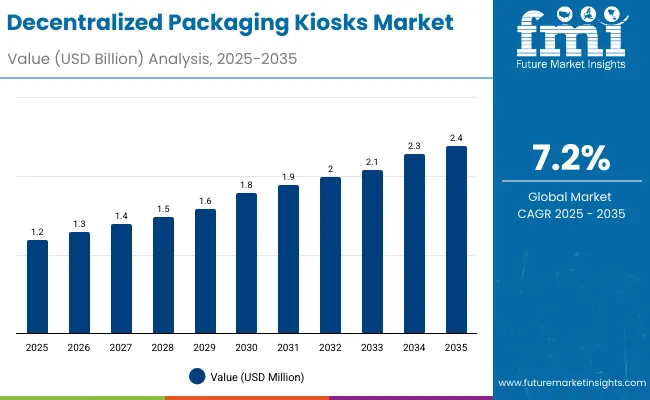

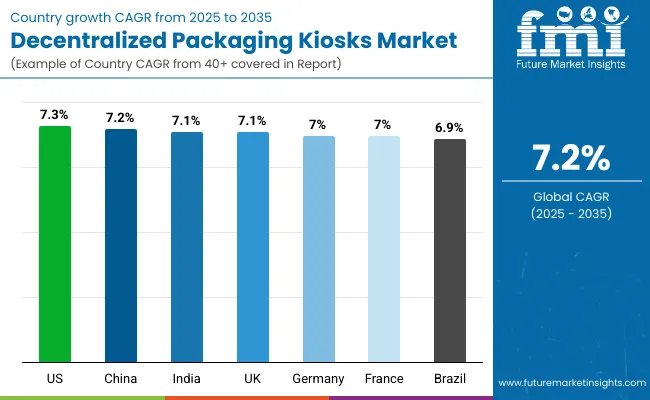

The decentralized packaging kiosks market will expand from USD 1.2 billion in 2025 to USD 2.4 billion by 2035, advancing at a CAGR of 7.2%. Growth is driven by automation in retail and manufacturing environments and the expansion of self-service packaging systems. Automated kiosks dominate due to enhanced accuracy and cloud integration for on-demand packaging.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.2 billion |

| Industry Value (2035F) | USD 2.4 billion |

| CAGR (2025 to 2035) | 7.2% |

Between 2025 and 2030, the market will add USD 0.5 billion, mainly through retail automation and food packaging. From 2030 to 2035, another USD 0.7 billion will emerge from pharmaceuticals and cosmetics packaging. Asia-Pacific will lead global expansion with strong adoption in retail hubs and e-commerce fulfillment centers.

From 2020 to 2024, decentralized packaging kiosks evolved from pilot installations to integrated retail systems. Automation, edge computing, and cloud connectivity enabled faster customer service and waste reduction. Food and FMCG companies led adoption due to sustainability initiatives promoting localized, refill-based packaging.

By 2035, the market will reach USD 2.4 billion, recording a 7.2% CAGR. Retail, FMCG, and healthcare sectors will dominate, integrating AI-based self-packaging and predictive maintenance systems. Asia-Pacific will emerge as a hotspot for adoption, supported by smart city infrastructure and digital retail expansion. North America and Europe will prioritize regulatory compliance and plastic reduction.

Growth is driven by rising sustainability goals, labour shortages, and consumer preference for convenience. Kiosks allow customizable, on-site packaging with minimal material use.

Food and beverage retailers lead adoption for refillable products, while healthcare and cosmetics industries integrate kiosks for sterile and personalized dispensing. Automation, IoT, and cloud integration enhance operational efficiency, positioning these systems as the future of retail packaging infrastructure.

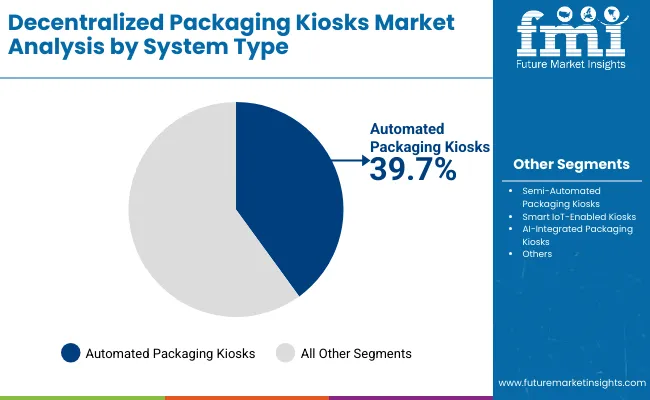

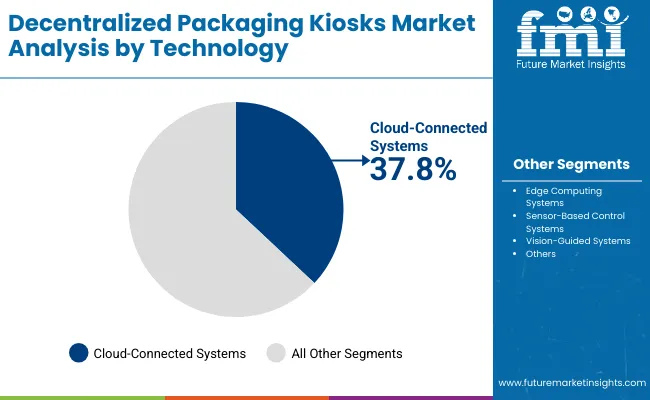

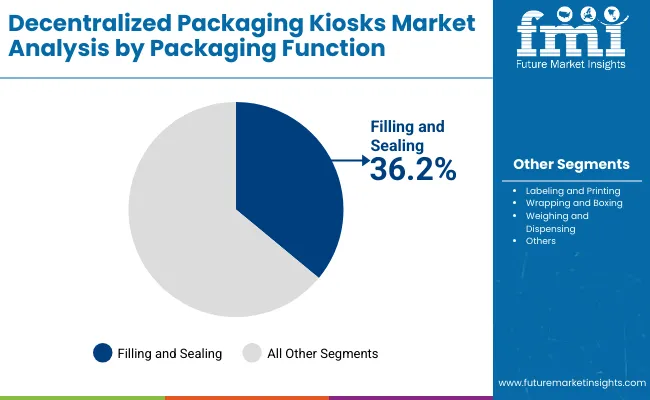

The market is segmented by system type, packaging function, packaging format, technology, application, location type, and region. System types include automated, semi-automated, smart IoT-enabled, and AI-integrated kiosks. Functions include filling, labelling, wrapping, and weighing. Packaging formats cover bottles, pouches, cartons, and reusable containers. Key technologies comprise cloud, edge, sensor-based, and vision-guided systems.

Automated kiosks will hold a 39.7% share in 2025, offering faster packaging cycles and lower operational errors. Retailers adopt them to minimize labour dependency and boost real-time order handling.

Future adoption will rise in retail hubs and airports, as automation enables customizable packaging for multiple product types. Integration with digital payment and labelling enhances convenience.

Cloud-connected systems will capture 37.8% share in 2025 due to real-time monitoring, software updates, and centralized control. These systems streamline packaging data across multiple retail points.

Future growth will be supported by AI-driven diagnostics and sustainability analytics. Cloud integration will remain the backbone of kiosk efficiency and remote maintenance.

Filling and sealing functions will represent 36.2% share in 2025, critical for on-demand food and cosmetic packaging. Precision dispensing ensures reduced wastage and consistency.

By 2035, adoption will increase in refillable product systems and pharmacies requiring sterilized filling mechanisms.

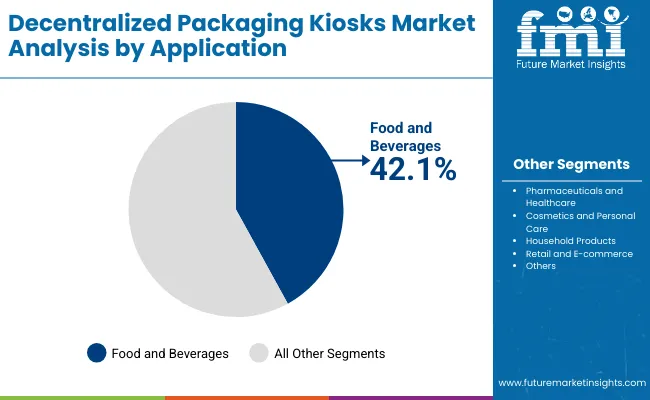

Food and beverage packaging will account for 42.1% share in 2025, reflecting high adoption of automated refill and takeaway packaging.

Future growth will be driven by reusable and eco-friendly packaging solutions in supermarkets and airports, aligning with circular economy policies.

Demand is driven by sustainability mandates, automation in retail, and labor optimization. Decentralized kiosks enable efficient, refill-based packaging, reducing carbon footprints.

High initial investment and limited standardization hinder mass deployment. Maintenance and integration with legacy retail systems remain barriers.

Retail and FMCG sectors offer expansion opportunities with AI-based systems. On-demand personalized packaging and IoT data analytics will open new revenue streams.

Trends include AI-integrated kiosks, biodegradable material compatibility, and sensor-based automation. Cloud-edge hybrid systems will enhance performance and uptime.

The decentralized packaging kiosks market is advancing as automation and sustainability merge across industries. Asia-Pacific leads in adoption, powered by smart retail ecosystems and rapid urbanization, while Europe emphasizes circular packaging solutions under strict environmental directives. North America focuses on digital retail integration and refill systems aligned with zero-waste goals. The convergence of smart automation, eco-materials, and data-driven retail technology is transforming packaging into an on-demand, consumer-centric solution worldwide.

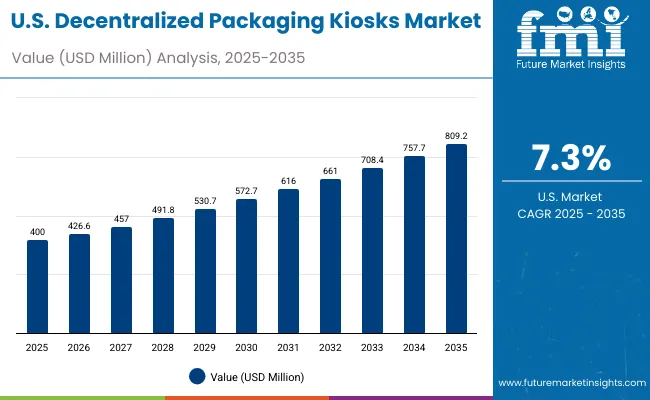

The USA market will grow at a CAGR of 7.3% from 2025 to 2035, driven by rapid retail digitization and the expansion of refillable packaging stations. Retailers are investing in decentralized kiosks to cut single-use plastic and enhance consumer engagement through smart dispensing. The country’s sustainability push, combined with advanced IoT integration, is reinforcing the use of packaging kiosks across supermarkets, personal care, and foodservice sectors.

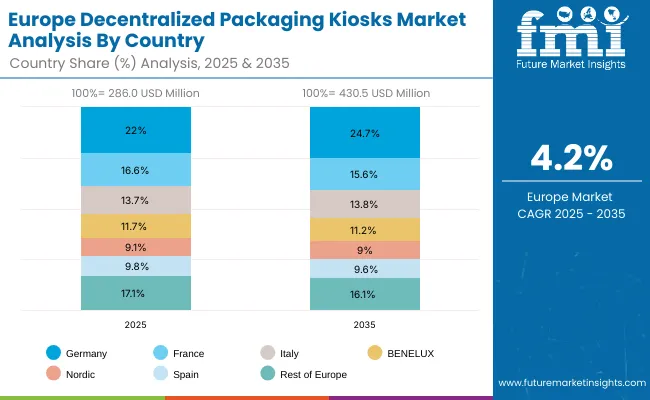

Germany will expand at a CAGR of 7.0%, supported by EU eco-packaging directives and automation in FMCG retail. Major retailers are deploying kiosks to meet reusable and refillable packaging targets under EU’s Circular Economy Action Plan. Integration with smart retail systems enables precise inventory tracking and waste reduction. Germany’s industrial expertise ensures the development of durable, energy-efficient kiosks tailored to the food and beverage sector.

The UK market will grow at a CAGR of 7.1%, with rapid adoption in urban retail zones and eco-conscious supermarkets. Government plastic-free policies are propelling the use of refill and reuse packaging systems. SMEs and sustainability startups are expanding kiosk networks in partnership with major FMCG brands. Integration of AI and cashless payment systems is further streamlining consumer engagement and operational efficiency in refill stations.

China will expand at a CAGR of 7.2%, fueled by the rise of digital retail ecosystems and smart city automation. E-commerce giants are investing in decentralized kiosks to enhance circular logistics. Urban foodservice chains and convenience stores are increasingly adopting refillable packaging systems aligned with green manufacturing targets. China’s government-backed sustainability drive and large consumer base make it a key growth hub for intelligent, eco-packaging kiosks.

India will grow at a CAGR of 7.1%, supported by digital retail transformation and sustainable packaging mandates. Startups are introducing affordable decentralized kiosks for FMCG and personal care sectors. Government initiatives like "Plastic Waste Management Rules" are encouraging refill packaging deployment in organized retail chains. Expanding middle-class consumption and increased emphasis on low-cost automation are further accelerating adoption across urban centers.

Japan will grow at a CAGR of 7.6%, driven by robotics integration, compact design, and automation in retail environments. Kiosks are being customized for cosmetics and healthcare sectors, emphasizing hygiene and precision dispensing. Retailers are adopting AI-powered maintenance systems to improve uptime. Japan’s high-tech retail infrastructure and focus on compact urban solutions make it a leading innovator in decentralized packaging kiosks.

South Korea is expected to lead with a CAGR of 7.8%, powered by its high-tech retail ecosystem and rapid FMCG automation. AI-enabled kiosks are improving packaging efficiency while ensuring compliance with sustainability goals. The integration of smart sensors and predictive analytics enhances product refilling precision. South Korea’s strong export orientation and advanced digital infrastructure position it as a pioneer in next-generation packaging automation.

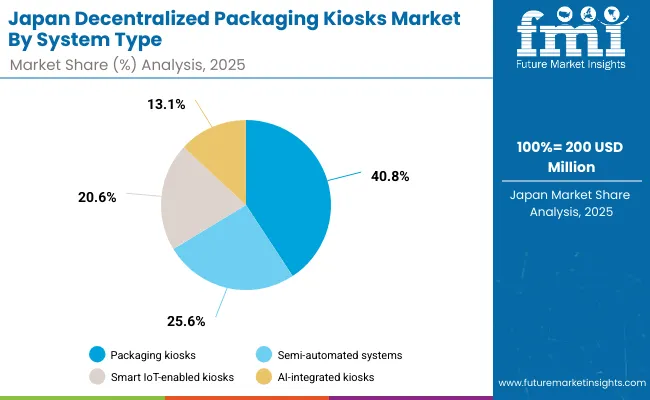

Japan’s decentralized packaging kiosks market, valued at USD 200 million in 2025, is led by automated packaging kiosks with a 40.8% share, driven by rising labor efficiency and precision packaging in retail. Semi-automated systems account for 25.6%, serving mixed-load facilities seeking flexibility. Smart IoT-enabled kiosks represent 20.6%, reflecting Japan’s strong Industry 4.0 integration. AI-integrated kiosks capture 13.1%, used in adaptive labeling and predictive maintenance. The market benefits from urban retail automation, vending ecosystems, and unmanned logistics hubs. Japan’s innovation-driven ecosystem supports compact, multifunctional kiosks, enhancing packaging throughput across convenience stores, healthcare retail, and last-mile e-commerce fulfillmentcenters.

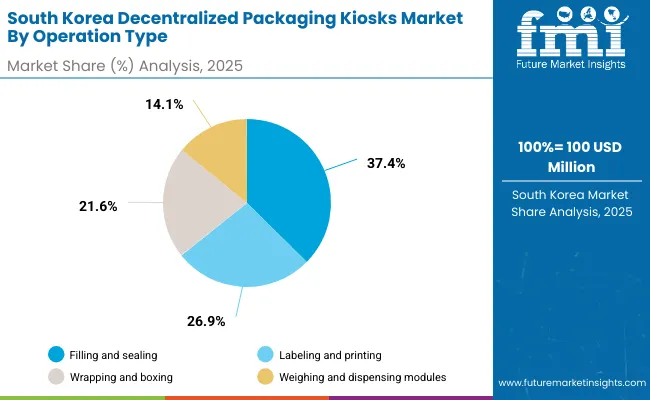

South Korea’s decentralized packaging kiosks market, valued at USD 100 million in 2025, is dominated by filling and sealing systems with a 37.4% share, reflecting food and cosmetic industry automation. Labeling and printing units account for 26.9%, favored by FMCG and pharmaceutical labeling compliance. Wrapping and boxing functions represent 21.6%, widely used in consumer goods and logistics. Weighing and dispensing modules hold 14.1%, enhancing operational accuracy in retail packaging. Compact smart kiosks align with Korea’s advanced retail digitalization initiatives. Government-backed technology adoption, AI-based supply chain systems, and SME digitization grants further accelerate market penetration in decentralized packaging environments.

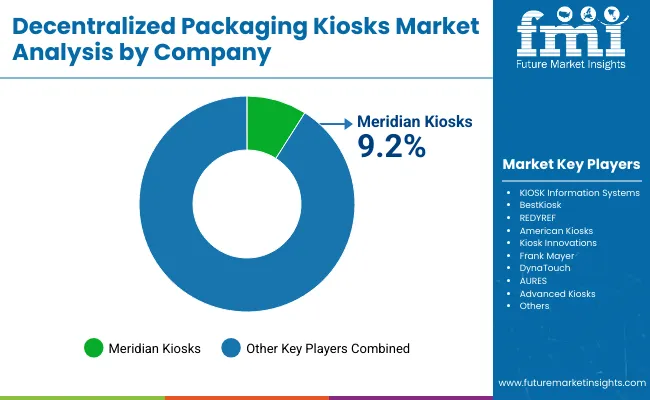

The market is moderately fragmented, with major players including Meridian Kiosks, KIOSK Information Systems, BestKiosk, REDYREF, American Kiosks, Kiosk Innovations, Frank Mayer, DynaTouch, AURES, and Advanced Kiosks. These companies emphasize automation, cloud compatibility, and sustainability.

Meridian Kiosks and KIOSK Information Systems dominate North America with advanced refillable units. REDYREF and American Kiosks focus on AI-integrated systems, while AURES and DynaTouch expand in Asia and Europe with modular self-service models. Competition centers on customization, real-time monitoring, and eco-material compatibility.

Key Developments of Decentralized Packaging Kiosks Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1.2 Billion |

| By System Type | Automated, Semi-Automated, Smart IoT, AI-Integrated Kiosks |

| By Packaging Function | Filling & Sealing, Labeling , Wrapping, Weighing & Dispensing |

| By Technology | Cloud, Edge, Sensor-Based, Vision-Guided Systems |

| By Application | Food & Beverages, Pharmaceuticals, Cosmetics, Household, Retail |

| By Location Type | Supermarkets, Retail Hubs, Airports, Corporate Facilities |

| Key Companies Profiled | Meridian Kiosks, KIOSK Information Systems, BestKiosk , REDYREF, American Kiosks, Kiosk Innovations, Frank Mayer, DynaTouch , AURES, Advanced Kiosks |

| Additional Attributes | Growth driven by smart retail, refill-based packaging, and AI automation. |

The market will be valued at USD 1.2 billion in 2025.

The market will reach USD 2.4 billion by 2035.

The market will grow at a CAGR of 7.2% during 2025-2035.

Automated packaging kiosks will lead with a 39.7% share in 2025.

Cloud-connected systems will dominate with a 37.8% share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Decentralized Social Network Market Size and Share Forecast Outlook 2025 to 2035

Decentralized Inverter Market by Product, Phase, Application, Nominal Output, Connection, Region through 2035

Decentralized Finance Technology Market Trends - Growth & Forecast 2025 to 2035

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Packaging Suction Cups Market Size and Share Forecast Outlook 2025 to 2035

Packaging Straps and Buckles Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA