The air quality monitoring equipment market is expected to grow extensively with the industry size, estimated to reach USD 7.6 billion in 2025, slated to be about USD 15.3 billion by the year 2035 at a growth rate of 7.3% CAGR. Growth in the industry comes on account of growing air pollution awareness, concerns regarding public health, and stiffening environmental legislation.

The upsurge in urbanization and industrialization has seen a steep increase in the level of pollution, especially in Asia Pacific and Latin America. Governments, municipalities, and nongovernmental organizations are increasingly utilizing monitoring systems to gain a better perspective on pollution sources, monitor emissions, and come up with efficient mitigation strategies.

One of the major growth drivers is the adoption of strict air quality norms by governing agencies like the USA Environmental Protection Agency (EPA), the European Environment Agency (EEA), and India's Central Pollution Control Board (CPCB). These authorities require real-time monitoring and reporting in city areas and industrial clusters.

The growth of smart cities and IoT-enabled environmental monitoring is revolutionizing the industry. Integrated air quality sensors on cloud-based platforms enable real-time sharing and predictive analysis of data. Such systems facilitate not only compliance but also public health notifications, academic studies, and environmental planning.

Indoor air quality (IAQ) monitoring is assuming equal significance with more time spent indoors and growing health issues over air transmission of diseases and indoor contaminants. Homes, offices, hospitals, and schools are deploying mini IAQ devices for occupant protection and HVAC optimization.

Challenges are high upfront costs, especially for reference-grade monitors, and technical restrictions on sensor precision, calibration, and upkeep. Yet, the industry is changing with an assortment of scalable offerings from low-cost portable monitors to high-precision stationary devices for full coverage.

Market Metrics

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 7.6 billion |

| Industry Value (2035F) | USD 15.3 billion |

| CAGR (2025 to 2035) | 7.3% |

The industryis shifting at a rapid rate due to changing assumptions about environmental stewardship, data transparency, and operational performance. The technologies have evolved from stand-alone sensors to smart, networked platforms for real-time data creation, real-time alerts, and interface with climate control systems.

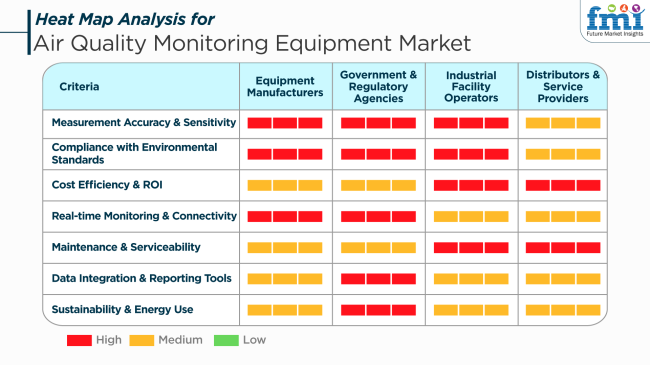

Equipment providers prioritize the production of high-sensitivity, multi-pollutant systems that are integrated with data analytics and lower operating expense. Design versatility is emphasized through support for fixed, portable, and wearable configuration modes suited for a variety of deployment environments.Regulatory Officials value systems meeting national and global standards, guaranteed enforcement reliability and public reporting confidence. Data consistency and integrity are required, complemented with policy modeling and public engagement capabilities.

Industrial operators require cost-effective, reliable solutions that communicate with process control systems and allow regulation compliance with emissions levels. Industrial Operators also appreciate predictive maintenance and automated notifications in a bid to reduce downtime.Distributors and service providers focus on the delivery of customized packages, from installation right through to calibration and cloud data access.

Their vision is to facilitate adoption in public, private, and industrial settings through scalable and easy-to-sustain systems.The industry is moving towards modular, IoT-connected, and environmentally friendly devices, with increasing demand for AI-driven insights that convert air quality data into actionable environmental intelligence.

Between 2020 and 2024, the industry experienced steady growth because of increased awareness of the health impacts of air pollution and the implementation of stringent environmental laws.The demand for real-time monitoring for industrial use and smart city initiatives also fueled the growth of the industry. Technological advancements, such as the integration of the Internet of Things (IoT) and sensor technology, enhanced the performance of the monitoring systems to be more efficient and cost-saving.

Forward to 2025 to 2035, the industry will likely experience dramatic changes, driven by advances in technology, population shifts, and changing industrial requirements.The increasing focus on sustainable and eco-friendly processes will most likely propel the need for green solvents, thereby fueling innovation in solvent development and solvent process manufacturing.

Increased application of biologics and personalized medication will further generate new business opportunities for solvents applied in pharmaceuticals because they will use special solvents in order to create and deliver them.Healthcare infrastructure growth in developing economies is also expected to spur industry growth, allowing the delivery of its larger patient population base and increasing its pharmaceutical product demand.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Sustained growth with increasing demand for pharmaceutical products. | Growth acceleration led by expansion in drug delivery systems and personalized medicine. |

| Growing incidence of chronic diseases, expansion in healthcare infrastructure, and increased production of pharmaceuticals. | Increased emphasis on sustainable operations, biologics adoption, and expansion in healthcare access in emerging industrie s. |

| Increased emphasis on improved solvent efficiency and environmental footprint reduction. | Development of green solvents, innovation in formulation technologies, and enhancements in biologic drug delivery. |

| Emerging industrie s expansion with expansion in healthcare infrastructure. | Continued expansion in emerging industrie s, with increased availability of pharmaceutical and healthcare products. |

| Implementation of more stringent controls on solvent usage and on environmental activity. | Increased focus on sustainability and environmentally responsible performance in the production and use of solvents. |

| Formulation of new solvent technologies that offer improved performance and reduced toxicity. | Formation of solvent products that are tailored to biologics and personalized medicine. |

The industry, valued at USD 4.9 billion in 2024, is vulnerable to immense threats from initial cost and maintenance hazards. Sophisticated systems are expensive to install, and hence less appealing for adoption, especially in developing nations with limited budgets.

Technical intricacies and data accuracy issues are concerns. Technological levels of air quality monitoring equipment can be challenging for ultimate consumers. Data inaccuracies and the necessity of professional interpretation could reduce monitoring operation effectiveness.

Disruptions to supply chains, such as transit time and geopolitical tensions, can interfere with timely delivery of components and finished products. Such interruptions could cause production stoppages and falling short of customers' demand, impacting sales and long-term business relationships negatively.

The industry is undermined by the unavailability of infrastructure in emerging economies. In poor nations, there can be limited critical infrastructure, such as networks for data collecting and communication, which may delay the application of air quality monitoring technology.

Industry acceptance can be inhibited by limited resources and a lower degree of concern regarding environmental issues. Dependence on government policy and regulation means that the power of environmental standard changes directly influence demand for air quality monitoring equipment. Uncertainty or policy delay could result in less investment and slower industry growth.

In conclusion, the industry for air quality monitoring equipment is exposed to threats from high prices, technicality, supply chain interruption, infrastructural constraints, and policy reliance. Mitigating these through innovation, strategic planning, and partnerships is crucial in maintaining growth and competitiveness in such a fast-moving industry.

The industry is expected to be led by air sampling pumps in 2025, accounting for nearly 30% of the total industry share. Filters & membranes will very closely follow with a projected 22% share. This might be due to the increasing global consciousness towards environmental sustainability and strictness in air pollution measures, along with health awareness due to poor air quality.

These air sampling pumps are widely used in all types of applications, including industrial, governmental, and environmental monitoring; they use sampling aerodynamic technologies to gather high-precision sampling for harmful air pollutants such as PM2.5, PM10, and VOCs. Companies like SKC Inc., Sensidyne, and Gilian manufacture portable high-flow pumps that enable occupational hygiene, indoor air quality, and compliance monitoring.

For example, SKC's AirChek® TOUCH and SensodyneGilian® BDX-II are significantly used in workplace environments to capture airborne contaminants with great precision and efficiency. Likewise, Thermo Fisher Scientific also goes beyond the provision of fully pumped systems to embrace real-time sensors, facilitating fast transmission of data into cloud-based analytic systems.

Also, with a consequent high share in the industry, Filters & Membranes become necessary for achieving sample purity and protecting the sensor. These parts are now present in air monitoring devices within urban and industrial areas. Pall Corporation, Sartorius AG, Merck Group (MilliporeSigma), and GE Healthcare Life Sciences are companies that provide high-efficiency filtration materials that will yield better quality data in the air quality monitoring sector. For instance, Pall's high-capacity PTFE membranes have been identified among the best in the capture of airborne particulates in the most extreme conditions.

Other leading companies, like Aeroqual, Honeywell International Inc., and Teledyne Technologies, provide air monitoring systems with embedded sampling and filtration technologies in a single system. Cumulatively, both standards are expected to push the advancements in smart air quality management even further in smart cities and industrial automation. All these contribute to having a booming, growing industry, mainly due to environmental awareness coupled with sensor technology advancements.

In 2025, the industry for air quality monitoring equipment is projected to be dominated by outdoor air quality monitors, which are expected to capture an estimated 60% of the total industry share, followed by indoor air quality monitors with a projection of 40%. The demand for outdoor monitoring solutions is growing fast, owing to stricter environmental regulations coupled with a rising need to monitor ambient air pollutants in urban and industrial areas and the deployment of smart-city infrastructure.

Outdoor air quality monitors are mainly classified into three categories: fixed, portable, and comprehensive air quality monitoring (AQM) stations. These instruments play an important role in near-real-time data acquisition on criteria air pollutants such as nitrogen dioxide (NO2), sulfur dioxide (SO2), ozone (O3), carbon monoxide (CO), and particulate matter (PM2.5, PM10).

Key players in AQM, such as Thermo Fisher Scientific, Teledyne API, and HORIBA, have developed industry-leading, state-of-the-art precision monitoring system installations for regulatory and research applications. For example, the 49i ozone analyzer made by Thermo Fisher and the T640 PM analyzer made by Teledyne are widely utilized by government institutions and environmental regulatory agencies for compliance monitoring and pollution control strategies.

Indoor air quality monitors, albeit small in number, have nonetheless gained prominence, with the health risks associated with indoor pollutants becoming more widely appreciated, especially in residential, commercial, and healthcare settings. These could consist of fixed systems for building management and portable monitors for personal or home use.

Companies such as Airthings, TSI Incorporated, and Kaiterra thus far have made appreciable inroads into this niche. Smart indoor monitors with connectivity features designed for real-time air quality analytics for individual users, as well as businesses, include the Airthings View Plus and Kaiterra Laser Egg.

Overall, steady growth in both categories of air quality monitoring is propelled by the interdependence of technology, health-conscious customers, and favorable government policy.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 7.3% |

| UK | 7.1% |

| France | 7.2% |

| Germany | 7.4% |

| Italy | 7.1% |

| South Korea | 7.5% |

| Japan | 7.3% |

| China | 7.7% |

| Australia | 7.2% |

| New Zealand | 7.1% |

The USA industry is anticipated to achieve a CAGR of 7.3% during the period 2025 to 2035. Rising occurrences of wildfire pollution, industrial discharges, and stringent federal Clean Air Act requirements are driving demand. Environmental agencies, municipalities, and private firms increasingly utilize advanced monitoring systems for real-time monitoring of pollutants.

Large manufacturers such as Thermo Fisher Scientific, Honeywell International Inc., and Aeroqual are investing in AI-powered systems, handheld devices, and remote monitoring technology. Federal grants and clean infrastructure financing are also aiding public and private sector adoption.

The UKindustry is also expected to post a CAGR of 7.1%. Government-backed air quality action plans on particulate and nitrogen dioxide emissions in urban and industrial regions propel demand. Deployment of continuous air monitoring stations and low-cost portable sensors is picking up pace, particularly with the backing of the UK Clean Air Strategy.

Suppliers such as Alphasense, EarthSense Systems, and Enviro Technology Services are broadening their product portfolio to include smart-city-compatible systems. Urban development and climate resilience programs with embedded monitoring networks are driving the industry.

France is expected to grow at a CAGR of 7.2%. NO?, SO2, and PM2.5 emissions have faced stringent national and EU-level regulation, and huge investments have been made in monitoring hardware. In large cities and industrial regions, real-time reporting systems for air quality are mandatory to increase public awareness and enhance regulatory compliance.

Primary stakeholders such as Environnement S.A. (ACOEM Group subsidiary) are driving IoT and modular sensor technology. Government incentives under the French Climate and Resilience Law further encourage infrastructure upgradation and environmental monitoring capabilities.

Germany's industry is likely to be 7.4% CAGR. The national industrial economy and the transportation network require total air quality monitoring to comply with EU directives. Environmental control and occupational health in emission-intensive industries make use of monitoring equipment.

Industry leaders like Siemens AG, Testo SE & Co. KGaA, and Lufft are developing intelligent, cloud-connected analyzers for real-time constant emissions monitoring. Federal initiatives promoting climate-neutral cities and clean transport are driving demand across public infrastructure and industrial segments.

Italy is expected to grow at a 7.1% CAGR. Large urban centers and transport corridors are assigned the highest priority for air quality monitoring modernizations due to high levels of particulate and ozone concentrations. Local environmental authorities are implementing localized monitoring strategies supported by EU air policy frameworks.

Large suppliers such as TCR Tecora and Delta OHM are producing integrated monitoring stations for meteorological data, gases, and particulate matter. Adoption is also facilitated by climate adaptation legislation and industrial plant emissions law.

South Korea is estimated to grow at a CAGR of 7.5%. Transboundary pollution, car emissions, and industrial processes cause repeated air quality problems in the country. Government initiatives in the National Fine Dust Reduction Strategy are working aggressively towards promoting the installation of smart monitoring systems.

Companies like Kweather, Aeroflow, and local offices of multinational companies are focusing on multi-parameter sensors and small-scale networks of urban monitors. Technological superiority in the integration of real-time data and public warning systems makes advanced urban air management possible.

The industry in Japan will increase with a CAGR of 7.3%. Increased demand for transparency in the issue of pollution and the protection of human health has driven the deployment of ambient air monitoring instruments surrounding urban, industrial, and academic zones. Emphasis is put on ongoing PM2.5, CO, and VOCs monitoring.

Firms such as Horiba Ltd., Panasonic Industry, and Riken Keiki Co. Ltd. are developing energy-efficient, miniaturized sensors. National clean air policies combined with monitoring of air quality due to infrastructure aging enable steady industry growth.

China is expected to remain the industry growth leader at a CAGR of 7.7%, driven by a sustained national focus on environmental reform and safeguarding public health. Government programs under the "Blue Sky Protection Campaign" have prioritized air quality monitoring across all of the provinces.

Major producers such as FPI Group, Hebei Sailhero, and ZhongkeDingshi are increasing intelligent monitoring networks and cloud data integration platforms. The growing use of low-cost monitoring stations in schools, communities, and industrial parks further enlarges the scope of the application.

Australia is projected to develop at a CAGR of 7.2%. Increased bushfire frequency, urban smog, and mining emissions have spurred extensive deployment of monitoring solutions. Industries are government-operated monitoring stations, occupational exposure monitoring, and transportable monitoring in wildfire areas.

Producers such as Airmet Scientific and Environmental Systems & Services are advancing field-deployable equipment and enhancing regional coverage. Alignment with policy under the National Clean Air Agreement allows standardization of monitoring practice and long-term public investment.

New Zealand is forecast to grow at a CAGR of 7.1%. While general pollution rates are moderate, localized issues related to wood combustion, vehicle emissions, and agriculture need proper monitoring. There is a growing need for portable, community-level air monitoring systems.

The public and importers are installing both reference-grade and indicative sensors in coordination with research networks from academia. National Environmental Standards for Air Quality (NESAQ) are updated to consider shifting priorities concerning environmental health.

The industry is dominated by established technology providers and specific environmental monitoring companies that compete based on their sensor accuracy, real-time analytics, or regulatory compliance capability. The competition in advanced air pollution detection systems is most especially among more companies with capabilities in industrial and environmental monitoring, such as Honeywell, Thermo Fisher Scientific, and Vaisala.

Industry positioning is entirely defined by product innovation and technological advancement. TSI Incorporated and ENVEA Group make high-performance particulate and gas analyzers. Ecotech and Aeroqual Limited are portable and IoT-enabled monitoring systems tailored for urban air surveillance and emissions monitoring with respect to industry.

Industry expansion relies heavily on strategic partnerships between the regulatory agencies and the industries. LumaSense Technologies and Testo SE & Co. KGaA have teamed up with governments and research institutions to develop networks for real-time monitoring, which can be leveraged in air quality forecasting. Adding to the list are Modcon Systems Ltd. and Oizom Instruments, which work for smart city installations and are in alignment with urban sustainability initiatives to comply with environmental standards.

The industry faces yet another competition from many new entrants into the air monitoring arena with AI abilities. A company like Airthinx and Opsis AB utilize cloud computing and remote sensing technologies to offer scalable, low-cost monitoring solutions for industrial and municipal applications. Companies with strong data analytics platforms and regulatory knowledge will win this changing battlefield.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Honeywell | 18-23% |

| Thermo Fisher Scientific | 15-20% |

| Vaisala | 10-15% |

| ENVEA Group | 8-12% |

| TSI Incorporated | 5-9% |

| Others (combined) | 30-40% |

| Company Name | Key Offerings and Activities |

|---|---|

| Honeywell | Develops integrated air quality monitoring networks for industrial and urban applications. |

| Thermo Fisher Scientific | Specializes in high-precision gas analyzers and PM monitoring solutions. |

| Vaisala | Focuses on real-time meteorological and environmental monitoring systems. |

| ENVEA Group | Offers advanced emission monitoring technologies for industrial and regulatory applications. |

| TSI Incorporated | Provides portable and stationary air quality monitoring instruments for scientific and industrial use. |

Key Company Insights

Honeywell (18-23%)

Honeywell dominates the air quality monitoring industry, integrating AI-driven analytics and IoT-enabled sensors for real-time industrial air surveillance.

Thermo Fisher Scientific (15-20%)

Thermo Fisher leads in high-precision pollutant detection systems, offering regulatory-compliant gas analyzers for environmental monitoring agencies.

Vaisala (10-15%)

Vaisala specializes in meteorological and air quality monitoring, focusing on climate-based predictive analytics and urban air pollution control.

ENVEA Group (8-12%)

ENVEA strengthens its industry presence with continuous emission monitoring systems, catering to industrial and regulatory bodies worldwide.

TSI Incorporated (5-9%)

TSI provides advanced air quality instrumentation, including aerosol monitoring solutions for scientific research and regulatory applications.

Other Key Players

By component, the industry is segmented into air sampling pumps, sorbent tubes, filters & membranes, sample bags, and other accessories.

By equipment type, the industry is categorized into indoor air quality monitors include indoor air quality monitors and portable indoor air quality monitors and outdoor air quality monitors include fixed outdoor air quality monitors, portable outdoor air quality monitors, and air quality monitoring (AQM) stations.

By end user, the industry is segmented into residential, government environment monitoring agencies, commercial (hotels & restaurants, corporates & academic institutions, construction & real estate, and others), and industrial (energy & utilities, pharmaceuticals, petrochemicals, and others).

By region, the industry spans North America, Latin America, Western Europe, Eastern Europe, Asia Pacific Excluding Japan, Japan, and the Middle East & Africa.

The industry is estimated to reach USD 7.6 billion by 2025.

The industry is projected to grow significantly, reaching USD 15.3 billion by 2035.

China is expected to register a 7.7% CAGR.

The air sampling pumps segment is leading the industry, owing to its vital role in accurate detection and measurement of airborne contaminants.

Key players include Honeywell, Thermo Fisher Scientific, Vaisala, ENVEA Group, TSI Incorporated, Ecotech, LumaSense Technologies, Inc., Modcon Systems Ltd., Testo SE & Co.KGaA, Aeroqual Limited, PCE Instruments, Opsis AB, Oizom Instruments Pvt. Ltd., Airthinx, and SKC Ltd.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Component, 2017 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Equipment Type, 2017 to 2033

Table 4: Global Market Value (US$ Million) Forecast by End User , 2017 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Component, 2017 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Equipment Type, 2017 to 2033

Table 8: North America Market Value (US$ Million) Forecast by End User , 2017 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Component, 2017 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Equipment Type, 2017 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by End User , 2017 to 2033

Table 13: Western Europe Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 14: Western Europe Market Value (US$ Million) Forecast by Component, 2017 to 2033

Table 15: Western Europe Market Value (US$ Million) Forecast by Equipment Type, 2017 to 2033

Table 16: Western Europe Market Value (US$ Million) Forecast by End User , 2017 to 2033

Table 17: Eastern Europe Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 18: Eastern Europe Market Value (US$ Million) Forecast by Component, 2017 to 2033

Table 19: Eastern Europe Market Value (US$ Million) Forecast by Equipment Type, 2017 to 2033

Table 20: Eastern Europe Market Value (US$ Million) Forecast by End User , 2017 to 2033

Table 21: Asia Pacific Excluding Japan Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 22: Asia Pacific Excluding Japan Market Value (US$ Million) Forecast by Component, 2017 to 2033

Table 23: Asia Pacific Excluding Japan Market Value (US$ Million) Forecast by Equipment Type, 2017 to 2033

Table 24: Asia Pacific Excluding Japan Market Value (US$ Million) Forecast by End User , 2017 to 2033

Table 25: Japan Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 26: Japan Market Value (US$ Million) Forecast by Component, 2017 to 2033

Table 27: Japan Market Value (US$ Million) Forecast by Equipment Type, 2017 to 2033

Table 28: Japan Market Value (US$ Million) Forecast by End User , 2017 to 2033

Table 29: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 30: Middle East and Africa Market Value (US$ Million) Forecast by Component, 2017 to 2033

Table 31: Middle East and Africa Market Value (US$ Million) Forecast by Equipment Type, 2017 to 2033

Table 32: Middle East and Africa Market Value (US$ Million) Forecast by End User , 2017 to 2033

Figure 1: Global Market Value (US$ Million) by Component, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Equipment Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End User , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2017 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Component, 2017 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Equipment Type, 2017 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Equipment Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Equipment Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by End User , 2017 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 17: Global Market Attractiveness by Component, 2023 to 2033

Figure 18: Global Market Attractiveness by Equipment Type, 2023 to 2033

Figure 19: Global Market Attractiveness by End User , 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Component, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Equipment Type, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by End User , 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Component, 2017 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Equipment Type, 2017 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Equipment Type, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Equipment Type, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by End User , 2017 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 37: North America Market Attractiveness by Component, 2023 to 2033

Figure 38: North America Market Attractiveness by Equipment Type, 2023 to 2033

Figure 39: North America Market Attractiveness by End User , 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Component, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Equipment Type, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by End User , 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Component, 2017 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Equipment Type, 2017 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Equipment Type, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Equipment Type, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by End User , 2017 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 57: Latin America Market Attractiveness by Component, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Equipment Type, 2023 to 2033

Figure 59: Latin America Market Attractiveness by End User , 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Western Europe Market Value (US$ Million) by Component, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) by Equipment Type, 2023 to 2033

Figure 63: Western Europe Market Value (US$ Million) by End User , 2023 to 2033

Figure 64: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Western Europe Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 66: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Western Europe Market Value (US$ Million) Analysis by Component, 2017 to 2033

Figure 69: Western Europe Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 70: Western Europe Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 71: Western Europe Market Value (US$ Million) Analysis by Equipment Type, 2017 to 2033

Figure 72: Western Europe Market Value Share (%) and BPS Analysis by Equipment Type, 2023 to 2033

Figure 73: Western Europe Market Y-o-Y Growth (%) Projections by Equipment Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) Analysis by End User , 2017 to 2033

Figure 75: Western Europe Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 76: Western Europe Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 77: Western Europe Market Attractiveness by Component, 2023 to 2033

Figure 78: Western Europe Market Attractiveness by Equipment Type, 2023 to 2033

Figure 79: Western Europe Market Attractiveness by End User , 2023 to 2033

Figure 80: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: Eastern Europe Market Value (US$ Million) by Component, 2023 to 2033

Figure 82: Eastern Europe Market Value (US$ Million) by Equipment Type, 2023 to 2033

Figure 83: Eastern Europe Market Value (US$ Million) by End User , 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: Eastern Europe Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: Eastern Europe Market Value (US$ Million) Analysis by Component, 2017 to 2033

Figure 89: Eastern Europe Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 90: Eastern Europe Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 91: Eastern Europe Market Value (US$ Million) Analysis by Equipment Type, 2017 to 2033

Figure 92: Eastern Europe Market Value Share (%) and BPS Analysis by Equipment Type, 2023 to 2033

Figure 93: Eastern Europe Market Y-o-Y Growth (%) Projections by Equipment Type, 2023 to 2033

Figure 94: Eastern Europe Market Value (US$ Million) Analysis by End User , 2017 to 2033

Figure 95: Eastern Europe Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 96: Eastern Europe Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 97: Eastern Europe Market Attractiveness by Component, 2023 to 2033

Figure 98: Eastern Europe Market Attractiveness by Equipment Type, 2023 to 2033

Figure 99: Eastern Europe Market Attractiveness by End User , 2023 to 2033

Figure 100: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: Asia Pacific Excluding Japan Market Value (US$ Million) by Component, 2023 to 2033

Figure 102: Asia Pacific Excluding Japan Market Value (US$ Million) by Equipment Type, 2023 to 2033

Figure 103: Asia Pacific Excluding Japan Market Value (US$ Million) by End User , 2023 to 2033

Figure 104: Asia Pacific Excluding Japan Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: Asia Pacific Excluding Japan Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 106: Asia Pacific Excluding Japan Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: Asia Pacific Excluding Japan Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: Asia Pacific Excluding Japan Market Value (US$ Million) Analysis by Component, 2017 to 2033

Figure 109: Asia Pacific Excluding Japan Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 110: Asia Pacific Excluding Japan Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 111: Asia Pacific Excluding Japan Market Value (US$ Million) Analysis by Equipment Type, 2017 to 2033

Figure 112: Asia Pacific Excluding Japan Market Value Share (%) and BPS Analysis by Equipment Type, 2023 to 2033

Figure 113: Asia Pacific Excluding Japan Market Y-o-Y Growth (%) Projections by Equipment Type, 2023 to 2033

Figure 114: Asia Pacific Excluding Japan Market Value (US$ Million) Analysis by End User , 2017 to 2033

Figure 115: Asia Pacific Excluding Japan Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 116: Asia Pacific Excluding Japan Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 117: Asia Pacific Excluding Japan Market Attractiveness by Component, 2023 to 2033

Figure 118: Asia Pacific Excluding Japan Market Attractiveness by Equipment Type, 2023 to 2033

Figure 119: Asia Pacific Excluding Japan Market Attractiveness by End User , 2023 to 2033

Figure 120: Asia Pacific Excluding Japan Market Attractiveness by Country, 2023 to 2033

Figure 121: Japan Market Value (US$ Million) by Component, 2023 to 2033

Figure 122: Japan Market Value (US$ Million) by Equipment Type, 2023 to 2033

Figure 123: Japan Market Value (US$ Million) by End User , 2023 to 2033

Figure 124: Japan Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Japan Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 126: Japan Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: Japan Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: Japan Market Value (US$ Million) Analysis by Component, 2017 to 2033

Figure 129: Japan Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 130: Japan Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 131: Japan Market Value (US$ Million) Analysis by Equipment Type, 2017 to 2033

Figure 132: Japan Market Value Share (%) and BPS Analysis by Equipment Type, 2023 to 2033

Figure 133: Japan Market Y-o-Y Growth (%) Projections by Equipment Type, 2023 to 2033

Figure 134: Japan Market Value (US$ Million) Analysis by End User , 2017 to 2033

Figure 135: Japan Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 136: Japan Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 137: Japan Market Attractiveness by Component, 2023 to 2033

Figure 138: Japan Market Attractiveness by Equipment Type, 2023 to 2033

Figure 139: Japan Market Attractiveness by End User , 2023 to 2033

Figure 140: Japan Market Attractiveness by Country, 2023 to 2033

Figure 141: Middle East and Africa Market Value (US$ Million) by Component, 2023 to 2033

Figure 142: Middle East and Africa Market Value (US$ Million) by Equipment Type, 2023 to 2033

Figure 143: Middle East and Africa Market Value (US$ Million) by End User , 2023 to 2033

Figure 144: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 146: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: Middle East and Africa Market Value (US$ Million) Analysis by Component, 2017 to 2033

Figure 149: Middle East and Africa Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 150: Middle East and Africa Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 151: Middle East and Africa Market Value (US$ Million) Analysis by Equipment Type, 2017 to 2033

Figure 152: Middle East and Africa Market Value Share (%) and BPS Analysis by Equipment Type, 2023 to 2033

Figure 153: Middle East and Africa Market Y-o-Y Growth (%) Projections by Equipment Type, 2023 to 2033

Figure 154: Middle East and Africa Market Value (US$ Million) Analysis by End User , 2017 to 2033

Figure 155: Middle East and Africa Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 156: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 157: Middle East and Africa Market Attractiveness by Component, 2023 to 2033

Figure 158: Middle East and Africa Market Attractiveness by Equipment Type, 2023 to 2033

Figure 159: Middle East and Africa Market Attractiveness by End User , 2023 to 2033

Figure 160: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Air Quality Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Air Quality Monitoring Software Market

HVAC Air Quality Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Interior Air Quality Monitoring Technology Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Air Flow Monitoring System Market

Air Audit Equipment Market Growth - Trends & Forecast 2025 to 2035

Air Measuring Equipment Market Size and Share Forecast Outlook 2025 to 2035

Airborne SATCOM Equipment Market

Indoor Air Quality Monitor Market Size and Share Forecast Outlook 2025 to 2035

Rugged Air Quality Monitors Market Insights - Growth & Forecast 2025 to 2035

Dairy Processing Equipment Market Outlook – Growth, Demand & Forecast 2023-2033

Power Quality Equipment Market Size and Share Forecast Outlook 2025 to 2035

Air Traffic Control Equipment Market

Air Pollution Control Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Survivability Equipment (ASE) Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cargo Handling Equipment Market

Seismic Monitoring Equipment Market Size and Share Forecast Outlook 2025 to 2035

Water Quality Testing Equipment Market Growth – Trends & Forecast 2018-2027

Pollution Monitoring Equipment Market Insights – Size, Trends & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA