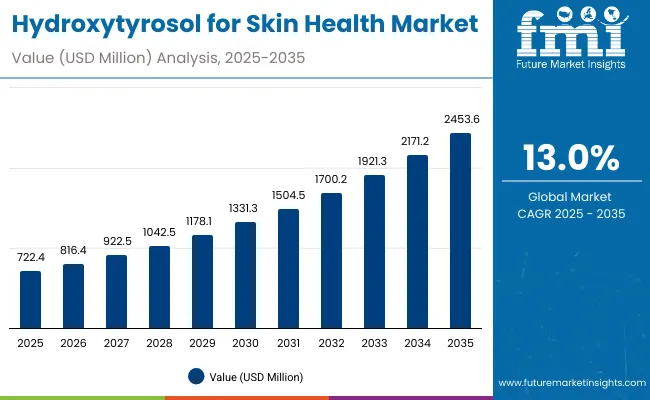

The Hydroxytyrosol for Skin Health Market is expected to record a valuation of USD 722.4 million in 2025 and USD 2,453.6 million in 2035, with an increase of USD 1,731.2 million, equal to a growth of 239% over the decade. The overall expansion represents a CAGR of 13.0% and more than a 3X increase in market size.

Hydroxytyrosol for Skin Health Market Key Takeaways

| Metric | Value |

|---|---|

| Hydroxytyrosol for Skin Health Market Estimated Value in (2025E) | USD 722.4 million |

| Hydroxytyrosol for Skin Health Market Forecast Value in (2035F) | USD 2,453.6 million |

| Forecast CAGR (2025 to 2035) | 13.0% |

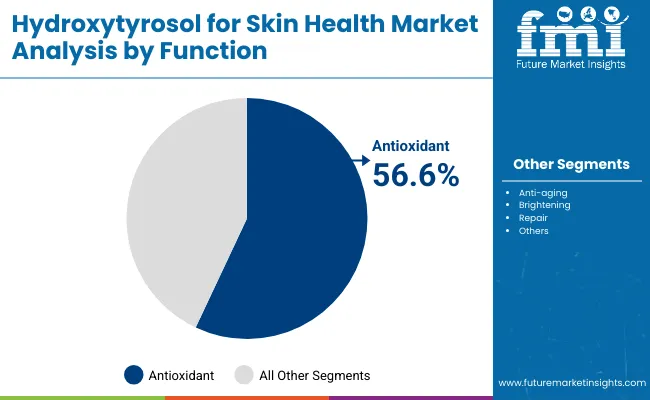

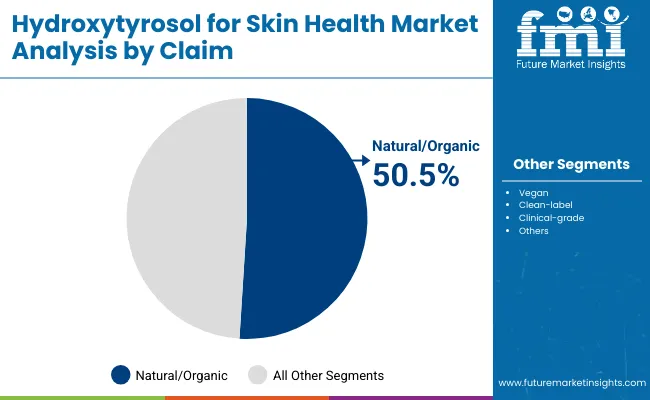

The market grows from USD 722.4 million to USD 1,331.3 million, adding USD 608.9 million, which accounts for 35% of the total decade growth. This phase records steady adoption of antioxidant-focused serums and creams, with the antioxidant function holding 56.6% share in 2025. Natural/organic claims (50.5%) play a key role in consumer preference, especially across e-commerce and specialty beauty store channels.

The market accelerates from USD 1,331.3 million to USD 2,453.6 million, contributing USD 1,122.3 million, equal to 65% of total decade growth. This rapid expansion is powered by strong uptake in Asia-Pacific, with India (22.9% CAGR) and China (22.7% CAGR) emerging as the fastest-growing markets. Increasing demand for clinical-grade and natural/organic products, coupled with rising digital retail penetration, further drives adoption. Europe and the U.S. maintain stable shares, driven by compliance with safety and clinical-grade efficacy standards.

From 2020 to 2024, the Hydroxytyrosol for Skin Health Market grew from USD 393.0 million to USD 650.0 million, driven by rising adoption of antioxidant-rich and anti-aging skincare products. During this period, major ingredient manufacturers controlling nearly 65% of revenue, with leaders such as DSM-Firmenich, BASF, and Seprox Biotech focusing on high-purity hydroxytyrosol extracts, dominated the competitive landscape. Competitive differentiation relied on clinical validation, ingredient stability, and sustainable sourcing, while software-like support services such as branded ingredient licensing and formulation consulting contributed less than 10% of the total market value.

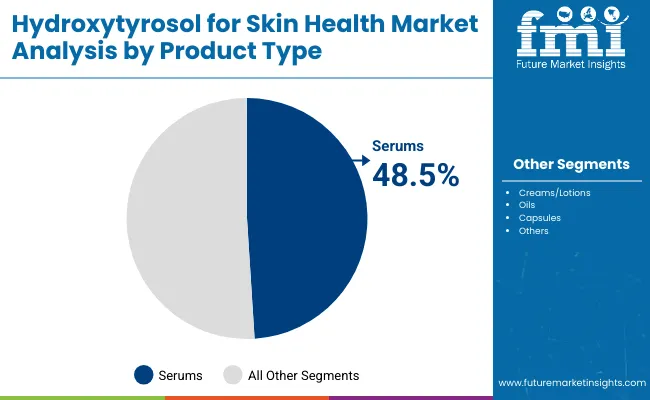

Demand for Hydroxytyrosol for Skin Health will expand to USD 722.4 million in 2025, and the revenue mix will shift as natural/organic claims (50.5%) and serums (48.5%) capture greater share. Traditional global leaders face rising competition from Ayurveda-inspired suppliers and niche biotech firms offering tailored formulations and high-potency extracts. Competitive advantage is moving away from ingredient purity alone toward ecosystem partnerships, clinical trial-backed efficacy, and brand-driven consumer education, enabling recurring revenue streams and strengthening scalability across cosmeceuticals and premium skincare categories.

Rising consumer awareness of antioxidant-rich skincare is fueling strong demand for hydroxytyrosol, as it provides powerful natural protection against oxidative stress, UV damage, and premature aging. This active compound is increasingly featured in anti-aging and brightening formulations, appealing to consumers seeking clinically proven, plant-based solutions. Its ability to support skin elasticity, reduce inflammation, and improve overall complexion positions hydroxytyrosol as a key growth driver in premium skincare products.

Increasing preference for clean-label and natural ingredients is significantly boosting market growth, with hydroxytyrosol gaining traction as a safe, plant-derived active backed by clinical studies. Consumers are moving away from synthetic additives and embracing formulations that emphasize purity and efficacy. Hydroxytyrosol is now widely integrated into serums, creams, oils, and capsules, meeting the demand for multi-functional skincare products while aligning with the global shift toward sustainable and transparent beauty solutions.

The Hydroxytyrosol for Skin Health Market is segmented by function, product type, claim, channel, and region. Functions include antioxidant, anti-aging, brightening, and repair, reflecting its core skincare benefits. Product types cover serums, creams/lotions, oils, and capsules, addressing varied consumer preferences and delivery formats. By claim, the segmentation spans natural/organic, vegan, clean-label, and clinical-grade, highlighting consumer demand for authenticity and efficacy. Key distribution channels include e-commerce, pharmacies, specialty beauty stores, and mass retail. Regionally, the market scope extends across North America, Latin America, Europe, East Asia, South Asia, and the Pacific, with China, India, Japan, Germany, the UK, and the USA being key contributors.

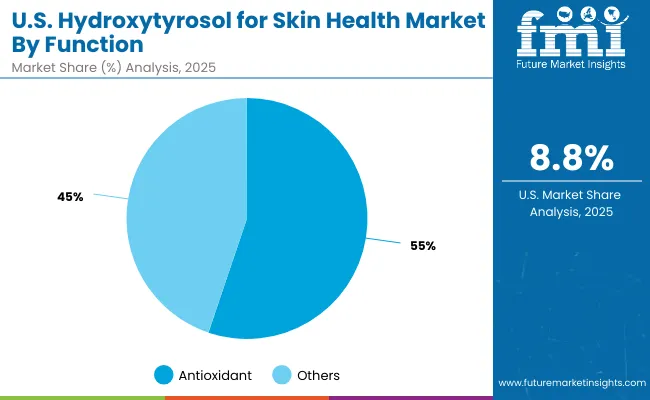

| Function | Value Share% 2025 |

|---|---|

| Antioxidant | 56.6% |

| Others | 43.4% |

The antioxidant segment is projected to account for the largest share of the Hydroxytyrosol for Skin Health Market in 2025, underscoring its role as the primary driver of product adoption. Hydroxytyrosol’s powerful antioxidant properties protect skin from oxidative stress, UV damage, and environmental pollutants, making it indispensable in anti-aging and skin-brightening formulations. Its rising popularity among consumers seeking natural, clinically proven actives has fueled strong demand in serums, creams, and capsules. This segment is expected to remain the backbone of hydroxytyrosol-based skincare solutions throughout the forecast period.

| Claim | Value Share% 2025 |

|---|---|

| Natural/organic | 50.5% |

| Others | 49.5% |

The natural/organic segment is forecasted to lead the Hydroxytyrosol for Skin Health Market in 2025, reflecting growing consumer demand for clean-label, plant-derived skincare products. Hydroxytyrosol’s natural origin from olives aligns perfectly with this preference, positioning it as a key ingredient in serums, creams, and oils marketed as pure and sustainable. This segment benefits from rising awareness about chemical-free beauty, regulatory support for safer cosmetics, and premiumization trends in skincare. As health-conscious consumers increasingly prioritize authenticity and efficacy, natural/organic claims are expected to remain the dominant growth driver of the market.

| Product Type | Value Share% 2025 |

|---|---|

| Serums | 48.5% |

| Others | 51.5% |

The serum segment is projected to account for a significant portion of the Hydroxytyrosol for Skin Health Market revenue in 2025, establishing itself as a leading product type. Serums are favored for their lightweight formulation, high concentration of hydroxytyrosol, and ability to deliver rapid absorption and targeted skin benefits. Their suitability for addressing anti-aging, antioxidant protection, and brightening has made them a staple in both clinical-grade and natural beauty lines. Supported by rising consumer demand for multifunctional and premium skincare, serums are expected to maintain strong momentum, positioning them at the forefront of hydroxytyrosol-based product innovation.

Rising Demand for Antioxidant-Based Skincare

The Hydroxytyrosol for Skin Health Market is being propelled by growing consumer awareness of antioxidant-driven skincare. Hydroxytyrosol, derived primarily from olives, is recognized for its strong free-radical neutralizing properties, offering natural protection against oxidative stress, UV damage, and premature aging. This scientific validation has spurred its adoption in serums, creams, and capsules aimed at anti-aging and brightening effects. As health-conscious consumers increasingly seek preventive skincare solutions with clinically proven efficacy, hydroxytyrosol has emerged as a key differentiator, driving significant demand across global beauty and wellness markets.

Shift Toward Natural and Clean-Label Ingredients

The market is also driven by the accelerating preference for natural, clean-label, and plant-derived ingredients in skincare formulations. Hydroxytyrosol offers a sustainable, traceable, and clinically supported alternative to synthetic antioxidants, aligning perfectly with the clean beauty movement. Brands are leveraging its natural origin to position products within vegan, organic, and clinical-grade skincare portfolios. Consumer trust in botanical actives has expanded hydroxytyrosol’s role beyond niche brands into mainstream offerings, strengthening its market penetration. This shift enhances adoption across regions where regulatory bodies promote natural formulations, boosting overall growth potential.

High Production Costs and Limited Availability

Despite strong demand, the Hydroxytyrosol for Skin Health Market faces challenges from its high extraction costs and limited raw material availability. Obtaining hydroxytyrosol in high purity requires advanced processing, which raises overall product costs compared to widely available synthetic alternatives. These elevated prices can restrict its accessibility in mass-market skincare, confining its reach primarily to premium and luxury categories. Moreover, fluctuations in olive crop yields impact supply chain stability. Such barriers could slow down broader adoption, particularly in cost-sensitive developing markets.

Growing Use of Hydroxytyrosol in Clinical-Grade and Functional Skincare

A notable trend shaping the market is the rapid integration of hydroxytyrosol into clinical-grade and multifunctional skincare products. Beyond cosmetic benefits, its anti-inflammatory and antimicrobial properties are being studied for dermatological applications, widening its role in skin repair and sensitive-skin solutions. Brands are increasingly launching hydroxytyrosol-infused serums, oils, and capsules marketed as hybrid wellness-cosmetic products. Coupled with rising e-commerce penetration and personalized beauty solutions, this trend positions hydroxytyrosol as a versatile ingredient bridging cosmetic efficacy with therapeutic benefits, appealing to both dermatologists and beauty consumers.

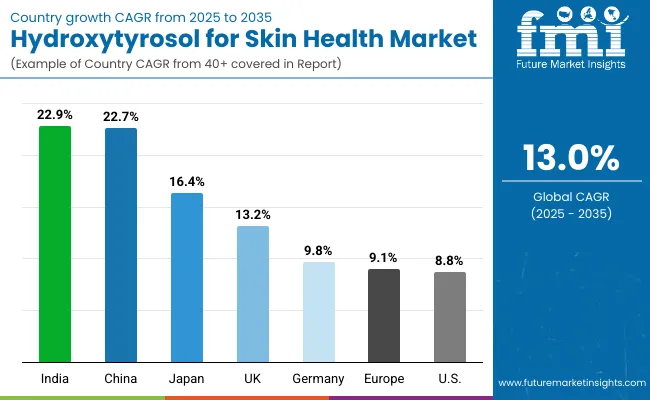

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 22.7% |

| USA | 8.8% |

| India | 22.9% |

| UK | 13.2% |

| Germany | 9.8% |

| Japan | 16.4% |

The global Hydroxytyrosol for Skin Health Market shows notable regional disparities in growth, driven by consumer awareness, regulatory environments, and the adoption of natural skincare trends. Asia-Pacific is the fastest-growing region, with China (22.7% CAGR) and India (22.9% CAGR) leading due to rising demand for antioxidant-rich products, expanding middle-class consumer bases, and increased e-commerce penetration. These countries are also benefiting from government-backed initiatives supporting natural and plant-based cosmetics.

Europe maintains a strong profile, led by Germany (9.8% CAGR) and the UK (13.2% CAGR), driven by strict cosmetic regulations, high spending on premium beauty, and strong demand for clean-label products. Japan (16.4% CAGR) reflects Asia’s innovation hub, where advanced formulations, clinical-grade skincare, and multifunctional products are highly valued. North America, led by the USA (8.8% CAGR), is expanding steadily but at a slower pace compared to Asia-Pacific. Growth here is supported by the premiumization of skincare, rising demand for antioxidant serums, and clean-beauty adoption, though market maturity and high competition limit acceleration.

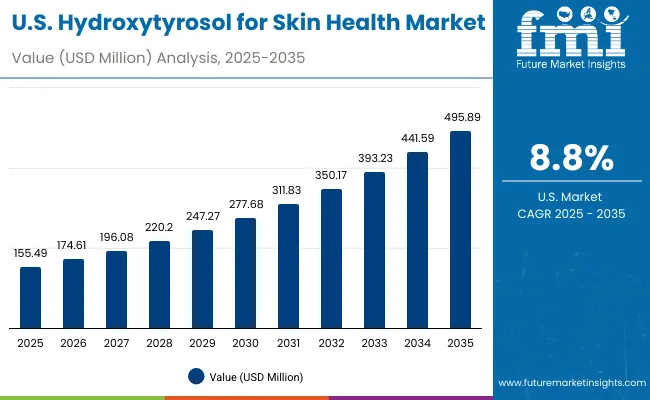

| Year | USA Hydroxytyrosol for Skin Health Market |

|---|---|

| 2025 | 155.49 |

| 2026 | 174.61 |

| 2027 | 196.08 |

| 2028 | 220.20 |

| 2029 | 247.27 |

| 2030 | 277.68 |

| 2031 | 311.83 |

| 2032 | 350.17 |

| 2033 | 393.23 |

| 2034 | 441.59 |

| 2035 | 495.89 |

The Hydroxytyrosol for Skin Health Market in the United States is projected to grow at a CAGR of 8.8% between 2025 and 2035, reflecting steady adoption of natural antioxidant skincare. Growth is driven by rising consumer preference for anti-aging and antioxidant serums, supported by increasing awareness of oxidative stress and its role in skin health. The USA market is also witnessing demand for clinical-grade and clean-label products, especially in dermatology clinics and premium retail chains. E-commerce remains a strong growth channel, offering wide product availability and brand visibility.

The Hydroxytyrosol for Skin Health Market in the United Kingdom is projected to grow at a CAGR of 13.2% from 2025 to 2035, reflecting the country’s strong adoption of natural antioxidant-based skincare solutions. Growth is supported by the rising demand for anti-aging and antioxidant serums, as British consumers are increasingly shifting toward clean-label, organic, and plant-derived formulations. Dermatology clinics, premium beauty retailers, and e-commerce channels are expanding their offerings of clinical-grade hydroxytyrosol-infused products, further driving adoption. Public awareness campaigns on skin health and government-backed innovation programs in natural bioactives are also accelerating market penetration.

India is set to record rapid expansion in the Hydroxytyrosol for Skin Health Market, projected at a CAGR of 22.9% through 2035. Rising consumer awareness of the benefits of antioxidant-rich skincare is driving strong demand for hydroxytyrosol in anti-aging and brightening formulations. Growth is also supported by the popularity of Ayurveda-inspired and natural product lines, where hydroxytyrosol is being positioned as a clinically validated, plant-derived ingredient. Increasing urbanization and e-commerce penetration across tier-2 and tier-3 cities are boosting accessibility, while local brands and global entrants are accelerating adoption with affordable product launches and clean-label positioning.

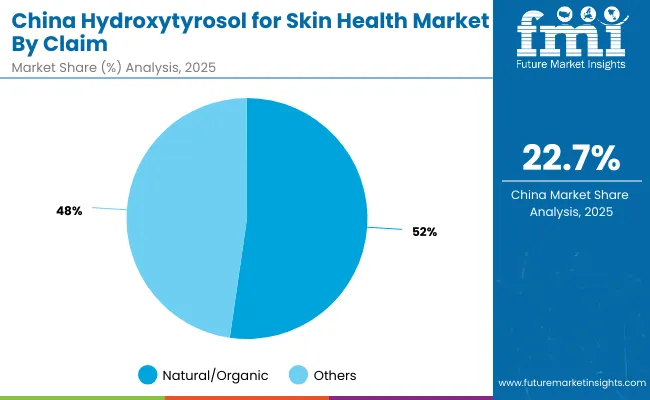

The Hydroxytyrosol for Skin Health Market in China is projected to grow at a CAGR of 22.7% (2025-2035), making it one of the fastest-growing markets globally. Growth is strongly supported by rising consumer awareness of natural antioxidants, government-backed wellness initiatives, and expanding clean-label beauty portfolios by both local and international players. The preference for natural/organic claims (52.3% in 2025) highlights China’s pivot toward safer, plant-derived skincare. E-commerce platforms are becoming the largest distribution enablers, connecting domestic producers with global buyers and amplifying adoption.

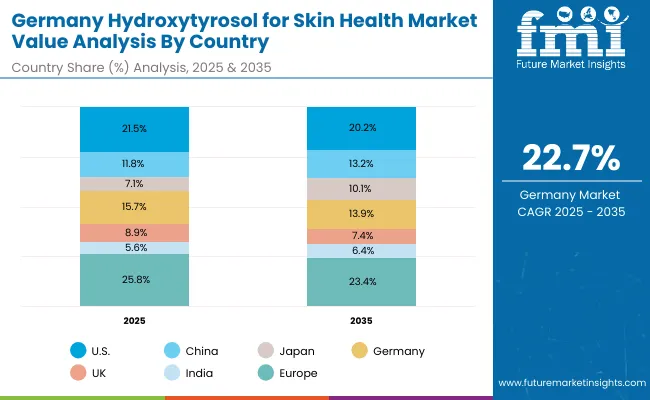

| Countries | 2025 Share (%) |

|---|---|

| USA | 21.5% |

| China | 11.8% |

| Japan | 7.1% |

| Germany | 15.7% |

| UK | 9.0% |

| India | 5.6% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 20.2% |

| China | 13.2% |

| Japan | 10.1% |

| Germany | 14.0% |

| UK | 7.4% |

| India | 6.4% |

The Hydroxytyrosol for Skin Health Market in China is forecast to grow at a CAGR of 22.7%, the highest among major economies between 2025 and 2035. Growth is driven by the rising popularity of natural and organic skincare formulations, with hydroxytyrosol emerging as a key antioxidant for anti-aging and brightening products. Chinese consumers’ preference for plant-derived and clinically backed actives has created a strong pull for hydroxytyrosol across serums, creams, and oils. Affordable product launches by both domestic and global brands are fueling mass adoption, while rapid e-commerce expansion ensures accessibility across urban and semi-urban regions. Cross-sector demand is further boosted by the integration of hydroxytyrosol into premium beauty, wellness supplements, and clinical-grade formulations.

| USA by Function | Value Share% 2025 |

|---|---|

| Antioxidant | 55.2% |

| Others | 44.8% |

The Hydroxytyrosol for Skin Health Market in the United States is projected to grow at a CAGR of 8.8% through 2035. Growth is strongly supported by the rising adoption of antioxidant-rich formulations, with antioxidants accounting for 55.2% of total demand in 2025. Increasing consumer preference for natural, science-backed skincare is fueling hydroxytyrosol integration into serums, creams, and capsules. The USA market is also benefiting from growing demand in cosmeceuticals and clinical-grade skincare, where dermatology-focused players emphasize anti-aging and repair properties. Expansion of e-commerce platforms and clean beauty retail channels is further enabling faster product penetration across demographics.

| China by Claim | Value Share% 2025 |

|---|---|

| Natural/organic | 52.3% |

| Others | 47.7% |

The Hydroxytyrosol for Skin Health Market in China is projected to grow at a CAGR of 22.7% from 2025 to 2035, making it one of the fastest-growing global markets. Demand is led by natural/organic claims, which account for 52.3% of total sales in 2025, supported by strong consumer interest in plant-derived antioxidants and government emphasis on clean-label, safe cosmetic ingredients. China’s growth is further powered by rising adoption of serums and creams in premium skincare, expansion of digital-first beauty platforms, and increasing collaborations between local and international players. The country’s rapid industrial scaling and consumer shift toward science-backed, sustainable skincare firmly positions hydroxytyrosol as a high-potential ingredient in the beauty and wellness sector.

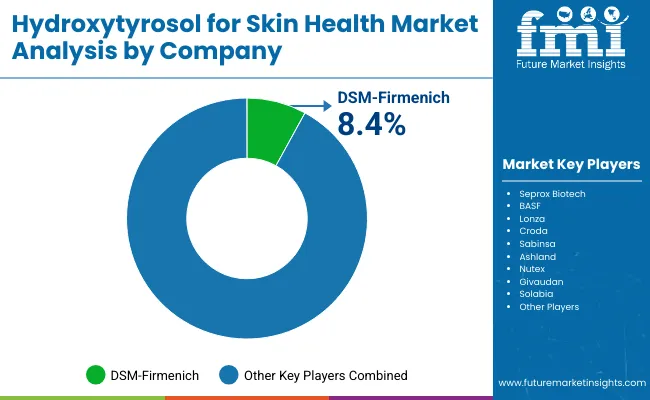

| Company | Global Value Share 2025 |

|---|---|

| DSM- Firmenich | 8.4% |

| Others | 91.6% |

The Hydroxytyrosol for Skin Health Market is moderately consolidated, with DSM-Firmenich emerging as the leading player, holding 8.4% of the global market share in 2025. DSM-Firmenich leverages its strength in clinical-grade antioxidant formulations and partnerships with premium skincare brands, ensuring consistent demand in anti-aging and brightening segments.

Other global players such as BASF, Lonza, Croda, Sabinsa, Ashland, Givaudan, Seprox Biotech, Solabia, and Nutex collectively represent the fragmented competitive landscape. These companies are actively investing in R&D for natural and clean-label ingredients, with a growing focus on hydroxytyrosol-based serums, oils, and creams to cater to rising consumer demand for plant-derived antioxidants. Mid-sized innovators like Seprox Biotech are carving out niches through biotechnology-based extraction methods, while established firms like Croda and Givaudan are prioritizing sustainability and traceability to strengthen brand value. The market is witnessing a gradual shift from commoditized ingredient supply toward value-added solutions, such as clinical validation, patented formulations, and premium-positioned cosmetic actives.

Competitive differentiation is increasingly determined by scientific credibility, clean-label positioning, and integration into holistic beauty platforms, rather than scale alone.

Key Developments in Hydroxytyrosol for Skin Health Market

| Item | Value |

|---|---|

| Quantitative Units | USD 722.4 Million |

| Function | Antioxidant, Anti-aging, Brightening, Repair |

| Product Type | Serums, Creams/lotions, Oils, Capsules |

| Channel | E-commerce, Pharmacies, Specialty beauty stores, Mass retail |

| Claim | Natural/organic, Vegan, Clean-label, Clinical-grade |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Seprox Biotech, DSM- Firmenich, BASF, Lonza, Croda, Sabinsa, Ashland, Nutex, Givaudan, Solabia |

| Additional Attributes | Dollar sales by product type (serums, creams/lotions, oils, capsules) and function (antioxidant, anti-aging, brightening, repair), adoption trends in natural/organic and clinical-grade claims, rising demand for multifunctional skincare combining hydration, repair, and antioxidant properties, sector-specific growth in cosmeceuticals, nutraceuticals, and dermatology, revenue segmentation by e-commerce, pharmacies, specialty beauty stores, and mass retail, integration with AI-driven personalized skincare and clean-label innovation, regional trends influenced by natural ingredient sourcing initiatives, and advancements in bioactive formulations, encapsulation, and clinical-grade delivery systems. |

The global Hydroxytyrosol for Skin Health Market is estimated to be valued at USD 722.4 million in 2025.

The market size for the Hydroxytyrosol for Skin Health Market is projected to reach USD 2,453.6 million by 2035.

The Hydroxytyrosol for Skin Health Market is expected to grow at a 13.0% CAGR between 2025 and 2035.

The key product types in the Hydroxytyrosol for Skin Health Market are serums, creams/lotions, oils, and capsules, with serums projected to account for 48.5% share in 2025.

In terms of claims, the natural/organic segment is expected to contribute the most significant share in 2025, commanding 52.3% of the market in China and holding strong global preference due to rising clean-label and plant-based skincare demand.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hydroxytyrosol Market Analysis by Product Type, Form, Source and Application Through 2035

Formaldehyde Removal Air Purifier Market Size and Share Forecast Outlook 2025 to 2035

Fortified Dairy Products Market Size and Share Forecast Outlook 2025 to 2035

Form-Fill-Seal (FFS) Films Market Size and Share Forecast Outlook 2025 to 2035

Formable Films Market Size and Share Forecast Outlook 2025 to 2035

Forchlorfenuron Market Size and Share Forecast Outlook 2025 to 2035

Formalin Market Size and Share Forecast Outlook 2025 to 2035

Formalin Vials Market Size and Share Forecast Outlook 2025 to 2035

Foreign Trade Digital Service Market Size and Share Forecast Outlook 2025 to 2035

Forged and Casting Component Market Size and Share Forecast Outlook 2025 to 2035

Fortified Rice Market Size and Share Forecast Outlook 2025 to 2035

Fortifying Agent Market Size and Share Forecast Outlook 2025 to 2035

Forestry Equipment Market Size and Share Forecast Outlook 2025 to 2035

Forensic Imaging Market Size and Share Forecast Outlook 2025 to 2035

Forklift Battery Market Size and Share Forecast Outlook 2025 to 2035

Formulation Development Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Forskolin Market Size and Share Forecast Outlook 2025 to 2035

Fortified Milk and Milk Products Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Form Fill Seal Equipment Market by Equipment Type from 2025 to 2035

Fortified Eggs Market Analysis - Size, Growth, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA