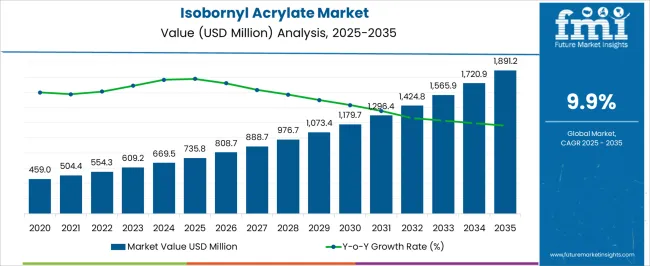

The Isobornyl Acrylate Market is expected to expand from USD 735.8 million in 2025 to USD 1,891.2 million by 2035, registering a strong CAGR of 9.9%, fueled by rising demand in adhesives, coatings, and advanced electronics applications. During the early adoption phase (2020–2024), the market grows from USD 459.0 million to USD 669.5 million, driven by initial penetration in specialty coatings, photopolymer resins, and niche adhesive formulations. At this stage, adoption is primarily limited to high-performance industries exploring isobornyl acrylate for its excellent adhesion, thermal stability, and low volatility.

The scaling phase (2025–2030) witnesses significant expansion from USD 735.8 million to USD 1,179.7 million as applications broaden into electronics, automotive, and packaging sectors. Manufacturers accelerate capacity expansions, regulatory compliance enhances adoption in eco-friendly formulations, and the material shifts from specialty use toward mainstream performance polymers. Innovation in polymer blends and UV-curable systems supports widespread integration.

In the consolidation phase (2030–2035), the market rises from USD 1,296.4 million to USD 1,891.2 million, with growth stabilizing as leading producers strengthen market positions through M&A, process optimization, and cost competitiveness. At this stage, isobornyl acrylate becomes a standardized performance material, with incremental innovations focused on sustainability and application-specific customizations, marking maturity in the adoption lifecycle.

| Metric | Value |

|---|---|

| Isobornyl Acrylate Market Estimated Value in (2025 E) | USD 735.8 million |

| Isobornyl Acrylate Market Forecast Value in (2035 F) | USD 1891.2 million |

| Forecast CAGR (2025 to 2035) | 9.9% |

The Isobornyl Acrylate market is experiencing robust growth, supported by its superior adhesion, weather resistance, and low volatility properties that cater to high-performance material applications. Growing demand from industries such as paints and coatings, adhesives, electronics, and packaging is shaping the market’s expansion, as manufacturers increasingly seek monomers that enhance durability and performance in end-use products.

Rising focus on sustainability and low-VOC formulations in coatings has further strengthened adoption, with isobornyl acrylate offering a balance between performance efficiency and environmental compliance. Technological developments in polymer synthesis and surface modification have enabled the creation of advanced formulations, catering to niche applications where thermal resistance and mechanical strength are critical.

Additionally, the rapid pace of industrial modernization in emerging economies, coupled with increasing R&D investments in specialty chemicals, is fostering wider product penetration Over the coming years, strategic collaborations between raw material suppliers, specialty chemical producers, and downstream industries are expected to further expand the market footprint globally.

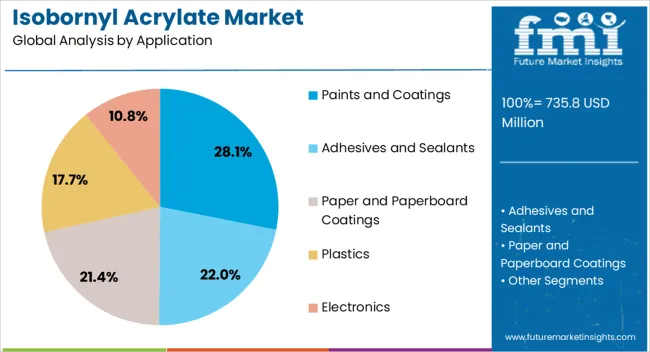

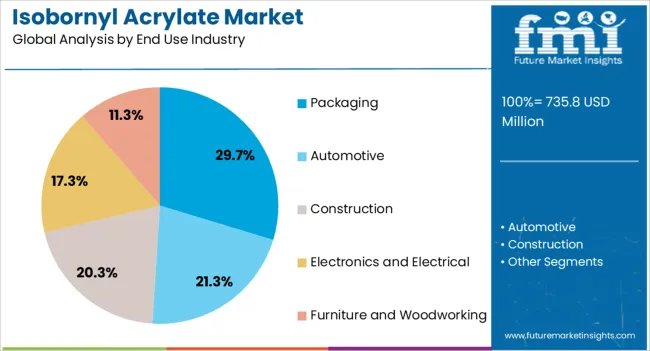

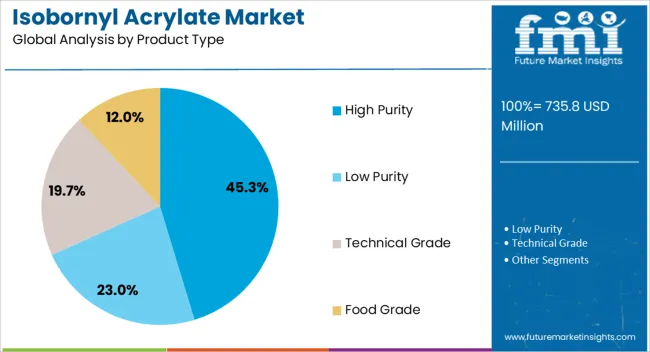

The isobornyl acrylate market is segmented by application, end use industry, product type, viscosity, and geographic regions. By application, isobornyl acrylate market is divided into Paints and Coatings, Adhesives and Sealants, Paper and Paperboard Coatings, Plastics, and Electronics. In terms of end use industry, isobornyl acrylate market is classified into Packaging, Automotive, Construction, Electronics and Electrical, and Furniture and Woodworking. Based on product type, isobornyl acrylate market is segmented into High Purity, Low Purity, Technical Grade, and Food Grade. By viscosity, isobornyl acrylate market is segmented into Medium, Low, and High. Regionally, the isobornyl acrylate industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The paints and coatings segment is projected to account for 28.1% of the total revenue share in the Isobornyl Acrylate market in 2025, supported by its superior film-forming capabilities and long-term weatherability. The material’s high refractive index and chemical resistance have driven its use in premium decorative and industrial coatings, where durability and aesthetic appeal are critical.

Increased adoption in protective coatings for automotive, marine, and infrastructure sectors has been driven by their ability to enhance gloss retention and UV resistance. Furthermore, the compatibility of isobornyl acrylate with multiple resin systems allows manufacturers to develop tailored formulations for specific performance requirements.

Rising infrastructure development and growing preference for low-VOC, eco-friendly coatings have reinforced its demand in both solvent-based and waterborne systems. The ability to maintain mechanical integrity under extreme environmental conditions has positioned it as a preferred choice for high-end coating solutions in competitive global markets.

The packaging segment is expected to hold 29.7% of the revenue share in the Isobornyl Acrylate market in 2025, driven by the material’s ability to deliver enhanced barrier properties and print adhesion. Its application in UV-curable inks, adhesives, and coatings has gained traction due to the increasing demand for high-quality, durable packaging solutions in food, pharmaceuticals, and consumer goods.

The shift toward lightweight, flexible packaging formats has further boosted demand for isobornyl acrylate-based formulations that offer superior flexibility without compromising strength. Advancements in printing technologies and labeling systems have expanded their utility in premium packaging, where clarity, gloss, and resistance to abrasion are critical.

Additionally, its compliance with safety regulations for indirect food contact has supported adoption in sensitive packaging segments. Growing e-commerce activity and the global emphasis on packaging durability during logistics and transportation are expected to continue reinforcing its position in the market.

The high purity segment is anticipated to represent 45.3% of the total revenue share in the Isobornyl Acrylate market in 2025, reflecting its critical role in high-performance applications requiring consistent quality and stability. Industries such as electronics, optical materials, and specialty coatings rely on high-purity grades to ensure reliability in end-use performance.

The segment’s dominance is driven by stringent quality control requirements and the need for materials with minimal impurities that could affect functional properties. Advanced purification processes have enabled the production of isobornyl acrylate with enhanced optical clarity, thermal stability, and reactivity, making it suitable for demanding applications in precision manufacturing.

Increasing adoption in photopolymer formulations for 3D printing and UV-curable systems has further reinforced demand for high-purity grades. The expanding scope of high-tech applications, along with the rising expectations for consistent material performance across industries, is expected to sustain the segment’s leadership in the market.

The isobornyl acrylate market is expanding due to its growing use as a specialty monomer in adhesives, coatings, inks, and electronics. Known for low shrinkage, strong adhesion, and excellent weather resistance, IBOA is favored in high-performance UV-curable systems. Demand is accelerating in optical displays, 3D printing resins, and protective coatings, supported by rapid industrialization and advanced manufacturing. Asia-Pacific leads consumption due to electronics and packaging industries, while Europe and North America emphasize sustainable, high-purity formulations to meet strict regulatory standards.

Isobornyl acrylate is increasingly used in UV-curable coatings, inks, and adhesives due to its outstanding light transmittance, adhesion strength, and weathering resistance. Its low volatility and rapid curing capability make it ideal for high-speed manufacturing processes in packaging, electronics, and automotive coatings. The shift toward solvent-free and environmentally friendly coatings further drives demand for IBOA as a reactive diluent. Manufacturers developing customized formulations for high-performance coatings gain a competitive edge. Until alternative acrylates with similar curing and adhesion properties are developed, UV-curable applications will remain a primary growth driver for the IBOA market.

IBOA’s excellent transparency, low shrinkage, and thermal stability make it highly valuable in electronics and optical components such as displays, touchscreens, and optical lenses. The material’s resistance to yellowing ensures long-term clarity, critical for advanced display technologies. Rising demand for consumer electronics, especially in Asia-Pacific, fuels IBOA consumption in these high-value applications. Manufacturers offering high-purity, low-residual formulations are positioned to capture opportunities in precision electronics. Until new specialty monomers can match IBOA’s balance of optical and thermal properties, its role in electronics and optics will continue to expand significantly.

The production of isobornyl acrylate depends on petrochemical feedstocks, making it vulnerable to crude oil price volatility and supply disruptions. Specialty chemical manufacturing requires precise processing, which adds cost pressure, especially in regions with high energy prices or stricter environmental regulations. Global supply constraints during peak demand, as seen in UV resin applications, further exacerbate shortages. Companies investing in backward integration, raw material diversification, or regional production hubs gain resilience. Until cost-stable and renewable alternatives for feedstock sourcing become widespread, pricing fluctuations and supply chain risks will remain a major restraint for the IBOA market.

The push for greener chemistry is opening opportunities for bio-based isobornyl acrylate and low-VOC formulations, aligning with regulatory shifts in Europe and North America. Additionally, IBOA’s low shrinkage and mechanical strength make it suitable for 3D printing resins, particularly in dental, medical, and industrial prototyping applications. Manufacturers focusing on customized, high-performance grades for additive manufacturing and sustainable coatings are tapping into high-growth niches. Until competing bio-acrylates reach commercialization at scale, isobornyl acrylate will maintain strong potential as a specialty monomer bridging sustainability, performance, and advanced manufacturing.

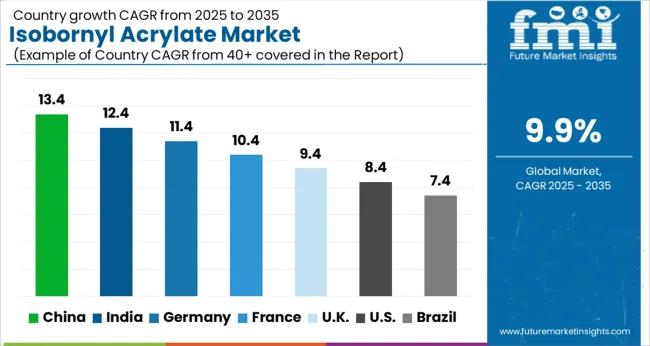

| Country | CAGR |

|---|---|

| China | 13.4% |

| India | 12.4% |

| Germany | 11.4% |

| France | 10.4% |

| UK | 9.4% |

| USA | 8.4% |

| Brazil | 7.4% |

The global Isobornyl Acrylate Market is projected to expand at a CAGR of 9.9% through 2035, driven by increasing applications in adhesives, coatings, and electronics. Within BRICS nations, China has been recorded with 13.4% growth, supported by large-scale production and utilization in industrial and specialty chemical applications, while India has been observed at 12.4%, reflecting rising demand across construction and packaging industries. In the OECD region, Germany has been measured at 11.4%, where consistent adoption in advanced material processing has been maintained. The United Kingdom has been noted at 9.4%, supported by growing applications in high-performance coatings and polymer formulations, while the U.S. has been recorded at 8.4%, with steady utilization across electronics, coatings, and specialty adhesives. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The isobornyl acrylate market in China is expected to expand at a CAGR of 13.4%, making it the fastest-growing region globally. Rising demand in adhesives, coatings, and printing inks is the primary driver of growth. With rapid urbanization and a booming construction industry, China’s need for high-performance coatings and adhesives continues to escalate. Isobornyl acrylate’s excellent adhesion, weather resistance, and durability make it highly suitable for these applications. In addition, the growth of the electronics sector, where the compound is used in UV-curable coatings, further supports demand. Increasing R&D investments and advancements in polymer chemistry are enhancing product performance and expanding its applications. Environmental regulations are also encouraging industries to adopt low-VOC and high-performance resins, boosting isobornyl acrylate usage. Manufacturers are focusing on scaling production and improving cost efficiency, positioning China as the leading hub for this market.

The isobornyl acrylate market in India is projected to grow at a CAGR of 12.4%, fueled by rapid industrialization and expansion of construction, automotive, and packaging sectors. Rising demand for durable adhesives and coatings across these industries is boosting adoption. The compound’s strong adhesion properties, chemical resistance, and stability make it ideal for high-performance applications. The packaging industry, especially flexible packaging and UV-curable inks, is witnessing strong growth, supporting demand for isobornyl acrylate. India’s electronics manufacturing sector is also adopting this compound in specialty coatings and adhesives, driven by rising domestic production and exports. Government initiatives to support industrial modernization and sustainable manufacturing add to market momentum. Technological advancements in polymer chemistry are further enhancing the performance of isobornyl acrylate in diverse applications. Overall, India’s growing industrial base, coupled with increased awareness of advanced materials, will sustain robust market growth.

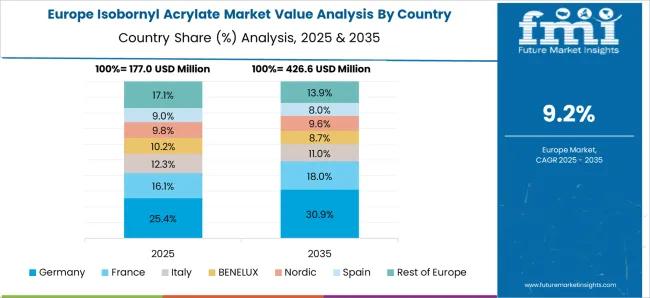

The isobornyl acrylate market in Germany is forecasted to grow at a CAGR of 11.4%, supported by strong demand from the automotive, industrial coatings, and packaging industries. Known for its advanced chemical manufacturing sector, Germany is witnessing increasing adoption of isobornyl acrylate due to its superior weather resistance, chemical stability, and durability. Automotive coatings and adhesives represent a major growth segment, as manufacturers demand high-performance, low-VOC solutions. The packaging industry, particularly UV-curable inks and coatings, is another key driver of adoption. Additionally, Germany’s electronics industry uses the compound in specialty coatings and adhesives for high-precision applications. Stringent EU environmental regulations encourage the use of eco-friendly and high-performance materials, further fueling demand. Continuous innovation in polymer technologies and investments in sustainable chemical production enhance market growth. Germany’s strong R&D infrastructure ensures continued adoption and expansion of isobornyl acrylate across industries.

The isobornyl acrylate market in the United Kingdom is expanding at a CAGR of 9.4%, supported by its adoption in coatings, adhesives, and specialty chemicals. Growing demand from the construction and packaging industries is driving market growth. The compound’s strong adhesion, chemical resistance, and weather durability make it ideal for industrial coatings and adhesives. UV-curable inks and coatings in the printing and packaging industry are also creating significant opportunities for adoption. The UK’s shift toward sustainable and low-VOC solutions aligns with the properties of isobornyl acrylate, boosting its usage across sectors. The automotive industry is another important contributor, requiring advanced adhesives and coatings for lightweight and durable vehicle components. Additionally, ongoing developments in electronics manufacturing further add to market momentum. Despite economic uncertainties, demand for high-performance resins in construction, packaging, and automotive sectors ensures steady growth for isobornyl acrylate.

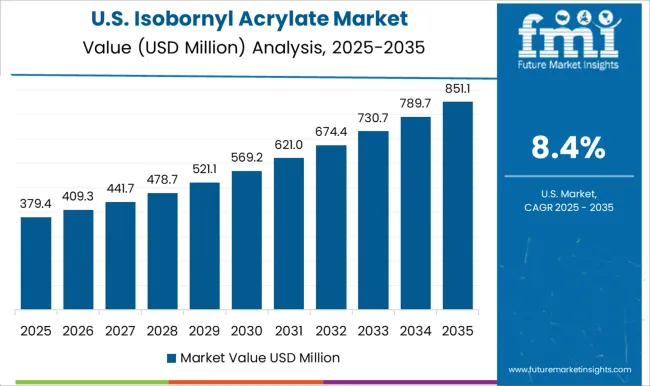

The isobornyl acrylate market in the United States is growing at a CAGR of 8.4%, driven by its adoption in adhesives, coatings, and specialty chemical applications. The automotive and construction industries are major demand drivers, requiring high-performance, durable, and low-VOC resins. In addition, the packaging sector, particularly in UV-curable coatings and inks, is fueling adoption. The compound’s strong adhesion, chemical resistance, and stability make it highly suitable for advanced industrial applications. Rising R&D investments in polymer chemistry are expanding application areas, including electronics and medical devices. Environmental regulations and sustainability initiatives are pushing industries toward eco-friendly resins, further supporting market expansion. The U.S. market emphasizes innovation and high-performance materials, with leading manufacturers focusing on enhancing product performance and cost efficiency. Overall, robust industrial demand, regulatory support, and technological advancements are ensuring steady growth for isobornyl acrylate in the U.S.

The isobornyl acrylate market is experiencing steady growth, fueled by its extensive use in adhesives, coatings, inks, and photopolymer applications. Known for its excellent adhesion, weather resistance, and low volatility, isobornyl acrylate is a key monomer in UV-curable formulations and high-performance polymers. Its increasing adoption in electronics, automotive, and packaging industries further strengthens its market outlook.

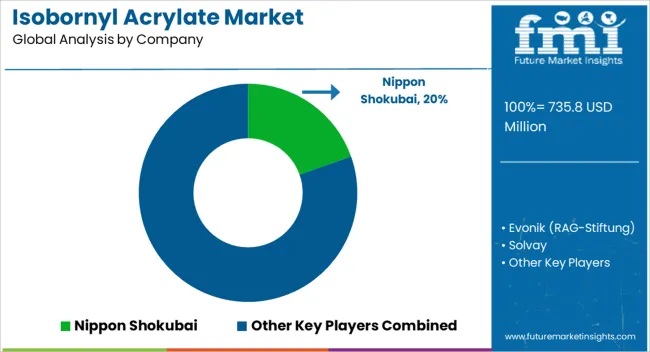

Among the leading players, Nippon Shokubai stands out as a major supplier with strong expertise in specialty acrylates and polymers. Evonik (RAG-Stiftung) offers advanced acrylate solutions with applications in coatings, adhesives, and high-performance materials. Solvay leverages its chemical innovation to provide specialty monomers for diverse industrial uses, while AkzoNobel integrates isobornyl acrylate into advanced coating formulations.

Mitsubishi is a prominent supplier with a strong presence in specialty chemicals, supporting applications in adhesives and electronics. IGM Resins is well known for its focus on UV-curable materials, where isobornyl acrylate plays a vital role in enhancing performance. Osaka Organic Chemical Industry Ltd. specializes in fine and specialty chemicals, catering to custom formulations across industries. Meanwhile, Green Pine Industries emphasizes eco-friendly solutions, supporting the sustainable production and use of acrylates.

The market outlook remains positive, driven by growing demand for high-performance adhesives, UV coatings, and advanced materials. Rising emphasis on eco-friendly and durable formulations, combined with advancements in polymer technology, is expected to create new opportunities for manufacturers and drive competitive innovation globally.

| Item | Value |

|---|---|

| Quantitative Units | USD 735.8 Million |

| Application | Paints and Coatings, Adhesives and Sealants, Paper and Paperboard Coatings, Plastics, and Electronics |

| End Use Industry | Packaging, Automotive, Construction, Electronics and Electrical, and Furniture and Woodworking |

| Product Type | High Purity, Low Purity, Technical Grade, and Food Grade |

| Viscosity | Medium, Low, and High |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Nippon Shokubai, Evonik (RAG-Stiftung), Solvay, AkzoNobel, Mitsubishi, IGM Resins, Osaka Organica Chemical Industry Ltd., and Green Pine Industries |

| Additional Attributes | Dollar sales vary by grade, including industrial grade and high-purity grade isobornyl acrylate; by application, such as adhesives & sealants, coatings, printing inks, and electronics; by end-use industry, spanning automotive, construction, packaging, and electronics; by region, led by Asia-Pacific, North America, and Europe. Growth is driven by increasing demand for UV-curable formulations, high-performance coatings, and environmentally friendly industrial materials. |

The global isobornyl acrylate market is estimated to be valued at USD 735.8 million in 2025.

The market size for the isobornyl acrylate market is projected to reach USD 1,891.2 million by 2035.

The isobornyl acrylate market is expected to grow at a 9.9% CAGR between 2025 and 2035.

The key product types in isobornyl acrylate market are paints and coatings, adhesives and sealants, paper and paperboard coatings, plastics and electronics.

In terms of end use industry, packaging segment to command 29.7% share in the isobornyl acrylate market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Acrylate Market Size and Share Forecast Outlook 2025 to 2035

Acrylate Oligomer Market Growth - Trends & Forecast 2025 to 2035

Polyacrylate Rubber Market Analysis - Size, Share, and Forecast 2025 to 2035

Butyl Acrylate Market Size and Share Forecast Outlook 2025 to 2035

Alkyl Acrylate Market Size and Share Forecast Outlook 2025 to 2035

Basic Methacrylate Copolymer Market Growth 2025 to 2035

Glycidyl Methacrylate Market Size and Share Forecast Outlook 2025 to 2035

Polymethyl Methacrylate (PMMA) Market Size and Share Forecast Outlook 2025 to 2035

1,6-Hexanediol Diacrylate Market Growth – Trends & Forecast 2024-2034

Synthetic And Bio Based PMMA Polymethyl Methacrylate Size Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA