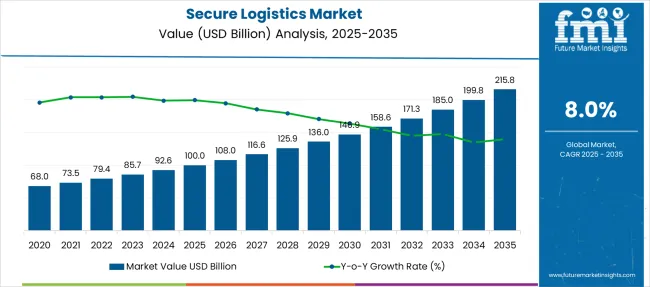

The Secure Logistics Market is estimated to be valued at USD 100.0 billion in 2025 and is projected to reach USD 215.8 billion by 2035, registering a compound annual growth rate (CAGR) of 8.0% over the forecast period. The baseline value of USD 68 billion in 2020 highlights consistent expansion driven by asset protection needs across cash management, precious metals, and high-value goods transportation. A strong performance trajectory emerges beyond 2029 when cash circulation and ATM replenishment networks scale in developing economies. Additionally, risk mitigation through armored vehicle deployment, smart vault integration, and biometric-based cargo access systems accelerates adoption across financial and retail sectors. Players are positioning for differentiation via integrated real-time monitoring, blockchain-based tracking, and end-to-end risk assessment protocols.

Competitive strategies emphasize multi-modal coverage combining land and air routes to reduce lead times for cross-border high-value transfers. Regional hotspots include Latin America and parts of Asia-Pacific, where regulatory focus on asset security and digital transaction systems coexists with cash-intensive ecosystems. The sector is expected to consolidate around tech-driven operational models, with predictive threat analytics and AI-enhanced routing playing central roles in next-generation logistics frameworks, redefining security standards globally.

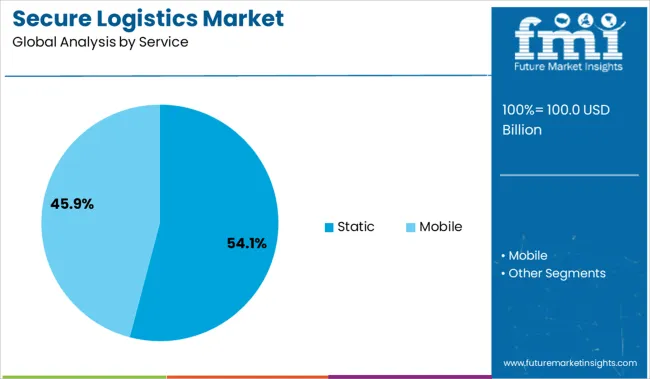

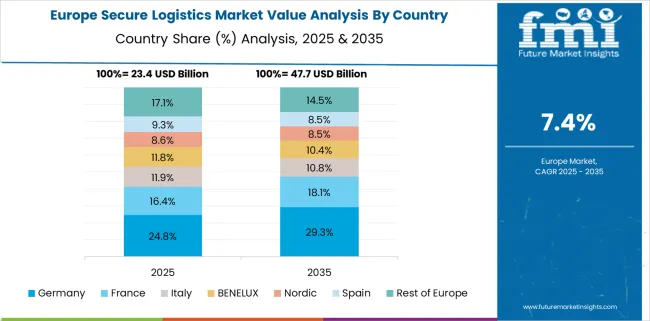

The static security segment, commanding 54.1% share in 2025, shows demand for vault management and fixed-location asset protection. North America leads on the back of armored transport and banking network integration, while Asia-Pacific is experiencing rapid traction due to the proliferation of ATMs, e-commerce cash cycles, and gold trade hubs in India and China. Europe continues to push advanced secure transport solutions driven by cross-border regulations and insurance requirements.

Emerging dynamics point toward digital convergence, real-time asset tracking, blockchain-based transaction authentication, and AI-enabled route optimization, which will redefine secure logistics models. Companies that pivot to hybrid strategies, blending physical security with cyber resilience, will outpace peers, as the market shifts from pure transport to risk-intelligence services.

| Metric | Value |

|---|---|

| Secure Logistics Market Estimated Value in (2025 E) | USD 100.0 billion |

| Secure Logistics Market Forecast Value in (2035 F) | USD 215.8 billion |

| Forecast CAGR (2025 to 2035) | 8.0% |

The secure logistics market is experiencing a notable surge in adoption due to rising threats associated with the transportation of high-value assets and increasing regulatory scrutiny across sectors such as banking, retail, and government services. Enhanced focus on secure handling, GPS-based tracking, and armored transport has elevated the relevance of secure logistics services across developed and emerging markets.

With financial institutions expanding ATM networks and increasing movement of sensitive documents and precious goods, secure logistics providers are investing in route risk management, AI-based surveillance, and blockchain-enabled audit trails. Market players are also optimizing fleet efficiency through centralized command systems and real-time communication protocols.

Furthermore, demand for end-to-end chain of custody, compliance with insurance and legal frameworks, and digital transparency is shaping future service models. As urbanization, e-commerce growth, and currency circulation intensify, secure logistics solutions are expected to evolve toward automation, interoperability, and sustainability in order to meet client expectations and global standards.

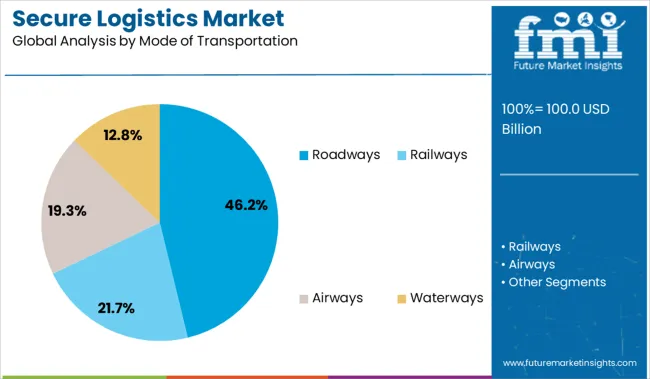

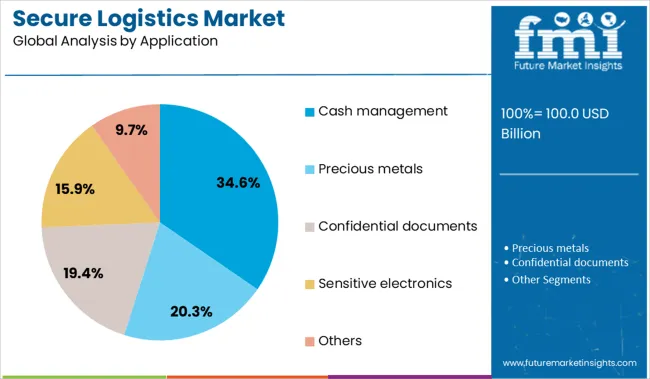

The secure logistics market is segmented by service, mode of transportation, application, and region. By service, it includes static and mobile solutions to ensure asset safety during storage and transit. In terms of mode of transportation, the segmentation comprises roadways, railways, airways, and waterways, offering flexibility for different security requirements. Based on application, the market is categorized into cash management, precious metals, confidential documents, sensitive electronics, and other high-value items. Regionally, the market spans North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

The static service segment is projected to command 54.1% of the overall revenue in the secure logistics market in 2025, positioning it as the leading service category. This segment's dominance is supported by the increasing need for fixed-location asset protection including vaulting, storage of confidential documents, and critical infrastructure security.

The preference for 24/7 surveillance and access-controlled environments has driven demand for static services across banks, government agencies, and luxury retail. Investments in fortified facilities, biometric access systems, and fireproof storage technologies have further validated the importance of static security setups.

In many operational models, static services serve as centralized nodes that support broader mobile logistics activities, thereby reinforcing their criticality in the secure logistics chain. The high level of accountability and minimal exposure to transit risks continue to make static services an indispensable component of secure logistics operations.

Roadways as a mode of transportation is expected to account for 46.2% of the secure logistics market revenue in 2025, making it the most utilized transport channel. This preference is attributed to the flexibility, last-mile reach, and scheduling control that road-based logistics offers, particularly for transporting cash, bullion, pharmaceuticals, and sensitive documents.

Armored vehicles equipped with tamper-proof containers, route analytics, and remote monitoring systems have become standard assets in fleet operations. The capacity to respond quickly to regional service requests and emergencies has further positioned road transport as the preferred mode among financial institutions and commercial sectors.

Additionally, regulatory bodies and insurance providers continue to favor roadways for its established safety protocols and contingency infrastructure, which reduces liability and operational disruption during high-value shipments. The combination of infrastructure maturity and technology integration is expected to sustain this mode's leadership in the years ahead.

Cash management is forecast to represent 34.6% of total application revenue in the secure logistics market by 2025, establishing it as the leading use case. This prominence stems from increasing global demand for ATM replenishment, bank cash transfers, currency movement for retail operations, and processing of public-sector disbursements.

Financial institutions and retail chains have prioritized secure cash handling due to the rising frequency of theft, fraud, and cyber-physical breaches. The implementation of sealed cassettes, GPS tracking, and real-time audit trails has strengthened the operational integrity of cash logistics.

Furthermore, specialized solutions for cash sorting, counting, and centralized vaulting have been deployed to enhance security and reduce handling costs. As emerging economies expand their ATM networks and developed markets continue to rely on physical currency for specific transactions, the demand for robust, compliant, and technology-enabled cash management services is expected to remain high.

Secure logistics services have become critical for organizations managing physical transfer of high-value assets, cash, sensitive documents, and precious materials. Demand has been shaped by stricter compliance mandates, banking sector outsourcing, and the rise in organized retail cash volumes.

Providers offering armoured transport, GPS-based monitoring, and insured vaulting services are seeing increased procurement from financial institutions, government agencies, and corporate security divisions. Asset traceability, time-sensitive delivery, and physical risk mitigation remain dominant expectations across end-user segments.

Secure logistics has evolved into a core function for commercial banks, ATM operators, and bullion handlers who face mounting regulatory obligations for asset custody. Institutions are no longer maintaining internal cash handling fleets and are turning to third-party armoured carriers with digital route tracking, secure vault access protocols, and real-time delivery updates. Cash-in-transit (CIT) services are being used not only for ATM replenishment but also for inter-branch cash pooling and retail collection logistics.

Currency printing presses, central banks, and foreign exchange offices have formalized long-term contracts for certified logistics providers to move currency under defined threat management procedures. Incidents of in-transit theft, cargo hijacking, and counterfeit currency insertion have pushed decision-makers to favor vendors that offer route risk analytics, panic alert systems, and secure transfer workflows across multiple zones of operation.

Opportunities are emerging in high-value storage and cross-border armoured logistics, particularly for sectors dealing with pharmaceuticals, electronics, and luxury goods. Digitized vaulting services with remote access logs, temperature-controlled chambers, and surveillance-backed inventory management are being adopted by clients needing secure mid-term storage for audit-critical stock.

Bullion trading platforms and auction houses are engaging logistics partners with expertise in bonded warehouse management and customs clearance across international corridors. High-net-worth clients, art handlers, and private wealth firms are contracting secure delivery services that integrate GPS-tagged lockboxes and dual-authentication handovers.

Demand is growing for flexible fleet deployment models ranging from up-armoured SUVs to discreet couriers equipped with biometric authentication and route anonymization protocols. Market players offering customizable security tiers, insurance-backed coverage, and end-to-end asset visibility are positioned to capitalize on rising vulnerability concerns and regulatory-driven audit trails.

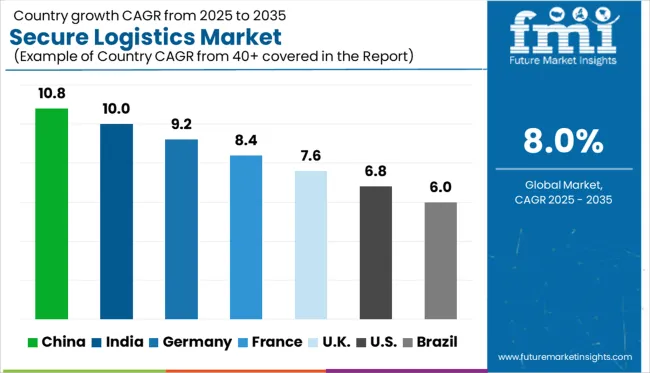

| Countries | CAGR |

|---|---|

| China | 10.8% |

| India | 10.0% |

| Germany | 9.2% |

| France | 8.4% |

| UK | 7.6% |

| USA | 6.8% |

| Brazil | 6.0% |

The global secure logistics market is projected to grow at a CAGR of 8.0% from 2025 to 2035, driven by rising ATM cash handling, high-value asset transport, and compliance-led chain-of-custody systems. China leads with a 10.8% CAGR, supported by demand in central bank circulation networks, e-commerce vault transport, and financial-grade armored fleet upgrades.

India follows at 10.0%, driven by bullion logistics, retail ATM replenishment, and digitization of chain verification. Germany grows at 9.2%, shaped by pharma cold-chain transit, high-end electronics movement, and regulated document logistics. France posts 8.4%, anchored in secure transport of medical diagnostics, judicial cargo, and art collections. The United Kingdom grows at 7.6%, influenced by security reforms, armored courier outsourcing, and insurance-backed valuables transit. These five markets represent key benchmarks in a broader review of 40+ countries.

Secure logistics demand in China is projected to expand at a 10.8% CAGR, outperforming the global growth average. As a BRICS leader with tightly integrated domestic supply chains, China continues to expand secure transit capacity across currency circulation, bullion transport, and e-commerce warehousing.

Central bank contracts and retail ATM routes are driving armored fleet growth, while high-value electronics manufacturers rely on real-time tracking for intra-provincial movement. Insurance-backed secure logistics services are being integrated with digital vault access and IoT-enabled containers. China’s scale, infrastructure, and policy alignment grant it a dominant position over ASEAN and OECD comparators in volume and value delivery.

Secure logistics demand in India is forecast to grow at a 10.0% CAGR through 2035, supported by high cash handling requirements, regulatory controls on gold transport, and growing financial inclusion. Bullion movement between refineries, banks, and retail outlets remains a consistent driver, while rural ATM replenishment contracts continue to increase.

Government-backed digital payment expansion has not significantly reduced cash volumes, preserving armored logistics relevance. Meanwhile, high-value pharmaceutical shipments and secure document transit are gaining traction in tiered cities. India’s large-volume market differs from OECD regions by prioritizing reliability, cost control, and 24/7 asset visibility.

Secure logistics demand in Germany is projected to expand at a 9.2% CAGR, shaped by regulated movement of pharmaceuticals, banknotes, and classified cargo across EU transit zones. Demand has increased for temperature-controlled armored vehicles in the life sciences sector and tamper-proof handling for military-grade components.

High-net-worth residential demand for secure storage and art logistics has created niche premium growth. Germany’s logistics providers offer dual compliance under EU GDPR and ISO standards, emphasizing security, transparency, and route optimization. Compared to BRICS economies, Germany’s growth strategy reflects high-value cargo control over volume-centric distribution.

Secure logistics demand in France is forecast to rise at an 8.4% CAGR, driven by public-sector contracts, pharmaceutical transit, and secure handling of cultural assets. Logistics providers work closely with customs and national security agencies to ensure compliance during cross-border movement.

Growth has been noted in armored van deployment for vaccine and diagnostic kit distribution, particularly under health ministry supervision. Secure delivery services for judicial files, jewelry exhibitions, and bond documents are expanding. France emphasizes standardization and traceability, aligning with broader EU directives, yet focuses less on scale and more on application-specific excellence.

The United Kingdom secure logistics market is expected to grow at a CAGR of 7.6%, slightly below the global average, with demand driven by armored courier outsourcing, regulatory tightening, and secure e-commerce returns. Bank of England’s note redistribution, pharmaceutical auditing logistics, and luxury retail asset transfers are core applications.

Asset protection strategies post-Brexit have accelerated local provider consolidation and spurred integration of telematics and digital tracking. Secure returns from high-ticket e-commerce and retail event storage are unique trends gaining traction. Unlike BRICS nations, the UK market remains compliance-driven and service-focused, with limited tolerance for infrastructure redundancy.

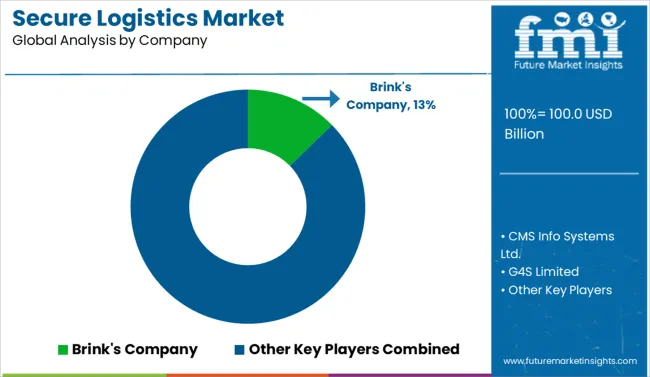

The secure logistics industry is led by Brink's Company, holding a 12.7% market share through its global footprint in cash-in-transit, ATM services, and high-value asset protection. Loomis AB and Prosegur Cash follow closely, offering armored transport and secure storage for banking, retail, and governmental sectors. G4S Limited and GardaWorld maintain strongholds in integrated security and logistics operations across Europe and North America.

CMS Info Systems and Sequel Logistics dominate the Indian market, catering to financial institutions and e-commerce sectors. SIS Group and Maltacourt Ltd. focus on regional cash handling and logistics for confidential goods. Competitive focus is shaped by armored fleet efficiency, digital tracking systems, risk assessment integration, and regulatory compliance for cash processing and asset movement.

Key Developments in the Secure Logistics Market

| Item | Value |

|---|---|

| Quantitative Units | USD 100.0 Billion |

| Service | Static and Mobile |

| Mode of Transportation | Roadways, Railways, Airways, and Waterways |

| Application | Cash management, Precious metals, Confidential documents, Sensitive electronics, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Brink's Company, CMS Info Systems Ltd., G4S Limited, Gardaworld, Loomis AB, Maltacourt Ltd., PlanITROI Inc., Prosegur Cash, Sequel Logistics, and SIS Group Enterprise |

| Additional Attributes | Dollar sales in secure logistics are segmented by service type cash-in-transit, valuables transportation, ATM replenishment, and guarding services with cash-in-transit leading overall share. Demand is growing for GPS-enabled tracking, real-time monitoring, and armored vehicle upgrades. CDMOs and logistics OEMs offer turnkey fleet solutions and software integration. Adoption is most prominent in North America, Latin America, and select Middle Eastern markets, driven by rising cash circulation, regulatory compliance needs, and heightened focus on end-to-end asset protection. |

The global secure logistics market is estimated to be valued at USD 100.0 billion in 2025.

The market size for the secure logistics market is projected to reach USD 215.8 billion by 2035.

The secure logistics market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types in secure logistics market are static and mobile.

In terms of mode of transportation, roadways segment to command 46.2% share in the secure logistics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Secure Web Gateway Market Analysis – Growth & Forecast 2019-2029

3D Secure Payment Authentication Market Insights by Components, Application, and Region - 2025 to 2035

Snap Secure Containers Market

Tracheostomy Securement Tapes Market

Tube and Dressing Securement Products Market

Logistics Robots Market Size and Share Forecast Outlook 2025 to 2035

Logistics Visibility Software Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in the Logistics Packaging Industry

Logistics Outsourcing Market Analysis - Growth & Forecast 2025 to 2035

Logistics Packaging Market from 2024 to 2034

Logistics Visualization System Market

Logistics Automation Market

Cash Logistics Market Size and Share Forecast Outlook 2025 to 2035

Rail Logistics Market Size and Share Forecast Outlook 2025 to 2035

Intralogistics Automation Solutions Market Size and Share Forecast Outlook 2025 to 2035

Drone Logistics & Transportation Market Size and Share Forecast Outlook 2025 to 2035

Smart Logistics Services Market Size and Share Forecast Outlook 2025 to 2035

Green Logistics Market Size and Share Forecast Outlook 2025 to 2035

Event Logistics Market Size and Share Forecast Outlook 2025 to 2035

Cloud Logistics Market Insights – Demand & Growth Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA