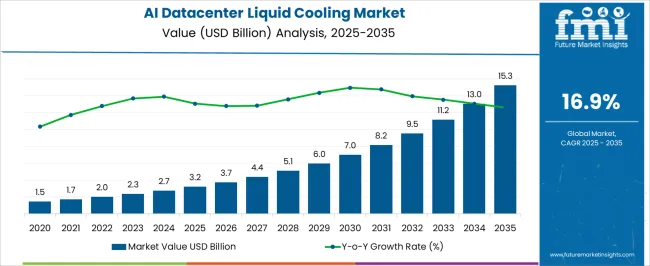

The global AI datacenter liquid cooling market is projected to grow from USD 3.2 billion in 2025 to approximately USD 15.7 billion by 2035, recording an absolute increase of USD 12.5 billion over the forecast period. This translates into a growth of 390.6% over the decade. The market is forecast to expand at a compound annual growth rate (CAGR) of 16.9%, with the overall market size projected to grow by nearly 4.9x by the end of the forecast period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 3.2 billion |

| Industry Value (2035F) | USD 15.7 billion |

| CAGR (2025 to 2035) | 16.9% |

Between 2025 and 2030, the market is projected to expand from USD 3.2 billion to USD 7.2 billion, adding approximately USD 4.0 billion. Growth in this first phase will be supported by accelerating AI workload deployment across hyperscale datacenters, particularly driven by generative AI and machine learning applications requiring unprecedented computational power. The surge in GPU-based processing and high-density server configurations will create critical thermal management challenges that traditional air cooling cannot address effectively.

From 2030 to 2035, the market is expected to grow from USD 7.2 billion to USD 15.7 billion, a further increase of USD 8.5 billion. This second phase will be shaped by mainstream adoption of immersion cooling technologies, advanced engineered coolants optimized for AI workloads, and integration of liquid cooling systems with renewable energy infrastructure. Edge AI datacenter deployments and emerging quantum-AI hybrid systems will drive demand for specialized cooling solutions capable of handling extreme power densities exceeding 100kW per rack.

From 2020 to 2024, the market rose from USD 0.8 billion to USD 3.2 billion, propelled by the explosive growth of AI training workloads and the deployment of high-performance GPUs in datacenter environments. The introduction of NVIDIA's H100 and subsequent AI accelerators created unprecedented power density challenges that traditional cooling methods could not address. Leading cloud providers including Microsoft, Google, and Meta began large-scale implementations of liquid cooling solutions to support their AI infrastructure buildouts, establishing the foundation for the 2025 to 2035 growth cycle.

AI Workload Intensity Drives Thermal Management Innovation

The rapid proliferation of generative AI, large language models, and machine learning training requires massive computational power concentrated in dense server configurations. Modern AI chips such as NVIDIA H100s and AMD MI300X generate heat loads exceeding 700W per GPU, creating thermal densities that air cooling systems cannot effectively manage. Liquid cooling technologies provide the thermal capacity and efficiency necessary to maintain optimal operating temperatures while enabling higher rack densities and improved energy efficiency.

Energy Efficiency Mandates Push Datacenter Operators Toward Advanced Cooling

Regulatory pressure from energy efficiency standards and sustainability commitments are driving datacenter operators to adopt liquid cooling solutions that can reduce overall power consumption by 20-40% compared to traditional air cooling systems. Government initiatives such as the EU Green Deal and DOE efficiency standards in the United States are mandating power usage effectiveness (PUE) improvements that can only be achieved through advanced thermal management technologies.

Hyperscale Infrastructure Expansion Accelerates Adoption

The global expansion of hyperscale AI datacenters by cloud service providers is creating unprecedented demand for scalable liquid cooling solutions. Major technology companies are investing billions in AI infrastructure to support growing demand for AI-as-a-service offerings, autonomous systems, and enterprise AI adoption. This infrastructure buildout requires cooling technologies capable of supporting rack densities exceeding 50kW while maintaining reliability and cost-effectiveness at scale.

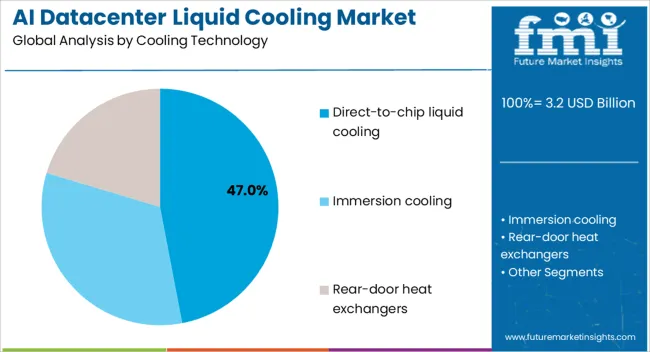

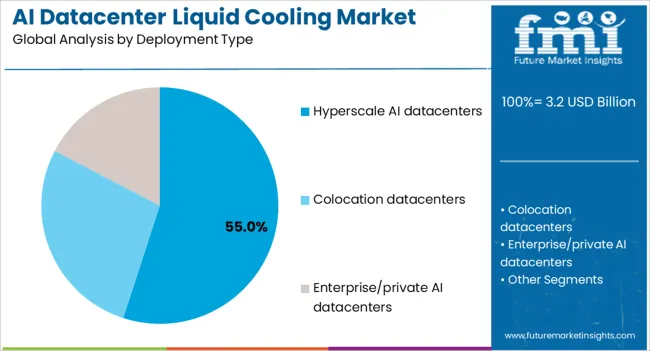

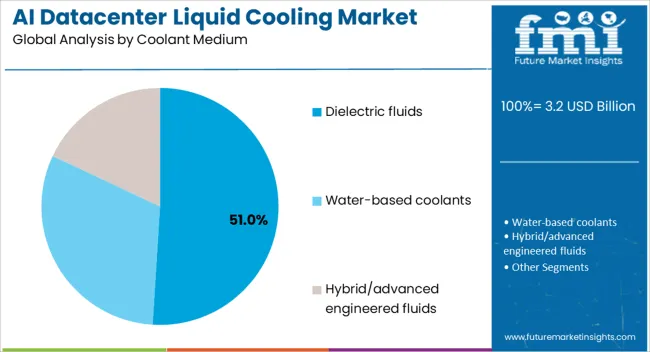

The market is segmented by cooling technology into direct-to-chip liquid cooling, immersion cooling, and rear-door heat exchangers. By deployment type, the market includes hyperscale AI datacenters, colocation datacenters, and enterprise/private AI datacenters. Coolant medium segmentation comprises dielectric fluids, water-based coolants, and hybrid/advanced engineered fluids. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

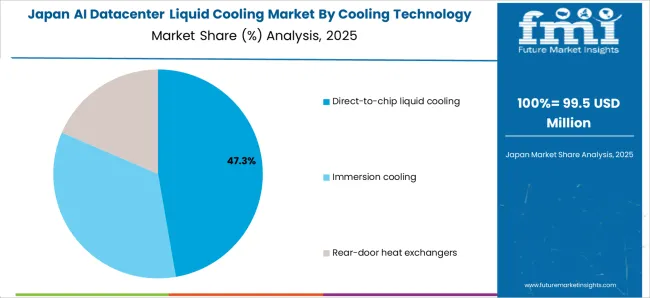

Direct-to-chip liquid cooling is projected to command a dominant 47% share of the AI datacenter liquid cooling market by 2025, establishing itself as the preferred solution for high-performance AI workloads. This technology delivers coolant directly to heat-generating components such as CPUs and GPUs through precisely engineered cold plates, enabling efficient heat transfer at the source. The approach provides superior thermal performance compared to air cooling while maintaining compatibility with existing datacenter infrastructure and server designs.

The widespread adoption of direct-to-chip cooling is driven by its ability to handle the extreme power densities of modern AI accelerators while providing precise temperature control essential for maintaining chip performance and reliability. Leading server manufacturers have integrated liquid cooling capabilities into their AI-optimized platforms, making direct-to-chip solutions readily available for hyperscale deployments. The technology's modularity and scalability enable datacenter operators to implement liquid cooling selectively for high-density AI clusters while maintaining air cooling for traditional workloads.

Hyperscale AI datacenters are set to account for 55% of liquid cooling deployments in 2025, reflecting their role as the primary drivers of AI infrastructure expansion. These facilities, operated by cloud service providers and technology giants, require cooling solutions capable of supporting thousands of AI accelerators in dense configurations while maintaining energy efficiency at scale. The concentrated deployment of high-power AI chips in these environments creates thermal challenges that can only be addressed through advanced liquid cooling technologies.

Colocation datacenters represent 27% of deployments, serving enterprise customers requiring dedicated AI infrastructure without the capital investment of private facilities. These providers are implementing liquid cooling capabilities to attract high-density AI workloads while differentiating their services in the competitive colocation market. Enterprise and private AI datacenters account for 18% of deployments, driven by organizations requiring on-premises AI capabilities for sensitive workloads, regulatory compliance, or latency-sensitive applications.

Dielectric fluids are forecasted to capture 51% of the coolant medium market in 2025, driven by their superior performance in immersion cooling applications and compatibility with sensitive electronic components. These engineered fluids provide excellent thermal conductivity while maintaining electrical insulation properties essential for direct contact with servers and networking equipment. Advanced dielectric formulations offer environmental benefits through reduced toxicity and improved biodegradability compared to traditional cooling fluids.

Water-based coolants represent 38% of the market, primarily used in direct-to-chip applications where cooling loops are isolated from electronic components. These solutions offer cost advantages and proven performance while requiring careful system design to prevent leaks and corrosion. Hybrid and advanced engineered fluids account for 11% of the market, representing emerging technologies that combine the benefits of multiple coolant types while addressing specific performance or environmental requirements.

Immersion Cooling Gains Traction for Ultra-High-Density Deployments

Datacenter operators are increasingly adopting immersion cooling systems that submerge entire servers in dielectric fluids, enabling rack densities exceeding 100kW while eliminating the need for traditional cooling infrastructure. These systems provide uniform temperature distribution and eliminate hot spots that can degrade AI accelerator performance.

Integration with Renewable Energy and Waste Heat Recovery

Advanced liquid cooling systems increasingly incorporate heat recovery capabilities that capture waste heat for building heating, district energy systems, or industrial processes. This integration enhances overall energy efficiency while supporting datacenter sustainability goals and reducing operating costs.

AI-Optimized Cooling System Intelligence

Cooling system manufacturers are developing AI-powered thermal management platforms that optimize coolant flow, predict maintenance requirements, and adapt cooling capacity based on dynamic workload patterns. These intelligent systems improve energy efficiency while ensuring optimal performance for varying AI computational loads.

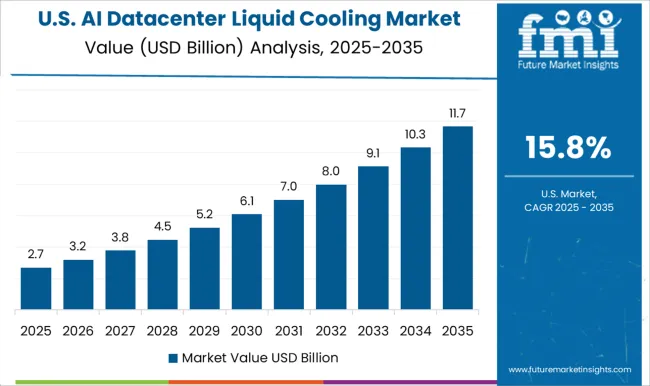

The USA's AI datacenter liquid cooling market is projected to grow at 18.2% CAGR through 2035, the highest globally. Major technology companies including NVIDIA, Microsoft, Google, and Meta are investing heavily in AI infrastructure buildouts requiring advanced cooling solutions. Department of Energy efficiency standards and state-level energy regulations are driving adoption of liquid cooling technologies that can achieve PUE improvements necessary for regulatory compliance.

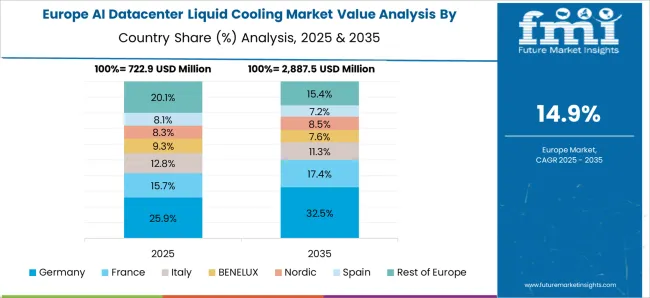

Germany's AI datacenter liquid cooling market is expected to expand at 17.5% CAGR, driven by EU Green Deal mandates and the country's leadership in renewable energy integration. German datacenter operators are implementing liquid cooling solutions to meet strict energy efficiency requirements while supporting the growth of AI applications across automotive, manufacturing, and financial services sectors. The country's engineering expertise in thermal management and industrial cooling systems supports market development.

The UK AI datacenter liquid cooling market is projected to grow at 16.9% CAGR, supported by rapid expansion of AI-as-a-service offerings and colocation capacity supporting enterprise AI adoption. London's position as a European technology hub is driving demand for high-density AI infrastructure requiring advanced cooling solutions. Government initiatives supporting AI development and digital transformation are creating favorable conditions for liquid cooling market expansion.

India's AI datacenter liquid cooling market is forecast to expand at 16.7% CAGR, driven by explosive growth in cloud services and AI datacenter deployment across major metropolitan areas. Government incentives for energy-efficient infrastructure and the country's tropical climate create strong demand for liquid cooling solutions that can maintain optimal operating temperatures while reducing energy consumption. Local and international providers are scaling AI infrastructure to serve the rapidly digitizing Indian economy.

China's AI datacenter liquid cooling market is expected to grow at 16.3% CAGR, supported by state-backed AI datacenter development and strategic shift toward liquid immersion cooling for power density optimization. The country's national AI strategy and significant government investment in AI infrastructure are creating demand for advanced cooling technologies. Chinese technology companies are implementing liquid cooling solutions to support domestic AI development while reducing dependence on foreign cooling technologies.

Japan's AI datacenter liquid cooling market is projected to grow at 15.8% CAGR, focused on AI workload clustering in telecommunications and robotics applications requiring precise thermal management. The country's advanced manufacturing sector and leadership in robotics are driving demand for liquid cooling solutions supporting AI-powered automation and control systems. Japanese technology companies are developing specialized cooling applications for edge AI and industrial automation environments.

Singapore's AI datacenter liquid cooling market is expected to expand at 15.2% CAGR, with tropical climate conditions making liquid cooling the preferred solution for energy efficiency and space optimization in land-constrained environments. The country's position as a regional datacenter hub and government support for sustainable technology adoption are driving liquid cooling implementation. Leading cloud providers are deploying advanced cooling technologies to optimize datacenter operations in challenging environmental conditions.

The AI datacenter liquid cooling market is rapidly evolving, characterized by intense competition between established cooling system manufacturers, specialized liquid cooling technology providers, and emerging companies developing next-generation thermal management solutions. With the explosive growth of AI workloads requiring unprecedented power densities, cooling system providers are prioritizing innovation in direct-to-chip cooling, immersion technologies, and intelligent thermal management systems. The market is witnessing significant consolidation as larger players acquire specialized technology companies to expand their liquid cooling capabilities and serve the growing hyperscale datacenter market.

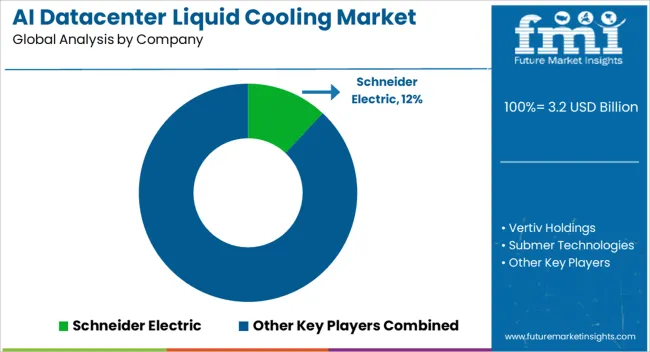

Schneider Electric is projected to lead the market with a 12% share in 2025, leveraging its comprehensive portfolio of cooling solutions and strong relationships with hyperscale datacenter operators. The company's strength lies in its integrated approach, combining advanced liquid cooling technologies with power distribution, monitoring systems, and datacenter infrastructure management. This holistic model has enabled strong partnerships with major cloud service providers and technology companies, reinforcing Schneider Electric's leadership position in the rapidly expanding AI datacenter cooling market.

| Items | Values |

|---|---|

| Quantitative Units | USD 3.2 billion (2025) |

| Cooling Technology | Direct-to-chip liquid cooling, Immersion cooling, Rear-door heat exchangers |

| Deployment Type | Hyperscale AI datacenters, Colocation datacenters, Enterprise/private AI datacenters |

| Coolant Medium | Dielectric fluids, Water-based coolants, Hybrid/advanced engineered fluids |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Germany, United Kingdom, Japan, China, India, Singapore |

| Key Companies Profiled | Schneider Electric, Vertiv Holdings, Submer Technologies, LiquidStack, CoolIT Systems, Asperitas, Green Revolution Cooling, Iceotope Technologies, Asetek, Rittal GmbH, Fujitsu Ltd. |

The global AI datacenter liquid cooling market is estimated to be valued at USD 3.2 billion in 2025.

The market size for the AI datacenter liquid cooling market is projected to reach USD 15.3 billion by 2035.

The AI datacenter liquid cooling market is expected to grow at a 16.9% CAGR between 2025 and 2035.

The key product types in AI datacenter liquid cooling market are direct-to-chip liquid cooling, immersion cooling and rear-door heat exchangers.

In terms of deployment type, hyperscale AI datacenters segment to command 55.0% share in the AI datacenter liquid cooling market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

AI-powered In-car Assistant Market Forecast and Outlook 2025 to 2035

Airborne Molecular Contamination Control Services Market Forecast and Outlook 2025 to 2035

Airflow Balancer Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

AI-defined Vehicle Market Forecast and Outlook 2025 to 2035

AI in Oil and Gas Market Forecast and Outlook 2025 to 2035

AIOps Platform Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Radar Market Size and Share Forecast Outlook 2025 to 2035

AI Trading Platform Market Forecast Outlook 2025 to 2035

AI-Powered CRM Platform Market Forecast Outlook 2025 to 2035

AI-driven Predictive Maintenance Market Forecast and Outlook 2025 to 2035

AI Animation Tool Market Forecast Outlook 2025 to 2035

AI in Packaging Market Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Airport Ground Transportation Market Forecast and Outlook 2025 to 2035

AI Waste Sorting Robots Market Forecast and Outlook 2025 to 2035

AI Image Editor Market Forecast and Outlook 2025 to 2035

Airless Sprayer Accessories Market Size and Share Forecast Outlook 2025 to 2035

Air Purge Valve Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA