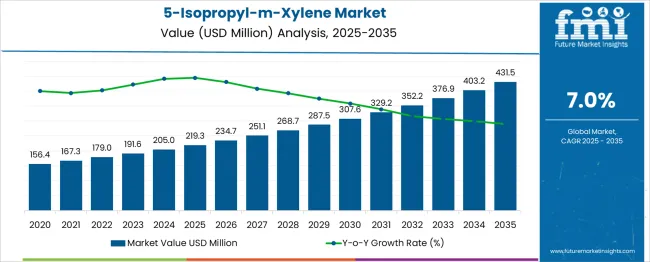

The 5-Isopropyl-m-Xylene Market is estimated to be valued at USD 219.3 million in 2025 and is projected to reach USD 431.5 million by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period. During the 2025-2030 period, the market is expected to grow steadily, reaching USD 307.6 million by 2030. Beginning at USD 219.3 million in 2025, it rises to USD 234.7 million in 2026, USD 251.1 million in 2027, and USD 268.7 million in 2028. Growth continues with USD 287.5 million in 2029 and USD 307.6 million in 2030. This upward trajectory is driven by the compound’s increasing use as an intermediate in pharmaceuticals, agrochemicals, and specialty materials. 5-Isopropyl-m-xylene offers structural versatility, making it suitable for producing advanced chemical derivatives. Rising demand for precision synthesis and high-purity aromatics in chemical manufacturing is fueling interest in this compound. Regions with strong industrial and R&D investment, particularly in Asia and North America, are key contributors to market growth. As industries look for consistent feedstocks with controlled reactivity, 5-isopropyl-m-xylene is becoming a preferred choice, supporting the market’s stable growth outlook through the end of the forecast period.

| Metric | Value |

|---|---|

| 5-Isopropyl-m-Xylene Market Estimated Value in (2025 E) | USD 219.3 million |

| 5-Isopropyl-m-Xylene Market Forecast Value in (2035 F) | USD 431.5 million |

| Forecast CAGR (2025 to 2035) | 7.0% |

The 5-isopropyl-m-xylene market is driven by its strong integration within multiple parent markets, particularly in the chemical and pharmaceutical sectors. The largest share approximately 70% to 80% is attributed to its use as a chemical intermediate, especially in the production of terephthalic acid and other derivatives used in polymers, resins, and high-performance coatings. Its molecular structure supports stable reactions in industrial synthesis, making it a preferred base material in polymer manufacturing. Additionally, around 38.8% of the compound’s demand comes from the pharmaceutical sector, where it is used as a purity-grade intermediate in the formulation of active pharmaceutical ingredients, particularly under stringent regulatory frameworks. The solvent and coatings industry also contributes about 15% to 20% to overall demand. 5-isopropyl-m-xylene is valued for its solvency, thermal stability, and compatibility with adhesives, inks, and coatings used in packaging and automotive applications. Furthermore, in the life sciences and laboratory chemicals segment, it holds an estimated 10% to 15% share, mainly due to its role in organic synthesis methods such as Suzuki coupling and carboxylation. Regionally, Asia-Pacific leads the market due to rapid industrial expansion, followed by North America and Europe, which maintain stable demand through established chemical and pharmaceutical infrastructures.

The current market environment is shaped by growing utilization of xylene derivatives in high-performance materials and industrial intermediates, as reported in corporate disclosures and chemical industry journals. Factors such as advancements in chemical processing technologies and rising investments in downstream capacity are fostering the adoption of 5-Isopropyl-m-Xylene in diverse applications. Future opportunities are anticipated to emerge from innovations in sustainable chemical synthesis and regulatory measures promoting cleaner production methods.

Industry news and investor briefings have highlighted that its unique chemical properties and suitability as a precursor for various derivatives position it as a critical component in specialty chemical value chains. Additionally, expansion of production facilities in emerging economies and the push for supply chain resilience are expected to further contribute to the market’s long-term growth trajectory.

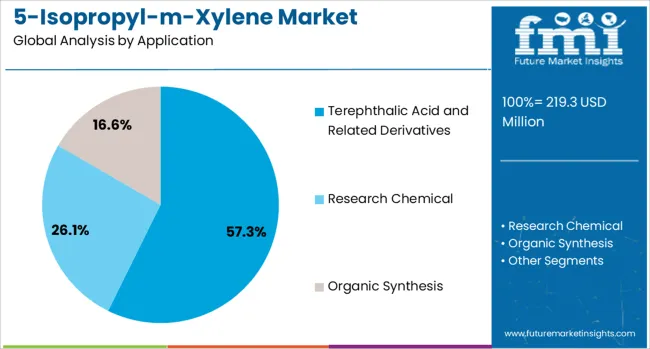

The 5-isopropyl-m-xylene market is segmented by application and geographic regions. By application of the 5-isopropyl-m-xylene market is divided into Terephthalic Acid and Related Derivatives, Research Chemical, and Organic Synthesis. Regionally, the 5-isopropyl-m-xylene industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The terephthalic acid and related derivatives application segment is projected to account for 57.3% of the 5-Isopropyl-m-Xylene market revenue share in 2025, making it the dominant segment. This leadership is being attributed to the compound’s suitability as an intermediate in the production of terephthalic acid which is extensively used in polyester manufacturing, as discussed in corporate strategy updates and technical whitepapers.

The segment’s growth has been reinforced by the rising global demand for polyester fibers and resins driven by the textile and packaging industries. Furthermore, investor presentations have noted that its chemical stability and high yield in oxidation processes make it a preferred choice for manufacturers aiming to optimize production efficiency.

Sustainability initiatives favoring recyclable polyester have also supported increased consumption of terephthalic acid thereby strengthening the segment’s position. These factors combined with expanding manufacturing capacities and technological improvements in oxidation processes have ensured the continued dominance of the segment in the market.

The 5‑Isopropyl‑m‑Xylene market is expanding across chemical, pharmaceutical, coatings, and niche industrial research sectors. It serves as a versatile intermediate for organic synthesis, terephthalic acid derivatives, specialty solvents, and reagent-grade chemicals. Market growth originates from increased demand in dyes, adhesives, battery additives, and laboratory applications. Asia‑Pacific drives expansion through investments in coatings, polymers, and wastewater treatment chemicals. Suppliers emphasize material purity, supply consistency, and tailored grades for reactive processes. Continued momentum depends on industrial chemical growth, expanding end‑use base, and the ability to serve precision markets with high‑quality chemical intermediates.

Regional regulatory variation creates markets that require multiple product versions, driving up costs for producers. Chemical standards, environmental approvals, and safety documentation differ by jurisdiction in Europe, Asia, and North America. This forces companies to maintain separate production lines or labeling for each region. Transparency requirements further complicate supply to pharmaceutical and food sectors, where higher purity certification is demanded. Smaller suppliers often lack internal compliance resources and must rely on third‑party labs. This fragmentation delays market entry and restricts scale. Manufacturers face certification burden and documentation overhead when serving global clients. Until regulation becomes harmonized, producers managing multiple region-specific compliance regimes incur additional cost and slower rollout timelines.

5‑Isopropyl‑m‑Xylene finds application across a broad range of industries, supporting market expansion. It is used as a key intermediate in high-performance coatings, paints, solvents, adhesives, agricultural chemical synthesis, and specialty polymers. In pharmaceutical synthesis, it serves as a starting point for active ingredients. In the electronics and battery sector, it supports high stability chemical processes. Growth in packaging, construction, and automotive industries continues to drive coating and polymer demand. Suppliers that offer product grades optimized for specific end‑use performance such as solvent properties or reaction compatibility gain preference. Its versatility across multiple industry chains provides resilience to market fluctuations. Companies able to co-develop chemistry with downstream users are positioned to capture long-term contracts and retain market presence across diverse sectors.

Manufacturing routes for 5‑Isopropyl‑m‑Xylene are evolving to focus on higher yield and cost efficiency. Improvements in catalytic synthesis and refining reduce impurities and lower energy consumption in batch processes. Automation and digital control help producers achieve consistent purity levels suitable for high-grade applications. Enhanced process optimization results in improved selectivity and reduced byproduct generation. These advances support lower per-unit production cost and more competitive pricing in commodity and specialty segments. Producers able to deliver high-purity product reliably at scale gain advantage in regions with tight quality standards. Continuous process optimization strengthens supplier competitiveness by aligning with regulatory demands and downstream purity needs in pharmaceuticals, coatings, and electronics markets.

5‑Isopropyl‑m‑Xylene production depends heavily on benzene-derived feedstocks, making the market sensitive to fluctuations in upstream petrochemical prices. Any instability in crude oil or benzene supply significantly affects production cost. Substitute aromatics such as linear alkylbenzene or less hazardous solvents are being adopted in some applications, limiting TAB penetration where cost is a concern or environmental rules tighten. Additionally, alternative solvents or intermediates with lower toxicity profiles increase competitive pressure. Until feedstock sourcing stabilizes or production becomes more efficient, raw material volatility and substitution options will restrict broader adoption, particularly in cost-constrained or regulated markets.

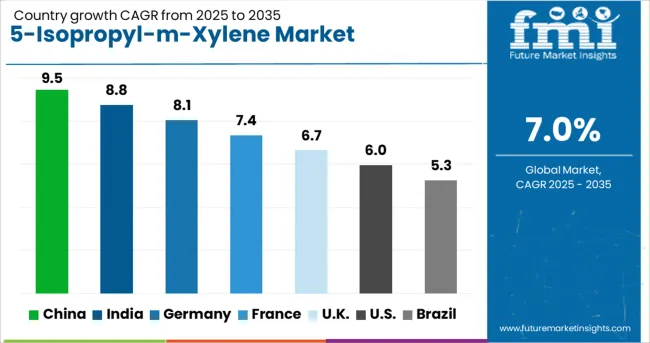

| Country | CAGR |

|---|---|

| China | 9.5% |

| India | 8.8% |

| Germany | 8.1% |

| France | 7.4% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

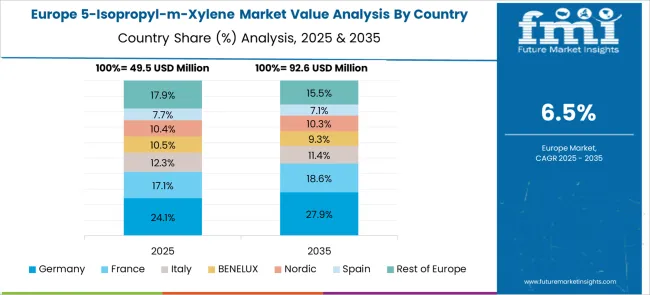

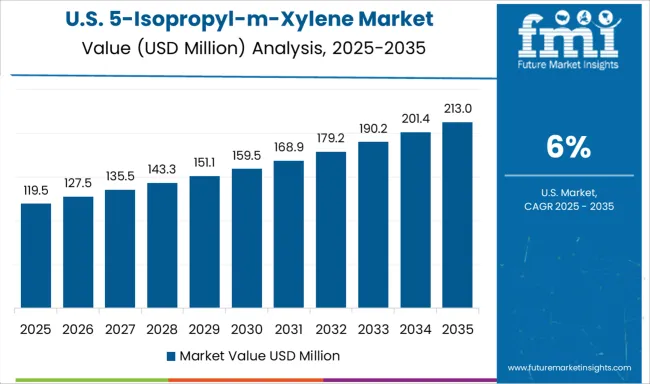

The global 5-isopropyl-m-xylene market is projected to grow at a CAGR of 7.0% through 2035, driven by demand in intermediates and performance chemicals. China leads with 9.5% growth, supported by large-scale output for use in specialty solvents and agrochemical blends. India follows at 8.8%, where production has been focused on supplying raw materials for coatings and polymer-related sectors. Germany, growing at 8.1%, continues to prioritize its use in high-efficiency chemical formulations and industrial compounds. The United Kingdom, at 6.7%, shows moderate uptake through targeted applications in niche synthetic pathways. The United States, with 6.0% growth, maintains output under stringent controls related to purity and storage classification. Market growth has been shaped by labeling norms, industrial safety codes, and bulk chemical transportation regulations. This report includes insights on 40+ countries; the top five markets are shown here for reference.

A CAGR of 9.5% has been observed in the 5-Isopropyl-m-Xylene market across China, supported by extensive growth in chemical intermediate production. Increased volumes have been directed toward specialty chemical synthesis, particularly in perfumery and agrochemical segments. Domestic processors have boosted throughput capacities to meet export-oriented blending needs. Regional manufacturing hubs have emphasized high-purity distillation infrastructure to attract international buyers. Strategic collaborations with industrial solvents distributors have enhanced access to niche downstream applications. A sharp uptick has also been recorded in custom formulation contracts, where isomer-specific requirements are being fulfilled. Provincial players have broadened their storage and container handling capabilities to handle increased shipping volumes.

The market for 5-Isopropyl-m-Xylene in India has been expanding at a CAGR of 8.8%, driven by rising utilization in fragrance manufacturing and resin applications. Domestic chemical units have reported higher procurement levels from mid-sized aroma compound formulators. Increased interest has been shown by flexible packaging resin producers, especially for high-performance solvent systems. Local facilities have scaled their separation units to deliver improved isomer precision in product grades. Enhanced warehousing near port cities has supported growing import-substitute programs. Greater uptake has been noted in specialty coatings, where intermediate-grade aromatics are required. Tier-2 city firms have been engaging in semi-bulk trade routes for improved supply chain continuity.

Germany has recorded a CAGR of 8.1% in the 5-Isopropyl-m-Xylene market, shaped by demand from fine chemicals, coatings, and advanced polymers. Utilization in binder synthesis for specialty paints has remained a key driver. Industrial buyers have focused on lower impurity loads and consistent distillation ranges, prompting suppliers to introduce advanced refining setups. Several mid-sized formulators have entered fixed-supply contracts with EU-wide coating distributors. High-purity forms of the compound have also been tested for performance in adhesive-grade chemical formulations. Chemical parks in North Rhine and Baden-Württemberg have expanded their feedstock adaptability to integrate isopropyl-m-xylene derivatives. Cross-border trade flows into Eastern Europe have intensified bulk transport demand.

A CAGR of 6.7% has been posted in the 5-Isopropyl-m-Xylene market in the United Kingdom, with increasing activity in chemical research, ink manufacturing, and solvent recovery operations. University-affiliated labs and independent R&D centers have increased their procurement for analytical and pilot-scale synthesis. A number of toll manufacturers have begun offering small-batch, high-specification blends to serve niche market users. Distribution agreements have been updated to accommodate rising safety and transport compliance. Substitution of older solvent systems in ink and coating lines has been favoring isopropyl-m-xylene variants. Urban blending facilities have adapted equipment for flexible aromatic handling. Packaging innovations have supported container reuse in the supply chain.

The United States has experienced a CAGR of 6% in the 5-Isopropyl-m-Xylene market, guided by end-user needs in high-purity solvents, lubricants, and coatings. Processing volumes have increased in Gulf Coast facilities focused on advanced aromatics. Strong interest has been observed from custom lubricants and metal-treatment compound developers. OEMs in paints and industrial adhesives have adopted this compound for better drying performance and blend stability. Regulatory adherence has led producers to shift toward batch monitoring systems for specification compliance. Regional terminals have expanded bulk rail access to support cost-efficient inland logistics. Midwestern firms have led uptake in lower-toxicity aromatic alternatives.

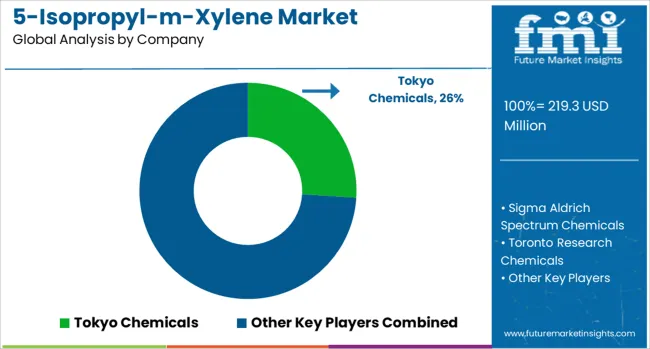

The 5-Isopropyl-m-xylene market is a niche segment within the broader aromatic hydrocarbons and specialty intermediates industry, serving applications in organic synthesis, material science, and pharmaceutical R&D. This compound, valued for its unique substituted xylene structure, is primarily used in research environments and as a chemical intermediate in fine chemical development. Tokyo Chemical Industry (TCI) is a leading global supplier offering high-purity 5-Isopropyl-m-xylene to academic, industrial, and pharmaceutical researchers. TCI is known for its extensive catalog of specialty chemicals and a strong commitment to consistent quality and traceable production. Sigma-Aldrich, now part of Merck KGaA, delivers lab-grade and analytical-grade 5-Isopropyl-m-xylene, supporting both R&D and scale-up processes in fine chemicals and materials chemistry. Its global logistics network and emphasis on regulatory documentation make it a preferred source for traceable, high-purity compounds. Spectrum Chemical provides a broad range of research and laboratory chemicals, including 5-Isopropyl-m-xylene, with a focus on quality assurance and compliance with USA Pharmacopeia and other standards. Their offerings are particularly suited for regulated and quality-sensitive environments. Toronto Research Chemicals (TRC) specializes in rare and complex organic molecules, including isomerically pure xylene derivatives like 5-Isopropyl-m-xylene. Their products are frequently used in life science research, diagnostics, and early-stage drug discovery. Santa Cruz Biotechnology supplies 5-Isopropyl-m-xylene primarily for biochemical and molecular research applications, aligning with their broader portfolio that supports life sciences, especially in custom synthesis and intermediate development. J&K Scientific serves as a key regional player with a growing international presence, offering high-purity aromatic intermediates for research and pilot-scale manufacturing, particularly in Asian and emerging markets. As the market remains research-driven, competition centers around purity, documentation, and global supply responsiveness. Future dynamics may be shaped by custom synthesis capabilities and demand from advanced materials and pharmaceutical innovation, with suppliers that emphasize technical support and rapid delivery gaining strategic advantage.

Tokyo Chemical Industry Co., Ltd. (TCI) lists 5‑Isopropyl‑m‑Xylene (CAS: 4706‑90‑5) on its official product catalog, confirming availability with ≥ 85% purity as determined by GC analysis, along with technical specifications and shipment details.

| Item | Value |

|---|---|

| Quantitative Units | USD 219.3 Million |

| Application | Terephthalic Acid and Related Derivatives, Research Chemical, and Organic Synthesis |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Tokyo Chemicals, Sigma Aldrich Spectrum Chemicals, Toronto Research Chemicals, Santa Cruz Biotechnology, and J&K Scientific |

| Additional Attributes | Dollar sales by TAB application type include pharmaceuticals, chemical intermediates, and batteries such as electrolyte additives; by industry use in pharma, electronics, and energy storage; by geographic region including North America, Europe, and Asia-Pacific; demand driven by lithium-ion battery adoption, antifungal pharmaceutical synthesis, and clean chemical routes; innovation in integrated supply partnerships and forward-controlled synthesis; costs influenced by feedstock availability, purification complexity, and interdisciplinary certification overhead. |

The global 5-isopropyl-m-xylene market is estimated to be valued at USD 219.3 million in 2025.

The market size for the 5-isopropyl-m-xylene market is projected to reach USD 431.5 million by 2035.

The 5-isopropyl-m-xylene market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in 5-isopropyl-m-xylene market are terephthalic acid and related derivatives, research chemical and organic synthesis.

In terms of , segment to command 0.0% share in the 5-isopropyl-m-xylene market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA