[251 Pages Report] FMI estimates the global Linear Alpha Olefin market to reach a value of US$ 9,511.4 million by the year 2022. Sales prospects of Linear Alpha Olefin are expected to expand CAGR of 4.8% and to top a valuation of US$ 15,246.4 million by 2032. Growing demand for lubricants, detergent alcohols, polyethylene & others is expected to bolster the demand for linear alpha olefins during the projected period.

|

Linear Alpha Olefin Sales (2021A) |

US$ 9,156.0 million |

|

Linear Alpha Olefin Sales (2022E) |

US$ 9,511.4 million |

|

Linear Alpha Olefin Market Projections (2032F) |

US$ 15,246.4 million |

|

Value CAGR (2022 to 2032) |

4.8% |

|

Collective Value Share: Top 3 Countries (2022E) |

47.8% |

Market growth for liner alpha olefins is anticipated to be led by factors such as the rising popularity of polyethylene and the demand for linear alpha olefin in the automotive industry. Polyethylene, plasticizer, fine chemicals, and detergent alcohol are some of the products that are manufactured with linear alpha olefins. Many other industries rely on these products as raw materials in the production of their final goods.

The Linear Alpha Olefin market witnessed a CAGR of 1.3% over the historical period of 2017 to 2021. The pandemic crisis in 2020 caused the market to contract, which was reflected in material prices, divergent demands for chemicals and specialty materials changed customer expectations for chemical products, and higher logistical costs. For the first few quarters, each of these factors negatively affected the market.

As per the current estimate, the forecast growth outlook for Linear Alpha Olefin remains around 4.8% for the period between 2022 and 2032. The growing demand for polyethylene, lubricants, detergent alcohols & others is expected to bolster the demand for linear alpha olefins during the projected period. The growing usage of LAO is the manufacturing of lubricants, polyethylene, fine chem & others, which are further utilized in end-use industries such as automotive, packaging, consumer goods & others, which are expected to drive the market growth.

Increasing changes in the global market of oil & gas, automotive, etc. are stimulated by a number of trends such as increased consumer power, sustainability, urbanization, consolidation, and a growing middle-class population. These changes are surging the demand for investments and opening up opportunities.

The Rising demand for various chemicals and their different type of manufacturing processes in the chemical and pharmaceutical industry for the production of various drugs is expected to create opportunities for the linear alpha olefin market.

Moreover, the need for vehicle parts maintenance and the introduction of new technologies in the automotive industry is attracting consumers to purchase and maintain new vehicles. Thus, the sales of linear alpha olefin are anticipated to rise significantly shortly. Hence, the rising demand for industrial infrastructure across the globe is creating significant opportunities for Linear Alpha Olefin manufacturers during the forecast period.

In the linear alpha olefin market, one of the limiting factors that may hamper the market growth is the high cost of raw materials & manufacturing process. The manufacturing process of linear alpha olefins includes oligomer zing ethylene in a polar phase compromising a solution of transition metal catalyst system at a temperature more than critical temperature and pressure. In the manufacturing process, if there is a change in critical temperature and process, that case, phase of the process fluid can change and it is difficult to manage the quality of the product.

Maintaining the critical temperature and pressure is highly expensive owing to the higher cost of equipment that needs to be designed and manufactured for critical temperature and pressure.

The high cost of raw materials and equipment to maintain the critical temperature and pressure involved in the manufacturing process of a linear alpha olefin may hamper the growth of the linear alpha olefin market.

The United States is expected to dominate the North American region owing to the growing end-use industries & availability of raw materials and a better manufacturing environment.

Due to its vast and diverse industrial base and ongoing petrochemical and gas & oil infrastructure development, the United States is expected to have a prominent share. Due to its abundant natural resource reserves, both domestic and international players view North America as a potential investment hub for the production of linear alpha olefins. Some of the top regional players, including Chevron Phillips Chemical Company, are located there. All these factors along with the growth of the end-use industries such as automotive, consumer goods, packaging, & others are expected to drive the demand for LAO during the forecast period. The Linear Alpha Olefin market in the USA is expected to reach about US$ 3,409.7 million by end of the year 2032.

The growing demand for high-performance lubricants and complete equipment management services will be fueled by China's efforts to become a global leader in smart manufacturing and sustainability. In turn, this will assist in modernizing and improving China's massive manufacturing hubs.

A study indicates that China is the second-largest market for finished lubricants worldwide. The spotlight being placed more on polyalphaolefin has influenced this growth. Chains of ethylene-derived linear alpha olefins are assembled to the desired weight and performance to create PAOs. In comparison to mineral base oils, PAOs offer better high-temperature wear protection and have greater oxidative stability. In addition to greases and driveline fluids, fluids and coolants for EV batteries can also contain PAOs. The growing consumption of these lubricants in automotive, industrial manufacturing & others is expected to drive the demand for LAO during the projected period. Hence, the Linear Alpha Olefin market in China is expected to expand at a CAGR of 5.7% during the forecast period.

The production of vehicles has significantly increased in recent years. Rapid industrialization in various regions such as the Asia Pacific is expected to boost automotive production, which will promote the sales of synthetic lubricants, which are produced by using linear alpha olefins. Along with this, the growing need for maintaining the automotive parts, smooth functioning, and increasing the life span of the vehicle, these factors are expected to upsurge the demand for lubricants will lead to the growth of the Linear Alpha Olefin market in the forecast period.

Synthetic lubricants offer great reliability especially in high temperature and more demanding automotive applications without requiring an oil change. Growing demand for such lubricants is anticipated to drive the demand for linear alpha olefins during the projected period. From the abovementioned factors, the lubricant's End use is anticipated to reach about US$ 3,678.7 million by end of the year 2032.

The increasing demand for plastic products, curtains, saline bottles, sampling containers, and personal protective equipment is expected to propel the demand for polyethylene. Low-density polyethylene has gained considerable popularity in recent years owing to the desired optimum sound insulation effects, heat insulation, and exceptional corrosion resistance.

Also, elevating demand for polyethylene in end-use industries such as agriculture, food, and beverage, packaging industries for packing frozen foods, liquid packaging, electric cables, and others are bolstering the demand for polyethylene, which is expected to boost the growth of linear alpha olefin market.

A major share of linear alpha olefins is consumed in the manufacturing of polyethylene; hence, the demand for polyethylene has a direct impact on the linear alpha olefin market.

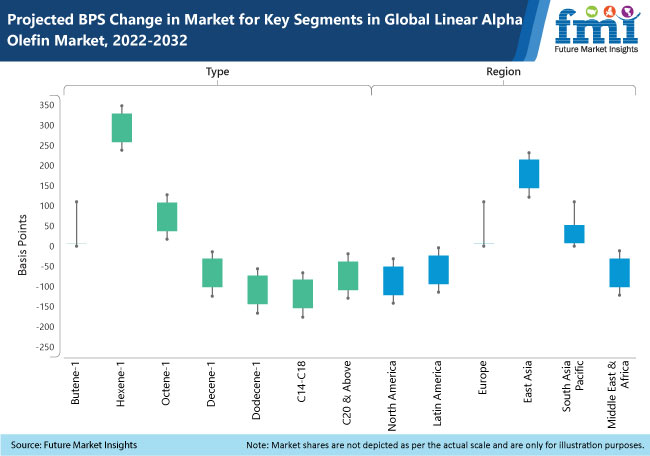

The above PR image depicts the BPS change in different segments in the Linear Alpha Olefin market. In Type segments, the Hexene-1 type is anticipated to witness more lucrative opportunities followed by Octene-1 & Decene-1 during the projected period.

The Global Linear Alpha Olefin market is a highly consolidated market with the presence of some dominant key market players. These players are holding more than 60% of the market share. Some of the prominent key trends, which are being observed during the last few years are an expansion of production capacities & adoption of new & modified manufacturing techniques.

Manufacturers are adopting new & enhanced modified manufacturing techniques such as Ziegler Ethylene Chain Growth Technology in order to get maximum yield with high-quality products, which will make them stand different from the other market players.

Also, the focus has been on the expansion of production capacities to meet the growing demand for linear alpha olefins. For instance:

|

Attribute |

Details |

|

Forecast Period |

2022 to 2032 |

|

Historical Data Available for |

2017 to 2021 |

|

Market Analysis |

USD Million for Value and Kilo Tons for Volume |

|

Key Countries Covered |

The USA, Canada, Brazil, Mexico, Germany, Italy, France, United Kingdom, Spain, BENELUX, Russia, China, Japan, South Korea, India, ASEAN, Australia and New Zealand, GCC Countries, Turkey, Northern Africa, South Africa |

|

Key Segments Covered |

Type, End-use, and Region |

|

Key Companies Profiled |

|

|

Report Coverage |

Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

|

Customization & Pricing |

Available Upon Request |

The global market for Linear Alpha Olefin is estimated to reach a valuation of US$ 9,511.4 million in 2022.

The Linear Alpha Olefin demand is anticipated to witness a growth rate of 4.8% over the forecast period of 2022 and 2032 in terms of value.

According to FMI analysis, SABIC, INEOS, Shell Plc, Chevron Phillips Chemical Company, Sasol Limited, Qatar Chemical Company Ltd, PJSC Nizhnekamskneftekhim, Jam Petrochemical Company, GELEST INC, Idemitsu Kosan Co., Ltd., TPC Group and others are identified as the key manufacturers in the Linear Alpha Olefin market.

Key players in the global Linear Alpha Olefin market are expected to account for about 70-75% of the overall market share.

The top countries driving the global Linear Alpha Olefin demand are the USA, China, Germany, Japan, and India.

1. Executive Summary | Linear Alpha Olefin Market

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Supply Side Trends

1.4. Technology Roadmap

1.5. Analysis and Recommendations

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Definition / Scope / Limitations

3. Key Market Trends

3.1. Key Trends Impacting the Market

3.2. Product Innovation / Development Trends

4. Key Success Factors

4.1. Product Adoption / Usage Analysis

4.2. Product USPs / Features

4.3. Strategic Promotional Strategies

5. Global Market Demand Analysis 2017 to 2021 and Forecast, 2022 to 2032

5.1. Historical Market Volume (KT) Analysis, 2017 to 2021

5.2. Current and Future Market Volume (KT) Projections, 2022 to 2032

5.3. Y-o-Y Growth Trend Analysis

6. Global Market - Pricing Analysis

6.1. Regional Pricing Analysis by Product Type

6.2. Pricing Breakup

6.3. Global Average Pricing Analysis Benchmark

7. Global Market Demand (in Value or Size in US$ million) Analysis 2017 to 2021 and Forecast, 2022 to 2032

7.1. Historical Market Value (US$ million) Analysis, 2017 to 2021

7.2. Current and Future Market Value (US$ million) Projections, 2022 to 2032

7.2.1. Y-o-Y Growth Trend Analysis

7.2.2. Absolute $ Opportunity Analysis

8. Market Background

8.1. Macro-Economic Factors

8.1.1. Global GDP Growth Outlook

8.1.2. Global Chemical Industry Overview

8.1.3. Global Oil and Gas Outlook

8.1.4. Other Factors

8.2. Forecast Factors - Relevance & Impact

8.2.1. GDP Growth forecast

8.2.2. Manufacturing Industry forecast

8.2.3. Growth in Chemical Industry

8.2.4. Demand from End-Use Industries

8.2.5. Other Forecast Factors

8.3. Value Chain Analysis

8.3.1. Raw Material Suppliers

8.3.2. Product Manufacturers

8.3.3. Product Distributors

8.3.4. Probable End Users

8.4. COVID-19 Crisis - Impact Assessment

8.4.1. Current Statistics

8.4.2. Short-Mid-Long Term Outlook

8.4.3. Likely Rebound

8.5. Market Dynamics

8.5.1. Drivers

8.5.2. Restraints

8.5.3. Opportunity Analysis

8.6. Global Supply Demand Analysis

8.7. Porter’s Five Forces Analysis

8.8. Key Regulations and Certifications

9. Global Market Analysis 2017 to 2021 and Forecast 2022 to 2032, By Type

9.1. Introduction / Key Findings

9.2. Historical Market Size (US$ million) and Volume Analysis By Type, 2017 to 2021

9.3. Current and Future Market Size (US$ million) and Volume Analysis and Forecast By Type, 2022 to 2032

9.3.1. Butene-1

9.3.2. Hexene-1

9.3.3. Octene-1

9.3.4. Decene-1

9.3.5. Dodecene-1

9.3.6. C14-C18

9.3.7. C20 & Above

9.4. Market Attractiveness Analysis By Type

10. Global Market Analysis 2017 to 2021 and Forecast 2022 to 2032, by End-Use

10.1. Introduction / Key Findings

10.2. Historical Market Size (US$ million) and Volume Analysis By End Use, 2017 to 2021

10.3. Current and Future Market Size (US$ million) and Volume Analysis and Forecast By End Use, 2022 to 2032

10.3.1. Oil Field Chemicals

10.3.2. Plasticizers

10.3.3. Fine Chem

10.3.4. Lubricants

10.3.5. Detergent Alcohols

10.3.6. Polyethylene

10.3.6.1. High Density Polyethylene (HDPE)

10.3.6.2. Linear Low Density Polyethylene (LLDPE)

10.4. Market Attractiveness Analysis By End Use

11. Global Market Analysis 2017 to 2021 and Forecast 2022 to 2032, by Region

11.1. Introduction

11.2. Historical Market Size (US$ million) and Volume Analysis By Region, 2017 to 2021

11.3. Current Market Size (US$ million) and Volume Analysis and Forecast By Region, 2022 to 2032

11.3.1. North America

11.3.2. Latin America

11.3.3. Europe

11.3.4. Middle East and Africa (MEA)

11.3.5. East Asia

11.3.6. South Asia and Pacific

11.4. Market Attractiveness Analysis By Region

12. North America Market Analysis 2017 to 2021 and Forecast 2022 to 2032

12.1. Introduction

12.2. Pricing Analysis

12.3. Historical Market Size (US$ million) and Volume Trend Analysis By Market Taxonomy, 2017 to 2021

12.4. Market Size (US$ million) and Volume Forecast By Market Taxonomy, 2022 to 2032

12.4.1. By Country

12.4.1.1. The USA

12.4.1.2. Canada

12.4.2. By Type

12.4.3. By End Use

12.5. Market Attractiveness Analysis

12.5.1. By Country

12.5.2. By Type

12.5.3. By End Use

12.6. Market Trends

12.7. Drivers and Restraints - Impact Analysis

13. Latin America Market Analysis 2017 to 2021 and Forecast 2022 to 2032

13.1. Introduction

13.2. Pricing Analysis

13.3. Historical Market Size (US$ million) and Volume Trend Analysis By Market Taxonomy, 2017 to 2021

13.4. Market Size (US$ million) and Volume Forecast By Market Taxonomy, 2022 to 2032

13.4.1. By Country

13.4.1.1. Brazil

13.4.1.2. Mexico

13.4.1.3. Rest of Latin America

13.4.2. By Type

13.4.3. By End Use

13.5. Market Attractiveness Analysis

13.5.1. By Country

13.5.2. By Type

13.5.3. By End Use

13.6. Market Trends

13.7. Drivers and Restraints - Impact Analysis

14. Europe Market Analysis 2017 to 2021 and Forecast 2022 to 2032

14.1. Introduction

14.2. Pricing Analysis

14.3. Historical Market Size (US$ million) and Volume Trend Analysis By Market Taxonomy, 2017 to 2021

14.4. Market Size (US$ million) and Volume Forecast By Market Taxonomy, 2022 to 2032

14.4.1. By Country

14.4.1.1. Germany

14.4.1.2. Italy

14.4.1.3. France

14.4.1.4. The United Kingdom

14.4.1.5. Spain

14.4.1.6. BENELUX

14.4.1.7. Russia

14.4.1.8. Rest of Europe

14.4.2. By Type

14.4.3. By End Use

14.5. Market Attractiveness Analysis

14.5.1. By Country

14.5.2. By Type

14.5.3. By End Use

14.6. Market Trends

14.7. Drivers and Restraints - Impact Analysis

15. South Asia and Pacific Market Analysis 2017 to 2021 and Forecast 2022 to 2032

15.1. Introduction

15.2. Pricing Analysis

15.3. Historical Market Size (US$ million) and Volume Trend Analysis By Market Taxonomy, 2017 to 2021

15.4. Market Size (US$ million) and Volume Forecast By Market Taxonomy, 2022 to 2032

15.4.1. By Country

15.4.1.1. India

15.4.1.2. ASEAN

15.4.1.3. Australia and New Zealand

15.4.1.4. Rest of South Asia & Pacific

15.4.2. By Type

15.4.3. By End Use

15.5. Market Attractiveness Analysis

15.5.1. By Country

15.5.2. By Type

15.5.3. By End Use

15.6. Market Trends

15.7. Drivers and Restraints - Impact Analysis

16. East Asia Market Analysis 2017 to 2021 and Forecast 2022 to 2032

16.1. Introduction

16.2. Pricing Analysis

16.3. Historical Market Size (US$ million) and Volume Trend Analysis By Market Taxonomy, 2017 to 2021

16.4. Market Size (US$ million) and Volume Forecast By Market Taxonomy, 2022 to 2032

16.4.1. By Country

16.4.1.1. China

16.4.1.2. Japan

16.4.1.3. South Korea

16.4.2. By Type

16.4.3. By End Use

16.5. Market Attractiveness Analysis

16.5.1. By Country

16.5.2. By Type

16.5.3. By End Use

16.6. Market Trends

16.7. Drivers and Restraints - Impact Analysis

17. Middle East and Africa Market Analysis 2017 to 2021 and Forecast 2022 to 2032

17.1. Introduction

17.2. Pricing Analysis

17.3. Historical Market Size (US$ million) and Volume Trend Analysis By Market Taxonomy, 2017 to 2021

17.4. Market Size (US$ million) and Volume Forecast By Market Taxonomy, 2022 to 2032

17.4.1. By Country

17.4.1.1. GCC Countries

17.4.1.2. Turkey

17.4.1.3. Northern Africa

17.4.1.4. South Africa

17.4.1.5. Rest of Middle East and Africa

17.4.2. By Type

17.4.3. By End Use

17.5. Market Attractiveness Analysis

17.5.1. By Country

17.5.2. By Type

17.5.3. By End Use

17.6. Market Trends

17.7. Drivers and Restraints - Impact Analysis

18. Country-Wise Market Analysis

18.1. Introduction

18.2. The USA Market Analysis

18.2.1. By Type

18.2.2. By End Use

18.3. Canada Market Analysis

18.3.1. By Type

18.3.2. By End Use

18.4. Mexico Market Analysis

18.4.1. By Type

18.4.2. By End Use

18.5. Brazil Market Analysis

18.5.1. By Type

18.5.2. By End Use

18.6. Germany Market Analysis

18.6.1. By Type

18.6.2. By End Use

18.7. Italy Market Analysis

18.7.1. By Type

18.7.2. By End Use

18.8. France Market Analysis

18.8.1. By Type

18.8.2. By End Use

18.9. The United Kingdom Market Analysis

18.9.1. By Type

18.9.2. By End Use

18.10. Spain Market Analysis

18.10.1. By Type

18.10.2. By End Use

18.11. Russia Market Analysis

18.11.1. By Type

18.11.2. By End Use

18.12. BENELUX Market Analysis

18.12.1. By Type

18.12.2. By End Use

18.13. China Market Analysis

18.13.1. By Type

18.13.2. By End Use

18.14. Japan Market Analysis

18.14.1. By Type

18.14.2. By End Use

18.15. S. Korea Market Analysis

18.15.1. By Type

18.15.2. By End Use

18.16. India Market Analysis

18.16.1. By Type

18.16.2. By End Use

18.17. ASEAN Market Analysis

18.17.1. By Type

18.17.2. By End Use

18.18. Australia and New Zealand Market Analysis

18.18.1. By Type

18.18.2. By End Use

18.19. Turkey Market Analysis

18.19.1. By Type

18.19.2. By End Use

18.20. South Africa Market Analysis

18.20.1. By Type

18.20.2. By End Use

19. Market Structure Analysis

19.1. Market Analysis by Tier of Companies

19.2. Market Concentration

19.3. Market Share Analysis of Top Players

19.4. Production Capacity of Key Players

19.5. Market Presence Analysis

20. Competition Analysis

20.1. Competition Dashboard

20.2. Competition Benchmarking

20.3. Competition Deep Dive

20.3.1. SABIC

20.3.1.1. Overview

20.3.1.2. Phthalate Portfolio

20.3.1.3. Profitability by Market Segments (Product /Channel/Region)

20.3.1.4. Sales Footprint

20.3.1.5. Strategy Overview

20.3.2. INEOS

20.3.2.1. Overview

20.3.2.2. Phthalate Portfolio

20.3.2.3. Profitability by Market Segments (Product /Channel/Region)

20.3.2.4. Sales Footprint

20.3.2.5. Strategy Overview

20.3.3. Shell plc

20.3.3.1. Overview

20.3.3.2. Phthalate Portfolio

20.3.3.3. Profitability by Market Segments (Product /Channel/Region)

20.3.3.4. Sales Footprint

20.3.3.5. Strategy Overview

20.3.4. Chevron Phillips Chemical Company

20.3.4.1. Overview

20.3.4.2. Phthalate Portfolio

20.3.4.3. Profitability by Market Segments (Product /Channel/Region)

20.3.4.4. Sales Footprint

20.3.4.5. Strategy Overview

20.3.5. Sasol Limited

20.3.5.1. Overview

20.3.5.2. Phthalate Portfolio

20.3.5.3. Profitability by Market Segments (Product /Channel/Region)

20.3.5.4. Sales Footprint

20.3.5.5. Strategy Overview

20.3.6. Qatar Chemical Company Ltd

20.3.6.1. Overview

20.3.6.2. Phthalate Portfolio

20.3.6.3. Profitability by Market Segments (Product /Channel/Region)

20.3.6.4. Sales Footprint

20.3.6.5. Strategy Overview

20.3.7. PJSC Nizhnekamskneftekhim

20.3.7.1. Overview

20.3.7.2. Phthalate Portfolio

20.3.7.3. Profitability by Market Segments (Product /Channel/Region)

20.3.7.4. Sales Footprint

20.3.7.5. Strategy Overview

20.3.8. Jam Petrochemical Company

20.3.8.1. Overview

20.3.8.2. Phthalate Portfolio

20.3.8.3. Profitability by Market Segments (Product /Channel/Region)

20.3.8.4. Sales Footprint

20.3.8.5. Strategy Overview

20.3.9. GELEST, INC

20.3.9.1. Overview

20.3.9.2. Phthalate Portfolio

20.3.9.3. Profitability by Market Segments (Product /Channel/Region)

20.3.9.4. Sales Footprint

20.3.9.5. Strategy Overview

20.3.10. Idemitsu Kosan Co., Ltd.

20.3.10.1. Overview

20.3.10.2. Phthalate Portfolio

20.3.10.3. Profitability by Market Segments (Product /Channel/Region)

20.3.10.4. Sales Footprint

20.3.10.5. Strategy Overview

20.3.11. TPC Group

20.3.11.1. Overview

20.3.11.2. Phthalate Portfolio

20.3.11.3. Profitability by Market Segments (Product /Channel/Region)

20.3.11.4. Sales Footprint

20.3.11.5. Strategy Overview

21. Primary Survey Analysis

22. Assumptions and Acronyms Used

23. Research Methodology

Table 01: Global Market Size Volume (KT) and Value (US$ million) Forecast By Type, 2017 to 2032

Table 02: Global Market Value (US$ million) Forecast By End Use, 2017 to 2032

Table 03: Global Market Size Volume (KT) Forecast By End Use, 2017 to 2032

Table 04: Global Market Size Volume (KT) and Value (US$ million) Forecast By Region, 2017 to 2032

Table 05: North America Market Size Volume (KT) and Value (US$ million) Forecast By Country, 2017 to 2032

Table 06: North America Market Size Volume (KT) and Value (US$ million) Forecast By Type, 2017 to 2032

Table 07: North America Market Size Value (US$ million) Forecast By End Use, 2017 to 2032

Table 08: North America Market Size Volume (KT) Forecast By End Use, 2017 to 2032

Table 09: Latin America Market Size Volume (KT) and Value (US$ million) Forecast By Country, 2017 to 2032

Table 10: Latin America Market Size Volume (KT) and Value (US$ million) Forecast By Type, 2017 to 2032

Table 11: Latin America Market Size Value (US$ million) Forecast By End Use, 2017 to 2032

Table 12: Latin America Market Size Volume (KT) Forecast By End Use, 2017 to 2032

Table 13: Europe Market Size Volume (KT) and Value (US$ million) Forecast By Country, 2017 to 2032

Table 14: Europe Market Size Volume (KT) and Value (US$ million) Forecast By Type, 2017 to 2032

Table 15: Europe Market Size Value (US$ million) Forecast By End Use, 2017 to 2032

Table 16: Europe Market Size Volume (KT) Forecast By End Use, 2017 to 2032

Table 17: East Asia Market Size Volume (KT) and Value (US$ million) Forecast By Country, 2017 to 2032

Table 18: East Asia Market Size Volume (KT) and Value (US$ million) Forecast By Type, 2017 to 2032

Table 19: East Asia Market Size Value (US$ million) Forecast By End Use, 2017 to 2032

Table 20: East Asia Market Size Volume (KT) Forecast By End Use, 2017 to 2032

Table 21: South Asia Pacific Market Size Volume (KT) and Value (US$ million) Forecast By Country, 2017 to 2032

Table 22: South Asia Pacific Market Size Volume (KT) and Value (US$ million) Forecast By Type, 2017 to 2032

Table 23: South Asia Pacific Market Size Value (US$ million) Forecast By End Use, 2017 to 2032

Table 24: South Asia Pacific Market Size Volume (KT) Forecast By End Use, 2017 to 2032

Table 25: MEA Market Size Volume (KT) and Value (US$ million) Forecast By Country, 2017 to 2032

Table 26: MEA Market Size Volume (KT) and Value (US$ million) Forecast By Type, 2017 to 2032

Table 27: MEA Market Size Value (US$ million) Forecast By End Use, 2017 to 2032

Table 28: MEA Market Size Volume (KT) Forecast By End Use, 2017 to 2032

Figure 01: Global Market Historical Volume (KT), 2017 to 2021

Figure 02: Global Market Current and Forecast Volume (KT), 2022 to 2032

Figure 03: Global Market Historical Value (US$ million), 2017 to 2021

Figure 04: Global Market Current and Forecast Value (US$ million), 2022 to 2032

Figure 05: Global Market Incremental $ Opportunity (US$ million), 2022 to 2032

Figure 06: Global Market Share and BPS Analysis By Type- 2022 to 2032

Figure 07: Global Market Y-o-Y Growth Projections By Type, 2022 to 2032

Figure 08: Global Market Attractiveness Analysis By Type, 2022 to 2032

Figure 09: Global Market Absolute $ Opportunity by Butene-1 Segment, 2017 to 2032

Figure 10: Global Market Absolute $ Opportunity by Hexene-1 Segment, 2017 to 2032

Figure 11: Global Market Absolute $ Opportunity by Octene-1 Segment, 2017 to 2032

Figure 12: Global Market Absolute $ Opportunity by Decene-1 Segment, 2017 to 2032

Figure 13: Global Market Absolute $ Opportunity by Dodecene-1 Segment, 2017 to 2032

Figure 14: Global Market Absolute $ Opportunity by C14-C18 Segment, 2017 to 2032

Figure 15: Global Market Absolute $ Opportunity by C20 - Above Segment, 2017 to 2032

Figure 16: Global Market Share and BPS Analysis By End Use- 2022 to 2032

Figure 17: Global Market Y-o-Y Growth Projections By End Use, 2022 to 2032

Figure 18: Global Market Attractiveness Analysis By End Use, 2022 to 2032

Figure 19: Global Market Absolute $ Opportunity by Oil Field Chemicals Segment, 2017 to 2032

Figure 20: Global Market Absolute $ Opportunity by Plasticizers Segment, 2017 to 2032

Figure 21: Global Market Absolute $ Opportunity by Fine Chem Segment, 2017 to 2032

Figure 22: Global Market Absolute $ Opportunity by Lubricants Segment, 2017 to 2032

Figure 23: Global Market Absolute $ Opportunity by Polyethylene Segment, 2017 to 2032

Figure 24: Global Market Absolute $ Opportunity by Detergent Alcohols Segment, 2017 to 2032

Figure 25: Global Market Share and BPS Analysis By Region- 2022 to 2032

Figure 26: Global Market Y-o-Y Growth Projections By Region, 2022 to 2032

Figure 27: Global Market Attractiveness Analysis By Region, 2022 to 2032

Figure 28: Global Market Absolute $ Opportunity by North America Segment, 2017 to 2032

Figure 29: Global Market Absolute $ Opportunity by Latin America Segment, 2017 to 2032

Figure 30: Global Market Absolute $ Opportunity by Europe Segment, 2017 to 2032

Figure 31: Global Market Absolute $ Opportunity by East Asia Segment, 2017 to 2032

Figure 32: Global Market Absolute $ Opportunity by South Asia Pacific Segment, 2017 to 2032

Figure 33: Global Market Absolute $ Opportunity by Segment, 2017 to 2032

Figure 34: North America Market Share and BPS Analysis By Country- 2022 to 2032

Figure 35: North America Market Y-o-Y Growth Projections By Country, 2022 to 2032

Figure 36: North America Market Attractiveness Projections By Country, 2022 to 2032

Figure 37: North America Market Share and BPS Analysis By Type- 2022 to 2032

Figure 38: North America Market Y-o-Y Growth Projections By Type, 2022 to 2032

Figure 39: North America Market Attractiveness Analysis By Type, 2022 to 2032

Figure 40: North America Market Share and BPS Analysis By End Use- 2022 to 2032

Figure 41: North America Market Y-o-Y Growth Projections By End Use, 2022 to 2032

Figure 42: North America Market Attractiveness Analysis By End Use, 2022 to 2032

Figure 43: Latin America Market Share and BPS Analysis By Country- 2022 to 2032

Figure 44: Latin America Market Y-o-Y Growth Projections By Country, 2020 to 2031

Figure 45: Latin America Market Attractiveness Projections By Country, 2020 to 2031

Figure 46: Latin America Market Share and BPS Analysis By Type- 2022 to 2032

Figure 47: Latin America Market Y-o-Y Growth Projections By Type, 2022 to 2032

Figure 48: Latin America Market Attractiveness Analysis By Type, 2022 to 2032

Figure 49: Latin America Market Share and BPS Analysis By End Use- 2022 to 2032

Figure 50: Latin America Market Y-o-Y Growth Projections By End Use, 2022 to 2032

Figure 51: Latin America Market Attractiveness Analysis By End Use, 2022 to 2032

Figure 52: Europe Market Share and BPS Analysis By Country- 2022 to 2032

Figure 53: Europe Market Y-o-Y Growth Projections By Country, 2022 to 2032

Figure 54: Europe Market Attractiveness Projections By Country, 2022 to 2032

Figure 55: Europe Market Share and BPS Analysis By Type- 2022 to 2032

Figure 56: Europe Market Y-o-Y Growth Projections By Type, 2022 to 2032

Figure 57: Europe Market Attractiveness Analysis By Type, 2022 to 2032

Figure 58: Europe Market Share and BPS Analysis By End Use- 2022 to 2032

Figure 59: Europe Market Y-o-Y Growth Projections By End Use, 2022 to 2032

Figure 60: Europe Market Attractiveness Analysis By End Use, 2022 to 2032

Figure 61: East Asia Market Share and BPS Analysis By Country- 2022 to 2032

Figure 62: East Asia Market Y-o-Y Growth Projections By Country, 2022 to 2032

Figure 63: East Asia Market Attractiveness Projections By Country, 2022 to 2032

Figure 64: East Asia Market Share and BPS Analysis By Type- 2022 to 2032

Figure 65: East Asia Market Y-o-Y Growth Projections By Type, 2022 to 2032

Figure 66: East Asia Market Attractiveness Analysis By Type, 2022 to 2032

Figure 67: East Asia Market Share and BPS Analysis By End Use- 2022 to 2032

Figure 68: East Asia Market Y-o-Y Growth Projections By End Use, 2022 to 2032

Figure 69: East Asia Market Attractiveness Analysis By End Use, 2022 to 2032

Figure 70: South Asia Pacific Market Share and BPS Analysis By Country- 2022 to 2032

Figure 71: South Asia Pacific Market Y-o-Y Growth Projections By Country, 2022 to 2032

Figure 72: South Asia Pacific Market Attractiveness Projections By Country, 2022 to 2032

Figure 73: South Asia Pacific Market Share and BPS Analysis By Type- 2022 to 2032

Figure 74: South Asia Pacific Market Y-o-Y Growth Projections By Type, 2022 to 2032

Figure 75: South Asia Pacific Market Attractiveness Analysis By Type, 2022 to 2032

Figure 76: South Asia Pacific Market Share and BPS Analysis By End Use- 2022 to 2032

Figure 77: South Asia Pacific Market Y-o-Y Growth Projections By End Use, 2022 to 2032

Figure 78: South Asia Pacific Market Attractiveness Analysis By End Use, 2022 to 2032

Figure 79: MEA Market Share and BPS Analysis By Country- 2022 to 2032

Figure 80: MEA Market Y-o-Y Growth Projections By Country, 2022 to 2032

Figure 81: MEA Market Attractiveness Projections By Country, 2022 to 2032

Figure 82: MEA Market Share and BPS Analysis By Type- 2022 to 2032

Figure 83: MEA Market Y-o-Y Growth Projections By Type, 2022 to 2032

Figure 84: MEA Market Attractiveness Analysis By Type, 2022 to 2032

Figure 85: MEA Market Share and BPS Analysis By End Use- 2022 to 2032

Figure 86: MEA Market Y-o-Y Growth Projections By End Use, 2022 to 2032

Figure 87: MEA Market Attractiveness Analysis By End Use, 2022 to 2032

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Alpha Olefin Market Forecast and Outlook 2025 to 2035

Alpha Olefin Sulfonates Market Growth - Trends & Forecast 2025 to 2035

Linear Regulator ICs (LDOs) Market Forecast and Outlook 2025 to 2035

Alpha-Sulfophenylacetic Acid Market Size and Share Forecast Outlook 2025 to 2035

Alpha-Linolenic Acid Market Size and Share Forecast Outlook 2025 to 2035

Alpha-Arbutin Market Size and Share Forecast Outlook 2025 to 2035

Alpha Hydroxy Acid (AHA) Serums Market Size and Share Forecast Outlook 2025 to 2035

Linear Alkylbenzene Sulfonate (LAS) Market Size and Share Forecast Outlook 2025 to 2035

Alpha Hydroxy Acid Market Size and Share Forecast Outlook 2025 to 2035

Linear Low-Density Polyethylene Market Size and Share Forecast Outlook 2025 to 2035

Linear Low Density Polyethylene Market Size and Share Forecast Outlook 2025 to 2035

Alpha-Methylstyrene Market Size and Share Forecast Outlook 2025 to 2035

Alpha-1 Antitrypsin Deficiency Market Size and Share Forecast Outlook 2025 to 2035

Linear Slide Units Market Size and Share Forecast Outlook 2025 to 2035

Linear Residential Voltage Regulator Market Size and Share Forecast Outlook 2025 to 2035

Alpha Glucosidase Inhibitors Market Size and Share Forecast Outlook 2025 to 2035

Linear Net Weighing Machines Market Size and Share Forecast Outlook 2025 to 2035

Alpha-lactalbumin Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Alpha-Amylase Baking Enzyme Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Linear Voltage Regulators Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA