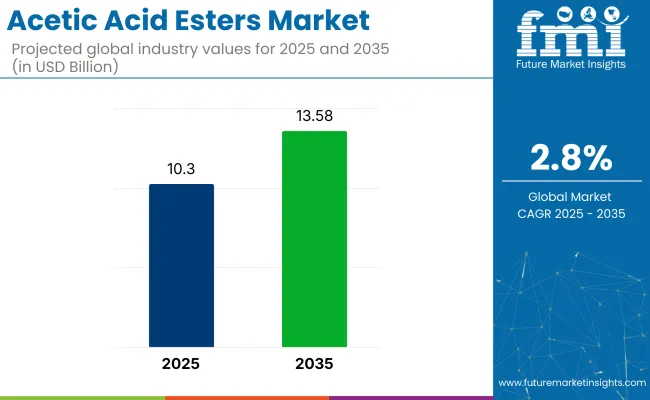

The acetic acid esters market is anticipated to rise from USD 10.3 billion in 2025 to USD 13.58 billion by 2035, with a compound annual growth rate (CAGR) of 2.8%.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 10.3 billion |

| Projected Market Size in 2035 | USD 13.58 billion |

| CAGR (2025 to 2035) | 2.8% |

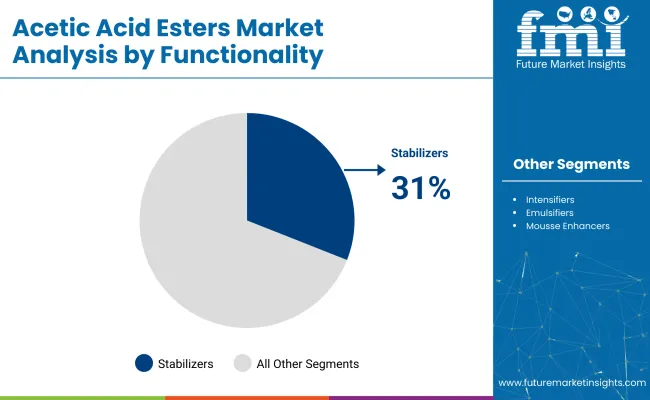

The industry is experiencing steady growth, driven by increasing demand in the food and beverages industry and printing and coatings applications. Stabilizers continue to be the most sought-after functionality, as they play a vital role in enhancing the shelf life and stability of food products.

As demand for processed food, confectionery items, and ready-to-use solutions continues to rise globally, the industry for acetic acid esters will maintain its steady growth trajectory. This growth is especially visible in regions like China, India, and the United States, where acetic acid esters are extensively used in various industrial applications.

In a 2024 statement, David Brooks, CEO of Ineos Acetyls, expressed frustration with government policies, stating, “We are being punished for doing the right thing. We've delivered on decarbonisation, exceeding our expectations, and this is the response we get.” His comments highlight the challenges faced by companies in the acetic acid esters industry when striving to implement eco-friendly practices amid regulatory hurdles, despite significant investments in green initiatives.

The acetic acid esters market holds significant shares within its parent markets. In the chemical industry market, it accounts for approximately 2-3%, as acetic acid esters are a niche chemical used across several industries. In the solvents market, its share is higher, contributing around 5-7%, due to the widespread use of esters like ethyl acetate in paints, coatings, and adhesives.

In the food and beverage additives market, acetic acid esters make up about 1-2%, primarily used as flavoring agents and preservatives. Within the pharmaceutical market, its share is smaller at 0.5-1%, as they are used mainly in the synthesis of active pharmaceutical ingredients. In the cosmetics and personal care market, acetic acid esters represent around 1&-2%, used in various formulations for their solvent properties and fragrance enhancement.

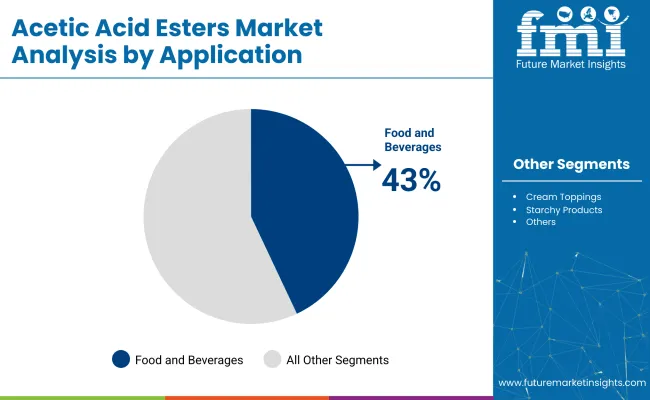

The industry is segmented by functionality into intensifiers, stabilizers, emulsifiers, and mousse enhancers. It is segmented by application into printing and coatings, food and beverages, cream toppings (coffee creams), whipping creams (shunt powders), starchy products, ice cream, sweet toppings, pastry, cakes, cake mixtures, bread and other bread varieties, candies (film coatings), sausages, and other industries.

Industry analysis has been carried out in North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic countries, Russia & Belarus, and the Middle East & Africa.

The food and beverages sector is projected to hold a leading 43% share of the market in 2025. The growing demand for processed foods and beverages, particularly in emerging economies, is the key driver behind this growth, with acetic acid esters being pivotal in enhancing flavor, texture, and shelf life.

While these ingredients help maintain food quality and meet consumer expectations, rising raw material costs and tighter regulations may restrict further growth. The sector could face potential disruptions from tariff expirations, which may cause pricing volatility and lead to a 5% increase in material costs for manufacturers.

The stabilizer segment is projected to dominate with a 31% share of the market in 2025. Their critical function in preventing degradation and maintaining consistency across various food products, such as emulsions, creams, and toppings, drives this demand.

While the cosmetics and pharmaceutical sectors also support growth, fluctuations in raw material availability, such as natural gums, could put pressure on pricing, potentially increasing stabilizer costs by up to 7% by 2027. The expiration of key patents in the stabilizer market could lead to increased competition and lower margins for established players.

The industry is driven by increasing demand for functional food ingredients and the expansion of food applications. However, supply chain constraints and price fluctuations may limit industry growth in certain regions.

Growing Demand for Functional Food Additives and Processed Foods

The industry is experiencing substantial growth, driven by their essential role in the food and beverage industry, especially within processed foods. As consumers demand longer shelf life and consistent quality in their food products, acetic acid esters serve as vital stabilizers and texture enhancers.

The growing convenience food sector, particularly in emerging economies like India and China, is accelerating the demand for these ingredients. The rising trend for functional food ingredients-foods that offer health benefits beyond basic nutrition-continues to fuel the use of acetic acid esters in a variety of products, including dairy, bakery, and snack foods.

Supply Chain Challenges and Price Volatility

Despite robust demand, the industry faces significant challenges due to raw material price fluctuations and supply chain disruptions. Acetic acid, a key precursor in the production of acetic acid esters, is subject to volatile pricing, impacting overall production costs.

Moreover, geopolitical instability and climate-related factors in key manufacturing regions create uncertainty in supply chains, leading to price hikes. These ongoing supply chain challenges could limit the scalability and affordability of acetic acid esters, particularly in emerging industries where price sensitivity is a major factor in consumer adoption.

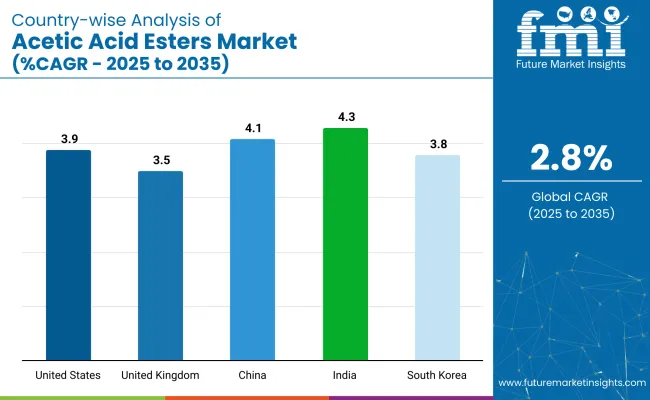

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 3.9% |

| United Kingdom | 3.5% |

| China | 4.1% |

| India | 4.3% |

| South Korea | 3.8% |

The global acetic acid esters market is forecast to expand at a CAGR of 2.8% between 2025 and 2035. Among OECD countries, the United States stands out with a CAGR of 3.9%, supported by consistent demand in food, pharmaceuticals, and plastics.

The United Kingdom follows at 3.5%, benefiting from its mature industrial base and steady consumption in food and manufacturing sectors. South Korea, another key OECD player, is expected to grow at 3.8%, backed by demand for specialty chemicals in electronics and packaging.

In contrast, BRICS economies are showing faster growth. China is projected to grow at 4.1%, with its industrial sector expanding applications in solvents, coatings, and plasticizers. India leads globally with a 4.3% CAGR, driven by rising use in pharmaceuticals and automotive chemicals.

This growth pattern reflects a regional shift. While OECD countries continue to provide stability, BRICS economies-particularly India and China-are becoming the main drivers. ASEAN economies are also expected to gain relevance in future demand trajectories.

Demand for acetic acid esters in the United States is projected to register 3.9% CAGR through 2035. The demand for acetic acid esters is driven by industries such as food and beverages, pharmaceuticals, and plastics, which continue to grow steadily. While domestic logistics costs remain 6% below the global mean, providing a margin advantage, rising labor costs and increasing compliance fees are expected to trim profitability by up to 3%.

Shifts in federal regulations, such as the introduction of new incentives for domestic production, are likely to drive a 4% increase in market growth. Furthermore, 70% of American consumers are reported to prefer clean-label products, driving demand for cleaner ingredient solutions (IFIC Survey, 2025).

The United Kingdom market is expected to grow at a CAGR of 3.5%. The demand for premium food products and functional ingredients, especially acetic acid esters, is driving significant growth. The UK benefits from a premium positioning with its average unit prices being 8% above the European mean, while the post-EU trade landscape introduces additional costs, such as customs processing fees, that erode profitability by approximately 3%. Regulatory frameworks, including food safety standards, continue to provide a stable environment, fostering industry growth by ensuring high standards in food production.

The growing consumer preference for health-conscious and clean-label products further supports this upward trend, with 65% of UK consumers showing a marked preference for functional ingredients in their food products (British Nutrition Foundation, 2025).

China is expected to grow at a CAGR of 4.1% through 2035. The rapid industrialization of China, coupled with the rising consumption of processed foods, is driving the demand for acetic acid esters. The growing middle class and increased consumer awareness of the health benefits of functional foods further contribute to market growth, particularly in dairy and bakery applications. Although a 5% increase in raw material costs is anticipated, the expanding consumer base provides a margin-positive outlook for the industry.

Government subsidies for food safety improvements are expected to raise the market by an additional 4%. The preference for functional ingredients is growing, with 69% of Chinese consumers choosing functional foods (China Consumer Health Survey, 2025).

Demand for acetic acid esters in India is set to grow at a CAGR of 4.3% through 2035. The increasing demand for convenience foods and the growing adoption of functional ingredients are key drivers for market growth, particularly in the food and beverage sectors.

Dairy products, bakery items, and beverages are the largest categories benefiting from the use of acetic acid esters for improved stability and shelf life. As rising incomes continue to drive food consumption, the need for longer shelf life in food products further fuels demand for acetic acid esters. Government policies supporting food innovation are expected to add 5% to market growth, while consumer preferences for convenience foods continue to shape the industry's future.

Sales of acetic acid esters in South Korea is likely to grow at a CAGR of 3.8% during the forecast period. The country’s strong demand for processed foods, particularly snacks and beverages, presents substantial growth potential for acetic acid esters. Health-conscious eating trends and a rising preference for stabilized, emulsified products in food continue to drive market expansion.

South Korea’s emphasis on food innovation and the growing demand for high-quality, premium food ingredients further boost the adoption of acetic acid esters, particularly in the food and beverage sector. Despite rising labor costs, which are expected to increase by 4%, the market remains favorable, with government incentives for food innovation expected to contribute an additional 3% to overall growth.

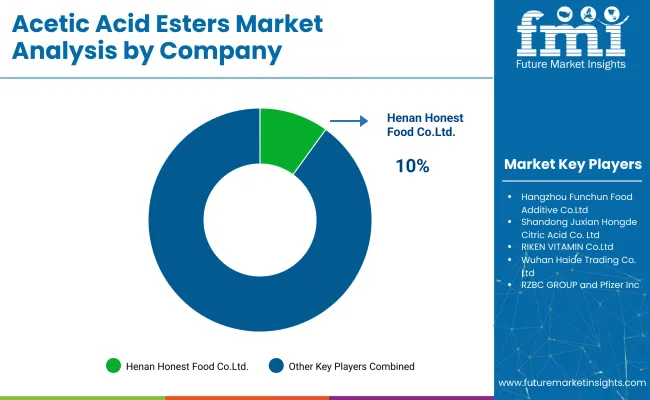

The global industry features a competitive landscape with dominant players, key players, and emerging players. Dominant players such as Henan Honest Food Co., Ltd., Hangzhou Funchun Food Additive Co., Ltd., and Shanghai Richem International Co., Ltd. lead the industry with extensive product portfolios, strong R&D capabilities, and robust distribution networks across food, beverage, nutraceutical, and cosmetic sectors.

Key players including Anhui Herman Impex Co., Ltd., Yantai Lushun Huitong Biotechnology Co., Ltd., and RZBC GROUP offer specialized formulations tailored to specific applications and regional industries. Emerging players, such as Pfizer Inc., Weifang Ensign Industry Co., Ltd., and RIKEN VITAMIN Co., Ltd., focus on innovative extraction technologies and cost-effective solutions, expanding their presence in the global industry.

In 2024, it was highlighted that industries are increasingly adopting bio-based acetic acid esters due to their reduced environmental impact. This growing preference aligns with consumer demand for sustainable products, driving the shift towards eco-friendly solutions in various industries.In 2024, it was noted that technological innovations in production processes are enhancing the properties of acetic acid esters. These advancements enable the development of high-performance esters, catering to specialized applications across industries, solidifying their role in industry growth.

| Report Attributes | Details |

|---|---|

| Estimated Industry Size (2025E) | USD 10.3 billion |

| Projected Industry Value (2035F) | USD 13.58 billion |

| Value-based CAGR (2025 to 2035) | 2.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million tons for volume |

| Application Segmentation | Printing and Coatings, Food and Beverages (Cream toppings, Whipping creams, Starchy products, Ice cream, Pastry, Bread, Candies, Sausages, Others) |

| Functionality Segmentation | Intensifier, Stabilizers, Emulsifiers, Mousse Enhancer |

| Regions Covered | North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, Australia, New Zealand, GCC Countries, South Africa |

| Key Players Influencing the Industry | Henan Honest Food Co., Ltd, Hangzhou Funchun Food Additive Co., Ltd., Shanghai Richem International Co., Ltd., Anhui Herman Impex Co., Ltd., Yantai Lushun Huitong Biotechnology Co., Ltd., RZBC GROUP, Pfizer Inc., Weifang Ensign Industry Co., Ltd., RIKEN VITAMIN Co., Ltd., Guangzhou Cardio Biotechnology Co., Ltd., Jiaxing Range Import and Export Co., Ltd., Wuhan Haide Trading Co., Ltd., COFCO Biochemical (Anhui) Co. Ltd, Archer Daniels Midland Company, Shandong Juxian Hongde Citric Acid Co. Ltd. |

| Additional Attributes | Dollar sales by application type, functionality, and region, increasing demand for acetic acid esters in the food industry, rising adoption of emulsifiers and stabilizers in food products, growing use of esters in coatings and printing, regional trends in biotechnological advancements in ester production. |

The industry is segmented into Intensifiers, Stabilizers, Emulsifiers, and Mousse Enhancers.

The industry is segmented into Printing and Coatings, Food and Beverages, Cream Toppings (coffee creams), Whipping Creams (shunt powders), Starchy Products, Ice Cream, Sweet Toppings, Pastry, Cakes, Cake Mixtures, Bread and Other Bread Varieties, Candies (film coatings), Sausages, and Other Industries.

Industry analysis has been carried out in North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus, and the Middle East & Africa.

The industry size is estimated to be USD 10.3 billion in 2025 and USD 13.58 billion by 2035.

The expected CAGR is 2.8% from 2025 to 2035.

The Food and Beverages application segment holds the largest industry share at 43%.

Henan Honest Food Co., Ltd. is the leading company in the industry, holding a 10% industry share.

The projected CAGR for India is 4.3% from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mixed Acetic and Tartaric Acid Esters of Mono and Diglycerides of Fatty Acids Market

Acetic Ether Market Size and Share Forecast Outlook 2025 to 2035

Acetic Anhydride Market Size and Share Forecast Outlook 2025 to 2035

Acetic Acid Market

Peracetic Acid Market Size and Share Forecast Outlook 2025 to 2035

Glacial Acetic Acid Market Growth – Trends & Forecast 2024-2034

Alpha-Sulfophenylacetic Acid Market Size and Share Forecast Outlook 2025 to 2035

Acid Resistant Pipe Market Forecast and Outlook 2025 to 2035

Acid Coil Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Acid Filling and Leveling Machine Market Size and Share Forecast Outlook 2025 to 2035

Acid Chlorides Market Size and Share Forecast Outlook 2025 to 2035

Acid-Sensitive APIs Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Acidified Whey Protein Market Analysis - Size, Share & Trends 2025 to 2035

Acid Dyes Market Growth - Trends & Forecast 2025 to 2035

Acidity Regulator Market Growth - Trends & Forecast 2025 to 2035

Acid Proof Lining Market Trends 2025 to 2035

Acid Citrate Dextrose Tube Market Trends – Growth & Industry Outlook 2024-2034

Acid Orange Market

Antacids Market Analysis – Size, Trends & Forecast 2025 to 2035

Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA