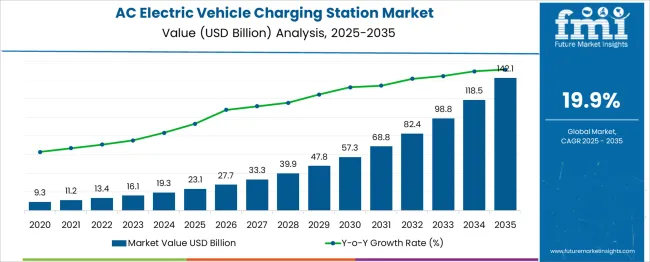

The AC electric vehicle charging station Market is estimated to be valued at USD 23.1 billion in 2025 and is projected to reach USD 142.1 billion by 2035, registering a compound annual growth rate (CAGR) of 19.9% over the forecast period. The shape of the growth curve follows an exponential trajectory, where early gains are modest but later-stage expansion becomes increasingly aggressive. From 2025 to 2030, the market will add USD 34.2 billion, reaching USD 57.3 billion. During the second half, from 2030 to 2035, the market adds USD 84.8 billion, more than doubling the gain of the earlier phase. This difference defines the steepening slope characteristic of high-CAGR infrastructure markets during the scale-up phase.

Annual incremental gains rise from USD 4.6 billion between 2025 and 2026 to USD 23.6 billion between 2034 and 2035. This acceleration supports the view that AC charging infrastructure will shift from pilot-stage to mass rollout, particularly across urban and semi-urban corridors. Growth is being supported by demand aggregation in residential, commercial fleet, and mixed-use real estate segments. Policy-linked incentives and reduced hardware installation costs are expected to widen deployment feasibility across both public and private settings. The curve shape reflects a maturing sector moving toward standardized hardware, energy optimization software, and service-layer monetization.

| Metric | Value |

|---|---|

| AC Electric Vehicle Charging Station Market Estimated Value in (2025 E) | USD 23.1 billion |

| AC Electric Vehicle Charging Station Market Forecast Value in (2035 F) | USD 142.1 billion |

| Forecast CAGR (2025 to 2035) | 19.9% |

The AC electric vehicle charging station market is experiencing strong growth driven by rising electric vehicle adoption, supportive government policies, and expanding charging infrastructure investments. The current market scenario is being shaped by the increasing penetration of electric vehicles in both developed and developing regions, alongside heightened focus on reducing carbon emissions.

As highlighted in automotive industry journals and corporate press releases, the market is also benefiting from technological innovations that improve charging efficiency and network management. Future growth opportunities are expected to emerge from advancements in grid integration, deployment of renewable energy-powered stations, and enhanced interoperability between hardware and software platforms.

Investor presentations and corporate disclosures indicate that public and private sector collaborations are accelerating infrastructure rollout while improving accessibility. These factors are anticipated to support sustained demand, ensuring the AC Electric Vehicle Charging Station market continues its upward trajectory in the coming years.

The AC electric vehicle charging station market is segmented by current, charging site, and geographic regions. Currently, the electric vehicle charging station market is divided into Level 2 and Level 1. In terms of charging site, the AC electric vehicle charging station market is classified into Public and Private.

Regionally, the AC electric vehicle charging station industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

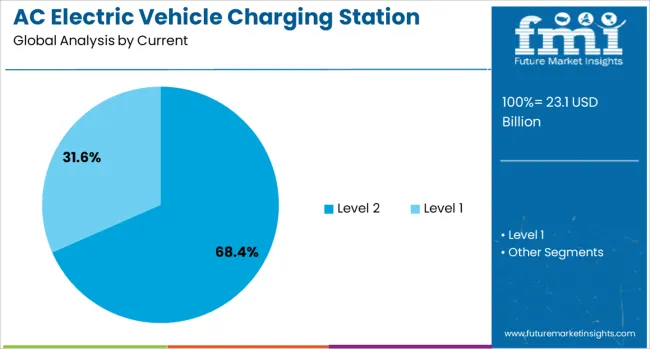

The Level 2 current segment is projected to hold 68.4% of the AC Electric Vehicle Charging Station market revenue share in 2025, making it the leading current segment. This prominence is being attributed to its optimal balance between charging speed and cost-effectiveness, as noted in technical bulletins and energy transition publications.

Level 2 chargers are being preferred in residential, workplace, and public environments because they provide significantly faster charging than Level 1 while remaining compatible with most electric vehicles without costly infrastructure upgrades. Investor briefings and product announcements have emphasized that Level 2 chargers offer sufficient power output to meet the daily needs of EV owners, enhancing convenience and supporting wider adoption.

Additionally, the ability to integrate Level 2 stations into smart grids and energy management systems has further strengthened their market presence. These factors have contributed to the dominance of the Level 2 segment within the current market category.

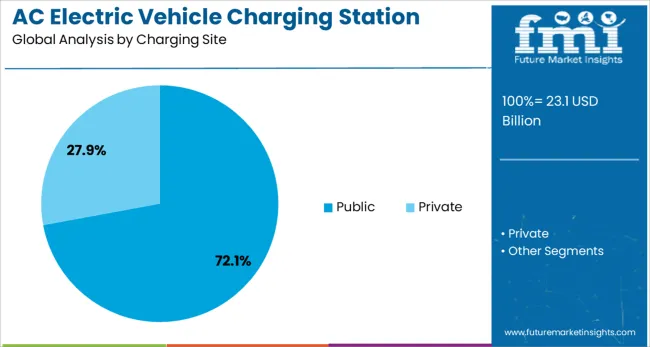

The public charging site segment is expected to capture 72.1% of the AC Electric Vehicle Charging Station market revenue share in 2025, establishing it as the leading site segment. This leadership is being driven by increased investments in urban infrastructure and rising demand for accessible, convenient charging solutions, as evidenced by city planning announcements and utility company reports.

Public stations have been widely adopted to address range anxiety and support EV users who lack private charging access. Industry news and corporate disclosures have highlighted that public charging networks are expanding rapidly through partnerships between governments, energy providers, and private enterprises.

The segment’s prominence has also been supported by the growing deployment of chargers in high-traffic locations such as shopping centers, parking facilities, and highways, enhancing convenience and utilization rates. These developments have reinforced the critical role of public sites in meeting the evolving charging needs of electric vehicle drivers, ensuring their continued dominance in the market.

The demand for AC electric vehicle charging stations is rising as the adoption of electric vehicles grows globally. These charging stations are crucial for residential and public charging, offering a cost-effective and reliable solution for EV owners. With advancements in charging technology and growing support from government initiatives and subsidies, the installation of AC charging stations is expanding. Despite challenges such as installation costs and grid infrastructure limitations, opportunities are increasing due to the shift towards electric mobility and the growing need for widespread, accessible charging infrastructure.

The growing adoption of electric vehicles (EVs) is a primary driver of the AC electric vehicle charging station market. As governments implement stricter emissions regulations and consumers shift toward sustainable transportation options, the demand for EVs has risen globally. This shift requires the development of an extensive EV charging infrastructure, particularly AC charging stations, which are essential for daily EV charging at home, offices, and public spaces. AC chargers offer cost-effective, widely accessible solutions that are becoming the preferred choice for residential and commercial installations. With increasing support from government incentives and subsidies for both EV purchases and charging infrastructure, the market is expanding. Moreover, the continuous improvement in EV battery efficiency and the growing awareness of reducing carbon footprints further boosts the demand for EVs and, consequently, the need for reliable AC charging stations.

Despite the growing demand, one of the main challenges facing the AC electric vehicle charging station market is the high installation cost. Installing an AC charging station, particularly at home or in public areas, involves significant infrastructure costs, including electrical upgrades, site preparation, and connectivity to the power grid. These upfront costs can be a barrier for consumers and small businesses, particularly in regions with less governmental support. Another challenge is the integration of charging stations with existing power grids, especially in areas with unstable or inadequate grid infrastructure. Ensuring that the grid can handle the increased load from EVs without causing reliability issues requires significant investments in grid upgrades and energy management systems. Additionally, charging station owners face challenges related to maintenance, standardization, and user experience to ensure the stations operate efficiently.

The expansion of the electric vehicle market presents significant growth opportunities for AC electric vehicle charging stations. As more consumers transition to electric vehicles, the need for a widespread and accessible charging network continues to increase. The growing demand for fast, efficient, and widespread charging infrastructure offers market players the opportunity to develop advanced solutions. Moreover, technological advancements in smart charging solutions, such as vehicle-to-grid (V2G) technology and real-time monitoring, can optimize charging station operations and enhance user convenience. Partnerships between automakers, utility companies, and charging station operators also present opportunities for collaborative growth. The increasing trend of charging stations in commercial spaces, workplaces, and public areas further expands the reach of EV charging infrastructure, opening up opportunities in both developed and emerging markets, particularly in regions with growing EV adoption.

A key trend in the AC electric vehicle charging station market is the increasing integration of smart features. Smart AC charging stations equipped with connectivity, mobile apps, and real-time monitoring are gaining popularity. These features allow users to track their charging patterns, set schedules, and monitor energy consumption for better cost management. Additionally, the development of home charging solutions is expanding as more consumers adopt electric vehicles. Home chargers are becoming more compact, affordable, and user-friendly, making them an attractive option for EV owners. Another trend is the increasing use of renewable energy sources for charging stations, aligning with the global push for cleaner energy solutions. These trends are helping to make the charging experience more efficient, accessible, and integrated with modern technologies, contributing to the overall growth of the AC charging station market.

| Country | CAGR |

|---|---|

| China | 26.9% |

| India | 24.9% |

| Germany | 22.9% |

| France | 20.9% |

| UK | 18.9% |

| USA | 16.9% |

| Brazil | 14.9% |

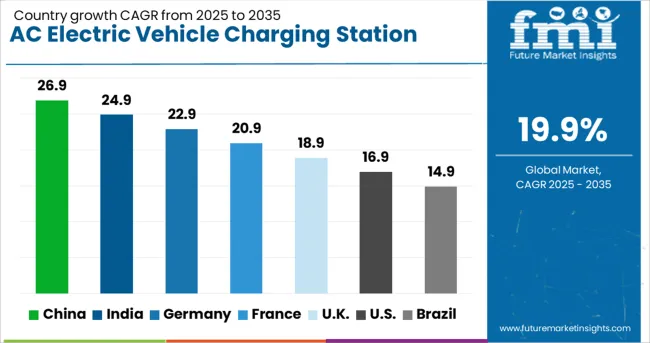

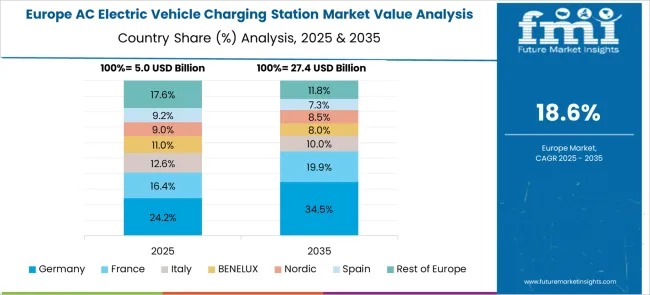

The global market is projected to grow at a CAGR of 19.9% from 2025 to 2035. China leads with 26.9%, outperforming the global rate by 7%, driven by high EV penetration and integrated urban charging infrastructure. India follows at 24.9%, supported by policy incentives and expanding two-wheeler EV segments. Germany (OECD) records 22.9%, exceeding the global average by 3%, aided by residential charger deployment and grid-readiness investments.

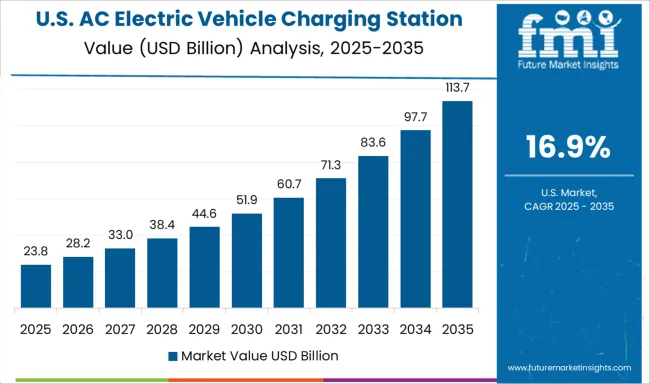

France (OECD) posts 20.9%, marginally above the benchmark, while the United Kingdom (OECD) stands at 18.9%, slightly under the global rate due to slower private installation uptake. The United States (OECD) trails at 16.9%, 3 points below average, hindered by regional permitting delays and utility coordination challenges. The report includes detailed analysis of 40+ countries, with the top five countries shared as a reference.

China accounted for 26.9% of the AC EV charging station market in 2025. National mandates for public charging availability have been applied in all first- and second-tier cities. The AC segment has seen expansion driven by residential installation subsidies and manufacturer-aligned infrastructure models. Grid-connected charging corridors have been introduced along interprovincial highways, managed by state utilities and private operators.

India held 24.9% of the global market in 2025. Public charging initiatives under FAME II and state EV policies have prioritized AC stations for urban and semi-urban deployment. Smart city programs and e-mobility partnerships with auto OEMs have encouraged mass-scale rollout. Dual-output AC chargers have been implemented in metro stations, commercial complexes, and high-footfall transport zones.

Germany accounted for 22.9% of the market in 2025. National Building Energy Act revisions have mandated AC charging point installations in commercial properties. Integration with solar PV systems and bidirectional charging trials have positioned AC chargers as core infrastructure in grid decarbonization. Certified installers and utility partners have deployed standardized chargers aligned with DIN EN IEC 61851 guidelines.

The United Kingdom captured 18.9% of the global AC EV charging station market in 2025. Deployment has been influenced by regulatory targets under the ZEV mandate and Local EV Infrastructure Fund. AC chargers have been installed in public libraries, council parking lots, and residential street locations via on-street residential charging schemes. Operator aggregation has enabled multi-network access to AC chargers via common mobile apps.

The United States accounted for 16.9% of the global market in 2025. AC station growth has followed incentives under the NEVI Formula Program, with deployments concentrated in urban neighborhoods and academic campuses. Multi-unit dwellings in states like California and New York have integrated AC Level 2 chargers via retrofit rebates. Smart load management features have been embedded into new residential installations.

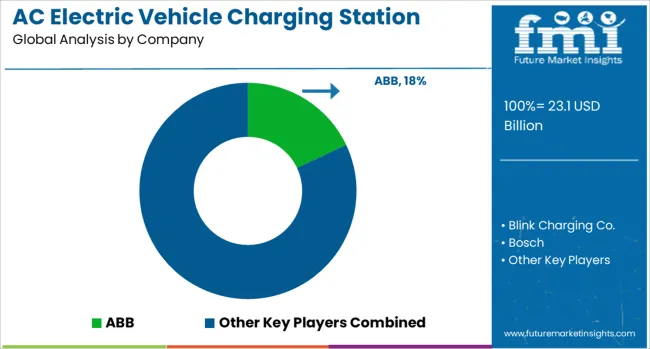

The AC electric vehicle charging station market features a mix of legacy power system companies, EV infrastructure providers, and automotive-led ventures. ABB and Siemens offer wall-mounted and pedestal AC chargers suitable for residential and commercial spaces, with product portfolios supporting dynamic load management and cloud-based monitoring. Schneider Electric combines modular hardware with energy management tools to streamline charger integration in buildings. Bosch develops compact AC chargers optimized for home use, targeting Europe and North America. Delta Electronics supplies AC chargers with customizable outputs and wide voltage compatibility for urban and suburban deployment.

ChargePoint, Inc. dominates the North American market with a large network of AC stations and back-end management software for site hosts. Blink Charging Co. emphasizes hardware sales and owned-station operation models, expanding through retail partnerships. EVBox supports AC charging through scalable business solutions used in Europe’s commercial sector. Enphase Energy leverages its inverter expertise to offer grid-tied AC chargers for residential solar customers.

Leviton Industries delivers residential AC stations backed by electrical hardware manufacturing experience. Emerging players like StarCharge and SIGNET EV support local infrastructure programs across Asia. Automotive-led entries include NIO and Vinfast, which deploy branded AC stations to enhance ownership experience. Zunder expands across Southern Europe, targeting shared AC charging infrastructure.

The AC electric vehicle charging station market is being shaped by advancements in smart grid integration, user-centric software platforms, and secure plug-and-charge protocols. Level 2 chargers remain the preferred choice for residential and workplace settings due to their balance of speed and cost-efficiency. Public and fleet operators are adopting modular AC units that support multi-network compatibility and remote diagnostics.

Load management software with AI-driven demand forecasting is being used to optimize grid usage and reduce peak load pressure. In urban areas, compact curbside AC chargers are gaining traction as space-efficient solutions. Vandal-resistant designs, theft-deterrent cables, and app-based authentication features are being added to improve reliability. Emphasis is increasing on integrating these stations with solar and battery storage systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 23.1 Billion |

| Current | Level 2 and Level 1 |

| Charging Site | Public and Private |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Blink Charging Co., Bosch, ChargePoint, Inc., Charge Zone India, Delta Electronics, Elli, Enphase Energy, EVBox, Leviton Industries, NIO, Schneider Electric, Siemens, SIGNET EV, StarCharge, Vinfast, Volta Industries Inc., and Zunder |

| Additional Attributes | Dollar sales by charging type (single-phase, three-phase) and application (residential, commercial, fleet), demand across home, workplace, and fleet EV adoption, led by Asia-Pacific with North America catching up, innovation in smart IoT load management and grid integration. |

The global ac electric vehicle charging station market is estimated to be valued at USD 23.1 billion in 2025.

The market size for the ac electric vehicle charging station market is projected to reach USD 142.1 billion by 2035.

The ac electric vehicle charging station market is expected to grow at a 19.9% CAGR between 2025 and 2035.

The key product types in ac electric vehicle charging station market are level 2 and level 1.

In terms of charging site, public segment to command 72.1% share in the ac electric vehicle charging station market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Account Planning Tool Market Size and Share Forecast Outlook 2025 to 2035

Acousto Optical Cavity Dumper Market Size and Share Forecast Outlook 2025 to 2035

Accounting Software Market Size and Share Forecast Outlook 2025 to 2035

Active Wear Market Size and Share Forecast Outlook 2025 to 2035

Acid Resistant Pipe Market Forecast and Outlook 2025 to 2035

AC DC Power Adapter Market Forecast and Outlook 2025 to 2035

Activated Carbon for Sugar Decolorization Market Forecast and Outlook 2025 to 2035

Acrylic Paint Market Forecast and Outlook 2025 to 2035

Acetate Silicone Sealant Market Size and Share Forecast Outlook 2025 to 2035

Active, Smart, and Intelligent Packaging Market Size and Share Forecast Outlook 2025 to 2035

Acetone Market Size and Share Forecast Outlook 2025 to 2035

Activated Alumina Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Fibre Market Size and Share Forecast Outlook 2025 to 2035

Acetoacetanilide Market Size and Share Forecast Outlook 2025 to 2035

Acetylacetone Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Emulsions Market Size and Share Forecast Outlook 2025 to 2035

AC Power Source Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Polymer Market Size and Share Forecast Outlook 2025 to 2035

Activated Carbon Fiber Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Resin Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA