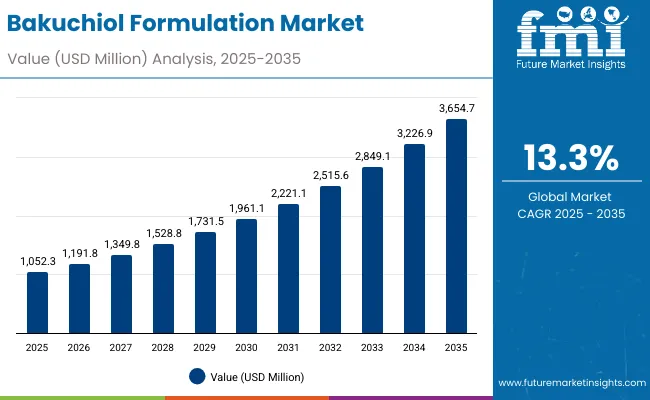

The Bakuchiol Formulations Market is expected to record a valuation of USD 1,052.3 million in 2025 and USD 3,654.7 million in 2035, with an increase of USD 2,602.4 million, which equals a growth of 247% over the decade. The overall expansion represents a CAGR of 13.3% and more than a 3X increase in market size.

Bakuchiol Formulations Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 1,052.3 million |

| Market Forecast Value in (2035F) | USD 3,654.7 million |

| Forecast CAGR (2025 to 2035) | 13.3% |

During the first five-year period from 2025 to 2030, the market increases from USD 1,052.3 million to USD 1,961.1 million, adding USD 908.8 million, which accounts for 34.9% of the total decade growth. This phase records steady adoption in global skincare, particularly in anti-aging and acne control categories, driven by the demand for retinol alternatives that are natural, less irritating, and safe for sensitive skin. Serums dominate this period as they cater to more than half of consumer preferences, offering concentrated formulations for targeted concerns. E-commerce platforms also accelerate growth during this stage, with digital-native brands gaining significant traction.

The second half from 2030 to 2035 contributes USD 1,693.6 million, equal to 65.1% of total growth, as the market jumps from USD 1,961.1 million to USD 3,654.7 million. This acceleration is powered by widespread deployment of AI-based personalized skincare recommendations, stronger consumer loyalty towards clean-label and vegan claims, and premiumization of bakuchiol-based products. Emerging categories like oils and masks see increasing integration with multifunctional formulations (anti-aging plus brightening). Brick-and-mortar channels such as pharmacies and specialty beauty stores expand their influence by adopting hybrid online-to-offline models. By the end of the decade, Asia-Pacific, particularly China and India, account for the largest growth shares, supported by double-digit CAGR trends.

From 2020 to 2024, the Bakuchiol Formulations Market grew from a niche category under USD 500 million to just over USD 1 billion in 2025, driven by consumer migration from synthetic retinol products to gentler, plant-derived alternatives. During this period, the competitive landscape was dominated by indie skincare brands and clean beauty pioneers controlling nearly 60% of revenue, with leaders such as Herbivore Botanicals and The Ordinary popularizing serums and oils with bakuchiol as the hero ingredient. Competitive differentiation relied heavily on natural/vegan claims, social media engagement, and dermatologist endorsements. Larger multinationals like Estée Lauder and L’Oréal entered selectively but had not yet captured significant share.

Demand for bakuchiol-based skincare expands significantly post-2025, with revenues projected to exceed USD 3.6 billion by 2035, and the revenue mix shifting as e-commerce and specialty beauty stores gain ground. Traditional leaders face rising competition from science-backed startups offering encapsulated bakuchiol formulations, multifunctional serums, and advanced delivery systems. Major beauty corporations are pivoting to sustainable sourcing models and AI-driven personalization to retain relevance. Competitive advantage is moving away from product claims alone to brand ecosystems, direct-to-consumer engagement, and subscription-based models that ensure recurring revenue streams.

Advances in natural actives formulation science have improved the stability and efficacy of bakuchiol, allowing it to function as a true alternative to retinol without the common side effects of redness, peeling, or sensitivity. Serums, as the most popular delivery format, are preferred by consumers seeking targeted treatments for wrinkles, fine lines, and pigmentation. The rise of social media trends, particularly Tik-Tok and Instagram-driven skincare routines, has amplified consumer awareness and trust in bakuchiol-based products. Global brands are also leveraging dermatologist-tested claims and clinical trial data to back performance, enhancing credibility.

Expansion of clean-label, vegan, and natural/organic skincare has fueled market growth. Innovations in oils and creams that combine bakuchiol with synergistic ingredients like hyaluronic acid, niacinamide, or peptides are opening new application areas. Segment growth is expected to be led by anti-aging formulations, serum formats, and e-commerce channels, due to their efficacy, adaptability, and alignment with consumer lifestyle shifts. Emerging markets such as India and China are witnessing rapid growth, with CAGR exceeding 20%, driven by aspirational middle-class consumers and rising online retail penetration.

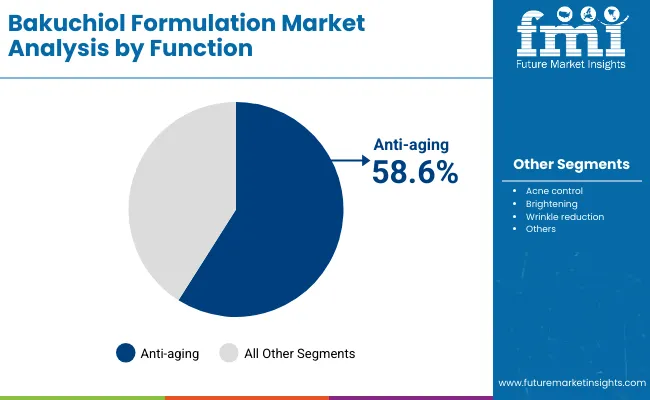

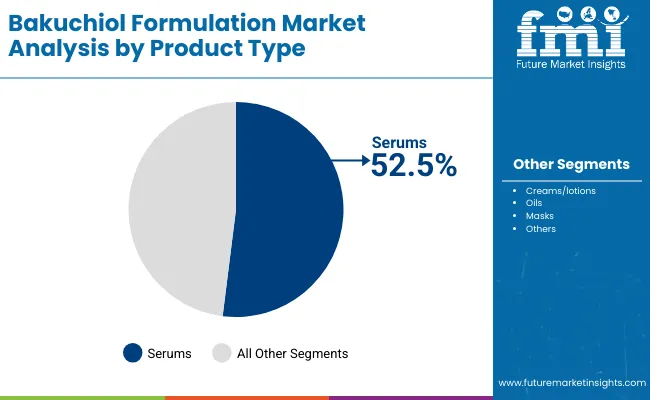

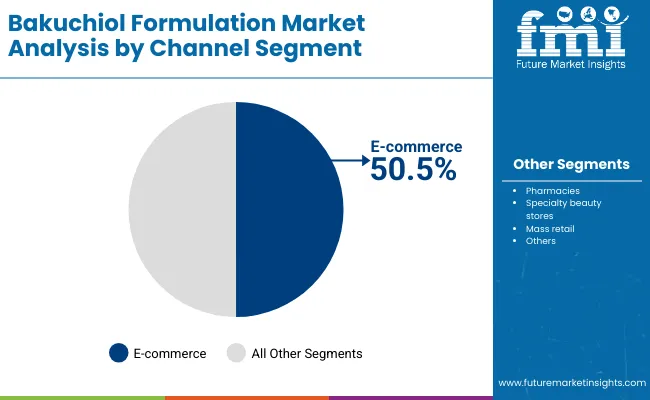

The market is segmented by function, product type, channel, and claim. Functions include anti-aging, acne control, brightening, and wrinkle reduction, highlighting the diverse skincare needs driving adoption. Product type segmentation covers serums, creams/lotions, oils, and masks, reflecting different consumer preferences in skincare routines. Channel segmentation includes e-commerce, specialty beauty stores, pharmacies, and mass retail, catering to varied shopping behaviors across regions. Claims segmentation spans vegan, natural/organic, clean-label, and dermatologist-tested, emphasizing the marketing and compliance factors shaping brand positioning.

| Function Segment | Market Value Share, 2025 |

|---|---|

| Anti-aging | 58.6% |

| Others | 41.4% |

The anti-aging segment is projected to contribute 58.6% of the Bakuchiol Formulations Market revenue in 2025, maintaining its lead as the dominant function category. This is driven by consumer demand for wrinkle reduction, skin elasticity improvement, and gentler alternatives to retinol. Anti-aging bakuchiol formulations are increasingly paired with vitamin C, peptides, and antioxidants for synergistic benefits. The segment’s growth is also supported by rising adoption among Gen X and older Millennials, who are seeking preventive anti-aging solutions. Anti-aging is expected to retain its position as the backbone of bakuchiol skincare innovation.

| Product Type Segment | Market Value Share, 2025 |

|---|---|

| Serums | 52.5% |

| Others | 47.5% |

The serum segment is forecasted to hold 52.5% of the market share in 2025, led by its concentrated format, high absorption rates, and ability to deliver visible results quickly. Serums are favored by premium skincare consumers and early adopters in both Western and Asian beauty markets. Their compact packaging and easy layering with other skincare steps make them ideal for personalized routines. With the expansion of online retail, serums are often the hero product featured in promotional campaigns, driving higher repeat purchase rates. As multifunctional serum innovations rise, this segment is expected to continue its dominance in the global market.

| Channel Segment | Market Value Share, 2025 |

|---|---|

| E-commerce | 50.5% |

| Others | 49.5% |

The e-commerce segment is projected to account for 50.5% of the Bakuchiol Formulations Market in 2025, establishing it as the leading channel. Online platforms enable consumers to explore niche and indie brands alongside multinational leaders, fostering brand discovery and comparison. Subscription-based delivery and personalized AI-driven recommendations are further boosting e-commerce adoption. Social commerce, particularly in Asia-Pacific, enhances visibility and trial rates. As digital-first beauty ecosystems expand, e-commerce is expected to remain the fastest-growing distribution channel through 2035.

Drivers

Rising Dermatological Backing and Clinical Validation of Bakuchiol

One of the strongest drivers for the Bakuchiol Formulations Market is the growing base of dermatological studies that validate bakuchiol as a viable alternative to retinol. Unlike retinol, which often causes irritation, dryness, and redness, bakuchiol is plant-derived and provides similar anti-aging, anti-inflammatory, and skin-brightening benefits without the harsh side effects. Clinical trials demonstrating measurable improvements in fine lines, wrinkles, and skin tone are increasingly cited by both indie and multinational brands in their marketing.

This validation builds consumer trust, allowing bakuchiol formulations to expand beyond niche “green beauty” segments into mainstream skincare portfolios. The rise of dermatologist endorsements in regions like North America and Europe has positioned bakuchiol as not just a natural ingredient, but as a clinically substantiated active, which significantly accelerates adoption.

Surge in Demand from Asia-Pacific Emerging Economies (China and India)

Asia-Pacific, particularly China and India, is driving rapid growth with CAGR projections of 22.2% and 24.1%, respectively. These economies are witnessing a convergence of factors: a rising middle class, higher disposable incomes, and increasing adoption of premium skincare products. Bakuchiol’s natural and plant-based origin resonates strongly with local consumer preferences for holistic and Ayurvedic-inspired routines in India and “herbal/clean-label” trends in China.

Local e-commerce giants such as Tmall, Flipkart, and Nykaa are also pushing bakuchiol serums and creams through curated online beauty stores. Moreover, younger demographics in these regions are highly influenced by K-beauty and J-beauty trends, where innovation in gentler actives is heavily marketed. This surge in consumer demand from APAC not only supports revenue growth but also diversifies the geographic footprint of bakuchiol, reducing dependency on Western markets.

Restraints

Higher Cost of Extraction and Limited Global Supply Chain for Bakuchiol

Unlike retinol, which has a well-established synthetic production pathway, bakuchiol is extracted from the seeds and leaves of the Psoraleacorylifolia plant. This extraction process is relatively costly and resource-intensive, leading to higher input costs for formulators. Limited cultivation areas and lack of large-scale, standardized supply chains constrain economies of scale. As demand surges globally, raw material price volatility and procurement challenges present significant risks to consistent product availability. This becomes especially problematic for mass retail brands, which depend on competitive pricing to scale their consumer base. Supply chain bottlenecks and premium raw material pricing therefore act as barriers to more widespread adoption.

Consumer Confusion and Lack of Standardized Labeling

Although awareness of bakuchiol is growing, many consumers remain confused about its efficacy compared to retinol. Some perceive it as “weaker” or only suitable for sensitive skin, while others fail to distinguish between different concentrations and formulation qualities across brands. Furthermore, the absence of globally standardized labeling guidelines for natural actives like bakuchiol creates inconsistencies in claims such as “vegan,” “clean-label,” or “dermatologist-tested.” This inconsistency can dilute consumer trust, especially in regulated markets like the USA and EU, where misleading or exaggerated claims can trigger regulatory scrutiny. Such perception and compliance challenges slow down adoption among more cautious consumer segments.

Key Trends

Hybrid Formulations Combining Bakuchiol with Other Proven Actives

A major trend shaping the Bakuchiol Formulations Market is the innovation of hybrid formulations. Instead of offering standalone bakuchiol serums or creams, brands are increasingly blending bakuchiol with other clinically proven actives such as vitamin C, peptides, hyaluronic acid, and niacinamide. This trend is fueled by consumer demand for “all-in-one” solutions that address multiple concerns like anti-aging, hydration, and brightening simultaneously. Hybridization also helps brands differentiate themselves in an increasingly crowded market by offering value-added efficacy while leveraging bakuchiol’s natural positioning. For example, products that pair bakuchiol with vitamin C provide both collagen support and antioxidant protection, appealing to consumers who want visible results faster.

E-commerce-First Growth and Social Media Amplification

E-commerce captured 50.5% of market share in 2025 and continues to be the leading channel for bakuchiol formulations. Unlike retinol, which entered the market decades ago through dermatology clinics and pharmacies, bakuchiol has risen in the digital-first era. Indie brands such as Herbivore Botanicals and BYBI Beauty rely heavily on Instagram, TikTok, and influencer marketing to build awareness. Social media “before-and-after” demonstrations and viral skincare routines have propelled bakuchiol products into mainstream consciousness. Platforms like Amazon, Sephora online, and specialty beauty e-retailers curate dedicated “clean beauty” sections that prominently feature bakuchiol serums. This e-commerce-first dynamic ensures faster global penetration and makes digital visibility as critical as formulation innovation.

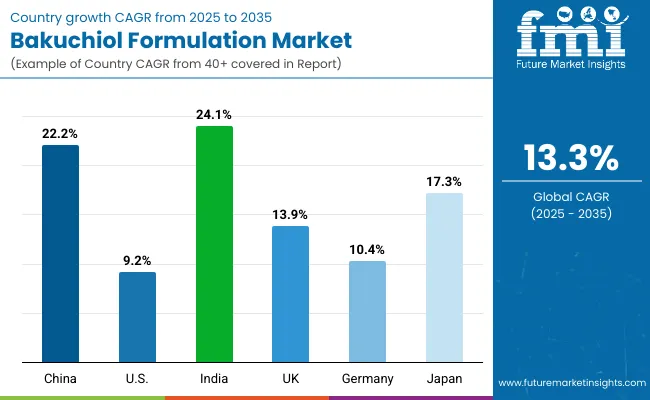

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 22.2% |

| USA | 9.2% |

| India | 24.1% |

| UK | 13.9% |

| Germany | 10.4% |

| Japan | 17.3% |

Between 2025 and 2035, the Bakuchiol Formulations Market is expected to witness the fastest expansion in India (24.1% CAGR) and China (22.2% CAGR). Both markets are benefiting from a rapidly growing middle class, rising disposable incomes, and strong cultural affinity for natural and plant-based remedies. In India, bakuchiol aligns with Ayurvedic-inspired positioning, making it attractive to consumers who prefer holistic anti-aging and acne-control solutions. China, on the other hand, is seeing rapid adoption of serums and creams through Tmall, Douyin, and other digital-first platforms, with younger Gen Z consumers showing high preference for vegan and clean-label claims. These two countries are poised to become the largest demand centers, significantly outpacing growth rates in Western economies.

Meanwhile, Japan (17.3% CAGR) and the UK (13.9% CAGR) represent mature but expanding markets driven by premiumization, strong retail ecosystems, and innovation in multifunctional skincare. Germany (10.4% CAGR) demonstrates moderate growth as consumers increasingly adopt dermatologist-tested and natural alternatives within the broader clean beauty movement. The USA (9.2% CAGR), despite already being the largest single-country market by value in 2025, is forecast to expand more steadily due to saturation in the anti-aging category and intense competition. However, innovation in hybrid formulations and subscription-based e-commerce models will ensure continued revenue growth. Together, these country-level dynamics highlight a clear divide: Asia-Pacific markets are scaling rapidly due to new consumer adoption, while Western markets are advancing through premium positioning and product innovation.

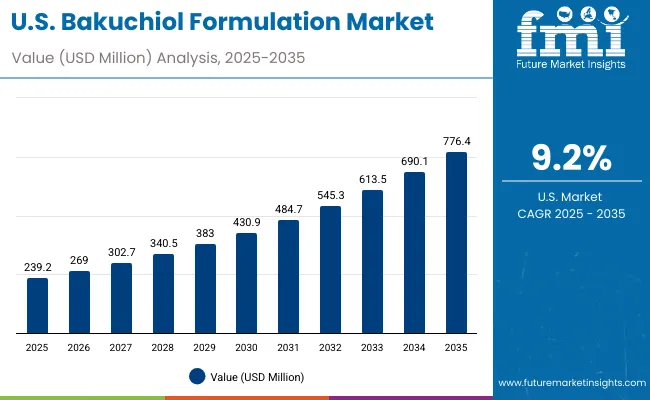

| Year | USA Bakuchiol Formulations Market (USD Million) |

|---|---|

| 2025 | 239.2 |

| 2026 | 269.0 |

| 2027 | 302.7 |

| 2028 | 340.5 |

| 2029 | 383.0 |

| 2030 | 430.9 |

| 2031 | 484.7 |

| 2032 | 545.3 |

| 2033 | 613.5 |

| 2034 | 690.1 |

| 2035 | 776.4 |

The Bakuchiol Formulations Market in the United States is projected to grow at a CAGR of 9.2%, led by strong consumer demand for natural and dermatologist-tested anti-aging products. Anti-aging accounts for over 60% of functional demand in the USA, as consumers look for effective retinol alternatives with fewer side effects. Dermatologist endorsements, influencer-driven campaigns, and strong penetration across Sephora, Ulta, and Amazon are reinforcing bakuchiol’s premium positioning. Growth is also being shaped by hybrid formulations that combine bakuchiol with niacinamide, vitamin C, and peptides, targeting multiple concerns in one product.

The Bakuchiol Formulations Market in the United Kingdom is expected to grow at a CAGR of 13.9%, supported by consumer preference for clean-label and vegan skincare. The UK market has seen strong adoption through both e-commerce platforms and specialty beauty retailers, where serums remain the leading product type. Indie brands and multinational players are leveraging bakuchiol as a hero ingredient in anti-aging and brightening products, aligning with the UK’s broader clean beauty movement. Government-supported sustainability initiatives and eco-friendly packaging campaigns also add momentum, positioning bakuchiol formulations as both effective and ethical.

India is witnessing the fastest growth in the Bakuchiol Formulations Market, forecast to expand at a CAGR of 24.1% through 2035. Growth is driven by a young, aspirational middle class and cultural alignment with natural, Ayurvedic-inspired skincare. Online platforms like Nykaa and Flipkart are showcasing bakuchiol serums and oils as accessible yet premium alternatives to retinol. Tier-2 and Tier-3 cities are increasingly adopting natural actives, as rising affordability and consumer awareness spread beyond metros. Local startups are combining bakuchiol with Ayurvedic herbs, driving innovation and local consumer resonance.

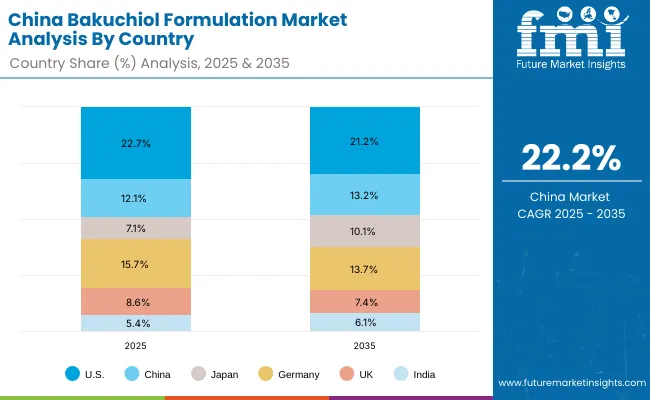

The Bakuchiol Formulations Market in China is expected to grow at a CAGR of 22.2%, the highest among leading economies. Growth is fueled by e-commerce platforms like Tmall and JD.com, where serums lead with over 56% of product demand in 2025. Younger Gen Z and Millennial consumers are driving adoption, with strong preference for vegan, clean-label, and dermatologist-tested claims. Competitive local players are introducing affordable formulations, intensifying competition with global brands. Government emphasis on local ingredient sourcing and sustainable beauty further strengthens bakuchiol’s position as a trusted, natural alternative.

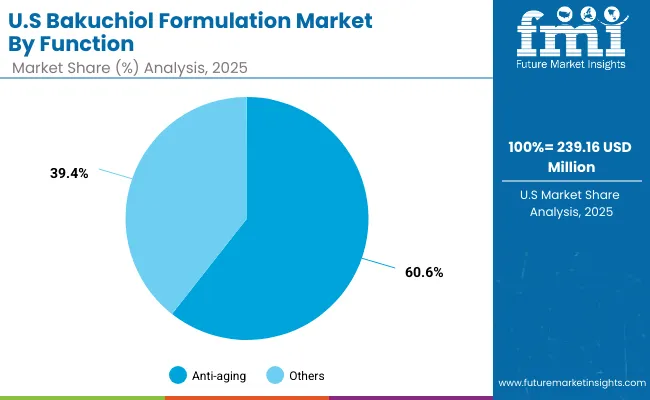

| Function Segment | Market Value Share, 2025 |

|---|---|

| Anti-aging | 60.6% |

| Others | 39.4% |

The Bakuchiol Formulations Market in the United States is valued at USD 239.16 million in 2025, with anti-aging dominating at 60.6%, followed by acne control, brightening, and wrinkle reduction collectively at 39.4%. The dominance of anti-aging reflects the USA consumer base’s preference for clinically validated, dermatologist-endorsed products targeting fine lines, elasticity loss, and pigmentation. Bakuchiol’s positioning as a gentler alternative to retinol makes it especially appealing to mature consumers seeking effective but irritation-free solutions.

This advantage positions bakuchiol as a staple in anti-aging skincare, supported by heavy e-commerce promotion through Sephora, Ulta, Amazon, and direct-to-consumer websites. While other functions such as acne control are growing steadily, they remain secondary compared to the broader anti-aging narrative. The USA market continues to lead in premium positioning, with brands introducing hybrid serums combining bakuchiol with vitamin C, niacinamide, and peptides. Over the forecast period, subscription-based models and AI-driven personalization are expected to expand penetration into younger demographics, securing consistent long-term growth.

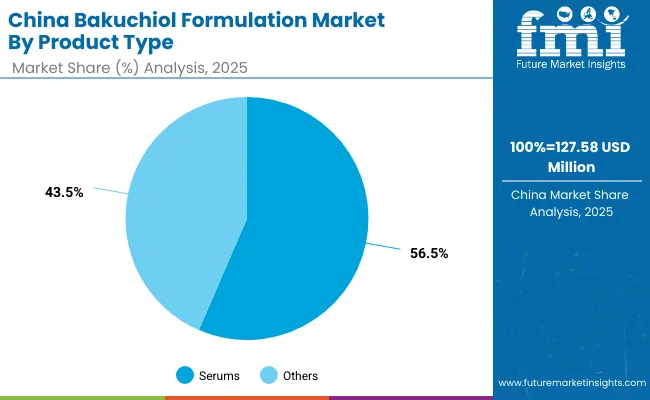

| Product Type Segment | Market Value Share, 2025 |

|---|---|

| Serums | 56.5% |

| Others | 43.5% |

The Bakuchiol Formulations Market in China is valued at USD 127.58 million in 2025, with serums leading at 56.5%, followed by creams/lotions, oils, and masks collectively at 43.5%. Serums dominate as Chinese consumers increasingly adopt lightweight, high-concentration formulations that align with the K-beauty and J-beauty inspired routines. E-commerce ecosystems such as Tmall, JD.com, and Douyin serve as critical enablers, offering both global and domestic brands immediate reach across China’s massive digital-first consumer base.

The dominance of serums is also linked to their strong marketing as premium, targeted solutions. Younger Chinese consumers, particularly Gen Z and Millennials, are drawn to vegan, clean-label, and dermatologist-tested claims, which are more easily highlighted in serum launches. Affordable local alternatives, introduced by domestic startups, are widening accessibility, intensifying competition with established global players. By 2035, with a CAGR of 22.2%, China is expected to more than triple its market size, making it a global hub for bakuchiol innovation and adoption.

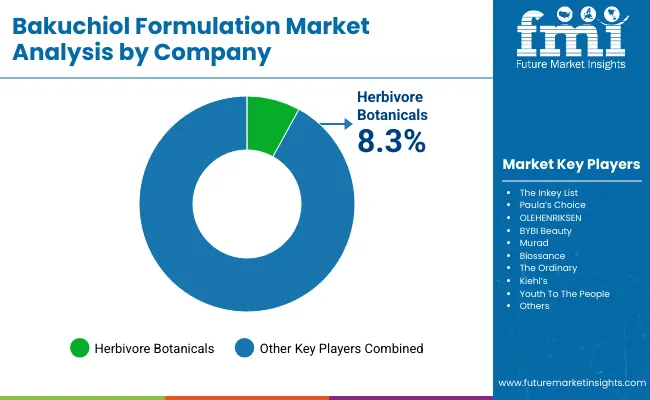

The Bakuchiol Formulations Market is moderately fragmented, with indie beauty brands, multinational skincare giants, and niche-focused specialists competing across anti-aging, brightening, and acne-control categories. Herbivore Botanicals leads in 2025 with an 8.3% share, driven by its pioneering role in clean beauty and early commercialization of bakuchiol serums. Its strategy relies heavily on e-commerce visibility, influencer-led campaigns, and eco-friendly packaging, giving it a strong edge in North America and Europe.

Indie brands such as The Inkey List, BYBI Beauty, and Youth To The People emphasize affordability, vegan claims, and community-driven marketing, gaining traction among Gen Z and Millennials. Mid-sized innovators like Paula’s Choice, Murad, and Biossance leverage dermatologist credibility, hybrid product innovation, and cross-channel presence in Sephora and specialty beauty retailers. Established global corporations such as The Ordinary and Kiehl’s (L’Oréal-owned) scale through diversified portfolios, strong clinical backing, and global distribution networks.

Competitive differentiation is shifting away from single-ingredient launches toward ecosystem strategies that combine hybrid formulations, subscription-based D2C models, and AI-driven personalization. The competitive landscape will continue to evolve, with Asia-Pacific players expected to gain greater prominence as local startups in China and India scale bakuchiol-based offerings at competitive price points.

Key Developments in Bakuchiol Formulations Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,052.3 million |

| Function | Anti-aging, Acne control, Brightening, and Wrinkle reduction |

| Product Type | Serums, Creams/lotions, Oils, and Masks |

| Channel | E-commerce, Pharmacies, Specialty beauty stores, and Mass retail |

| Claim | Vegan, Natural/organic, Clean-label, and Dermatologist-tested |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Herbivore Botanicals, The Inkey List, Paula’s Choice, OLEHENRIKSEN, BYBI Beauty, Murad, Biossance, The Ordinary, Kiehl’s, Youth To The People |

| Additional Attributes | Dollar sales by function, product type, and channel, adoption trends in anti-aging and brightening skincare, rising demand for vegan and clean-label claims, segment-specific growth in serums and e-commerce, integration of bakuchiol with synergistic actives (vitamin C, niacinamide, peptides), regional trends influenced by K-beauty and Ayurvedic positioning, and innovations in encapsulation and biotech-derived bakuchiol formulations. |

The Bakuchiol Formulations Market is estimated to be valued at USD 1,052.3 million in 2025.

The market size for the Bakuchiol Formulations Market is projected to reach USD 3,654.7 million by 2035.

The Bakuchiol Formulations Market is expected to grow at a 13.3% CAGR between 2025 and 2035.

The key product types in the Bakuchiol Formulations Market are serums, creams/lotions, oils, and masks.

In terms of function, the anti-aging segment is projected to command 58.6% share in the Bakuchiol Formulations Market in 2025, making it the leading category.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bakuchiol Market Analysis by Form, Type, Application and Region: Forecast from 2025 to 2035

Retinol Alternatives (Bakuchiol) Market Size and Share Forecast Outlook 2025 to 2035

Niacinamide Formulations Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Modified Release Formulations Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Demand for Hybrid Protein Blends in Private Label Formulations in CIS Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA