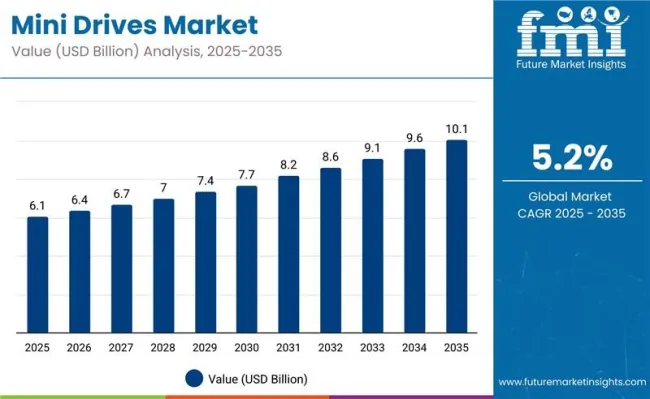

The global mini drives market is projected to be valued at USD 6.1 billion in 2025 and is forecast to reach approximately USD 10.1 billion by 2035. This reflects an absolute increase of USD 4.0 billion, indicating a total expansion of 65.6% during the forecast period. The market is set to grow at a compound annual growth rate (CAGR) of 5.2% between 2025 and 2035, resulting in an overall growth of nearly 1.7X by the end of the decade.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 6.1 billion |

| Industry Size (2035E) | USD 10.1 billion |

| CAGR (2025-2035) | 5.2% |

From 2025 to 2030, the market is expected to advance from USD 6.1 billion to USD 7.7 billion, accounting for an incremental value addition of USD 1.6 billion. This growth phase is projected to be driven by increased demand for compact motion control systems in automation, HVAC, and precision manufacturing segments.

Mini drives are increasingly being used in compact conveyor belts, robotic arms, and packaging lines to manage energy-efficient motor operations across low-to-medium power ranges. The rising deployment of industrial robots and collaborative robots (cobots) in small-to-medium-sized enterprises (SMEs) is reinforcing demand for miniature variable frequency drives (VFDs) that offer programmable control and precise torque management.

Between 2030 and 2035, the mini drives market is projected to increase from USD 7.7 billion to USD 10.1 billion, with an absolute gain of USD 2.4 billion. This growth is anticipated to be shaped by the evolution of decentralized automation, where smart mini drives will enable edge-level control of motors in distributed architectures. The ongoing shift toward modular production systems in sectors such as food & beverage, pharmaceuticals, and consumer goods is bolstering demand for miniaturized and intelligent motor drives with embedded diagnostics, safety relays, and fault detection.

Mini drives are also gaining relevance in HVAC-R systems, where energy optimization and variable air flow control are essential under regulatory norms. The replacement of oversized or fixed-speed drives with compact alternatives is being supported by life-cycle cost reduction targets and compliance with energy efficiency classes IE3 and IE4. Moreover, as the adoption of wireless motor controllers and remote condition monitoring increases, mini drives equipped with IoT telemetry features are finding broader appeal among facility managers and system integrators.

Between 2020 and 2025, the mini drives market experienced moderate yet steady growth, moving from USD 5.0 billion in 2020 to an estimated USD 6.1 billion in 2025, marking a CAGR of 4.1%. This growth trajectory was supported by automation expansion in East Asia, upgrades in European manufacturing facilities, and a growing emphasis on compact motor control solutions for small horsepower ranges.

The proliferation of miniaturized industrial control panels and cost-effective production platforms in countries like China, India, and Poland facilitated higher adoption rates. Key players focused on developing low-voltage AC drives with simplified interfaces, built-in filters, and multi-environment compatibility. Efforts to reduce noise levels and achieve optimal space utilization in control cabinets further positioned mini drives as the preferred choice for OEMs and panel builders.

The expansion of the mini drives market is primarily fueled by the rising demand for compact and energy-efficient motion control systems across a broad range of industries, including manufacturing, HVAC, packaging, and building automation. Mini drives are increasingly seen as essential components for achieving precise speed control, energy savings, and space optimization in decentralized control architectures.

Manufacturers are shifting towards miniaturized equipment footprints to align with modern industrial layouts that prioritize flexibility and modularity. This shift is encouraging OEMs to adopt mini drives for applications where space constraints and power efficiency are critical. As a result, industries involved in conveyor systems, automated storage and retrieval systems (AS/RS), and robotic tooling are embracing these compact VFDs (variable frequency drives) to improve throughput and reduce downtime.

Global sustainability goals and energy-efficiency regulations are also playing a major role. Mini drives help operators comply with efficiency classes (such as IE3 and IE4) by enabling variable motor speeds and optimizing energy usage. HVAC systems and water treatment facilities, in particular, are deploying these drives to regulate flow rates and air handling units, which leads to reduced energy consumption and operating costs.

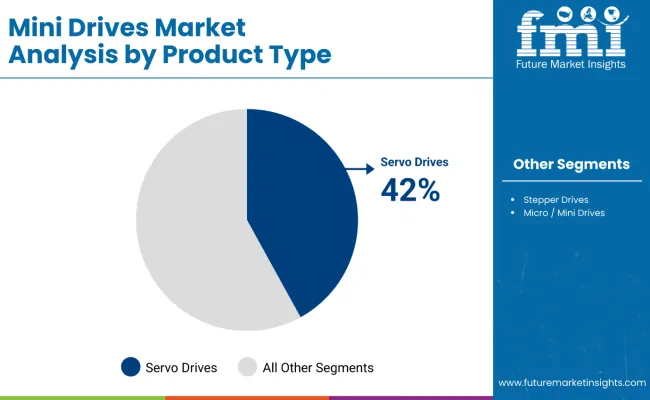

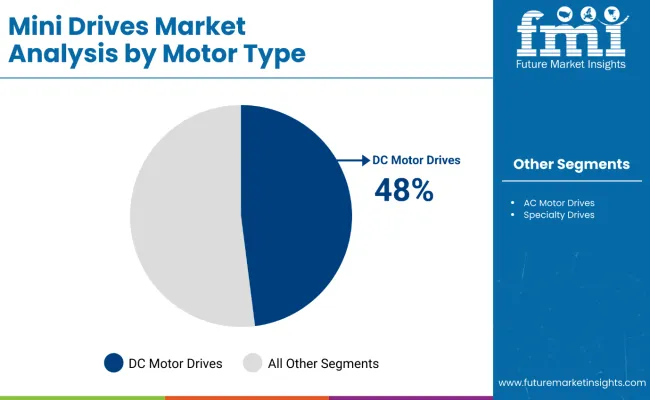

The mini drives market is segmented by product type into servo drives, stepper drives, and micro/mini drives, each supporting different torque, speed, and control requirements. By motor type, it includes DC motor drives, AC motor drives, and specialty drives such as linear and piezoelectric systems.

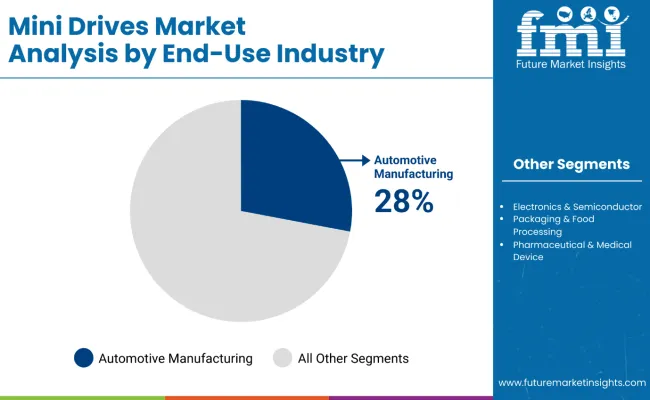

Key end-use industries comprise automotive manufacturing, electronics and semiconductors, packaging and food processing, pharmaceuticals and medical devices, and robotics and automation, reflecting strong demand across industrial automation and precision equipment sectors.

Servo drives are projected to hold 42% of the global market share in 2025 and are expected to grow at a CAGR of 5.5% through 2035. These drives are favored for their high precision, dynamic response, and closed-loop control features, making them suitable for tasks requiring fine motion control. Their integration in robotics, CNC machining, and packaging machinery continues to grow due to enhanced performance efficiency and reduced footprint. Servo drives also support a variety of communication protocols, enabling seamless compatibility with modern automation environments.

DC motor drives are expected to account for 48% of market revenue in 2025 and are projected to register a CAGR of 5.3% over the forecast period. Their dominance is supported by use in battery-operated equipment, portable machinery, and applications requiring variable speed control. Brushless variants are increasingly replacing brushed types owing to improved energy efficiency, longer life, and reduced maintenance. These drives are widely adopted in conveyor systems, medical pumps, and handheld equipment, where compact size and low noise are critical.

The automotive manufacturing segment is estimated to capture 28% of the global mini drives market in 2025 and is forecast to expand at a CAGR of 5.4% through 2035. Mini drives are utilized extensively in welding systems, paint booths, powertrain assembly lines, and robotic arms. With rising automation in vehicle production and increasing EV manufacturing, the need for compact, energy-efficient motion control systems continues to grow. Suppliers are optimizing servo and stepper drives for seamless integration with programmable logic controllers (PLCs) and AI-powered motion software in automotive settings.

The mini drives market continues to advance on the back of compact design demand, energy efficiency compliance, and the ongoing adoption of automation across various industrial tiers. While technical advantages make these drives an attractive choice for decentralized and confined-space operations, adoption is moderated by factors such as limited output capacities and cost sensitivity among small-scale manufacturers.

Energy Optimization Gains Priority in Motion Systems

Rising electricity prices and energy efficiency mandates are prompting end users to replace conventional fixed-speed motors with mini drives to enable variable control. This shift is particularly evident in HVAC, pumping systems, and material handling operations where load variability is high. Governments in Europe and North America have established stricter motor efficiency norms, pushing OEMs to integrate drives that contribute to total system efficiency improvements.

Modularization and Decentralized Automation Drive Use Cases

Manufacturing ecosystems are increasingly moving toward modular production lines where decentralized control and plug-and-play installation are preferred. Mini drives, with integrated control features and compact form factors, are enabling these design trends. Their ability to be mounted closer to the motor without requiring extensive panel wiring reduces installation time and supports scalable expansion, especially in packaging, printing, and assembly industries.

Communication Protocol Compatibility Enhances System Integration

Modern mini drives are incorporating Ethernet/IP, EtherCAT, and Modbus TCP communication stacks, enabling seamless integration into digital factory networks. This compatibility supports real-time data capture, condition monitoring, and network redundancy. These features are critical for Industry 4.0-enabled environments. This trend is encouraging OEMs to favor intelligent mini drives in smart equipment designs, expanding the addressable market.

Cost Constraints Among Small Operators Affect Premium Drive Uptake

Despite the technical merits, small manufacturers in cost-sensitive regions hesitate to adopt high-end mini drives due to upfront pricing and lack of in-house automation expertise. This restraint is most visible in South Asia and parts of Latin America, where legacy systems continue to dominate. Market growth is thus somewhat constrained by affordability barriers and training gaps in electrical integration.

| Countries | 2025 Share |

|---|---|

| Germany | 30% |

| France | 16% |

| United Kingdom | 17% |

| Italy | 11% |

| Spain | 8% |

| BENELUX | 6% |

| Russia | 4% |

| Rest of Europe | 8% |

| Countries | 2035 Share |

|---|---|

| Germany | 28% |

| France | 17% |

| United Kingdom | 16% |

| Italy | 12% |

| Spain | 9% |

| BENELUX | 7% |

| Russia | 3% |

| Rest of Europe | 8% |

Europe is projected to contribute USD 1.3 billion to the global mini drives market in 2025, with growth expected to reach approximately USD 2.1 billion by 2035, marking a CAGR of 5.0% over the forecast period. Demand is anchored by industrial automation, energy-efficient retrofit programs, and modular drive applications in compact equipment across the region.

Germany remains the largest contributor, holding a 30% share in 2025, although this is expected to slightly reduce to 28% by 2035. France and the UK follow, driven by rising investments in energy-efficient motor upgrades and factory modernization. Italy and Spain are expanding steadily with increased focus on packaging and logistics automation.

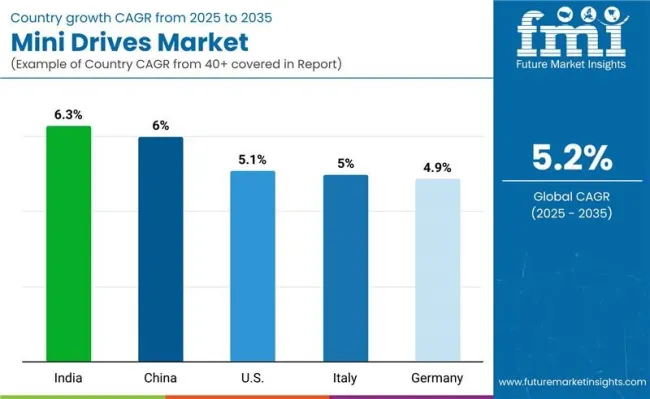

India is expected to register the highest CAGR of 6.3% in the mini drives market between 2025 and 2035. This growth is being driven by large-scale electrification initiatives, the development of industrial corridors, and increased automation in SMEs. Government programs such as “Make in India” and the Production-Linked Incentive (PLI) schemes are incentivizing localized production of compact automation systems, including motor drives. Moreover, rapid urbanization and the shift toward energy-efficient solutions in Tier 2 and Tier 3 cities are pushing demand for low-voltage, compact drives for HVAC, pumps, and building systems.

China is projected to grow at a CAGR of 6.0% through 2035, driven by strong end-user demand across packaging, printing, and light industrial machinery. Local manufacturers are increasingly exporting mini drives to Southeast Asia, Africa, and Latin America. The country’s drive modernization program, aimed at improving energy efficiency in factories, is also supporting growth. Mini drives are becoming standard in conveyor belts, filling machines, and textile automation systems.

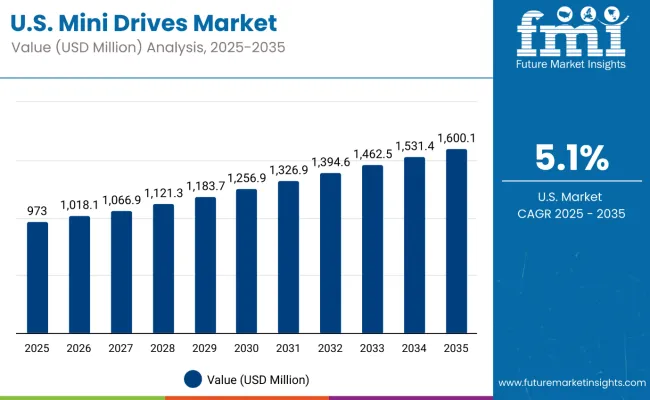

The USA mini drives market is set to expand at a CAGR of 5.1% from 2025 to 2035. Growth will primarily stem from replacement demand in the manufacturing sector and upgrades in HVAC systems. Compact VFDs are being increasingly deployed in packaging lines, warehouse conveyors, and laboratory equipment. Demand from electric vehicle assembly lines and food processing units is also gaining traction.

Italy is forecast to register a CAGR of 5.0%, supported by its strong base in industrial machinery and component exports. The country is focusing on upgrading older production lines with compact drives that offer better control and energy savings. Small and medium enterprises (SMEs) are turning to modular, affordable drives to support their transition to digital production models.

Germany is expected to grow at a CAGR of 4.9% during the forecast period, reflecting its continued emphasis on factory digitization and process control. Mini drives are increasingly used in machine tools, robotic arms, and mobile automation systems. The shift toward predictive maintenance and Industry 4.0 integration is also pushing OEMs and tier suppliers to adopt intelligent drive solutions.

Servo drives are projected to account for 50% of the mini drives market in Japan by 2025. This high share reflects the country’s reliance on precision motion control systems in electronics, robotics, and semiconductor manufacturing. Servo technology is favored for its ability to deliver real-time torque, speed, and position control in compact spaces which are vital for Japan’s advanced manufacturing setups.

Stepper drives make up 30% of the market, commonly used in 3D printers, CNC machines, and automated assembly units. Micro and mini drives hold the remaining 20%, catering to applications requiring cost-effective, space-saving motor control.

In South Korea, DC motor drives including brushed and brushlessare expected to lead with a 55% share of the market in 2025. The country's strong electronics and automotive component manufacturing sectors prefer DC drives for their efficiency, quiet operation, and compatibility with smart controllers.

AC motor drives, comprising 35%, find use in conveyor systems, compressors, and HVAC applications. Specialty drives, including linear and piezoelectric types, make up the remaining 10%, gaining traction in semiconductor fabrication and precision testing equipment.

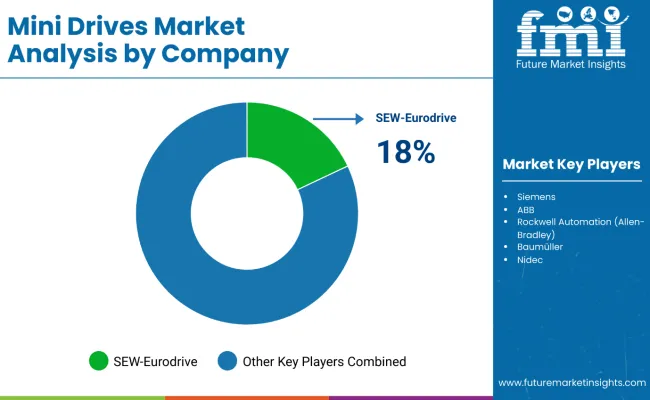

Competition in the mini drives market is being shaped by the introduction of compact, high-precision, and energy-efficient solutions. New developments emphasize miniaturized linear motor stages and high-efficiency motors that deliver superior accuracy, speed, and operational reliability while fitting space-constrained applications. Market players are focusing on energy optimization, low-emission designs, and adherence to regional manufacturing initiatives to strengthen local presence.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.1 Billion (2025); Forecast to reach USD 10.1 Billion by 2035 |

| Product Type | Servo Drives, Stepper Drives, Micro / Mini Drives |

| Motor Type | DC Motor Drives (Brushed / Brushless), AC Motor Drives (Synchronous / Asynchronous), Specialty Drives (Linear, Piezoelectric) |

| End-Use Industry | Automotive Manufacturing, Electronics & Semiconductors, Packaging & Food Processing, Pharmaceuticals & Medical Devices, Robotics & Automation |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Germany, United Kingdom, Japan, South Korea |

| Key Companies Profiled | Siemens, Schneider Electric, Omron Corporation, ABB, Yaskawa Electric, Rockwell Automation, Delta Electronics, Oriental Motor, Panasonic Industry, Lenze SE |

The market is estimated at USD 6.1 billion in 2025 and is projected to reach USD 10.1 billion by 2035, growing at a CAGR of 5.2%.

Servo drives dominate due to their high precision and real-time control capabilities, followed by stepper and micro drives for compact and cost-sensitive applications.

Key industries include electronics and semiconductor manufacturing, robotics and automation, automotive assembly lines, and pharmaceutical equipment.

Integration with smart controllers, compact multi-axis control units, energy-efficient brushless motor drives, and low-voltage drive innovations are key trends.

Asia-Pacific, particularly China, Japan, and South Korea, lead in manufacturing applications. Europe and North America are growing due to industrial automation and smart factory investments.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Miniplate for Bone Fixation Market Size and Share Forecast Outlook 2025 to 2035

Miniature Electrochemical CO Sensor Market Size and Share Forecast Outlook 2025 to 2035

Mini LED Solder Pastes and Fluxes Market Size and Share Forecast Outlook 2025 to 2035

Miniature Duplex Connectors Market Size and Share Forecast Outlook 2025 to 2035

Mining Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Mining Remanufacturing Component Market Forecast Outlook 2025 to 2035

Mining Hose Market Size and Share Forecast Outlook 2025 to 2035

Mining Equipment Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Mining Tester Market Size and Share Forecast Outlook 2025 to 2035

Mini Cranes Market Size and Share Forecast Outlook 2025 to 2035

Mining Pneumatic Saw Market Size and Share Forecast Outlook 2025 to 2035

Mini Grid Market Size and Share Forecast Outlook 2025 to 2035

Mini POS Terminals Market Size and Share Forecast Outlook 2025 to 2035

Mini Track Machinery Market Size and Share Forecast Outlook 2025 to 2035

Minimally Invasive Spine Technologies Market Size and Share Forecast Outlook 2025 to 2035

Mining Drilling Service Market Size and Share Forecast Outlook 2025 to 2035

Mini Hair Straightener Market Size and Share Forecast Outlook 2025 to 2035

Minimally Invasive Laser Therapy Devices Market Size and Share Forecast Outlook 2025 to 2035

Mining Trucks Market Size and Share Forecast Outlook 2025 to 2035

Mini Packaging Market Size, Growth, and Forecast for 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA