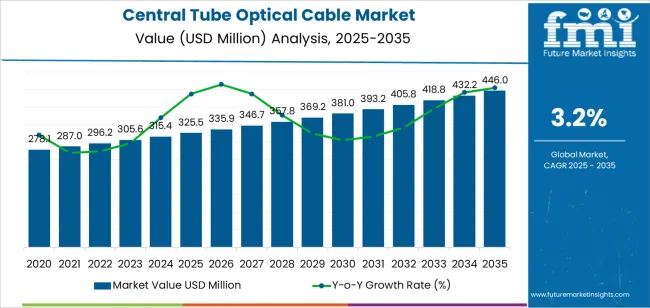

The central tube optical cable market is forecast to grow from USD 325.5 million in 2025 to USD 446 million by 2035, reflecting a CAGR of 3.2%. Growth is driven by the increasing demand for high-capacity, reliable, and high-speed communication networks globally. Central tube optical cables, commonly used in telecommunications, data centers, and broadband applications, can support higher data transmission rates over longer distances than traditional cables. As industries such as 5G networks, fiber-to-the-home (FTTH), and internet infrastructure expand, the need for advanced optical fiber solutions continues to rise.

With the increasing adoption of high-speed internet, the demand for optical cables is expected to increase significantly, especially as businesses and consumers seek faster and more reliable data connections. In addition, the push towards smart cities and digitalization across industries will require robust fiber-optic infrastructure, further driving demand for central tube optical cables. As technological advancements continue to evolve, such as the integration of AI, IoT, and cloud computing, the market for optical fiber solutions will remain critical for maintaining seamless, high-speed communication systems.

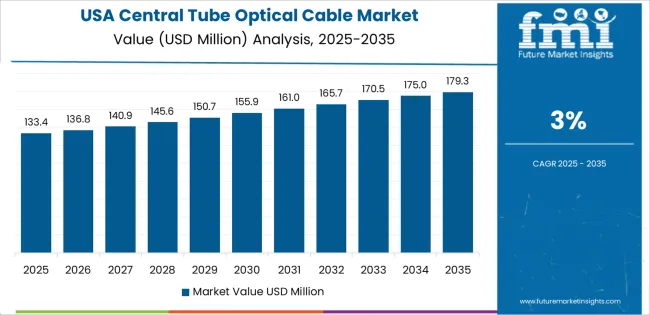

The Rolling CAGR Analysis for the central tube optical cable market reflects how the growth rate evolves over time across different segments of the 10-year forecast period, highlighting periods of acceleration or deceleration. The overall CAGR of 3.2% indicates consistent, moderate growth, but the year-over-year (YoY) growth rates show some variability.

Between 2025 and 2030, the market experiences steady growth, driven by ongoing investments in telecommunications infrastructure and the expansion of fiber optic networks globally. The rolling CAGR during this phase will likely remain close to the average CAGR of 3.2%, with slight increases each year. This gradual growth reflects both technological advancements and continued demand for optical cables as industries shift to high-speed internet and advanced networking systems.

From 2030 to 2035, the growth rate may experience mild acceleration due to the expanding demand for 5G networks and increased investments in broadband infrastructure. The rolling CAGR may slightly rise to around 3.4% as smart cities and digital ecosystems grow, further increasing the adoption of fiber optic technologies. The market will benefit from a higher volume of deployments, with the focus shifting toward meeting the demands of next-generation communication networks. As a result, the market’s growth will continue at a steady pace but with slightly enhanced momentum in the latter half of the forecast period.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 325.5 million |

| Market Forecast Value (2035) | USD 446 million |

| Forecast CAGR (2025-2035) | 3.2% |

The central tube optical cable market is being driven by the rapid expansion of broadband and high speed fiber deployments, particularly in support of 5G networks, data centers, and fiber to the home (FTTH) infrastructure. As network operators and telecommunication service providers seek cable solutions that offer higher fiber counts, better protection, and enhanced reliability, central tube constructions where a buffer tube at the cable core houses multiple fibers are becoming more attractive. The broader optical fiber cable market is growing at a compound annual growth rate (CAGR) of about 10% or higher due to these underlying drivers.

Another key factor is the need for cables that simplify installation, reduce space requirements, and improve thermal or mechanical performance in challenging environments. Central tube cables offer improved mechanical stability, easier fiber management, and higher packing density compared to some alternative designs. This makes them favorable for high density urban micro ducts, data center interconnects, and long haul telecom applications. Cost pressures, installation labor constraints, and competition from alternate cable designs, such as loose tube or ribbon tube, may moderate growth in certain regions or segments.

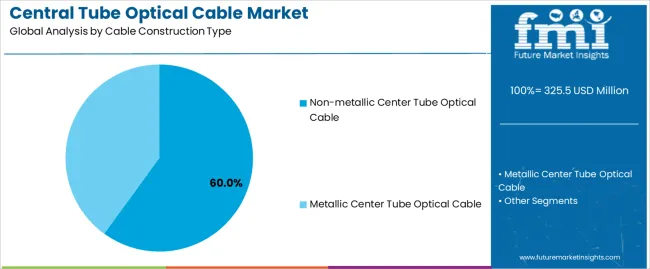

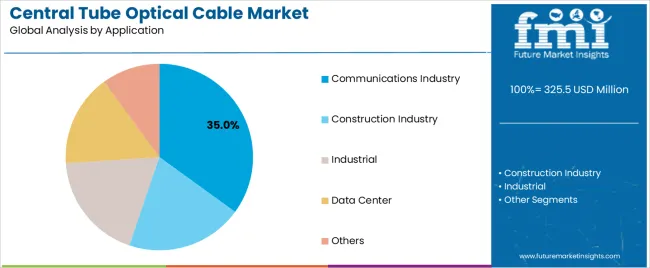

The central tube optical cable market is segmented by cable construction type and application. The leading cable construction type is non-metallic center tube optical cable, which holds a 60% market share, while the dominant application segment is the communications industry, accounting for 35% of the market. These segments play a significant role in the growth of the market, driven by the increasing demand for high-speed data transmission and network infrastructure across various industries.

The non-metallic center tube optical cable segment leads the market with a 60% share. Non-metallic center tube cables are preferred in various applications due to their lightweight design, flexibility, and ease of installation. These cables are primarily used in environments where flexibility, resistance to corrosion, and lower weight are critical considerations, such as in aerial installations and underground applications. Non-metallic center tube cables are typically composed of a central tube that houses the optical fibers, surrounded by a protective layer that ensures durability and reliable performance over long distances.

The demand for non-metallic center tube optical cables is driven by their widespread use in telecommunications, internet infrastructure, and network backbone installations. These cables are particularly effective in urban and rural network deployments, where space and installation ease are key considerations. Additionally, as the demand for faster internet speeds and broader connectivity continues to grow, the non-metallic center tube optical cable segment is expected to maintain its dominant position in the market, especially in emerging markets where network expansion is critical.

The communications industry is the leading application segment in the central tube optical cable market, accounting for 35% of the market share. Optical cables are essential for high-speed data transmission in the communications industry, where the demand for faster, more reliable networks continues to increase. The use of central tube optical cables in the communications industry is driven by the need for robust and high-performance cables that can support internet, telephone, and television services over long distances without signal degradation.

The growing demand for broadband infrastructure, 5G networks, and fiber-to-the-home (FTTH) solutions is significantly boosting the need for central tube optical cables in the communications industry. As more businesses and consumers rely on fast and stable internet connectivity, the communications sector is expected to remain the largest driver of growth in the optical cable market. Furthermore, as global telecommunications infrastructure expands, particularly in developing regions, the demand for central tube optical cables in the communications industry is anticipated to continue increasing.

The central tube optical cable market is shaped by several major factors stemming from the expanding demand for high density fibre deployments in telecommunications, data centres and utility backhaul networks. As network operators push for increased bandwidth and lower latency, the central tube design which allows multiple optical fibres within a protective central tube is gaining traction for its space efficiency and simplified installation. Meanwhile, growth in 5G, fibre to the home (FTTH) rollouts and smart grid expansion are driving volumes. On the other hand, higher material and installation costs, supply chain constraints, and competing cable construction types (such as loose tube or ribbon designs) temper growth prospects.

One key growth driver is the surge in fibre deployment linked to 5G network densification and increased mobile data traffic, which forces telecom operators to invest in cabling infrastructure that supports higher fibre counts and more compact cable geometries. The central tube configuration meets this need by packing many fibres in a space efficient form, making it appealing for urban deployments and data centre interconnects. Another driver is the expansion of FTTH initiatives globally, especially in emerging markets, where operators aim to upgrade to full fibre networks. Additionally, the rising need for resilient communications in utilities (smart metering, grid automation) and the push for network upgrades in industrial and enterprise settings further enhance demand for robust optical cable systems like central tube types.

Despite the favourable outlook, the central tube optical cable market faces constraints that may slow widespread adoption. The higher cost associated with manufacturing cables configured in central tube designs owing to precision in fibre placement, enhanced protection and possibly special jacketing can pose a barrier, especially in cost sensitive applications or regions. Installation challenges also exist: deploying high fibre count central tube cables may require more careful handling, specialized connectors and more advanced installation infrastructure compared to simpler cable types. Supply chain dependencies for key raw materials (optical fibres, high performance plastics, jackets) and geographical disparities in installation skills or standards may further restrict growth. Moreover, competing cable designs and technologies may reduce uptake if operators prioritise lower cost alternatives.

Several notable trends are emerging in this space. Manufacturers are increasingly developing central tube cables with ultra high fibre counts to accommodate next generation network demands, thereby reducing the number of individual cable runs and simplifying infrastructure. A move toward pre terminated or plug and play cable assemblies that incorporate central tube designs is also gaining traction for quicker deployment. In parallel, sustainability considerations like lower carbon materials, recycling pathways and longer life cable designs are influencing product development. Geographically, while mature markets continue to grow, emphasis is shifting to rapid deployment in Asia Pacific, Latin America and parts of Africa, where operators are leap frogging to full fibre networks and adopting central tube cables in large scale.

The central tube optical cable market is experiencing steady growth, driven by increasing demand for high-speed internet, telecommunications infrastructure, and advancements in network technologies. Central tube optical cables are widely used for long-distance data transmission due to their ability to support high bandwidth and low signal attenuation. As global internet connectivity and digital infrastructure expand, the demand for optical cables, including central tube configurations, continues to rise.

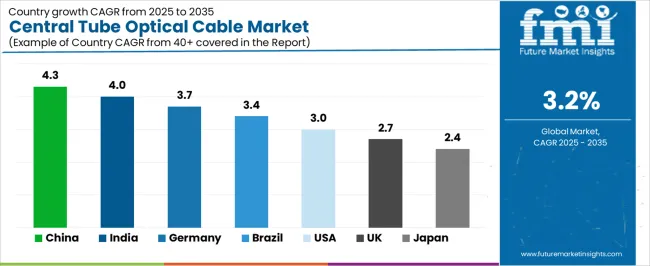

Emerging markets like China and India are seeing rapid growth, driven by infrastructure development and the increasing need for faster and more reliable communication networks. Developed markets like the USA and Germany also show consistent growth, fueled by ongoing investments in network upgrades and 5G rollouts. This analysis explores the key drivers influencing the growth of the central tube optical cable market in these regions.

| Country | CAGR (2025-2035) |

|---|---|

| China | 4.3% |

| India | 4% |

| Germany | 3.7% |

| Brazil | 3.4% |

| USA | 3% |

| United Kingdom | 2.7% |

| Japan | 2.4% |

China leads the central tube optical cable market with a robust CAGR of 4.3%. The country’s rapidly growing telecommunications infrastructure and ongoing digital transformation are key drivers of this market growth. As China continues to expand its internet and telecommunications networks, the demand for high-performance optical cables that provide reliable, high-speed connectivity is increasing.

The ongoing rollout of 5G networks, coupled with China's investments in fiber optic infrastructure, is further driving the demand for central tube optical cables. Additionally, the government’s focus on improving national infrastructure and connectivity, especially in rural areas, has contributed to the market’s growth. With China's emphasis on becoming a global leader in digital technologies, the central tube optical cable market will continue to see strong demand.

India’s central tube optical cable market is growing steadily, with a CAGR of 4.0%. The increasing need for high-speed internet, the government’s initiatives to improve digital infrastructure, and the expanding mobile network in the country are key drivers of this growth. The push towards expanding fiber optic networks and providing reliable internet services to underserved areas is boosting the demand for central tube optical cables.

The government’s Digital India initiative, which aims to improve connectivity and make the country digitally empowered, is helping to accelerate the adoption of optical cables. Moreover, India’s growing telecommunications sector, driven by both domestic and international investments, is driving demand for high-performance optical fiber cables. As India continues to develop its digital infrastructure, the demand for central tube optical cables is expected to grow rapidly.

Germany’s central tube optical cable market is projected to grow at a CAGR of 3.7%. Germany, known for its strong telecommunications and digital infrastructure, continues to invest in expanding fiber optic networks to support high-speed internet and 5G deployments. The demand for optical cables, including central tube configurations, is rising in line with these efforts.

Germany's focus on advancing its digital economy and improving broadband connectivity, both for urban and rural areas, is further driving the market. The growing demand for reliable, high-speed data transmission for applications such as cloud computing, IoT, and smart cities is supporting the continued adoption of central tube optical cables. As Germany leads innovation in digital infrastructure, its market for optical cables is expected to see steady growth.

Brazil’s central tube optical cable market is expected to grow at a CAGR of 3.4%. The demand for optical cables in Brazil is primarily driven by the country’s efforts to improve internet infrastructure, expand broadband coverage, and support the adoption of 5G technology. As Brazil modernizes its telecommunications and broadband networks, there is a significant need for reliable, high-capacity fiber optic cables.

The government’s initiatives to improve digital infrastructure, along with increasing mobile internet penetration, are contributing to the market’s growth. Additionally, the demand for optical cables is also growing in sectors like telecommunications, education, and healthcare, where reliable and high-speed data transmission is essential. As Brazil continues to develop its telecommunications networks, the demand for central tube optical cables will remain strong.

The United States has a projected CAGR of 3.0% for the central tube optical cable market. The USA has a well-established telecommunications and internet infrastructure, and the ongoing demand for higher-speed networks and 5G deployments is driving the market. With significant investments in upgrading broadband networks, the need for high-performance optical cables, including central tube designs, continues to grow.

The expansion of fiber optic networks to support next-generation technologies, such as 5G, broadband for rural areas, and increased data center capacity, is fueling the demand for optical cables. As the USA government and private sector continue to invest in digital infrastructure, the central tube optical cable market is expected to experience steady growth.

The United Kingdom’s central tube optical cable market is projected to grow at a CAGR of 2.7%. The UK is undergoing a digital transformation, with a focus on improving broadband speeds and expanding fiber optic networks. The increasing demand for high-speed internet and data connectivity, particularly with the ongoing rollout of 5G networks, is driving the need for high-quality optical cables.

The government’s efforts to improve digital infrastructure and increase broadband access across the country are contributing to the growth of the market. Additionally, the rise in demand for reliable data transmission in industries such as healthcare, finance, and education is further supporting the need for optical cables. The UK’s commitment to improving internet access and adopting next-generation technologies will continue to drive steady demand for central tube optical cables.

Japan’s central tube optical cable market is expected to grow at a CAGR of 2.4%. Japan, known for its advanced telecommunications infrastructure, is experiencing continued demand for optical cables as it expands its broadband networks and adopts 5G technology. The country’s strong emphasis on digital innovation and the growing demand for high-speed internet and data services are key factors driving the market.

The increasing adoption of fiber optic networks to support emerging technologies, including IoT and smart cities, is driving the need for reliable, high-performance optical cables. As Japan continues to upgrade its telecommunications infrastructure and invest in digital technologies, the demand for central tube optical cables will continue to grow at a moderate pace. The market growth is expected to remain steady as Japan continues to be a leader in technological advancements.

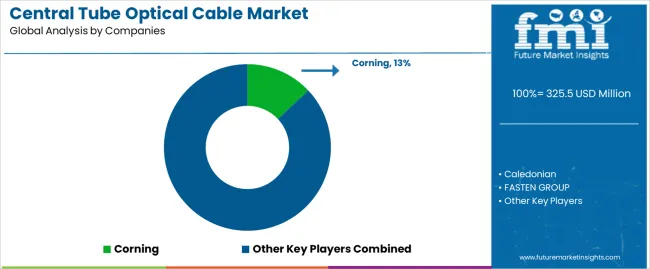

In the central tube optical cable market, companies such as Corning (holding about 13% market share), Caledonian, FASTEN GROUP, Canovate, Belden, Furukawa, Norden Communication, Sumitomo, FOS TECHNOLOGY, Futong Group, KINGSIGNAL, POTEL, SDGI, YOFC, SHEN ZHEN HAN XIN, LINKBASIC, CCOFCN, ZHONGLI GROUP, Simpact, OUFUR CABLE, ZHAOLONG, and HEADWAY are active participants. Growth is driven by rising demand for data transmission infrastructure, expansions in broadband networks, 5G roll out, and data centre build outs. The central tube construction variant is valued for its compact design, ease of installation, and durability in both indoor and outdoor deployments.

The competitive strategies of these firms vary and reflect their differing strengths and market focus. The market leader uses its global manufacturing footprint and broad product range to secure large scale contracts. Other companies seek to differentiate through regional manufacturing presence, tailored product specifications (such as tighter diameter tolerances, high fiber count options, specialized armor or jacket materials), and faster lead times for emerging markets.

Some firms emphasize low total cost of ownership (installation ease, reduced maintenance), while others highlight premium features (higher fiber counts, advanced sheath materials, higher tensile or crush ratings). Partnerships with telecom operators, participation in major network build programs, and compliance with local standards also feature in their strategies. In sum, firms that can combine scale, specification flexibility, regional reach, and cost efficiency are positioned to increase their share in the central tube optical cable market.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Cable Construction Type | Non-metallic Center Tube Optical Cable, Metallic Center Tube Optical Cable |

| Application | Communications Industry, Construction Industry, Industrial, Data Center, Others |

| Key Companies Profiled | Corning, Caledonian, FASTEN GROUP, Canovate, Belden, Furukawa, Norden Communication, Sumitomo, FOS TECHNOLOGY, Futong Group, KINGSIGNAL, POTEL, SDGI, YOFC, SHEN ZHEN HAN XIN, LINKBASIC, CCOFCN, ZHONGLI GROUP, Simpact, OUFUR CABLE, ZHAOLONG, HEADWAY |

| Additional Attributes | The market analysis includes dollar sales by cable construction type and application categories. It also covers regional adoption trends across major markets such as Asia Pacific, Europe, and North America. The competitive landscape highlights key manufacturers in the central tube optical cable sector, focusing on innovations in non-metallic and metallic center tube optical cables. Trends in the growing demand for optical cables in communications, industrial, and data center applications are explored, along with advancements in fiber optic technology and network infrastructure. |

The global central tube optical cable market is estimated to be valued at USD 325.5 million in 2025.

The market size for the central tube optical cable market is projected to reach USD 446.0 million by 2035.

The central tube optical cable market is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types in central tube optical cable market are non-metallic center tube optical cable and metallic center tube optical cable.

In terms of application, communications industry segment to command 35.0% share in the central tube optical cable market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Central Dialysis Fluid Delivery System (CDDS) Market Size and Share Forecast Outlook 2025 to 2035

Central Computing Architecture Vehicle OS Market Forecast and Outlook 2025 to 2035

Central Reinforced Tape Market Size and Share Forecast Outlook 2025 to 2035

Central Monitoring Station Market Size and Share Forecast Outlook 2025 to 2035

Centralized Workstation Market Size and Share Forecast Outlook 2025 to 2035

Central Venous Catheter (CVC) Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Central Lab Market Growth – Industry Trends & Forecast 2025 to 2035

Central Nervous System (CNS) Lymphoma Treatment Market Analysis by Treatment, End User, and Region: Forecast for 2025 to 2035

Central Pain Syndrome Management Market – Size, Share & Growth 2025 to 2035

Central Patient Monitoring System Market

Decentralized Packaging Kiosks Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Decentralized Social Network Market Size and Share Forecast Outlook 2025 to 2035

Decentralized Inverter Market by Product, Phase, Application, Nominal Output, Connection, Region through 2035

Decentralized Finance Technology Market Trends - Growth & Forecast 2025 to 2035

Hotel Central Reservation System Market Size and Share Forecast Outlook 2025 to 2035

North and Central America Proppant Market Size and Share Forecast Outlook 2025 to 2035

Demand for Central Computing Architecture Vehicle OS in USA Size and Share Forecast Outlook 2025 to 2035

Automotive Central Lubrication System Market

Peripherally Inserted Central Catheter Analysis by Product Type by Indication and by End User through 2035

Tube and Core Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA