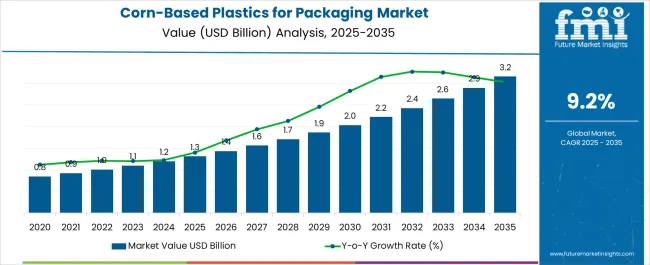

The Corn-Based Plastics for Packaging Market is estimated to be valued at USD 1.3 billion in 2025 and is projected to reach USD 3.2 billion by 2035, registering a compound annual growth rate (CAGR) of 9.2% over the forecast period.

| Metric | Value |

|---|---|

| Corn-Based Plastics for Packaging Market Estimated Value in (2025 E) | USD 1.3 billion |

| Corn-Based Plastics for Packaging Market Forecast Value in (2035 F) | USD 3.2 billion |

| Forecast CAGR (2025 to 2035) | 9.2% |

The Corn-Based Plastics for Packaging market is witnessing strong growth, driven by the rising global demand for sustainable and biodegradable packaging solutions. Increasing consumer awareness regarding environmental sustainability, coupled with regulatory measures targeting single-use plastics, has accelerated the adoption of bio-based materials. Corn-based plastics offer reduced carbon footprint and improved compostability compared with conventional petroleum-based plastics, making them a preferred choice among manufacturers and retailers.

The market is further supported by advancements in polymer processing and bioplastic formulation technologies, which enhance material performance, strength, and barrier properties for packaging applications. Growing emphasis on circular economy initiatives, corporate sustainability targets, and eco-friendly product labeling is driving investments and adoption across the supply chain.

As manufacturers seek cost-effective and scalable alternatives to traditional plastics, corn-based plastics are increasingly being incorporated in packaging for food, beverages, and consumer goods Rising production capacities, coupled with technological innovations, are expected to sustain market expansion over the coming decade while addressing environmental and regulatory requirements.

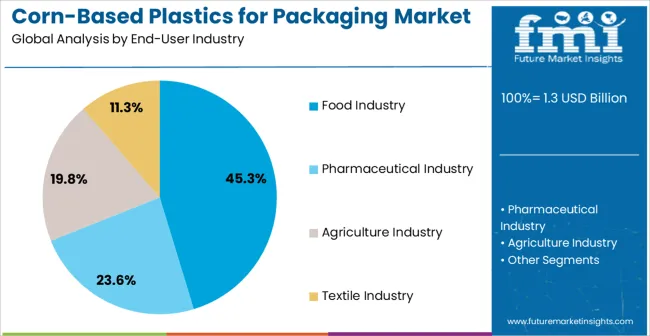

The corn-based plastics for packaging market is segmented by end-user industry, and geographic regions. By end-user industry, corn-based plastics for packaging market is divided into Food Industry, Pharmaceutical Industry, Agriculture Industry, and Textile Industry. Regionally, the corn-based plastics for packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The food industry segment is projected to hold 45.3% of the market revenue in 2025, establishing it as the leading end-use industry. Growth in this segment is being driven by increasing demand for sustainable packaging solutions that meet regulatory requirements and consumer preferences for environmentally friendly products. Corn-based plastics are widely adopted for packaging perishable and processed foods due to their biodegradability, safety for direct food contact, and effective moisture and gas barrier properties.

The ability to produce lightweight, flexible, and customizable packaging has strengthened their adoption in food retail, fast-moving consumer goods, and catering sectors. Growing awareness among consumers regarding plastic pollution and sustainability is influencing manufacturers to transition from conventional plastics to bio-based alternatives.

Additionally, corporate sustainability initiatives and eco-labeling trends are further supporting the preference for corn-based packaging materials As the demand for safe, eco-friendly, and cost-effective packaging solutions continues to rise, the food industry segment is expected to maintain its leading position, supported by ongoing innovation and increasing regulatory compliance in sustainable packaging practices.

Corn-based plastics are primarily a biodegradable group of polymers that can be manufactured from renewable resources. Corn-based plastics are starch-based bioplastics in the form of disposable tableware and carrier bags. Bioplastics have widespread applications in various industries, including the packaging industry.

There are numerous advantages of corn-based plastics in the packaging industry. One of the key factors positively influencing preference for corn-based plastics is that they are 100% biodegradable, which results in less pollution. Another important property possessed by corn-based plastics is that they are carbon neutral which results in reducing the number of greenhouse gases significantly.

Corn-based plastics are free from toxic substances and do not leach harmful substances into the food even at high temperatures. Corn-based plastics are made up of polylactic acid, which is a plastic replacement made from fermented plant starch, and is expected to quickly emerge as a popular alternative to traditional petroleum-based plastics.

As corn-based plastics garner more attention as an environment-friendly alternative to traditional plastics, the global corn-based plastics for packaging market is expected to expand at a healthy CAGR, during the forecast period.

| Country | CAGR |

|---|---|

| China | 12.4% |

| India | 11.5% |

| Germany | 10.6% |

| Brazil | 9.7% |

| USA | 8.7% |

| UK | 7.8% |

| Japan | 6.9% |

The Corn-Based Plastics for Packaging Market is expected to register a CAGR of 9.2% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 12.4%, followed by India at 11.5%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 6.9%, yet still underscores a broadly positive trajectory for the global Corn-Based Plastics for Packaging Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 10.6%. The USA Corn-Based Plastics for Packaging Market is estimated to be valued at USD 494.0 million in 2025 and is anticipated to reach a valuation of USD 494.0 million by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 67.7 million and USD 34.6 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 Billion |

| End-User Industry | Food Industry, Pharmaceutical Industry, Agriculture Industry, and Textile Industry |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

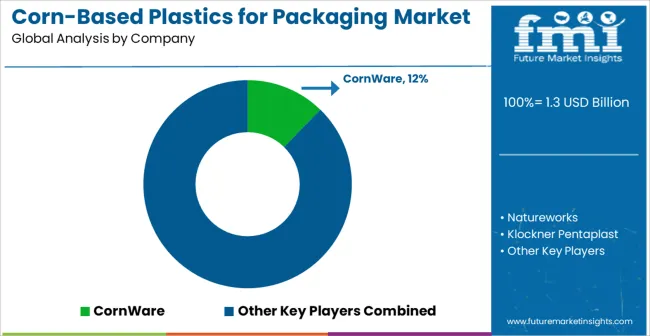

| Key Companies Profiled | CornWare, Natureworks, Klockner Pentaplast, Braskem, NatureWorks, Novamont, BASF, Corbion, PSM, DuPont, Arkema, Kingfa, FKuR, Biomer, and Mitsubishi |

The global corn-based plastics for packaging market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the corn-based plastics for packaging market is projected to reach USD 3.2 billion by 2035.

The corn-based plastics for packaging market is expected to grow at a 9.2% CAGR between 2025 and 2035.

The key product types in corn-based plastics for packaging market are food industry, pharmaceutical industry, agriculture industry and textile industry.

In terms of , segment to command 0.0% share in the corn-based plastics for packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bioplastics For Packaging Market Size and Share Forecast Outlook 2025 to 2035

Starch-Based Bioplastics Packaging Market Insights - Growth & Forecast 2025 to 2035

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Plastics-To-Fuel (PTF) Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Packaging Suction Cups Market Size and Share Forecast Outlook 2025 to 2035

Packaging Straps and Buckles Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA