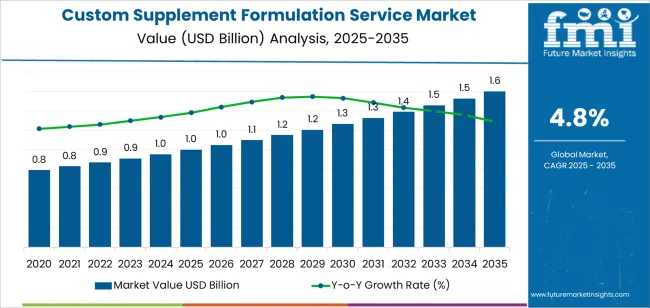

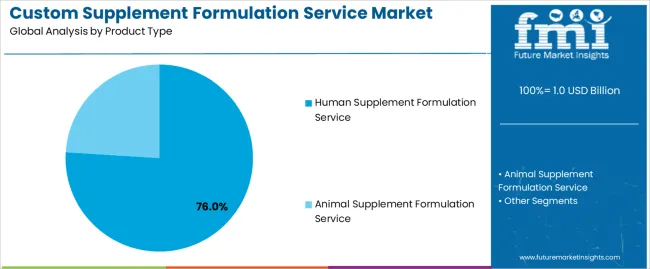

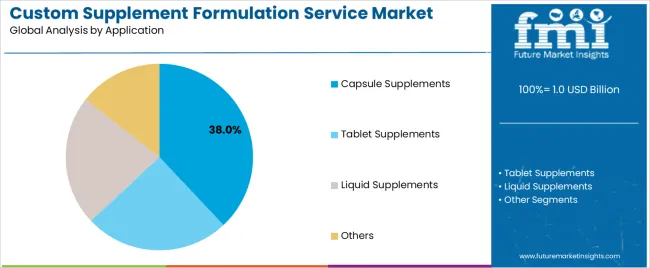

The custom supplement formulation service market is forecast to grow from USD 1.0 billion in 2025 to USD 1.6 billion by 2035, at a CAGR of 4.8%, driven by rising demand for personalized nutrition and increasing reliance on contract formulators for rapid product development. Growth through 2025–2030 is shaped by strong adoption of targeted formulations in immunity, sports performance, metabolic wellness, and cognitive support, as brands accelerate personalized supplement portfolios. Services involving ingredient sourcing, dosage design, regulatory documentation, and stability validation become central to product pipelines for private-label nutraceutical and DTC brands. Capsule supplements lead with a 38.0% share due to dosing flexibility and compatibility with botanical extracts, probiotics, and multi-ingredient blends, while human supplement formulation services dominate with 76.0% share.

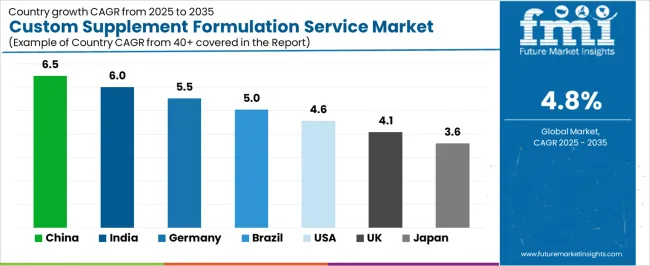

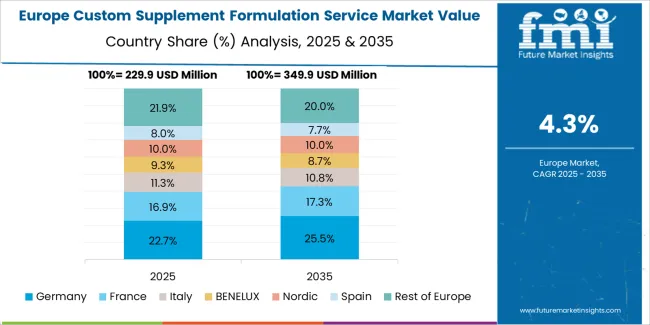

From 2030 to 2035, market growth continues despite a mild regulatory-driven slowdown between 2029 and 2031, followed by renewed momentum anchored in science-backed formulations, improved bioavailability technologies, and broader adoption of personalized nutrition strategies among mid-sized brands. Regionally, expansion is led by China at a 6.5% CAGR and India at 6.0%, reflecting strong nutraceutical manufacturing capacity and rising wellness product consumption. Germany grows at 5.5%, Brazil at 5.0%, the USA at 4.6%, the UK at 4.1%, and Japan at 3.6%. Competitive positioning is shaped by Natural Alternatives International with 16.0% share, followed by Supplement Factory, Uckele, Activ’Inside, Superior Supplement Manufacturing, Vitaquest, Nutra Coast, LifeLab, and others offering GMP-compliant formulation, ingredient validation, and scalable production across capsules, tablets, liquids, powders, and functional blends.

Human supplement formulation services represent the leading segment, driven by strong demand for customized formulas targeting immunity, cognitive health, sports performance, digestive health, and healthy aging. These services integrate ingredient sourcing, stability testing, allergen control, and nutritional optimization to deliver market-ready formulations aligned with regional regulatory standards. Advancements in nutrigenomics, bioavailability enhancement, and clean-label formulation strategies continue to influence service offerings. Asia Pacific leads market expansion due to growing nutrition awareness and expanding contract manufacturing capacity in China and India. Europe and North America maintain steady demand through established supplement brands and sustained consumer interest in specialized wellness products. Key companies include Natural Alternatives International, Supplement Factory, Uckele, Activ'Inside, and Superior Supplement Manufacturing, focusing on formulation precision, quality assurance, and end-to-end product development support.

Peak-to-trough analysis shows a moderate cyclical pattern influenced by consumer-health trends, regulatory shifts, and manufacturing capacity. Between 2025 and 2028, the market is expected to reach an early growth peak as brands expand personalized nutrition portfolios and contract manufacturers increase formulation capabilities for powders, capsules, and functional blends. Rising demand for targeted supplements in sports nutrition, immunity, and metabolic health will support this initial acceleration.

A mild trough is likely between 2029 and 2031 as regulatory tightening, ingredient-sourcing constraints, and cost adjustments slow new product introductions. During this period, companies will focus on reformulation, compliance alignment, and inventory balancing, which will moderate growth without creating sharp declines. After 2031, the market is expected to re-enter an upward phase driven by improved access to clinically validated ingredients, advances in formulation science, and broader adoption of personalized supplement strategies by mid-sized brands. The peak-to-trough pattern reflects a stable cycle shaped by innovation, compliance requirements, and steady demand for customized nutritional solutions across consumer-health segments.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.0 billion |

| Market Forecast Value (2035) | USD 1.6 billion |

| Forecast CAGR (2025-2035) | 4.8% |

The custom supplement formulation service market is growing as wellness brands and nutrition-segment entrepreneurs demand tailor-made product formulas to meet specific health-goals, lifestyle needs and consumer preferences. This service allows companies to develop bespoke capsules, tablets, liquids or chewables using unique combinations of vitamins, botanicals and functional ingredients crafted for fitness, immunity, beauty or niche demographic segments. Growing awareness about preventive healthcare, personalised nutrition and direct-to-consumer (DTC) brand models drives interest in customised formulations.

Contract manufacturers and formulation specialists invest in research, ingredient sourcing and regulatory compliance services to support rapid product launch and market differentiation. Global expansion of health-supplement sales and macro-trends such as clean-label, vegan-friendly and plant-based ingredients widen the addressable market. Constraints include higher development cost and minimum volumes for customised formulations, complexity of regulatory compliance across multiple jurisdictions and the necessity for rigorous ingredient safety and stability testing before commercial release.

The custom supplement formulation service market is segmented by product type and application. By product type, the market includes human supplement formulation services and animal supplement formulation services. Based on application, it is categorized into capsule supplements, tablet supplements, liquid supplements, and others. Regionally, the market is divided into Asia Pacific, Europe, North America, and other key regions.

The human supplement formulation service segment represents the leading category, accounting for an estimated 76.0% of the total market share in 2025. Human-focused formulation services dominate due to strong demand for personalized nutrition, functional health products, and specialized formulations designed for immunity, sports performance, cognitive support, and metabolic health. These services involve ingredient selection, dosage optimization, regulatory compliance, and stability evaluation tailored to consumer health needs.

The animal supplement formulation service segment, estimated at 24.0%, supports veterinary, livestock, and companion animal nutrition markets. Growth in this segment is linked to increasing awareness of pet wellness and specialized formulations used in performance animals and herd health programs.

Key factors supporting the human supplement formulation service segment include:

The capsule supplements segment accounts for approximately 38.0% of the market in 2025. Capsules support controlled dosing, ingredient stability, and broad compatibility with botanical extracts, probiotics, and specialty formulations. They remain widely selected by brands due to cost efficiency and consumer familiarity.

The tablet supplements segment follows with an estimated 31.0%, supported by demand for high-volume nutraceutical products requiring longer shelf life and robust structural integrity. The liquid supplements category accounts for about 22.0%, used primarily for fast absorption formulas and products intended for children or elderly populations. The others segment, representing roughly 9.0%, includes powders, gummies, and softgels.

Primary dynamics driving demand from the capsule supplements segment include:

The custom supplement formulation service market is expanding as brands seek unique formulations that address targeted health needs across immunity, cognitive support, fitness recovery, metabolic wellness, and healthy aging. Rising consumer preference for personalised supplements encourages companies to develop proprietary blends based on demographic profiles, lifestyle habits, and functional ingredient trends. Small and mid-sized wellness brands use contract formulators to access R&D support, ingredient sourcing, stability testing, and regulatory documentation without maintaining in-house laboratories. Growth in clean-label, plant-based, and allergen-conscious supplements further strengthens demand for formulation services that can validate ingredient purity and design compliant product claims. E-commerce expansion increases the number of private-label brands entering the market, creating sustained demand for custom formulation expertise.

Custom formulation involves development fees, pilot runs, stability studies, and minimum order quantities that may be challenging for start-ups or brands operating with limited capital. Regulatory frameworks differ across regions, requiring specialised knowledge of permissible claims, ingredient limits, and documentation standards for dietary supplements, which increases compliance cost. Supply constraints in high-demand ingredients such as botanical extracts, probiotics, amino acids, and specialty minerals can delay production or affect formulation stability. Variability in ingredient quality across suppliers requires extensive testing, raising operational complexity for service providers.

Brands are requesting formulations supported by clinical research, leading to increased use of studied ingredients, standardized extracts, and validated dosage levels. Digital formulation tools that model ingredient interactions, shelf-life behavior, and bioavailability are improving development efficiency. Emerging markets in Asia Pacific, Latin America, and the Middle East are adopting custom supplement services as wellness retailers introduce region-specific products. Growth in personalised packs, ready-to-mix powders, functional gummies, and sustained-release capsules is also expanding the range of custom formulation projects managed by contract developers.

The global custom supplement formulation service market is expanding through 2035, supported by increased consumer demand for personalized nutrition, broader adoption of contract formulation services, and rising interest in targeted wellness products. China leads with a 6.5% CAGR, followed by India at 6.0%, reflecting strong nutraceutical manufacturing capacity and growing use of specialized formulation services. Germany grows at 5.5%, supported by regulated product standards and increased demand for evidence-based supplement development. Brazil records 5.0%, driven by expanding wellness-product consumption. The United States grows at 4.6%, while the United Kingdom (4.1%) and Japan (3.6%) maintain stable demand supported by mature supplement industries and established formulation networks.

| Country | CAGR (%) |

|---|---|

| China | 6.5 |

| India | 6.0 |

| Germany | 5.5 |

| Brazil | 5.0 |

| USA | 4.6 |

| UK | 4.1 |

| Japan | 3.6 |

China’s market grows at 6.5% CAGR, supported by extensive nutraceutical production capacity, expanding demand for personalized wellness products, and increased use of contract formulation services among domestic and international brands. Manufacturers offer custom formulations featuring plant extracts, functional nutrients, probiotics, and condition-specific blends tailored for energy, immunity, and general wellness. Contract formulators provide testing, ingredient standardization, dosage optimization, and regulatory documentation. Growth in e-commerce and direct-to-consumer supplement brands strengthens demand for unique formulations. Increased health awareness across major cities reinforces adoption of customized supplement development.

Key Market Factors:

India’s market grows at 6.0% CAGR, driven by expanding nutraceutical production, increased demand for personalized-health products, and strong participation of contract manufacturers offering custom formulation solutions. Companies develop tailored blends using herbal extracts, micronutrients, probiotics, and functional additives aligned with regional wellness preferences. Domestic formulators offer stability testing, functional-ingredient sourcing, and compliance support for domestic and export markets. Growth in lifestyle-oriented supplement consumption among urban populations increases demand for unique formulations. Broader presence of online supplement brands strengthens long-term adoption.

Market Development Factors:

Germany’s market grows at 5.5% CAGR, supported by strict regulatory standards, strong consumer preference for clinically substantiated products, and widespread demand for scientifically aligned supplement formulations. Formulation service providers develop targeted blends for cognition, immunity, metabolic health, and sports nutrition. Companies focus on ingredient purity, documented sourcing, and compliance with European nutritional regulations. Demand rises for custom formulations used in pharmacy channels, health stores, and direct-to-consumer brands emphasizing evidence-based ingredients. Growth in functional-food and wellness-product development strengthens use of specialized formulation services.

Key Market Characteristics:

Brazil’s market grows at 5.0% CAGR, driven by rising health-awareness, growth in local supplement brands, and increased use of custom formulation for sports nutrition, wellness blends, and condition-specific products. Contract formulators offer services including ingredient blending, flavor development, dosage refinement, and regulatory support aligned with national guidelines. Adoption increases among small and mid-sized supplement brands expanding their product portfolios. E-commerce growth and fitness-community demand strengthen market activity.

Market Development Factors:

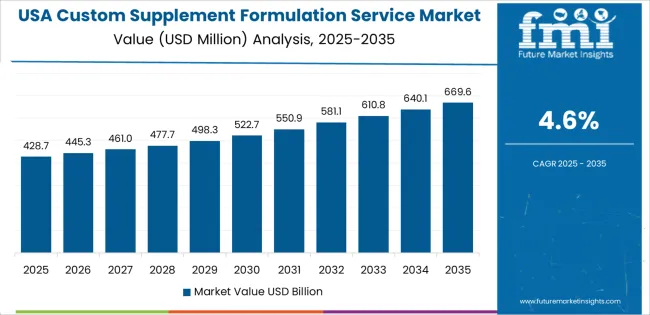

The United States grows at 4.6% CAGR, supported by an established supplement industry, increased consumer interest in personalized-health solutions, and strong participation of contract formulating firms. Companies develop custom blends for cognitive health, metabolic wellness, immunity, and performance nutrition. Providers offer ingredient sourcing, dosage optimization, stability testing, and compliance documentation tailored to regulated markets. Growth in direct-to-consumer brands and subscription-based wellness programs increases demand for unique, targeted formulations. Broader focus on premium ingredients strengthens customized formulation services.

Key Market Factors:

The United Kingdom’s market grows at 4.1% CAGR, supported by steady consumer interest in clean-label and plant-based supplements, expansion of boutique formulation services, and increased demand for targeted blends. Providers offer custom formulations for digestive health, immunity, energy support, and lifestyle-oriented wellness. Companies emphasize compliance with regional labeling and ingredient standards. Growth in online supplement brands and small nutraceutical firms drives consistent use of formulation services.

Market Development Factors:

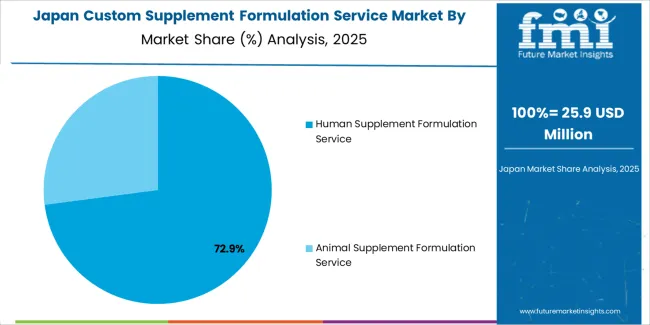

Japan’s market grows at 3.6% CAGR, supported by established nutraceutical consumption, strong interest in functional ingredients, and demand for compact, precise formulations suited to adult wellness routines. Providers develop targeted blends for energy, immunity, digestion, and healthy aging using plant-based compounds and micronutrients. Domestic formulators emphasize ingredient integrity, dosage accuracy, and packaging suited for daily-use formats. Growth in online health retail and personalized-nutrition tools supports stable demand.

Key Market Characteristics:

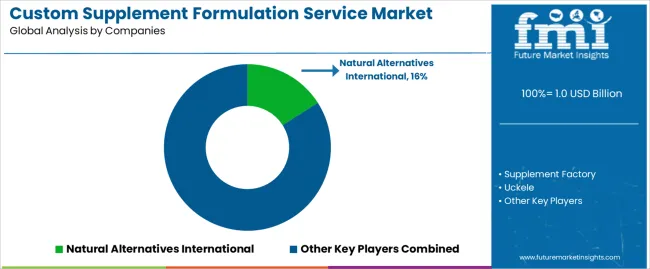

The custom supplement formulation service market is moderately fragmented, with about fifteen manufacturers providing contract formulation, blending, encapsulation, and packaging for nutrition brands and private-label manufacturers. Natural Alternatives International leads the market with an estimated 16.0% global share, supported by its long-standing expertise in nutritional formulation, controlled manufacturing environments, and validated processes for sports nutrition and wellness products. Its position is reinforced by documented quality systems and stable raw material sourcing.

Supplement Factory, Vitaquest, Superior Supplement Manufacturing, and Uckele follow as major competitors, each offering end-to-end formulation support combined with GMP-compliant production. Their competitive strengths include broad ingredient libraries, in-house R&D teams, and scalability across tablets, capsules, powders, and functional blends. Activ’Inside, Nutra Coast, LifeLab, and Canyonside Lab maintain mid-tier roles, focusing on specialized botanical extracts, cognitive health formulations, and rapid prototype development suited to emerging brands.

Manufacturers such as SDC Nutrition, Quality Supplement Manufacturing, Millmax, NutraBest, Arnet, and Martínez Nieto expand regional access through cost-efficient production, diverse dosage formats, and private-label services aligned with market-specific regulatory requirements.

Competition in this market centers on formulation precision, ingredient quality, regulatory compliance, lead times, and batch consistency. Growth is driven by increasing demand for personalized nutrition, expansion of private-label supplement brands, and greater reliance on contract developers capable of delivering science-based formulations, clean-label compliance, and scalable production for global nutrition markets.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Product Type | Human Supplement Formulation Service, Animal Supplement Formulation Service |

| Application | Capsule Supplements, Tablet Supplements, Liquid Supplements, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | India, China, USA, Germany, South Korea, Japan, Italy, and 40+ countries |

| Key Companies Profiled | Natural Alternatives International, Supplement Factory, Uckele, Activ'Inside, Superior Supplement Manufacturing, Canyonside Lab, SDC Nutrition, Vitaquest, Nutra Coast, LifeLab, Quality Supplement Manufacturing, Millmax, NutraBest, Arnet, MARTÍNEZ NIETO |

| Additional Attributes | Dollar sales by product type and application categories; regional adoption trends across Asia Pacific, Europe, and North America; competitive landscape of custom nutraceutical formulation and contract manufacturing providers; advancements in personalized supplement formulation, clean-label ingredients, and GMP-certified production; integration with DTC supplement brands, clinical nutrition programs, and animal health product development. |

The global custom supplement formulation service market is estimated to be valued at USD 1.0 billion in 2025.

The market size for the custom supplement formulation service market is projected to reach USD 1.6 billion by 2035.

The custom supplement formulation service market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in custom supplement formulation service market are human supplement formulation service and animal supplement formulation service.

In terms of application, capsule supplements segment to command 38.0% share in the custom supplement formulation service market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Custom Packaging Box Market Size and Share Forecast Outlook 2025 to 2035

Custom Face Care Market Forecast Outlook 2025 to 2035

Customized Skincare Market Size and Share Forecast Outlook 2025 to 2035

Custom Vacation Planning Market Size and Share Forecast Outlook 2025 to 2035

Customer Revenue Optimization (CRO) Software Market Size and Share Forecast Outlook 2025 to 2035

Customer Communications Management Market Size and Share Forecast Outlook 2025 to 2035

Customer Experience Management (CEM) In Telecommunication Market Size and Share Forecast Outlook 2025 to 2035

Custom Dry Ingredients Blends Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Customer Engagement Hub (CEH) Market Size and Share Forecast Outlook 2025 to 2035

Custom Probiotics Market Size and Share Forecast Outlook 2025 to 2035

Customer Journey Analytics Software Market Size and Share Forecast Outlook 2025 to 2035

Customer-To-Customer (C2C) Community Marketing Software Market Size and Share Forecast Outlook 2025 to 2035

Customer Journey Mapping Software Market Size and Share Forecast Outlook 2025 to 2035

Customized Premix Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Custom Binders Market Growth & Industry Forecast 2025 to 2035

Custom Printed Tape Market Size and Share Forecast Outlook 2025 to 2035

Customisation and Personalisation in Travel Market Size and Share Forecast Outlook 2025 to 2035

Customer-Facing Technology Market Size and Share Forecast Outlook 2025 to 2035

Custom Display Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Custom Hearing Aids Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA