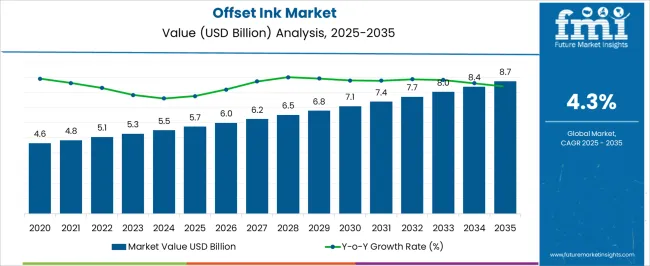

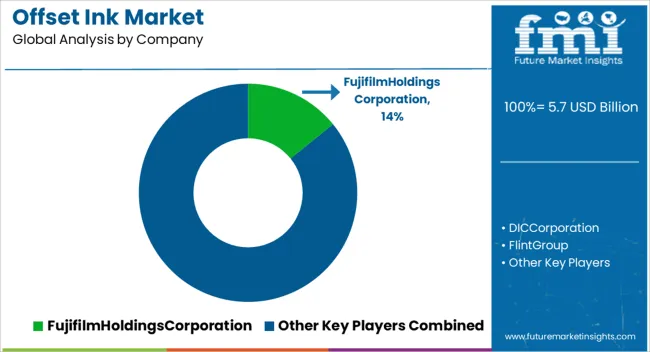

The offset ink market is estimated to be valued at USD 5.7 billion in 2025 and is projected to reach USD 8.7 billion by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period.

During the early forecast years, demand is primarily driven by commercial printing and packaging, with newspapers, magazines, folding cartons, and labels sustaining ink consumption. In parallel, developing economies in Asia-Pacific and parts of Latin America are witnessing heightened adoption as businesses seek affordable yet high-quality printing solutions.

Toward the latter half of the decade, expansion is reinforced by the packaging sector, where offset inks continue to be critical for corrugated boxes, branded retail packs, and specialty print applications. Innovations in UV-curable and eco-friendly ink formulations, offering improved drying times, color vibrancy, and lower environmental impact, are expected to preserve relevance and enable gradual penetration into sustainable packaging markets.

Commercial printing operations represent the largest consumption segment where offset inks enable high-volume production of magazines, catalogs, brochures, and direct mail materials requiring precise color matching and consistent reproduction quality across extended press runs. Production managers specify ink systems optimized for specific press configurations and substrate combinations while balancing performance characteristics against cost considerations that directly impact job profitability. Quality control protocols emphasize color consistency, dot gain control, and drying characteristics that affect production efficiency and finished product appearance standards demanded by advertising agencies and corporate clients.

Packaging applications create specialized market segments requiring offset inks formulated for food contact compliance, barrier coating compatibility, and specialized substrate adhesion on corrugated cardboard, folding cartons, and flexible packaging materials. Food packaging producers utilize migration-resistant ink formulations that prevent chemical transfer to packaged products while maintaining vibrant colors and print durability throughout product distribution and storage cycles. Pharmaceutical packaging demands inks that comply with stringent regulatory requirements while providing tamper-evident printing and serialization capabilities necessary for product authentication and supply chain security.

Technology development trajectories concentrate on rheological control systems and temperature stability improvements that enable consistent print performance across varying press conditions and environmental factors. Quick-setting ink formulations reduce production cycle times while preventing set-off and improving handling characteristics during finishing operations. Energy-curing systems utilizing ultraviolet and electron beam technologies enable instant drying capabilities that eliminate traditional oxidation-based curing methods while reducing volatile emissions and improving workplace air quality conditions.

Supply chain considerations emphasize raw material availability and pricing stability for petroleum-based solvents, synthetic resins, and specialty pigments that constitute primary ink components. Pigment suppliers maintain strategic inventory positions to buffer against supply disruptions while providing consistent color performance across production batches. Distribution networks prioritize temperature-controlled storage and handling procedures that maintain ink viscosity and performance characteristics during transportation and storage operations.

| Metric | Value |

|---|---|

| Offset Ink Market Estimated Value in (2025 E) | USD 5.7 billion |

| Offset Ink Market Forecast Value in (2035 F) | USD 8.7 billion |

| Forecast CAGR (2025 to 2035) | 4.3% |

The offset ink market is experiencing steady expansion, supported by the growing demand for high-precision printing in packaging, publishing, and commercial printing sectors. Advancements in ink chemistry, including low-VOC formulations and enhanced curing processes, are aligning with global sustainability objectives and regulatory compliance requirements. The adoption of offset printing in emerging markets is further stimulated by rising investments in high-capacity printing equipment and expanding consumer product markets.

Technological innovations in ink formulations have improved print sharpness, durability, and color consistency, making offset inks suitable for a broader range of substrates. The integration of quick-drying and energy-efficient curing systems has reduced operational costs and increased productivity for printers.

Additionally, the rising preference for premium packaging designs and customized print solutions is creating new growth avenues Over the forecast period, collaboration between ink manufacturers and printing technology providers is expected to accelerate, enabling further development of high-performance, application-specific inks that cater to evolving industry needs.

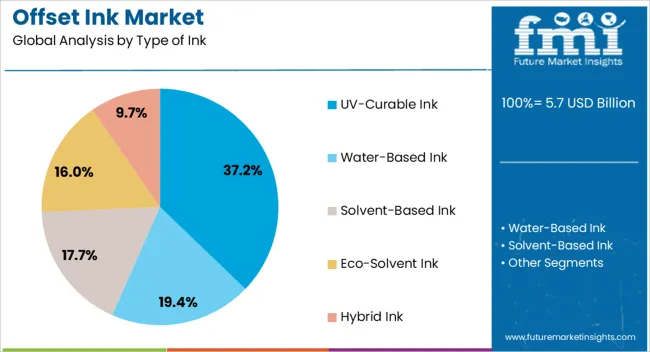

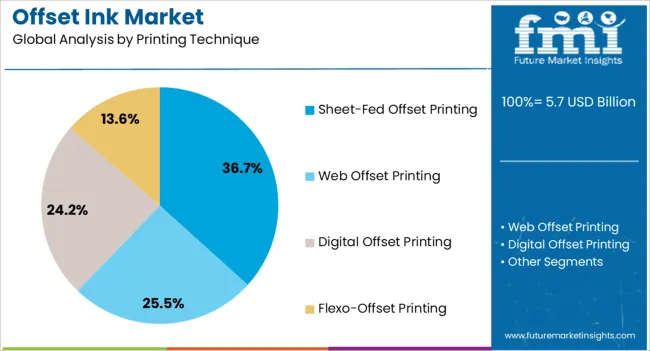

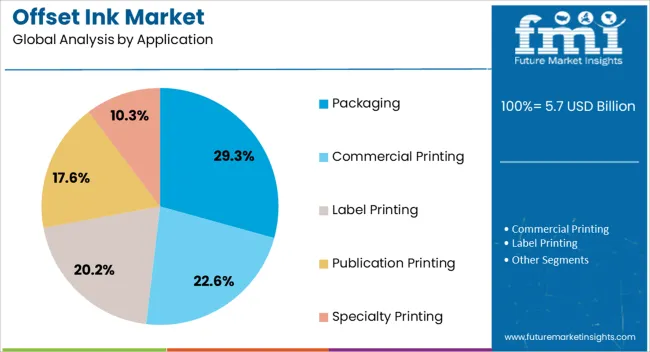

The offset ink market is segmented by type of ink, printing technique, application, end-user industry, viscosity level, and geographic regions. By type of ink, offset ink market is divided into UV-Curable Ink, Water-Based Ink, Solvent-Based Ink, Eco-Solvent Ink, and Hybrid Ink. In terms of printing technique, offset ink market is classified into Sheet-Fed Offset Printing, Web Offset Printing, Digital Offset Printing, and Flexo-Offset Printing. Based on application, offset ink market is segmented into Packaging, Commercial Printing, Label Printing, Publication Printing, and Specialty Printing. By end-user industry, offset ink market is segmented into Food & Beverage, Cosmetics & Personal Care, Electronics, Pharmaceuticals, and Textiles. By viscosity level, offset ink market is segmented into Medium Viscosity Ink, Low Viscosity Ink, and High Viscosity Ink. Regionally, the offset ink industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The UV-curable ink segment is expected to hold 37.2% of the overall revenue share in the offset ink market in 2025, securing its position as the leading type of ink. Its growth has been driven by the ability to deliver instant curing under UV light, resulting in faster turnaround times and higher production efficiency. This ink type offers superior adhesion on various substrates, high resistance to abrasion, and excellent color vibrancy, which are critical for premium print applications.

The absence of solvents in UV-curable inks aligns with sustainability goals and regulatory mandates on volatile organic compound emissions. Furthermore, reduced energy consumption during curing and minimal waste generation have enhanced its appeal among commercial printers.

Continuous advancements in photoinitiator technology and pigment dispersion have further improved the performance of UV-curable inks, enabling their deployment in high-volume packaging and label printing These capabilities, combined with long-term cost efficiency, have reinforced their widespread adoption across printing operations.

The sheet-fed offset printing technique is anticipated to account for 36.7% of the total revenue share in the offset ink market in 2025, maintaining its dominance due to its versatility and superior print quality. This method is preferred for producing high-end commercial prints, catalogs, and packaging materials, owing to its ability to handle a wide variety of paper grades and thicknesses. The segment's growth has been supported by the integration of automation features and advanced ink control systems, which have enhanced productivity and color accuracy.

Sheet-fed presses enable precise registration and sharp image reproduction, meeting the needs of brand-conscious clients. Additionally, compatibility with eco-friendly and specialty inks has increased its use in sustainable printing projects.

The ability to accommodate both short-run and high-volume jobs efficiently has strengthened its position in the market These attributes, coupled with consistent investments in upgrading press technology, are expected to sustain demand for sheet-fed offset printing in diverse applications.

The packaging application segment is projected to capture 29.3% of the total revenue share in the offset ink market in 2025, emerging as a key growth driver. The increasing emphasis on brand differentiation and consumer engagement has led to a surge in demand for high-quality, visually appealing packaging. Offset inks are widely used in folding cartons, labels, and corrugated packaging due to their ability to deliver vibrant colors, fine detailing, and durable print finishes.

The segment’s growth has been reinforced by the expansion of e-commerce and fast-moving consumer goods industries, which require large volumes of printed packaging. Regulatory compliance for food-grade inks and the adoption of sustainable printing practices have further boosted the use of offset inks in packaging.

Technological advancements in ink formulations, including enhanced rub resistance and quick-drying capabilities, have improved packaging durability during logistics These factors, along with the rise of premium and customized packaging solutions, continue to drive the segment’s leadership in the market.

Offset ink demand is supported by commercial printing, packaging growth, eco-friendly shifts, and competitive strategies. Its adaptability ensures continued relevance despite competition from digital alternatives

The offset ink market continues to thrive within the commercial printing sector, where newspapers, magazines, catalogs, and advertising materials demand consistent color accuracy and cost efficiency. Despite the rise of digital platforms, large-scale print production remains highly relevant, especially in developing regions where print media is still dominant. Offset inks deliver high-quality output and uniform coverage, making them indispensable for long print runs at competitive costs. Heat-set and sheet-fed offset inks are particularly in demand due to their adaptability to coated and uncoated papers. The resilience of the print advertising sector, combined with promotional material production, continues to anchor growth, sustaining offset inks as a backbone of commercial printing globally.

Packaging has become one of the most influential drivers of offset ink consumption, particularly in folding cartons, labels, and corrugated boxes. Offset inks offer flexibility and superior print clarity, making them highly suitable for brand-driven packaging. The expansion of e-commerce and consumer goods packaging has significantly increased the requirement for reliable and visually appealing ink solutions. Food packaging regulations are encouraging the adoption of low-VOC and vegetable oil-based inks, which offset systems readily support. The balance of cost-effectiveness, print quality, and adaptability across packaging substrates positions offset inks as an important component of global packaging strategies, ensuring strong growth momentum in this segment.

Offset ink producers are increasingly focusing on environmentally safer alternatives that reduce emissions while meeting strict regulatory requirements. Vegetable oil-based inks and quick-drying water-based formulations are gaining traction as industries transition from solvent-heavy products. These innovations not only appeal to regulatory compliance needs but also offer printers more efficient turnaround times with reduced downtime. The growing consumer awareness regarding eco-labeled packaging has reinforced the importance of adopting compliant inks. While alternative printing methods such as digital and flexographic inks continue to advance, offset ink retains a strong foothold by leveraging eco-friendly solutions, reinforcing its competitiveness across both developed and emerging print markets.

The competitive landscape of the offset ink market is shaped by global and regional players focusing on product differentiation, cost management, and customer-specific solutions. Leading companies are investing in R&D to expand product lines into specialized inks such as UV-curable and low-migration variants. Partnerships with printers and packaging converters are central to enhancing customer retention and driving tailored innovations. Mergers, acquisitions, and capacity expansions are frequent strategies among major producers to strengthen regional presence and manage raw material cost fluctuations. The shift toward value-added services, including technical support and ink customization, further enhances market positioning, ensuring that competition remains intense across global markets.

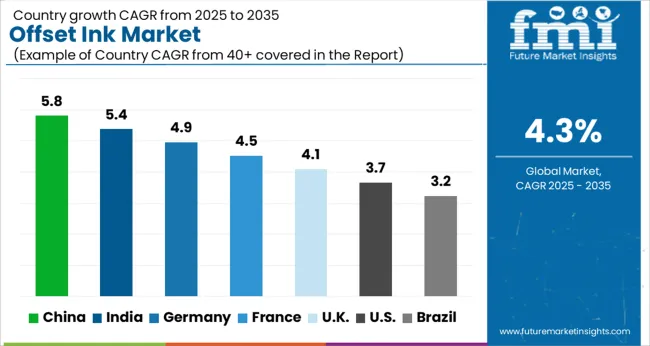

| Country | CAGR |

|---|---|

| China | 5.8% |

| India | 5.4% |

| Germany | 4.9% |

| France | 4.5% |

| UK | 4.1% |

| USA | 3.7% |

| Brazil | 3.2% |

The offset ink market is projected to grow globally at a CAGR of 4.3% between 2025 and 2035, supported by expanding packaging demand, resilient commercial printing, and increased adoption of eco-friendly formulations. China leads with a CAGR of 5.8%, fueled by strong packaging demand, large-scale newspaper and magazine printing, and investments in environmentally compliant inks. India follows at 5.4%, benefiting from growth in carton packaging, publishing activities, and expanding adoption of water-based offset inks across commercial applications. France posts 4.5%, driven by packaging and advertising print segments with emphasis on specialized coatings and improved print aesthetics. The United Kingdom achieves 4.1%, reflecting steady adoption in packaging and commercial print despite structural industry challenges. The United States records 3.7%, showing moderate growth due to mature print markets, with packaging remaining the key driver of offset ink consumption. The analysis spans more than 40 countries, with these six serving as benchmarks for capacity expansion, eco-friendly ink adoption, and strategic growth in commercial and packaging print applications in the global offset ink industry.

China is projected to post a CAGR of 5.8% during 2025–2035, ahead of the global 4.3% pace, as packaging converters, publishers, and commercial printers keep long-run offset capacity busy. The earlier period, 2020–2024, was estimated near 4.6%, when recovery in advertising inserts and catalog work supported press utilization while input prices created cost discipline. Sheet-fed grades for folding cartons and labels continued to gain, while heat-set volumes stabilized with better pressroom make-ready practices. Printers favored quick-set, low-odor formulations to protect turnaround times on coated stocks. Local producers invested in dispersion control to improve gloss and rub resistance. China is viewed as the scale anchor where pricing ladders, ink series extensions, and service programs are tested before wider rollouts.

India is expected to register a 5.4% CAGR during 2025–2035, above the global average. During 2020–2024, growth was estimated around 4.7%, as newspaper circulations normalized and packaging converters expanded litho-laminate programs for FMCG and e-commerce. Printers showed preference for fast-setting emulsions that tolerate humidity and varied paper quality, keeping wastage low on mid-range presses. Education textbook tenders supported long runs on web offset, while regional packaging firms added sheet-fed capacity for short to medium campaigns. Local ink makers improved resin sourcing and pigment dispersion to stabilize shade consistency. India is judged to keep momentum as brand owners demand sharper graphics on cartons and as regional print parks add multi-press halls.

France is projected to grow at 4.5% during 2025–2035, modestly above the global path. The 2020–2024 phase was gauged near 3.9%, when premium packaging and branded retail promotions carried most of the offset workload. Printers in cosmetics, wine, and gourmet foods specified sharper dot reproduction and stable trapping on coated boards, which favored refined emulsions and controlled tack levels. Heat-set activity centered on retail flyers and regional magazines, with tighter pagination but better press speeds. Importers and local producers emphasized low-odor, low-migration options for food-adjacent jobs. France is expected to keep a value-skewed mix as converters request specialty spot colors, metallic effects, and varnish systems that pair cleanly with offset ink sets.

The United Kingdom is expected to post a 4.1% CAGR during 2025–2035, slightly below the global 4.3% rate yet stronger than recent history. For the earlier span, 2020–2024 CAGR is estimated at about 3.3%. This figure captured cautious print advertising, slower refurbishments of sheet-fed lines, and cost sensitivity at regional houses. The later projection stands at 4.1%, as packaging converters enlarge carton programs, supermarkets expand private-label campaigns, and print buyers request higher coverage with clean dry-back on recycled boards. The rise is credited to better substrate pairing, quick-set formulations that shorten cure windows, and service packages that reduce makeready waste. UK printers are set to benefit from upgraded color management and tighter ink-water balance on modernized presses.

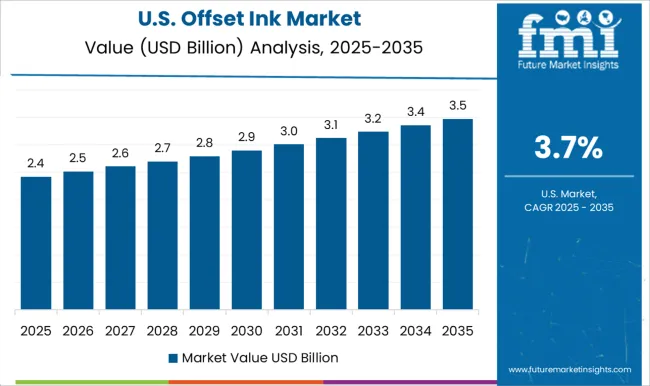

The United States is projected to grow at 3.7% during 2025–2035, below the global mark as commercial print remains mature. The 2020–2024 period was estimated near 3.1%, when catalog rationalization and shifts to digital media tempered long-run volumes. Packaging kept presses active through folding cartons and litho-labels for beverages and household goods. Printers favored vegetable-oil and low-VOC systems to support large retail accounts. Brand owners sought consistent Pantone execution and scuff resistance on coated board, which encouraged adoption of improved resin packages. The outlook shows steady but measured gains, with value carried by packaging graphics, regional food brands, and premium promotional work that prizes color fidelity.

The offset ink market is highly competitive, led by global ink manufacturers and chemical producers offering advanced formulations for commercial, packaging, and publishing applications. Fujifilm Holdings Corporation maintains a leading position with high-performance, eco-friendly offset inks designed for packaging and publishing, supported by a robust R&D network and focus on sustainability. DIC Corporation dominates globally with a diverse portfolio of sheet-fed, cold-set, and energy-curable inks, emphasizing low-VOC content, superior color reproduction, and rapid curing performance. Flint Group specializes in heat-set and sheet-fed inks tailored for high-speed commercial and packaging printing, focusing on color consistency, print clarity, and operational efficiency.

Toyo Ink SC Holdings Co., Ltd. provides advanced pigment and resin technologies for offset applications, offering environmentally responsible products that deliver superior adhesion and gloss. Sakata INX Corporation leverages strong Asia-Pacific manufacturing capabilities, integrating digital and offset technologies for both traditional and hybrid printing systems. Siegwerk Druckfarben AG & Co. KGaA focuses on packaging inks, especially low-migration formulations for food and pharmaceutical compliance. hubergroup delivers sustainable ink systems with bio-renewable materials and high pigment concentration for premium print quality.

SICPA Holding SA supplies secure and specialty inks for anti-counterfeiting and document printing. Yip’s Chemical Holdings Limited and Dainichiseika Color & Chemicals Mfg. Co., Ltd. contribute with cost-effective and regionally optimized formulations, supporting expanding print markets in Asia. T&K Toka Co., Ltd. stands out for its UV-curable offset inks, combining fast curing, superior adhesion, and environmental compliance.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.7 Billion |

| Type of Ink | UV-Curable Ink, Water-Based Ink, Solvent-Based Ink, Eco-Solvent Ink, and Hybrid Ink |

| Printing Technique | Sheet-Fed Offset Printing, Web Offset Printing, Digital Offset Printing, and Flexo-Offset Printing |

| Application | Packaging, Commercial Printing, Label Printing, Publication Printing, and Specialty Printing |

| End-User Industry | Food & Beverage, Cosmetics & Personal Care, Electronics, Pharmaceuticals, and Textiles |

| Viscosity Level | Medium Viscosity Ink, Low Viscosity Ink, and High Viscosity Ink |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Fujifilm Holdings Corporation; DIC Corporation; Flint Group; Toyo Ink SC Holdings Co., Ltd.; Sakata INX Corporation; Siegwerk Druckfarben AG & Co. KGaA; hubergroup; SICPA Holding SA; Yip’s Chemical Holdings Limited; Dainichiseika Color & Chemicals Mfg. Co., Ltd.; and T&K Toka Co., Ltd. |

| Additional Attributes | Dollar sales, share, CAGR, packaging vs commercial print demand, raw material cost trends, UV-curable adoption, regional growth hotspots, pricing benchmarks, competitor moves, regulatory compliance impacts, supply chain risks. |

The global offset ink market is estimated to be valued at USD 5.7 billion in 2025.

The market size for the offset ink market is projected to reach USD 8.7 billion by 2035.

The offset ink market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in offset ink market are uv-curable ink, water-based ink, solvent-based ink, eco-solvent ink and hybrid ink.

In terms of printing technique, sheet-fed offset printing segment to command 36.7% share in the offset ink market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Inkjet Printers Market Size and Share Forecast Outlook 2025 to 2035

Ink Abrasion Resistance Tester Market Size and Share Forecast Outlook 2025 to 2035

Ink Resin Market Size and Share Forecast Outlook 2025 to 2035

Ink Cartridge Printer Market Size and Share Forecast Outlook 2025 to 2035

Ink-Cartridge Market Size and Share Forecast Outlook 2025 to 2035

Ink Additives Market Growth – Trends & Forecast 2025 to 2035

Inkjet Printer Market in Korea – Growth & Demand Forecast through 2035

Ink Receptive Coatings Market Trend Analysis Based on Inks, Applications, and Region 2025 to 2035

Inkjet Coders Market Growth - Trends & Outlook 2025 to 2035

Key Players & Market Share in the Inkjet Printers Industry

Inkjet Paper Market Trends & Industry Growth Forecast 2024-2034

Inkjet Label Market Trends & Industry Growth Forecast 2024-2034

Ink Tank Printer Market

Linkage Bending Machine Market Size and Share Forecast Outlook 2025 to 2035

Ginkgo Biloba Extract Market Size and Share Forecast Outlook 2025 to 2035

Sinker Type EDM Market Size and Share Forecast Outlook 2025 to 2035

Sinker Drill Market Size and Share Forecast Outlook 2025 to 2035

Sink Bowls Market Size and Share Forecast Outlook 2025 to 2035

Painkillers Market Size and Share Forecast Outlook 2025 to 2035

Trinket Box Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA