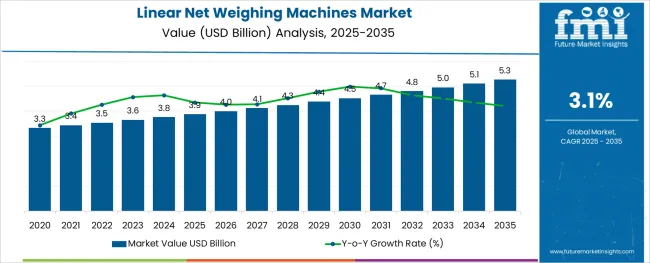

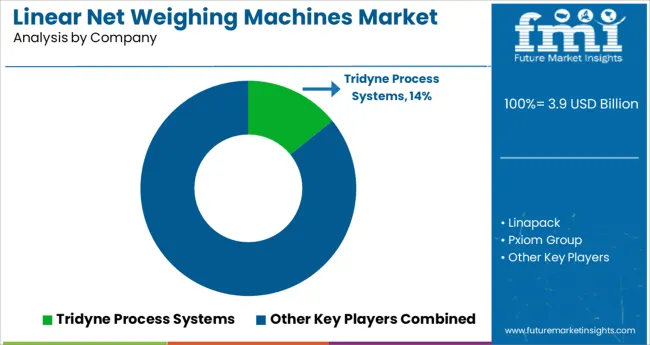

The Linear Net Weighing Machines Market is estimated to be valued at USD 3.9 billion in 2025 and is projected to reach USD 5.3 billion by 2035, registering a compound annual growth rate (CAGR) of 3.1% over the forecast period.

The linear net weighing machines market is experiencing steady growth as manufacturers across sectors pursue automation to improve packaging accuracy, throughput, and cost efficiency. Advancements in load cell technology, servo-driven actuators, and digital integration are enhancing weighing precision for a wide range of fill types and product textures. Industries are adopting these machines to minimize product giveaway and meet stringent packaging standards, particularly in food safety and traceability.

Real-time data integration with MES and ERP platforms is enabling operators to monitor weight consistency and production line performance, further optimizing line efficiency. As sustainability and clean design become priority areas, manufacturers are introducing easy-to-clean formats with tool-free changeovers, stainless steel construction, and CIP compatibility.

Emerging economies are embracing these machines to scale packaged food and commodity operations while mature markets are replacing legacy systems with higher-speed, more compact models. The growing focus on food quality, regulatory compliance, and operational agility is expected to shape sustained demand for linear net weighing machines globally.

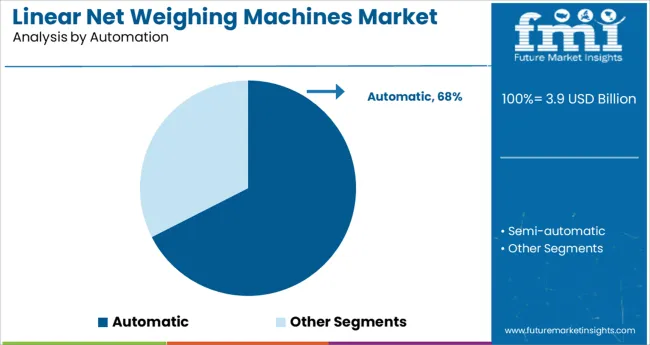

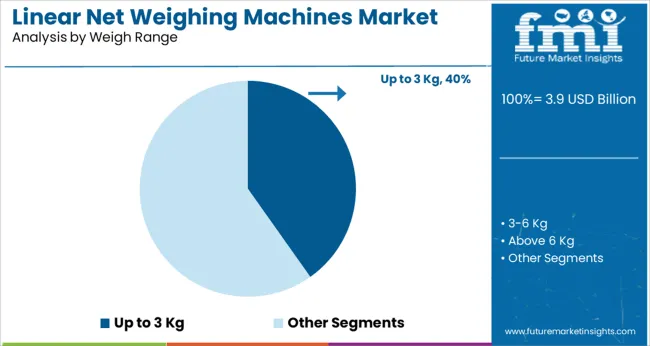

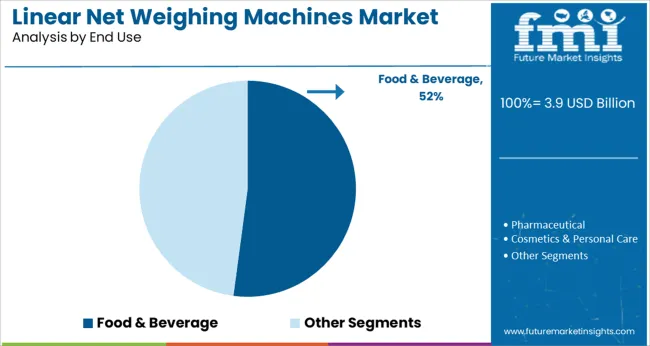

The market is segmented by Automation, Weigh Range, and End Use and region. By Automation, the market is divided into Automatic and Semi-automatic. In terms of Weigh Range, the market is classified into Up to 3 Kg, 3-6 Kg, and Above 6 Kg. Based on End Use, the market is segmented into Food & Beverage, Pharmaceutical, Cosmetics & Personal Care, and Chemical & Fertilizers. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Automatic machines are projected to dominate the automation segment with a 67.50% revenue share in 2025. This leadership is attributed to the ability of automatic linear net weighing machines to deliver high-speed, high-accuracy weighing with minimal human intervention.

The reduction in manual labor not only ensures consistent fill weights but also minimizes contamination risks and human error. These machines are being integrated with programmable logic controllers and digital HMI interfaces, which allow real-time diagnostics and recipe management.

As manufacturers seek to comply with global food safety certifications and lean manufacturing practices, automatic systems have become the standard across large-scale operations. Their capability to support multiple packaging formats and seamless line integration with filling, sealing, and labeling units further strengthens their market position.

The up to 3 Kg weigh range segment is expected to account for 40.20% of market revenue in 2025, establishing it as the dominant range. This preference is being driven by the packaging requirements of high-volume, lightweight consumer goods, particularly in food staples, snacks, confectionery, and powdered products.

Machines configured for this range offer a balanced combination of speed, accuracy, and cost efficiency, especially for mid-sized product batches. The compact footprint of machines within this segment enables easier integration into existing packaging lines and modular expansion.

Additionally, demand for smaller pack sizes driven by changing consumer lifestyles and convenience-oriented packaging trends has made the sub 3 Kg range the most viable option for manufacturers looking to maximize output while maintaining weight compliance.

The food and beverage industry is projected to hold 52.10% of total market revenue in 2025, positioning it as the leading end-use sector. This dominance is being propelled by increasing demand for hygienic, high-speed packaging solutions that comply with food safety regulations and labeling standards.

From snacks and bakery items to frozen goods and dry powders, food manufacturers require net weighing machines that ensure accuracy, reduce product giveaway, and enable rapid changeovers. The sector’s strict operational requirements around washdown capability, stainless steel construction, and cleanroom compatibility have driven manufacturers to develop industry-specific models.

Moreover, as food producers invest in automation to address labor shortages and scale production volumes, linear net weighing machines have become essential in achieving consistency, traceability, and cost control. The integration of these machines into complete packaging ecosystems, including conveyors and inspection systems, has further entrenched their use in the food and beverage space.

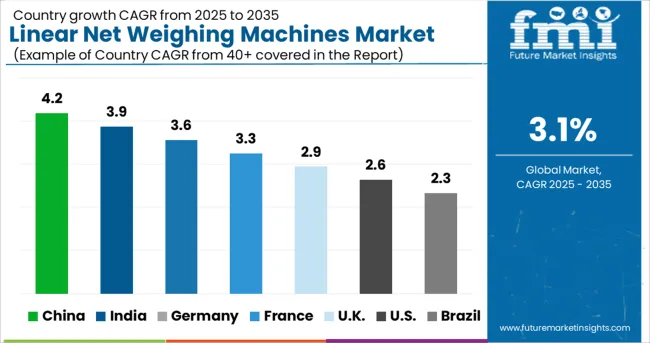

East & South Asia are expected to be highly attractive regions for the growth of the linear net weighing machines market due to the high growth rate of end-use industries. Continuous expansion of food, pharmaceuticals, chemicals & fertilizers in East & South Asia is expected to create significant demand for linear net weighing machines during the forecast period.

China in East Asia and India in South Asia is expected to remain at the forefront regarding linear net weighing market share throughout the forecast period. The Europe region is a substantial shareholder of the linear net weighing machines market and is likely to expand with a moderate growth rate during the forecast period.

It is attributed to the increasing acceptance of linear net weighing machines in various end-use industries. North America is projected to register a healthy growth rate in the linear net weighing machines market during the forecast period.

In North America, the USA is highly attractive in terms of market share, while Canada is highly attractive regarding the growth rate of the linear net weighing machines market.

The key players in the Linear net weighing machines market are focusing on. The competitors also focus on factors like product launches, and partnerships for better access to distribution channels. Companies also work on an optimized design that drives the demand for linear net weighing machines business. This drives the sales of linear net weighing machines.

Key players in the linear net weighing machines market include Tridyne Process Systems, Linapack, Pxiom Group, Coastal Counting & Industrial Scales Inc, Unitech, and Zhongshan Multiweigh Packaging Machinery Co Ltd

Recent Market Development:

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 3.1% from 2025 to 2035 |

| The base year for estimation | 2024 |

| Historical data | 2020 to 2024 |

| Forecast period | 2025 to 2035 |

| Quantitative units | Revenue in million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis, |

| Segments Covered | Automation Type, Number of Heads, Weighing Range, End-Use |

| Regional scope | North America; Western Europe; Eastern Europe; Middle East; Africa; ASEAN; South Asia; Rest of Asia; Australia; and New Zealand |

| Country scope | United States of America, Canada, Mexico, Germany, United Kingdom, France, Italy, Spain, Russia, Belgium, Poland, Czech Republic, China, India, Japan, Australia, Brazil, Argentina, Colombia, Saudi Arabia, UAE, Iran, South Africa |

| Key companies profiled | Tridyne Process Systems; Linapack; Pxiom Group; Coastal Counting & Industrial Scales Inc; Unitech; Zhongshan Multiweigh Packaging Machinery Co Ltd |

| Customization scope | Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. |

The global linear net weighing machines market is estimated to be valued at USD 3.9 billion in 2025.

It is projected to reach USD 5.3 billion by 2035.

The market is expected to grow at a 3.1% CAGR between 2025 and 2035.

The key product types are automatic and semi-automatic.

up to 3 kg segment is expected to dominate with a 40.2% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Linear Regulator ICs (LDOs) Market Forecast and Outlook 2025 to 2035

Linear Alkylbenzene Sulfonate (LAS) Market Size and Share Forecast Outlook 2025 to 2035

Linear Low-Density Polyethylene Market Size and Share Forecast Outlook 2025 to 2035

Linear Low Density Polyethylene Market Size and Share Forecast Outlook 2025 to 2035

Linear Slide Units Market Size and Share Forecast Outlook 2025 to 2035

Linear Residential Voltage Regulator Market Size and Share Forecast Outlook 2025 to 2035

Linear Alpha Olefin Market

Linear Voltage Regulators Market

Linear Actuators Market

Linear Slides Market

Linear Bearings Market

Non-Linear Optical Polymers Market Trend Analysis Based on Product, Application, and Region 2025 to 2035

Electric Linear Actuator Market Trends – Growth & Forecast 2025 to 2035

Industrial Linear Accelerator Market Growth & Demand 2025 to 2035

Network Simulator Software Market Size and Share Forecast Outlook 2025 to 2035

Network Connectivity Tester Market Size and Share Forecast Outlook 2025 to 2035

Network Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Network as a Service (NaaS) Market Size and Share Forecast Outlook 2025 to 2035

Network Analytics Market Size and Share Forecast Outlook 2025 to 2035

Network Devices Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA