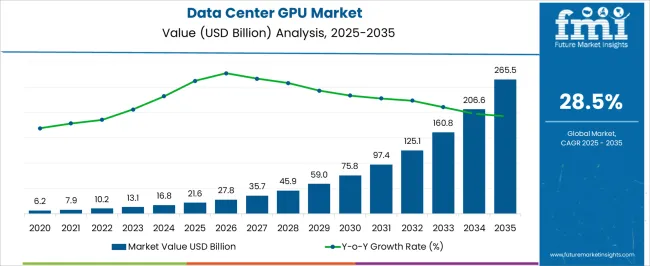

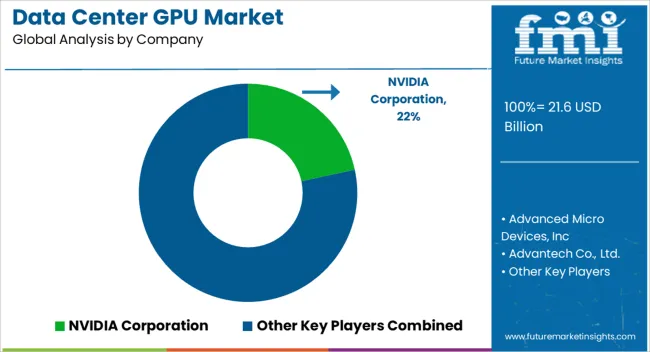

The data center GPU market, estimated at USD 21.6 billion in 2025 and projected to reach USD 265.5 billion by 2035 at a CAGR of 28.5%, demonstrates a significant shift in technological contributions driving market expansion. The growth trajectory indicates that advanced GPU architectures, particularly those optimized for artificial intelligence, machine learning, and high-performance computing workloads, will dominate value contribution across the forecast period.

Initially, general-purpose GPUs accounted for a substantial share due to widespread deployment in conventional data center operations, but their relative contribution is gradually declining as specialized accelerators gain prominence. Throughout the forecast period, AI-focused GPUs are expected to capture an increasing share, reflecting the surge in demand for AI training and inference applications within hyperscale data centers. Parallel to this, high-throughput computing GPUs and cloud-optimized accelerators are contributing significantly to total market value, with their adoption accelerated by virtualization and multi-tenant infrastructure requirements.

Enhanced memory subsystems, interconnect bandwidth, and software integration further strengthen their contribution to overall performance-driven market adoption. Emerging technologies, such as GPUs designed for edge computing and low-power AI inference, will also incrementally influence market composition, particularly in hybrid cloud environments. By 2035, contribution from next-generation GPU technologies is expected to constitute the majority of market value, driven by increasing computational demands, large-scale AI workloads, and cloud service provider investments.

| Metric | Value |

|---|---|

| Data Center GPU Market Estimated Value in (2025 E) | USD 21.6 billion |

| Data Center GPU Market Forecast Value in (2035 F) | USD 265.5 billion |

| Forecast CAGR (2025 to 2035) | 28.5% |

The data center GPU market represents a specialized segment within the global data center and high-performance computing industry, emphasizing accelerated computing, AI workloads, and graphics processing. Within the broader data center hardware market, it accounts for about 6.2%, driven by demand for machine learning, deep learning, and large-scale simulation applications. In the high-performance computing and AI infrastructure segment, it holds nearly 5.8%, reflecting adoption for training neural networks, scientific research, and enterprise analytics.

Across the cloud computing and virtualization solutions sector, the market captures 4.7%, supporting multi-tenant workloads and GPU virtualization. Within the server and storage hardware category, it represents 4.1%, highlighting integration with CPUs, memory, and networking for optimized performance. In the enterprise IT and hyperscale data center sector, it secures 4.3%, emphasizing efficiency, scalability, and energy-conscious operation. Recent developments in this market have focused on GPU architecture advancement, AI optimization, and thermal efficiency. Innovations include multi-GPU clusters, tensor cores for AI acceleration, and energy-efficient designs to reduce power consumption in hyperscale environments.

Key players are collaborating with cloud service providers, research institutions, and enterprise IT firms to enhance AI model training, real-time analytics, and high-performance computing capabilities. Integration with software frameworks, virtualization platforms, and AI toolkits is gaining traction to maximize hardware utilization. The developments in liquid cooling, modular GPU systems, and AI-based workload scheduling are improving operational efficiency and reliability.

The data center GPU market is experiencing accelerated growth, driven by surging demand for high-performance computing, AI model training, and advanced analytics across industries. Developments in GPU architectures, coupled with increasing availability of AI-optimized hardware, have significantly enhanced computational efficiency and throughput. Industry announcements and technology roadmaps have emphasized the role of GPUs in enabling real-time data processing, deep learning, and simulation workloads, positioning them as critical assets in modern data center infrastructure.

The expansion of hyperscale facilities and investments in AI-driven cloud services have further amplified demand. In addition, energy-efficient GPU designs are gaining traction as sustainability goals influence procurement strategies.

Strategic partnerships between GPU manufacturers and data center operators are expanding deployment capabilities, while advancements in interconnect technologies are improving scalability for complex workloads. Market growth will be supported by the adoption of AI and machine learning at scale, hybrid deployment strategies, and expanding cloud-native services requiring robust GPU-backed infrastructure.

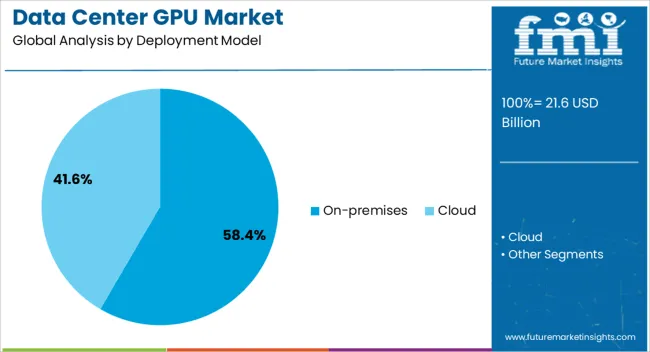

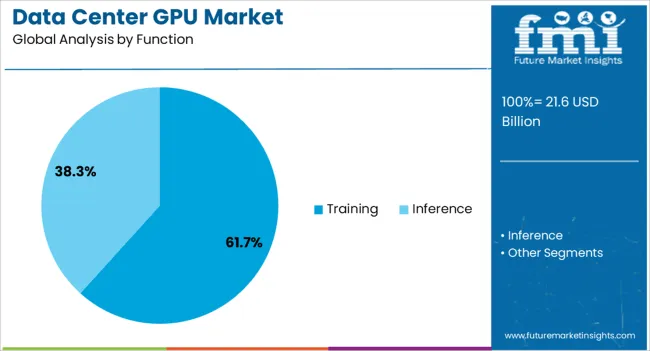

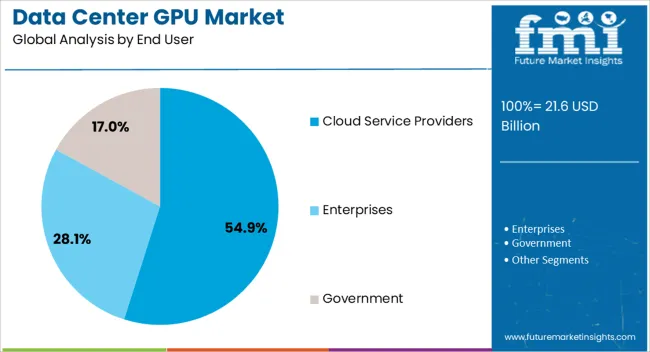

The data center gpu market is segmented by deployment model, function, end user, and geographic regions. By deployment model, data center gpu market is divided into On-premises and Cloud. In terms of function, data center gpu market is classified into Training and Inference. Based on end user, data center gpu market is segmented into Cloud Service Providers, Enterprises, and Government. Regionally, the data center gpu industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The on-premises segment is projected to hold 58.4% of the data center GPU market revenue in 2025, maintaining its lead due to enterprise preference for direct control over infrastructure, data security, and latency optimization. Organizations operating in sectors such as finance, healthcare, and defense have favored on-premises GPU deployment to meet strict compliance requirements and ensure full governance over sensitive datasets.

Industry sources have indicated that high-performance workloads, such as large-scale AI training and scientific simulations, benefit from on-premises infrastructure’s ability to deliver predictable performance without reliance on external network connectivity.

Additionally, existing investments in private data centers and the availability of tailored GPU clusters for specialized workloads have reinforced this model’s adoption. While cloud GPU adoption is growing, on-premises solutions continue to dominate in scenarios where consistent performance, regulatory adherence, and cost predictability are prioritized.

The training segment is projected to account for 61.7% of the data center GPU market revenue in 2025, establishing itself as the primary functional application. This dominance is driven by the computational intensity of training deep learning models, which requires high parallel processing power and large memory bandwidth — strengths inherent to GPUs.

Technology trend reports have shown that enterprises and research institutions are investing heavily in GPU-accelerated infrastructure to reduce model training times and improve algorithm accuracy.

The growing scale of AI models, particularly in natural language processing, computer vision, and generative AI, has amplified the need for powerful GPU clusters. Furthermore, the integration of training workloads into both enterprise AI pipelines and public cloud AI services has increased demand for specialized GPU configurations optimized for training tasks. These factors collectively underpin the training segment’s leadership within the market.

The cloud service providers segment is projected to contribute 54.9% of the data center GPU market revenue in 2025, retaining its leading end-user share due to the rapid expansion of GPU-backed cloud computing services. Hyperscale cloud providers have been at the forefront of deploying large-scale GPU infrastructure to meet demand from AI developers, research organizations, and enterprises seeking scalable, on-demand GPU resources.

Press releases and earnings calls from leading providers have highlighted significant capital investments in GPU clusters optimized for AI training, inference, and rendering workloads.

The cloud model offers customers flexibility, cost efficiency, and access to cutting-edge GPU technology without the need for heavy upfront infrastructure investment. As AI adoption accelerates across industries, cloud service providers are expanding GPU availability globally, integrating them into managed AI platforms, and offering specialized GPU instances for varied workloads, reinforcing their dominant role in the market.

The market has experienced significant growth as artificial intelligence, machine learning, high-performance computing, and cloud-based workloads increasingly demand parallel processing capabilities. GPUs accelerate data-intensive computations, enabling efficient handling of large datasets for AI training, inference, and real-time analytics. Rising adoption of cloud computing, virtualization, and hyperscale data centers has driven deployment of GPU-accelerated servers.

Advanced GPU architectures, improved memory bandwidth, and energy-efficient designs have enhanced performance and reduced operational costs. Despite high initial investment, power consumption concerns, and cooling requirements, GPUs remain critical for modern data centers seeking optimized computational efficiency, reduced latency, and faster processing of AI, analytics, and rendering workloads across global enterprises and cloud providers.

Artificial intelligence and machine learning workloads have been major drivers for GPU adoption in data centers. Training complex neural networks, natural language processing models, and computer vision systems requires extensive parallel processing, which GPUs provide efficiently. Cloud service providers and enterprise IT departments deploy GPU-accelerated servers to reduce training time, improve inference speed, and support real-time AI applications. The integration of GPUs with AI frameworks, optimized libraries, and software-defined infrastructure enhances overall computational performance. Companies focusing on autonomous systems, recommendation engines, and predictive analytics increasingly rely on GPU capabilities to maintain competitiveness. The growing AI ecosystem, combined with demand for faster and more accurate data insights, continues to fuel GPU integration in modern data centers.

High-performance computing (HPC) and cloud-based applications drive demand for data center GPUs by enabling faster simulations, scientific research, and big data processing. Industries including finance, life sciences, energy, and automotive leverage GPU-accelerated HPC for risk modeling, drug discovery, weather forecasting, and virtual prototyping. GPUs improve throughput, reduce computation time, and allow complex calculations that would be infeasible with traditional CPUs alone. Cloud providers integrate GPUs to offer scalable, on-demand compute resources for customers, supporting AI workloads, virtual desktops, and rendering services. The combination of HPC capabilities and flexible cloud deployment ensures that GPUs remain a strategic component for data center operators seeking enhanced computational power and optimized resource utilization across multiple industries.

Technological advancements have enhanced GPU performance, energy efficiency, and scalability for data center applications. Innovations in architecture, memory technology, interconnect bandwidth, and thermal management improve parallel processing efficiency. Multi-GPU configurations and NVLink interconnects enable high-throughput data transfers and distributed computation for complex workloads. Integration with AI-optimized software frameworks, containerized deployments, and virtualization platforms ensures seamless workload management. Energy-efficient designs reduce operational costs and minimize environmental impact, which is critical for hyperscale and enterprise data centers. Continuous innovation in GPU acceleration, coupled with improved monitoring and management software, strengthens adoption by providing measurable performance gains, operational reliability, and flexibility for evolving computational demands.

Despite growth, data center GPU adoption faces challenges, including high upfront costs, increased power consumption, and cooling requirements. GPUs generate substantial heat, necessitating advanced thermal management and airflow optimization. Integration into existing server architectures requires careful planning to avoid bottlenecks and ensure compatibility with CPUs, memory, and storage. Procurement, maintenance, and lifecycle management add complexity to data center operations. The software and driver optimization are critical to leverage full GPU performance. However, investments in efficient cooling systems, modular server designs, and GPU virtualization technologies help mitigate these challenges, enabling broader adoption.

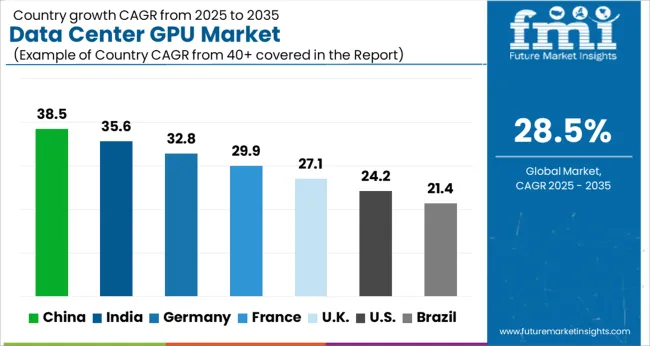

| Country | CAGR |

|---|---|

| China | 38.5% |

| India | 35.6% |

| Germany | 32.8% |

| France | 29.9% |

| UK | 27.1% |

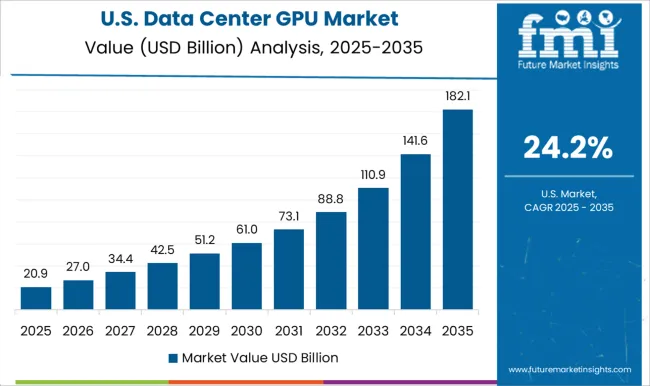

| USA | 24.2% |

| Brazil | 21.4% |

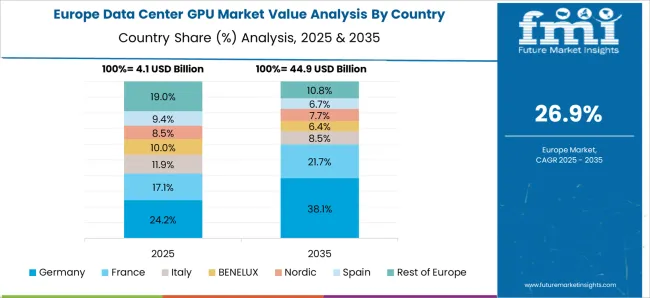

The market is witnessing rapid growth, with India expanding at 35.6%, driven by rising cloud adoption and AI workloads across enterprises. China dominates at 38.5%, supported by large-scale hyperscale data centers and government-backed AI initiatives. Germany follows with 32.8%, reflecting investments in high-performance computing and research infrastructures. The United Kingdom registers 27.1%, with growth fueled by enterprise digital transformation projects. The United States records 24.2%, sustained by cloud service expansion and advanced GPU deployments. These countries showcase a dynamic mix of manufacturing, deployment, and technological innovation shaping global GPU adoption. This report includes insights on 40+ countries; the top markets are shown here for reference.

China’s market is projected to grow at a CAGR of 38.5%, fueled by the rapid expansion of cloud computing infrastructure and AI-driven applications. The increasing need for high-performance computing, large-scale data processing, and AI-based analytics in enterprises is driving GPU deployment. Government initiatives promoting digital transformation, data center modernization, and smart city development are further accelerating market growth. Technological innovations in GPU architectures, energy efficiency, and parallel processing capabilities are enhancing computational performance. The integration of GPUs with AI, machine learning, and deep learning frameworks positions China as a key hub for data center GPU adoption.

India’s market for data center GPUs is expected to grow at a CAGR of 35.6%, driven by increasing adoption of AI, machine learning, and high-performance computing in commercial and government sectors. Rising investments in digital infrastructure, cloud services, and IT modernization contribute to growing GPU demand. Technological advancements in GPU architectures, memory management, and energy-efficient solutions enhance operational efficiency and scalability. The growing need for data analytics, AI-powered applications, and real-time processing in enterprises positions India as an emerging market. Policy support for digitalization and smart city initiatives further boosts the deployment of advanced GPUs in data centers across the country.

Germany’s data center GPU market is projected to expand at a CAGR of 32.8%, supported by increasing demand for AI-based data analytics and high-performance computing solutions. Industrial and commercial sectors, including automotive, finance, and manufacturing, are integrating GPU-powered data centers for advanced analytics and simulation. Government regulations promoting energy efficiency and sustainable IT infrastructure encourage the adoption of GPUs with improved performance and lower energy consumption. Technological advancements such as parallel processing, enhanced memory bandwidth, and AI optimization enhance computational capabilities. Germany’s focus on digital transformation and intelligent automation reinforces the market’s growth potential.

The United Kingdom is expected to grow at a CAGR of 27.1%, driven by adoption of AI, cloud computing, and high-performance analytics. Increasing investments in data centers, AI infrastructure, and enterprise computing solutions create a robust demand for advanced GPU technologies. Government initiatives focused on digitalization and energy-efficient IT infrastructure encourage adoption. Innovations in GPU architectures, including multi-core processing, energy-efficient designs, and integration with AI frameworks, support scalability and performance. The rising need for real-time analytics, AI applications, and intelligent automation positions the United Kingdom as a growing market for data center GPUs.

The United States’ market is projected to grow at a CAGR of 24.2%, fueled by demand for AI, machine learning, and high-performance computing in enterprise, government, and research sectors. Data center operators are increasingly adopting GPUs for AI training, data analytics, and scientific simulations. Technological advancements in GPU processing speed, memory optimization, and energy efficiency support enhanced operational performance. Government initiatives promoting cloud infrastructure, AI research, and sustainable computing further boost GPU adoption. The United States continues to lead in innovation and deployment of advanced GPUs for data center applications, reinforcing its position as a significant global market.

The market is dominated by major semiconductor and technology companies delivering high-performance graphics processing units for artificial intelligence, machine learning, and large-scale computing applications. NVIDIA Corporation leads with its GPU architectures optimized for parallel processing, AI workloads, and cloud computing services. Advanced Micro Devices (AMD) provides competitive GPU solutions emphasizing performance per watt, energy efficiency, and scalability for enterprise data centers. Intel Corporation and Qualcomm Technologies focus on integrating GPUs with CPUs and custom accelerators to enhance data throughput and processing efficiency, catering to both cloud service providers and hyperscale data centers.

Google and IBM offer GPU-powered cloud platforms and AI infrastructure, enabling enterprises to deploy GPU-accelerated workloads without heavy on-premises investment. Huawei Technologies and Samsung Electronics contribute GPUs for both server-grade and AI-centric data centers, emphasizing reliability and integration with broader hardware ecosystems. Advantech Co., Ltd. and Imagination Technologies provide specialized GPU solutions and IP cores for embedded and high-performance computing applications, supporting data center flexibility, scalability, and energy optimization.

| Item | Value |

|---|---|

| Quantitative Units | USD 21.6 Billion |

| Deployment Model | On-premises and Cloud |

| Function | Training and Inference |

| End User | Cloud Service Providers, Enterprises, and Government |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | NVIDIA Corporation, Advanced Micro Devices, Inc, Advantech Co., Ltd., Google Inc., Huawei Technologies Co., Ltd., IBM Corporation, Imagination Technologies, Intel Corporation, Qualcomm Technologies, Inc., and Samsung Electronics Co., Ltd. |

| Additional Attributes | Dollar sales by GPU type and application, demand dynamics across hyperscale, enterprise, and cloud data centers, regional trends in AI and high-performance computing adoption, innovation in processing power, energy efficiency, and cooling solutions, environmental impact of energy consumption and electronic waste, and emerging use cases in AI training, scientific simulations, and real-time data analytics. |

The global data center GPU market is estimated to be valued at USD 21.6 billion in 2025.

The market size for the data center GPU market is projected to reach USD 265.5 billion by 2035.

The data center GPU market is expected to grow at a 28.5% CAGR between 2025 and 2035.

The key product types in data center GPU market are on-premises and cloud.

In terms of function, training segment to command 61.7% share in the data center GPU market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

DataOps Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Acquisition Hardware Market Size and Share Forecast Outlook 2025 to 2035

Data Discovery Market Size and Share Forecast Outlook 2025 to 2035

Data Masking Technology Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Rack Server Market Size and Share Forecast Outlook 2025 to 2035

Data Business in Oil & Gas Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Colocation Market Size and Share Forecast Outlook 2025 to 2035

Data Lake Market Size and Share Forecast Outlook 2025 to 2035

Data Lakehouse Market Size and Share Forecast Outlook 2025 to 2035

Data Centre UPS Market Size and Share Forecast Outlook 2025 to 2035

Data-Driven Retail Solution Market Size and Share Forecast Outlook 2025 to 2035

Data Science Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Monetization Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Conversion Services Market Size and Share Forecast Outlook 2025 to 2035

Data Exfiltration Market Size and Share Forecast Outlook 2025 to 2035

Data Virtualization Cloud Market Analysis – Growth & Forecast 2025 to 2035

Data Management Platforms Market Analysis and Forecast 2025 to 2035, By Type, End User, and Region

Data Fabric Market Analysis - Trends, Size & Forecast 2025 to 2035

Data Warehouse as a Service Market - Cloud Trends & Forecast 2025 to 2035

Data Catalog Market Trends - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA