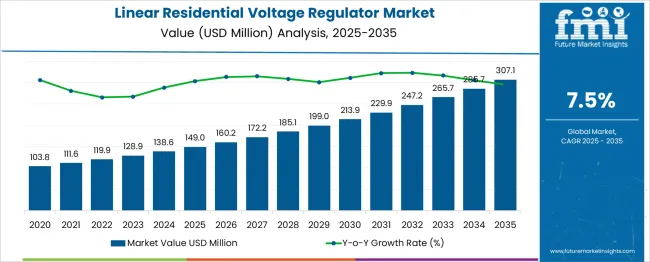

The Linear Residential Voltage Regulator Market is estimated to be valued at USD 149.0 million in 2025 and is projected to reach USD 307.1 million by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period.

The linear residential voltage regulator market is projected to grow from USD 149.0 million in 2025 to USD 307.1 million by 2035, achieving a CAGR of 7.5% during the forecast period. Between 2025 and 2030, the market is expected to increase steadily from USD 149.0 million to USD 213.9 million, showing consistent demand across residential power management systems. Year-on-year analysis indicates gradual yet significant growth, with values rising to USD 160.2 million in 2026 and USD 172.2 million in 2027.

These gains are attributed to growing household dependency on electronic appliances and the necessity for stable voltage supply. By 2028, the market is forecasted to reach USD 185.1 million, followed by USD 199.0 million in 2029 and USD 213.9 million by 2030. This upward momentum reflects advancements in energy-efficient designs and rising adoption of smart home technologies requiring reliable voltage stabilization.

Demand is expected to be reinforced by the increasing penetration of distributed energy resources and renewable power systems in residential grids. Manufacturers focusing on compact, high-efficiency regulators and integration with home automation platforms are likely to gain a competitive edge. This trend positions linear voltage regulators as a key element for ensuring electrical safety and consistent performance in modern homes.

| Metric | Value |

|---|---|

| Linear Residential Voltage Regulator Market Estimated Value in (2025 E) | USD 149.0 million |

| Linear Residential Voltage Regulator Market Forecast Value in (2035 F) | USD 307.1 million |

| Forecast CAGR (2025 to 2035) | 7.5% |

The linear residential voltage regulator market represents a focused yet vital subset of multiple power and electronics markets. Within the power management ICs market, it accounts for around 7–8%, as linear regulators are integral to stable power delivery in low-noise residential applications. In the voltage regulators market, its share is higher at 20–22%, since linear regulators serve as a fundamental category alongside switching regulators.

For the consumer electronics power supply market, the contribution is about 5–6%, primarily driven by their role in televisions, audio systems, and home appliances requiring precise voltage regulation. Within the residential electrical equipment market, the share remains modest at 3–4%, as this category includes wiring, circuit breakers, and other infrastructure components.

The home automation and smart energy devices market sees a share of 2–3%, where linear regulators support smart devices with stable low-dropout performance. Although smaller compared to broader markets, this segment’s significance is growing due to the need for efficient thermal management, noise reduction, and cost-effective designs in modern households. Adoption is further accelerated by trends in smart homes, connected devices, and renewable power integration at the residential level, ensuring steady growth for linear regulators as essential components in reliable and energy-stable home environments.

The linear residential voltage regulator market is demonstrating sustained growth as residential energy consumption patterns evolve alongside the increasing integration of sensitive electronic appliances. The market is being shaped by rising concerns over power quality, voltage fluctuations, and the need for uninterrupted supply to protect household devices.

Consumer demand for efficient and reliable voltage regulation has intensified as urbanization accelerates and grid infrastructure faces mounting stress. Future outlook remains positive, driven by growing residential electrification, energy efficiency initiatives, and technological enhancements that improve regulator durability and responsiveness.

Opportunities are expected to emerge from the ongoing electrification of rural areas and the deployment of smart home technologies that require stable power input. Cost reductions and product innovations are paving the way for greater penetration across varied residential settings, positioning the market for long term expansion.

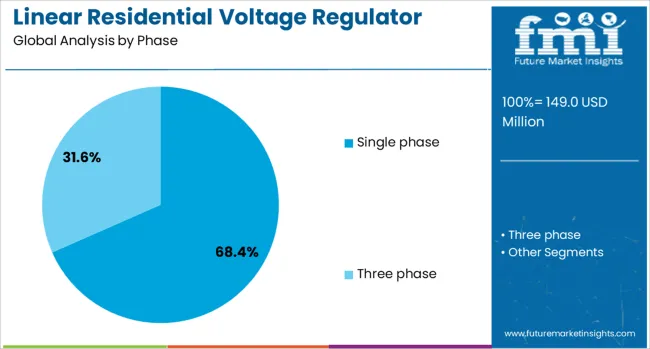

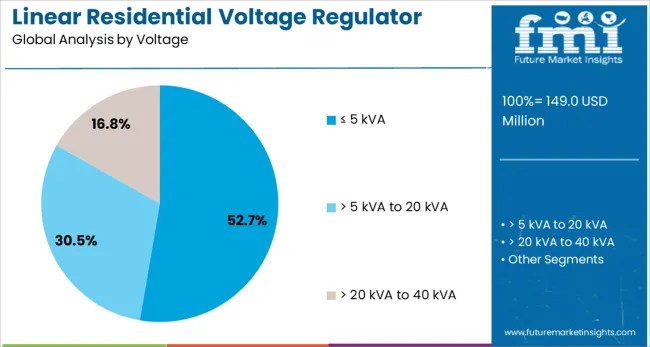

The linear residential voltage regulator market is segmented by phase, voltage, and geographic regions. The linear residential voltage regulator market is divided into single-phase and three-phase. In terms of voltage, the linear residential voltage regulator market is classified into ≤ 5 kVA, > 5 kVA to 20 kVA, and > 20 kVA to 40 kVA.

Regionally, the linear residential voltage regulator industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by phase, the single phase segment is projected to account for 68.4% of the total market revenue in 2025, affirming its dominant position. This prominence is attributed to the widespread prevalence of single phase electrical connections in residential environments, which has necessitated the deployment of compatible voltage regulators.

The simplicity of installation, lower operational costs, and compatibility with standard household circuits have reinforced the preference for single phase regulators. Enhanced product designs that address common residential voltage instability issues have further cemented adoption.

Additionally, the ability of single phase regulators to deliver reliable performance without complex infrastructure modifications has contributed to their market leadership, ensuring continued preference in the residential sector.

Segmented by voltage, the ≤ 5 kVA segment is expected to hold 52.7% of the market revenue in 2025, maintaining its leadership position. This dominance is underpinned by the suitability of ≤ 5 kVA regulators for typical household power demands, which rarely exceed this capacity.

Their affordability, compact form factor, and efficiency in managing residential voltage variations have supported widespread deployment. The segment has also benefited from advancements in thermal management and component reliability, enabling consistent operation even in environments with frequent fluctuations.

Ease of integration into existing electrical setups and alignment with standard residential energy loads have strengthened the segment’s adoption, reinforcing its leading share within the market.

The linear residential voltage regulator market is witnessing growth as energy stability becomes a priority for homes integrating smart appliances and renewable systems. In 2024, demand rose from suburban households using smart devices and inverter-based setups.

In 2025, the inclusion of rooftop solar systems and residential energy storage solutions further amplified the requirement for precise voltage regulation. Manufacturers offering compact, high-accuracy regulators tailored for modern residential electrical networks are well positioned to meet this surge in demand.

The rise in smart home devices, connected appliances, and energy-efficient systems has increased reliance on voltage stability. In 2024, homes equipped with automation technologies and inverter-based equipment widely adopted linear regulators to maintain optimal voltage levels.

By 2025, distributed energy systems, including rooftop solar and small-scale battery setups, reinforced this trend as fluctuations became common in residential grids. These changes show that consistent energy quality has become a central concern. Providers offering durable, precise linear regulators compatible with smart home and renewable applications are expected to gain strong traction in the market.

The rapid expansion of electric vehicle charging in residential settings is creating strong opportunities for advanced voltage regulation solutions. In 2024, homeowners began installing regulators to counter voltage dips and prevent surge-related damage during charging cycles. By 2025, integration of EV chargers with home solar and energy storage systems further emphasized the need for dependable voltage conditioning.

This trend highlights how EV adoption is transforming regulators from optional components into critical system elements. Companies delivering high-capacity, heat-tolerant regulators specifically designed for EV charging compatibility are likely to benefit from this emerging demand.

In 2024 and 2025, demand for linear residential voltage regulators was dampened by the high expense of producing precision regulation units. Manufacturing of low-dropout regulators and thermal‑tolerant circuitry required costly semiconductor materials and tight tolerance control. Budget constraints were reported in regions where cost‑sensitive alternatives, such as switching regulators, continued to dominate.

This cost-driven disparity inhibited adoption by smaller HVAC and residential installations. Because pricing remained rigid due to material and labor expense, linear regulators struggled to compete on value in many markets. That restraint significantly limited broader market uptake.

In 2024‑2025, uptake of linear regulators with remote monitoring and diagnostic features was observed in higher‑end residential projects and managed facilities. Developments included units outfitted with digital interfaces and fault‑reporting capabilities that allowed utility providers and homeowners to monitor voltage stability and logs from afar.

The trend was notably adopted in pilot installations in Europe and India. As this feature has enriched maintenance service models, early deployments signaled a clear opportunity for regulators outfitted with networked monitoring to command premium positioning.

| Country | CAGR |

|---|---|

| China | 10.1% |

| India | 9.4% |

| Germany | 8.6% |

| France | 7.9% |

| UK | 7.1% |

| USA | 6.4% |

| Brazil | 5.6% |

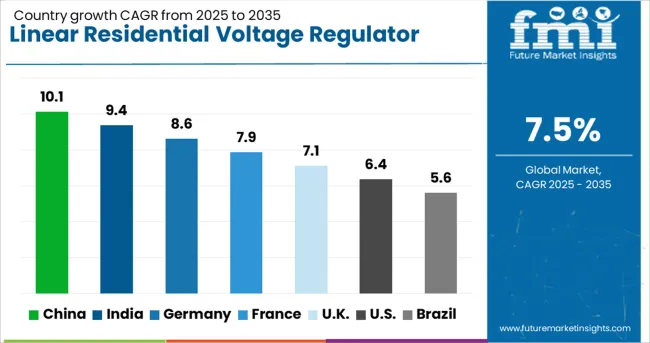

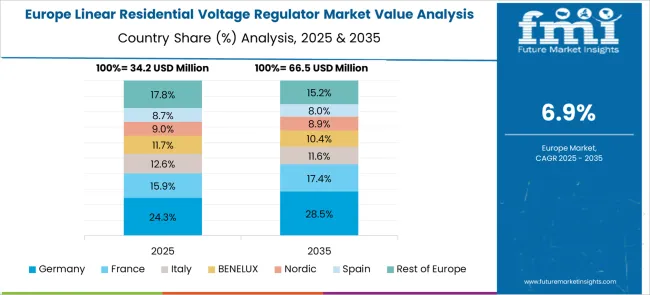

The global linear residential voltage regulator market is projected to grow at a CAGR of 7.5% from 2025 to 2035. China leads with 10.1%, followed by India at 9.4% and Germany at 8.6%. France records 7.9%, while the United Kingdom posts 7.1%. Growth is fueled by rising residential electricity consumption, increased adoption of home automation systems, and demand for voltage stabilization for sensitive electronic devices. China and India dominate due to expanding housing projects and smart home installations. Germany emphasizes energy efficiency standards, while France and the UK prioritize safety compliance and compact designs for modern residential spaces.

China is projected to grow at 10.1%, driven by rapid urban housing expansion and growing demand for smart home technologies. High-precision voltage regulators dominate modern residential installations to protect home appliances. Domestic manufacturers focus on energy-efficient designs to comply with government energy-saving mandates. Increased investment in IoT-based monitoring solutions enhances product functionality.

India is expected to grow at 9.4%, supported by increasing electrification in semi-urban regions and expanding middle-class housing projects. Cost-effective voltage regulators dominate demand in residential areas to protect against power fluctuations. Manufacturers develop compact, modular units for easy installation. Growth in home appliance adoption further accelerates the use of reliable voltage stabilization systems.

Germany is forecast to grow at 8.6%, driven by high penetration of advanced energy management systems in residential spaces. Voltage regulators with integrated surge protection dominate premium housing projects. Manufacturers innovate with low-noise and heat-dissipation designs for sustainability compliance. Demand is further boosted by integration into smart grid-enabled homes under EU efficiency programs.

France is projected to grow at 7.9%, supported by a shift toward smart housing and stringent electrical safety regulations. Advanced voltage regulators dominate applications in urban apartments and connected homes. Manufacturers prioritize aesthetic designs integrated with automation features. Government initiatives for energy-efficient living fuel the transition to modern voltage stabilization solutions.

The UK is expected to grow at 7.1%, driven by modernization of residential power systems and increased adoption of electric appliances. Compact regulators with overload protection dominate usage in apartments and homes. Manufacturers develop AI-enabled regulators for predictive performance optimization. Growth in EV charging infrastructure further supports voltage stabilization in households.

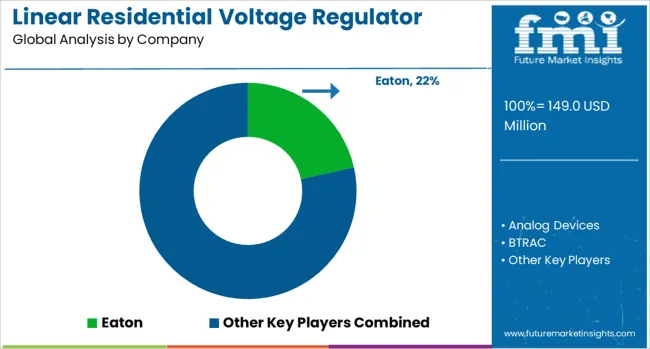

The linear residential voltage regulator market is moderately competitive, with Eaton recognized as a leading player for its advanced residential power management solutions, high reliability, and global distribution network. Eaton’s expertise in energy control and integration into modern home systems strengthens its market position in providing stable voltage for household electronics.

Key players include Analog Devices, BTRAC, Infineon Technologies, Legrand, Maschinenfabrik Reinhausen, MaxLinear, Microchip Technology, NXP Semiconductors, Renesas Electronics Corporation, Ricoh USA, ROHM, SEMTECH, Sollatek, STMicroelectronics, TTM Technologies, TOREX SEMICONDUCTOR, Toshiba Electronic Devices & Storage Corporation, Vicor, and Vishay Intertechnology. These companies deliver a wide range of linear regulator ICs and power modules optimized for consistent voltage supply, low noise, and thermal stability in residential environments.

The market is being driven by the rising integration of smart home systems, increased demand for power quality management, and growing use of sensitive electronic appliances that require stable voltage. Manufacturers are focusing on developing compact, energy-efficient linear regulators with enhanced performance for LED lighting, HVAC systems, and home automation devices. Additionally, advancements in IC design and real-time monitoring capabilities are enabling regulators to meet evolving household energy needs. Regional growth is expected to remain strong in North America and Asia-Pacific due to expanding smart home adoption and investments in modern electrical infrastructure.

| Item | Value |

|---|---|

| Quantitative Units | USD 149.0 Million |

| Phase | Single phase and Three phase |

| Voltage | ≤ 5 kVA, > 5 kVA to 20 kVA, and > 20 kVA to 40 kVA |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Eaton, Analog Devices, BTRAC, Infineon Technologies, Legrand, Maschinenfabrik Reinhausen, MaxLinear, Microchip Technology, NXP Semiconductors, Renesas Electronics Corporation, Ricoh USA, ROHM, SEMTECH, Sollatek, STMicroelectronics, TTM Technologies, TOREX SEMICONDUCTOR, Toshiba Electronic Devices & Storage Corporation, Vicor, and Vishay Intertechnology |

| Additional Attributes | Dollar sales by regulator type (single‑phase vs three‑phase), regional demand trends (North America largest share, APAC fastest growth), competitive landscape, buyer preferences for smart home integration, innovations in IoT-enabled, high-efficiency regulators. |

The global linear residential voltage regulator market is estimated to be valued at USD 149.0 million in 2025.

The market size for the linear residential voltage regulator market is projected to reach USD 307.1 million by 2035.

The linear residential voltage regulator market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in linear residential voltage regulator market are single phase and three phase.

In terms of voltage, ≤ 5 kva segment to command 52.7% share in the linear residential voltage regulator market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Linear Alkylbenzene Sulfonate (LAS) Market Size and Share Forecast Outlook 2025 to 2035

Linear Low-Density Polyethylene Market Size and Share Forecast Outlook 2025 to 2035

Linear Low Density Polyethylene Market Size and Share Forecast Outlook 2025 to 2035

Linear Slide Units Market Size and Share Forecast Outlook 2025 to 2035

Linear Net Weighing Machines Market Size and Share Forecast Outlook 2025 to 2035

Linear Alpha Olefin Market

Linear Actuators Market

Linear Slides Market

Linear Bearings Market

Linear Regulator ICs (LDOs) Market Forecast and Outlook 2025 to 2035

Linear Voltage Regulators Market

Non-Linear Optical Polymers Market Trend Analysis Based on Product, Application, and Region 2025 to 2035

Electric Linear Actuator Market Trends – Growth & Forecast 2025 to 2035

Industrial Linear Accelerator Market Growth & Demand 2025 to 2035

Residential Generator Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy-Efficient Technologies Market Size and Share Forecast Outlook 2025 to 2035

Residential Interior Wood Doors Market Size and Share Forecast Outlook 2025 to 2035

Residential Air-to-Air Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Automatic Motor Starter Market Size and Share Forecast Outlook 2025 to 2035

Residential AMI Gas Meter Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA