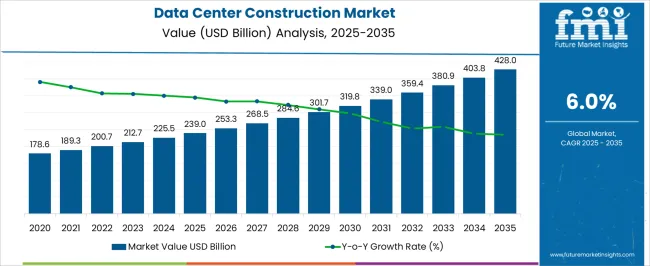

The data center construction market is projected to grow from USD 239.0 billion in 2025 to USD 428.0 billion in 2035, reflecting a CAGR of 6.0%. This represents an absolute dollar opportunity of USD 189.0 billion over the decade. The market is expected to expand steadily, reaching USD 253.3 billion in 2026, USD 284.6 billion in 2029, USD 319.8 billion in 2031, and USD 403.8 billion in 2034.

The consistent growth highlights rising demand for data center infrastructure, offering construction firms and investors significant potential to capture incremental revenue and strengthen their market presence over the ten-year period. From an absolute dollar perspective, annual incremental growth starts at approximately USD 11–14 billion in the early years and rises to around USD 25 billion in the later stages, culminating in USD 189.0 billion by 2035. Intermediate values, such as USD 225.5 billion in 2025, USD 301.7 billion in 2030, and USD 380.9 billion in 2033, illustrate a predictable growth trajectory. This allows stakeholders to strategically plan investments, optimize resources, and expand operational capacity efficiently.

| Metric | Value |

|---|---|

| Data Center Construction Market Estimated Value in (2025 E) | USD 239.0 billion |

| Data Center Construction Market Forecast Value in (2035 F) | USD 428.0 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

Between 2025 and 2027, the market rises from USD 239.0 billion to USD 253.3 billion, marking the early growth phase where initial investments in data center projects drive moderate incremental gains. Another significant breakpoint occurs around 2029–2031, as the market grows from USD 284.6 billion to USD 319.8 billion, reflecting a period of faster expansion and higher absolute dollar growth. These stages are critical for construction firms and investors to align resources, optimize project planning, and capture revenue during periods of rising demand.

The final major breakpoint is observed between 2033 and 2035, when the market increases from USD 403.8 billion to USD 428.0 billion, representing the largest absolute dollar growth in the later stage of the decade. Intermediate years, such as 2030–2032, show steady expansion from USD 301.7 billion to USD 380.9 billion, acting as bridging periods that sustain momentum.

The market is experiencing robust growth driven by the increasing global demand for cloud computing, big data analytics, and digital transformation across various industries. Current market dynamics are shaped by rapid expansion in internet infrastructure, rising adoption of edge computing, and escalating investments in hyperscale data centers to support remote work and digital services.

The increasing need for energy-efficient and scalable data centers has led to innovations in construction techniques and modular designs, enabling faster deployment and enhanced operational efficiency. Additionally, evolving regulations around data security and environmental standards are influencing construction practices and material choices.

The market outlook remains positive as enterprises and governments prioritize upgrading legacy data centers to meet the surging demand for bandwidth and storage capacity, paving the way for significant growth opportunities in medium-sized and specialized facility constructions.

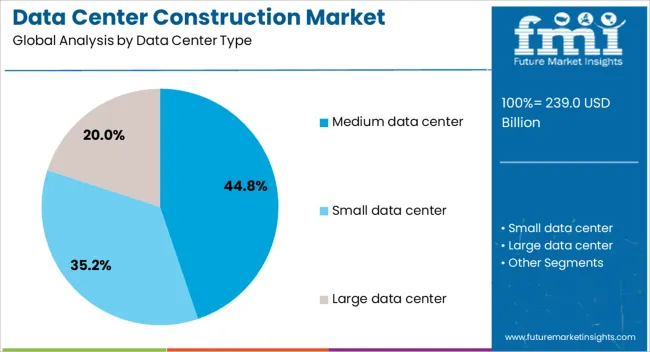

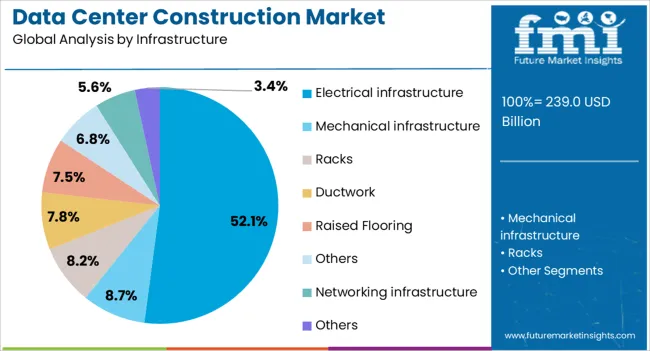

The data center construction market is segmented by data center type, infrastructure, end use, and geographic regions. By data center type, data center construction market is divided into Medium data center, Small data center, and Large data center. In terms of infrastructure, data center construction market is classified into Electrical infrastructure, Mechanical infrastructure, Racks, Ductwork, Raised Flooring, Others, Networking infrastructure, and Others.

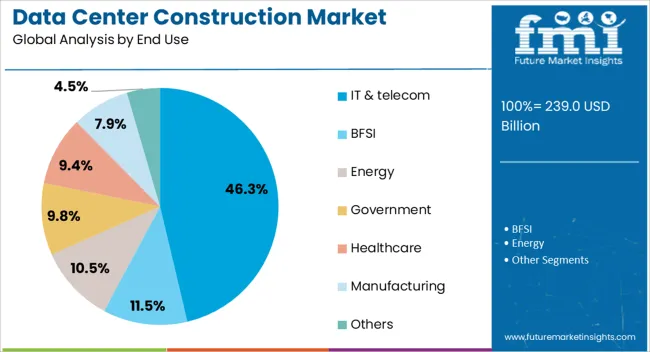

Based on end use, data center construction market is segmented into IT & telecom, BFSI, Energy, Government, Healthcare, Manufacturing, and Others. Regionally, the data center construction industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Medium data center type is projected to hold 44.8% of the market revenue share in 2025, establishing it as the leading segment. This prominence is attributed to the balance these facilities offer between scalability and cost efficiency, making them ideal for enterprises seeking to expand capacity without the complexity of hyperscale centers.

The growing preference for localized data processing, driven by latency reduction needs and data sovereignty requirements, has fueled demand for medium data centers. Additionally, the modular construction approach often adopted in this segment facilitates quicker build times and flexibility in design, which aligns with the evolving technological and operational demands.

The adaptability of medium data centers to support hybrid cloud architectures and specialized workloads further reinforces their market dominance.

The electrical infrastructure segment is expected to command 52.1% of the market revenue in 2025, positioning it as the most significant infrastructure component. This dominance stems from the critical role electrical systems play in ensuring uninterrupted power supply, operational reliability, and energy efficiency.

The increasing deployment of high-density computing equipment necessitates advanced electrical infrastructure capable of handling elevated power loads with minimal downtime. Innovations in power distribution units, uninterruptible power supplies, and energy management systems have been integrated to optimize efficiency and reduce carbon footprints.

Regulatory pressures and sustainability initiatives have further driven investments in electrical infrastructure upgrades, making it a focal point in data center construction projects.

The IT and telecom end-use industry segment is anticipated to hold 46.3% of the market revenue in 2025, marking it as the dominant sector. This leadership results from the exponential growth in data traffic and the proliferation of digital services that rely heavily on robust data center infrastructure.

Telecom operators and IT service providers are investing substantially in building and upgrading data centers to support 5G networks, cloud platforms, and content delivery networks. The surge in demand for low-latency, high-availability services has necessitated the expansion of data center footprints within this sector.

Furthermore, the trend toward distributed computing models has emphasized the need for strategically located facilities to enhance network performance, further contributing to the growth of this segment.

The data center construction market is expanding as global demand for cloud computing, edge computing, and high-performance data storage rises. Enterprises, hyperscale cloud providers, and colocation facilities require state-of-the-art infrastructure to support AI, big data analytics, and 5G services. Construction involves building highly resilient facilities with advanced power, cooling, and network systems.

Manufacturers and contractors offering modular, energy-efficient, and scalable designs gain a competitive edge. The adoption of prefabricated components, smart building automation, and sustainable construction practices further accelerates growth. Rising investments in hyperscale and edge data centers, especially in emerging regions, alongside corporate sustainability initiatives, reinforce demand for modern, secure, and high-performance data center facilities worldwide.

Market growth is restrained by high capital expenditure and complex regulatory compliance requirements. Data center construction demands significant investment in land acquisition, power supply systems, cooling infrastructure, fire safety, and security measures. Compliance with local building codes, environmental regulations, and energy efficiency standards adds operational complexity. Obtaining permits and meeting zoning requirements can lengthen project timelines. Skilled labor and specialized contractors are essential for building resilient, high-density facilities. Additionally, integrating advanced electrical and mechanical systems while maintaining redundancy and uptime standards increases costs and technical risks. Until construction methods become more cost-efficient and regulatory approvals are streamlined, adoption may remain concentrated among large enterprises, hyperscale providers, and regions with established energy and infrastructure support.

Technological advancements are reshaping data center construction trends. Modular and prefabricated designs allow faster deployment, scalability, and cost optimization. Smart building technologies, including automated monitoring, AI-enabled energy management, and predictive maintenance, enhance operational efficiency. Liquid cooling, high-density rack configurations, and sustainable power solutions reduce energy consumption and improve performance. Integration with renewable energy sources, microgrids, and edge computing nodes supports environmental and operational objectives. These trends reflect a shift toward flexible, sustainable, and highly optimized data center facilities, catering to enterprise, cloud, and hyperscale operators seeking to meet evolving IT demands efficiently and reliably.

Opportunities in the data center construction market are driven by growing cloud adoption, digitalization, and enterprise IT transformation. Hyperscale and colocation providers continue to invest in large-scale facilities to support cloud services, AI, and IoT applications. Emerging markets, particularly in Asia-Pacific, Latin America, and the Middle East, present significant potential due to increasing internet penetration, digital infrastructure initiatives, and foreign investments. Corporations are expanding on-premise and hybrid data centers to meet internal and customer demands. Providers offering energy-efficient, modular, and compliant construction solutions can capture significant market share. Additionally, the increasing importance of edge data centers for low-latency applications creates new growth avenues in distributed and regional facility deployment.

Market growth is restrained by intense competition, site selection challenges, and operational complexity. Global and regional construction firms compete on cost, expertise, and delivery timelines, affecting profitability. Selecting appropriate locations requires balancing power availability, connectivity, climate considerations, and disaster risk. Construction and integration of complex electrical, mechanical, and cooling systems demand highly skilled personnel, increasing project risk. Maintenance, uptime assurance, and future scalability add operational challenges. Furthermore, fluctuating material costs and logistical constraints can extend timelines and budgets. Until construction processes become more standardized, efficient, and cost-effective, data center development may remain concentrated in regions with strong infrastructure, stable regulatory environments, and high enterprise or cloud demand.

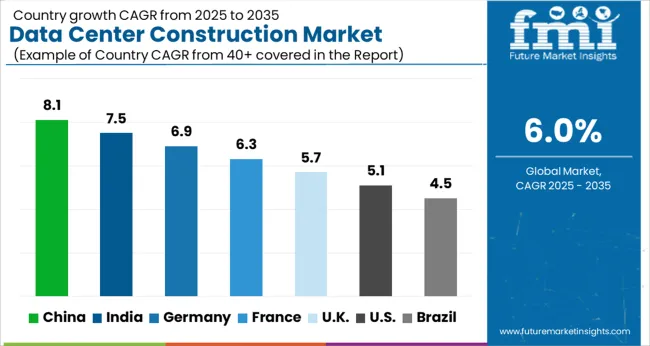

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

The global data center construction market was projected to grow at a 6.0% CAGR through 2035, driven by demand in IT infrastructure, cloud computing, and enterprise applications. Among BRICS nations, China recorded 8.1% growth as large-scale construction projects were commissioned and compliance with building and operational standards was enforced, while India at 7.5% growth saw expansion of development units to meet rising regional demand. In the OECD region, Germany at 6.9% maintained substantial output under strict industrial and safety regulations, while the United Kingdom at 5.7% relied on moderate-scale operations for commercial and enterprise data centers. The USA, expanding at 5.1%, remained a mature market with steady demand across cloud, IT, and enterprise segments, supported by adherence to federal and state-level quality and safety standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The data center construction market in China is growing at a CAGR of 8.1% due to increasing demand for cloud computing, big data, and internet services. Businesses, technology companies, and government organizations are investing in new data center facilities to support digital transformation and high performance computing. Growth is supported by the expansion of e-commerce, digital services, and enterprise IT infrastructure. Construction companies and developers are focusing on energy efficient designs, scalable architecture, and high reliability systems. Suppliers provide critical equipment including power systems, cooling solutions, and structural components tailored for large scale and high density data centers. Distribution networks through engineering, construction, and technology service providers enhance project delivery. Adoption is further driven by government initiatives promoting digital economy and secure data storage infrastructure. China continues to be a key growth region due to high technology adoption, rising data traffic, and large scale industrial and commercial digitalization.

Germany is growing at a CAGR of 6.9% in the data center construction market due to increasing demand for cloud computing, enterprise IT infrastructure, and digital services. Businesses, government institutions, and technology providers are investing in new facilities with high reliability, scalable capacity, and energy efficient design. Suppliers provide critical components such as power systems, cooling equipment, and structural solutions to ensure uninterrupted operation. Growth is supported by digitalization initiatives, rising data traffic, and enterprise IT expansion. Construction firms focus on modular and sustainable designs to optimize energy consumption and operational efficiency. Distribution networks through engineering and technology service providers ensure timely availability of materials and equipment. Adoption is further driven by regulations encouraging energy efficiency, renewable integration, and secure data storage infrastructure. Germany remains a key European market due to its strong IT ecosystem and digital economy.

India is witnessing growth at a CAGR of 7.5% in the data center construction market due to increasing adoption of cloud services, IT outsourcing, and digital infrastructure development. Technology companies, financial institutions, and government agencies are investing in new facilities to support secure, high performance, and scalable data storage. Growth is supported by rising internet usage, digital services, and enterprise IT requirements. Construction and engineering firms focus on energy efficiency, modular design, and high reliability systems. Suppliers provide critical equipment including power management, cooling systems, and structural components for modern data centers. Distribution through construction and technology service providers ensures timely project execution. Government policies promoting digital economy, cybersecurity, and IT infrastructure investments further drive market adoption. India’s expanding digital economy, rising data traffic, and corporate IT growth make it a key market for data center construction.

The United Kingdom market is expanding at a CAGR of 5.7% due to rising demand for cloud computing, digital services, and enterprise IT infrastructure. Corporates, technology companies, and government agencies are investing in data center construction to ensure secure, reliable, and scalable operations. Construction companies focus on energy efficient designs, modular systems, and high reliability structures. Suppliers provide power management solutions, cooling systems, and structural components tailored for high density data centers. Growth is further supported by digital economy initiatives, increasing data traffic, and rising demand for secure and high performance IT infrastructure. Distribution through engineering, construction, and technology service providers ensures timely delivery and accessibility. Adoption is also driven by government policies promoting data security, renewable energy integration, and energy efficient building standards. The United Kingdom continues to see steady growth in modern data center construction projects.

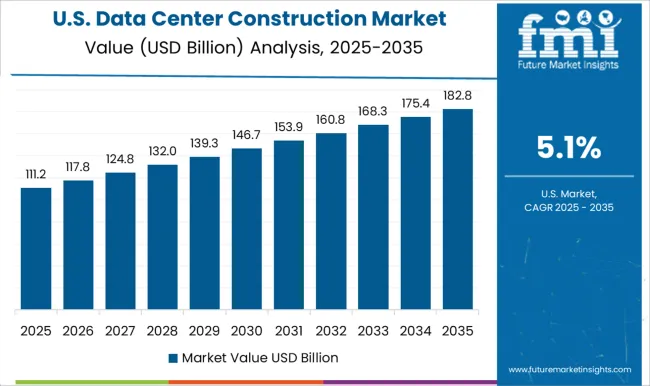

The United States market is growing at a CAGR of 5.1% supported by high demand for cloud services, IT infrastructure, and enterprise digital transformation. Corporates, technology providers, and government agencies are investing in data center construction to achieve scalable, secure, and energy efficient operations. Construction and engineering firms focus on modular design, high reliability, and energy efficient facilities. Suppliers provide power management systems, cooling solutions, and structural components suitable for high density data centers. Growth is further supported by increasing internet traffic, adoption of cloud computing, and rising demand for secure enterprise IT infrastructure. Distribution through technology and construction service providers ensures material and equipment accessibility. Government regulations promoting energy efficiency, renewable energy integration, and cybersecurity further drive market adoption. The United States remains a key region for modern and large scale data center construction projects.

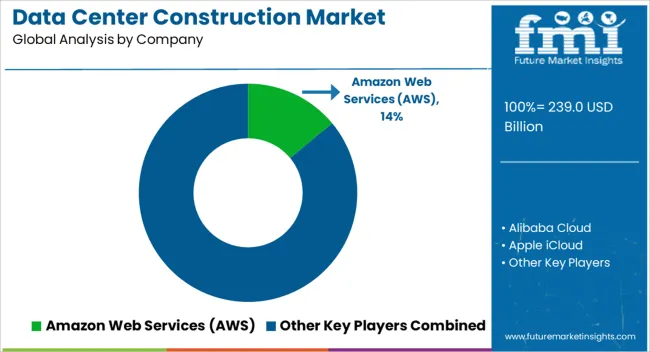

The data center construction market is dominated by providers such as Amazon Web Services (AWS), Alibaba Cloud, Apple iCloud, Baidu Cloud, Facebook (Meta), Google Cloud Platform (GCP), IBM Cloud, Microsoft Azure, Oracle Cloud Infrastructure (OCI), and Tencent Cloud. Product brochures emphasize modular and scalable infrastructure designs, high-density power distribution, advanced cooling solutions, and integration with cloud services. Key specifications often include redundancy levels, energy efficiency metrics, rack density, and security certifications. Detailed diagrams and datasheets highlight server layouts, power and cooling schematics, and disaster recovery capabilities for enterprise and hyperscale clients.

Competition is driven by efficiency, scalability, and reliability. AWS and Microsoft Azure focus on highly modular and geographically distributed facilities to support large-scale cloud operations. Google Cloud and Oracle Cloud Infrastructure emphasize energy-efficient designs, low PUE (Power Usage Effectiveness), and rapid deployment for enterprise workloads. Alibaba Cloud and Tencent Cloud prioritize region-specific compliance, high-availability zones, and integration with existing enterprise networks.

| Item | Value |

|---|---|

| Quantitative Units | USD 239.0 Billion |

| Data Center Type | Medium data center, Small data center, and Large data center |

| Infrastructure | Electrical infrastructure, Mechanical infrastructure, Racks, Ductwork, Raised Flooring, Others, Networking infrastructure, and Others |

| End Use | IT & telecom, BFSI, Energy, Government, Healthcare, Manufacturing, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amazon Web Services (AWS), Alibaba Cloud, Apple iCloud, Baidu Cloud, Facebook (Meta), Google Cloud Platform (GCP), IBM Cloud, Microsoft Azure, Oracle Cloud Infrastructure (OCI), and Tencent Cloud |

| Additional Attributes | Dollar sales vary by construction type, including greenfield, brownfield, and modular data centers; by application, such as hyperscale, colocation, and enterprise facilities; by end-use industry, spanning IT, telecom, finance, and cloud service providers; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising cloud adoption, digital transformation, and demand for high-performance computing infrastructure. |

The global data center construction market is estimated to be valued at USD 239.0 billion in 2025.

The market size for the data center construction market is projected to reach USD 428.0 billion by 2035.

The data center construction market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in data center construction market are medium data center, small data center and large data center.

In terms of infrastructure, electrical infrastructure segment to command 52.1% share in the data center construction market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

DataOps Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Acquisition Hardware Market Size and Share Forecast Outlook 2025 to 2035

Data Discovery Market Size and Share Forecast Outlook 2025 to 2035

Data Masking Technology Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Rack Server Market Size and Share Forecast Outlook 2025 to 2035

Data Business in Oil & Gas Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Colocation Market Size and Share Forecast Outlook 2025 to 2035

Data Lake Market Size and Share Forecast Outlook 2025 to 2035

Data Lakehouse Market Size and Share Forecast Outlook 2025 to 2035

Data Centre UPS Market Size and Share Forecast Outlook 2025 to 2035

Data-Driven Retail Solution Market Size and Share Forecast Outlook 2025 to 2035

Data Science Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Monetization Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Conversion Services Market Size and Share Forecast Outlook 2025 to 2035

Data Exfiltration Market Size and Share Forecast Outlook 2025 to 2035

Data Virtualization Cloud Market Analysis – Growth & Forecast 2025 to 2035

Data Management Platforms Market Analysis and Forecast 2025 to 2035, By Type, End User, and Region

Data Fabric Market Analysis - Trends, Size & Forecast 2025 to 2035

Data Warehouse as a Service Market - Cloud Trends & Forecast 2025 to 2035

Data Catalog Market Trends - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA