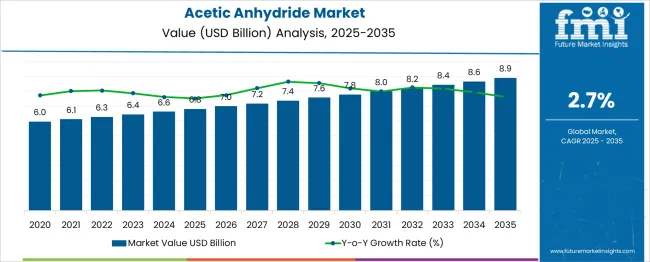

The Acetic Anhydride Market is estimated to be valued at USD 6.8 billion in 2025 and is projected to reach USD 8.9 billion by 2035, registering a compound annual growth rate (CAGR) of 2.7% over the forecast period.

The acetic anhydride market is forecast to expand from USD 6.8 billion in 2025 to USD 8.9 billion by 2035 at a 2.7% CAGR. Over the ten‑year span, the market multiplier stands at approximately 1.31 times, indicating steady expansion. Annual increments are consistent at roughly USD 0.2 billion, rising through values of 7.0 billion in 2026, 7.2 billion in 2027, 7.4 billion in 2028, 7.6 billion in 2029, and 7.8 billion in 2030, then continuing to 8.0 billion in 2031, 8.2 billion in 2032, 8.4 billion in 2033, 8.6 billion in 2034, and 8.9 billion in 2035.

The first half‑decade multiplier (2025-2030) is about 1.15 times, while the second half (2030–2035) yields a comparable 1.14 times, underscoring uniform momentum rather than back‑loaded acceleration. Year‑over‑year percentage growth holds within a narrow band of 2.7% ± 0.1 percentage point, highlighting low volatility and predictable demand linked to downstream acetic acid derivatives and cellulose acetate applications.

Such a trajectory suggests that supply‑side planning can rely on incremental capacity additions, gradual feedstock alignment, and marginal process optimizations without the need for disruptive scale‑ups or aggressive hedging strategies. Manufacturers focusing on continuous improvement in yield, logistics optimization, and steady contract pricing will capture value across this stable growth environment.

| Metric | Value |

|---|---|

| Acetic Anhydride Market Estimated Value in (2025 E) | USD 6.8 billion |

| Acetic Anhydride Market Forecast Value in (2035 F) | USD 8.9 billion |

| Forecast CAGR (2025 to 2035) | 2.7% |

The acetic anhydride market occupies a focused yet influential share across multiple chemical value chains. Within the acetyl chemicals market, a contribution near 12–14 % is recorded, because acetic acid and vinyl acetate monomer dominate volume yet acetic anhydride remains the preferred acetylating reagent for specialty routes. Across the chemical intermediates market, only 2–3 % of expenditure is linked to acetic anhydride, given the vast range of carbonyls, amines, and halogenated blocks competing for budget. In the cellulose derivatives domain, roughly 32–34 % of demand can be traced to acetic anhydride, as cellulose acetate, triacetate, and cigarette filter tow production rely on large acetylation batches.

Within pharmaceutical ingredients and excipients procurement, a share around 4–5 % is observed, since paracetamol, aspirin, and assorted APIs require acylation steps but broader spending targets solvents, binders, and active molecules. The agrochemical raw materials market directs about 6–8 % of its reagent budget toward acetic anhydride, with herbicide and plant growth regulator synthesis depending on controlled acetylation.

Growth in cigarette filter production, expanding analgesic output, and tighter purity specifications across agrochemical syntheses are expected to elevate acetic anhydride demand despite volatile feedstock prices and increasingly strict emission guidelines. Capacity debottlenecking in Asia and North America will reinforce supply resilience.

The acetic anhydride market is exhibiting robust growth driven by its critical role as an intermediate in a wide range of chemical synthesis processes. The market is being shaped by increasing demand from pharmaceutical manufacturers for active pharmaceutical ingredient (API) production, particularly for acetylated compounds. In addition, industrial applications such as agrochemical synthesis, plasticizers, and modified starch production are supporting a consistent demand base.

Heightened utilization of acetic anhydride in the manufacturing of cellulose acetate, especially in textile and filtration applications, is further reinforcing its market relevance. Regulatory tightening around controlled substances in certain regions has led to a more structured and compliant supply chain, influencing pricing and production capacities.

Asia-Pacific and North America are emerging as key production hubs due to integrated chemical ecosystems and access to raw materials like acetic acid. Moving forward, the market is anticipated to benefit from expansion in pharmaceutical R&D, growth in end-use industries, and sustained demand for high-purity chemical intermediates across developed and emerging economies.

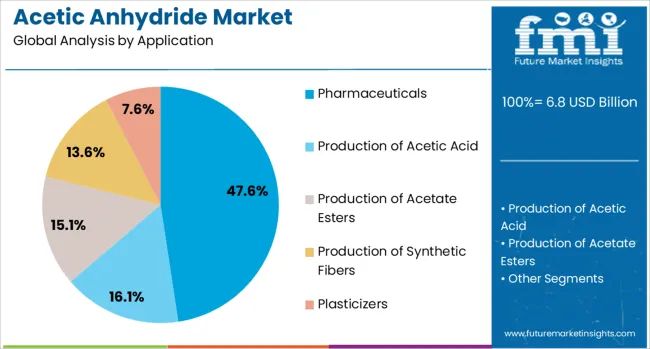

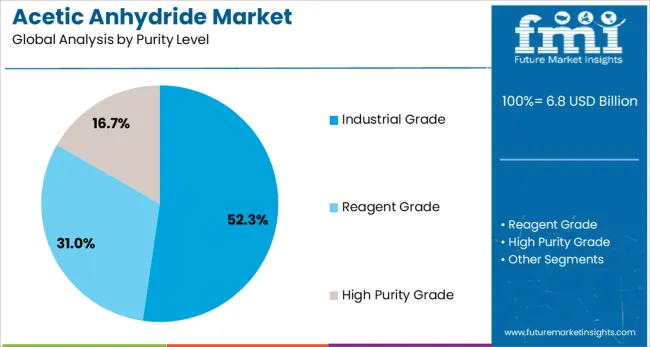

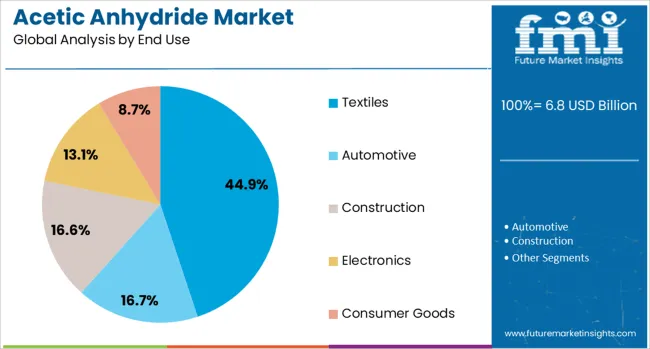

The acetic anhydride market is segmented by application, purity level, end use, and form and geographic regions. By application of the acetic anhydride market is divided into Pharmaceuticals, Production of Acetic Acid, Production of Acetate Esters, Production of Synthetic Fibers, and Plasticizers. In terms of purity level of the acetic anhydride market is classified into Industrial Grade, Reagent Grade, and High Purity Grade. Based on end use of the acetic anhydride market is segmented into Textiles, Automotive, Construction, Electronics, and Consumer Goods. By form of the acetic anhydride market is segmented into Liquid and Solid. Regionally, the acetic anhydride industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The pharmaceuticals segment is expected to account for 47.6% of the total revenue share in the acetic anhydride market in 2025. This dominant position is being driven by the compound’s widespread use as a reagent in the synthesis of aspirin, paracetamol, and other essential APIs. The high acetylation efficiency and purity requirements of pharmaceutical formulations have made acetic anhydride a key chemical input across major drug manufacturing pipelines.

The expansion of global healthcare access, rising demand for over-the-counter medications, and increasing chronic disease burden have further intensified production of drugs that require acetic anhydride in intermediate stages. Enhanced investments in pharmaceutical infrastructure, particularly in India, China, and the United States, have contributed to steady consumption patterns.

Strict regulatory standards have also elevated demand for consistent-quality reagents, positioning acetic anhydride as a reliable choice for pharmaceutical-grade applications. The compound’s ability to maintain stability and compatibility in sensitive reaction environments has played a significant role in sustaining its importance in this segment.

Industrial grade acetic anhydride is projected to capture 52.3% of the market share in 2025, making it the leading segment by purity level. The dominance of this grade is being attributed to its extensive utilization in large-scale chemical production, where ultra-high purity is not a stringent requirement.

Applications in the production of cellulose acetate, agrochemicals, dyes, and plastic additives have relied heavily on industrial grade acetic anhydride due to its cost-effectiveness and availability. This grade is also widely preferred in regions with established chemical manufacturing clusters, where efficiency in sourcing and logistics significantly impacts input selection.

The ability of industrial grade acetic anhydride to deliver stable performance across varied batch sizes and reaction profiles has supported its broad usage across synthetic chemistry platforms. Moreover, as industries continue to scale up operations in response to demand from textile and polymer markets, industrial grade variants are being integrated into long-term procurement frameworks, reinforcing their stronghold in the market.

The textiles segment is anticipated to hold 44.9% of the revenue share in the acetic anhydride market in 2025, reflecting its strategic relevance in cellulose acetate fiber production. The use of acetic anhydride in acetylating cellulose to create fibers with desirable properties such as durability, breathability, and moisture resistance has remained central to textile manufacturing.

The ongoing shift toward synthetic and blended textiles in apparel, home furnishing, and industrial fabrics is generating heightened demand for performance-enhancing fiber precursors, of which cellulose acetate is a key component. Manufacturing hubs in Asia have significantly ramped up acetic anhydride consumption, driven by high export volumes of processed textile goods.

The segment’s growth has also been influenced by technological advancements in fiber engineering and dyeability improvements associated with acetylated fibers. As consumer demand leans toward versatile, lightweight, and sustainable textile materials, the integration of acetic anhydride in the production value chain is expected to expand further, consolidating its importance in textile end-use markets.

Acetic anhydride is widely used as an acetylation agent in industries such as pharmaceuticals, polymers, and textiles. In pharmaceutical production, its role is critical in the synthesis of aspirin and antibiotics. Demand has arisen in cellulose acetate regions for film and fiber applications, and in chemical intermediates for flavorings and pesticides. Adoption by industrial users has been encouraged by its reactivity, purity, and regulatory compliance when handled under controlled conditions. Manufacturers providing high‑quality acetylating agents with consistent concentration and documentation of trace impurity levels are positioned to serve global chemical and life science supply chains.

Acetic anhydride has been utilised extensively for introducing acetyl functional groups into pharmaceutical compounds, specialty polymers and cellulose derivatives. Its capacity to enable efficient synthesis of active pharmaceutical ingredients such as acetyl‑salicylic acid and penicillin derivatives has reinforced its role in drug manufacturing workflows. Applications in cellulose acetate production have supported demand in photographic film, cigarette filters, and textile fibre markets, where acetylation offers improved solubility and thermal stability. Chemical intermediates for flavoring agents, controlled‑release coatings and agrochemicals have also depended on its acetylating reactivity. As regulatory frameworks for pharmaceutical manufacturing continue to emphasize impurity control and batch consistency, high‑purity acetic anhydride has become a critical reagent across life science and material science sectors.

Use of acetic anhydride has been constrained by strict regulatory controls due to its classification as a precursor chemical with diversion risk. Licensing, tracking and transport protocols have increased logistical overhead for producers and importers. Handling concerns such as corrosivity, vapour irritation and flammability have mandated specialised containment, ventilation and operator training. Purity standards and impurity limits must be verified batch‑wise to meet pharmaceutical grades, adding analytical burden and release testing costs. Regional restrictions on acetylating reagent importation have fragmented supply chains and increased lead times for end‑user industries. As substitution options such as acetyl chloride or enzymatic acetylation emerge, reliance on acetic anhydride remains tempered by compliance and safety infrastructure considerations.

Innovations in catalytic acetylation methods have opened pathways for lower‑temperature and solvent‑free processes, reducing energy consumption. Development of solid acid catalysts with enhanced activity has been pursued to simplify separation and minimize waste streams. Integration of reactive distillation techniques has enabled simultaneous reaction and separation, improving conversion rates. Closed‑loop recovery systems for unreacted acetic acid have been deployed to improve process economics and reduce raw material requirements. Partnerships with chemical recycling firms are being explored to convert biomass‑derived feedstocks into acetic acid and subsequent anhydride. Expansion of on‑site reagent generation units in pharmaceutical plants is being considered to secure supply and cut logistics costs.

Real‑time process analytics using inline spectroscopic sensors have been adopted for continuous quality control of acetylation reactions and impurity tracking. Predictive maintenance platforms are being used to monitor reactor integrity and anticipate catalyst performance decline. Modular skid‑mounted production units are gaining traction for rapid deployment in specialty chemical parks and remote industrial zones. Implementation of advanced control algorithms has optimized reaction parameters, reducing cycle times and improving selectivity. Collaborative technology licensing between equipment manufacturers and reagent suppliers is facilitating standardized production packages. Data‑driven optimization of feed ratios and temperature profiles is enhancing throughput while maintaining stringent purity standards for end‑use applications.

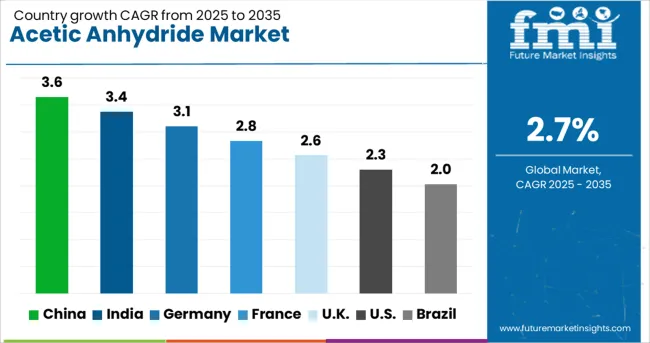

| Country | CAGR |

|---|---|

| China | 3.6% |

| India | 3.4% |

| Germany | 3.1% |

| France | 2.8% |

| UK | 2.6% |

| USA | 2.3% |

| Brazil | 2.0% |

The global acetic anhydride market is projected to expand at a 2.7% CAGR from 2025 to 2035, driven by demand in pharmaceuticals, cellulose acetate, and specialty chemicals. China, a BRICS member, leads with 3.6%, supported by large-scale chemical manufacturing and export-oriented cellulose acetate production. India, also a BRICS member, follows at 3.4%, fueled by pharmaceutical intermediates and expansion in textile-grade cellulose acetate. Among OECD markets, Germany records 3.1%, with demand driven by advanced coatings and food additive processing. France posts 2.8%, where fine chemical applications remain dominant. The UK grows at 2.6%, supported by requirements in drug synthesis and controlled substances manufacturing. The analysis includes insights from 40+ countries, with five key markets profiled below.

India is expected to grow at a 3.4% CAGR during 2025–2035, driven primarily by its strong pharmaceutical sector and the demand for cellulose acetate in textiles and packaging. The country has emerged as a major hub for API (Active Pharmaceutical Ingredient) manufacturing, where acetic anhydride serves as a critical intermediate. Demand is also increasing in the textile industry for acetate fibers used in apparel and film packaging solutions. Regulatory compliance for controlled substances remains essential, and companies are investing in dedicated facilities to meet safety standards. Exports of value-added chemicals are expanding, supported by policy incentives. Domestic producers are enhancing backward integration and introducing energy-efficient processes to lower costs and ensure stable supply for industrial users.

China is projected to register a 3.6% CAGR through 2035, supported by large-scale cellulose acetate production and strong presence in cigarette filter manufacturing. The country is home to integrated chemical clusters that enable cost-effective production, making it a global supplier of acetyl derivatives. Increased output in pharmaceuticals and high-performance coatings is boosting domestic utilization, while surplus production is directed toward exports. Strategic investments in process automation and waste minimization are improving operating efficiencies. Government policies supporting chemical sector modernization further strengthen competitiveness. The expansion of downstream applications in plastics and agricultural chemicals contributes additional demand. Chinese producers are actively forming partnerships with multinational firms to expand their technological capabilities and maintain a lead in specialty acetyl intermediates.

Germany is forecast to grow at a 3.1% CAGR, supported by demand in high-purity applications such as specialty coatings, engineered polymers, and food-grade acetates. Its advanced chemical sector enables precise formulation for regulated markets, including pharmaceuticals and fine chemicals. EU-driven compliance standards encourage adoption of optimized processes, ensuring reduced emissions and resource efficiency. German producers maintain competitive strength through innovation in acetyl derivatives for high-performance materials and coatings. Rising applications in diagnostic reagents and medical intermediates offer incremental growth opportunities. Additionally, R&D collaborations under European chemical innovation programs are fostering improvements in process sustainability and operational safety. Export potential remains strong for high-specification products required by niche global markets.

France is expected to expand at a 2.8% CAGR, primarily due to fine chemical synthesis and demand from food-grade acetate applications. Local production serves pharmaceuticals, flavorings, and high-value ester derivatives. French companies are focusing on optimizing operational efficiency and securing raw material supply to maintain competitiveness under strict EU chemical norms. Increasing use of acetate-based formulations in perfumery and cosmetics contributes to steady consumption. The government’s emphasis on compliance and process modernization supports adoption of cleaner production routes. Import substitution for critical intermediates remains a strategic objective, creating opportunities for domestic producers to invest in capacity enhancement and advanced processing facilities. Market players are also expanding research efforts in specialty acetyl chemistry for high-margin applications.

The United Kingdom is projected to grow at a 2.6% CAGR, driven by demand from pharmaceutical synthesis and fine chemical processing. Domestic supply is limited, making imports essential for meeting consistent demand across regulated applications. Acetic anhydride plays a critical role in manufacturing aspirin, antibiotics, and other drug intermediates, which ensures continued consumption from the healthcare sector. Growth is also seen in laboratory-grade reagents and acetate derivatives used in specialty polymers. Companies are focusing on regulatory compliance and process safety to maintain operational continuity. Opportunities exist in supply-chain localization, particularly in high-purity grades, where precision and traceability are paramount for pharmaceutical and diagnostic markets.

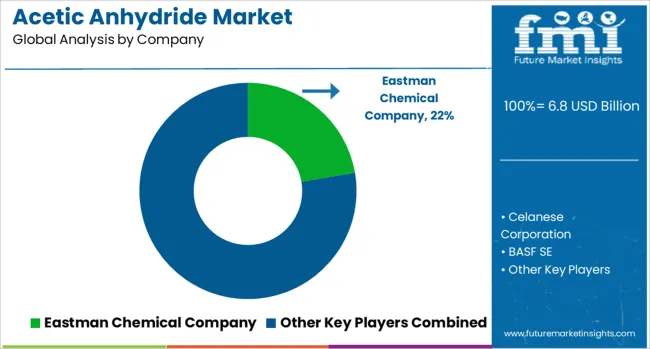

The acetic anhydride market is shaped by a moderate concentration of global chemical producers including Eastman Chemical Company, Celanese Corporation, BASF SE, PetroChina Ltd. (China National Petroleum Corp.), Jubilant Life Sciences, DuPont, Daicel Corporation, and Luna Chemical Industries Pvt. Ltd. The industry features high entry barriers due to substantial capital investment, strict regulatory oversight on chemical handling and emissions, and economies of scale favoring incumbents.

Supplier power remains moderate, driven by availability and pricing of raw materials such as acetic acid and ketene, while buyer power is influenced by large end-use sectors like pharmaceuticals, acetylation processes, and cellulose acetate production. Substitution risk is low given the limited alternatives offering similar chemical reactivity and efficiency. Industry rivalry is intense, with competitors grouped strategically by geographic presence, product grades, and distribution channels, focusing on either high-purity pharmaceutical grade or industrial-grade acetic anhydride.

Cost leadership is primarily driven by scale advantages, proprietary manufacturing technologies, and integrated supply chains, while differentiation stems from product purity, customer service, and regulatory compliance. Value chain analysis reveals that companies investing in backward integration and process innovation maintain cost competitiveness and pricing power. Competitive advantage sustainability is reinforced by patents, know-how, and established customer relationships, with switching costs elevated by technical qualifications in pharmaceutical applications. Future competitive moves will likely include capacity expansions in emerging markets, strategic alliances for raw material security, and enhanced R&D focusing on process intensification and green chemistry approaches. Benchmarking is conducted on market share, profitability, capacity utilization, and innovation intensity. The market faces potential disruptions from regulatory tightening and emerging bio-based chemical platforms, necessitating agile strategies for sustained leadership and market adaptation.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.8 Billion |

| Application | Pharmaceuticals, Production of Acetic Acid, Production of Acetate Esters, Production of Synthetic Fibers, and Plasticizers |

| Purity Level | Industrial Grade, Reagent Grade, and High Purity Grade |

| End Use | Textiles, Automotive, Construction, Electronics, and Consumer Goods |

| Form | Liquid and Solid |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Eastman Chemical Company, Celanese Corporation, BASF SE, PetroChina Ltd. (China National Petroleum Corp.), Jubilant Life Sciences, DuPont, Daicel Corporation, and Luna Chemical Industries Pvt. Ltd. |

| Additional Attributes | Dollar sales are segmented by application (pharmaceutical intermediates, cellulose acetate, organic solvents) and end-use sector (pharma, textiles, coatings). Global demand is driven by pharmaceutical synthesis and acetate-based film production. Regional adoption leads in North America and Asia-Pacific, where industrial chemical production and pharmaceutical sectors are growing. Innovation targets catalyst optimization, renewable feedstock integration, and production efficiency improvements to meet regulatory standards and cost pressures. |

The global acetic anhydride market is estimated to be valued at USD 6.8 billion in 2025.

The market size for the acetic anhydride market is projected to reach USD 8.9 billion by 2035.

The acetic anhydride market is expected to grow at a 2.7% CAGR between 2025 and 2035.

The key product types in acetic anhydride market are pharmaceuticals, production of acetic acid, production of acetate esters, production of synthetic fibers and plasticizers.

In terms of purity level, industrial grade segment to command 52.3% share in the acetic anhydride market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Acetic Ether Market Size and Share Forecast Outlook 2025 to 2035

Acetic Acid Esters Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Acetic Acid Market

Peracetic Acid Market Size and Share Forecast Outlook 2025 to 2035

Mixed Acetic and Tartaric Acid Esters of Mono and Diglycerides of Fatty Acids Market

Glacial Acetic Acid Market Growth – Trends & Forecast 2024-2034

Alpha-Sulfophenylacetic Acid Market Size and Share Forecast Outlook 2025 to 2035

Maleic Anhydride Market Size and Share Forecast Outlook 2025 to 2035

Trimellitic Anhydride Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA