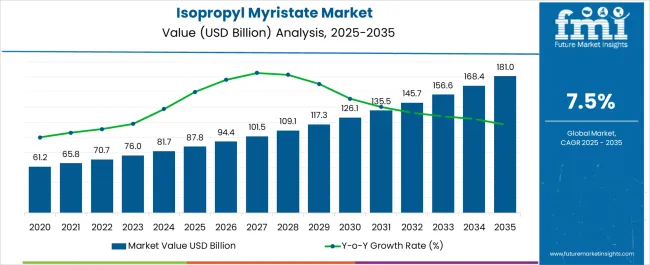

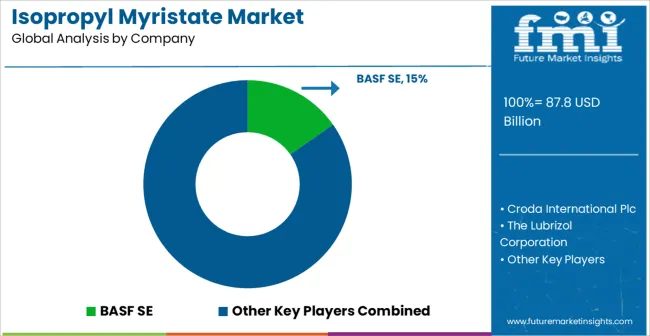

The Isopropyl Myristate Market is estimated to be valued at USD 87.8 billion in 2025 and is projected to reach USD 181.0 billion by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period.

| Metric | Value |

|---|---|

| Isopropyl Myristate Market Estimated Value in (2025 E) | USD 87.8 billion |

| Isopropyl Myristate Market Forecast Value in (2035 F) | USD 181.0 billion |

| Forecast CAGR (2025 to 2035) | 7.5% |

The Isopropyl Myristate market is experiencing steady growth, driven by the increasing demand for multifunctional emollients and solvents across personal care and pharmaceutical industries. Rising consumer awareness of skincare and cosmetic products that provide enhanced absorption, smooth texture, and non-greasy formulations is fueling adoption. The market is further supported by the versatile properties of isopropyl myristate, including its ability to improve product spreadability, enhance penetration of active ingredients, and provide desirable sensory characteristics in creams, lotions, and other topical formulations.

Growth in skincare, haircare, and cosmetic segments, coupled with rising disposable income and urbanization in emerging markets, is contributing to increased consumption. Additionally, regulatory approvals and the safety profile of isopropyl myristate in personal care applications are encouraging manufacturers to expand product offerings.

Innovations in formulation technologies and a focus on natural and sustainable ingredients are expected to support continued market expansion As demand for high-quality, multifunctional emollients increases globally, the market is positioned for sustained growth over the next decade.

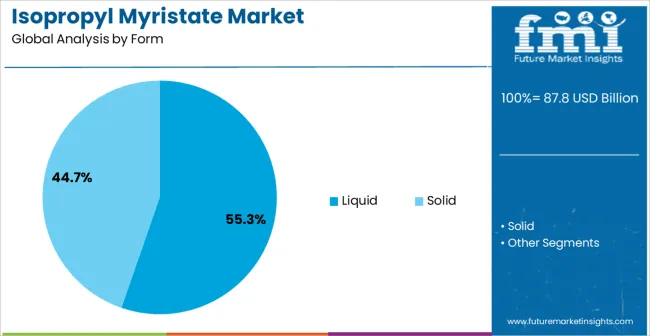

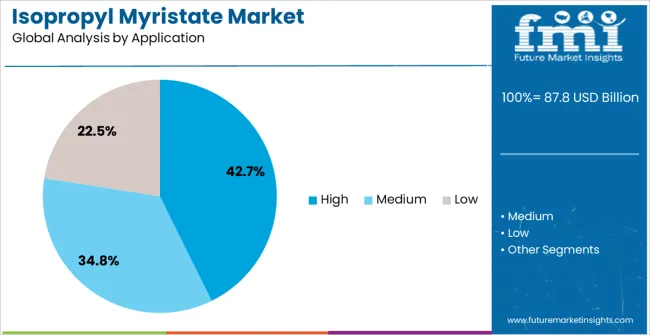

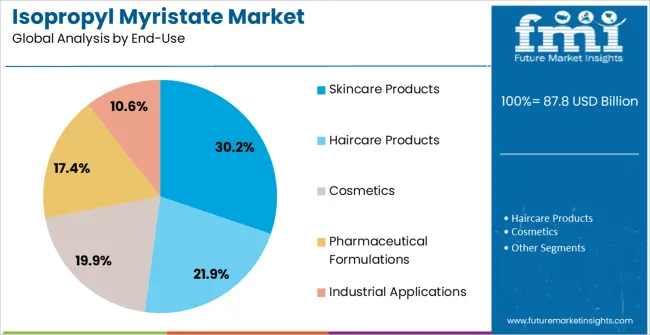

The isopropyl myristate market is segmented by form, application, end-use, and geographic regions. By form, isopropyl myristate market is divided into Liquid and Solid. In terms of application, isopropyl myristate market is classified into High, Medium, and Low. Based on end-use, isopropyl myristate market is segmented into Skincare Products, Haircare Products, Cosmetics, Pharmaceutical Formulations, and Industrial Applications. Regionally, the isopropyl myristate industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The liquid form segment is projected to hold 55.3% of the Isopropyl Myristate market revenue in 2025, establishing it as the leading form. This dominance is being driven by the segment’s ease of handling, superior solubility, and versatility across various formulations. Liquid isopropyl myristate is widely preferred by manufacturers due to its compatibility with oils, active ingredients, and emulsifiers, which enhances product consistency and performance.

The ability to achieve smooth, homogeneous formulations in skincare, cosmetic, and pharmaceutical applications reinforces its market leadership. Liquid forms also enable precise dosing and incorporation into complex product matrices, improving manufacturing efficiency.

Rising demand for topical products, lightweight formulations, and enhanced absorption properties further supports the adoption of liquid isopropyl myristate As product innovation and formulation customization continue to evolve, the liquid form segment is expected to maintain its dominant position, supported by broad industrial applicability, favorable physical properties, and operational convenience.

The high application segment is anticipated to account for 42.7% of the market revenue in 2025, making it the largest application category. Its growth is being driven by extensive usage in skincare, cosmetic, and pharmaceutical formulations where rapid absorption and enhanced delivery of active ingredients are required. Isopropyl myristate in high concentrations improves texture, reduces greasiness, and increases penetration efficiency in topical products.

Manufacturers are leveraging its chemical stability and emollient properties to enhance product performance, thereby improving consumer acceptance. The high application segment is also supported by growing R&D initiatives in dermatology, cosmeceuticals, and pharmaceutical product development.

As awareness of skin health and the demand for multifunctional formulations continue to rise globally, the high application segment is expected to remain the primary driver of market growth Its role in improving efficacy, sensory experience, and formulation versatility positions it as a critical component across multiple industries.

The skincare products end-use segment is projected to hold 30.2% of the market revenue in 2025, establishing it as the leading end-use industry. Growth in this segment is driven by the increasing consumer preference for creams, lotions, and serums that incorporate emollients like isopropyl myristate to improve texture, absorption, and moisturizing properties. Rising awareness of skin health, anti-aging, and cosmetic benefits is accelerating demand in developed and emerging markets alike.

Skincare formulations leverage the solubility and emollient characteristics of isopropyl myristate to enhance spreadability, product feel, and active ingredient penetration, which improves overall product performance. Manufacturers are focusing on innovative formulations that combine efficacy with sensory appeal, meeting consumer expectations for premium skincare products.

Regulatory approvals and the safety profile of isopropyl myristate further support widespread adoption As the personal care industry continues to expand and consumer demand for high-performance, multifunctional skincare products increases, the skincare products segment is expected to maintain its leadership position, driving sustained growth in the market.

Isopropyl myristate is among the commonly used fatty acid ester and is isopropyl ester of tetradecanoic acid. Isopropyl myristate is categorized mainly employed as synthetic oil and is produced by reaction of isopropyl alcohol and myristic acid. Isopropyl myristate is among the foremost available substitutes for natural oil in the cosmetics industry.

Isopropyl myristate is also used as solvent in several trans-dermal pharmaceutical products and pharmaceuticals creams.

Major end user industries for isopropyl myristate include personal care, pharmaceuticals, food and lubricants among several others. Personal care is the largest application segment for isopropyl myristate and the trend is anticipated to continue for a foreseeable future. Isopropyl myristate is also used as a pesticide free product for killing lice.

Isopropyl myristate helps in enhancing skin penetration properties of products owing to which, pharmaceutical is anticipated to be the fastest growing application segment for isopropyl myristate. Other applications of isopropyl myristate include solvents, plasticizer and bio diesel among others.

Low production cost as compared to other available substitute is among the foremost driver for demand of isopropyl myristate. Moreover the apparatus employed in the production of isopropyl myristate can be used for production of several other products. Therefore low capital investment is among the major growth drivers for isopropyl myristate market.

Isopropyl myristate is employed in several pharmaceutical products primarily creams. Therefore, high growth in pharmaceutical industry across the globe is a major factor fuelling demand for isopropyl myristate. Increasing disposable income leading to surge in demand for personal care products including oil and other skin products is anticipated to drive isopropyl myristate market growth during the forecast period.

Isopropyl myristate is used in combination with several other products including petroleum products. Isopropyl myristate is easily penetrated into the skin whereas the petrochemicals get clogged in pores leading to a decline in supply of oxygen to the skin resulting in several skin related issues.

Isopropyl myristate when in contact with diethanolamine leads to production of carcinogenic compounds. Therefore intensive care has to be taken while using isopropyl myristate based products which has been a major restraint for isopropyl myristate market growth. Increasing research and development for increasing the application scope of isopropyl myristate is expected to offer huge growth opportunity in the market.

North America followed by Europe has been dominating the global isopropyl myristate market. Increasing demand for bio based products in North America and Europe is anticipated to restraint market growth for isopropyl myristate in the regions. Demand for isopropyl myristate in North America and Europe is anticipated to grow at a sluggish rate during the forecast period.

Asia Pacific is anticipated to be the fastest growing region for isopropyl myristate market during the forecast period. High GDP growth and increasing disposable income in the emerging economies of India and China leading to high growth in major end user industries including personal care and pharmaceuticals is expected to drive demand for isopropyl myristate in the region.

Isopropyl myristate is a highly fragmented market and is dominated by regional players. The market is characterized by high degree of competition and major players compete by price differentiation thus increasing price sensitivity. Major players in the isopropyl myristate market include ABITEC Corporation, Sumitomo Chemical Co. Ltd., Archer Daniels Midland Company, Croda International Plc, Akzo Nobel N.V, Evonik Goldschmidt GmbH, Subhash Chemical Industries and Sasol Limited among others.

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data. It also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to market segments such as geographies, application, and industry.

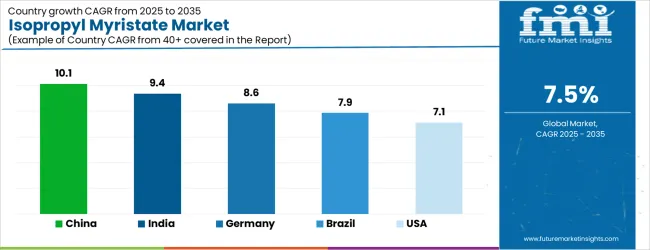

| Country | CAGR |

|---|---|

| China | 10.1% |

| India | 9.4% |

| Germany | 8.6% |

| Brazil | 7.9% |

| USA | 7.1% |

| UK | 6.4% |

| Japan | 5.6% |

The Isopropyl Myristate Market is expected to register a CAGR of 7.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 10.1%, followed by India at 9.4%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 5.6%, yet still underscores a broadly positive trajectory for the global Isopropyl Myristate Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 8.6%. The USA Isopropyl Myristate Market is estimated to be valued at USD 30.2 billion in 2025 and is anticipated to reach a valuation of USD 30.2 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 4.5 billion and USD 2.4 billion respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 87.8 Billion |

| Form | Liquid and Solid |

| Application | High, Medium, and Low |

| End-Use | Skincare Products, Haircare Products, Cosmetics, Pharmaceutical Formulations, and Industrial Applications |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, Croda International Plc, The Lubrizol Corporation, KLK Oleo Group, Oleon NV, Stearinerie Dubois, Vantage Specialty Ingredients, Univar Solutions Inc., Acme-Hardesty Co, McKinley Resources, Sino Lion (USA), A&A Fratelli Parodi Spa, and Alzo International Inc |

The global isopropyl myristate market is estimated to be valued at USD 87.8 billion in 2025.

The market size for the isopropyl myristate market is projected to reach USD 181.0 billion by 2035.

The isopropyl myristate market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in isopropyl myristate market are liquid and solid.

In terms of application, high segment to command 42.7% share in the isopropyl myristate market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

5-Isopropyl-m-Xylene Market Size and Share Forecast Outlook 2025 to 2035

1,4-Diisopropylbenzene Market Growth - Trends & Forecast 2025 to 2035

Methyl Isopropyl Ketone Market

UK 1,4-Diisopropylbenzene Market Insights – Demand, Size & Industry Trends 2025–2035

GCC 1,4-Diisopropylbenzene Market Report – Trends, Demand & Industry Forecast 2025–2035

USA 1,4-Diisopropylbenzene Market Outlook – Share, Growth & Forecast 2025–2035

Japan 1,4-Diisopropylbenzene Market Growth – Trends, Demand & Innovations 2025–2035

ASEAN 1,4-Diisopropylbenzene Market Report – Size, Trends & Forecast 2025-2035

Germany 1,4-Diisopropylbenzene Market Analysis – Demand, Growth & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA