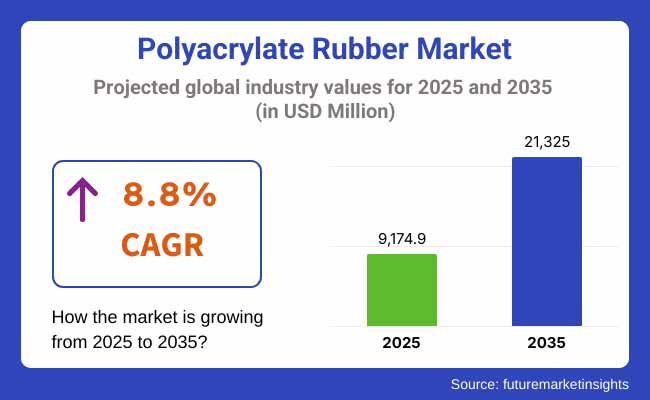

The polyacrylate rubber market reached a valuation of USD 9.17 billion in 2025. It is expected to reach USD 21.33 billion by 2035. A CAGR of 8.8% is projected during the forecast period. The United States is expected to dominate the polyacrylate rubber market in terms of revenue. South Korea is anticipated to experience the fastest growth between 2025 and 2035.

Increased demand for heat- and oil-resistant elastomers has been observed. Growth has been driven by the automotive and industrial sectors. Emissions regulations have fueled the use of polyacrylate rubber in engine systems. The rise in electric vehicle production has strengthened this trend. Industrial machinery requiring durable sealing materials has contributed to rising usage. Rapid technological advancement has enabled product innovation in polymer formulations. Restraints have included high production costs and material limitations at extreme temperatures.

Supply chain fluctuations have also affected raw material availability. Regulatory challenges concerning synthetic rubber disposal have constrained adoption. Strategic expansions and R&D investments have been implemented by market players. Enhanced product durability and versatility have been prioritized. Custom solutions for extreme environments have been developed.

Between 2025 and 2035, the polyacrylate rubber market is projected to remain robust. Electric vehicle penetration is expected to boost demand for heat-resistant sealing applications. Infrastructure growth in emerging markets is likely to support industrial machinery needs. Technological advances are predicted to improve temperature tolerance and material resilience. Oil and gas sectors are anticipated to increase usage in high-temperature environments. Environmental regulations may accelerate transitions to cleaner rubber alternatives.

Material recycling innovations are projected to lower production costs. Global expansion strategies are expected to drive capacity additions. New formulations with superior aging resistance are likely to be launched. The market is anticipated to evolve with a focus on performance, sustainability, and compliance.

The polyacrylate rubber market has been comprehensively analyzed across a wide range of investment segments. By source, the market is segmented into Ethyl Acrylate (EA), Butyl Acrylate (BA), Methoxyethyl Acrylate (MEA), and Ethoxy Ethyl Acrylate (EEA). In terms of application, key segments include Gaskets, O-rings, Beltings, Adhesives, Shaft seals, Plastics, Engine Oils and Lubricants, and Piping.

End-user analysis spans across the Packaging, Automotive, Consumer Goods, and Chemicals & Materials industries. Regionally, the market assessment covers North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and the Middle East and Africa.

Ethyl Acrylate (EA) is projected to be the fastest-growing segment within the polyacrylate rubber market by source from 2025 to 2035 at a CAGR of 9.3%. This growth is driven by its superior performance in high-temperature automotive applications, especially in oil seals and gaskets used in electric and hybrid vehicles. EA’s widespread compatibility with other monomers supports custom formulation for specific industrial needs, giving it a competitive edge.

Butyl Acrylate (BA) is expected to grow steadily, although at a slower rate, due to its comparatively lower resistance to heat and aging. Methoxyethyl Acrylate (MEA) and Ethoxy Ethyl Acrylate (EEA) are anticipated to witness modest growth due to limited commercial adoption and higher production costs. These niche segments remain constrained to specialized industrial uses with minimal volume contribution. Over the forecast period, market growth is expected to concentrate in EA, as OEMs and Tier 1 suppliers shift toward longer-life sealing systems under extreme conditions.

| Category | CAGR (2025 to 2035) |

|---|---|

| Ethyl Acrylate (EA) | 9.3% |

Gaskets are projected to be the fastest-growing application segment in the polyacrylate rubber market at 9.6% CAGR between 2025 and 2035. This segment’s acceleration is fueled by stringent regulatory standards in the automotive sector, requiring durable, heat- and oil-resistant sealing components. The transition toward electric vehicles (EVs) also demands high-performance gasket solutions, supporting segmental growth.

O-rings and shaft seals are expected to maintain stable demand, primarily within legacy automotive systems and industrial machinery, but with relatively moderate growth due to material substitution in cost-sensitive applications. Engine oils and lubricants, once a major driver, are likely to see muted expansion due to declining demand from combustion engines.

Adhesives and piping segments will show steady, application-specific growth, driven by aftermarket maintenance and niche industrial use. Plastics and beltings are projected to grow below the industry average, restrained by performance limitations under high thermal stress. Gaskets, by contrast, offer an optimal blend of performance, cost-efficiency, and adaptability.

| Category | CAGR (2025 to 2035) |

|---|---|

| Gaskets | 9.6% |

Automotive is expected to be the fastest-growing end-user segment in the polyacrylate rubber market from 2025 to 2035 at a CAGR of 9.8%. Growth will be driven by rapid electrification, rising demand for thermal-resistant elastomers, and emission reduction targets. The segment benefits significantly from the increasing adoption of polyacrylate rubber in under-the-hood components such as gaskets, seals, and hoses in EVs and hybrid vehicles. High operating temperatures and long product life cycles necessitate advanced sealing materials, making polyacrylate rubber a preferred choice.

The chemicals & materials segment will exhibit steady growth, led by process reliability demands in chemical plants. However, it will trail behind automotive due to its slower innovation cycle. Packaging will grow at a slower pace due to the dominance of low-cost synthetic rubbers, limiting polyacrylate penetration. Consumer goods will remain a niche segment with limited scalability, constrained by the performance-to-cost ratio. Automotive technology-led demand shift secures its position as the key long-term value driver.

| Category | CAGR (2025 to 2035) |

|---|---|

| Automotive | 9.8% |

Challenges: High Production Costs, Temperature Limitations, and Regulatory Compliance

Production costs inhibit the polyacrylate rubber (ACM) market; ACMs are costly to manufacture due to specialized elastomer formulations. Polyacrylate rubber is a well-established specialized polymer used in automotive seals, gaskets, and hoses, but polyacrylate rubber has a relatively high price compared to other conventional elastomers such as Nitrile Rubber (NBR) and Silicone Rubber (VMQ) restricting their wider market growth.

Another limitation, a big one as compared to metals, is temperature; while ACM exhibits better heat and oil resistance than rubber, it starts to degrade at extremely high temperatures and when exposed to certain chemicals, limiting its use for extreme conditions in the industry. Stringent environmental and safety regulations like REACH, EPA, and ISO compliance standards also require low-VOC, and non-toxic formulations, leading manufactures to gradually shift towards eco-friendly polymer substitutes.

Opportunities: Growth in Electric Vehicles (EVs), AI-Driven Material Innovation, and Sustainable Elastomers

Nevertheless, the polyacrylate rubber market still offers substantial growth opportunities due to growth of electric vehicle (EV) manufacturing, AI development for material research, and eco-friendly elastomer developments. This is driving ACM adoption in the automotive industry owing to high-performance requirements of the EV motors and battery systems with superior oil resistance, flexibility, and thermal stability.

Integrated with AI, the material science domain is optimizing ACM formulations, resulting in better heat resistance, chemical durability, and mechanical strength to strengthen its current positions in automotive, aerospace, and energy & utility sectors. The pressure for sustain-ability, bio-based elastomers is also unlocking new opportunities for low emission, recyclable ACM materials.

The global polyacrylate rubber market based on manufacturers, regions, types and applications, and has the opportunity, challenge, drivers and risk of the overall market. Increasing use of high-temperature and oil-resistant elastomers in gaskets, seals, and hoses is driving the market expansion. The market has also simplified by advancing in synthetic rubber innovation to meet the expanding need for durable closing alternatives.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 8.9% |

In the UK, the polyacrylate rubber market is all set to grow as demand from the automotive and industrial equipment industry rises. Growing use of fuel efficient and high-performance engine parts is going to steer the production of polyacrylate rubber for used as oil seals & transmission parts, turbo charger hoses. Moreover, stricter environmental policies supporting low-emission vehicles are shaping the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 8.7% |

This is driving the polyacrylate rubber market growth in the European Union over the forecast period. The increasing focus on turbocharged engines and rising importance for heat-resistant rubber materials in EV battery insulation are also expected to thrive in the market. Furthermore, regulations by the European Union regarding sustainability and low-VOC rubber formulations are driving industry expansion.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 8.8% |

Japan polyacrylate rubber market is growing moderately with strong automotive manufacturing, success in polymer technology, and demand for high-performance elastomers. The demand is being driven by the increasing utilization of polyacrylate rubber in hybrid and electric vehicles (EV) to provide thermal stability and oil resistance. In addition, R&D investments in next-generation elastomer formulations are helping fuel long-term market potential.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 8.7% |

The polyacrylate rubber market in South Korea is projected to grow as the country makes strides in varied sectors such as automotive, electronics, and heavy machinery. Demand is driven by the adoption of polyacrylate rubber in high-performing transmission systems, industrial seals and heat-resistant applications. Moreover, government support for bio-based polymer innovations and electric vehicle components is promoting the growth of the market in the region.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.9% |

The growing use of polyacrylate rubber (ACM) in automotive seals and gaskets, hoses, and demanding industrial applications is driving the ACM market, driven by oil, heat and oxidation resistant applications. Market Growth The growth of the market is influenced by the growing automotive sector, increasing demand for high-performance elastomers, and innovation in AI material engineering.

The market is witnessing companies transitioning towards sustainable production of ACM, optimization of rubber formulation through artificial intelligence, developing elastomers for high temperatures along with their durability, performance, and environmental compliance..

Zeon Corporation (18-22%)

Zeon leads the polyacrylate rubber market, offering AI-powered elastomer enhancements, automotive-grade ACM solutions, and next-generation oil-resistant rubber formulations.

Dow Inc. (12-16%)

Dow specializes in heat-resistant ACM rubbers, ensuring AI-driven material optimization for industrial and automotive sealing applications.

NOK Corporation (10-14%)

NOK provides high-temperature-resistant polyacrylate rubbers, optimizing AI-assisted elastomer durability and automotive gasket performance.

Changzhou Haiba Ltd. (8-12%)

Changzhou Haiba focuses on cost-effective ACM production, integrating AI-driven quality testing and customized elastomer solutions for industrial markets.

Shin-Etsu Chemical Co., Ltd. (5-9%)

Shin-Etsu develops high-performance ACM rubbers, ensuring AI-assisted production efficiency and eco-friendly elastomer material innovations.

Other Key Players (30-40% Combined)

Several specialty elastomer manufacturers, chemical companies, and automotive parts suppliers contribute to next-generation ACM rubber innovations, AI-powered material engineering, and high-performance rubber solutions. These include:

The industry is slated to reach USD 9.17 billion in 2025.

The industry is predicted to reach a size of USD 21.33 billion by 2035.

Key companies include Zeon Corporation, Dow Inc., NOK Corporation, and LG Chem.

The USA is projected to grow at 8.9% CAGR during the forecast period, is poised for the fastest growth.

Ethyl Acrylate (EA) is widely used due to its high thermal and oil resistance.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Rubber Molding Market Forecast Outlook 2025 to 2035

Rubber Track for Defense and Security Market Size and Share Forecast Outlook 2025 to 2035

Rubber Frame Monitors Market Size and Share Forecast Outlook 2025 to 2035

Rubber Coating Market Size and Share Forecast Outlook 2025 to 2035

Rubber Anti-Tack Agents Market Size and Share Forecast Outlook 2025 to 2035

Rubber to Metal Bonded Articles Market Analysis Size and Share Forecast Outlook 2025 to 2035

Rubber-to-Metal Adhesion Market Analysis - Size, Share, and Forecast Outlook 2025-2035

Rubber Coatings Market Growth - Trends & Forecast 2025 to 2035

Rubber Conveyor Belt Market Size, Growth, and Forecast 2025 to 2035

Rubber Testing Equipment Market Growth – Trends & Forecast 2025 to 2035

Rubber Tapes Market Trends - Growth & Forecast 2025 to 2035

Rubber Extruder Market Growth - Trends & Forecast 2025 to 2035

Rubber choppers Market

Gas Scrubber Market Size and Share Forecast Outlook 2025 to 2035

Air Scrubbers Market

Sleeve Rubber Stopper Market Size and Share Forecast Outlook 2025 to 2035

Europe Rubber Derived Unrefined Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Sterile Rubber Stopper Market Size and Share Forecast Outlook 2025 to 2035

Natural Rubber Market Size and Share Forecast Outlook 2025 to 2035

Plastic-Rubber Composite Market Trend Analysis Based on Product, Application, and Region 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA