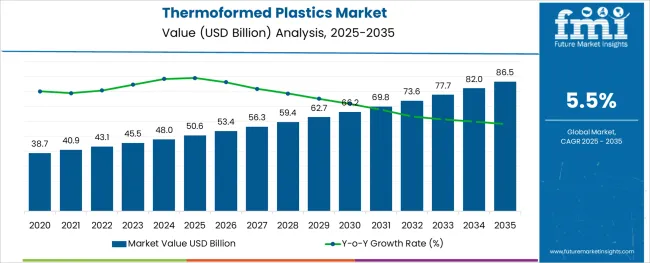

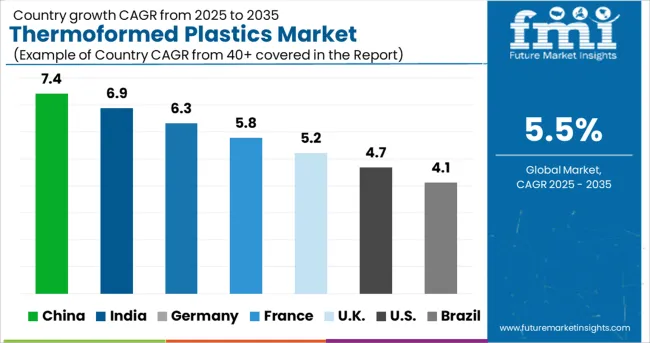

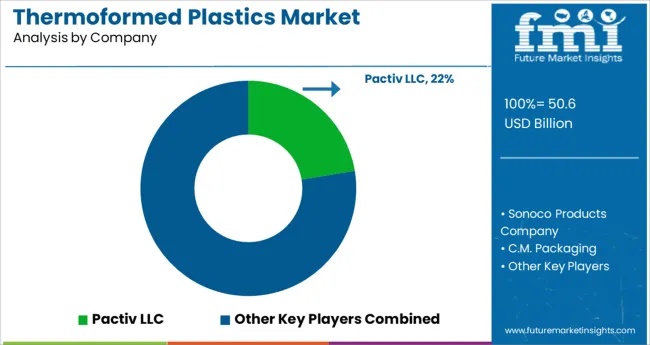

The Thermoformed Plastics Market is estimated to be valued at USD 50.6 billion in 2025 and is projected to reach USD 86.5 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

The thermoformed plastics market is progressing steadily, supported by increasing demand for lightweight and cost-effective packaging solutions across various industries. Industry sources have highlighted the preference for thermoformed products due to their ability to be custom-designed for specific applications while maintaining durability and visual appeal. The food packaging sector has been a significant driver, with growing consumer demand for convenience and sustainable packaging materials.

Innovations in thin gauge thermoforming techniques have improved production efficiency and material utilization, reducing waste and lowering costs. Additionally, the rise of e-commerce and the need for protective yet lightweight packaging have boosted market demand. Environmental concerns and regulations have prompted manufacturers to explore recyclable and biodegradable plastics, influencing product development.

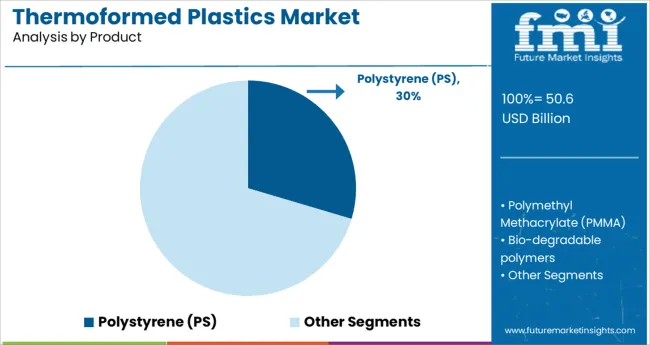

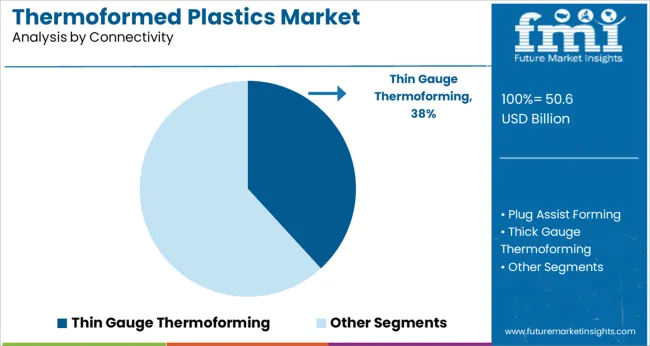

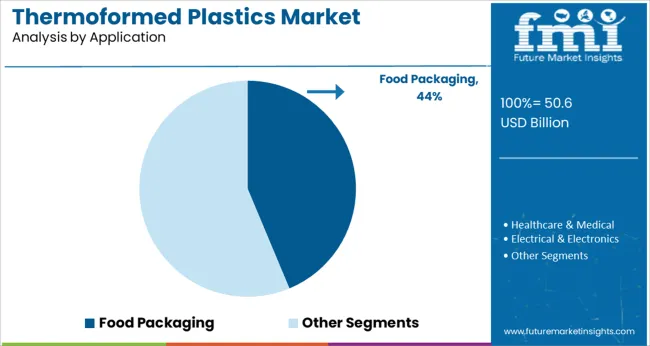

The market outlook is positive as advancements in connectivity and automation in manufacturing processes enhance production capabilities. Segment growth is expected to be driven by the Polystyrene (PS) product segment, Thin Gauge Thermoforming as the primary connectivity method, and Food Packaging as the leading application area.

The market is segmented by Product, Connectivity, and Application and region. By Product, the market is divided into Polystyrene (PS), Polymethyl Methacrylate (PMMA), Bio-degradable polymers, Polyethylene (PE), Acrylonitrile Butadiene Styrene (ABS), Poly Vinyl Chloride (PVC), High Impact Polystyrene (HIPS), and Polypropylene (PP). In terms of Connectivity, the market is classified into Thin Gauge Thermoforming, Plug Assist Forming, Thick Gauge Thermoforming, and Vacuum Snapback. Based on Application, the market is segmented into Food Packaging, Healthcare & Medical, Electrical & Electronics, Automotive, Construction, and Consumer Goods & Appliances. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Polystyrene (PS) segment is expected to hold 29.6% of the thermoformed plastics market revenue in 2025, making it the leading product type. This material is favored for its clarity, rigidity, and ease of thermoforming, which allows the creation of versatile packaging solutions. Its cost-effectiveness and ability to protect food products have made it popular among manufacturers.

Furthermore, PS offers good moisture barrier properties, which is critical for maintaining food freshness. The segment has benefited from ongoing improvements in material formulations to enhance recyclability and reduce environmental impact.

With consumer preferences leaning toward clear and lightweight packaging, the Polystyrene segment is expected to maintain strong demand.

The Thin Gauge Thermoforming segment is projected to account for 38.2% of the market revenue in 2025, establishing itself as the dominant connectivity type. This process allows for rapid production of lightweight, thin plastic components with consistent quality, making it ideal for high-volume packaging applications.

The efficiency of thin gauge thermoforming reduces material usage and energy consumption, aligning with sustainability goals. This connectivity method is widely used in producing disposable food containers and trays due to its cost-effectiveness and design flexibility.

Advancements in machinery and automation have further enhanced throughput and precision. As demand for eco-friendly and functional packaging grows, thin gauge thermoforming is expected to remain the preferred manufacturing process.

The Food Packaging segment is anticipated to contribute 43.7% of the thermoformed plastics market revenue in 2025, sustaining its lead as the primary application. Growth in this segment is fueled by the rising need for convenient, protective, and visually appealing packaging that extends shelf life and reduces food waste.

Consumers increasingly seek packaging solutions that provide transparency and ease of use while ensuring product safety. The food industry’s focus on lightweight and recyclable packaging materials has increased the adoption of thermoformed plastics.

Additionally, the rise in ready-to-eat and fresh food consumption has created further demand for innovative packaging formats. Regulatory requirements for food contact safety and sustainability are also influencing product development. The Food Packaging segment is expected to continue driving market expansion through ongoing innovation and evolving consumer preferences.

The thermoformed plastic survey explains that the government initiatives, increasing plastic use coupled with the latest advanced technology increase the sales of thermoformed plastics.

The increase in popularity of retail shopping and online shopping has pushed the demand for thermoformed plastic as it is applicable in the packaging of multiple brands. These e-retailing channels deliver goods to the end user through long sales and distribution channels. This takes a lot of precision and carefulness in packaging.

The chemical resistance quality of a certain class of plastics helps it in being used in chemical laboratories to store certain utensils and chemicals, including the vacuum plastic jars for the sortation of chemical products. These applications gain traction in the market, fueling the sales of thermoformed plastics.

Advanced technology like machine learning has provided substantial data that helps plastic manufacturers to produce plastic that has lower impacts on environmental degradation. Making it decomposable to some extent. The government setting up Research and Analysis programs to produce better plastic.

The challenging process of gaining the thick form of plastic, including consistent product thickness. Another way that restricts the sales of thermoformed plastics is the alternatives expanding their market spaces. These alternatives are anticipated to hinder the growth of thermoformed plastic.

As per the new research report on thermoformed plastics market for the years 2025 to 2035, polypropylene is dominating the product segment and holds more than 21.0% of the share.

This segment is likely to expand its use because of its increasing distribution channel and increased consumption. Other commonly used products of thermoformed plastic are polyethylene (PE), polystyrene (PS), and Polypropylene (PP). The growing number of manufacturers is also owing to the sales of Polypropylene. This played a driving factor in the sales of thermoformed plastics.

By process, the thermoformed plastics are distributed into plus assist forming thick gauge thermoforming, thin gauge thermoforming, and vacuum snapback. These segments are performed differently in different regions.

The thin-gauge thermoformed plastic segment is likely to dominate the process category while holding sales through the process. It holds a 35% revenue share in the global thermoformed plastics market. Thermoformed plastics are made through radiant, contact, and hot air heating techniques, adding new sales of thermoformed plastics.

Food packaging is the leading application segment in the thermoformed plastics market. The other segments of the application are healthcare & medical, food packaging, electrical & electronics, automotive, construction, and consumer goods & appliances.

The food packaging segment holds 42% of the global revenue. The factors contributing to the growth of this segment are the most commonly used food packaging, including high-quality packaging materials and bacteria-free plastic crockery and packaging.

The thermoformed plastics market survey divides the market into regions; North America, Latin America, Asia Pacific, Middle East and Africa, and Europe. The biggest and highest-growing market is the USA, holding a 53.8% share of the global market.

The region is likely to hold a major share through 2035. The growing manufacturing and suppliers of thermoformed plastics in the region are attributed to the high consumption.

Increasing food and e-commerce industry are also pushing the demand for thermoformed plastics in the region. Other regions like the Asia Pacific include the second highest growing region for the Thermoformed plastics market.

Thermoformed plastics market has various key competitors that focus on expanding their sales channel and opening up new distribution networks. The key players are currently focusing on the variety of thermoformed plastics. This makes the competitive landscape more dynamic and versatile, owing to the expansion of thermoformed plastics market size.

The key players attributing to the growth of thermoformed plastics are Greiner Packaging GmbH; Dongguan Ditai Plastic Products Co., Ltd; Palram Americas Ltd, Pactiv LLC; Genpak LLC; Sonoco Products Company; CM Packaging; Placon Corporation; Anchor Packaging LLC; Brentwood Industries.

The global thermoformed plastics market is estimated to be valued at USD 50.6 billion in 2025.

It is projected to reach USD 86.5 billion by 2035.

The market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types are polystyrene (ps), polymethyl methacrylate (pmma), bio-degradable polymers, polyethylene (pe), acrylonitrile butadiene styrene (abs), poly vinyl chloride (pvc), high impact polystyrene (hips) and polypropylene (pp).

thin gauge thermoforming segment is expected to dominate with a 38.2% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thermoformed Containers Market Size and Share Forecast Outlook 2025 to 2035

Thermoformed Tray Market Size and Share Forecast Outlook 2025 to 2035

Thermoformed Skin Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thermoformed Tubs Market Trend Analysis Based on Material, Shape, End-Users and Regions through 2025 to 2035

Market Share Distribution Among Thermoformed Tubs Manufacturers

Market Share Breakdown of Thermoformed Tray Market

Thermoformed Lids Market

Vacuum Thermoformed Packaging Market Size and Share Forecast Outlook 2025 to 2035

Key Companies & Market Share in the Vacuum Thermoformed Packaging Sector

Plastics-To-Fuel (PTF) Market Size and Share Forecast Outlook 2025 to 2035

Bioplastics For Packaging Market Size and Share Forecast Outlook 2025 to 2035

Bioplastics Market Analysis - Size, Share & Forecast 2025 to 2035

Foam Plastics Market Size and Share Forecast Outlook 2025 to 2035

Medical Plastics Market Size and Share Forecast Outlook 2025 to 2035

Extruded Plastics Market Size and Share Forecast Outlook 2025 to 2035

Biopharma Plastics Market Size and Share Forecast Outlook 2025 to 2035

Corn-Based Plastics for Packaging Market Size and Share Forecast Outlook 2025 to 2035

Conductive Plastics Market Growth - Trends & Forecast 2025 to 2035

Transparent Plastics Market Size and Share Forecast Outlook 2025 to 2035

Evaluating Algae-Based Bioplastics Market Share & Provider Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA