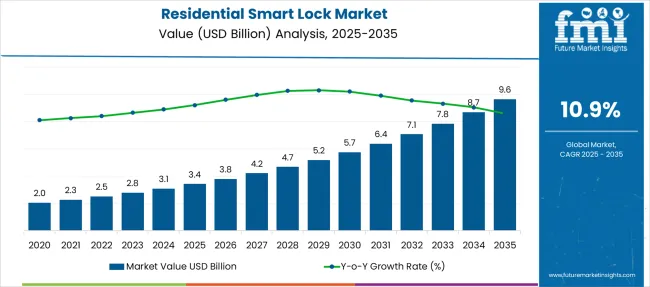

The Residential Smart Lock Market is estimated to be valued at USD 3.4 billion in 2025 and is projected to reach USD 9.6 billion by 2035, registering a compound annual growth rate (CAGR) of 10.9% over the forecast period. Early decade adoption faces moderate barriers due to upfront pricing and retrofit complexity; however, rapid smart home integration accelerates penetration from 2028 onward. YoY growth exceeds 11% between 2029 and 2032 before marginally tapering post-2033. The market structure favors early movers leveraging bundled home automation offerings, reducing acquisition costs per household. While incremental gains appear modest in nominal terms compared to large-scale industries, consumer adoption elasticity is critical.

Subscription-based lock management services and cloud integrations help retain margins. Regional analysis indicates Asia-Pacific outpacing North America in unit deployments after 2032, driven by low-cost smart home ecosystems. Strategic levers include leveraging distribution partnerships with property developers and security integrators.

The growth curve demonstrates an accelerating slope, signaling rapid adoption driven by the convergence of home automation, security enhancement, and convenience-focused technologies. Unlike traditional locks, smart locks integrate IoT functionality, biometric verification, and remote access, making them a key component of connected home ecosystems.

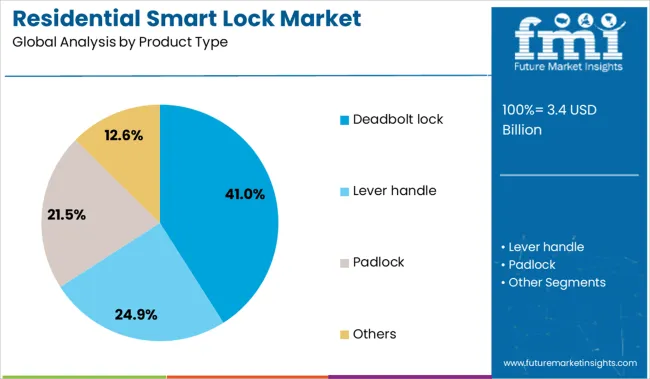

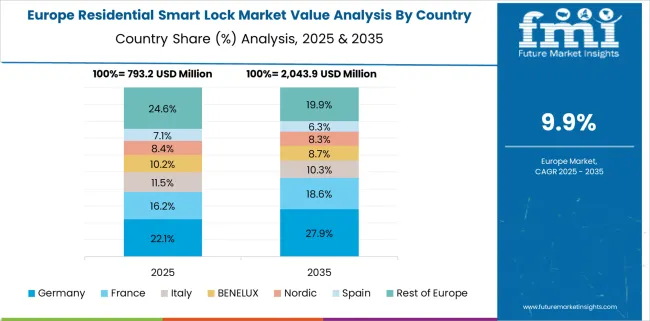

The deadbolt lock segment leads with 41.0% share in 2025, attributed to its versatility and compatibility with existing door systems. North America commands a dominant position, supported by mature smart home infrastructure and high consumer adoption of app-based security solutions. Asia-Pacific is emerging as the fastest-growing region, propelled by increasing urban housing projects and smartphone penetration, while Europe sustains momentum through strong demand for premium security products in residential retrofits. The market trajectory will likely steepen after 2028 as AI-enabled predictive security and voice-integrated controls become mainstream.

| Metric | Value |

|---|---|

| Residential Smart Lock Market Estimated Value in (2025E) | USD 3.4 billion |

| Residential Smart Lock Market Forecast Value in (2035F) | USD 9.6 billion |

| Forecast CAGR (2025 to 2035) | 10.9% |

The residential smart lock market is witnessing accelerated growth, supported by increasing consumer awareness of home security, rising smart home adoption, and growing demand for remote access solutions. Enhanced integration of smart locks with home automation platforms and IoT ecosystems has strengthened their appeal among urban homeowners and tech-savvy consumers.

Regulatory focus on smart infrastructure, along with heightened safety concerns in urban centers, is encouraging the replacement of traditional locking systems with intelligent, app-controlled alternatives. Manufacturers are investing in seamless user interfaces, biometric verification, and cloud-based access management to improve usability and data security.

The market’s future growth will be influenced by innovations in battery life, encrypted connectivity protocols, and expansion of smart residential developments in both developed and emerging economies.

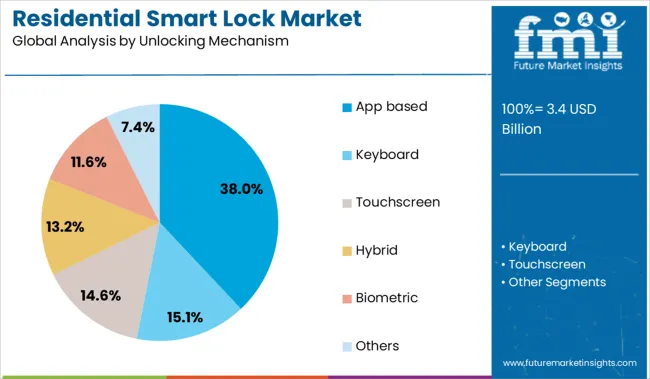

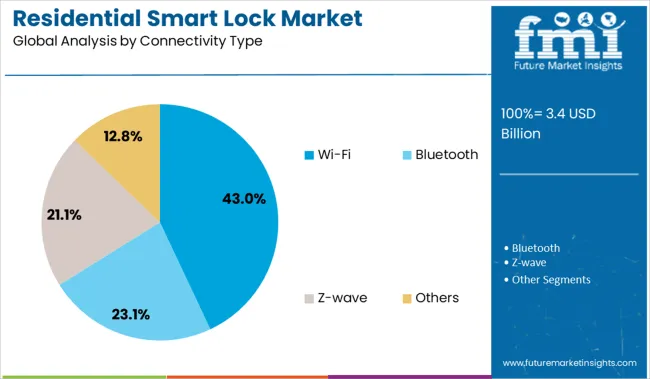

The residential smart lock market is segmented by product type, unlocking mechanism, connectivity type, price range, end use, and region. By product type, it includes deadbolt locks, lever handles, padlocks, and other smart locking solutions. In terms of unlocking mechanism, the segmentation comprises app-based, keyboard, touchscreen, hybrid, biometric, and other methods, offering multiple access options. Based on connectivity type, the market is divided into Wi-Fi, Bluetooth, Z-Wave, and others for seamless integration with smart home systems. By price range, it is classified into low (under USD 100), mid (USD 100–300), and high (above USD 300) segments. End use includes individual houses, condominiums, apartments, and other residential setups. Regionally, the market spans North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

Deadbolt locks are expected to lead the residential smart lock market with a projected 41.0% share of total revenue in 2025. Their dominance is being driven by their robust mechanical design, higher resistance to forced entry, and compatibility with a wide range of smart modules.

These locks offer enhanced protection for exterior doors, making them a preferred choice for homeowners seeking to upgrade security without compromising on traditional locking strength. Their integration into app-controlled and voice-activated systems has further increased utility, allowing users to remotely monitor and control entry.

Deadbolt smart locks are also benefiting from wide availability across both premium and mass-market product ranges, making them accessible to a broader consumer base.

App-based unlocking mechanisms are forecast to capture 38.0% of the market share in 2025, emerging as the most utilized unlocking method in residential settings. Their growth has been enabled by the proliferation of smartphones and improved user comfort with app-driven control systems.

This segment offers real-time lock status, digital key sharing, and remote locking capabilities-features highly valued in modern households. App interfaces also enable integration with home security ecosystems, allowing centralized control and alerts through a single platform.

The ability to update firmware and manage multiple user profiles through applications adds to their appeal. This unlocking method’s flexibility and security personalization continue to support its rapid adoption across new residential projects and retrofit installations.

Wi-Fi-enabled smart locks are expected to hold the leading position in the market, accounting for 43.0% of the overall revenue share in 2025. This segment’s growth has been supported by its superior remote access capabilities, seamless app integration, and real-time data synchronization.

Wi-Fi connectivity eliminates the need for additional hubs or bridges, simplifying installation and enhancing user convenience. Homeowners increasingly prefer Wi-Fi-enabled devices for their ability to send instant alerts, track entry logs, and support voice assistant integration.

The growing expansion of residential broadband access, along with improvements in cybersecurity protocols, has further encouraged the use of Wi-Fi as the primary connectivity standard. As smart home ecosystems evolve toward full-device interoperability, Wi-Fi-based locks are expected to remain a foundational element of connected home security infrastructure.

Smart home adoption, concerns about home security, and remote access needs are driving smart lock demand. Emerging opportunities include integration with home services, credential-free entry, and scalable leasing models.

Homeowners increasingly view smart locks as essential for enhancing entryway security and remote convenience. Features like mobile-controlled locking, temporary access codes, and real-time feed alerts appeal to families, rental hosts, and properties managed remotely. The ability to grant access without keys reduces risk of duplication and enables doorstep deliveries or contractor entry without being present.

Smart locks support integration with alarm systems and door sensors, helping residents manage security centrally. The convenience of remote control and automated locking schedules drives purchase decisions, especially among technology-savvy users and multi‑unit property managers. Adoption is also influenced by the desire for secure digital keys, audit trails of access events, and mobile monitoring in modern living contexts.

Growth potential lies in pairing smart locks with home service platforms, such as cleaning, pet care, and vacation rental turnover management. Credential-free access via facial recognition or proximity sensors removes friction for guests and service providers. Offering subscription-based package options that include installation, firmware upgrades, support, and lock maintenance can attract users, avoiding upfront investment.

Partnerships with property rental sites, co-living spaces and managed home networks allow bundled smart lock solutions. Integration with voice assistants and home automation enables locking behavior that adapts to occupancy or event schedules. Affordable modular products that combine keypad, mobile, and biometric options appeal to broader consumer segments, supporting scaled adoption among modern rental, multifamily and homeowner markets.

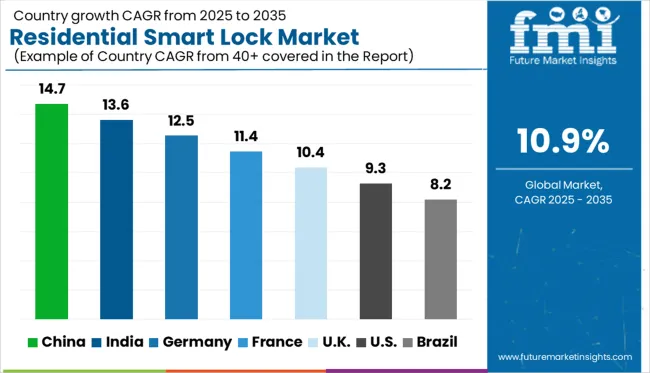

| Countries | CAGR |

|---|---|

| China | 14.7% |

| India | 13.6% |

| Germany | 12.5% |

| France | 11.4% |

| UK | 10.4% |

| USA | 9.3% |

| Brazil | 8.2% |

The global residential smart lock market is expected to grow at a CAGR of 10.9% from 2025 to 2035, driven by rising urbanization, connected home adoption, and increasing demand for security and convenience. Among BRICS, China leads with a 14.7% CAGR, fueled by rapid smart city development, tech-savvy consumers, and strong local manufacturing ecosystems.

India follows with 13.6%, supported by growing urban middle-class adoption, digital infrastructure push, and housing demand. Germany, an OECD member, sees a 12.5% CAGR owing to high-tech integration in home construction and energy-efficient housing initiatives. The UK records a 10.4% CAGR, driven by retrofitting of smart security in urban dwellings.

The USA, with a 9.3% CAGR, reflects demand for remote access control and integrated home platforms. This report covers detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

China is expanding rapidly with a 14.7% CAGR, the highest in this segment, supported by increasing adoption in urban housing and apartment complexes. YoY growth remains strong as developers integrate smart locks into new residential buildings to attract middle-class buyers.

Retail channels are expanding in parallel, with e-commerce platforms driving high-volume sales through bundled security packages. While biometric locks dominate urban demand, keypad and remote-access models are growing in tier-2 and tier-3 cities. Domestic brands are aggressively pricing products to appeal to multi-family households and gated community developers. This upward trend is sustained by rising awareness around access control and improved digital integration across property management systems.

India is estimated to record a 13.6% CAGR, with high YoY acceleration due to rising adoption in mid-income housing, gated colonies, and builder projects. Consumer behavior is shifting in metros and tier-1 cities, where fingerprint and Wi-Fi-enabled locks are becoming popular in apartments and independent houses. Local brands are increasing their presence through dealer networks and housing partnerships.

Installation support and multi-language app interfaces are boosting adoption in regional markets. Unlike China, India’s market remains more price-sensitive, pushing demand for simplified digital locks with fewer connectivity layers. Growth is concentrated in states like Maharashtra, Karnataka, and Tamil Nadu, where property developers are aligning with home automation providers.

Germany is estimated to grow at a 12.5% CAGR, supported by strong YoY gains as homeowners retrofit existing doors with secure, connected locking systems. Demand is concentrated in detached homes and suburban properties, where users seek to enhance access control without overhauling entire security setups.

Sales are being boosted by insurance incentives tied to certified digital locks. Most popular models include Bluetooth and keypad-based systems with offline backup access. DIY-compatible products are gaining traction through retail hardware chains. German buyers place emphasis on build quality, encryption standards, and power redundancy. Growth is stable and widespread, with no overreliance on any single region.

The United Kingdom is projected to expand at a 10.4% CAGR, showing stable YoY performance led by demand in rental properties, shared housing, and holiday homes. Real estate agents and landlords are increasingly specifying smart locks to simplify key management and reduce tenant turnover issues.

PIN-enabled and Bluetooth-compatible models are most popular, especially in city flats and commuter towns. Adoption is also climbing in short-stay rental properties, where remote access control is vital. Retailers are bundling locks with doorbell cameras to appeal to security-conscious buyers. However, higher costs and installation complexities in older buildings continue to limit penetration in some areas.

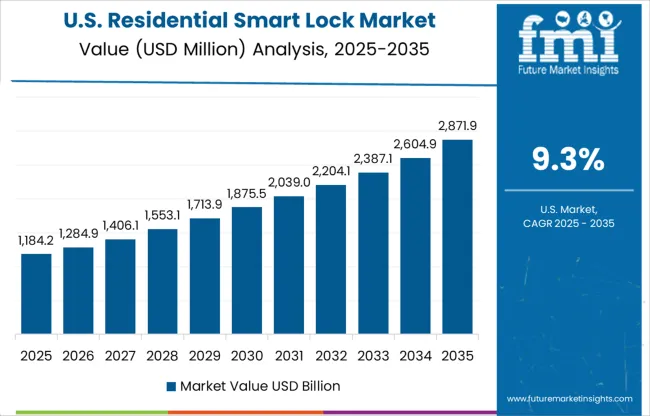

The United States is likely to grow at a 9.3% CAGR, with consistent YoY growth driven by increased home automation and real estate renovations. Demand is spread across single-family homes and townhouses, especially in suburban neighborhoods. Voice assistant integration and remote mobile control are key purchase motivators.

Retailers offer bundled packages including cameras and alarm systems, which appeal to first-time buyers. Consumers often choose between Wi-Fi and Z-Wave based connectivity, depending on home automation ecosystems. Price variability and brand trust continue to influence buyer behavior. DIY installation kits are widely accepted, making the upgrade process easier for tech-savvy households.

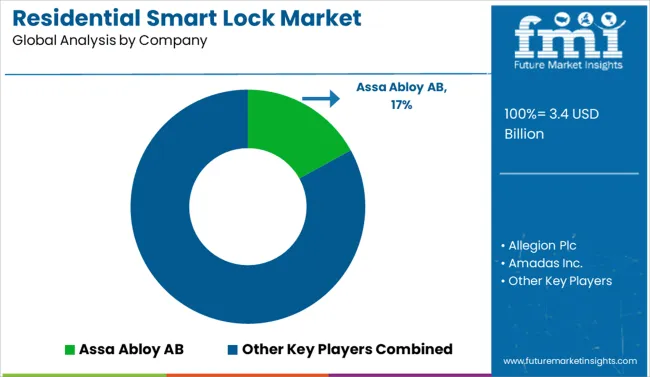

The residential smart lock market is moderately consolidated, featuring a mix of well-established security companies and tech-driven newcomers. Assa Abloy AB leads the market with its globally recognized brands like Yale and August Home, offering a wide portfolio of Bluetooth, Wi-Fi, and Z-Wave enabled smart locks that are compatible with leading smart home ecosystems.

Competitors like Allegion Plc (with its Schlage brand), Samsung Electronics, and Honeywell International Inc. maintain strong positions through trusted brand value and integration with home automation platforms. Spectrum Brands, Inc. (through Kwikset) also holds significant market share in North America.

Tech-forward entrants such as Xiaomi Corporation, ZKTeco USA, and Amadas Inc. emphasize affordability and mobile-first control interfaces, appealing to the tech-savvy and budget-conscious segments. European and niche players like Salto Systems, Gantner Electronic, and Avent Security target premium and access-control-integrated applications.

On March 10, 2025, Yale Home announced that its Linus® Smart Lock L2 received the prestigious iF Design Award 2025 in the Building Technology category, chosen from nearly 11,000 entries for its sleek form, intuitive interface, and advanced functionality.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.4 Billion |

| Product Type | Deadbolt lock, Lever handle, Padlock, and Others |

| Unlocking Mechanism | App based, Keyboard, Touchscreen, Hybrid, Biometric, and Others |

| Connectivity Type | Wi-Fi, Bluetooth, Z-wave, and Others |

| Price Range | Mid (100 USD - 300 USD), Low (100 USD), and High (> 300 USD) |

| End Use | Individual houses, Condominium, Apartments, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Assa Abloy AB, Allegion Plc, Amadas Inc., August Home Inc., Avent Security, Gantner Electronic GmbH, Honeywell International Inc., Megadoorlock Technology Co., Ltd., Nord-Lock International AB, Onity Inc., Salto Systems S.L., Samsung Electronics Co. Ltd., Spectrum Brands, Inc., Xiaomi Corporation, and ZKTeco USA |

| Additional Attributes | Dollar sales by lock type, connectivity technology, and housing type; regional demand driven by home automation adoption, security concerns, and urbanization; innovation in biometric access, remote control, and AI-enabled threat detection; cost dynamics shaped by installation services, battery life, and integration with smart home systems; environmental impact from electronic waste; and emerging use cases in rental properties, aging-in-place solutions, and contactless entry systems. |

The global residential smart lock market is estimated to be valued at USD 3.4 billion in 2025.

The market size for the residential smart lock market is projected to reach USD 9.6 billion by 2035.

The residential smart lock market is expected to grow at a 10.9% CAGR between 2025 and 2035.

The key product types in residential smart lock market are deadbolt lock, lever handle, padlock and others.

In terms of unlocking mechanism, app based segment to command 38.0% share in the residential smart lock market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Residential Generator Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy-Efficient Technologies Market Size and Share Forecast Outlook 2025 to 2035

Residential Interior Wood Doors Market Size and Share Forecast Outlook 2025 to 2035

Residential Air-to-Air Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Automatic Motor Starter Market Size and Share Forecast Outlook 2025 to 2035

Residential AMI Gas Meter Market Size and Share Forecast Outlook 2025 to 2035

Residential Vacuum Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Tracker Market Size and Share Forecast Outlook 2025 to 2035

Residential Non-metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Carpet Roll Market Size and Share Forecast Outlook 2025 to 2035

Residential Air Insulated Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Residential Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy Efficient Windows Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Residential Electric Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Residential Water Treatment Devices Market Size and Share Forecast Outlook 2025 to 2035

Residential Air to Water Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Hydronic Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA