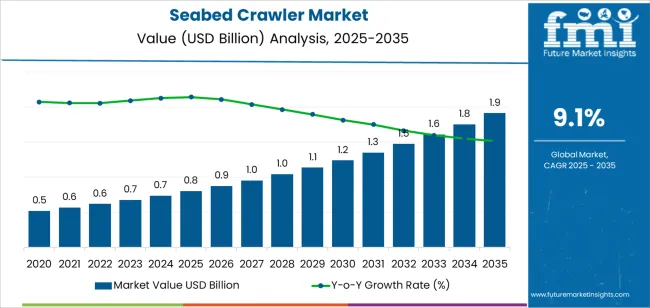

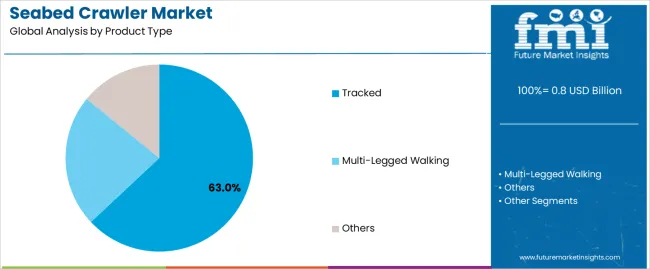

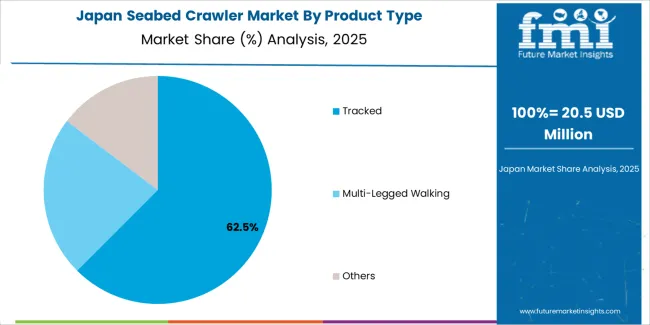

The seabed crawler market is forecast to expand from USD 0.8 billion in 2025 to USD 1.9 billion by 2035, at a CAGR of 9.1%, driven primarily by segment-level demand across propulsion formats and end-use missions. Tracked crawlers dominate with a 63.0% share due to their superior traction, load-handling stability, and ability to move across soft sediments, sloped terrain, and irregular substrates. This segment aligns with high-intensity commercial operations such as trenching, cable burial, deepwater inspection, and heavy-duty geotechnical work. Their compatibility with modular trenchers, cutters, survey sleds, and intervention tool skids further reinforces segment leadership in both shallow and deepwater deployments. Multi-legged walking crawlers constitute a 27.0% specialized segment used in research, ecological surveys, and inspection tasks that require precise negotiation of fragile or rocky environments.

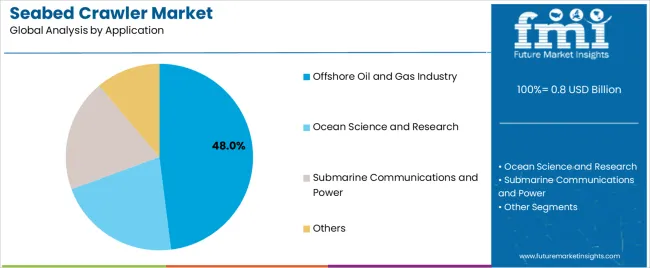

The offshore oil and gas industry leads application segmentation at 48.0%, where crawlers support pipeline inspection, structural monitoring, umbilical placement, route clearance, and seabed preparation for subsea installations. Their high endurance, stable positioning, and integration with HD imaging, sonar, and multi-sensor survey payloads make them essential for deepwater maintenance and expansion projects. Ocean science and research, at 28.0%, relies on compact crawlers equipped with sediment-sampling tools, imaging suites, and benthic-habitat mapping systems. Submarine communications and power, representing 17.0%, deploy crawlers for cable laying, burial, inspection, and repair across long-distance marine routes.

Asia Pacific leads market growth, supported by expanding offshore energy and subsea mapping programs in China, Japan, and Australia. Europe and North America maintain strong demand through offshore wind expansion, subsea cables, and oil and gas activities. Key companies include Royal IHC, Saab Seaeye, Oceaneering International, ECA Group, Fugro, and Soil Machine Dynamics, focusing on crawler durability, modular tooling, and enhanced subsea mobility.

Breakpoint analysis shows two key transition phases shaped by subsea mining activity, offshore energy expansion, and advances in underwater robotics. The first breakpoint, expected between 2026 and 2029, will occur as seabed crawlers gain wider use in offshore oilfield inspection, pipeline monitoring, and deep-sea mineral exploration. Rising investment in autonomous underwater systems and improved crawler mobility will accelerate adoption during this period.

A second breakpoint is likely between 2031 and 2033 as the market transitions from capability-driven expansion to structured operational deployment. During this stage, demand will shift toward high-endurance crawlers with advanced sensing, navigation stability, and low-impact sediment interaction for regulated marine environments. Growth will stabilize as major offshore operators standardize the use of crawlers across maintenance routines and exploration projects. The progression across these breakpoints reflects a market moving from early technology integration to mature operational adoption, supported by robotics enhancements, subsea infrastructure development, and an increasing reliance on unmanned systems for deep-water inspection and resource-assessment tasks.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 0.8 billion |

| Market Forecast Value (2035) | USD 1.9 billion |

| Forecast CAGR (2025-2035) | 9.1% |

The seabed crawler market is growing because offshore infrastructure development, underwater resource extraction and subsea inspection tasks require vehicles capable of operating on the seabed. Crawlers provide mobility and stability on the ocean floor, making them well suited for pipeline inspection, cable burial, subsea mining operations and marine research. Demand is rising in oil & gas, offshore wind, deep-sea mining and defence sectors where precise and reliable underwater work is critical. Advances in crawler technology, including autonomous navigation, real-time sensor payloads and improved manoeuvrability on uneven seabeds, expand the utility of the platform under challenging conditions.

Growth is also supported by increased global investment in subsea infrastructure, rising exploration of deep ocean resources and focus on maintaining existing assets. The market faces constraints such as extremely high development and operational costs, complex regulatory requirements related to environmental impact and subsea operations and technical challenges associated with deep-water pressure, remote communication and maintenance. The niche nature of the market means volume growth is limited compared to broader subsea equipment segments.

The seabed crawler market is segmented by product type and application. By product type, the market includes tracked, multi-legged walking, and others. Based on application, it is categorized into offshore oil and gas industry, ocean science and research, submarine communications and power, and others. Regionally, the market is divided into Asia Pacific, Europe, North America, and other key regions.

The tracked segment holds the leading position in the seabed crawler market, representing an estimated 63.0% of total market share in 2025. Tracked crawlers provide high traction, stability, and load-bearing capability on soft sediments, slopes, and uneven seabed terrains. These characteristics support their widespread use in offshore inspection, pipeline intervention, and seabed trenching operations.

Tracked platforms also offer strong operational endurance and compatibility with heavy tooling systems, making them suitable for long-duration subsea tasks. The multi-legged walking segment, estimated at 27.0%, serves specialized missions requiring precise maneuvering around obstacles, fragile ecosystems, or irregular seabed structures. The others category, representing roughly 10.0%, includes hybrid mobility systems and emerging crawler concepts used in low-intensity research missions.

Key factors supporting the tracked segment include:

The offshore oil and gas industry segment accounts for approximately 48.0% of the seabed crawler market in 2025. Crawlers are used for pipeline inspection, seabed trenching, cable burial, structural monitoring, and maintenance support in offshore production fields. Demand is driven by the need for reliable subsea intervention systems that can operate at significant depths with minimal human risk.

The ocean science and research segment follows with an estimated 28.0%, using crawlers for benthic habitat studies, sediment sampling, and environmental monitoring. The submarine communications and power segment, representing about 17.0%, employs crawlers for cable laying, inspection, and protective trenching. The others category, at around 7.0%, includes defense applications and underwater archaeological work.

Primary dynamics driving demand from the offshore oil and gas industry segment include:

Rising demand for subsea mineral exploration, increased offshore energy development, and growth in seabed inspection and maintenance activities are driving market growth.

The seabed crawler market is expanding as offshore industries adopt robotic systems designed for stable movement and heavy-duty operations on the ocean floor. Deep-sea mineral exploration projects rely on crawlers to survey, sample, and transport seabed materials in environments where traditional vessels or divers cannot operate safely. Offshore oil, gas, and renewable energy operators use crawlers for structural inspection, buried pipeline tracking, sediment analysis, and seabed preparation. Growing construction of offshore wind farms increases the need for seabed levelling and cable burial systems, which strengthens crawler demand. Advances in hydrodynamic design, traction control, and subsea navigation improve crawler reliability in soft sediments and uneven terrain. Rising use of high-resolution sonar, imaging units, and autonomous capabilities further supports adoption across research and industrial applications.

High capital cost, strict regulatory oversight, and operational challenges in extreme deep-sea environments are restraining adoption.

Seabed crawlers require specialised engineering, corrosion-resistant materials, sealed electronic housings, and robust propulsion systems, which increase manufacturing and deployment costs. Regulatory requirements for environmental protection, sediment disturbance management, and resource extraction approvals add complexity, especially for deep-sea mining activities. Operating at high pressure and low visibility can lead to performance limitations, greater maintenance needs, and higher mission risk. Smaller enterprises or academic institutions may face budget constraints that limit access to large-scale crawler systems, particularly those equipped for deep water. Logistics for deployment, retrieval, and vessel support further increase operational cost.

Growth in autonomous subsea systems, expansion of deep-sea research programs, and development of hybrid crawler-remotely operated platforms are shaping industry trends.

Manufacturers are introducing crawlers with advanced autonomy, real-time mapping, and adaptive traction for long-duration missions. Research institutions are increasing investment in benthic ecosystem monitoring, seafloor mapping, and subsea geology, which expands demand for compact scientific crawlers. Hybrid platforms that combine crawler stability with ROV mobility are gaining traction for cable burial, trenching, and targeted sampling. These innovations support broader adoption across exploration, environmental assessment, and offshore infrastructure maintenance.

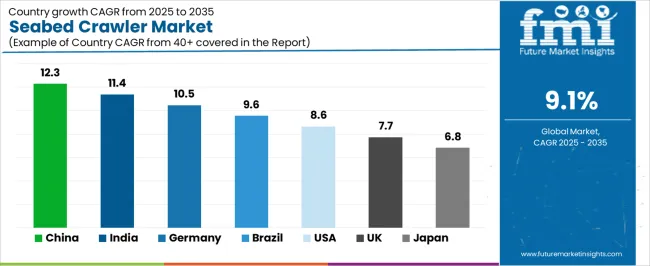

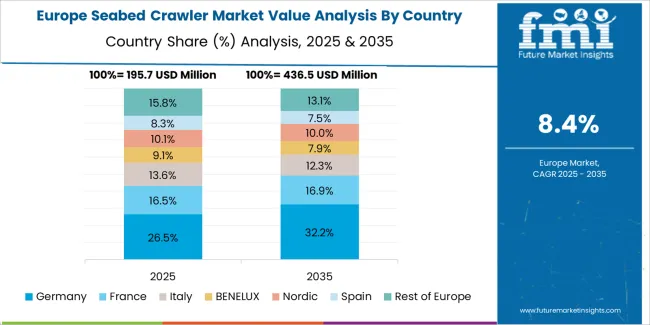

The global seabed crawler market is expanding through 2035, supported by increased offshore exploration, wider adoption of underwater inspection systems, and rising demand for seabed-intervention equipment in energy, research, and marine-engineering operations. China leads with a 12.3% CAGR, followed by India at 11.4%, reflecting strong investment in ocean-technology capabilities and offshore infrastructure. Germany grows at 10.5%, supported by engineering expertise and regulated marine-technology applications. Brazil records 9.6%, driven by offshore oil-and-gas activity. The United States grows at 8.6%, while the United Kingdom (7.7%) and Japan (6.8%) sustain steady demand through established marine-research and subsea-engineering programs.

| Country | CAGR (%) |

|---|---|

| China | 12.3 |

| India | 11.4 |

| Germany | 10.5 |

| Brazil | 9.6 |

| USA | 8.6 |

| UK | 7.7 |

| Japan | 6.8 |

China’s market grows at 12.3% CAGR, driven by expanding offshore-energy operations, rapid development of marine-engineering capabilities, and rising investment in ocean-technology infrastructure. Seabed crawlers are used for underwater inspection, pipeline monitoring, sediment profiling, and shallow-depth intervention tasks across coastal industrial zones. Universities, marine-research institutes, and offshore-engineering firms adopt crawler platforms equipped with sonar imaging, laser-based profiling tools, sediment-sampling modules, and high-capacity mobility systems designed to operate on varied seabed textures. Growth in offshore-wind deployment and subsea-infrastructure expansion strengthens long-term procurement of advanced robotic crawlers. Domestic developers introduce corrosion-resistant housings, modular toolheads, and integrated control systems suited for continuous offshore operations in harsh environments.

Key Market Factors:

India’s market grows at 11.4% CAGR, supported by expanding offshore-exploration activities, coastal-infrastructure development, and increased use of underwater-inspection robotics. Seabed crawlers are deployed for port-survey operations, pipeline monitoring, benthic-habitat assessment, and sediment-mobility studies aligned with coastal-protection projects. Marine-research centers and ocean-technology institutes incorporate crawlers into seabed-mapping programs using structured-light imaging, wide-band sonar, and sediment-sampling attachments. Offshore-energy and maritime-infrastructure projects increase demand for corrosion-resistant, low-profile crawler designs operated in silt-rich and variable-terrain conditions. Broader national investments in ocean-research capabilities reinforce recurring procurement across research, dredging, and coastal-engineering units.

Market Development Factors:

Germany’s market grows at 10.5% CAGR, supported by mature marine-engineering sectors, structured environmental-monitoring requirements, and consistent use of seabed crawlers in offshore-wind and coastal-infrastructure applications. Crawlers are used for seabed-impact assessments, turbine-foundation inspections, erosion-pattern mapping, and sediment-profiling tasks aligned with regulatory guidelines. Engineering consultancies integrate high-resolution sonar, optical-imaging units, and multi-sensor survey packages designed for North Sea and Baltic Sea operating conditions. Research institutions deploy crawlers for benthic-habitat analysis and substrate-characterization programs. Continuous upgrades in offshore-wind infrastructure sustain long-term demand for accurate and durable crawler platforms.

Key Market Characteristics:

Brazil’s market grows at 9.6% CAGR, driven by extensive offshore oil-and-gas activity, subsea-pipeline inspection requirements, and sediment-analysis needs across petroleum basins. Marine-engineering contractors adopt crawler systems with reinforced tracks, subsea imaging modules, and sampling tools to operate in deepwater and turbidity-affected conditions. Existing offshore fields require routine integrity assessments, strengthening demand for robust crawlers capable of capturing stable imagery and performing structural-monitoring tasks on risers and pipelines. Coastal-engineering and sediment-stability programs also contribute to annual deployment. Research organizations adopt crawlers for ecological-survey and seabed-structure analysis.

Market Development Factors:

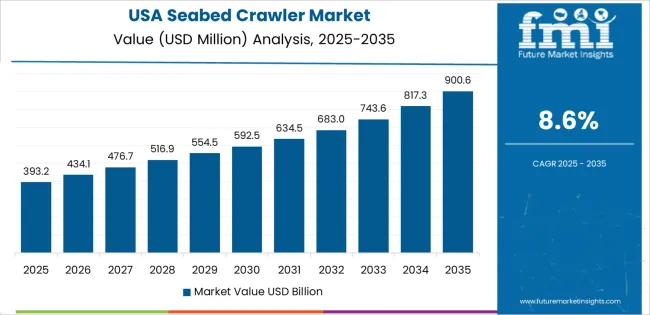

The United States grows at 8.6% CAGR, supported by established marine-science programs, offshore-energy operations, and strong adoption of underwater-inspection equipment for subsea-infrastructure monitoring. Research centers deploy crawlers for benthic mapping, coastal-erosion studies, and habitat-assessment activities. Offshore-energy operators integrate crawler systems for pipeline inspection, structural-condition surveys, and shallow-water maintenance tasks. Manufacturers supply crawler platforms incorporating sonar arrays, high-definition imaging systems, sediment-profiling modules, and modular tooling attachments. Expanding coastal-resilience and environmental-monitoring programs reinforce demand for scalable seabed-crawler solutions.

Key Market Factors:

The United Kingdom’s market grows at 7.7% CAGR, supported by offshore-wind expansion, underwater-cable inspection needs, and strong marine-research capabilities. Seabed crawlers support turbine-foundation assessment, sediment-transport analysis, and ecological-monitoring programs across North Sea environments. Engineering contractors adopt crawler platforms with imaging, sonar, and sampling tools for routine maintenance and seabed-stability evaluation. Academic institutions deploy crawlers for benthic-habitat studies and coastal-impact assessments. Increased offshore-infrastructure installations maintain steady use of crawler-based inspection solutions.

Market Development Factors:

Japan’s market grows at 6.8% CAGR, supported by strong marine-research institutions, seismic-risk assessment needs, and coastal-engineering projects requiring reliable seabed-intervention tools. Research centers use crawlers for benthic-habitat mapping, substrate analysis, underwater imaging, and sediment-stability evaluations in earthquake-prone regions. Engineering firms adopt crawlers for structural-inspection tasks related to coastal infrastructure, harbor development, and offshore-maintenance operations. Domestic manufacturers design compact crawler systems optimized for rocky, sloped, and irregular seabed terrain. Stable investment in ocean-monitoring programs reinforces long-term market activity.

Key Market Characteristics:

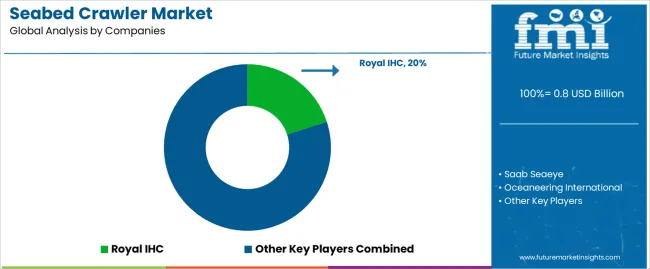

The seabed crawler market is moderately consolidated, with about ten manufacturers supplying tracked subsea vehicles for pipeline inspection, deepwater construction support, mineral surveys, and geotechnical operations. Royal IHC leads the market with an estimated 20.0% global share, supported by its long-standing offshore engineering capability, proven crawler designs, and integration with dredging, trenching, and seabed intervention systems. Its position is reinforced by reliable traction performance, robust subsea hydraulics, and documented operational stability in challenging seabed conditions.

Saab Seaeye, Oceaneering International, and ECA Group follow as major competitors, offering hybrid and electric-powered crawlers configured for inspection, maintenance, and light construction tasks. Their competitive strengths include stable control systems, sensor integration, and compatibility with existing ROV and vessel-based support infrastructure. Fugro and Soil Machine Dynamics maintain strong positions through geotechnical and trenching-focused crawler platforms, supported by detailed survey capability and high-pull subsea tooling.

Large industrial firms such as TechnipFMC, Forum Energy Technologies, Kawasaki Heavy Industries, and Hyundai Heavy Industries contribute to the market through specialized heavy-duty crawlers for pipeline burial, seabed preparation, and subsea construction support. Their competitiveness depends on engineering scale, subsea reliability, and integration with broader offshore installation services.

Competition centers on traction stability, payload capacity, sensor integration accuracy, and endurance under high-pressure conditions. Market growth is driven by offshore renewable energy expansion, greater demand for deep-sea survey capability, and continued investment in seabed intervention equipment across oil, gas, and infrastructure sectors.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Product Type | Tracked, Multi-Legged Walking, Others |

| Application | Offshore Oil and Gas Industry, Ocean Science and Research, Submarine Communications and Power, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | India, China, USA, Germany, South Korea, Japan, Italy, and 40+ countries |

| Key Companies Profiled | Royal IHC, Saab Seaeye, Oceaneering International, ECA Group, Fugro, Soil Machine Dynamics, TechnipFMC, Forum Energy Technologies, Kawasaki Heavy Industries, Hyundai Heavy Industries |

| Additional Attributes | Dollar sales by product type and application categories; regional adoption trends across Asia Pacific, Europe, and North America; competitive landscape of subsea robotics and seabed intervention system manufacturers; advancements in deep-sea mobility, autonomous operation, and high-pressure durability; integration with offshore energy operations, marine research missions, and subsea cable installation and maintenance. |

The global seabed crawler market is estimated to be valued at USD 0.8 billion in 2025.

The market size for the seabed crawler market is projected to reach USD 1.9 billion by 2035.

The seabed crawler market is expected to grow at a 9.1% CAGR between 2025 and 2035.

The key product types in seabed crawler market are tracked, multi-legged walking and others.

In terms of application, offshore oil and gas industry segment to command 48.0% share in the seabed crawler market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Crawler Excavator Market Growth - Trends & Forecast 2025 to 2035

Crawler Drilling Machine Market

Electric Crawler Crane Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA