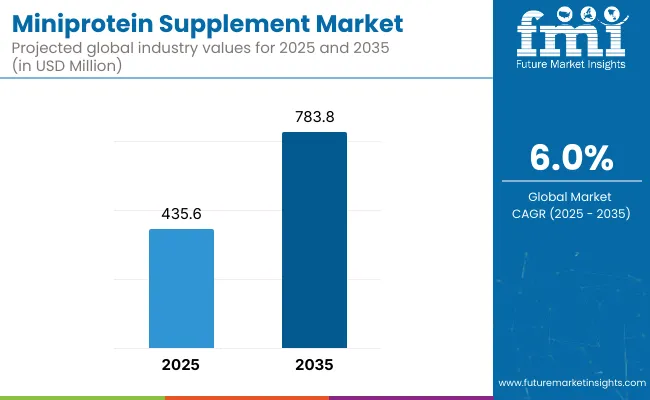

The miniprotein supplement market is on track for strong growth rising from USD 435.6 million in 2025 to USD 783.8 million by 2035. This marks a 6.0% CAGR and an absolute increase of USD 348.2 million, signaling long-term expansion potential across performance nutrition and wellness segments.

Miniprotein Supplement Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 435.6 million |

| Market Forecast Value in (2035F) | USD 783.8 million |

| Forecast CAGR (2025 to 2035) | 6.0% |

The overall momentum is expected to be driven by the convergence of precision nutrition, personalized health trends, and the increasing integration of low-molecular-weight proteins into clinical and performance nutrition regimes.

Between 2025 and 2030, the market is forecast to expand from USD 435.6 million to USD 589.3 million, contributing USD 153.7 million, or approximately 44% of the total decade growth. This initial growth phase is likely to be underpinned by increasing consumer demand for muscle recovery and metabolic health supplements, particularly among athletes and active lifestyle consumers. Powder-based formats are expected to dominate this period due to their formulation flexibility and cost-efficiency, while sports nutrition remains the primary application area, benefiting from brand-backed clinical claims and advanced amino acid profiling.

In the second half, from 2030 to 2035, the market is anticipated to add another USD 194.5 million, accounting for 56% of total growth, as the segment shifts further toward medical and healthy aging nutrition applications. Increased institutional usage across specialty clinics, hospitals, and pediatric nutrition programs is expected to enhance demand. Meanwhile, plant-based blended miniproteins and RTD (ready-to-drink) innovations are likely to gain traction, supported by scientific backing in areas such as joint, cognitive, and skin health.

From 2020 to 2024, the global Miniprotein Supplement Market expanded steadily as consumer awareness shifted toward targeted protein delivery, digestive efficiency, and personalized nutritional support. During this early phase, market leadership remained concentrated among clinical nutrition giants, with Nestlé and Abbott collectively holding over 25-30% of market share through strong hospital distribution, patented peptide formulations, and early entry into aging and post-operative care channels.

Competitive differentiation primarily focused on whey and collagen-based innovation, with most revenue driven by bulk powders and limited penetration of newer delivery formats. Clinical integration and retail personalization were minimal during this period.

By 2025, market demand is projected to rise significantly, led by expanding applications in healthy aging, sports recovery, and medical nutrition. The revenue mix is shifting, as plant-based, blended, and bioengineered miniproteins begin to outpace traditional proteins in innovation pipelines. Major players are evolving toward subscription-based wellness models, flavor-neutral RTDs, and condition-specific formulations for cognitive, joint, and metabolic health.

The competitive edge is now transitioning from ingredient volume to precision, digestibility, and clinical validation, as firms that integrate scientific substantiation, regulatory readiness, and multi-format accessibility are expected to command future growth.

The growth of the miniprotein supplement market is being driven by a convergence of health personalization, functional wellness, and scientific advancements in protein engineering. Rising consumer awareness of sarcopenia prevention, muscle maintenance, and healthy aging has accelerated the adoption of bioavailable, low-molecular-weight proteins. Miniproteins have been increasingly positioned as efficient alternatives for individuals seeking faster absorption, improved digestibility, and targeted physiological benefits.

Clinical validation of miniprotein efficacy in post-operative recovery, pediatric nutrition, and cognitive support has further strengthened their role in medical and specialized nutrition. The market has been boosted by innovations in formulation technologies, enabling incorporation into RTD beverages, powders, and gummies without compromising stability or taste.

Additionally, plant-based miniproteins have been supported by sustainability narratives, meeting the preferences of ethical and environmentally conscious consumers. Integration of omics-based precision nutrition and expanding distribution through online D2C and pharmacy channels are expected to further sustain demand across diverse demographic segments.

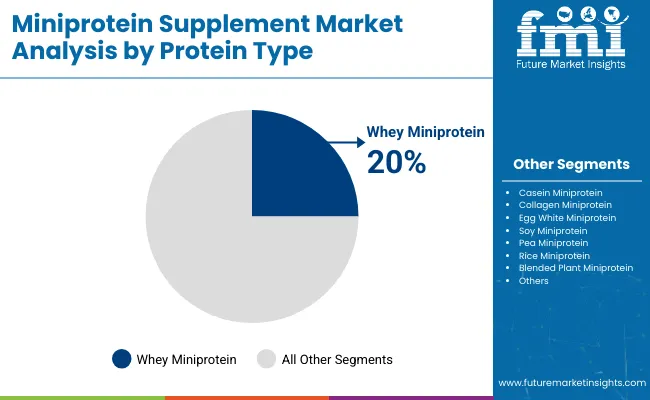

The miniprotein supplement market has been segmented across protein type, application, and product format, offering a structured view into its multi-dimensional evolution. Each segment reflects a unique demand trajectory shaped by consumer lifestyle, clinical outcomes, and innovation in protein science.

By protein type, animal- and plant-based miniproteins have been analyzed for their functional specificity and absorption dynamics. Applications range from performance-oriented sports nutrition to clinical-grade recovery support and aging health. Product format segmentation reveals shifts in convenience, bioavailability, and formulation stability.

This structured segmentation allows for precise strategic planning, as brands target niche demographics with tailored delivery systems. Segment-level analysis highlights the critical roles of whey miniprotein, sports nutrition, and powder formats in shaping near-term growth and long-term market leadership.

| Protein Type | Market Value Share, 2025 |

|---|---|

| Whey Miniprotein | 20% |

| Casein Miniprotein | 8% |

| Collagen Miniprotein | 15% |

| Egg White Miniprotein | 7% |

| Soy Miniprotein | 10% |

| Pea Miniprotein | 8% |

| Rice Miniprotein | 5% |

| Blended Plant Miniprotein | 12% |

| Other Specialty Miniproteins | 15% |

Whey miniprotein is expected to account for 20% of the market share in 2025, maintaining its position as the most preferred protein type in this category. Recognized for its rapid digestibility, complete amino acid profile, and clinical validation, whey continues to be utilized extensively in muscle recovery and sports performance applications.

Its efficacy in lean muscle synthesis and immune modulation has been widely supported by peer-reviewed nutritional science. Growth is further underpinned by innovations in whey hydrolysates and nano-peptide formulations, enhancing absorption while reducing allergenic potential.

As personalization of protein intake becomes mainstream, whey-based miniproteins are projected to remain a cornerstone of both performance and clinical nutrition formulations.

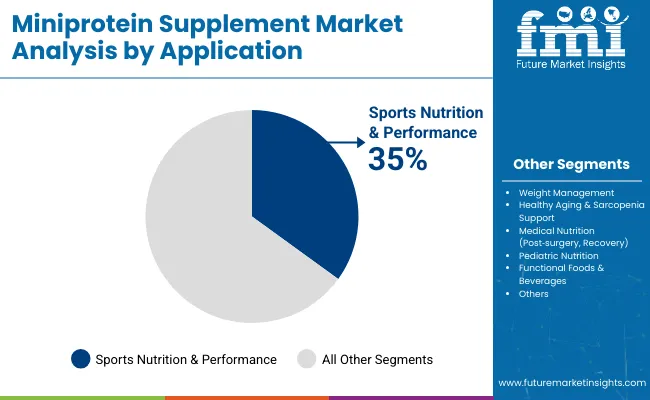

| Application | Market Value Share, 2025 |

|---|---|

| Sports Nutrition & Performance | 35% |

| Weight Management | 18% |

| Healthy Aging & Sarcopenia Support | 15% |

| Medical Nutrition (Post surgery, Recovery) | 10% |

| Pediatric Nutrition | 7% |

| Functional Foods & Beverages | 15% |

The sports nutrition & performance segment is projected to lead with a 35% share in 2025, fueled by a sustained surge in active lifestyle adoption and performance-focused dietary interventions. Miniproteins are being favored by athletes and fitness consumers due to their faster bioavailability and efficient amino acid delivery.

The segment is also benefiting from partnerships between sports brands and ingredient manufacturers offering science-backed miniprotein blends. Innovations in clean-label, non-GMO, and hormone-free formulations are expected to reinforce demand. Moreover, clinical studies demonstrating enhanced muscle recovery and reduced fatigue markers have validated the inclusion of miniproteins in pre- and post-workout regimes, solidifying the segment’s dominance.

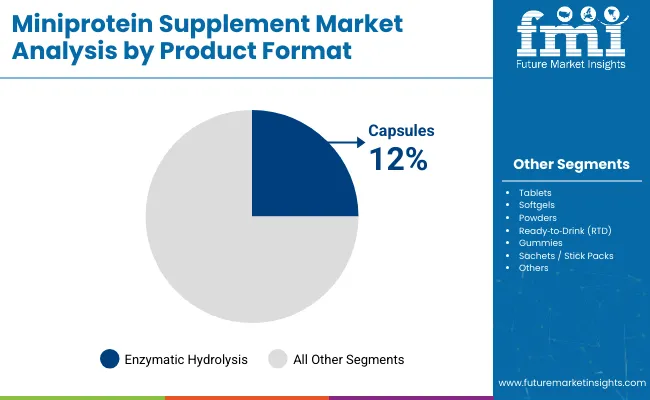

| Product Format | 2025 Share % |

|---|---|

| Capsules | 12% |

| Tablets | 8% |

| Softgels | 5% |

| Powders | 40% |

| Ready to Drink (RTD) | 20% |

| Gummies | 7% |

| Sachets / Stick Packs | 8% |

Powder-based miniprotein supplements are expected to contribute 40% of market revenue in 2025, reflecting their versatility in formulation, customization, and cost efficiency. Their widespread usage in performance nutrition, meal replacements, and clinical formulations has been enabled by compatibility with a wide range of dietary ingredients.

Powders allow precise dosage control, extended shelf stability, and easy mixing into beverages and food. Manufacturers have prioritized flavor masking, solubility, and fast-dissolving features to enhance user experience. As consumer preference shifts toward flexible dosing and portable nutrition, the powder format is expected to retain its leadership, while RTD innovations continue to grow as a convenience-driven alternative.

Despite the expanding use of targeted nutrition in clinical and wellness sectors, the miniprotein supplement market faces nuanced barriers in raw material standardization and delivery optimization. Still, innovation in formulation science and functional precision continues to redefine growth opportunities across segments.

Integration of Precision Amino Acid Profiling in Clinical Protocols

The adoption of precision amino acid profiling in clinical nutrition protocols has significantly supported the demand for miniprotein supplements. Unlike conventional proteins, miniproteins offer optimized bioavailability tailored to individual metabolic requirements, especially in post-operative care, oncology recovery, and pediatric development. Hospitals and specialty clinics have begun integrating structured peptide intake plans into treatment pathways, driven by personalized medicine initiatives.

The shift toward molecularly defined protein regimens is being supported by metabolomics and AI-led diagnostics, enabling miniprotein formulations to match exact nutrient deficits. This integration has been critical in improving patient outcomes, enhancing recovery speed, and reducing adverse reactions associated with larger protein molecules. Over the forecast period, this clinical alignment is expected to serve as a core strategic advantage for manufacturers operating in high-value therapeutic segments.

Development of Thermostable, Flavor-Neutral Miniprotein Powders

A key formulation trend has been the development of thermostable and flavor-neutral miniprotein powders that retain integrity in varied temperature and pH environments. This advancement has enabled wider use in RTD beverages, heat-processed functional foods, and tropical climate markets.

Proteins derived from enzymatically refined sources (e.g., sunflower seed or rice peptides) are being processed with next-generation microencapsulation techniques, minimizing taste fatigue and improving consumer compliance. These innovations are positioning miniproteins as viable for mainstream and clinical hybrid formats such as therapeutic smoothies or geriatric soup mixes where palatability and shelf-life are equally critical.

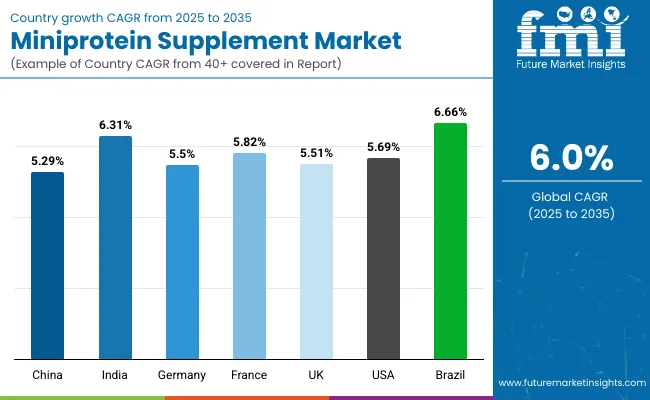

| Countries | CAGR |

|---|---|

| China | 5.29% |

| India | 6.31% |

| Germany | 5.50% |

| France | 5.82% |

| UK | 5.51% |

| USA | 5.69% |

| Brazil | 6.66% |

The global miniprotein supplement market demonstrates differentiated momentum across key economies, shaped by clinical adoption rates, demographic health priorities, and functional nutrition policies. A shift toward precision nutrition protocols, protein customization, and elder care supplementation is influencing regional demand curves.

The Asia-Pacific region, particularly India (6.31% CAGR) and China (5.29% CAGR), is expected to witness accelerated uptake, supported by population-scale wellness initiatives, expanding sports infrastructure, and public-private collaborations in malnutrition intervention. India’s surge is being fueled by inclusion of peptide-based supplements in school nutrition programs and rising market penetration through D2C platforms targeting young urban consumers.

China’s market, while more mature, is gaining traction through integration of miniproteins in TCM-adjacent formulations and innovation hubs focusing on digestive-friendly sports products tailored to lactose-intolerant consumers.

In Europe, France (5.82%), UK (5.51%), and Germany (5.50%) are maintaining robust growth, anchored by healthy aging initiatives, clinical dietary guidelines, and sustainability standards in protein sourcing. France’s demand is being driven by medical nutrition adoption in geriatrics, while the UK has shown strong preference for plant-based blended miniproteins amid ethical consumption narratives.

The USA market (5.69%) is expected to remain innovation-led, with traction in pediatric and oncology nutrition, alongside retail expansion of flavorless RTD and functional snacking formats. In Latin America, Brazil (6.66%) stands out, propelled by government-driven health interventions and rapid mainstreaming of protein-enriched staple foods targeting middle-income households.

| Years | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | 2035 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| USA | 104.5 | 110.9 | 116.8 | 124.5 | 131.6 | 139.7 | 147.4 | 156.0 | 164.1 | 173.3 | 183.1 |

The USA miniprotein supplement market is forecasted to expand from USD 104.54 million in 2025 to USD 183.10 million by 2035, achieving a CAGR of 5.8% over the decade. This consistent growth is being underpinned by the incorporation of targeted peptide-based formulations in chronic care, sports recovery, and lifestyle-driven nutrition.

Hospitals and specialized clinics have increasingly adopted miniprotein protocols in post-surgical and immunonutrition therapy, especially in elderly and oncology patients. Meanwhile, product innovation in flavor-neutral, high-solubility powders and sachets has enabled broader use across pediatric and outpatient dietary regimens.

Digital health platforms in the USA have begun pairing microbiome testing and amino acid panels with customized miniprotein dosing kits, expanding the market toward preventive wellness.

The Miniprotein Supplement Market in the United Kingdom is expected to grow at a CAGR of 5.53% from 2025 through 2035, driven by the country’s aging population, NHS-supported dietary research, and strong consumer demand for clinical-grade functional nutrition. A shift from traditional protein powders to condition-specific miniproteins has been observed across senior wellness programs and outpatient care.

Consumer preferences have increasingly favored plant-based blended miniproteins aligned with ethical and sustainability values. Pharmacy chains and specialist health retailers have expanded their offerings of gastro-friendly and lactose-free peptide formats, particularly among elderly and IBS-sensitive users.

Digital platforms in the UK have supported adoption through nutrigenomic pairing and personalized supplement tracking tools.

The Miniprotein Supplement Market in the India is expected to grow at a CAGR of 6.31%, through 2035, supported by government-led health interventions, growing sports nutrition infrastructure, and rising demand for affordable, high-absorption protein formats. Miniproteins have been increasingly positioned as a solution to India’s double burden of undernutrition and lifestyle disorders.

Adoption has been accelerated through integration into state-run school meal and maternal health programs, where lightweight, sachet-based miniproteins are being deployed to address regional protein gaps. The private healthcare sector has promoted clinical-grade peptides in oncology recovery and dialysis nutrition.

Urban D2C brands have introduced ayurvedic-infused miniproteins and digestive enzyme-enhanced formulations targeting fitness, aging, and women's health segments.

The miniprotein supplement market in China is expected to grow 5.29% through 2035, driven by growing clinical acceptance, public health integration, and strong demand for digestively mild protein solutions in both preventive and therapeutic care. Regulatory support for functional food labeling and expanded health insurance coverage for enteral nutrition have positioned miniproteins as a viable solution in hospital and home settings.

Aging population trends and digestive intolerance to conventional proteins have catalyzed the shift toward hydrolyzed peptides and microproteins, especially for oncology, elderly care, and post-viral recovery diets. In addition, TCM-integrated formulations featuring herbal-miniprotein blends are gaining adoption, particularly in retail pharmacies and wellness centers.

| Countries | 2025 | 2035 |

|---|---|---|

| UK | 20.50% | 19.32% |

| Germany | 21.31% | 20.89% |

| Italy | 9.61% | 9.81% |

| France | 12.63% | 13.72% |

| Spain | 10.42% | 11.77% |

| BENELUX | 6.32% | 5.89% |

| Nordic | 5.83% | 5.94% |

| Rest of Europe | 13% | 13% |

Germany’s miniprotein supplement market is projected to grow at 5.50% over the next decade, underpinned by stringent clinical nutrition protocols, insurance-backed outpatient dietary programs, and the country's advanced regulatory support for medical-grade supplements. Formulations with documented therapeutic outcomes are prioritized in both hospital and pharmacy networks.

Institutional buyers have focused on collagen and whey-based miniproteins for orthopedic recovery, sarcopenia prevention, and post-cardiac rehabilitation. Market preference remains centered on clean-label and allergen-free formulations, often verified through third-party clinical testing and eco-certifications.The aging demographic has driven expansion in nutritionally fortified RTDs, especially in the homecare segment, where ease of administration and digestibility are critical.

| Protein Type | Market Value Share, 2025 |

|---|---|

| Whey Miniprotein | 22% |

| Casein Miniprotein | 7% |

| Collagen Miniprotein | 18% |

| Egg White Miniprotein | 6% |

| Soy Miniprotein | 10% |

| Pea Miniprotein | 7% |

| Rice Miniprotein | 5% |

| Blended Plant Miniprotein | 12% |

| Other Specialty Miniproteins | 13% |

The miniprotein supplement market in Japan is projected to reach USD 32.67 million in 2025, with whey (22%) and collagen (18%) miniproteins leading the market by value. This dominance reflects Japan’s continued emphasis on clinically validated, high-bioavailability proteins for specialized applications in healthy aging, skin health, and muscle preservation. The country’s structured approach to functional food regulation has favored ingredient-backed supplements, especially among elderly and health-conscious adult populations.

A distinct consumer inclination toward collagen-based solutions driven by dermal, joint, and mobility health concerns has amplified demand for bioactive miniproteins in RTD and powder form. Concurrently, whey proteins are being widely used in hospital recovery diets, gym-based performance products, and sarcopenia-prevention programs for seniors.

| Application | Market Value Share, 2025 |

|---|---|

| Sports Nutrition & Performance | 36% |

| Weight Management | 17% |

| Healthy Aging & Sarcopenia Support | 14% |

| Medical Nutrition (Post surgery, Recovery) | 9% |

| Pediatric Nutrition | 6% |

| Functional Foods & Beverages | 18% |

The miniprotein supplement market in South Korea is expected to achieve robust growth by 2025, reaching USD 20.9 million, with sports nutrition (36%) and functional foods & beverages (18%) emerging as the dominant application areas. South Korea's growth trajectory is being shaped by convergence between performance nutrition, beauty innovation, and a tech-enabled food retail ecosystem. Brands have prioritized science-backed personalization and clean-label positioning, aligning with consumer preferences for precise, convenient, and aesthetically beneficial supplements.

The dominance of sports nutrition stems from a cultural shift toward active living and gym culture among millennials and Gen Z consumers. Simultaneously, the popularity of functional miniprotein-infused beverages, particularly in the RTD and convenience categories, reflects a growing demand for on-the-go supplementation without compromise on taste or digestibility.

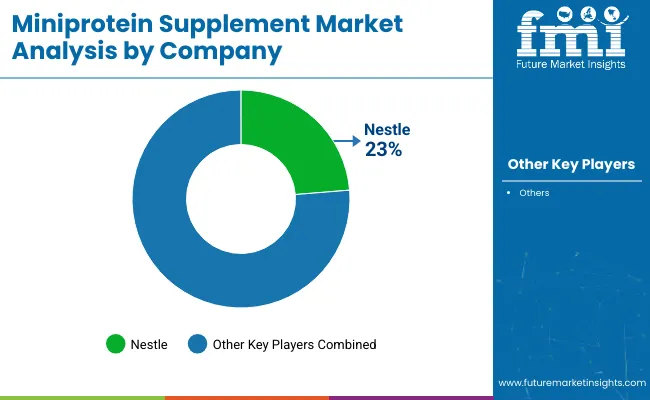

| Global Leaders | Global Value Share 2025 |

|---|---|

| Nestle | 23 % |

| Others | 77 % |

The miniprotein supplement market remains moderately fragmented, characterized by a mix of global nutrition giants, functional ingredient innovators, and specialty wellness brands competing across clinical, performance, and lifestyle-driven use cases. Market competition is increasingly shaped by clinical efficacy, protein source diversification, and delivery format innovation, rather than pure volume or brand recognition.

Global leaders such as Nestlé Health Science, Abbott Nutrition, and Glanbia Performance Nutrition are projected to collectively account for approximately 35-40% of global market share in 2025. Their leadership has been underpinned by investments in therapeutic nutrition, plant-based miniprotein R&D, and personalized wellness platforms. These companies are expanding clinical applications through hospital partnerships, subscription-based DTC models, and integration of diagnostic tools to guide protein intake.

Mid-sized ingredient players, including FrieslandCampina Ingredients, Arla Foods Ingredients, and Hilmar Ingredients, have specialized in functional peptide development, catering to B2B clients in the medical nutrition, healthy aging, and infant care sectors. Their strength lies in bioactive protein customization, traceable sourcing, and EFSA/GRAS-aligned regulatory compliance.

Niche-focused wellness brands such as Amway (Nutrilite), Herbalife Nutrition, and NOW Foods are innovating through gummies, RTD drinks, and flavor-neutral sachets, appealing to younger, active consumers via D2C and health store channels.

Competitive differentiation is rapidly evolving toward format flexibility, digestive optimization, and science-backed claims, with sustained focus on bioavailability, gut health integration, and clean-label positioning across all tiers of players.

| Item | Value |

|---|---|

| Quantitative Units | USD 435.6 million in 2025 |

| Ingredient Type | Whey Miniprotein, Casein Miniprotein, Collagen Miniprotein, Egg White Miniprotein, Soy Miniprotein, Pea Miniprotein, Rice Miniprotein, Blended Plant Miniprotein, Specialty Miniproteins (e.g., Sunflower, Pumpkin Seed) |

| Application | Sports Nutrition & Performance, Weight Management, Healthy Aging & Sarcopenia Support, Medical Nutrition (Post-surgery, Recovery), Pediatric Nutrition, Functional Foods & Beverages |

| Product Format | Capsules, Tablets, Softgels, Powders, Ready-to-Drink (RTD), Gummies, Sachets/Stick Packs |

| Functionality | Muscle Maintenance & Recovery, Joint & Bone Health, Metabolic Health, Skin, Hair & Nail Support, Cognitive Support |

| Sales Channel | Pharmacies & Drugstores, Health & Nutrition Stores, Supermarkets/Hypermarkets, Online Retail, Direct-to-Consumer (D2C), Specialty Clinics & Hospitals |

| End User | Athletes & Fitness Enthusiasts, Elderly Consumers, Patients in Recovery, Active Lifestyle Consumers |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Korea |

The global Miniprotein Supplement Market is estimated to be valued at USD 435.6 million in 2025, driven by increasing demand for targeted protein delivery in clinical, performance, and active lifestyle nutrition applications.

The market size for the Miniprotein Supplement Market is projected to reach USD 783.8 million by 2035, reflecting its expanding role across healthy aging, medical recovery, and functional food applications.

The Miniprotein Supplement Market is expected to grow at a compound annual growth rate (CAGR) of 6.0% between 2025 and 2035, nearly doubling in size over the forecast decade.

The key protein types in the Miniprotein Supplement Market include Whey, Collagen, Blended Plant, Casein, Egg White, Soy, Pea, Rice, and Other Specialty Miniproteins such as pumpkin seed and sunflower-based formulations.

In terms of application, the Sports Nutrition & Performance segment is projected to command the largest share at 35% in 2025, owing to strong adoption among athletes and active lifestyle consumers seeking rapid protein absorption.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Supplements And Nutrition Packaging Market

Supplementary Protectors Market

ACF Supplements Market Size and Share Forecast Outlook 2025 to 2035

Food Supplement Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Viscosupplementation Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

PDRN Supplements Market Size and Share Forecast Outlook 2025 to 2035

Viscosupplementation Industry Analysis in Europe - Size, Share & Forecast 2025 to 2035

Feed Supplements Market Analysis - Size, Share & Forecast 2025 to 2035

Sleep Supplement Market Size and Share Forecast Outlook 2025 to 2035

Gummy Supplements Market Size and Share Forecast Outlook 2025 to 2035

Fiber Supplements Market Size and Share Forecast Outlook 2025 to 2035

Vegan Supplements Market Analysis by Ingredient Type, Form, Customer Orientation , Sales Channel and Health Concer Through 2035

Analysis and Growth Projections for Green Supplement Business

Andro Supplements Market

Custom Supplement Formulation Service Market Size and Share Forecast Outlook 2025 to 2035

Beauty Supplements Packaging Market Size and Share Forecast Outlook 2025 to 2035

Herbal Supplement Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Beauty Supplement Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Biotin Supplement Market Analysis – Size, Share & Forecast 2025 to 2035

Energy Supplement Market Analysis by Product Type, End-user and Distribution Channel through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA