The data center storage market is estimated to be valued at USD 66.0 billion in 2025 and is projected to reach USD 162.0 billion by 2035, registering a compound annual growth rate (CAGR) of 9.4% over the forecast period. This represents 41.5% of the total incremental growth over the 10-year forecast period. The early growth is driven by increasing data storage needs in cloud computing, enterprise data management, and digital transformation. Rising demand for high-performance, scalable storage solutions to support big data, AI, and IoT applications will drive adoption in both established and emerging markets.

The second half (2030–2035) will contribute USD 53.3 billion, representing 58.5% of the total growth, as industries continue to generate large volumes of data, and the need for advanced storage technologies like NVMe and hybrid cloud solutions intensifies. Annual increments during the first phase average USD 7.5 billion per year, with the market seeing stronger growth in the later years, driven by increased automation, AI-driven storage solutions, and enhanced data security. Manufacturers focusing on high-efficiency, energy-saving storage systems will capture the largest share of this USD 89.6 billion opportunity globally.

| Metric | Value |

|---|---|

| Data Center Storage Market Estimated Value in (2025 E) | USD 66.0 billion |

| Data Center Storage Market Forecast Value in (2035 F) | USD 162.0 billion |

| Forecast CAGR (2025 to 2035) | 9.4% |

The data center storage market is undergoing accelerated transformation as enterprises and cloud service providers invest in scalable, high-performance storage infrastructures to support data-intensive workloads. The shift toward hybrid and multi-cloud environments is driving demand for flexible storage solutions capable of handling structured and unstructured data seamlessly.

Rising adoption of AI, machine learning, and real-time analytics is further elevating the need for low-latency, high-capacity storage systems. Increasing regulatory focus on data sovereignty and privacy is prompting organizations to deploy storage architectures that ensure compliance while optimizing operational costs.

Future growth is expected to be fueled by advancements in storage technologies, such as NVMe over fabrics, and increased investments in edge data centers to enable faster data access and processing closer to the source. Strategic collaborations between storage vendors and hyperscalers are also paving the way for innovation and expansion of storage capabilities across industries.

The data center storage market is segmented by storage, architecture, component, medium, deployment model, vertical, and geographic regions. By storage, the data center storage market is divided into Storage Area Network (SAN), Network-Attached Storage (NAS), Direct-Attached Storage (DAS), and Software-Defined Storage (SDS). In terms of the architecture of the data center storage market, it is classified into Block storage, File storage, and Object storage. Based on component, the data center storage market is segmented into Hardware and Software.

By medium, the data center storage market is segmented into Solid-state drive (SSD), Hard disk drive (HDD), and Tape Storage. By deployment model, the data center storage market is segmented into Cloud-based, On-premises, and Hybrid. By vertical, the data center storage market is segmented into IT & telecommunications, BFSI, Healthcare, Retail & E-commerce, Government & defence, Media & entertainment, and others. Regionally, the data center storage industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by storage, the storage area network SAN subsegment is projected to hold 42.3% of the total market revenue in 2025, making it the leading solution. This leadership has been supported by the capability of SAN to deliver high-speed, reliable, and dedicated connectivity between servers and storage devices, which is essential for mission-critical enterprise applications.

The ability to centralize storage resources while maintaining superior performance and scalability has strengthened its appeal in large-scale data center deployments. SAN has also enabled better utilization of storage assets, reduced downtime, and simplified management, factors that have reinforced its widespread adoption.

Its compatibility with virtualization technologies and support for high-throughput workloads have further positioned SAN as the preferred choice for organizations seeking robust and efficient storage networks.

Segmented by architecture, block storage is expected to account for 45.7% of the market revenue in 2025, emerging as the top architecture segment. This dominance has been driven by the inherent flexibility, performance, and scalability of block storage, which makes it suitable for a wide range of data center applications.

Block storage has allowed organizations to break data into manageable blocks and distribute them across multiple servers, thereby optimizing performance and ensuring fast access. Its ability to support transactional databases, high-performance computing, and virtualized environments has further enhanced its attractiveness among enterprises and service providers.

The ease of integrating block storage with cloud and hybrid infrastructures has contributed to its leading position, as businesses prioritize architectures that deliver both reliability and agility in managing dynamic workloads.

When segmented by component, hardware is projected to capture 61.4% of the market revenue in 2025, establishing itself as the leading component segment. This leadership has been reinforced by the continued reliance of data centers on physical storage systems, including arrays, drives, and networking equipment, to meet performance and capacity demands.

Hardware investments have remained critical as enterprises and cloud providers expand data center footprints to accommodate surging data volumes. The durability, high throughput, and predictable performance of hardware solutions have ensured their sustained demand despite the rise of software-defined and cloud-native alternatives.

Innovations in hardware design, such as all-flash arrays and energy-efficient systems, have further strengthened their role in enabling high-density, low-latency storage environments. The tangible control and security offered by on-premises hardware have also supported its ongoing prominence in the data center storage landscape.

The data center storage market is witnessing strong growth driven by the exponential rise in data creation and the increasing demand for cloud services. Growth drivers in 2024 and 2025 include rising enterprise IT infrastructure needs and the surge in data processing requirements. Opportunities arise from the expansion of edge computing and hybrid cloud solutions. Emerging trends include the move towards high-performance storage systems. However, market restraints, such as high operational costs and data security concerns, remain prevalent.

The primary growth driver in the data center storage market is the exponential increase in data creation, especially with the growing demand for cloud storage solutions. In 2024, businesses and consumers continued generating vast amounts of data, which prompted enterprises to scale their IT infrastructure. This led to a heightened demand for reliable and scalable storage systems. As data processing needs continue to escalate, the need for advanced data storage solutions in data centers becomes more essential.

Opportunities in the data center storage market are emerging with the expansion of edge computing and hybrid cloud solutions. In 2025, companies increasingly adopted edge computing to process data closer to its source, reducing latency and bandwidth requirements. Additionally, hybrid cloud adoption surged as businesses sought flexible storage solutions combining on-premise infrastructure and public cloud services. This shift creates a significant opportunity for innovative storage solutions that can support these modern computing paradigms.

Emerging trends in the data center storage market include a shift toward high-performance storage systems that meet the demands of modern data processing. In 2024, businesses began prioritizing the need for faster, more reliable storage solutions to support activities like big data analytics and artificial intelligence. This transition to high-performance systems, such as all-flash arrays and NVMe storage, ensures faster data retrieval and processing. As data workloads grow, this trend is expected to gain momentum.

Major market restraints for the data center storage market include high operational costs and data security concerns. In 2024 and 2025, the cost of installing and maintaining large-scale storage systems remained high, especially with the growing demand for high-performance and secure storage solutions. Furthermore, as data centers store sensitive information, security concerns regarding data breaches and cyber-attacks also persist. These factors could limit market expansion, especially in regions with stringent data protection regulations.

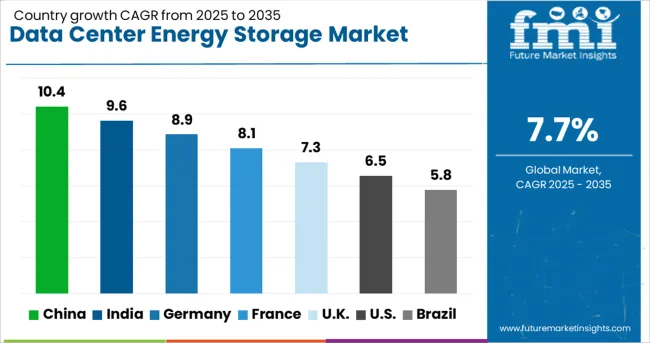

| Country | CAGR |

|---|---|

| China | 12.7% |

| India | 11.8% |

| Germany | 10.8% |

| France | 9.9% |

| UK | 8.9% |

| USA | 8.0% |

| Brazil | 7.1% |

The global data center storage market is projected to grow at a strong 9.4% CAGR from 2025 to 2035. China leads with a remarkable 12.7% CAGR, followed by India at 11.8%, and Germany at 10.8%. The United Kingdom records a growth rate of 8.9%, while the United States shows the slowest growth at 8.0%. These variations are influenced by the pace of digital transformation, infrastructure investments, and the rising demand for data storage across various industries. While China and India are witnessing rapid data center expansion, driven by digitalization and cloud adoption, mature markets like the USA and the UK are growing more steadily due to the existing infrastructure and established data center markets.

The data center storage market in China is experiencing substantial growth, with a projected CAGR of 12.7%. The country’s rapid digital transformation and growing demand for cloud services are key factors fueling this growth. As China continues to lead in manufacturing and technology, data center storage demand is expanding across industries such as e-commerce, finance, and telecommunications. The government’s ongoing investments in infrastructure and its push for the development of smart cities and digital economies are further accelerating the adoption of advanced storage solutions. China’s large-scale data centers and the drive toward data sovereignty also contribute significantly to the market’s expansion.

The data center storage market in India is projected to grow at a CAGR of 11.8%. The country’s booming IT and telecommunications industries are driving this demand, as businesses require scalable and secure data storage solutions. The growing adoption of cloud computing, combined with the rise in internet penetration and mobile device usage, is leading to an explosion in data generation. India’s focus on data localization and increasing investments in building data center infrastructure further supports market growth. The expanding e-commerce, fintech, and digital media sectors also create a significant demand for advanced storage solutions to handle large volumes of data.

The data center storage market in Germany is expected to grow at a CAGR of 10.8%. As the largest economy in Europe, Germany is witnessing increased investments in data center infrastructure to support the expanding digital economy. The demand for high-performance storage solutions is particularly strong in industries like automotive, finance, and manufacturing, where large volumes of data need to be securely stored and processed. Germany’s focus on compliance with data protection regulations and the push toward Industry 4.0 further boosts the demand for reliable and secure data center storage solutions. Additionally, Germany’s role as a hub for cloud computing in Europe contributes to the market’s growth.

The data center storage market in the United Kingdom is projected to grow at a CAGR of 8.9%. As a mature market, the UK continues to see steady demand for data storage solutions, especially as businesses shift to cloud-based services and digital platforms. The UK government’s emphasis on data protection and cybersecurity, along with its growing digital infrastructure, contributes to the market’s continued expansion. The rise in the adoption of big data analytics, IoT, and artificial intelligence across various sectors is also driving the demand for advanced data storage solutions. Despite a more mature market, the need for modernized data storage solutions continues to grow.

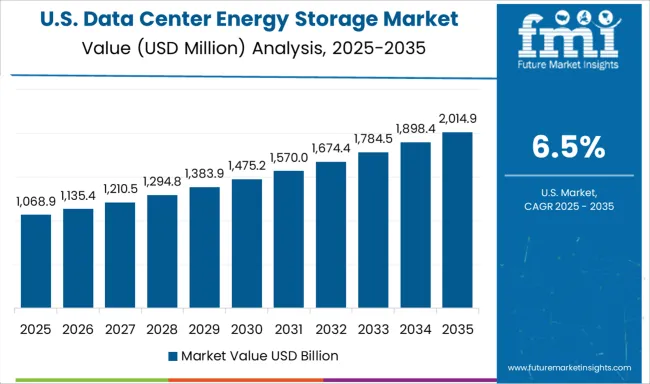

The data center storage market in the United States is expected to grow at a CAGR of 8.0%. The USA remains a key player in the global data center industry, with robust demand for storage solutions driven by the rise of cloud computing, digital transformation, and data-intensive applications like AI and machine learning. While the USA market is more mature, the continued growth of industries such as healthcare, finance, and media is contributing to the need for scalable and secure storage systems. Additionally, the increased adoption of hybrid cloud solutions and the expansion of edge computing are supporting the demand for advanced data storage technologies.

Historical strategies in the data center storage market have centered around infrastructure expansion, scalability, and cloud integration. Amazon leveraged AWS to establish dominance through the rapid deployment of global data centers, high-performance storage clusters, and comprehensive security protocols. Google and Microsoft focused on hybrid and multi-cloud storage offerings, ensuring seamless integration with existing enterprise systems. Dell and HPE concentrated on on-premises storage solutions and converged infrastructure, targeting large enterprises seeking high reliability and centralized management.

Forecast strategies are expected to prioritize AI-driven storage optimization, software-defined storage adoption, and high-density storage systems to manage exponentially growing data volumes. Emerging players such as Fujitsu, Huawei, and Oracle are emphasizing vertical-specific solutions, including healthcare and finance, alongside next-generation storage hardware and enhanced cybersecurity features. Strategic partnerships, co-development of storage-as-a-service platforms, and edge data center deployment are also anticipated as key growth levers.

Differentiation levers include advanced data security, rapid data retrieval, integration with cloud and on-premises systems, energy-efficient storage hardware, and automation of data management workflows. Growth opportunities exist in regions with emerging cloud adoption, enterprises undergoing digital transformation, and sectors requiring high compliance, such as finance, healthcare, and telecom.

| Item | Value |

|---|---|

| Quantitative Units | USD 66.0 Billion |

| Storage | Storage area network (SAN), Network-attached storage (NAS), Direct-attached storage (DAS), and Software-defined storage (SDS) |

| Architecture | Block storage, File storage, and Object storage |

| Component | Hardware and Software |

| Medium | Solid-state drive (SSD), Hard disk drive (HDD), and Tape Storage |

| Deployment Model | Cloud-based, On-premises, and Hybrid |

| Vertical | IT & telecommunications, BFSI, Healthcare, Retail & E-commerce, Government & defence, Media & entertainment, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amazon, Dell, Fujitsu, Google, HPE, Huawei, Microsoft, and Oracle |

| Additional Attributes | Dollar sales by storage type and application, demand dynamics across cloud, enterprise, and hybrid data centers, regional trends in data storage adoption, innovation in high-density and energy-efficient storage solutions, impact of regulatory standards on data protection and security, and emerging use cases in big data analytics and AI-driven storage management. |

The global data center storage market is estimated to be valued at USD 66.0 billion in 2025.

The market size for the data center storage market is projected to reach USD 162.0 billion by 2035.

The data center storage market is expected to grow at a 9.4% CAGR between 2025 and 2035.

The key product types in data center storage market are storage area network (san), network-attached storage (nas), direct-attached storage (das) and software-defined storage (sds).

In terms of architecture, block storage segment to command 45.7% share in the data center storage market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

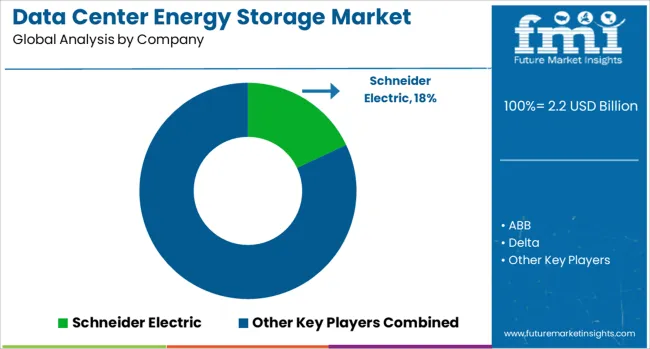

Data Center Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

DataOps Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Acquisition Hardware Market Size and Share Forecast Outlook 2025 to 2035

Data Discovery Market Size and Share Forecast Outlook 2025 to 2035

Data Masking Technology Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Rack Server Market Size and Share Forecast Outlook 2025 to 2035

Data Business in Oil & Gas Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Colocation Market Size and Share Forecast Outlook 2025 to 2035

Data Lake Market Size and Share Forecast Outlook 2025 to 2035

Data Lakehouse Market Size and Share Forecast Outlook 2025 to 2035

Data Centre UPS Market Size and Share Forecast Outlook 2025 to 2035

Data-Driven Retail Solution Market Size and Share Forecast Outlook 2025 to 2035

Data Science Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Monetization Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Conversion Services Market Size and Share Forecast Outlook 2025 to 2035

Data Exfiltration Market Size and Share Forecast Outlook 2025 to 2035

Data Virtualization Cloud Market Analysis – Growth & Forecast 2025 to 2035

Data Management Platforms Market Analysis and Forecast 2025 to 2035, By Type, End User, and Region

Data Fabric Market Analysis - Trends, Size & Forecast 2025 to 2035

Data Warehouse as a Service Market - Cloud Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA