The global industrial stackers market is expected to grow in the coming years, owing to the growing requirement of efficient material handling solutions in industrial verticals such as manufacturing, logistics, warehousing, and retail. The increase in the adoption of stackers is a result of growing initiatives towards improving operational efficiency and streamlining workflow processes in most companies.

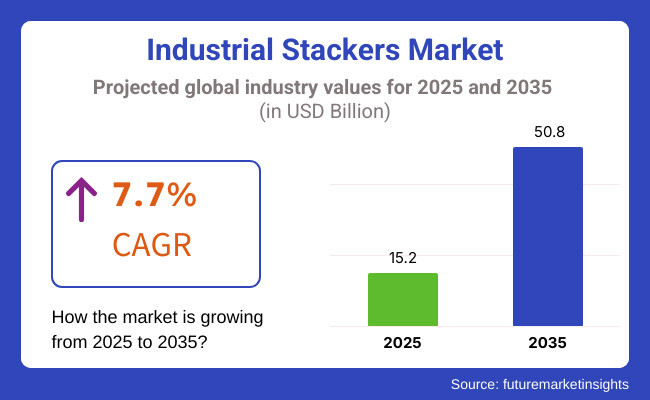

The market was worth almost USD 11.7 billion in 2023 and stands to surpass USD 15.2 billion by 2025. The market is forecasted to further increase up to USD 50.8 billion by 2035, with a CAGR of 7.7%, alongside continued industrial automation and warehouse management solutions development.

Growing focus toward workplace safety, cost reduction, and productivity improvement have spurred the demand for advanced stackers, such as electric and automated ones. Rising Investment in new logistics infrastructure drives Strong growth of Industrial Stackers Market segment as companies adapt to the new reality.

The industrial stackers market segment is likely to see solid double-digit growth across all regions as more and more companies invest in new logistics infrastructure; modernisation of traditional logistics infrastructure; and implementation of electric forklifts and industrial wind-supplied stackers across the verticals is only the tip of the iceberg, and demand for sophisticated solutions to solve the delivery and shipping bottleneck during the pandemic itself is evidence of the company's 2020 growth plans.

The industrial stackers market will expand steadily from 2020 to 2024, as more mature industrialisation, warehouse automation, and increased demand for efficient material handling equipment. The market was valued at nearly USD 9.2 billion in 2020, but the COVID-19 pandemic disrupted supply chains and affected production and sales.

But as industries reopened in 2021, the market returned to USD 10.1 billion, as companies began to use automation and operational efficiencies to cope with labour shortages.

By 2022, demand increased significantly for electric and semi-automated stackers, pushing the market to around USD 10.9 billion, with sustainability and cost-efficiency becoming the main concerns. In 2023, the trend persisted as the market increased to USD 11.7 billion as industrial sectors flourished and investments in logistics infrastructure grew.

The market is projected to exceed 13.0 USD billion in 2024 with increasing adoption of smart warehouse solutions and electric stackers. With such an incredible, continuous growth pattern, right now is just the beginning, as the market is expected to grow into a USD 15.2 billion powerhouse by 2025 and beyond.

| Key Drivers | Key Restraints |

|---|---|

| Artificial Intelligence and IoT Integration for Real-Time Monitoring. | Cybersecurity risks associated with connected stackers |

| Expansion in cold storage and pharmaceutical logistics. | Difficulties with electric stackers batteries performance. |

| Need for multi-functional and high load capacity stackers. | Urban warehouses restricting large stacker use due to space. |

| Shifting towards rental and leasing models. | Variability in the price of raw inputs impacting the factory. |

| Labor shortages are speeding up the robotization. | Regulatory Barriers Affecting Cross-Border Trade in Goods. |

| Innovations in lightweight and compact stackers. | Regulatory Barriers Affecting Cross-Border Trade in Goods. |

| Multi-tier warehouse systems expansion. | Heavily reliant on aftersales service and the availability of spare parts. |

| Hybrid-powered stackers (electric + fuel cell). | Absence of a global standardization of stacker regulations. |

| Key Drivers | Impact Level |

|---|---|

| Integration of IoT and AI for real-time monitoring | High |

| Growth in cold storage and pharmaceutical logistics | Medium |

| Demand for multi-functional and high-load capacity stackers | High |

| Increasing preference for rental and leasing models | Medium |

| Rising labor shortages accelerating automation | High |

| Technological advancements in lightweight and compact stackers | Medium |

| Expansion of multi-tier warehouse systems | High |

| Development of hybrid-powered stackers (electric + fuel cell) | Medium |

| Key Restraints | Impact Level |

|---|---|

| Cybersecurity risks associated with connected stackers | Medium |

| Challenges in battery performance for electric stackers | High |

| Space constraints in urban warehouses limiting large stacker deployment | Medium |

| Fluctuations in raw material costs affecting manufacturing | High |

| Regulatory barriers in cross-border equipment trade | Medium |

| Resistance to automation in traditional industries | Low |

| High dependency on after-sales service and spare parts availability | High |

| Lack of standardization in global stacker regulations | Medium |

The industrial stackers market will continue to change across various fragments, unconscious of mechanisation, needs of productivity, and industry explicit requests.

When bulk industries emphasise energy-optimised and maintenance-free solutions, electric stackers display high growth by type; likewise, adoption will be triggered when stackers are integrated into smart warehouse systems and sustainability initiatives.

However, mid-sized enterprises and cost-sensitive segments will continue to prefer semi-electric stacker types as they offer a cost-effective trade-off between automation and flexibility. Manual and hydraulic stackers will still be demanded, particularly in declining warehouses and industries where lifting needs are limited, but their market share may decrease as automated solutions gain prominence.

Retail, alongside wholesale, will rely on stackers for effective inventory streamlining and for meeting the heightened demand of e-commerce. Global supply chains will need even more logistics to reach the end customer and will generally lead to deeper and more powerful growth in the logistics business. Hygiene-compliant designs that accommodate cold storage as well as handling of perishables will also be guided by the food and beverages sector, which will also determine advanced stackers.

Stackers will remain a part of the offering from the automotive industry, a part of the assembly line, and material movement from storage to production on the factory floor. Pharmaceuticals, construction, and electronics are other sectors that will support market growth, as automation trends transform how warehouses and factories operate.

Flexible and automated processing in industrial stackers will fuel the expansion of the United States industrial stackers market. Global stackers market in the United States With energy-efficient and sustainable material handling solutions, electric stackers will have a large user base.

Rapid e-commerce and 3rd-party logistic growth will propel investment growth in advanced stacking equipment. With a robust supply chain network and growing warehouse sizes in the USA market, the focus will be on integrating stackers enabled with IoT for improved operational efficiency. As labour shortages make it more difficult for businesses to hire enough workers, they will increasingly turn to automated and semi-electric stackers, making this country a key market in North America.

The industrial stackers market in Canada will register steady growth, driven by rising investments in warehouse automation and logistics infrastructure. The expansion of the retail and e-commerce sectors will drive demand for electric and semi-electric stackers, particularly in urban distribution centres. Tremendous demand for battery-powered stackers is expected to create new opportunities for efficient utilisation of resources through government favour for sustainable and energy-efficient machinery.

But the evolution of Canada’s market could be somewhat constrained by higher equipment costs and dependence on imports, though advancements in domestic manufacturing may alleviate some pressure on the supply chain.

The stable growth for industrial stackers is mainly supported by the country's increasing reliance on automation and labour efficiency inside the warehouses. The post-Brexit trade regulations will highly promote local manufacturers to improve domestic stackers production to minimise import dependence.

With the growth of the retail and wholesale industry because of e-commerce comes the need for sophisticated stacking solutions. Sustainability measures will boost the use of electric stackers, while logistics companies will channel funds into smart warehouses fitted with AI-powered machinery.

The deployment of industrial stackers in Germany will be driven by the nation’s technologically advanced manufacturing sector, in addition to the growing automation of material handling operations. The core economy, the automotive sector, is going to use stackers for the linked production processes.

There would be strong demand for logistics and warehousing as demand on the country remains as a distribution centre for Europe. Government intervention on factory and emission safety will boost the demand by the implementation of IoT & electric stackers. The rise of Industry 4.0 will also act as a market driver for AI and robotics stackers. But the high upfront costs of automation may make it slower to adopt among smaller firms.

As smart logistics & automation is gaining traction rapidly, it is expected that South Korea will be at the forefront of the industrial stackers market growth in the country. In controlled environments, the electronics and semiconductor sectors will drive demand for high-precision automated stackers. With online shopping on the rise, distribution canters are now more reliant than ever on electric and semi-electric stackers for their stock.

The transition to battery-powered stackers will also be accelerated by governmental programs promoting green technologies. A new generation of compact and multi-purpose stackers will be important because urban warehouses will have limited space. In the long run, the South Korean industrial stackers market will be clearly characterised by the introduction of robotics and AI logistics.

With the necessity of mechanisation in Japan's ageing population, the industrial stackers market will keep its growth path. Electric and autonomous stackers are increasingly adopted in automotive, electronics, and logistics industries to enhance operational efficiency. Due to the emphasis placed on technological innovation in the country, stackers will be developed using IoT-integrated and AI-powered stackers in the future to make smarter warehouses.

Demand for energy-efficient material handling equipment will continue to be triggered on the back of sustainability initiatives. However, the expensive investment made in advanced automation may limit adoption in small and medium enterprises. The Japanese invest in cutting-edge industrial products so the market will remain strong.

China-thanks to the manufacturing and e-commerce industries-will lead the world in industrial stackers market growth. It can be observed, in the case of a smart warehouse, that businesses are expected to invest heavily in electric and semi-electric stackers.

The encouraging government initiatives for factory automation and sustainability are expected to lead to high adoption of battery-based stackers. With Korea's automotive and electronics industries booming, the demand for advanced stacking solutions will only grow. But increased labour costs and disruptions to the supply chain could become obstacles. With new domestic manufacturing, China will be well placed to meet demand through 2023, keeping it among the top global producers of equipment such as industrial stackers.

Rapid urbanisation and industry expansion in India, thus, provide an impetus for the growth of the Indian industrial stackers market. Government interventions to promote manufacturing under Make in India and investment in smart infrastructure will further bolster logistics and warehousing as strong contributors in this regard. The surging requirement of electric and semi-electric stackers at distribution centres will further foster the e-commerce surge.

Food and drink will follow-and the supply chain management will be greatly aided by intelligent stackers at the next higher level. Nonetheless, equipment costs and awareness of how automation helps are likely to restrict growth. Nevertheless, industries are upgraded-the market will progress in different ways.

Moving forward from 2025 to 2035, the leading Tier 1 companies Toyota Material Handling, KION Group AG, Hyster-Yale, Jungheinrich AG, and Crown Equipment Corporation that are analysed in the Marketing Trend Analysis are focused on technological innovation, sustainability, and global expansion.

They will also make significant investments in AI-driven automation, IoT-integrated stackers, and electrification initiatives to improve productivity and decrease carbon emissions. Its strategic acquisitions and partnerships with local refining companies in emerging economies such as India and Southeast Asia, where industrialisation is increasing and growing energy demand, can help expand their market.

Toyota Material Handling launched new hydrogen fuel cell stackers in 2024 focused on sustainability, while Jungheinrich AG extended its product range with lithium-ion products due to growing demand for environmentally friendly alternatives.

KION Group also chose to deliver AI-based fleet management solutions, whereas Crown Equipment opted to broaden its automation offering. In the coming years, these businesses will shift their focus towards research and development, digitalisation, and local production to remain competitive and keep up with evolving needs in their respective industries.

By contrast, another startup you have written about is Pattern Labs-building advanced autonomous mobility systems. You are an operator trained with data a decade back.

BMPower has been especially innovative, exploring the use of hydrogen fuel cells to extend the working time of drones and robots. Although primarily developing tools for aerial and mobile robotics, their lightweight plug-and-play power systems can also be adapted in industrial stackers, providing a greener alternative for conventional battery-powered equipment.

| Past Trends (2020 to 2024) | Future Trends (2025 to 2035) |

|---|---|

| Growth powered by e-commerce and warehouse automation | Autopilot and AI-based fleet management. |

| Energy piles up electric stackers and semi electric stackers. | Electric stackers and hydrogen stackers dominate. |

| We will give you a brief overview of Lithium-ion battery stackers, which are gaining popularity. | Use case of IoT-enabled for real-time data analytics |

| In 2020, the acceleration of Digital Transformation by COVID-19 | Autonomous navigation and predictive maintenance |

| Supply chains in the way of growth. | Artificial intelligence and machine learning optimizing smart warehouses |

| Cost cutting and efficiency become the focus. | Increased demand for rental and leasing models. |

It is segmented into Electric, Semi-electric and Manual/Hydraulic.

It is fragmented in Retail & Wholesale, Logistics, Food & Beverages, Automobiles and Others etc.

It is divided into North America, Latin America, Europe, Asia Pacific and Middle East and Africa.

Demand is powered by warehouse automation, e-commerce expansion, and other material managing conditions.

AI, IoT, and autonomous navigation are among the concepts being incorporated by companies, which are also moving toward stackers powered by electricity or hydrogen to ensure sustainability.

Some of the critical domains include logistics, retail, food, beverages, automotive, and manufacturing, which require material handling solutions at scale.

Some other future trends include complete automation, AI-based fleet management, smart warehouses, and increased rental and leasing models.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 22: Western Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 24: Western Europe Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 30: Eastern Europe Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 40: East Asia Market Volume (Units) Forecast by Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 42: East Asia Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Units) Forecast by Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Units) Forecast by End-Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 16: Global Market Attractiveness by Type, 2023 to 2033

Figure 17: Global Market Attractiveness by End-Use, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 34: North America Market Attractiveness by Type, 2023 to 2033

Figure 35: North America Market Attractiveness by End-Use, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by End-Use, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 67: Western Europe Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by End-Use, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by End-Use, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by End-Use, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 117: East Asia Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 121: East Asia Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by End-Use, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Grade Electrochemical CO Sensor Market Size and Share Forecast Outlook 2025 to 2035

Industrial Bench Scale Market Size and Share Forecast Outlook 2025 to 2035

Industrial Low Profile Floor Scale Market Size and Share Forecast Outlook 2025 to 2035

Industrial Sand Mill Market Size and Share Forecast Outlook 2025 to 2035

Industrial Control Network Modules Market Size and Share Forecast Outlook 2025 to 2035

Industrial Precision Oven Market Size and Share Forecast Outlook 2025 to 2035

Industrial Water Chiller for PCB Market Size and Share Forecast Outlook 2025 to 2035

Industrial & Commercial HVLS Fans Market Size and Share Forecast Outlook 2025 to 2035

Industrial Robot Controller Market Size and Share Forecast Outlook 2025 to 2035

Industrial Wired Routers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Evaporative Condensers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Energy Management System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Insulation Market Size and Share Forecast Outlook 2025 to 2035

Industrial Safety Gloves Market Size and Share Forecast Outlook 2025 to 2035

Industrial Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Industrial Dust Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Vertical Washing Tower Market Size and Share Forecast Outlook 2025 to 2035

Industrial Pepper Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronics Packaging Market Forecast and Outlook 2025 to 2035

Industrial Absorbent Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA