging in a single product. This convergence reflects a shift toward simplified beauty routines, particularly among millennials and Gen Z. Brands adopting vegan formulations, recyclable packaging, and dermatologist-tested claims are gaining traction, positioning alpha-arbutin as a key ingredient in sustainable and multifunctional skincare portfolios.

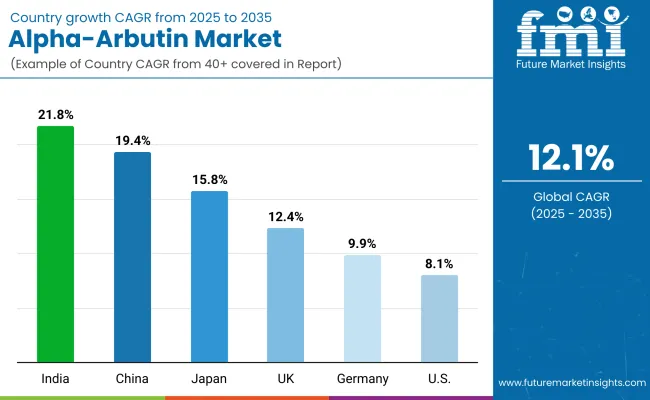

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 19.4% |

| USA | 8.1% |

| India | 21.8% |

| UK | 12.4% |

| Germany | 9.9% |

| Japan | 15.8% |

Asia-Pacific emerges as the fastest-growing region, anchored by India (21.8% CAGR) and China (19.4% CAGR). India’s rapid growth reflects increasing awareness of pigmentation issues, demand for safe hydroquinone alternatives, and rising e-commerce penetration across tier-2 cities. China benefits from K-beauty and J-beauty influences, with strong adoption of water-based serums and essence formats driven by digital-first retail ecosystems.

Europe maintains a strong growth profile, led by the UK (12.4% CAGR) and Germany (9.9% CAGR). Growth is supported by strict EU regulations favoring safe skin-lightening actives, strong consumer demand for clean-label and vegan claims, and established pharmacy and dermocosmetic retail networks. Japan is another high-growth market (15.8% CAGR), reflecting strong cosmeceutical positioning and consumer preference for premium, multifunctional formulations.

North America, with the USA at 8.1% CAGR, reflects maturity in brightening skincare but continues to expand with dermatologist-recommended formulations and strong brand presence from players like The Ordinary and Paula’s Choice. Growth here is driven more by premium innovation and clinical credibility than volume expansion.

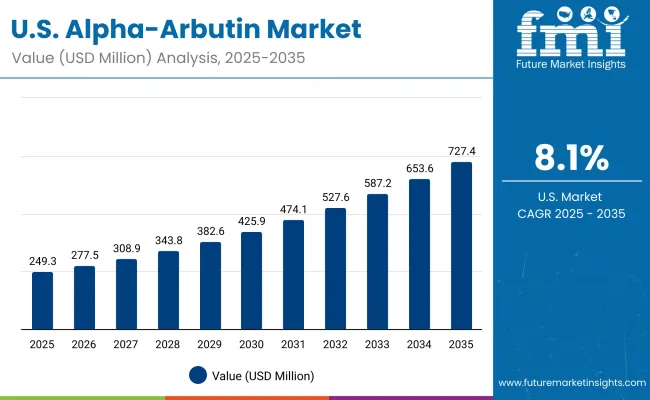

| Year | USA Alpha-Arbutin Market (USD Million) |

|---|---|

| 2025 | 249.38 |

| 2026 | 277.56 |

| 2027 | 308.92 |

| 2028 | 343.83 |

| 2029 | 382.68 |

| 2030 | 425.92 |

| 2031 | 474.05 |

| 2032 | 527.62 |

| 2033 | 587.24 |

| 2034 | 653.60 |

| 2035 | 727.46 |

The Alpha-Arbutin Market in the United States is projected to grow at a CAGR of 8.1% (2025 to 2035), reflecting steady but moderate expansion in a mature skincare environment. Growth is led by rising consumer demand for safe and dermatologist-recommended alternatives to hydroquinone in brightening treatments. Hyperpigmentation and spot-fading remain the dominant use cases, supported by strong adoption in water-based serums and emulsion formats.

Market expansion is reinforced by the popularity of clean-label and vegan claims, which resonate with USA consumers seeking safer long-term skincare options. Brands like The Ordinary, Paula’s Choice, and SkinCeuticals leverage e-commerce, pharmacy retail, and dermatologist endorsements to maintain their competitive advantage. While mass adoption has already occurred, incremental growth will come from hybrid formulations combining alpha-arbutin with peptides and hyaluronic acid, as well as subscription-based D2C channels.

The Alpha-Arbutin Market in the United Kingdom is expected to grow at a CAGR of 12.4% (2025 to 2035), supported by rising consumer awareness of safe skin-brightening ingredients and the continued shift toward clean-label and dermatologist-tested formulations. Hyperpigmentation treatment is the leading application, with alpha-arbutin increasingly positioned as a safer alternative to hydroquinone. Demand is reinforced by strong pharmacy and specialty beauty retail channels, as well as robust e-commerce penetration that accelerates product accessibility across both urban and regional markets.

Premiumization is also fueling growth, as brands introduce multi-functional alpha-arbutin serums blended with niacinamide, peptides, and hyaluronic acid to address multiple skincare concerns in one product. U.K. consumers are particularly responsive to sustainability initiatives, such as recyclable packaging and vegan certifications, which further support market expansion. Global players like The Ordinary and Paula’s Choice maintain dominance, while niche and local brands leverage influencer-driven campaigns to capture market share among younger demographics.

India is witnessing rapid growth in the Alpha-Arbutin Market, which is forecast to expand at a CAGR of 21.8% through 2035, the highest among key countries. This momentum is fueled by rising consumer awareness of pigmentation issues, post-acne mark care, and the demand for safer hydroquinone alternatives. Tier-2 cities are emerging as strong growth hubs, supported by the affordability of new product launches and the accessibility of e-commerce platforms that deliver premium skincare solutions directly to consumers.

The adoption of alpha-arbutin is further reinforced by India’s deep-rooted preference for herbal and plant-derived beauty solutions, making naturally positioned and clean-label formulations particularly appealing. Global brands are tailoring strategies to local needs by introducing smaller pack sizes and affordable price points, while domestic players leverage Ayurveda-inspired marketing to build trust. Social media and influencer-driven awareness campaigns are amplifying demand, especially among millennials and Gen Z, who view alpha-arbutin serums as an essential part of daily skincare routines.

The Alpha-Arbutin Market in China is expected to grow at a CAGR of 19.4% (2025 to 2035), making it one of the fastest-expanding markets globally. This strong momentum is driven by rising consumer demand for safe and effective brightening solutions, fueled by growing awareness of hyperpigmentation, sun damage, and post-acne mark treatments. E-commerce giants such as Tmall and JD.com are pivotal in scaling product accessibility, enabling both global and domestic brands to capture share among China’s digitally active millennial and Gen Z consumers.

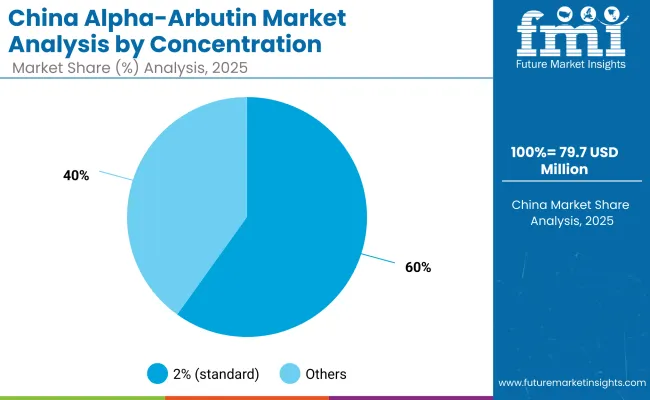

By concentration, standard 2% formulations dominate with 59.9% share in 2025 (USD 79.7 million), reflecting consumer preference for clinically proven and dermatologist-endorsed solutions. However, premium opportunities lie in multifunctional products blending alpha-arbutin with hyaluronic acid, niacinamide, and peptides, which appeal to consumers seeking comprehensive skincare routines.

Local brands are further driving competitive pricing and accessibility, offering affordable formulations while adopting clean-label and vegan positioning. At the same time, international players such as The Ordinary, Paula’s Choice, and COSRX are leveraging influencer campaigns on platforms like Douyin and WeChat to promote transparency and efficacy, reinforcing China’s position as a central growth hub in the global Alpha-Arbutin Market.

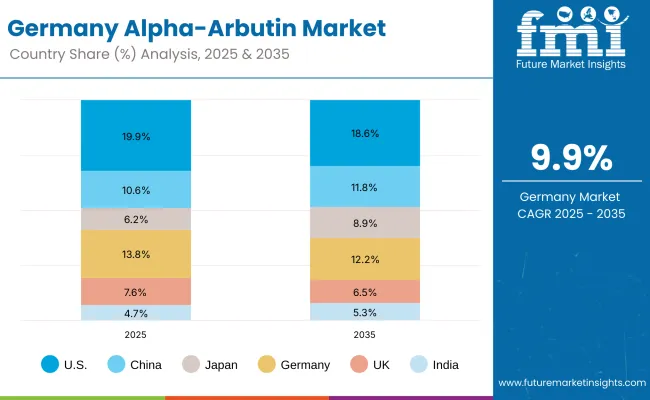

| Country | 2025 Share (%) |

|---|---|

| USA | 19.9% |

| China | 10.6% |

| Japan | 6.2% |

| Germany | 13.8% |

| UK | 7.6% |

| India | 4.7% |

| Country | 2035 Share (%) |

|---|---|

| USA | 18.6% |

| China | 11.8% |

| Japan | 8.9% |

| Germany | 12.2% |

| UK | 6.5% |

| India | 5.3% |

The Alpha-Arbutin Market in Germany is projected to grow at a CAGR of 9.9% (2025 to 2035), underpinned by the country’s strong demand for dermatologist-tested and regulatory-compliant skincare. German consumers are highly ingredient-conscious, making alpha-arbutin a preferred choice for safe brightening and hyperpigmentation treatments following restrictions on hydroquinone in the EU. Pharmacies and dermocosmetic retailers dominate distribution, supported by rising demand in e-commerce for clean-label, vegan, and multifunctional formulations.

Premiumization is a key theme, with global brands such as La Roche-Posay, Vichy, and The Ordinary enjoying strong brand trust, while local organic skincare brands are leveraging sustainability positioning to capture niche segments. Alpha-arbutin serums and ampoules blended with peptides and hyaluronic acid are gaining traction as multifunctional products, appealing to consumers who prefer simplified skincare routines without compromising efficacy.

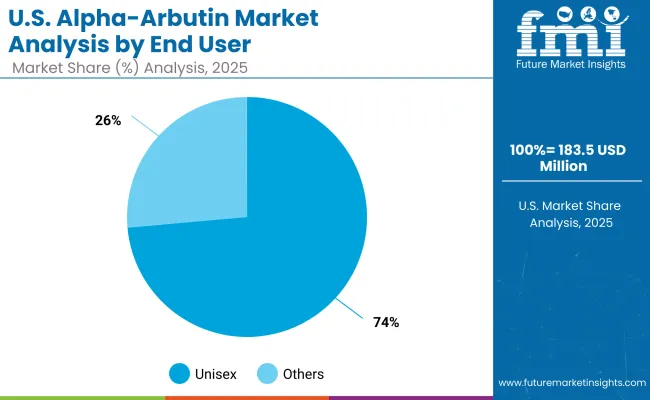

| USA by End User | Value Share % 2025 |

| Unisex | 73.6% |

| Others | 26.4% |

The Alpha-Arbutin Market in the United States is projected to grow at a CAGR of 8.1% (2025 to 2035), reflecting steady expansion in a mature skincare market. The unisex segment dominates with 73.6% share in 2025, underscoring the broad acceptance of alpha-arbutin as a safe and effective brightening ingredient across all genders. Hyperpigmentation and post-acne mark care are key drivers, with water-based serums and emulsion serums serving as the most popular product formats.

Growth in the USA is also supported by consumer preference for dermatologist-tested, clean-label, and vegan formulations, which align with heightened awareness of skin safety and transparency. Established players such as The Ordinary, Paula’s Choice, and SkinCeuticals continue to lead with clinically validated claims, while niche indie brands focus on affordability and e-commerce-led penetration. Long-term growth will be sustained by hybrid formulations combining alpha-arbutin with peptides and hyaluronic acid, supported by subscription-based direct-to-consumer models.

| China by Concentration | Value Share % 2025 |

|---|---|

| 2% (standard) | 59.9% |

| Others | 40.1% |

The Alpha-Arbutin Market in China presents significant growth opportunities, expanding at a CAGR of 19.4% (2025 to 2035). The 2% standard concentration dominates with 59.9% share in 2025 (USD 79.7 million), supported by its dermatologist-recommended status as the most effective and safe formulation for hyperpigmentation and tone-evening. Chinese consumers prefer proven efficacy paired with safety assurances, making this segment the anchor of market growth.

Opportunities are rising in the “others” concentration segment (40.1%), where premium skincare brands are introducing multi-active blends that combine alpha-arbutin with niacinamide, peptides, and hyaluronic acid. These hybrid formulations resonate strongly with urban millennials and Gen Z consumers seeking multifunctional solutions. E-commerce platforms like Tmall and JD.com amplify market access, while local players are leveraging competitive pricing to capture mass-market adoption. International brands are focusing on influencer-driven campaigns via Douyin and WeChat to build trust and scale visibility.

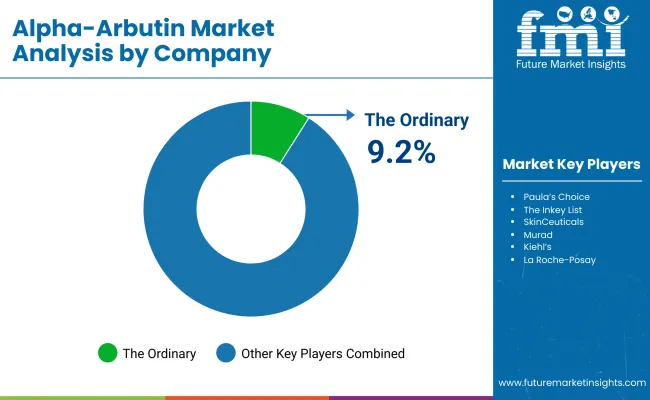

| Company | Global Value Share 2025 |

|---|---|

| The Ordinary | 9.2% |

| Others | 90.8% |

The Alpha-Arbutin Market is moderately fragmented, with global leaders, established dermocosmetic brands, and niche clean-label specialists competing across formats such as serums, ampoules, and toners. Global leaders like The Ordinary, Paula’s Choice, and SkinCeuticals dominate with clinically validated formulations, strong dermatologist endorsements, and extensive e-commerce penetration. Their strategies emphasize ingredient transparency, clean-label positioning, and multifunctional blends with actives like niacinamide and hyaluronic acid.

Mid-sized players such as The Inkey List, Murad, and COSRX are accelerating adoption through affordable formulations, innovative packaging, and influencer-led campaigns. Their hybrid approachbalancing price accessibility with premium positioningmakes them especially popular among younger, digitally engaged consumers.

Niche-focused brands like Good Molecules, Vichy, La Roche-Posay, and Kiehl’s cater to specialized needs, leveraging dermatologist trust, vegan claims, and sensitive-skin targeting to differentiate in a crowded market. Their strength lies in regional adaptability, pharmacy-led retail, and expansion into emerging markets like India and China.

Competitive differentiation is shifting away from concentration levels alone toward ecosystem-based strategies that combine sustainability, multifunctionality, and digital-first marketing. E-commerce, influencer-driven branding, and subscription-based D2C models are becoming essential levers for long-term competitiveness in the Alpha-Arbutin Market.

Key Developments in Alpha-Arbutin Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,250.4 Million |

| Function | Hyperpigmentation/spot fading, Tone evening/brightening, Post-inflammation marks care |

| Format | Water-based serums, Emulsion serums, Ampoules, Essence/toners |

| Channel | E-commerce, Pharmacies, Specialty beauty retail, Mass retail |

| Claim | Fragrance-free, Dermatologist-tested, Clean-label, Vegan |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | The Ordinary, Paula’s Choice, The Inkey List, SkinCeuticals , Murad, Kiehl’s , La Roche- Posay , Vichy, COSRX, Good Molecules |

| Additional Attributes | Dollar sales by format and concentration, adoption trends in hyperpigmentation and post-acne care, rising demand for unisex and sensitive-skin formulations, sector-specific growth in e-commerce and pharmacy-led retail, revenue segmentation by clean-label, vegan, and dermatologist-tested claims, integration with multifunctional actives like niacinamide , peptides, and hyaluronic acid, regional trends influenced by regulatory bans on hydroquinone, and innovations in serum, ampoule, and toner delivery systems that enhance efficacy and consumer compliance. |

The global Alpha-Arbutin Market is estimated to be valued at USD 1,250.4 million in 2025.

The market size for the Alpha-Arbutin Market is projected to reach USD 3,902.4 million by 2035.

The Alpha-Arbutin Market is expected to grow at a 12.1% CAGR between 2025 and 2035.

The key product types in the Alpha-Arbutin Market are water-based serums, emulsion serums, ampoules, and essence/toners.

In terms of concentration, the 2% standard formulations segment is expected to command the largest share of the Alpha-Arbutin Market in 2025, accounting for 58.6% of total market value.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA