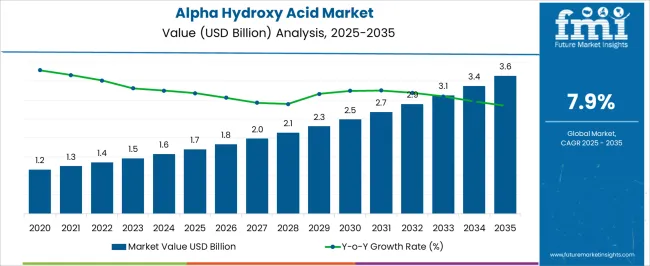

The alpha hydroxy acid market is estimated to be valued at USD 1.7 billion in 2025 and is projected to reach USD 3.6 billion by 2035, registering a compound annual growth rate (CAGR) of 7.9% over the forecast period. This steady growth presents a notable absolute dollar opportunity of USD 1.9 billion over the decade. Starting from USD 1.2 billion in the early years, the market experiences gradual expansion, reaching USD 2.7 billion by 2030. For companies operating in personal care and cosmetic sectors, this growth represents a reliable revenue potential, allowing businesses to plan product launches, marketing strategies, and capacity expansions in line with the steady demand increase.

The absolute dollar opportunity from 2025 to 2035 highlights incremental gains each year, with the market expanding from USD 1.7 billion to USD 3.6 billion, creating consistent value for investors and stakeholders. Annual growth increases modestly from USD 1.8 billion in 2026 to USD 3.4 billion in 2034, before reaching USD 3.6 billion in 2035. This pattern indicates a low-risk, stable growth environment, making it possible for companies to capture meaningful market share gradually. By strategically aligning operations with these growth trends, businesses can optimize returns and strengthen their position in the evolving AHA market.

| Metric | Value |

|---|---|

| Alpha Hydroxy Acid Market Estimated Value in (2025 E) | USD 1.7 billion |

| Alpha Hydroxy Acid Market Forecast Value in (2035 F) | USD 3.6 billion |

| Forecast CAGR (2025 to 2035) | 7.9% |

A breakpoint analysis of the Alpha Hydroxy Acid (AHA) market reveals periods where growth accelerates and strategic focus becomes critical. From 2025 to 2028, the market grows from USD 1.7 billion to USD 1.8 billion, indicating a slow but steady phase where early investments yield incremental gains. During this period, annual increases are modest, between USD 0.1 and 0.2 billion, offering a low-risk window for companies to establish a presence, fine-tune product offerings, and understand consumer preferences.

Recognizing this early breakpoint helps businesses optimize resource allocation and prepare for the gradual acceleration in the following years. The next breakpoint emerges between 2030 and 2035, as the market expands from USD 2.5 billion to USD 3.6 billion, reflecting stronger annual increments of USD 0.3–0.4 billion. This phase represents higher revenue potential and increased competition, making strategic positioning crucial for maximizing market share. Companies entering or scaling operations during this period can capture significant absolute dollar gains while benefiting from the consistent 7.9% CAGR. Understanding these breakpoints enables investors and businesses to plan product launches, marketing strategies, and capacity expansion to align with periods of accelerated market growth.

The alpha hydroxy acid (AHA) market is experiencing steady growth, driven by rising demand for advanced skincare solutions and increased consumer awareness of ingredient efficacy in cosmetic formulations. Industry announcements and beauty sector reports have underscored the expanding use of AHAs in products targeting exfoliation, skin rejuvenation, and anti-aging benefits.

Technological advancements in formulation science have improved the stability and delivery of AHAs, allowing brands to offer effective yet skin-friendly solutions. Additionally, the clean beauty movement and preference for science-backed active ingredients have further elevated AHAs’ profile in both mass-market and premium skincare lines.

Emerging markets are witnessing stronger adoption due to growing disposable incomes and the influence of global beauty trends through digital platforms. Regulatory approvals and safety evaluations have supported their inclusion in a wider range of personal care products, enhancing consumer trust. Looking ahead, continued product innovation, expansion of multifunctional formulations, and integration of AHAs in hybrid skincare-makeup products are expected to strengthen market growth, with demand led by glycolic acid and cosmetic applications.

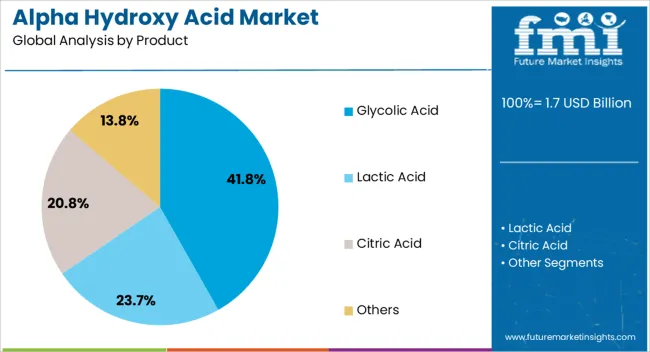

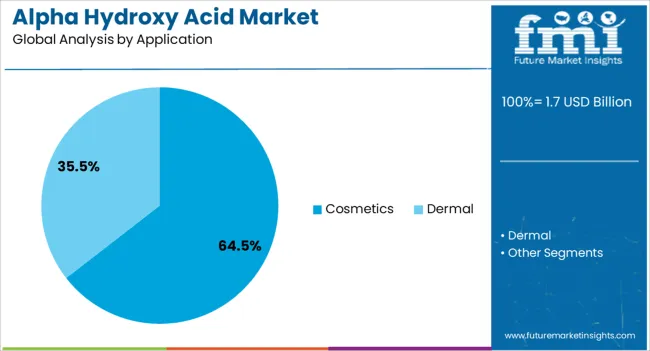

The alpha hydroxy acid market is segmented by product, application, and geographic regions. By product, alpha hydroxy acid market is divided into glycolic acid, lactic acid, citric acid, and others. In terms of application, alpha hydroxy acid market is classified into cosmetics and dermal. Regionally, the alpha hydroxy acid industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The glycolic acid segment is projected to account for 41.8% of the alpha hydroxy acid market revenue in 2025, maintaining its lead due to its proven efficacy in skin resurfacing and renewal. Derived primarily from sugarcane, glycolic acid is valued for its small molecular size, which allows deeper skin penetration compared to other AHAs.

Dermatological publications have recognized its ability to promote collagen synthesis, improve skin texture, and address hyperpigmentation, making it a preferred active in both professional treatments and at-home skincare products. Manufacturers have leveraged its versatility by incorporating glycolic acid into cleansers, serums, peels, and creams across various concentrations. Additionally, advances in controlled-release formulations have minimized irritation risks, broadening its suitability for different skin types. Consumer preference for visible and rapid skincare results has reinforced the segment’s growth, with ongoing research expected to further optimize glycolic acid applications in cosmetic and dermatological fields.

The cosmetics segment is projected to hold 64.5% of the alpha hydroxy acid market revenue in 2025, positioning it as the dominant application category. Growth in this segment has been fueled by the increasing integration of AHAs into a wide spectrum of skincare and beauty products aimed at improving skin appearance and health.

Cosmetic formulators have adopted AHAs for their exfoliating, brightening, and anti-aging properties, aligning with consumer demand for multifunctional products. Industry data has highlighted strong uptake in facial peels, anti-wrinkle creams, and brightening treatments, where AHAs play a key role in delivering visible results.

The segment has also benefited from marketing campaigns that educate consumers on active ingredients, fostering informed purchasing decisions. Additionally, rising demand in emerging economies, where beauty-conscious consumers are rapidly adopting global skincare trends, has expanded the application scope. As innovation continues in textures, delivery systems, and synergistic formulations, the cosmetics segment is expected to sustain its market leadership and growth momentum.

The alpha hydroxy acid market is expanding as consumers increasingly adopt skincare products with exfoliating, anti-aging, and brightening benefits. AHAs, including glycolic acid, lactic acid, and citric acid, are widely used in creams, serums, masks, and chemical peels for improving skin texture, reducing wrinkles, and promoting cell turnover. Rising awareness of dermatological health, growing demand for natural and plant-derived AHAs, and increasing adoption of personalized skincare routines drive market growth. Manufacturers offering standardized, high-purity, and stable AHA formulations with proven efficacy gain competitive advantages. Additionally, the surge in e-commerce and social media influence supports product visibility and accessibility. Trends in clean-label, sustainable, and multifunctional skincare products further reinforce the expansion of the global alpha hydroxy acid market.

Market growth is restrained by regulatory compliance and formulation challenges associated with alpha hydroxy acids. Concentration limits, labeling requirements, and safety regulations differ across regions, impacting product development and market access. High concentrations of AHAs may cause skin irritation, photosensitivity, or allergic reactions, requiring careful formulation and consumer guidance. Stability and compatibility with other active ingredients also pose technical challenges for manufacturers. Additionally, sourcing natural AHAs from fruit or plant extracts involves variability in purity and activity levels. Compliance with Good Manufacturing Practices (GMP), ISO standards, and regional cosmetic regulations adds operational complexity. Until standardized formulations and consistent regulatory frameworks are adopted globally, these challenges may slow adoption and expansion in personal care and cosmeceutical markets.

Market trends are influenced by technological innovations in formulation, delivery systems, and product efficacy. Encapsulation, microemulsion, and time-release technologies improve stability, skin penetration, and tolerability of AHAs. Multifunctional products combining AHAs with antioxidants, peptides, or hyaluronic acid enhance anti-aging, brightening, and moisturizing effects. Plant-derived and sustainably sourced AHAs are gaining traction due to consumer preference for natural, eco-friendly ingredients. Digital tools and AI-based skincare analysis also support personalized AHA formulations for different skin types and concerns. These trends highlight the integration of scientific innovation, sustainability, and personalization in expanding AHA applications across skincare, dermatology, and cosmetic industries globally.

Opportunities in the alpha hydroxy acid market are driven by increasing skincare awareness, demand for anti-aging solutions, and growth in cosmetic and cosmeceutical products. Millennials and Gen Z consumers are actively seeking exfoliating and brightening solutions, creating strong demand for AHA-containing formulations. Expansion of e-commerce platforms and beauty retail chains improves product accessibility and visibility. Manufacturers offering stable, safe, and multi-functional AHA formulations with natural or plant-derived sources can capture significant market share. Emerging markets with rising disposable incomes and increasing interest in personal grooming also present growth opportunities. Partnerships with dermatologists, cosmetic brands, and wellness plat

Market growth is restrained by intense competition, cost considerations, and ingredient stability issues. Multiple global and regional suppliers compete on price, purity, and formulation innovation, affecting margins. Natural AHA sources, extraction processes, and high-purity synthetic AHAs can be expensive, limiting adoption in cost-sensitive markets. Stability challenges, such as oxidation and degradation in formulations, require careful storage and packaging. Differences in concentration and formulation standards across manufacturers can affect product efficacy and consumer trust. Until cost-effective, stable, and standardized AHA solutions are widely available, market growth may remain concentrated among premium skincare products and regions with strong regulatory oversight and high consumer awareness.

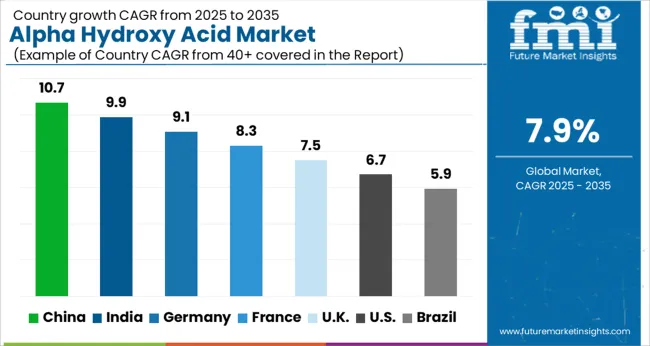

| Country | CAGR |

|---|---|

| China | 10.7% |

| India | 9.9% |

| Germany | 9.1% |

| France | 8.3% |

| UK | 7.5% |

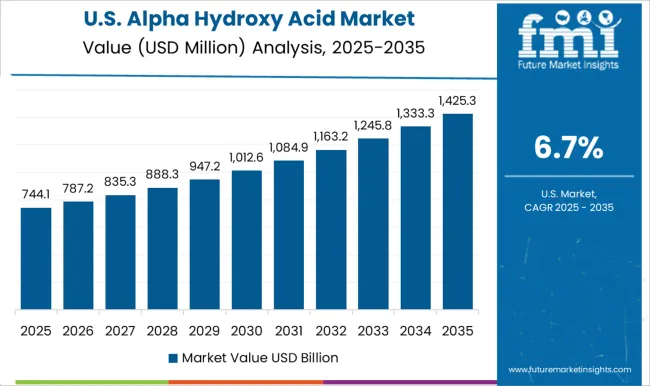

| USA | 6.7% |

| Brazil | 5.9% |

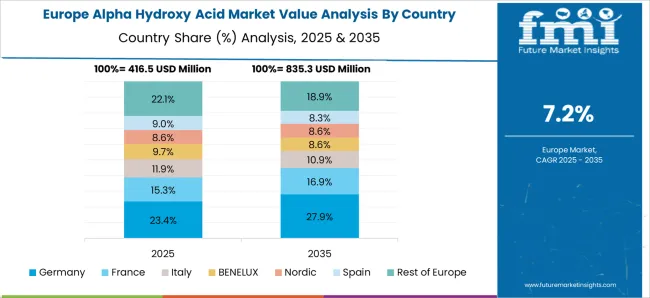

The global alpha hydroxy acid (AHA) market was projected to grow at a 7.9% CAGR through 2035, driven by demand in skincare, cosmetics, and personal care applications. Among BRICS nations, China recorded 10.7% growth as large-scale production facilities were commissioned and compliance with quality and safety standards was enforced, while India at 9.9% growth saw expansion of manufacturing units to meet rising regional consumption. In the OECD region, Germany at 9.1% maintained substantial output under strict cosmetic and chemical regulations, while the United Kingdom at 7.5% relied on moderate-scale operations for skincare and beauty product applications. The USA, expanding at 6.7%, remained a mature market with steady demand in personal care and cosmetic segments, supported by adherence to federal and state-level product safety and quality standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

Alpha hydroxy acid market in China is expanding at a CAGR of 10.7%, driven by increasing consumer awareness of skincare and anti-aging products. Rising disposable incomes and growing beauty and personal care industries are fueling demand for cosmetic formulations containing AHAs. Both domestic and international brands are launching products such as serums, creams, and exfoliators that include glycolic, lactic, and citric acids. E-commerce platforms and online beauty retailers are improving product accessibility across urban and semi-urban regions. Dermatologists and beauty professionals are promoting AHAs for chemical exfoliation, brightening, and skin texture improvement. Consumers are showing preference for formulations with natural ingredients combined with AHAs, creating opportunities for innovative product development. Regulatory approvals for safe concentration levels further support market growth and product expansion in the competitive Chinese beauty market.

Alpha hydroxy acid market in India is growing at a CAGR of 9.9%, supported by rising skincare awareness and expanding middle class population. Increasing interest in anti-aging and chemical exfoliation products is driving demand for AHAs in creams, lotions, and serums. Both domestic and multinational beauty companies are introducing affordable and premium formulations suited for diverse Indian skin types. E-commerce platforms and social media marketing campaigns are enhancing consumer education and product reach. Professional skincare clinics are recommending AHA based treatments for pigmentation, uneven skin tone, and mild acne. The growing trend for natural and plant derived AHAs is influencing product development strategies. Regulatory frameworks ensure safety and concentration compliance, further encouraging consumer confidence. Rising urbanization and modern retail expansion continue to drive market adoption across key cities.

Alpha hydroxy acid market in Germany is growing at a CAGR of 9.1%, driven by increasing demand for high quality and dermatologist recommended skincare products. Consumers are adopting AHAs for chemical exfoliation, anti-aging, and skin brightening benefits. Both premium and mid-tier cosmetic brands are incorporating glycolic and lactic acids into creams, masks, and serums. Organic and natural formulations are gaining popularity due to rising consumer preference for chemical-free skincare. Beauty clinics and dermatology centers are recommending professional treatments that complement home care products. Retail chains and e-commerce platforms are enhancing product availability, while strict EU regulations ensure safety and concentration compliance. Market growth is influenced by a combination of strong consumer education, professional endorsements, and innovative product formulations.

Alpha hydroxy acid market in the United Kingdom is expanding at a CAGR of 7.5%, supported by increasing demand for anti-aging and skin rejuvenation products. Both specialty and mass market brands are offering serums, creams, and peels enriched with glycolic, lactic, and citric acids. E-commerce and online beauty platforms are providing easy access to a variety of formulations and brands. Beauty salons and dermatology clinics are educating consumers on proper usage, benefits, and precautions for AHAs. Consumer preference for gentle and skin friendly products is encouraging development of low concentration and natural derived AHAs. Regulatory oversight ensures safety and quality standards for cosmetic formulations. The combination of growing awareness, professional guidance, and diverse product offerings is driving gradual market growth in the United Kingdom.

Alpha hydroxy acid market in the United States is growing at a CAGR of 6.7%, driven by consistent demand for anti-aging, chemical exfoliation, and brightening skincare products. Both high-end and drugstore brands are launching creams, serums, and peels enriched with glycolic, lactic, and citric acids. Professional dermatology clinics and spas are offering AHA based treatments, complementing home care products. Consumers show increasing interest in natural and plant derived AHAs due to skin sensitivity concerns. E-commerce platforms, subscription boxes, and online marketing campaigns are supporting product awareness and accessibility. Regulatory oversight ensures concentration compliance and product safety, maintaining consumer confidence. Innovation in packaging, formulations, and multifunctional skincare products continues to influence market growth across urban and suburban areas.

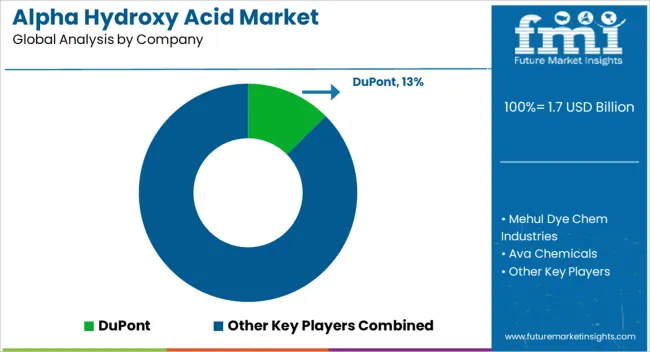

The alpha hydroxy acid market is supplied by DuPont, Mehul Dye Chem Industries, Ava Chemicals, Parchem, Dow, Crosschem, H Plus Limited, Airedale Chemical Company Limited, Sculptra Aesthetics, Lotion Crafter, Bulk Actives, and Tokyo Chemical Industry, with competition shaped by purity levels, concentration consistency, and regulatory compliance. DuPont and Dow brochures highlight cosmetic- and dermatology-grade AHAs, specifying molecular structure, solubility, pH stability, and intended skin applications. Parchem and Ava Chemicals provide datasheets detailing glycolic, lactic, and citric acid grades, with product sheets covering viscosity, water content, and storage requirements.

Mehul Dye Chem Industries and Crosschem emphasize industrial-grade formulations suitable for chemical intermediates, with technical documentation on assay percentage, melting point, and moisture content. Observed industry patterns indicate growing demand for cosmetic formulations and peel applications requiring high-purity, stable alpha hydroxy acids. Market strategies focus on differentiation through purity, formulation support, and global regulatory alignment.

DuPont, Dow, and Parchem invest in high-purity production processes and standardized testing to ensure batch-to-batch consistency. Ava Chemicals and H Plus Limited provide customized blends for cosmetic manufacturers, including formulation guidance and compatibility testing. Bulk Actives and Lotion Crafter target small-scale and niche cosmetic producers, emphasizing flexible quantities and consistent quality for formulation trials.

Tokyo Chemical Industry and Airedale Chemical Company prioritize consistent quality with detailed safety and handling documentation to meet international chemical regulations. Observed trends suggest that suppliers are increasingly offering traceable sourcing, quality certifications, and multi-grade options for personal care, pharmaceutical, and industrial applications. Product brochures and datasheets communicate critical parameters such as concentration range, molecular weight, pH stability, solubility, storage conditions, and handling precautions.

DuPont and Dow include performance data for cosmetic formulations and peel applications, while Sculptra Aesthetics highlights compatibility with injectable and skincare products. Ava Chemicals and Parchem provide safety sheets, material compliance certifications, and shelf-life data. Mehul Dye Chem Industries and Crosschem detail industrial handling, solubility profiles, and purity verification. Clear technical documentation allows formulators, chemical engineers, and regulatory teams to assess suitability, ensuring adoption based on verified quality, stability, and compliance across cosmetic, pharmaceutical, and industrial markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.7 billion |

| Product | Glycolic Acid, Lactic Acid, Citric Acid, and Others |

| Application | Cosmetics and Dermal |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DuPont, Mehul Dye Chem Industries, Ava Chemicals, Parchem, Dow, Crosschem, H Plus Limited, Airedale Chemical Company Limited, Sculptra Aesthetics, Lotion crafter, Bulk Actives, and Tokyo Chemical Industry |

| Additional Attributes | Dollar sales vary by product type, including glycolic acid, lactic acid, citric acid, and malic acid; by application, such as skincare, cosmetics, anti-aging, and chemical peels; by end-use industry, spanning personal care, dermatology, and cosmetics manufacturing; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising demand for skincare products, anti-aging solutions, and natural cosmetic ingredients. |

The global alpha hydroxy acid market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the alpha hydroxy acid market is projected to reach USD 3.6 billion by 2035.

The alpha hydroxy acid market is expected to grow at a 7.9% CAGR between 2025 and 2035.

The key product types in alpha hydroxy acid market are glycolic acid, lactic acid, citric acid and others.

In terms of application, cosmetics segment to command 64.5% share in the alpha hydroxy acid market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Alpha Hydroxy Acid (AHA) Serums Market Size and Share Forecast Outlook 2025 to 2035

Alpha Olefin Market Forecast and Outlook 2025 to 2035

Alpha-Arbutin Market Size and Share Forecast Outlook 2025 to 2035

Alpha-Methylstyrene Market Size and Share Forecast Outlook 2025 to 2035

Alpha-1 Antitrypsin Deficiency Market Size and Share Forecast Outlook 2025 to 2035

Alpha Glucosidase Inhibitors Market Size and Share Forecast Outlook 2025 to 2035

Alpha-lactalbumin Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Alpha-Amylase Baking Enzyme Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Alpha Olefin Sulfonates Market Growth - Trends & Forecast 2025 to 2035

Alpha-Linolenic Acid Market Size and Share Forecast Outlook 2025 to 2035

Alpha-Sulfophenylacetic Acid Market Size and Share Forecast Outlook 2025 to 2035

Linear Alpha Olefin Market

Hydroxypropyl Guar Gum for Coatings Market Size and Share Forecast Outlook 2025 to 2035

Hydroxytyrosol for Skin Health Market Size and Share Forecast Outlook 2025 to 2035

Hydroxylamine Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Hydroxyproline Market Analysis - Size, Share & Forecast 2025 to 2035

Hydroxypropyl Distarch Phosphate Market Growth - Trends & Forecast 2025 to 2035

Hydroxyapatite Market Growth - Trends & Forecast 2025 to 2035

Hydroxytyrosol Market Analysis by Product Type, Form, Source and Application Through 2035

Global Hydroxyzine Market Analysis – Size, Share & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA