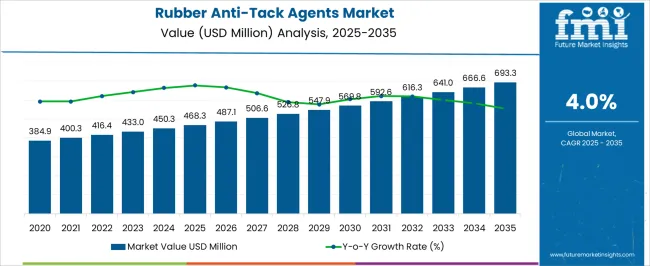

The rubber anti-tack agents market is projected to expand from USD 468.3 million in 2025 to USD 693.3 million by 2035, exhibiting a compound annual growth rate (CAGR) of 4%. Market growth is being driven by the increasing demand for improved rubber processing efficiency and enhanced product performance across automotive, industrial, and consumer goods applications.

The steady progression from USD 468.3 million to USD 693.3 million over the decade indicates that manufacturers are actively investing in formulations that reduce stickiness, improve mold release, and optimize production processes. Adoption is being influenced by evolving industrial standards and rising awareness of quality enhancements in rubber products, which are shaping the market trajectory. Over the forecast period, the rubber anti-tack agents market is expected to witness continuous uptake across tire manufacturing, conveyor belts, and molded rubber components. Product application techniques are being refined to ensure uniform coverage and minimize defects, which strengthens operational efficiency and output quality. Investments in raw material sourcing, production capacity, and supply chain optimization are being prioritized to meet rising demand from key manufacturing regions. The market is being positioned as a critical enabler for manufacturers seeking to reduce waste, enhance processing speed, and maintain product consistency. Growth is being supported by strategic collaborations, regulatory compliance, and targeted marketing efforts by leading suppliers within the rubber anti-tack segment.

| Metric | Value |

|---|---|

| Rubber Anti-Tack Agents Market Estimated Value in (2025 E) | USD 468.3 million |

| Rubber Anti-Tack Agents Market Forecast Value in (2035 F) | USD 693.3 million |

| Forecast CAGR (2025 to 2035) | 4.0% |

The rubber anti-tack agents market has established a notable position across its parent industries, driven by its essential role in ensuring smooth processing, reducing surface stickiness, and enhancing productivity in rubber manufacturing. Within the rubber chemicals market, anti-tack agents account for approximately 18–20% share, reflecting their widespread use in compounding and finishing operations. In the synthetic rubber market, they represent around 12–14%, as these agents are critical for preventing block formation and improving handling characteristics in production lines. The tire manufacturing market shows a higher reliance, with anti-tack agents contributing nearly 25–28% of the share, given that tires require consistent surface quality and adhesion control during curing and storage.

In the industrial rubber products market, the segment accounts for roughly 15–17%, as conveyor belts, hoses, and molded components benefit from anti-tack treatments to maintain dimensional stability and performance. Within the adhesives and sealants market, rubber anti-tack agents hold about 10–12% share, since they are occasionally employed to optimize rubber-based formulations and prevent premature bonding. While some argue that rising raw material costs and alternative processing aids may affect adoption, the enduring demand for high-quality rubber products ensures that anti-tack agents remain indispensable. From my perspective, their integration across multiple rubber applications highlights the market’s critical contribution to operational efficiency, product consistency, and quality assurance in the global rubber ecosystem.

The rubber anti-tack agents market is progressing steadily, supported by the growing demand for high-performance rubber products across automotive, industrial, and consumer goods applications. Industry publications and company updates have highlighted the increasing importance of processing aids in enhancing manufacturing efficiency and preventing adhesion during handling and storage.

Rising production volumes in tire manufacturing, coupled with the expansion of industrial rubber applications, have intensified the need for reliable anti-tack solutions. Sustainability trends have also influenced the market, with manufacturers focusing on bio-based and environmentally safe formulations to meet regulatory and customer expectations.

Advancements in formulation chemistry have enabled anti-tack agents to offer better compatibility with different rubber types, improving overall processing quality. Looking ahead, growth is expected to be driven by innovations in multi-functional agents that combine anti-tack properties with dust suppression and improved mixing efficiency.

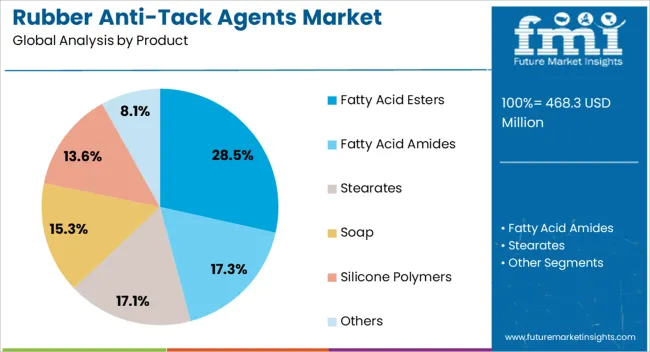

The rubber anti-tack agents market is segmented by product and geographic regions. By product, rubber anti-tack agents market is divided into Fatty Acid Esters, Fatty Acid Amides, Stearates, Soap, Silicone Polymers, and Others. Regionally, the rubber anti-tack agents industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Fatty Acid Esters segment is projected to hold 28.5% of the rubber anti-tack agents market revenue in 2025, making it a key contributor to overall market growth. This segment’s expansion has been supported by the superior lubricating and anti-stick properties of fatty acid esters, which facilitate smooth processing of rubber compounds.

Their compatibility with a wide range of rubber types, including both natural and synthetic variants, has increased their adoption in tire manufacturing and other industrial applications. Manufacturers have favored fatty acid esters for their ability to provide uniform coating, minimize material build-up, and maintain product quality during storage.

Additionally, these esters have been aligned with industry trends toward environmentally friendly additives, as many are derived from renewable sources. Consistent performance, coupled with growing regulatory emphasis on safer chemical usage, is expected to sustain the demand for fatty acid esters in the coming years, reinforcing their role as a preferred anti-tack solution in rubber processing.

Opportunities are strong in emerging regions and high-performance sectors, while trends emphasize eco-friendly and advanced formulations. Challenges from raw material costs, regulatory compliance, and supply chain constraints persist. Overall, the market outlook remains favorable as manufacturers prioritize efficiency, quality, and sustainability in rubber processing, creating steady demand for reliable and innovative anti-tack solutions worldwide.

The rubber anti-tack agents market is experiencing increased demand as the tire and rubber manufacturing sectors prioritize efficient production and defect-free products. Anti-tack agents prevent unwanted adhesion between rubber sheets or components during processing, reducing downtime and material waste. With the automotive sector expanding globally, especially in emerging economies, manufacturers are investing in high-performance anti-tack agents to maintain production efficiency. The demand is further supported by the need for consistent product quality, faster processing cycles, and reduced maintenance, positioning anti-tack solutions as essential additives in modern rubber production.

Significant opportunities are arising as rubber anti-tack agents find applications beyond tires, including conveyor belts, seals, hoses, and industrial rubber components. The growing use of specialty rubber in medical devices, electronics, and industrial machinery creates avenues for innovative, high-performance anti-tack formulations. Market players focusing on customizable, non-migrating, and environmentally compliant solutions can capture these opportunities. Emerging regions investing in rubber-based manufacturing infrastructure also present untapped demand. Strategic collaborations with manufacturers to co-develop application-specific agents strengthen market penetration while diversifying product portfolios for long-term growth.

A prominent trend in the market is the development of eco-friendly, low-residue, and high-efficiency anti-tack agents that meet environmental and regulatory standards. Manufacturers are optimizing formulations to reduce smoke generation, odor, and migration onto finished rubber products. The adoption of synthetic and bio-based agents is increasing as industries seek sustainable alternatives to traditional petroleum-based solutions. Additionally, innovations in dispersion technologies and additive compatibility enhance processing performance. These trends highlight a move toward safer, more efficient, and environmentally conscious solutions, enabling rubber manufacturers to improve operational productivity while maintaining product quality.

The rubber anti-tack agents market faces challenges from fluctuating raw material prices, which can affect production costs and profit margins. Compliance with environmental and safety regulations, especially regarding VOC emissions and chemical residues, adds further complexity. Inconsistent supply of specialty chemicals and dependence on imports in some regions may disrupt production schedules. Additionally, adoption in smaller manufacturing units is limited due to cost considerations. Manufacturers addressing these challenges must focus on cost-effective formulations, local sourcing, and regulatory alignment while educating customers on the long-term productivity benefits of anti-tack agents.

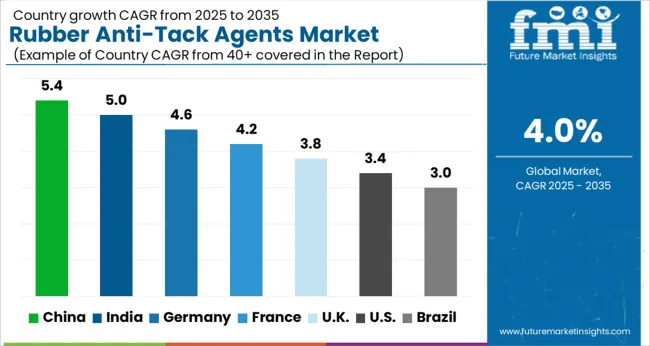

| Country | CAGR |

|---|---|

| China | 5.4% |

| India | 5.0% |

| Germany | 4.6% |

| France | 4.2% |

| UK | 3.8% |

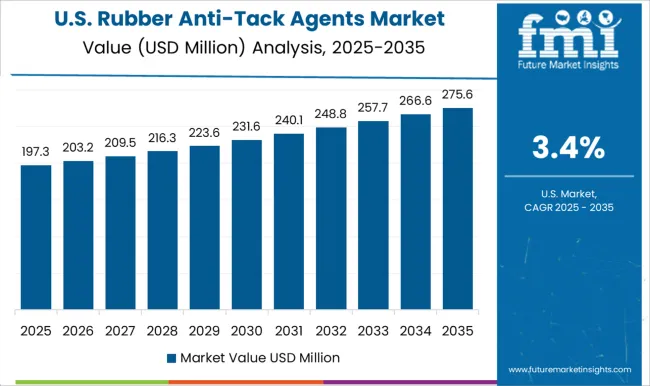

| USA | 3.4% |

| Brazil | 3.0% |

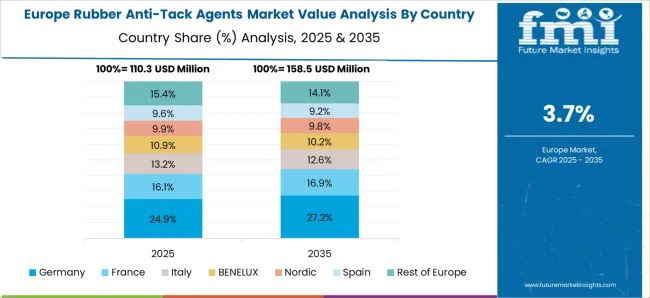

The global rubber anti-tack agents market is projected to grow at a CAGR of 4% from 2025 to 2035. China leads with a growth rate of 5.4%, followed by India at 5% and France at 4.2%. The United Kingdom records a growth rate of 3.8%, while the United States shows the slowest growth at 3.4%. Expansion is driven by rising demand in tire manufacturing, automotive components, and industrial rubber products. Emerging markets like China and India experience higher growth due to expanding automotive production and industrial rubber processing, while developed economies such as France, the UK, and the USA witness steady growth supported by established tire and rubber industries and adoption of high-performance anti-tack solutions. This report includes insights on 40+ countries; the top markets are shown here for reference.

The rubber anti-tack agents market in China is projected to grow at a CAGR of 5.4%. Increasing tire and rubber product manufacturing is driving demand, supported by rapid growth in the automotive sector. Industrial rubber applications, including conveyor belts and molded rubber components, also contribute to market expansion. Local manufacturers focus on producing high-quality anti-tack agents to meet stringent performance standards in tires and rubber goods. Research and development initiatives enhance product efficiency and durability, while government policies supporting industrial production indirectly benefit market growth.

The rubber anti-tack agents market in India is expected to grow at a CAGR of 5%. Increasing tire production and automotive manufacturing are major growth drivers. India’s expanding rubber processing industry, including industrial and consumer goods, supports rising demand. Domestic manufacturers are focusing on high-quality anti-tack agents that meet international standards. Growing adoption of advanced tire technologies and reinforced rubber products further enhances market growth. Government initiatives supporting industrial growth and manufacturing competitiveness indirectly boost the market.

The rubber anti-tack agents market in France is projected to grow at a CAGR of 4.2%. Established automotive and tire manufacturing industries create steady demand for high-performance anti-tack agents. Industrial rubber applications in conveyor belts, gaskets, and molded products also contribute. Manufacturers focus on product quality, compliance with European standards, and efficiency improvements. Innovation in polymer formulations ensures performance enhancement and longer lifecycle of rubber products, which supports consistent adoption of anti-tack agents across various industrial segments.

The rubber anti-tack agents market in the United Kingdom is expected to grow at a CAGR of 3.8%. Tire manufacturing, automotive components, and industrial rubber processing form the core demand segments. Focus on high-performance anti-tack agents and adherence to EU quality standards ensure product reliability. Manufacturers are investing in optimized formulations to improve production efficiency and product lifespan. Growing use of reinforced and specialty rubber products in industrial and consumer applications supports steady market growth in the UK

The rubber anti-tack agents market in the United States is projected to grow at a CAGR of 3.4%. Steady demand arises from tire manufacturing, automotive parts, and industrial rubber applications. Manufacturers focus on high-quality anti-tack agents that meet stringent safety and performance standards. Adoption of reinforced rubber products and specialty compounds enhances market growth. Research initiatives aimed at improving product efficiency, durability, and environmental compliance continue to support steady market expansion across the country.

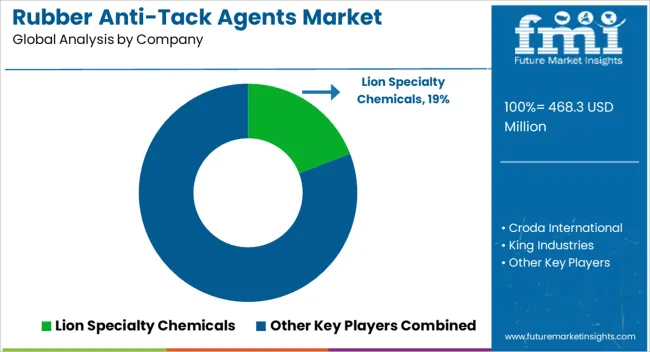

The rubber anti-tack agents market is dominated by chemical and specialty ingredient suppliers competing on efficacy, compatibility, and processing performance. Lion Specialty Chemicals, Croda International, and King Industries lead with brochures highlighting high-performance formulations that prevent rubber surface tackiness, enhance productivity, and maintain compound integrity during processing. FACI SPA and Peter Greven GmbH emphasize environmentally compliant solutions and multi-application versatility, showcasing brochure content that targets tire, automotive, and industrial rubber manufacturers. SASCO Chemical Group differentiates through specialty powders and liquid anti-tack agents optimized for extrusion, calendering, and molding processes. Brochures are heavily leveraged to convey operational efficiency, material consistency, and ease of incorporation into existing manufacturing lines, addressing the practical needs of compounders and processors.

Mid-sized suppliers such as McLube and Stephenson Alkon Solutions focus on niche performance characteristics, promoting solutions for specialty elastomers and low-temperature applications. Marketing strategies across the sector rely on brochures to emphasize benefits such as reduced downtime, minimized product defects, and improved handling safety. Competitive intensity is influenced by the ability to deliver consistent performance across diverse rubber types, regulatory compliance, and cost-effective solutions. Suppliers position themselves through detailed product datasheets and application notes, making brochures central to demonstrating technical credibility, formulation expertise, and reliability in a market where processing efficiency and product quality are paramount.

| Item | Value |

|---|---|

| Quantitative Units | USD 468.3 Million |

| Product | Fatty Acid Esters, Fatty Acid Amides, Stearates, Soap, Silicone Polymers, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Lion Specialty Chemicals, Croda International, King Industries, FACI SPA, Peter Greven GmbH, SASCO Chemical Group, McLube, and Stephenson Alkon Solutions |

| Additional Attributes | Dollar sales by agent type (fatty acids, esters, amides) and application (tires, conveyor belts, molded rubber products) are key metrics. Trends include rising demand for improved processing efficiency, growth in automotive and industrial rubber products, and adoption of eco-friendly formulations. Regional adoption, technological advancements, and regulatory compliance are driving market growth. |

The global rubber anti-tack agents market is estimated to be valued at USD 468.3 million in 2025.

The market size for the rubber anti-tack agents market is projected to reach USD 693.3 million by 2035.

The rubber anti-tack agents market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in rubber anti-tack agents market are fatty acid esters, fatty acid amides, stearates, soap, silicone polymers and others.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Rubber Molding Market Forecast Outlook 2025 to 2035

Rubber Track for Defense and Security Market Size and Share Forecast Outlook 2025 to 2035

Rubber Frame Monitors Market Size and Share Forecast Outlook 2025 to 2035

Rubber Coating Market Size and Share Forecast Outlook 2025 to 2035

Rubber to Metal Bonded Articles Market Analysis Size and Share Forecast Outlook 2025 to 2035

Rubber-to-Metal Adhesion Market Analysis - Size, Share, and Forecast Outlook 2025-2035

Rubber Coatings Market Growth - Trends & Forecast 2025 to 2035

Rubber Conveyor Belt Market Size, Growth, and Forecast 2025 to 2035

Rubber Testing Equipment Market Growth – Trends & Forecast 2025 to 2035

Rubber Tapes Market Trends - Growth & Forecast 2025 to 2035

Rubber Extruder Market Growth - Trends & Forecast 2025 to 2035

Rubber choppers Market

Gas Scrubber Market Size and Share Forecast Outlook 2025 to 2035

Air Scrubbers Market

Sleeve Rubber Stopper Market Size and Share Forecast Outlook 2025 to 2035

Europe Rubber Derived Unrefined Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Sterile Rubber Stopper Market Size and Share Forecast Outlook 2025 to 2035

Natural Rubber Market Size and Share Forecast Outlook 2025 to 2035

Plastic-Rubber Composite Market Trend Analysis Based on Product, Application, and Region 2025 to 2035

Snap on Rubber Stopper Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA