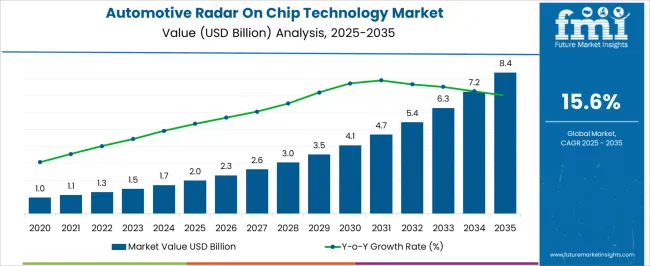

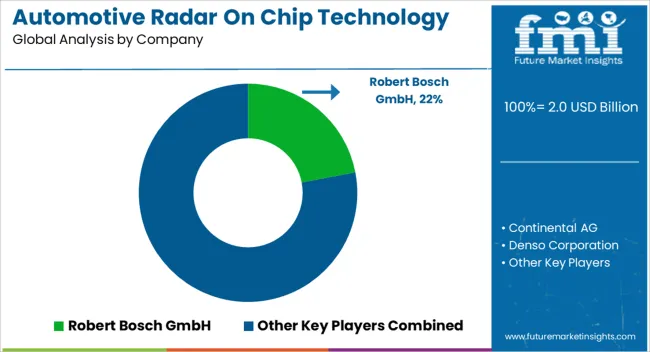

The automotive radar on chip technology market is valued at USD 2.0 billion in 2025 and expands to USD 8.4 billion by 2035, with a CAGR of 15.6%. The growth curve demonstrates a distinctly steep trajectory, shaped by rapid adoption cycles in the automotive industry as radar sensors transition from premium vehicle segments into mass-market platforms. In the early block from 2021 to 2025, the market rises steadily from USD 1.0 billion to USD 2.0 billion. This initial stretch of the curve indicates foundational adoption, with radar-on-chip technology primarily implemented in advanced driver assistance systems (ADAS) for higher-end models. Growth is relatively measured as OEMs and Tier-1 suppliers validate chip-level integration for radar units. Between 2026 and 2030, the curve steepens significantly, moving from USD 2.2 billion to approximately USD 5.0 billion. This reflects the inflection point where volume adoption accelerates, supported by regulatory mandates for collision avoidance, adaptive cruise control, and lane-change assistance in mid-segment vehicles. The curve’s steepness in this phase underscores strong demand elasticity once price points fall and integration improves. From 2031 to 2035, the curve maintains momentum but tapers slightly, climbing from USD 5.0 billion to USD 8.4 billion. The shape reflects a market moving toward maturity, with growth driven more by replacement cycles, radar density per vehicle, and advanced applications such as autonomous driving.

| Metric | Value |

|---|---|

| Automotive Radar On Chip Technology Market Estimated Value in (2025 E) | USD 2.0 billion |

| Automotive Radar On Chip Technology Market Forecast Value in (2035 F) | USD 8.4 billion |

| Forecast CAGR (2025 to 2035) | 15.6% |

The automotive radar on chip technology market sits within several overlapping parent domains, with each showing a different degree of dependency on this innovation. Within the automotive semiconductor market, radar-on-chip solutions represent about 5 to 6%, as they compete with processors, memory, and power electronics in overall silicon value. In the advanced driver assistance systems (ADAS) market, their role is more pronounced, contributing nearly 18 to 20%, since radar-on-chip devices are central to adaptive cruise control, emergency braking, and lane-change assist. When considered within the automotive sensors market, they account for close to 10 to 12%, sharing space with cameras, LiDAR, and ultrasonic units but retaining strong importance for all-weather reliability. In the automotive electronics market, radar-on-chip contributes around 7 to 8%, integrated into safety, infotainment, and navigation modules that define modern electronic architectures. Their positioning is even more critical in the autonomous vehicle technology market, where they hold roughly 15 to 17%, enabling perception and object detection layers essential for Level 3 and beyond automation. These shares highlight a pattern of dual impact: high relative weight within ADAS and autonomous vehicle ecosystems, but modest representation in larger semiconductor and electronics pools.

The Automotive Radar On Chip Technology market is experiencing sustained momentum, supported by the growing integration of advanced driver assistance systems and the global push toward vehicle safety automation. Demand has been reinforced by stricter safety regulations and the adoption of radar-based sensing as a critical component in collision avoidance and adaptive cruise control.

The shift toward higher frequency bands and integrated chip solutions has enhanced radar resolution and detection accuracy, enabling better performance in complex driving environments. Automakers and technology providers are increasingly collaborating to create scalable platforms that meet both cost efficiency and performance requirements.

Advancements in semiconductor design have reduced power consumption and chip size, allowing for broader deployment across vehicle categories As the transition toward autonomous and semi-autonomous vehicles accelerates, the market is poised to expand further, driven by the dual need for precision sensing and integrated, software-upgradable radar platforms that ensure adaptability to evolving road and traffic conditions.

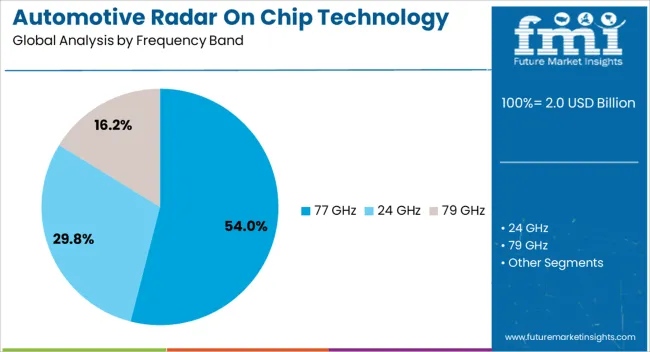

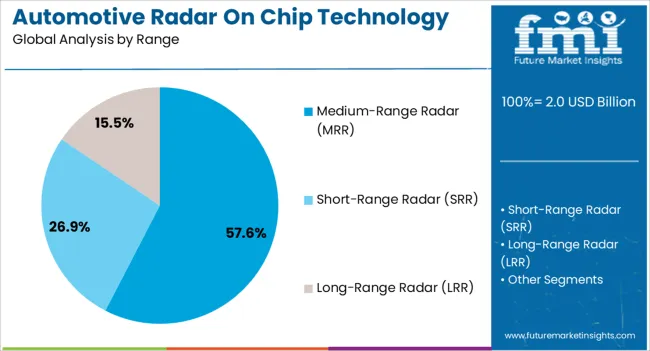

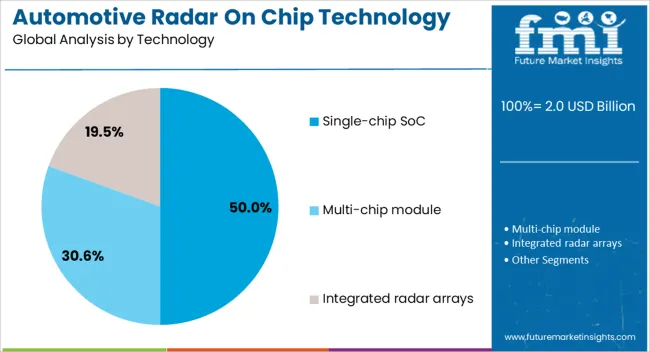

The automotive radar on chip technology market is segmented by frequency band, range, technology, vehicle, sales channel, application, and geographic regions. By frequency band, automotive radar on chip technology market is divided into 77 GHz, 24 GHz, and 79 GHz. In terms of range, automotive radar on chip technology market is classified into Medium-Range Radar (MRR), Short-Range Radar (SRR), and Long-Range Radar (LRR). Based on technology, automotive radar on chip technology market is segmented into Single-chip SoC, Multi-chip module, and Integrated radar arrays. By vehicle, automotive radar on chip technology market is segmented into Passenger vehicle and Commercial vehicle. By sales channel, automotive radar on chip technology market is segmented into OEM and Aftermarket. By application, automotive radar on chip technology market is segmented into Adaptive Cruise Control (ACC), Blind Spot Detection (BSD), Forward Collision Warning (FCW), Automatic Emergency Braking (AEB), Advanced parking assist, Corner radar for autonomous vehicles, and Others. Regionally, the automotive radar on chip technology industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 77 GHz frequency band segment is projected to hold 54% of the Automotive Radar On Chip Technology market revenue share in 2025, making it the leading frequency choice. Its dominance has been supported by superior range resolution and target separation capabilities, which are critical for identifying multiple objects in complex traffic situations.

This frequency band enables enhanced detection accuracy in adverse weather conditions, making it highly reliable for safety-critical applications. The segment has benefited from regulatory endorsements and global automotive safety standards that promote the use of higher frequency radar systems.

Continuous advancements in chip design have allowed integration of 77 GHz radar into compact and cost-effective modules, facilitating deployment across a wide range of vehicles Furthermore, the compatibility of this frequency band with both short and long-range radar functions has increased its adoption, ensuring it remains the preferred option for next-generation automotive sensing technologies.

The medium-range radar segment is anticipated to account for 57.60% of the Automotive Radar On Chip Technology market revenue share in 2025, establishing its position as the leading range category. Growth in this segment has been attributed to its optimal balance between detection distance and field of view, enabling reliable performance in lane-change assistance, blind-spot monitoring, and forward collision warning.

Medium-range radar systems have gained traction due to their cost-effectiveness compared to long-range alternatives, while still offering sufficient resolution for most driver assistance functions. Advancements in radar chip integration have improved processing speeds and reduced latency, enhancing the responsiveness of MRR systems.

Their adaptability for both urban and highway driving conditions has strengthened their presence in mass-market vehicles As automakers prioritize versatile sensing technologies that meet a wide array of safety requirements, medium-range radar is expected to maintain its leadership in the range segment.

The single-chip SoC segment is expected to hold 50% of the Automotive Radar On Chip Technology market revenue share in 2025, reflecting its strong position in the technology landscape. Its growth has been driven by the integration of radio frequency, baseband processing, and digital signal processing into a single compact unit, significantly reducing system complexity and manufacturing costs.

This consolidation has improved reliability and reduced the physical footprint, enabling easier installation in space-constrained vehicle designs. The capability of single-chip SoC solutions to support multiple radar functions with minimal additional hardware has made them attractive for automakers seeking scalable and efficient radar architectures.

Additionally, the reduced power consumption and enhanced thermal management of these systems have supported broader adoption across electric and hybrid vehicles With continuous innovation in semiconductor processes and AI integration, single-chip SoC technology is set to play a central role in delivering high-performance radar solutions for future automotive platforms.

Automotive radar on chip adoption is being fueled by expanding ADAS fitment and the need for compact, cost effective sensing across vehicle zones. Constraints persist around mmWave design, thermal control, packaging yields, and compliance obligations that raise cost and lead time. Clear upside lies in imaging radar, software defined features, and in cabin sensing, with commercial and off highway segments adding volume. The competitive edge will favor vendors coupling silicon, perception software, packaging know how, and validation tools. Programs that guarantee safety, cybersecurity, data quality, and rapid integration will capture the strongest momentum.

Adoption is being driven by wider deployment of driver assistance features that depend on precise range, velocity, and angle measurement. Radar on chip solutions integrate RF front end, baseband, memory, and control onto a compact die or package, allowing corner, front, and rear placements with simplified wiring. Multi antenna MIMO arrays and digital beamforming enable finer resolution for adaptive cruise, automatic emergency braking, blind spot monitoring, cross traffic alerts, and parking aids. Small form factors fit behind painted radomes and grilles without redesign of exterior panels. Cost per sensing channel is being lowered as RF CMOS and SiGe processes mature, bringing higher channel counts to volume platforms. Interference mitigation, phase coding, and adaptive chirp schemes are being incorporated to keep performance stable in dense traffic. As automakers expand standard fit ADAS, radar on chip is being treated as a primary sensing pillar.

Progress is constrained by mmWave design complexity, thermal management, and packaging yield for antenna in package structures. Calibration across temperature, humidity, and vibration adds test time and requires disciplined production flows. Compliance with functional safety, electromagnetic compatibility, and cybersecurity rules demands extensive documentation, tool qualification, and continuous software maintenance. Procurement teams face exposure to wafer supply bottlenecks, specialty substrate availability, and long lead times for power management, oscillators, and memory. Mechanical constraints behind bumpers and badges introduce detuning risks from paints and plastic fillers, which forces joint validation with exterior trim suppliers. Mutual interference among radars in congested corridors still challenges field performance when coding schemes are not coordinated. Integration into zonal electrical architectures raises bandwidth and time synchronization demands on automotive Ethernet and gateways. These realities keep total cost of ownership sensitive to engineering discipline, supplier depth, and lifecycle support.

Higher virtual aperture counts and elevation channels allow point cloud outputs that approach camera like scene understanding in poor visibility. Software defined radar stacks are enabling over the air feature upgrades, object classification at the edge, and usage based licensing for premium trims. In cabin radar is gaining attention for child presence detection, occupant monitoring, and gesture control, where low power operation and privacy friendly sensing are prized. Commercial vehicles, construction equipment, and agriculture are adopting ruggedized modules for blind spot and junction assists, creating incremental demand outside passenger cars. Open SDKs, standardized interfaces, and domain controller integration favor vendors that pair silicon with reference designs, perception libraries, and calibration toolchains. Partnerships with test equipment providers, bumper material suppliers, and mapping firms are being used to accelerate validation and shorten program timelines.

Radar on chip modules are being designed to stream preprocessed detections or raw data over automotive Ethernet to sensor fusion engines that combine camera, lidar, and ultrasonic inputs. Functional safety targets under ISO 26262 and process maturity under ASPICE are being emphasized, while cybersecurity type approval under UNECE frameworks is treated as non negotiable for global launches. Antenna in package and fan out packaging reduce footprint and improve thermal paths, while conformal coatings and venting elements increase resilience against condensation and icing. Edge machine learning is being embedded to stabilize tracking in cluttered scenes and reduce false alarms. Toolchains now include digital twins for bumper materials and paint stacks, allowing earlier co design. Suppliers that offer repeatable production, traceability, and fast field diagnostics are gaining preferred status.

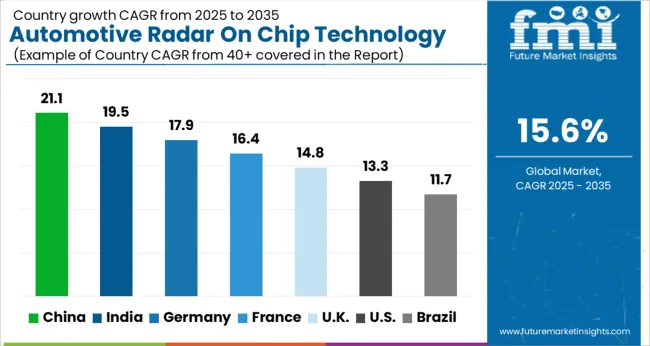

| Country | CAGR |

|---|---|

| China | 21.1% |

| India | 19.5% |

| Germany | 17.9% |

| France | 16.4% |

| UK | 14.8% |

| USA | 13.3% |

| Brazil | 11.7% |

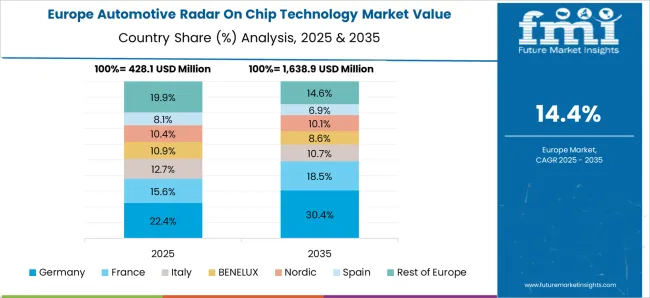

The automotive radar on chip technology market is forecast to grow globally at a CAGR of 15.6% from 2025 to 2035. China leads with 21.1%, followed by India at 19.5% and France at 16.4%, while the UK grows at 14.8% and the USA at 13.3%. China and India secure the strongest growth premiums of +5.5% and +3.9% above baseline, driven by ADAS adoption, infrastructure investments, and autonomous driving pilots. France remains a European hub with strong OEM and Tier-1 participation, while the UK benefits from regulatory push and autonomous testing. The USA, despite slower growth, remains a high-value market due to technological leadership in radar fusion and regulatory momentum in safety. The analysis includes over 40+ countries, with the leading markets detailed below.

The automotive radar on chip technology market in China is forecast to grow at a CAGR of 21.1% between 2025 and 2035, the highest globally. Demand is being fueled by rapid adoption of advanced driver assistance systems (ADAS) and the aggressive rollout of autonomous driving pilot programs. Local automotive OEMs are integrating radar-on-chip solutions into mid-range and premium vehicles to improve collision avoidance, adaptive cruise control, and lane-keeping systems. Domestic semiconductor firms are scaling capabilities, while international suppliers expand joint ventures with Chinese automakers to gain market access. With government-backed smart mobility programs, radar chips are becoming critical for both passenger and commercial vehicle applications.

The automotive radar on chip technology market in India is projected to expand at a CAGR of 19.5% during 2025–2035. Growth is supported by rising vehicle safety regulations, increasing penetration of ADAS features, and growing awareness of road safety among consumers. Indian automakers are gradually integrating radar-based features such as blind spot detection and forward collision warning in mid-segment passenger vehicles. Imports currently dominate supply, but partnerships between global radar chip manufacturers and local Tier-1 suppliers are emerging. Government emphasis on vehicle safety through Bharat NCAP protocols is expected to accelerate radar technology adoption. Commercial fleets and logistics providers are also showing interest in radar-based solutions for driver monitoring and accident prevention, creating further opportunities for radar-on-chip systems.

The automotive radar on chip technology market in France is expected to grow at a CAGR of 16.4% from 2025 to 2035. The country’s strong automotive engineering base and focus on safety technologies are key growth drivers. French automakers are incorporating radar chips into new electric and hybrid vehicle platforms, emphasizing adaptive cruise control, emergency braking, and collision avoidance systems. The government’s emphasis on connected mobility solutions further supports adoption. Tier-1 suppliers in France are investing in R&D to develop compact radar-on-chip systems that deliver high resolution while consuming less power. The rising trend of premium vehicles with integrated ADAS features is creating steady market opportunities. France is expected to remain a key European hub for radar-based automotive electronics.

The automotive radar on chip technology market in the United Kingdom is projected to grow at a CAGR of 14.8% between 2025 and 2035. Demand is driven by strong ADAS adoption across both premium and mass-market vehicle categories. Automotive OEMs are investing in radar-on-chip integration to meet Euro NCAP safety requirements, particularly in collision avoidance and pedestrian detection features. The UK is also advancing autonomous vehicle testing, with radar technology being central to sensor fusion architectures. Local suppliers are collaborating with global chipmakers to enhance system performance and compliance with evolving safety standards.

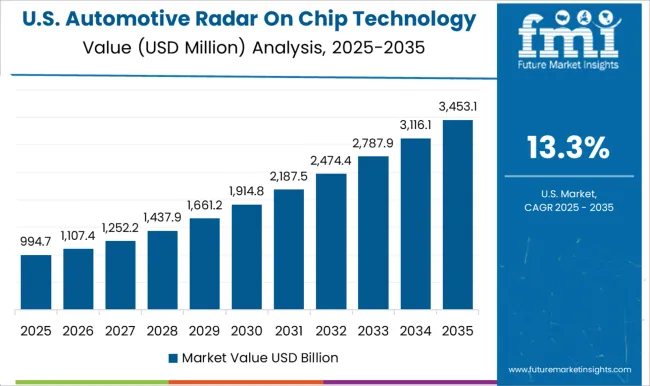

The automotive radar on chip technology market in the United States is expected to grow at a CAGR of 13.3%, the slowest among the profiled regions but significant in scale. USA automakers and technology companies are pioneering radar fusion with LiDAR and camera systems for advanced autonomous driving platforms. Radar-on-chip solutions are being widely adopted in luxury and high-end vehicles for adaptive cruise control, blind spot detection, and collision mitigation. The National Highway Traffic Safety Administration (NHTSA) is actively promoting safety regulations that are expected to make radar-based ADAS features more widespread. Commercial fleets, ride-hailing firms, and logistics operators are also integrating radar technology for safety monitoring.

Competition in automotive radar on chip technology is shaped by sensor resolution, interference immunity, and software integration with ADAS stacks. Portfolios are positioned across long range forward radar, high resolution imaging radar, and compact corner units at 77 to 81 GHz. Bosch and Continental are seen at the front through imaging radar families that promise lane level object separation and low false alarms under rain or glare. Denso emphasizes OEM specific tuning, thermal stability, and tightly managed supply for Japanese platforms. Aptiv is positioned around scalable sensor suites and domain control integration, where perception software and fusion timing are treated as core levers. NXP Semiconductors supplies RFCMOS radar SoCs, front ends, and reference designs used by multiple Tier 1s, so time to qualification is shortened and bill of material risk is reduced. Valeo, ZF, and Hella compete through dense corner radar networks and forward units that support automated emergency braking, highway pilot, and urban detection. Autoliv is associated with active safety portfolios and program integration for selected platforms. Strategy has been centered on three plays. First, imaging radar has been advanced using larger virtual apertures and cascaded MIMO to unlock finer angular resolution. Second, software defined radar has been pursued, with over the air calibration, interference mitigation, and function upgrades tied to compute roadmaps. Third, cost curves have been addressed through RFCMOS integration, shared platforms across corner and forward units, and modular harnessing that eases vehicle packaging. Product brochure themes are consistent. Bosch, Continental, Valeo, ZF, and Hella list forward radar with long detection ranges, wide field of view corner units, high range accuracy, and elevation resolution for cut in, cut out, and debris detection. Denso highlights compact modules, low latency tracking, and stable performance across temperature. Aptiv presents radar families pre validated with perception software and centralized controllers. NXP details radar SoCs, transceivers, power management, and reference boards that enable Tier 1 calibration, cascading, and high channel counts.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Frequency Band | 77 GHz, 24 GHz, and 79 GHz |

| Range | Medium-Range Radar (MRR), Short-Range Radar (SRR), and Long-Range Radar (LRR) |

| Technology | Single-chip SoC, Multi-chip module, and Integrated radar arrays |

| Vehicle | Passenger vehicle and Commercial vehicle |

| Sales Channel | OEM and Aftermarket |

| Application | Adaptive Cruise Control (ACC), Blind Spot Detection (BSD), Forward Collision Warning (FCW), Automatic Emergency Braking (AEB), Advanced parking assist, Corner radar for autonomous vehicles, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Robert Bosch GmbH, Continental AG, Denso Corporation, Aptiv PLC, NXP Semiconductors, Valeo, ZF Friedrichshafen, Hella, and Autoliv |

| Additional Attributes | Dollar sales by product type cover short-range, mid-range, and long-range radar-on-chip modules, with segmentation by frequency bands (24 GHz legacy, 77 GHz, 79 GHz) and by application (adaptive cruise control, blind spot detection, emergency braking, cross-traffic alerts). Dollar sales by end use include passenger vehicles, commercial fleets, and premium autonomous-ready platforms. Demand dynamics are supported by safety regulations, NCAP scoring incentives, and OEM mandates for radar redundancy in sensor fusion stacks. Regional trends highlight Europe leading adoption with regulatory push, North America emphasizing integration into advanced driver assistance suites, and Asia Pacific showing rapid scale with cost-optimized RoC solutions deployed across high-volume passenger cars. |

The global automotive radar on chip technology market is estimated to be valued at USD 2.0 billion in 2025.

The market size for the automotive radar on chip technology market is projected to reach USD 8.4 billion by 2035.

The automotive radar on chip technology market is expected to grow at a 15.6% CAGR between 2025 and 2035.

The key product types in automotive radar on chip technology market are 77 ghz, 24 ghz and 79 ghz.

In terms of range, medium-range radar (mrr) segment to command 57.6% share in the automotive radar on chip technology market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Vacuum Brake Booster Market Size and Share Forecast Outlook 2025 to 2035

Automotive Smart Antenna Market Size and Share Forecast Outlook 2025 to 2035

Automotive Actuator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Manifold Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Counter Shaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Wheel Coating Market Size and Share Forecast Outlook 2025 to 2035

Automotive Refinish Coating Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA