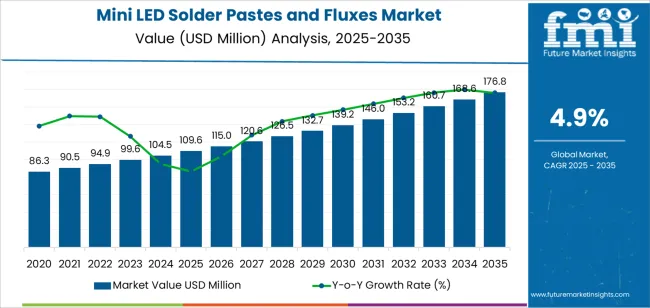

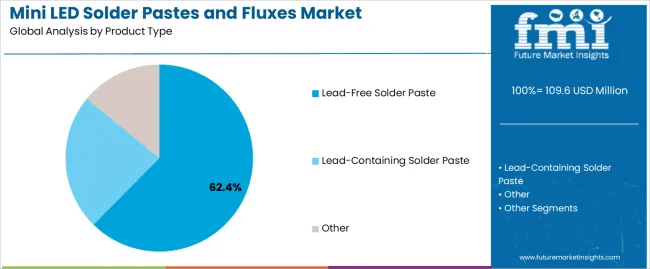

The mini LED solder pastes and fluxes market is valued at USD 109.6 million in 2025 and is projected to reach USD 176.8 million by 2035, rising at a CAGR of 4.9% during the forecast period. The market is expected to expand by 1.6 times, adding USD 67.2 million in incremental revenue, driven by accelerating adoption of mini LED backlighting in premium display panels across televisions, monitors, tablets, notebooks, and automotive displays. Miniaturization of LED chip dimensions to below 200 micrometers increases the technical complexity of assembly, requiring solder pastes with ultra-fine powder grades (Type 5–7), stable flux chemistries, and controlled rheology for defect-free printability. Lead-free solder pastes account for 62.4% of the market in 2025 due to RoHS compliance, with SAC305 and SAC0307 compositions dominating fine-pitch mini LED applications because of their reliability and reflow consistency. Lead-containing variants retain a 33.1% share, primarily in exempt industrial and defense applications.

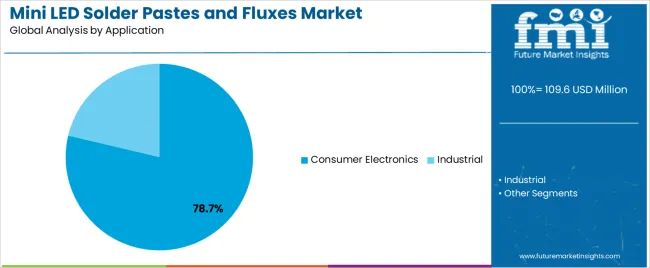

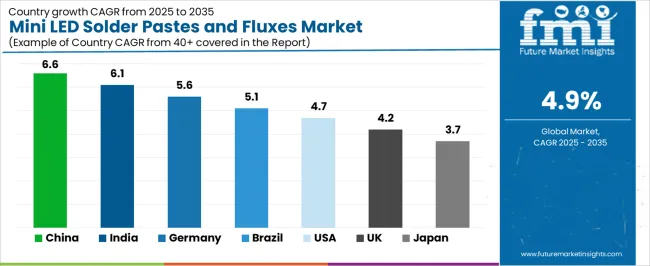

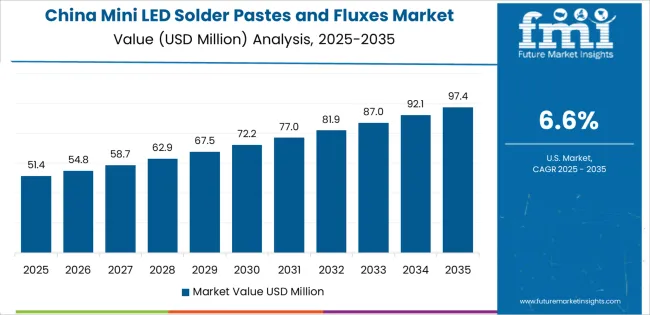

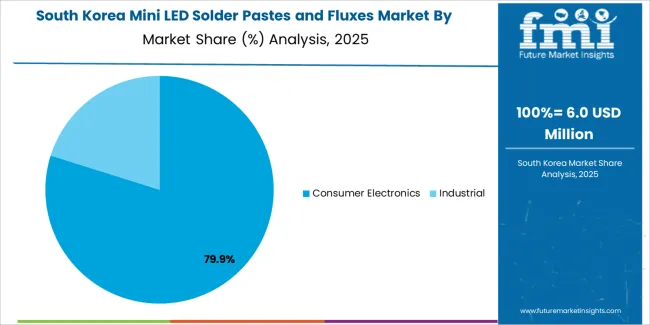

Consumer electronics represent 78.7% of total demand in 2025, as panel manufacturers transition from conventional LCD edge-lit designs to mini LED local dimming architectures. Industrial and automotive displays account for the remaining 21.3%, a segment expected to grow faster due to cockpit digitalization and reliability testing requirements such as high-temperature cycling and vibration endurance. China leads global growth at a 6.6% CAGR through supply chain concentration in Shenzhen, Guangzhou, and Suzhou manufacturing clusters, followed by India at 6.1% and Germany at 5.6% where automotive-grade material qualification is a critical selection factor.

Technology advancement in flux activator chemistry, solder particle morphology control, and rheology optimization is enhancing paste printability while reducing defect rates for manufacturers managing ultra-fine pitch assembly processes with placement tolerances measured in single-digit micrometers. Material suppliers are developing application-specific formulations optimized for die bonding operations, chip-on-board assembly techniques, and flip-chip attachment processes, creating segmented product portfolios addressing diverse substrate materials, reflow atmospheres, and cleaning requirements. The competitive landscape features established solder paste manufacturers expanding mini LED portfolios alongside specialized electronics assembly material suppliers capturing market share through technical service capabilities and process optimization support programs that reduce qualification barriers for display manufacturers transitioning to mini LED production.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 109.6 million |

| Market Forecast Value (2035) | USD 176.8 million |

| Forecast CAGR (2025-2035) | 4.9% |

| DISPLAY TECHNOLOGY ADVANCEMENT | ASSEMBLY PRECISION REQUIREMENTS | REGULATORY & PERFORMANCE STANDARDS |

|---|---|---|

|

|

|

| Category | Segments Covered |

|---|---|

| By Product Type | Lead-Free Solder Paste, Lead-Containing Solder Paste, Other |

| By Application | Consumer Electronics, Industrial |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Segment | 2025 to 2035 Outlook |

|---|---|

| Lead-Free Solder Paste |

|

| Lead-Containing Solder Paste |

|

| Other |

|

| Segment | 2025 to 2035 Outlook |

|---|---|

| Consumer Electronics |

|

| Industrial |

|

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

|

|

|

| Country | CAGR (2025-2035) |

|---|---|

| China | 6.6% |

| India | 6.1% |

| Germany | 5.6% |

| Brazil | 5.1% |

| United States | 4.7% |

| United Kingdom | 4.2% |

| Japan | 3.7% |

China is projected to exhibit strong growth with a market value of USD 92.3 million by 2035, driven by expanding display panel manufacturing infrastructure and comprehensive mini LED production capabilities creating substantial opportunities for assembly material suppliers across television manufacturing, smartphone production, and automotive display operations. The country's dominant position in consumer electronics manufacturing and expanding domestic mini LED panel capacity are creating significant demand for both conventional and advanced solder paste formulations. Major electronics manufacturing service providers and display manufacturers including BOE Technology, TCL, and Tianma are establishing comprehensive local assembly operations supporting large-scale mini LED production and requiring consistent material supply supporting quality standards and cost targets.

Display panel industry expansion programs are supporting widespread adoption of mini LED backlight technology across television and monitor manufacturing, driving demand for specialized solder materials capable of supporting ultra-fine pitch assembly operations with placement accuracy below 50 micrometers. Government initiatives supporting domestic semiconductor and display industries are creating substantial opportunities for material suppliers developing localized production capabilities and technical support infrastructure. Consumer electronics manufacturing growth and automotive display development programs are facilitating adoption of advanced assembly materials throughout major manufacturing clusters in Guangdong, Jiangsu, and Sichuan provinces.

India is expanding to reach USD 38.6 million by 2035, supported by government electronics manufacturing incentives and comprehensive domestic production development creating steady demand for assembly materials across consumer electronics assembly operations and emerging display manufacturing capabilities. The country's expanding electronics manufacturing services sector and growing component assembly capabilities are driving demand for solder materials that provide reliable performance while supporting competitive manufacturing cost structures. Material distributors and technical service providers are investing in local infrastructure to support growing customer base and application engineering requirements.

Production-Linked Incentive schemes and Make in India programs are creating opportunities for assembly materials across diverse electronics manufacturing categories requiring consistent material performance and technical support capabilities. Consumer electronics assembly growth and automotive component manufacturing development are driving investments in material supply chains supporting operational requirements throughout major manufacturing regions in Karnataka, Tamil Nadu, and Uttar Pradesh. Mobile device assembly expansion and television manufacturing programs are enhancing demand for solder paste formulations throughout emerging production facilities.

Germany is projected to reach USD 29.7 million by 2035, supported by the country's leadership in automotive electronics and premium display integration requiring specialized assembly materials meeting automotive qualification standards for instrument clusters, head-up displays, and infotainment systems. German automotive suppliers including Continental, Bosch, and HELLA drive sophisticated material requirements through stringent reliability testing and comprehensive qualification protocols. The market is characterized by focus on long-term durability, temperature cycling resistance, and compliance with automotive industry specifications including AEC-Q200 component standards.

Automotive manufacturers are prioritizing materials demonstrating superior joint reliability under thermal shock, vibration exposure, and extended operating temperature ranges characteristic of automotive environments. Electric vehicle development programs and advanced driver assistance system integration initiatives are driving adoption of premium display technologies requiring specialized assembly materials supporting safety-critical applications. Research and development programs for autonomous vehicle cockpits are facilitating adoption of multi-display architectures throughout premium automotive platforms.

The United States is growing to reach USD 27.4 million by 2035, driven by premium television manufacturing, professional display production, and specialized electronics assembly creating constant opportunities for material suppliers serving both original equipment manufacturers and contract manufacturing operations. The country's advanced electronics assembly capabilities and sophisticated display integration requirements are creating demand for high-performance materials that support demanding optical specifications while maintaining assembly process reliability. Material manufacturers and distribution partners are developing technical service programs supporting customer qualification efforts and process optimization initiatives.

Premium consumer electronics manufacturing and professional display assembly operations are facilitating adoption of advanced solder materials capable of supporting high-brightness backlight requirements and precise thermal management specifications. Medical equipment manufacturing and aerospace electronics programs are enhancing demand for materials meeting stringent reliability standards and comprehensive traceability documentation requirements. Industrial display manufacturing and automotive supplier operations are creating opportunities for specialized formulations throughout American electronics assembly facilities.

United Kingdom is projected to reach USD 20.8 million by 2035, expanding at a CAGR of 4.2%, driven by automotive display integration and industrial electronics manufacturing supporting specialized assembly requirements for premium applications. The country's established electronics manufacturing capabilities and growing automotive electronics sector are creating demand for materials that support both performance requirements and regulatory compliance standards. Technical distributors and material suppliers are maintaining comprehensive product portfolios supporting diverse customer requirements.

Automotive supply chain development and industrial equipment manufacturing programs are supporting demand for solder materials that meet contemporary reliability and environmental compliance standards. Medical device assembly and aerospace electronics manufacturing are creating opportunities for specialized materials providing comprehensive qualification documentation and technical support services. Premium consumer electronics assembly and professional display integration programs are facilitating adoption of advanced formulations throughout electronics manufacturing operations.

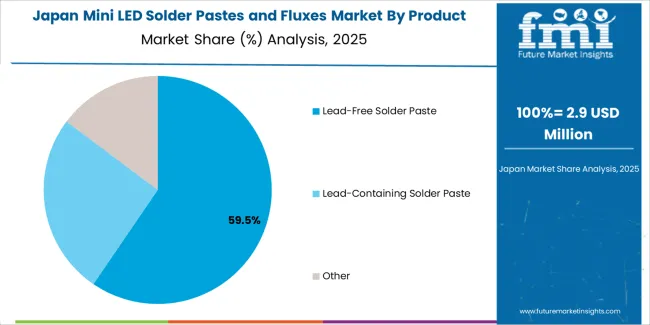

Demand for Mini LED Solder Pastes and Fluxes in Japan is projected to reach USD 24.1 million by 2035, expanding at a CAGR of 3.7%, driven by advanced materials development and precision electronics manufacturing supporting sophisticated assembly processes for automotive displays, industrial equipment, and premium consumer electronics. The country's established materials science capabilities and sophisticated manufacturing operations are creating demand for ultra-high performance materials that support demanding application requirements and stringent quality standards. Materials suppliers including Senju Metal Industry, Harima, and Nihon Superior maintain comprehensive development capabilities supporting advanced formulation requirements.

Automotive electronics excellence and precision manufacturing operations are supporting demand for materials that meet stringent performance and reliability standards across thermal cycling, humidity exposure, and mechanical stress conditions. Industrial automation equipment and robotics manufacturing are creating opportunities for specialized assembly materials supporting high-reliability applications. Consumer electronics component manufacturing and display assembly programs are facilitating adoption of advanced flux chemistry formulations throughout major electronics production regions.

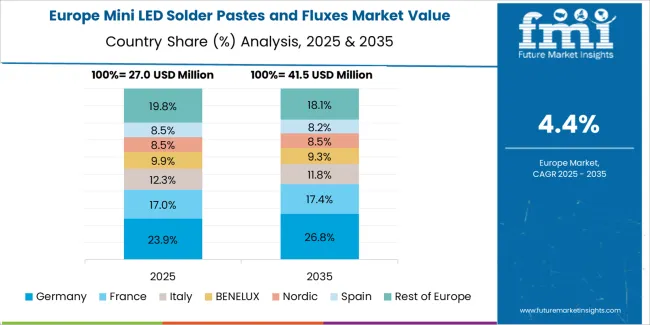

The mini LED solder pastes and fluxes market in Europe is projected to grow from USD 38.5 million in 2025 to USD 62.7 million by 2035, registering a CAGR of 5.0% over the forecast period. Germany is expected to maintain its leadership position with a 31.2% market share in 2025, declining slightly to 30.4% by 2035, supported by its advanced automotive electronics sector and stringent material qualification requirements for display integration across premium vehicle platforms manufactured by Mercedes-Benz, BMW, and Volkswagen Group.

France follows with a 21.7% share in 2025, projected to reach 22.1% by 2035, driven by automotive supplier capabilities and industrial electronics manufacturing requiring specialized assembly materials for transportation and aerospace applications. The United Kingdom holds a 18.4% share in 2025, expected to stabilize at 18.2% by 2035 as automotive electronics manufacturing maintains steady demand despite broader industry consolidation trends. Italy commands a 14.3% share, while Spain accounts for 9.8% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 4.6% to 5.7% by 2035, attributed to increasing electronics manufacturing activity in Nordic countries developing specialized industrial equipment and Eastern European contract manufacturers supporting automotive supply chains serving European original equipment manufacturers.

Japanese mini LED solder pastes and fluxes operations reflect the country's materials science excellence and precision manufacturing capabilities supporting advanced electronics assembly applications. Major materials suppliers including Senju Metal Industry, Harima Chemicals, and Nihon Superior maintain extensive research and development programs focused on ultra-fine particle technology, halogen-free flux chemistry, and low-voiding formulations addressing demanding mini LED assembly requirements. The domestic market emphasizes materials demonstrating exceptional printing characteristics, minimal flux residue, and superior wetting performance across diverse substrate materials including flexible circuits and glass panels.

Regulatory oversight through the Ministry of Economy, Trade and Industry emphasizes comprehensive material safety documentation and environmental compliance verification supporting export operations to global electronics manufacturers. Japanese Industrial Standards establish testing methodologies and performance criteria that influence global material specifications, with particular focus on thermal cycling reliability, electromigration resistance, and long-term stability under elevated temperature storage conditions characteristic of automotive and industrial operating environments.

Supply chain management prioritizes close collaboration between material suppliers and assembly equipment manufacturers, with joint development programs optimizing paste rheology for specific printing equipment and stencil technologies. Companies invest in application laboratories providing process development support and reflow profiling assistance for customers implementing mini LED production lines. The market structure rewards suppliers demonstrating continuous innovation in flux chemistry and alloy composition rather than purely cost-competitive positioning.

South Korean mini LED solder pastes and fluxes operations benefit from the country's dominant position in display panel manufacturing and advanced electronics assembly capabilities. Major display manufacturers including Samsung Display and LG Display drive sophisticated material requirements through their mini LED television production programs and premium monitor manufacturing operations requiring materials optimized for high-throughput automated assembly processes. The Korean market demonstrates particular focus on materials supporting ultra-fine pitch applications below 100 micrometers, low-temperature reflow profiles protecting temperature-sensitive components, and optical clarity requirements ensuring minimal light absorption in backlight architectures.

Material suppliers collaborate closely with display manufacturers during early-stage technology development, participating in joint qualification programs and process optimization studies that establish material specifications for volume production. This collaborative approach creates opportunities for suppliers demonstrating technical responsiveness and process troubleshooting capabilities rather than purely transactional relationships. Korean display manufacturers typically maintain dual-source strategies for critical materials while investing in supplier development programs ensuring consistent material quality across global production facilities.

Regulatory frameworks emphasize chemical safety and worker protection, with comprehensive material safety data sheet requirements and workplace exposure monitoring programs influencing flux chemistry selection and volatile organic compound content specifications. The certification environment requires materials meeting Korean occupational safety standards while demonstrating compatibility with manufacturing equipment and facility exhaust systems designed for specific emission profiles.

Supply chain efficiency remains critical given rapid product development cycles and short time-to-market requirements in consumer electronics industries. Materials suppliers maintain local technical support capabilities and regional distribution centers ensuring responsive delivery supporting just-in-time manufacturing strategies. The market increasingly emphasizes sustainability attributes including recyclable packaging, reduced volatile content, and comprehensive environmental compliance documentation supporting corporate responsibility initiatives.

Profit pools are consolidating around specialized formulation capabilities and application engineering services where technical expertise in ultra-fine pitch assembly commands premiums over commodity solder paste offerings. Value is migrating from standard product sales to integrated material solutions combining paste formulations, flux chemistry optimization, and process parameter development supporting customer qualification programs and production ramp activities. Several archetypes define competitive positioning: global materials corporations leveraging broad product portfolios and established customer relationships across electronics manufacturing; specialized solder paste manufacturers focusing on advanced formulations and technical service differentiation; regional suppliers competing through localized support and responsive customization capabilities; and emerging materials innovators pursuing novel alloy compositions and flux chemistry platforms addressing unmet performance requirements.

Switching costs remain moderate for established manufacturing operations due to extensive qualification requirements and process parameter optimization investments, creating barriers favoring incumbent suppliers with proven reliability records. Supply chain disruptions affecting tin availability and silver pricing periodically reshape competitive dynamics as manufacturers with diversified sourcing capabilities and alloy composition flexibility gain advantage over single-formulation suppliers. Market consolidation continues through acquisitions of regional manufacturers by multinational corporations seeking geographic expansion and specialized technology portfolios, while vertical integration initiatives enable leading suppliers to capture margin opportunities across powder production, flux chemistry, and finished paste manufacturing.

| Stakeholder Type | Primary Advantage | Repeatable Plays |

|---|---|---|

| Global materials corporations | Brand recognition, technical resources, global supply chain | Multi-product bundling, corporate account management, comprehensive testing capabilities |

| Specialized paste manufacturers | Formulation expertise, application engineering, customization | Process optimization services, rapid prototyping, technical problem-solving |

| Regional suppliers | Local presence, responsive service, market knowledge | Fast turnaround customization, on-site technical support, flexible order quantities |

| Powder producers | Raw material control, alloy development, cost structure | Vertical integration, composition optimization, supply security |

| Equipment partnerships | Integrated solutions, process validation, reference profiles | Co-development programs, equipment demonstrations, training services |

| Items | Values |

|---|---|

| Quantitative Units | USD 109.6 million |

| Product Type | Lead-Free Solder Paste, Lead-Containing Solder Paste, Other |

| Application | Consumer Electronics, Industrial |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Country Covered | United States, Germany, United Kingdom, China, India, Japan, Brazil, and other 40+ countries |

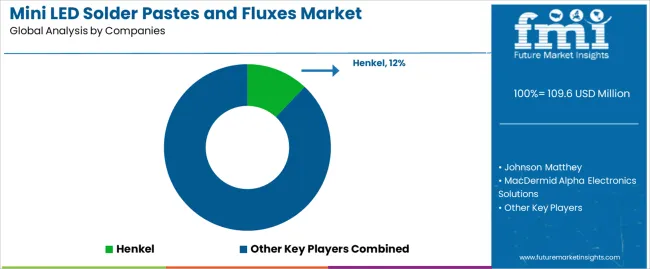

| Key Companies Profiled | Henkel, Johnson Matthey, MacDermid Alpha Electronics Solutions, Senju Metal Industry, Shenzhen Weite'ou New Materials, Shenmao, Harima, Heraeus, Indium, Tongfang Tech, Inventec, AIMKO, KI, Sumitomo Bakelite, Nihon Superior |

| Additional Attributes | Dollar sales by product type/application, regional demand (NA, EU, APAC), competitive landscape, lead-free adoption trends, fine-pitch assembly dynamics, and flux chemistry innovations driving reliability enhancement, environmental compliance, and manufacturing efficiency |

The global mini led solder pastes and fluxes market is estimated to be valued at USD 109.6 million in 2025.

The market size for the mini led solder pastes and fluxes market is projected to reach USD 176.8 million by 2035.

The mini led solder pastes and fluxes market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in mini led solder pastes and fluxes market are lead-free solder paste, lead-containing solder paste and other.

In terms of application, consumer electronics segment to command 78.7% share in the mini led solder pastes and fluxes market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Miniature Duplex Connectors Market Size and Share Forecast Outlook 2025 to 2035

Mining Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Mining Remanufacturing Component Market Forecast Outlook 2025 to 2035

Mining Hose Market Size and Share Forecast Outlook 2025 to 2035

Mining Equipment Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Mining Tester Market Size and Share Forecast Outlook 2025 to 2035

Mini Cranes Market Size and Share Forecast Outlook 2025 to 2035

Mining Pneumatic Saw Market Size and Share Forecast Outlook 2025 to 2035

Mini Grid Market Size and Share Forecast Outlook 2025 to 2035

Mini POS Terminals Market Size and Share Forecast Outlook 2025 to 2035

Mini Track Machinery Market Size and Share Forecast Outlook 2025 to 2035

Minimally Invasive Spine Technologies Market Size and Share Forecast Outlook 2025 to 2035

Mining Drilling Service Market Size and Share Forecast Outlook 2025 to 2035

Mini Hair Straightener Market Size and Share Forecast Outlook 2025 to 2035

Minimally Invasive Laser Therapy Devices Market Size and Share Forecast Outlook 2025 to 2035

Mining Trucks Market Size and Share Forecast Outlook 2025 to 2035

Mini Drives Market Analysis Size and Share Forecast Outlook 2025 to 2035

Mini Packaging Market Size, Growth, and Forecast for 2025-2035

Miniprotein Supplement Market Size and Share Forecast Outlook 2025 to 2035

Mini Brew Fermenter Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA