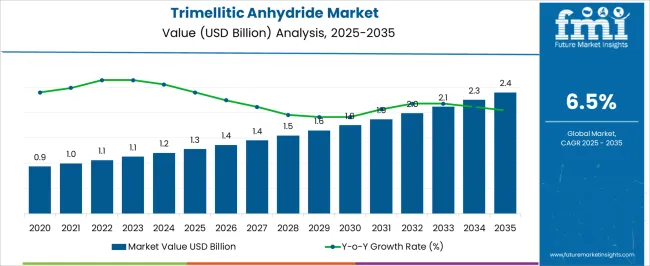

The Trimellitic Anhydride Market is estimated to be valued at USD 1.3 billion in 2025 and is projected to reach USD 2.4 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period. From 2020 to 2024, the market expanded from USD 0.9 billion to USD 1.2 billion, with annual growth rates ranging between 5.5% and 6.3%. Early adoption was gradual, driven by demand in plasticizers, resins, and coating applications. Year-on-year growth during this period reflects incremental integration into manufacturing processes, steady procurement across chemical and industrial sectors, and rising awareness among end users. These years established the foundation for broader adoption and consistent market expansion.

Between 2025 and 2030, the market enters a scaling phase, increasing from USD 1.3 billion to USD 1.8 billion, with YoY growth averaging 6–6.8%. Broader uptake occurs across automotive, electronics, and industrial coatings, supported by consistent supply and distribution networks. From 2030 to 2035, growth continues steadily to USD 2.4 billion, with annual increases around 6.4–6.6%. The YoY analysis highlights predictable expansion, with recurring procurement, process integration, and adoption across multiple applications driving steady market growth. Demand stabilizes across sectors, reflecting a transition toward a mature and reliable market environment.

| Metric | Value |

|---|---|

| Trimellitic Anhydride Market Estimated Value in (2025 E) | USD 1.3 billion |

| Trimellitic Anhydride Market Forecast Value in (2035 F) | USD 2.4 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

Rising applications in the production of plasticizers, wire and cable insulation, automotive coatings, and powder coatings are driving consumption levels. The market is benefiting from advancements in manufacturing processes that improve yield efficiency and reduce environmental impact, meeting the growing demand for sustainable production practices.

Expanding construction activities, increasing investment in infrastructure projects, and the shift towards lightweight and durable materials in the automotive and aerospace industries are creating favorable growth conditions. Additionally, the chemical’s ability to enhance thermal stability, mechanical strength, and chemical resistance in end-use products is reinforcing its adoption.

Regulations encouraging the use of higher-quality raw materials for improved product performance are also influencing demand. As global industrialization continues and the need for performance-driven materials increases, the trimellitic anhydride market is expected to witness consistent expansion, with manufacturers focusing on both capacity expansion and the development of specialized grades for niche applications.

The trimellitic anhydride market is segmented by product type, application, end-use industry, formulation type, distribution channel, and geographic regions. By product type, the trimellitic anhydride market is divided into High Purity Trimellitic Anhydride and Commercial Grade Trimellitic Anhydride. In terms of application, the trimellitic anhydride market is classified into Polyester Resin Production, Plasticizers, Adhesives and Sealants, Coatings, and Other Industrial Applications.

Based on end-use industry, trimellitic anhydride market is segmented into Construction, Automotive, Aerospace, Electrical and Electronics, and Consumer Goods. By formulation type, trimellitic anhydride market is segmented into Single Component Formulation and Multi-Component Formulation. By distribution channel, trimellitic anhydride market is segmented into Direct Sales, Online Sales, Distributors, and Retailers. Regionally, the trimellitic anhydride industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

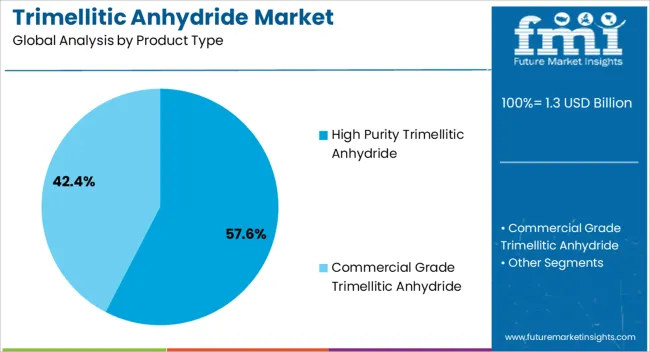

The high purity trimellitic anhydride segment is projected to account for 57.6% of the trimellitic anhydride market revenue share in 2025, making it the leading product type. This dominance is being driven by the increasing preference for high-purity grades in critical applications where performance consistency and safety are essential. High purity material ensures reduced impurities, improving product quality in applications such as high-grade coatings, specialty resins, and performance-driven plastics.

Industries requiring strict adherence to technical specifications, including automotive, aerospace, and electronics, are driving adoption due to the enhanced thermal stability, chemical resistance, and mechanical strength that high purity grades provide. Advancements in purification technologies are enabling efficient large-scale production, ensuring consistent supply to global markets.

Compliance with stringent quality and environmental standards in various regions further strengthens the demand for high-purity trimellitic anhydride The segment is expected to maintain its lead as end users increasingly shift towards materials that deliver higher efficiency, improved product performance, and extended service life in demanding applications.

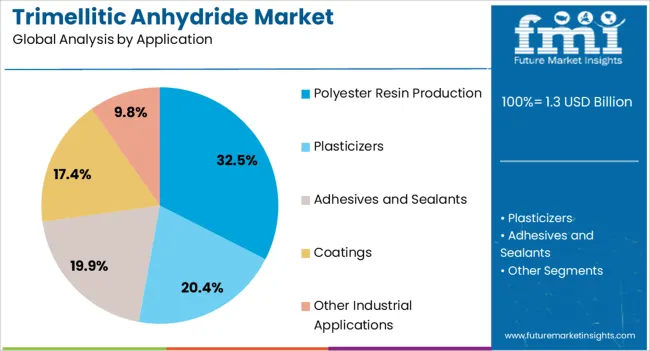

The polyester resin production segment is anticipated to represent 32.5% of the trimellitic anhydride market revenue share in 2025, making it the dominant application area. This leadership is supported by the increasing use of polyester resins in coatings, adhesives, and composites across construction, automotive, and marine industries. The addition of trimellitic anhydride in polyester resin formulations improves weather resistance, mechanical strength, and durability, which are essential for long-term performance in outdoor and industrial environments.

Growing demand for corrosion-resistant coatings in infrastructure projects and high-performance composites in transportation is contributing to segment growth. Technological advancements in resin manufacturing are enhancing formulation efficiency, reducing production costs, and enabling greater customization for specific end-use requirements.

Sustainability initiatives are also driving the segment’s expansion, as polyester resins offer recyclability and compatibility with eco-friendly formulations. With infrastructure development and industrial activities continuing to grow globally, polyester resin production is expected to remain a key driver of trimellitic anhydride consumption.

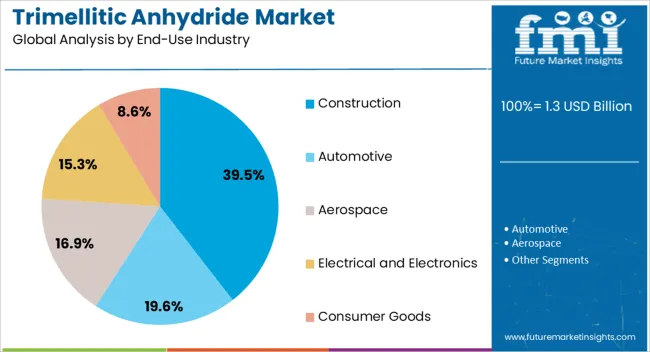

The construction segment is expected to capture 39.5% of the trimellitic anhydride market revenue share in 2025, making it the leading end-use industry. This position is being reinforced by the rising demand for durable, weather-resistant, and energy-efficient materials in building and infrastructure projects. Trimellitic anhydride-based coatings, sealants, and composites are widely utilized in construction due to their ability to enhance surface protection, structural integrity, and long-term performance.

Rapid urbanization, particularly in emerging economies, is leading to increased residential, commercial, and industrial construction activities, thereby driving material consumption. The segment is also benefiting from stricter building codes and regulations that require the use of high-performance materials to ensure safety, sustainability, and efficiency.

In addition, the development of eco-friendly and low-emission construction products incorporating trimellitic anhydride is aligning with global green building trends. As construction markets expand and modernize, the demand for advanced materials that deliver both performance and compliance is expected to maintain the construction industry’s leadership in trimellitic anhydride consumption.

The trimellitic anhydride market is growing due to its widespread use in the production of plasticizers, polyesters, resins, and coatings. TMA provides excellent thermal stability, chemical resistance, and compatibility with various polymers. Rising demand in automotive, electronics, and construction sectors drives adoption. Asia-Pacific leads production and consumption due to expanding industrial activity, while Europe focuses on high-purity applications. Manufacturers emphasize quality consistency, low impurity levels, and efficient production processes to meet stringent industrial and environmental requirements.

Trimellitic anhydride is a key raw material in the production of trimellitate plasticizers, which are used in high-performance PVC products such as cables, wires, and flexible films. These plasticizers provide heat stability, low volatility, and resistance to migration, which is crucial for applications requiring long-term durability under high-temperature conditions. Electrical and automotive industries rely on TMA-based plasticizers to meet safety and performance standards. Suppliers providing high-purity, consistent-grade TMA ensure reliable plasticizer synthesis. Until alternative chemicals match TMA’s thermal stability, low volatility, and compatibility with PVC, it will remain essential in high-performance plasticizer production and related industrial applications.

Trimellitic anhydride is used to manufacture polyesters, alkyd resins, and coating resins, providing superior chemical resistance, adhesion, and thermal properties. TMA-based polyesters are widely applied in protective coatings, paints, and varnishes for industrial and automotive applications. Consistent particle size, purity, and anhydride content are critical for predictable polymerization and final product quality. Manufacturers delivering TMA with low moisture content and high thermal stability gain preference among resin producers. Until alternative anhydrides or polycarboxylic acids offer similar performance and compatibility with polyester and resin production, TMA will continue to play a central role in these high-performance industrial materials.

The automotive and electronics industries are major consumers of TMA-derived products such as heat-stable plasticizers, resins, and coatings. Automotive wiring, flexible electronic components, and high-temperature insulation materials require TMA-based solutions due to their durability, chemical resistance, and thermal stability. Manufacturers offering high-purity, reliable TMA supply can secure long-term contracts with OEMs and component producers. Regional demand is strongest in Asia-Pacific due to the rapid expansion of automotive manufacturing and electronics production. Until substitutes with equivalent performance, safety, and process compatibility are commercially viable, TMA will remain a critical raw material for automotive and electronics applications requiring high-performance polymeric solutions.

Trimellitic anhydride is regulated in various regions due to potential health and environmental impacts during handling, transport, and production. Manufacturers must comply with chemical safety regulations, emission limits, and handling protocols to minimize risks. Packaging in moisture-proof containers and providing safety documentation ensures adherence to global standards. Industrial buyers prioritize suppliers that deliver consistent quality and meet regulatory requirements to avoid production interruptions or legal liabilities. Until alternative chemicals with lower handling risks and similar performance are widely adopted, regulatory compliance and safe handling practices will remain essential factors influencing the adoption and distribution of trimellitic anhydride in industrial markets.

| Countries | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

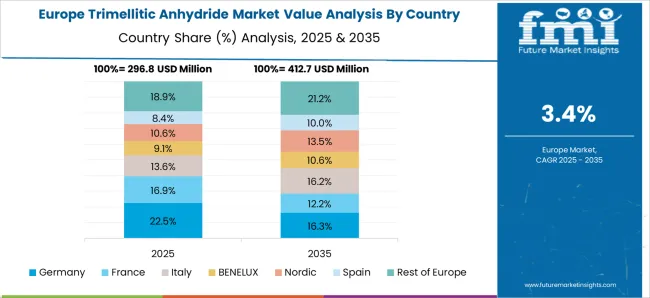

The global trimellitic anhydride market is expected to grow at a CAGR of 6.5% through 2035, supported by increasing demand across coatings, plastics, and chemical intermediate applications. Among BRICS nations, China has been recorded with 8.8% growth, driven by large-scale production and deployment in industrial and specialty chemical processes, while India has been observed at 8.1%, supported by rising utilization in coatings and plastic manufacturing. In the OECD region, Germany has been measured at 7.5%, where production and adoption for industrial, chemical, and coating applications have been steadily maintained. The United Kingdom has been noted at 6.2%, reflecting consistent use in specialty chemical and coating applications, while the USA has been recorded at 5.5%, with production and utilization across plastics, coatings, and chemical intermediates being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The trimellitic anhydride market in China is growing at a CAGR of 8.8%, driven by expanding demand in coatings, plastics, and chemical intermediates industries. Trimellitic anhydride is widely used in the production of plasticizers, resins, and polyesters, which find applications in automotive coatings, industrial paints, and high-performance plastics. China’s strong manufacturing base and growing automotive and construction sectors contribute significantly to market growth. Technological advancements in anhydride synthesis and process optimization enhance product quality, reduce costs, and increase efficiency. Government policies supporting industrial expansion, export promotion, and environmental regulations further shape market dynamics. Rising demand for sustainable and high-performance coatings, coupled with the increasing production of specialty chemicals, provides growth opportunities. The market benefits from continuous innovation, expanding end-use applications, and adoption in automotive, electronics, and industrial sectors across China.

The trimellitic anhydride market in India is expanding at a CAGR of 8.1%, supported by growth in automotive, construction, and industrial coatings sectors. Trimellitic anhydride is utilized in producing plasticizers, alkyd resins, and high-performance polymers, which are essential for coatings, adhesives, and specialty chemicals. Increasing industrial production and infrastructure development drive the adoption of these compounds. Indian manufacturers focus on cost-efficient production while maintaining product performance to meet domestic and export requirements. Government initiatives promoting chemical manufacturing, Make in India programs, and export competitiveness further accelerate market growth. Technological improvements in anhydride production, along with environmental compliance, are shaping market practices. Rising demand from automotive coatings, industrial paints, and polymer applications ensures steady consumption. Overall, the trimellitic anhydride market in India is poised for sustainable growth driven by industrial demand, process innovation, and supportive government policies.

The trimellitic anhydride market in Germany is growing at a CAGR of 7.5%, driven by industrial, automotive, and specialty chemical applications. Trimellitic anhydride is a key raw material for plasticizers, alkyd resins, and high-performance polymers used in coatings, adhesives, and electronics. Germany’s stringent quality and environmental standards encourage the production of high-purity anhydrides with minimal environmental impact. Industrial growth in automotive manufacturing, construction, and electronics drives consistent demand. Technological innovations in synthesis and processing enhance efficiency and product performance. Export opportunities to European markets further strengthen the market. Sustainability trends and eco-friendly production methods are influencing manufacturers’ practices. Overall, the trimellitic anhydride market in Germany maintains steady growth, supported by industrial applications, regulatory compliance, and technological advancements.

The trimellitic anhydride market in the United Kingdom is expanding at a CAGR of 6.2%, driven by coatings, plasticizers, and specialty polymer applications. The growing demand from automotive, construction, and industrial coatings sectors supports market growth. Manufacturers focus on producing high-quality trimellitic anhydride to meet industrial and regulatory standards. Technological advancements in chemical processing improve efficiency, reduce costs, and enhance product performance. Government policies promoting chemical safety, industrial innovation, and export competitiveness further influence market dynamics. Adoption in high-performance polymers, adhesives, and resins provides steady growth opportunities. The UK market continues to evolve with an emphasis on sustainable production and environmental compliance. Overall, industrial demand, technological improvements, and regulatory trends are driving the expansion of the trimellitic anhydride market in the United Kingdom.

The trimellitic anhydride market in the United States is growing at a CAGR of 5.5%, fueled by demand from automotive coatings, industrial paints, and polymer production. Trimellitic anhydride is a critical raw material for plasticizers, alkyd resins, and specialty polymers used in high-performance applications. Technological innovations in synthesis and processing improve product quality, reduce production costs, and ensure environmental compliance. Industrial expansion in automotive, construction, and electronics sectors drives steady demand. Government regulations promoting safety, chemical handling, and sustainable manufacturing influence market practices. The market benefits from R&D efforts focused on eco-friendly products, high-performance resins, and industrial coatings. Overall, the USA trimellitic anhydride market is expected to grow steadily, supported by industrial applications, technological improvements, and regulatory compliance across manufacturing and specialty chemical sectors.

The trimellitic anhydride (TMA) market plays a critical role in the production of plasticizers, resins, coatings, and adhesives, with applications spanning automotive, construction, and electrical industries. The growing demand for high-performance polymers and environmentally compliant products is driving the expansion of this market globally. TMA is valued for its thermal stability, chemical resistance, and ability to enhance the durability of polymers, making it a preferred choice in industrial applications.

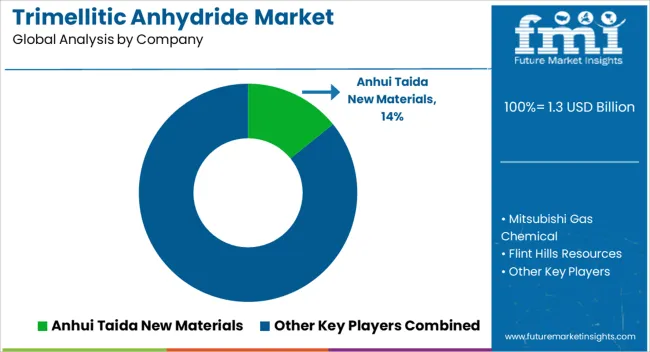

Anhui Taida New Materials is a key supplier, offering high-purity TMA suitable for advanced polymer synthesis and industrial applications. Mitsubishi Gas Chemical has established a strong presence with its consistent quality and large-scale production capabilities. Flint Hills Resources focuses on TMA applications in plasticizers and coatings, meeting stringent industrial standards. BASF SE and Clariant AG provide a diverse portfolio of TMA-based solutions, catering to various sectors such as automotive coatings and electronics. Polynt S.p.A and DOW Chemical Company are recognized for innovation in specialty chemicals and resin production using TMA.

Wuxi Baichuan Chemical and Jiangsu Zhengdan Chemical deliver cost-effective, high-quality TMA products for domestic and international markets, supporting resin and plasticizer manufacturing. Ineos Joliet and Sanco Industries provide TMA tailored for high-performance industrial applications, including insulation materials and coatings. As industries increasingly demand sustainable, durable, and versatile chemical intermediates, leading TMA suppliers continue to innovate and expand their capacities to meet evolving global needs.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 Billion |

| Product Type | High Purity Trimellitic Anhydride and Commercial Grade Trimellitic Anhydride |

| Application | Polyester Resin Production, Plasticizers, Adhesives and Sealants, Coatings, and Other Industrial Applications |

| End-Use Industry | Construction, Automotive, Aerospace, Electrical and Electronics, and Consumer Goods |

| Formulation Type | Single Component Formulation and Multi-Component Formulation |

| Distribution Channel | Direct Sales, Online Sales, Distributors, and Retailers |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Anhui Taida New Materials, Mitsubishi Gas Chemical, Flint Hills Resources, BASF SE, Clariant AG, Polynt S.p.A, DOW Chemical Company, Wuxi Baichuan Chemical, Ineos Joliet, Jiangsu Zhengdan Chemical, and Sanco Industries |

| Additional Attributes | Dollar sales vary by product type, including purified TMA and technical-grade TMA; by application, such as plasticizers, coatings, adhesives, and resins; by end-use industry, spanning automotive, construction, electronics, and industrial manufacturing; by region, led by Asia-Pacific, Europe, and North America. Growth is driven by rising demand for high-performance coatings, flexible plastics, and specialty chemical applications. |

The global trimellitic anhydride market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the trimellitic anhydride market is projected to reach USD 2.4 billion by 2035.

The trimellitic anhydride market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in trimellitic anhydride market are high purity trimellitic anhydride and commercial grade trimellitic anhydride.

In terms of application, polyester resin production segment to command 32.5% share in the trimellitic anhydride market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Maleic Anhydride Market Size and Share Forecast Outlook 2025 to 2035

Acetic Anhydride Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA