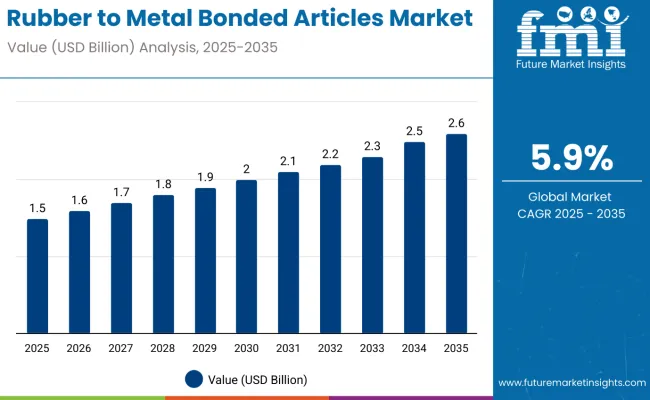

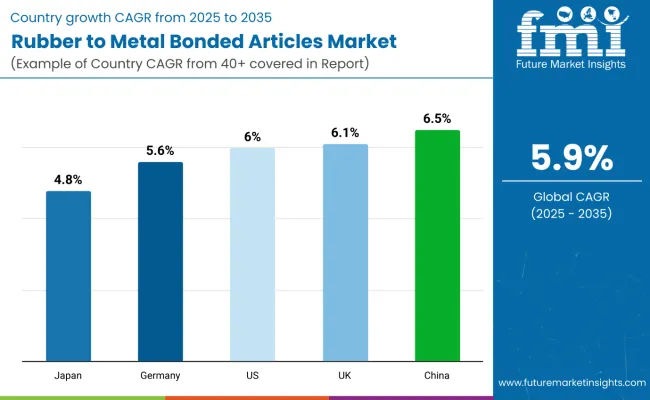

The global rubber to metal bonded articles market is expected to be valued at USD 1.5 billion in 2025 and is projected to reach approximately USD 2.6 billion by 2035. This reflects an absolute increase of USD 1.1 billion, equivalent to a growth of 73.3% over the forecast period. The expansion is forecast to occur at a compound annual growth rate (CAGR) of 5.9%, with the market size estimated to grow by nearly 1.73X by the end of the decade.

Quick Stats For Rubber to Metal Bonded Articles Market

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.5 billion |

| Industry Value (2035F) | USD 2.6 billion |

| CAGR (2025 to 2035) | 5.9% |

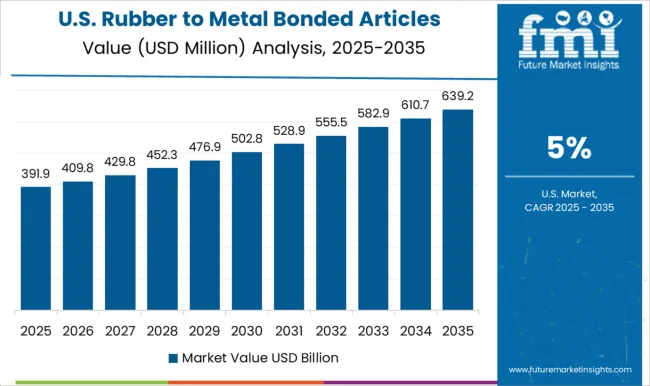

Between 2025 and 2030, the market is projected to expand from USD 1.5 billion to USD 2.0 billion, adding USD 0.5 billion in incremental value. This initial phase is expected to benefit from rising automotive production, increased use in vibration isolation systems, and greater adoption in industrial sealing applications.

From 2030 to 2035, the market is projected to grow from USD 2.0 billion to USD 2.6 billion, contributing USD 0.6 billion in additional value. Growth during this period will likely be shaped by innovations in bonding adhesives, rising demand from electric vehicles, and material advancements in high-durability elastomer-metal interfaces.

From 2020 to 2024, the rubber to metal bonded articles market expanded steadily, increasing from USD 1.1 billion in 2020 to USD 1.4 billion in 2024. Growth during this period was supported by consistent demand from the automotive, construction, and general manufacturing sectors. Applications such as anti-vibration mounts, suspension bushings, and industrial seals continued to anchor demand, especially in Asia-Pacific and Western Europe.

Market stability was maintained despite cost pressures in raw materials like synthetic rubber and steel, due to the indispensable role of bonded components in ensuring mechanical integrity and shock resistance in dynamic systems. Manufacturers focused on improving rubber-metal adhesion processes and introduced corrosion-resistant interfaces to extend service life, particularly in off-road vehicles and heavy machinery.

By 2025, the market is projected to reach USD 1.5 billion, supported by ongoing component standardization across OEM platforms and the gradual recovery of automotive supply chains from earlier pandemic-driven disruptions.

The growth of the rubber to metal bonded articles market is being driven by rising demand for noise, vibration, and harshness (NVH) control solutions across transportation, industrial, and machinery sectors. With increasing emphasis on vehicle comfort, equipment durability, and performance reliability, the integration of bonded elastomer-metal components has become essential in suspension, engine mounting, and chassis systems.

In the automotive industry, these components are being adopted across internal combustion, hybrid, and electric vehicles to improve ride quality, isolate vibration, and minimize structural fatigue. As electric vehicle designs introduce new dynamic load patterns and reduced engine noise, the need for advanced vibration damping is becoming more pronounced, thereby supporting the shift to optimized rubber-metal interfaces.

Industrial applications are also reinforcing demand, particularly in power generation, HVAC systems, construction equipment, and process manufacturing. In these settings, bonded articles play a critical role in sealing, noise dampening, and shock absorption especially in high-load or variable-frequency operating environments.

Material advancements, including the development of high-temperature elastomers, chemically resistant bonding agents, and multi-layered composite structures, are enabling the use of rubber to metal bonded components in more demanding environments.

The rubber to metal bonded articles market is segmented based on product type, rubber formulation, metal substrate, and end-use industry. By product type, the categories include mountings and bushes, gaskets and seals, anti-vibration components, caps and sleeves, and custom moldings, each serving roles in damping, sealing, or structural support.

In terms of rubber type, natural rubber, NBR, EPDM, silicone rubber, and polyurethane are assessed for their performance in various thermal, chemical, and mechanical conditions. Material selection depends on application-specific durability and resistance requirements.

The metal substrate segment covers steel, stainless steel, aluminum, brass and copper, and others, chosen based on strength, corrosion resistance, and bonding compatibility.

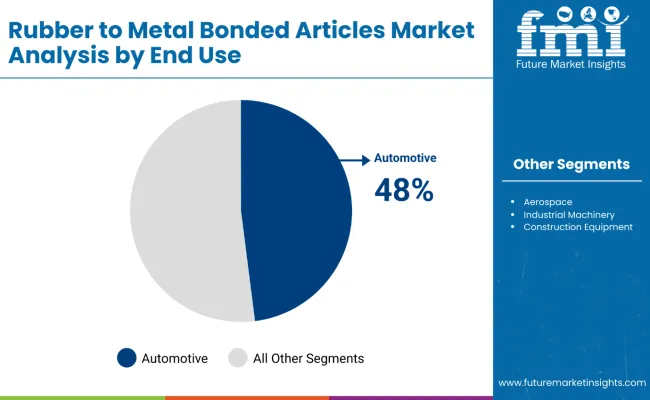

By end use, the market spans automotive, aerospace, industrial machinery, construction equipment, medical devices, railways, and other sectors, reflecting the cross-industry utility of these bonded components in vibration control, sealing, and isolation functions.

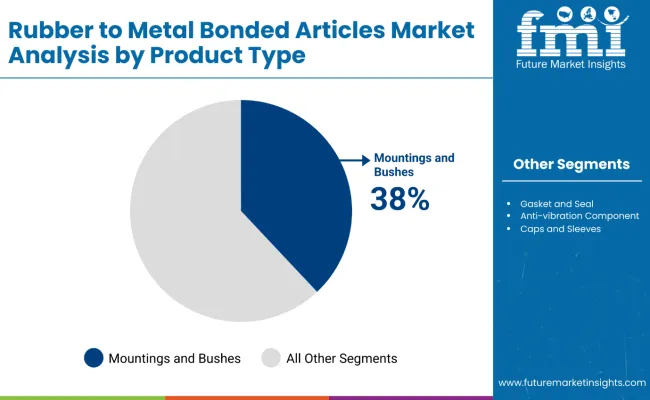

Mountings and bushes are expected to account for 38% of the global rubber to metal bonded articles market in 2025, making them the leading product type. Their extensive application in suspension systems, engine assemblies, and drivetrain components across automotive, rail, and industrial sectors supports their dominance. These parts play a critical role in isolating vibration, absorbing shocks, and minimizing structural fatigue under dynamic operating conditions. In electric vehicles, they are increasingly integrated to dampen high-frequency vibrations caused by lightweight architectures and battery modules.

In industrial machinery, rubber-to-metal mountings are used in compressors, pumps, and motors to extend equipment life and reduce maintenance frequency. Growth in this category is further reinforced by rising demand for customized geometries, long-life elastomers, and improved bonding techniques that ensure durability under variable loads and environmental exposure. As OEMs move toward modular and lightweight platforms, mountings and bushes are expected to remain essential to performance and reliability.

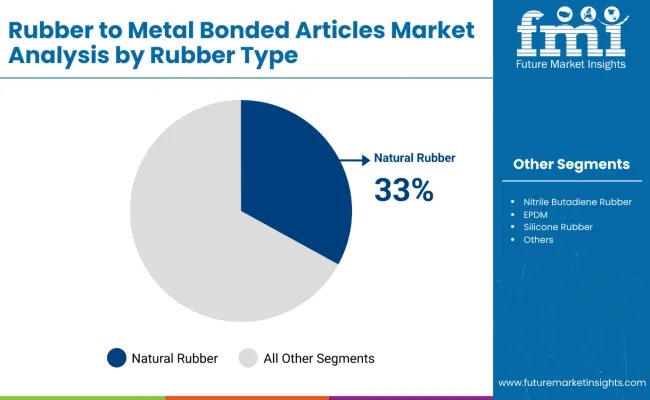

Natural rubber is projected to lead the rubber type segment with a 33% market share in 2025. Its dominance is supported by high elasticity, fatigue resistance, and cost-effectiveness across a wide range of bonded applications. In automotive use, natural rubber remains the preferred choice for mountings, bushings, and vibration isolators due to its superior dynamic properties and resistance to wear under moderate temperatures. Its ability to maintain shape and rebound under repeated compression makes it particularly suitable for absorbing road and engine-induced shocks.

Industrial users also favor natural rubber in seals and pads for rotating machinery, where flexibility and resilience are critical. The material is widely compatible with both standard and custom metal substrates, simplifying production and reducing assembly complexity. Although synthetic rubbers are gaining ground in specialty applications, natural rubber continues to dominate in cost-sensitive and volume-driven product lines, especially in emerging markets where material pricing and sourcing remain top priorities.

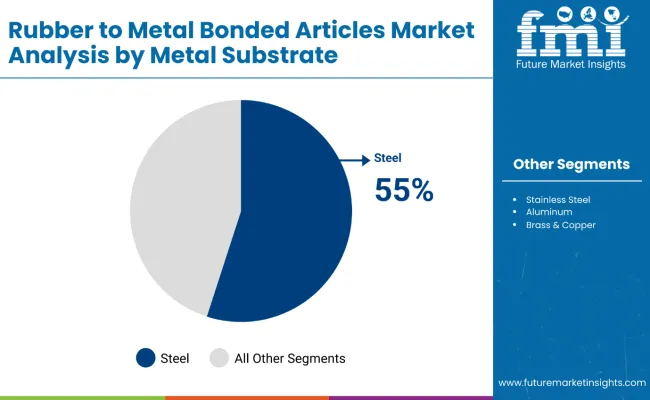

Steel is projected to account for 55% of the metal substrate segment in 2025, making it the most widely used bonding surface for rubber components. Its high mechanical strength, fatigue endurance, and ease of fabrication support widespread use across automotive, industrial, and heavy equipment applications. Bonded steel components offer superior performance under heavy loads and are highly durable in harsh operating environments, such as undercarriages, engine mounts, and rail couplings.

Steel’s compatibility with most rubber types, especially natural rubber and NBR, enables efficient bonding processes through mechanical anchoring and adhesive layering. Moreover, its thermal expansion profile aligns well with that of many elastomers, reducing delamination risks. As sustainability becomes more important, steel’s recyclability and wide availability make it a preferred choice for high-volume manufacturing. While lighter metals such as aluminum are gaining attention in electric mobility, steel continues to dominate in applications where structural integrity and cost-efficiency are critical.

The automotive industry is expected to remain the largest end-use segment, contributing 48% of global demand for rubber to metal bonded articles in 2025. Components such as engine mounts, bushings, vibration isolators, and seals are essential across internal combustion, hybrid, and electric vehicle platforms. As OEMs work to enhance comfort, reduce noise, and extend durability, bonded elastomer-metal parts are being widely adopted in suspension systems, drivetrain assemblies, and chassis structures.

In electric vehicles, the absence of engine noise increases sensitivity to road vibrations, amplifying the need for advanced NVH (noise, vibration, and harshness) control components. Regulatory shifts toward lighter, more efficient vehicles are also driving material innovation in both rubber and bonding substrates.

The market for rubber to metal bonded articles is being driven by increasing demand for NVH (noise, vibration, harshness) control in automotive and industrial systems, supported by advances in bonding technologies and elastomer formulations. However, growth is somewhat constrained by volatile raw material prices, production complexity, and performance variability under extreme environmental conditions. The need for precision bonding, material compatibility, and long-term durability remains a challenge, especially in applications involving high loads or corrosive exposure.

Electrification and Lightweighting are Shaping Bonded Component Design

As electric vehicles become more prevalent, the demand for vibration-dampening solutions that operate under quieter conditions is increasing. Bonded rubber-to-metal components are being redesigned to handle the altered load distribution and silent operating conditions of EV platforms. Additionally, automakers are prioritizing weight reduction, prompting the development of bonded components using thinner metal substrates and lightweight elastomers without compromising performance.

Advancements in Adhesion and Durability Reinforce Industrial Adoption

New bonding agents and surface preparation technologies are improving adhesion between elastomers and metallic substrates, extending component life in demanding industrial environments. Applications in power generation, rail systems, and construction equipment now require bonded components that maintain integrity under high-frequency motion, exposure to oils or chemicals, and fluctuating thermal loads. These advancements are increasing the appeal of bonded articles beyond automotive use, supporting steady market expansion.

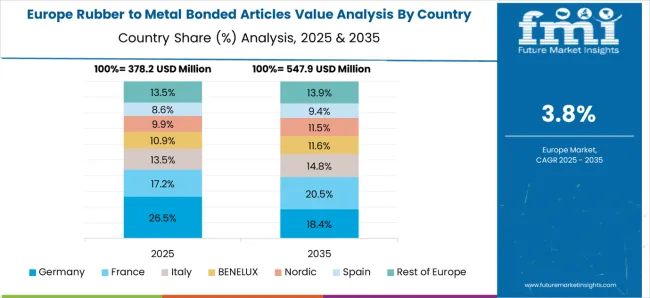

The Europe rubber to metal bonded articles market is projected to grow at a CAGR of 3.8% from 2025 to 2035, rising from USD 378.2 million to USD 547.9 million. Germany is expected to remain the largest contributor, although its share is projected to decline from 26.5% in 2025 to 18.4% in 2035. Spain is poised to expand its share from 17.2% to 20.5%, supported by strong automotive component manufacturing. Italy is also expected to see gains, rising from 13.5% to 14.8%, led by investments in industrial machinery and medical equipment production.

The BENELUX and Nordic regions are forecast to grow steadily, driven by rising adoption of anti-vibration components in railway and construction sectors. France is set to grow moderately as local OEMs integrate bonded articles into engine and chassis systems. Rest of Europe is projected to remain stable, backed by infrastructure-led demand in Eastern markets.

The USA market is forecast to expand at a CAGR of 6.0% between 2025 and 2035, driven by surging demand for NVH (Noise, Vibration, and Harshness) solutions across electric and hybrid vehicles. Increased investments in railway modernization and urban transit projects are boosting demand for bonded bushings, gaskets, and vibration isolation mounts. Industrial adoption is also rising in sectors where mechanical damping and component sealing are critical to operational safety.

The UK market is expected to register a CAGR of 6.1% through 2035, supported by expanding EV production hubs and OEM component sourcing within the country. Mountings and custom rubber-metal molded parts are gaining usage in battery-electric platforms and associated subsystems. Industrial machinery manufacturers are also increasing their reliance on high-performance bonded seals for motion and noise control.

China is projected to be the fastest-growing market with a CAGR of 6.5%, led by surging volumes in automotive, construction, and railway applications. Local component production and integration into domestic OEM platforms are contributing to a wider acceptance of rubber to metal bonded articles. Advancements in high-temperature elastomers and dual-function bonding technologies are aligning with China’s evolving performance standards.

Germany’s rubber to metal bonded articles market is expected to grow at a CAGR of 5.6%, supported by increasing automation, machine upgrades, and powertrain refinements in industrial equipment. Mountings, sleeves, and custom-molded bushings are witnessing broader adoption across heavy vehicles and smart factory components.

Japan is projected to expand at a CAGR of 4.8% between 2025 and 2035, with demand supported by adoption in compact automotive engines, medical devices, and metro train sets. Manufacturers are prioritizing compact, lightweight rubber to metal bonded articles that can operate under tight tolerances and multifunctional load conditions. The medical and precision tooling sectors are emerging as niche growth contributors.

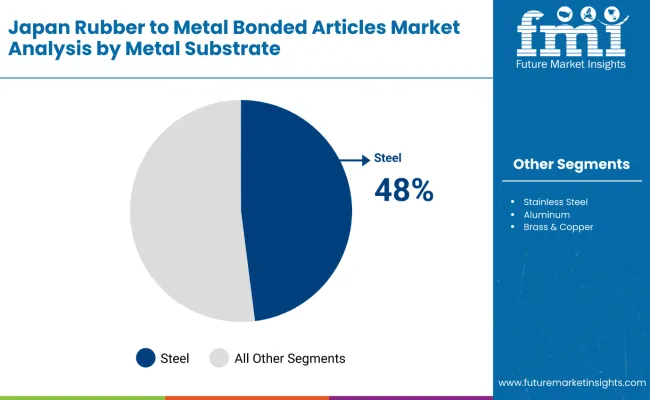

In Japan, steel is projected to account for 48% of the total substrate usage in rubber to metal bonded articles by 2025. This dominance is attributed to steel’s superior strength-to-weight ratio, compatibility with various elastomers, and widespread availability across domestic component suppliers. These characteristics are particularly valuable in Japan’s precision manufacturing environment, where consistency and mechanical durability are essential.

Stainless steel, contributing 24%, finds use in medical and food-grade equipment due to its corrosion resistance. Aluminum holds a 14% share, primarily in applications where weight reduction is criticalsuch as in compact automotive components and electronics. Brass & copper, together accounting for 8%, are favored in vibration damping products used in HVAC, rail, and specialized instrumentation.

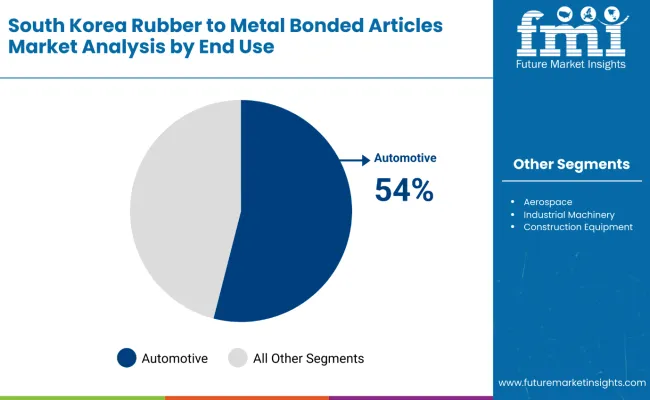

The automotive industry in South Korea is projected to consume 54% of all rubber to metal bonded articles by 2025, underpinned by consistent output from Hyundai, Kia, and their Tier 1 suppliers. Applications span suspension mounts, engine gaskets, NVH components, and drivetrain bushings, with increased demand from electric vehicle lines enhancing unit volumes.

Industrial machinery accounts for 18%, where shock absorption, precision sealing, and thermal resistance are essential. The medical devices segment holds 9%, largely driven by rising exports and domestic innovations in hospital and diagnostic equipment. Other notable segments include construction equipment (5%) and aerospace (4%), with applications centered around performance isolation and operational safety.

The rubber-to-metal bonded articles industry is seeing increased focus on high-performance solutions capable of withstanding extreme temperatures and corrosive environments. Developments in thermally resistant gaskets and bonded components are enhancing joint integrity, durability, and operational safety across energy, chemical processing, aerospace, and industrial applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.5 Billion (2025) |

| Product Type | Mountings and Bushes, Gasket and Seals, Anti-vibration Components, Caps and Sleeves, Custom Moldings |

| Rubber Type | Natural Rubber, Nitrile Butadiene Rubber, EPDM, Silicone Rubber, PU Rubber, Others |

| Metal Substrate | Steel, Stainless Steel, Aluminum, Brass & Copper, Others |

| End Use | Automotive, Aerospace, Industrial Machinery, Construction Equipment, Medical Devices, Railways, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Germany, United Kingdom, Japan, China |

| Key Companies Profiled | Trelleborg AB, ContiTech AG, Sumitomo Riko Company Limited, Boge Rubber & Plastics, Vibracoustic, Hutchinson SA, Bridgestone Corporation, Yamashita Rubber Co. Ltd., Toyo Tire Corporation, Henniges Automotive |

The global rubber to metal bonded articles market is estimated to be valued at USD 1.5 billion in 2025, driven by widespread use in automotive suspension systems, engine mounts, and vibration isolation components across industries.

The market is expected to reach approximately USD 2.6 billion by 2035, supported by growth in electric vehicles, medical equipment, and automated industrial machinery.

The market is forecast to expand at a CAGR of 5.9%, with total value increasing by 1.73X over the forecast period.

Mountings and Bushes lead the market with a 38% share, followed by gaskets and seals, primarily due to their use in automotive and machinery vibration control.

Natural rubber, with its superior elasticity and shock-absorbing properties, accounts for the largest share at 33% in 2025.

Steel dominates substrate usage with a 55% share, especially in high-load and fatigue-prone applications such as engine mounts and bushings.

China is expected to register the highest growth at a CAGR of 6.5%, driven by automotive part exports, industrialization, and rising adoption of NVH solutions.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Rubber Molding Market Forecast Outlook 2025 to 2035

Rubber Track for Defense and Security Market Size and Share Forecast Outlook 2025 to 2035

Rubber Coating Market Size and Share Forecast Outlook 2025 to 2035

Rubber Anti-Tack Agents Market Size and Share Forecast Outlook 2025 to 2035

Rubber Coatings Market Growth - Trends & Forecast 2025 to 2035

Rubber Conveyor Belt Market Size, Growth, and Forecast 2025 to 2035

Rubber Testing Equipment Market Growth – Trends & Forecast 2025 to 2035

Rubber Tapes Market Trends - Growth & Forecast 2025 to 2035

Rubber Extruder Market Growth - Trends & Forecast 2025 to 2035

Rubber choppers Market

Rubber-to-Metal Adhesion Market Analysis - Size, Share, and Forecast Outlook 2025-2035

Rubber Frame Monitors Market Size and Share Forecast Outlook 2025 to 2035

Gas Scrubber Market Size and Share Forecast Outlook 2025 to 2035

Air Scrubbers Market

Europe Rubber Derived Unrefined Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Sleeve Rubber Stopper Market Size and Share Forecast Outlook 2025 to 2035

Natural Rubber Market Size and Share Forecast Outlook 2025 to 2035

Plastic-Rubber Composite Market Trend Analysis Based on Product, Application, and Region 2025 to 2035

Sterile Rubber Stopper Market Size and Share Forecast Outlook 2025 to 2035

Snap on Rubber Stopper Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA