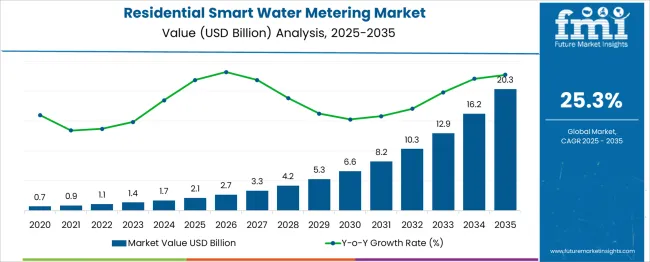

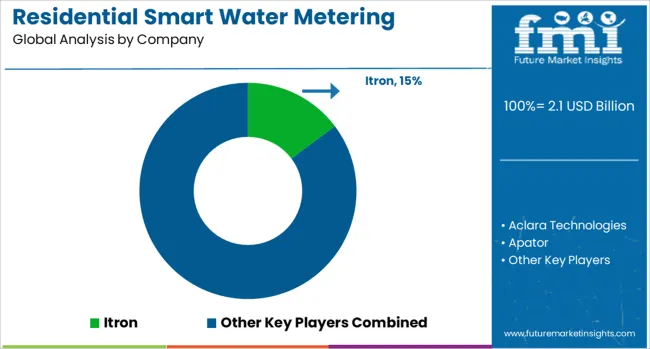

The Residential Smart Water Metering Market is estimated to be valued at USD 2.1 billion in 2025 and is projected to reach USD 20.3 billion by 2035, registering a compound annual growth rate (CAGR) of 25.3% over the forecast period.

| Metric | Value |

|---|---|

| Residential Smart Water Metering Market Estimated Value in (2025 E) | USD 2.1 billion |

| Residential Smart Water Metering Market Forecast Value in (2035 F) | USD 20.3 billion |

| Forecast CAGR (2025 to 2035) | 25.3% |

Urbanization, coupled with growing environmental awareness, has pushed municipal bodies and utilities to adopt smart metering solutions that support sustainable usage patterns and reduce non-revenue water losses. Regulatory mandates promoting digital infrastructure in utility services and government-led initiatives for smart city development have further accelerated market adoption. Consumers are also displaying greater interest in solutions that offer usage transparency, billing accuracy, and smartphone integration.

Future growth is expected to be driven by the integration of IoT, advanced data analytics, and remote monitoring capabilities, enhancing user control and utility efficiency. As infrastructure modernization continues and technology costs decline, residential deployment of smart water meters is projected to expand across both developed and emerging economies.

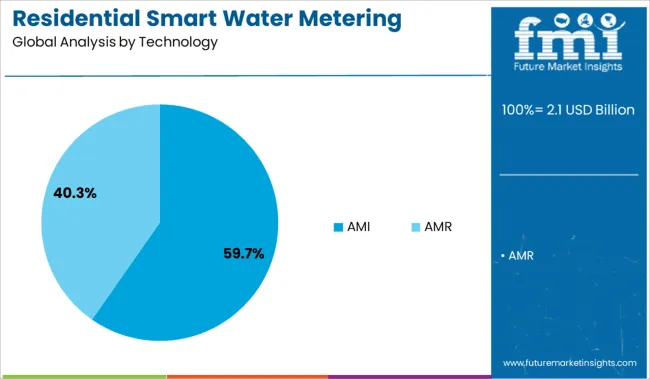

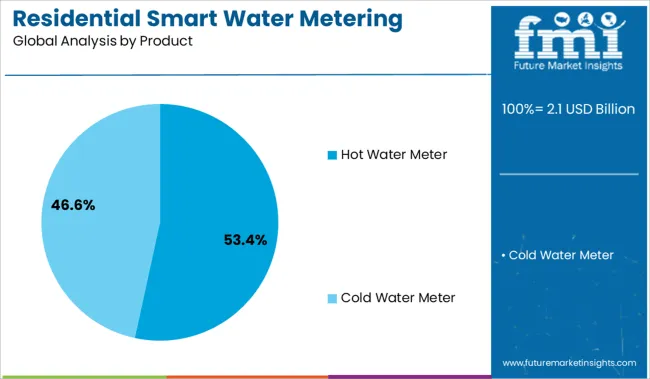

The residential smart water metering market is segmented by technology and product, and geographic regions. The residential smart water metering market is divided into AMI and AMR. In terms of the product, the residential smart water metering market is classified into Hot Water Meter and Cold Water Meter. Regionally, the residential smart water metering industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The AMI technology segment leads the residential smart water metering market with a dominant 59.7% share, highlighting its role in enabling two-way communication between meters and utility providers. Advanced Metering Infrastructure allows for real-time data collection, remote meter reading, and immediate leak detection, which significantly enhances operational efficiency and customer service.

Utilities are increasingly adopting AMI to reduce manual labor costs, address billing disputes, and comply with data-driven regulatory requirements. The ability to analyze consumption patterns in real time enables proactive maintenance and effective demand management.

Furthermore, AMI’s compatibility with smart grid infrastructure positions it as a strategic investment for long-term water conservation and digital transformation efforts. As smart city projects and sustainability goals intensify, the AMI segment is expected to maintain its market leadership due to its high functionality, scalability, and regulatory alignment.

Hot water meters account for a leading 53.4% share in the product category, reflecting their widespread adoption in residential buildings for accurate monitoring of thermal water consumption. These meters are particularly critical in multi-unit dwellings and urban residential complexes where centralized water heating systems are common.

The increasing need for cost allocation transparency and energy efficiency in water heating has driven demand for precise, durable, and tamper-resistant hot water metering solutions. Technological advancements have improved meter performance under high-temperature conditions and enabled integration with smart home platforms.

The rising emphasis on energy conservation, coupled with stricter building efficiency codes, continues to support the growth of this segment. Future adoption is expected to grow further as smart home developers and utility companies prioritize hot water metering to optimize resource usage and billing practices in residential environments.

Smart water meters have been deployed to enable accurate household consumption monitoring, reduce water loss, and streamline billing processes. Features such as automatic meter readings, leak detection alerts, and Bluetooth or RF connectivity are being included in new smart metering systems. Utilities and municipalities have adopted remote meter reading and data analytics platforms driven by regulatory water management targets and the need to improve customer engagement. Devices supporting two-way communication and modular replacements have been preferred by service providers aiming to modernize residential metering infrastructure.

Adoption of residential smart water meters is driven by their capability to deliver accurate consumption data and early leak detection. Meters integrated with flow sensors and communication modules identify abnormal patterns, preventing significant water loss and property damage. Automated meter reading eliminates manual errors, reduces the need for field visits, and supports transparent billing processes. Consumer-facing dashboards and mobile applications provide real-time usage insights, allowing proactive conservation. Regulatory initiatives promoting water conservation and non-revenue water reduction further accelerate utility deployments. Transitioning from manual systems to digital metering enhances operational efficiency, improves revenue assurance, and strengthens customer engagement. Smart meters also enable demand forecasting and dynamic pricing strategies through continuous data collection.

Growth in smart water metering faces challenges from inconsistent connectivity in low-signal areas, causing delays in data transmission and billing updates. RF and cellular modules present variations in power efficiency and reliability, complicating hardware selection and deployment. Hourly consumption readings generate large data volumes, creating pressure on utility analytics platforms to support real-time processing. Deployment requires scheduling home visits, retrofitting old meters, and securing consumer approvals, adding complexity and cost. Data security concerns, including risks of hacking and unauthorized access, remain significant. Additionally, high upfront costs compared to traditional mechanical meters limit adoption by smaller utilities with constrained budgets, delaying modernization initiatives in cost-sensitive regions.

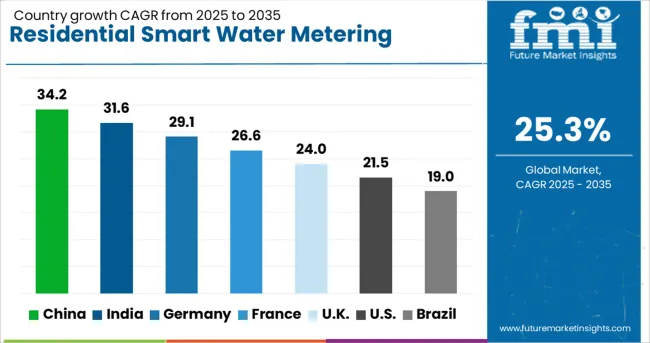

| Country | CAGR |

|---|---|

| China | 34.2% |

| India | 31.6% |

| Germany | 29.1% |

| France | 26.6% |

| UK | 24.0% |

| USA | 21.5% |

| Brazil | 19.0% |

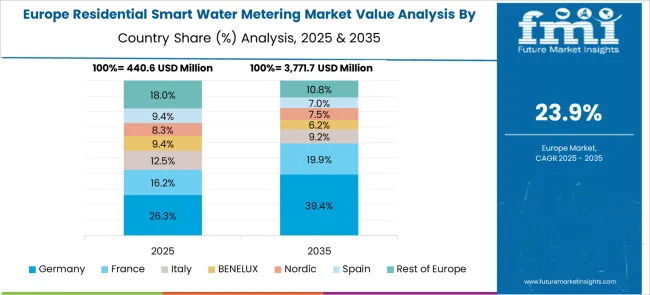

The global residential smart water metering market is projected to grow at a 25.3% CAGR from 2025 to 2035. Of the five profiled markets among 40 analyzed, China leads at 34.2%, followed by India at 31.6% and Germany at 29.1%, while France posts 26.6% and the United Kingdom records 24.0%. These figures represent growth premiums of +35% for China, +25% for India, and +15% for Germany, whereas France and the UK track closer to the global baseline. Key drivers include large-scale smart city deployments in China, nationwide water efficiency initiatives in India, advanced IoT integration in Germany, government-backed metering mandates in France, and infrastructure digitalization in the UK. The report includes analysis of over 40 countries, with five profiled below for reference.

China is projected to grow at a 34.2% CAGR, driven by extensive smart city programs and utility digitalization across Tier I and Tier II cities. Government mandates for real-time water monitoring accelerate IoT-enabled meter adoption. Domestic manufacturers are scaling production of ultrasonic and electromagnetic meters integrated with cloud-based platforms for analytics. Expansion of high-rise residential projects and municipal modernization projects further supports deployments. E-commerce procurement channels enhance access for private developers and municipal contracts. Cloud-integrated metering solutions enable accurate billing, early leak detection, and predictive maintenance, creating efficiency across large distribution networks. The strong push for digital infrastructure positions China as a global leader in advanced water metering deployments.

India is expected to register a 31.6% CAGR, supported by national water conservation programs and accelerated housing development under government-led initiatives. Utilities are increasingly deploying AMI systems to monitor consumption and detect leaks in real time. Domestic manufacturers are introducing low-cost smart meters for semi-urban and rural zones, reducing reliance on mechanical meters. Partnerships between global IoT providers and Indian OEMs drive localization of advanced technologies. Digital payment integration improves billing transparency and enhances consumer experience. Smart metering adoption is gaining momentum in municipal distribution grids and private housing projects, ensuring operational efficiency and reduced non-revenue water losses. Growing urbanization and technology-driven governance frameworks strengthen future demand.

France is projected to grow at a 26.6% CAGR, driven by regulatory measures promoting efficient water and energy use. Utilities prioritize two-way communication meters to improve demand forecasting and billing accuracy. Vendors invest in interoperability standards to ensure compatibility with legacy infrastructure, accelerating large-scale rollouts. AMI deployment expands coverage in suburban and rural grids, improving operational transparency. Manufacturers integrate AI-driven leakage detection systems and automated billing to enhance reliability and reduce non-revenue water. Digital engagement platforms help consumers monitor usage through apps and web dashboards, reinforcing conservation efforts. Growing focus on reducing water loss and modernizing utility infrastructure drives significant investment in advanced metering technology.

The United Kingdom is expected to grow at a 24.0% CAGR, supported by water infrastructure modernization and energy-efficiency objectives. Smart meter installations are gaining momentum in high-density residential clusters through government funding initiatives. Utilities are deploying NB-IoT and LoRaWAN connectivity for reliable real-time data exchange across complex urban networks. Cloud-based monitoring platforms offer consumers usage dashboards and predictive analytics, enabling better water management. Manufacturers introduce retrofit-ready compact meters suitable for older housing stock, reducing installation complexity. Collaborations with cloud service providers ensure secure data handling and remote diagnostics for improved system uptime. Integration of smart meters with home automation platforms further accelerates adoption.

Germany is forecast to achieve a 29.1% CAGR, driven by EU energy-efficiency mandates and rapid adoption of smart home technologies. Wireless ultrasonic meters dominate installations across multi-family housing, providing real-time data transmission for utilities. Manufacturers prioritize designs with long-life batteries to extend operational lifespan and minimize service interruptions. Cloud-based platforms support predictive analytics for leak detection and usage optimization. Integration of smart meters with district heating and water recycling systems enables bundled smart utility packages for urban infrastructure projects. Digital twin applications in municipal networks enhance modeling for resource management and planning. The focus on interoperability and sustainability positions Germany as a hub for advanced water metering technology.

The residential smart water metering market is dominated by Itron, with a significant share, leveraging AMI-enabled meters and advanced IoT infrastructure for utilities. Key players such as Aclara Technologies, Kamstrup, Sensus (Xylem), Badger Meter, Neptune Technology Group, Diehl Stiftung, Honeywell International, and Landis+Gyr provide AMR and AMI solutions integrated with wireless protocols including LoRaWAN and Wireless M-Bus. Regional manufacturers like Apator, Arad Group, BMETERS, Schneider Electric, Sontex, and Zenner International address localized needs across Europe, Asia, and Latin America. Competitive differentiation is centered on accurate leak detection, real-time data analytics, and interoperability with smart home systems. Utilities increasingly prefer vendors offering scalable endpoint networks and secure platforms that ensure compliance with regulatory and water conservation mandates.

On June 9, 2025, Itron announced the start of manufacturing for its Cyble five communication module in Indonesia. This development aims to enhance AMI connectivity for water utilities across the APAC region, improving operational efficiency and enabling advanced remote monitoring capabilities.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.1 Billion |

| Technology | AMI and AMR |

| Product | Hot Water Meter and Cold Water Meter |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Itron, Aclara Technologies, Apator, Arad Group, Badger Meter, BMETERS, Diehl Stiftung, Honeywell International, Kamstrup, Landis+Gyr, Nepune Technology Group, Ningbo Water Meter, Schneider Electric, Sensus, Siemens, Sontex, and Zenner International |

| Additional Attributes | Dollar sales by solution type (real-time monitoring, leak detection, efficient billing), with AMI systems dominating for remote data capture and improved operational visibility. Regional trends led by North America and Europe due to infrastructure modernization, while Asia-Pacific accelerates through large-scale housing developments. Key players focus on smart home integration, advanced data analytics, and interoperability for optimized utility management. |

The global residential smart water metering market is estimated to be valued at USD 2.1 billion in 2025.

The market size for the residential smart water metering market is projected to reach USD 20.3 billion by 2035.

The residential smart water metering market is expected to grow at a 25.3% CAGR between 2025 and 2035.

The key product types in residential smart water metering market are ami and amr.

In terms of product, hot water meter segment to command 53.4% share in the residential smart water metering market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Residential Generator Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy-Efficient Technologies Market Size and Share Forecast Outlook 2025 to 2035

Residential Interior Wood Doors Market Size and Share Forecast Outlook 2025 to 2035

Residential Air-to-Air Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Automatic Motor Starter Market Size and Share Forecast Outlook 2025 to 2035

Residential AMI Gas Meter Market Size and Share Forecast Outlook 2025 to 2035

Residential Vacuum Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Tracker Market Size and Share Forecast Outlook 2025 to 2035

Residential Non-metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Carpet Roll Market Size and Share Forecast Outlook 2025 to 2035

Residential Air Insulated Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Residential Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy Efficient Windows Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Residential Electric Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Residential Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Hydronic Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Residential Electric Boiler Market Size and Share Forecast Outlook 2025 to 2035

Residential PVC Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA