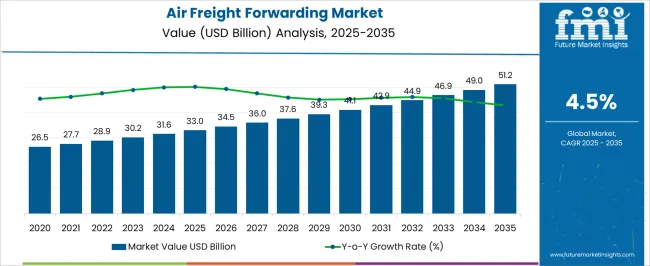

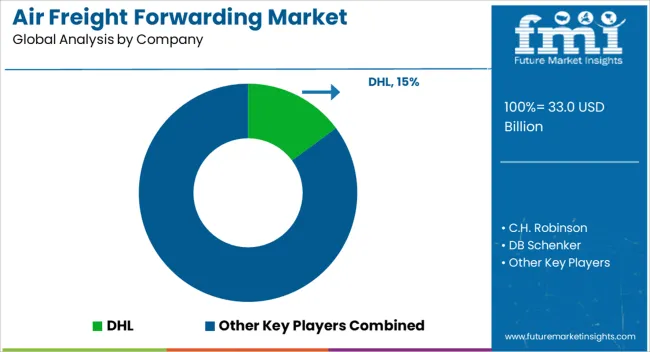

The air freight forwarding market, valued at USD 33.0 billion in 2025 and forecasted to reach USD 51.2 billion by 2035 at a CAGR of 4.5%, is significantly influenced by regulatory frameworks that govern international trade, aviation safety, and environmental compliance. Regulatory impact on this sector is multifaceted, shaping operational costs, route efficiency, and adoption of digital logistics platforms.

Stringent customs regulations and trade compliance requirements remain central to forwarding operations, as delays in clearance and document verification directly affect service reliability and cost competitiveness. Environmental policies also hold growing significance. Regulations on carbon emissions by international aviation authorities, particularly under ICAO’s CORSIA framework, are likely to compel freight forwarders to partner with airlines investing in fuel-efficient fleets and carbon offset initiatives. This shift increases costs in the short term but enhances long-term market sustainability.

Security regulations concerning cargo screening and digital tracking further intensify investment in technology adoption, including blockchain for supply chain transparency and IoT-enabled cargo monitoring. The forecasted steady market growth indicates that regulatory compliance will not only be a challenge but also a driver of modernization. Operators able to integrate digital solutions and maintain strong compliance frameworks will remain more resilient, while those relying on traditional processes may face rising operational risks and margin pressures.

The air freight forwarding market is considered a central component of international trade and logistics. It is estimated to hold 6.2% of the global logistics and supply chain management market, showing reliance on air cargo for time sensitive shipments. Within international freight transportation, an 8.5% share is observed, as air forwarding complements sea and land freight in multimodal operations. In the air cargo services market, the share is significantly higher at 12.4%, reflecting the importance of freight forwarders in managing capacity and routes. A 4.7% contribution is assessed within e commerce logistics, where express delivery demand has intensified. Global trade facilitation services represent 3.9%, supported by customs clearance and documentation expertise that freight forwarders provide.

Recent industry trends highlight the role of digital freight platforms, blockchain enabled documentation, and AI powered route optimization. Groundbreaking developments include automated booking systems, predictive analytics for cargo demand, and end to end visibility tools. Strategies by key players have involved alliances with airlines, investments in cargo handling facilities, and integration of green air freight solutions. Partnerships are being pursued with e commerce giants to ensure priority capacity allocation and last mile connectivity. The Asia Pacific region is expanding rapidly due to manufacturing exports, while North America and Europe are advancing with digital freight ecosystems. The industry is steadily moving toward sustainability initiatives, including carbon offsetting programs and fuel efficient cargo solutions.

| Metric | Value |

|---|---|

| Air Freight Forwarding Market Estimated Value in (2025 E) | USD 33.0 billion |

| Air Freight Forwarding Market Forecast Value in (2035 F) | USD 51.2 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The air freight forwarding market is expanding steadily, supported by global trade growth, time-sensitive delivery requirements, and the increasing integration of multimodal logistics solutions. Market performance is being shaped by the resilience of supply chains, rising e-commerce volumes, and the need for efficient handling of high-value and perishable goods.

Digital transformation in freight forwarding, including real-time tracking, automated documentation, and AI-driven route optimization, is improving operational efficiency and customer satisfaction. Strategic alliances between freight forwarders, airlines, and third-party logistics providers are enhancing service capabilities and global reach.

Additionally, capacity constraints in ocean freight and the growing demand for faster transit times are pushing businesses toward air freight solutions despite higher costs. Over the forecast period, the sector is expected to benefit from sustained B2B demand, expansion in emerging trade routes, and investment in sustainable aviation initiatives, ensuring a competitive and adaptive growth trajectory.

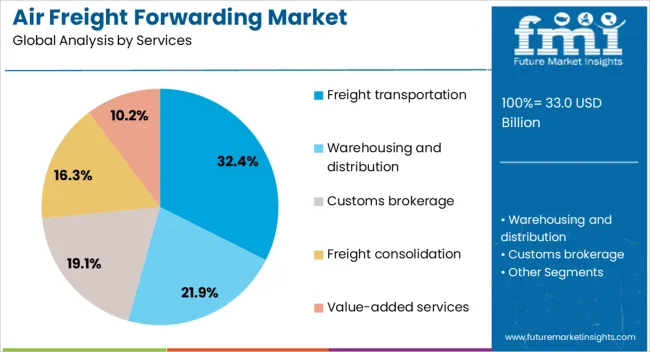

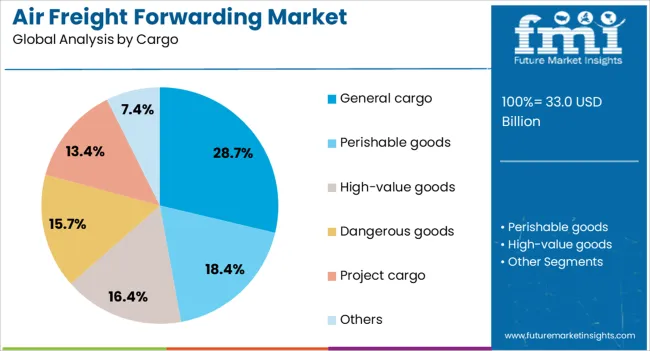

The air freight forwarding market is segmented by services, cargo, customer, destination, end user, and geographic regions. By services, air freight forwarding market is divided into Freight transportation, Warehousing and distribution, Customs brokerage, Freight consolidation, and Value-added services. In terms of cargo, air freight forwarding market is classified into General cargo, Perishable goods, High-value goods, Dangerous goods, Project cargo, and Others.

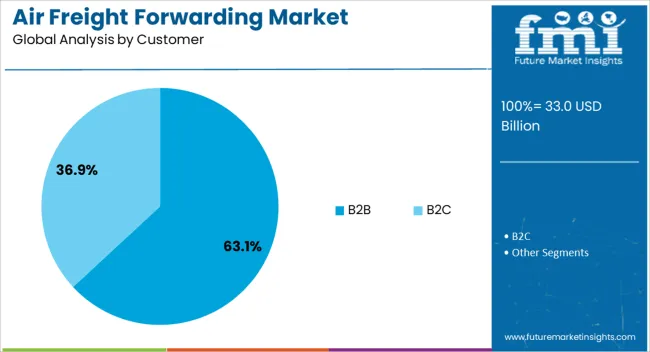

Based on customer, air freight forwarding market is segmented into B2B and B2C. By destination, air freight forwarding market is segmented into International and Domestic. By end user, the air freight forwarding market is segmented into Manufacturing, E-commerce & retail, Automotive, Healthcare & pharmaceuticals, Oil & gas, Food & beverage, Consumer goods, and Others. Regionally, the air freight forwarding industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The freight transportation segment, holding 32.40% of the services category, leads due to its core role in delivering timely and reliable cargo movement across global networks. Its prominence is reinforced by consistent demand from industries such as manufacturing, pharmaceuticals, and electronics, where speed and reliability are critical.

Service enhancements, including temperature-controlled shipping, dedicated charter services, and express delivery options, have further strengthened its market position. Investments in fleet modernization and digital platforms have optimized scheduling, reduced delays, and improved customer transparency.

The segment’s resilience is also supported by its adaptability to market fluctuations, allowing rapid capacity adjustments in response to seasonal peaks or supply chain disruptions.

The general cargo segment, accounting for 28.70% of the cargo category, dominates due to its broad applicability across industries and its steady contribution to air freight volumes. This segment encompasses a wide range of goods, from consumer products to industrial components, offering flexibility in load consolidation and routing.

Demand stability is underpinned by ongoing global trade activity and the ability to accommodate diverse shipment sizes and specifications. Technological advancements in cargo handling and packaging solutions are improving efficiency, reducing damage risks, and supporting compliance with international safety standards.

The segment also benefits from competitive pricing strategies that enhance accessibility for both small and large shippers.

The B2B segment, representing 63.10% of the customer category, leads due to sustained reliance on air freight for high-value, time-critical shipments across industrial supply chains. This customer base includes sectors such as aerospace, automotive, healthcare, and electronics, where operational continuity depends on rapid parts and product movement.

Long-term contracts and integrated logistics partnerships are common, ensuring stable revenue streams for service providers. Customized solutions, including scheduled deliveries, specialized handling, and dedicated account management, reinforce the segment’s dominance.

Additionally, the shift toward just-in-time inventory models is increasing the necessity for reliable air freight services, securing B2B’s leadership within the market.

The market has developed into a core element of international logistics, enabling rapid movement of goods across continents while addressing increasingly complex trade and supply chain requirements. Forwarders play a central role in coordinating shipments, managing customs processes, providing cargo insurance, and integrating air services with land and sea transport. Demand has been driven by the globalization of commerce, expansion of cross border e commerce, and the growing movement of high value and perishable goods. At the same time, industry dynamics have been reshaped by technological adoption, shifting trade routes, regulatory complexities, environmental considerations, and cost competitiveness.

The sharp rise in cross border e commerce has been a dominant factor driving the need for air freight forwarding. Consumers expect quick international deliveries for electronics, apparel, pharmaceuticals, and other time sensitive products. This has placed pressure on forwarders to streamline customs procedures, integrate with digital marketplaces, and enhance last mile delivery solutions. Growing demand for express and same day delivery has also reinforced the reliance on air freight for specific trade lanes. To meet this demand, forwarders have been investing in automated booking platforms, improved cargo visibility tools, and real time inventory management systems. These measures have ensured that e commerce continues to fuel sustained cargo throughput for the sector.

Technological innovation has significantly improved operational workflows in air freight forwarding. Cloud platforms, AI driven analytics, blockchain based contracts, and IoT enabled monitoring devices have all been incorporated into modern forwarding solutions. These technologies have enabled predictive demand forecasting, minimized manual documentation, and strengthened compliance with trade regulations. Enhanced visibility across the supply chain has improved customer trust, while digital freight marketplaces have increased efficiency and competition by providing transparent pricing and capacity options. By embedding technology at the core of operations, forwarders have managed to reduce inefficiencies, mitigate risks, and support the growing demand for transparency and speed in global trade.

Geopolitical developments, trade disputes, and new trade agreements have influenced air freight flows and the strategies of forwarding companies. Realignment of supply chains due to regional manufacturing hubs, tariffs, and diversification efforts has required forwarders to create adaptive logistics frameworks. Stronger demand for specialized cargo such as pharmaceuticals, machinery, automotive parts, and fresh produce has further reinforced the role of air transport in maintaining international trade continuity. Forwarders have been required to navigate complex customs regimes and comply with global trade security standards, solidifying their value as critical facilitators of cross border commerce. Strategic partnerships with airlines and ground handlers have also been used to strengthen service reliability in volatile trade environments.

The environmental footprint of air cargo operations has become a central consideration for the forwarding market. Concerns regarding emissions have prompted the adoption of carbon offset initiatives, route optimization technologies, and collaboration with carriers investing in energy-efficient aircraft and sustainable aviation fuels. At the same time, volatility in fuel prices and high operational costs have driven forwarders to pursue load consolidation, capacity sharing, and advanced yield management practices.

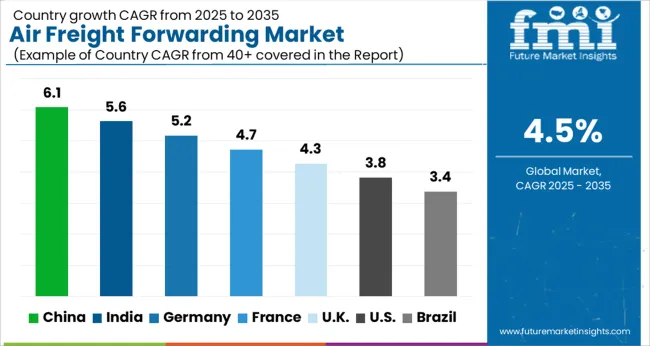

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

| USA | 3.8% |

| Brazil | 3.4% |

China held the strongest position in the air freight forwarding market with a forecast CAGR of 6.1%, supported by its role as a global manufacturing hub and extensive cargo handling infrastructure. India followed with 5.6%, driven by rising cross border trade and expansion of e commerce logistics. Germany recorded 5.2%, where advanced logistics frameworks and strong export activity sustained consistent growth. The United Kingdom accounted for 4.3%, benefiting from its role in transatlantic trade and integration with European supply chains. The United States registered 3.8%, shaped by demand from high value industries such as pharmaceuticals and technology. Together, these countries highlight critical regional strengths that define the future landscape of air freight forwarding. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is estimated to witness a CAGR of 6.1% in the market, supported by robust manufacturing activity, global trade expansion, and the rising demand for efficient cargo handling. Growth in cross-border e-commerce and increased export volumes are driving greater reliance on air freight solutions. Airlines and logistics operators are investing in digital platforms, automation, and cargo-specific infrastructure to improve speed and reduce transit risks. Strategic international partnerships are also strengthening China’s position in the global freight network. The market outlook remains positive, driven by consistent demand for rapid and reliable freight forwarding services in both international and domestic segments.

India is expected to record a CAGR of 5.6% in the market, with growth influenced by expanding pharmaceutical exports, agricultural shipments, and increasing global trade partnerships. Rising demand for temperature-controlled logistics is strengthening the use of specialized air freight services. Investments in airport cargo terminals and digital freight booking platforms are enhancing operational efficiency. The government’s initiatives to develop cargo infrastructure and simplify regulatory frameworks are also contributing to steady expansion. India’s growing role in global supply chains positions the market for sustained development in the coming years.

Germany is projected to advance at a CAGR of 5.2% in the air market, influenced by its strong automotive, pharmaceutical, and industrial export sectors. Frankfurt and other major hubs are being modernized with smart cargo handling systems to streamline freight operations. Rising demand for efficient and time-sensitive delivery solutions is encouraging the use of digital freight platforms and AI-driven logistics management. With Germany’s strategic position in Europe, its role as a central freight transit hub is further reinforced. The market is expected to maintain steady growth due to innovation and export-driven demand.

The United Kingdom is forecasted to grow at a CAGR of 4.3% in the air market, supported by rising demand for e-commerce shipments and international trade flows. Major airports such as Heathrow and Manchester are investing in expanding cargo capacity and streamlining customs clearance processes. Logistics providers are adopting cloud-based booking systems and real-time cargo tracking technologies to enhance transparency and reduce delays. Demand for specialized freight, including pharmaceuticals and electronics, also supports market expansion. The UK presents a stable growth outlook with emphasis on efficiency and service diversification.

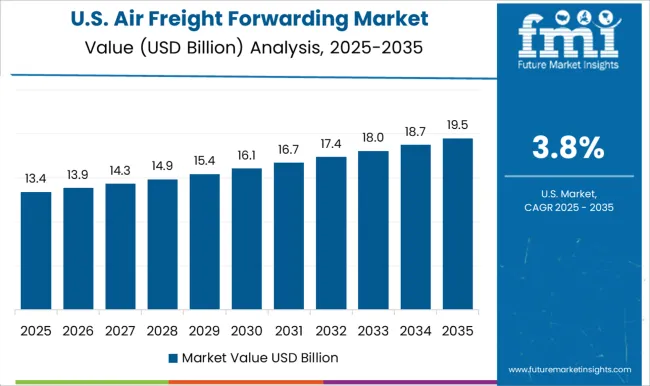

The United States is anticipated to expand at a CAGR of 3.8% in the air market, driven by high demand for expedited delivery across retail, electronics, and healthcare sectors. Investments in airport modernization and cargo automation are improving freight throughput and reducing processing delays. Digital freight platforms are reshaping logistics operations, making booking and tracking more efficient. Rising e-commerce volumes and supply chain complexities continue to strengthen the reliance on air freight forwarding. The market is expected to grow steadily, supported by technology adoption and strong domestic and international trade volumes.

The market is characterized by the presence of global logistics giants that manage vast international networks to ensure the seamless movement of goods. DHL has built its leadership through a highly developed infrastructure that combines freight forwarding and express services, making it a central player in international trade. C.H. Robinson brings value through flexible forwarding operations that integrate multimodal transport solutions with capacity management strategies, giving shippers more reliable options.

DB Schenker has established a strong footprint with customized freight forwarding services, particularly for complex global supply chains where speed and efficiency are essential. DSV continues to rise as a major competitor with scalable air freight solutions powered by digital booking platforms and customer-centric systems. Expeditors is recognized for its technology-driven approach, offering tailored forwarding solutions that serve sensitive industries such as aerospace, electronics, and healthcare. FedEx and UPS enhance the competitive scope with their extensive air fleets, enabling integrated express and forwarding services that provide unmatched reliability. Kuehne + Nagel and Nippon Express remain influential, leveraging specialized sector expertise and analytics to deliver consistent and competitive global forwarding services.

| Item | Value |

|---|---|

| Quantitative Units | USD 33.0 Billion |

| Services | Freight transportation, Warehousing and distribution, Customs brokerage, Freight consolidation, and Value-added services |

| Cargo | General cargo, Perishable goods, High-value goods, Dangerous goods, Project cargo, and Others |

| Customer | B2B and B2C |

| Destination | International and Domestic |

| End User | Manufacturing, E-commerce & retail, Automotive, Healthcare & pharmaceuticals, Oil & gas., Food & beverage, Consumer goods, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DHL, C.H. Robinson, DB Schenker, DHL Express, DSV, Expeditors, FedEX, Kuehne + Nagel, Nippon Express, and UPS |

| Additional Attributes | Dollar sales by service type and cargo category, demand dynamics across manufacturing, retail, and pharmaceutical sectors, regional trends in global trade and logistics adoption, innovation in digital platforms, tracking, and automation, environmental impact of fuel consumption and carbon emissions, and emerging use cases in e-commerce fulfillment and time-sensitive shipments. |

The global air freight forwarding market is estimated to be valued at USD 33.0 billion in 2025.

The market size for the air freight forwarding market is projected to reach USD 51.2 billion by 2035.

The air freight forwarding market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in air freight forwarding market are freight transportation, warehousing and distribution, customs brokerage, freight consolidation and value-added services.

In terms of cargo, general cargo segment to command 28.7% share in the air freight forwarding market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Air Freight Forwarding System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Airborne Molecular Contamination Control Services Market Forecast and Outlook 2025 to 2035

Airflow Balancer Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Radar Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Airport Ground Transportation Market Forecast and Outlook 2025 to 2035

Airless Sprayer Accessories Market Size and Share Forecast Outlook 2025 to 2035

Air Purge Valve Market Size and Share Forecast Outlook 2025 to 2035

Air Flow Sensors Market Size and Share Forecast Outlook 2025 to 2035

Air Separation Plant Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Turbo Generators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Air Conditioning Compressor Market Size and Share Forecast Outlook 2025 to 2035

Air Measuring Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA