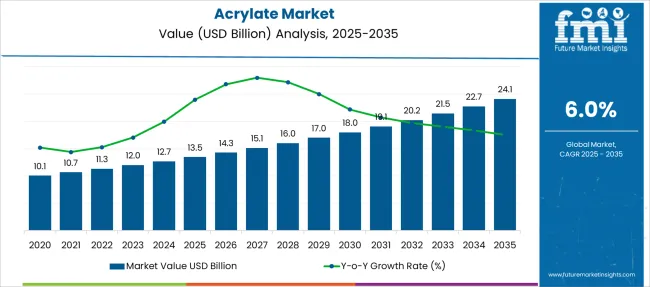

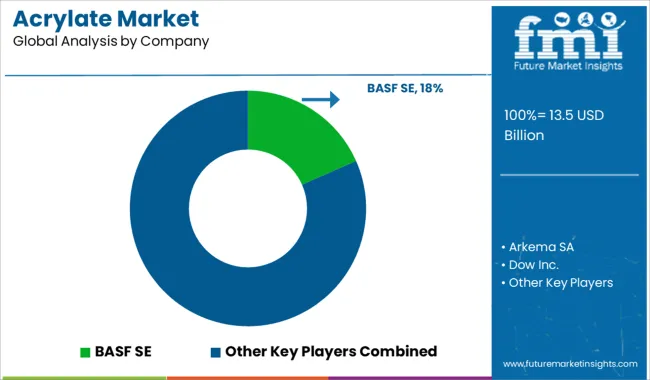

The Acrylate Market is estimated to be valued at USD 13.5 billion in 2025 and is projected to reach USD 24.1 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period.

| Metric | Value |

|---|---|

| Acrylate Market Estimated Value in (2025 E) | USD 13.5 billion |

| Acrylate Market Forecast Value in (2035 F) | USD 24.1 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The acrylate market is advancing steadily, driven by rising demand across construction, automotive, packaging, and consumer goods industries. Acrylates are widely utilized for their excellent adhesion, weather resistance, and flexibility, making them integral to various formulations, especially in paints, coatings, adhesives, and sealants.

As industries increasingly shift toward water-based and eco-friendly chemistries, acrylates play a vital role in meeting regulatory and performance standards. Ongoing infrastructure development in emerging economies, coupled with renovation and refurbishing activities in mature markets, continues to support strong consumption.

Future growth is anticipated due to innovation in polymer chemistry and the expansion of specialty acrylates in high-performance applications. With sustainability and durability emerging as priority factors, manufacturers are refining product offerings to align with customer and regulatory expectations, ensuring consistent market expansion over the long term.

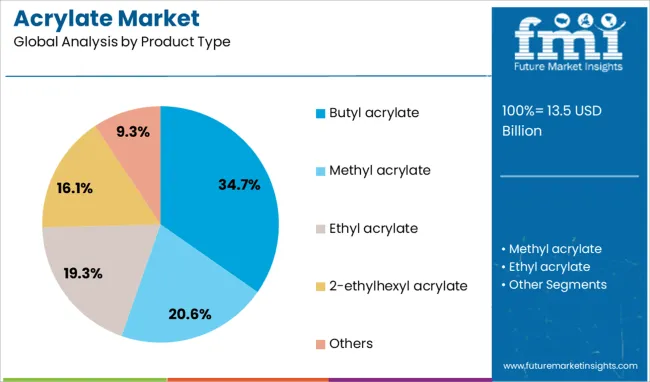

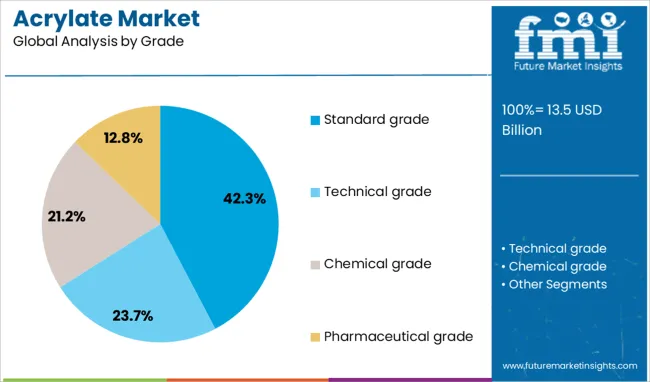

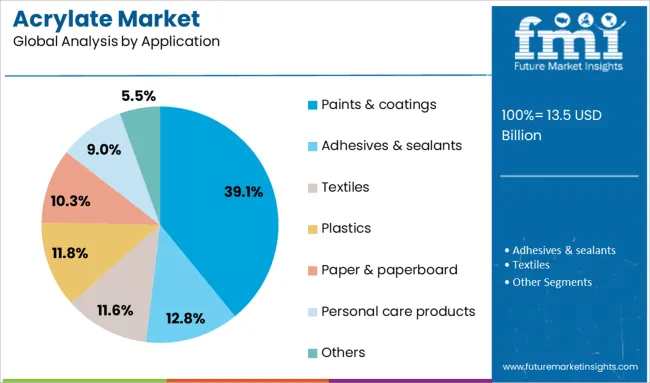

The acrylate market is segmented by product type, grade, application, and end use and geographic regions. By product type of the acrylate market is divided into Butyl acrylate, Methyl acrylate, Ethyl acrylate, 2-ethylhexyl acrylate, and Others. In terms of grade of the acrylate market is classified into Standard grade, Technical grade, Chemical grade, and Pharmaceutical grade. Based on application of the acrylate market is segmented into Paints & coatings, Adhesives & sealants, Textiles, Plastics, Paper & paperboard, Personal care products, and Others. By end use of the acrylate market is segmented into Paints & coatings, Construction, Automotive, Packaging, Textile, Adhesives & sealants, Personal care, and Others. Regionally, the acrylate industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The butyl acrylate segment holds a leading 34.7% share within the product type category, driven by its widespread use in the production of acrylic polymers for adhesives, sealants, and especially coatings. Its favorable properties, including flexibility, hydrophobicity, and compatibility with other monomers, make it a versatile choice across industrial and commercial applications.

The segment benefits from consistent demand in architectural and automotive coatings due to its ability to enhance weatherability and surface durability. As regulatory bodies emphasize the reduction of volatile organic compounds, butyl acrylate-based formulations are being optimized for environmental compliance.

Producers are also focusing on operational efficiency and raw material availability to stabilize pricing and maintain supply continuity. The steady integration of butyl acrylate in diversified end-use formulations ensures its continued dominance in the acrylate market landscape.

The standard grade segment leads with a 42.3% market share, reflecting its broad applicability in general-purpose formulations across key end-use industries. Standard grade acrylates offer a balanced profile of performance and cost-efficiency, making them suitable for high-volume applications such as adhesives, sealants, and coatings.

Their consistent quality, ease of processing, and availability have cemented their role as the preferred grade for manufacturers operating in cost-sensitive environments. This segment continues to attract demand due to its ability to meet standard mechanical and chemical resistance requirements without the need for premium customization.

As industries seek scalable and economically viable solutions, standard grade acrylates are expected to retain market leadership. Growth in emerging markets, where cost considerations are paramount, further reinforces this segment's strategic importance within the global acrylate supply chain.

The paints and coatings segment accounts for 39.1% of the acrylate market, making it the most dominant application area due to the material’s role in enhancing adhesion, gloss, and durability. Acrylates serve as essential binders in both water-based and solvent-based coating systems, offering excellent film formation, UV stability, and resistance to environmental degradation.

This segment has seen strong growth from the construction and automotive sectors, where surface protection and aesthetic value are critical. The ongoing shift toward low-VOC and eco-friendly formulations has amplified the relevance of acrylate-based coatings.

Innovations in high-solids and radiation-curable systems are also opening new avenues for acrylate use in advanced coating technologies. As global infrastructure and industrial activity remain robust, the paints and coatings segment is expected to continue driving the bulk of acrylate demand in the foreseeable future.

The global acrylate market is seeing stable growth across adhesives, sealants, coatings, and textiles. These polymers are favored for their clarity, flexibility, weather resistance, and rapid curing characteristics. End users in automotive, electronics, packaging, and medical sectors rely on acrylates to improve performance and design flexibility. The market is expanding through new specialty acrylate grades, regional compounding, and tailored formulations to meet varying application standards. Acrylates also offer low VOC and high-strength features, making them a versatile base for pressure-sensitive and UV-curable systems.

Formulating acrylate systems to meet increasingly specific performance expectations has become more challenging for manufacturers. Applications in automotive, electronics, and construction now require resins that deliver mechanical strength, optical clarity, and resistance to moisture or temperature fluctuations all within tight processing windows. Meeting these criteria often involves fine-tuning molecular weight, crosslinking density, and additive ratios. However, adjusting one property can negatively affect another, forcing trade-offs between adhesion, durability, or reworkability. In multilayer structures, for instance, failure to control interfacial behavior can lead to delamination or poor bonding. Customers also demand batch consistency, even when feedstock availability shifts. This growing complexity increases development cycles and heightens the risk of requalification delays. To remain competitive, suppliers must balance cost, performance, and reliability while meeting varied downstream technical and regulatory requirements—without overcomplicating processing steps or requiring specialized handling equipment.

Producers are gaining ground by expanding compounding operations closer to end-user locations. Establishing regional blending or formulation centers enables faster delivery, better inventory control, and quicker adaptation to changing customer needs. These facilities often work alongside local technical teams that provide onsite troubleshooting, support, and pilot testing. For adhesives, coatings, and films, this localized model allows formulators to adjust viscosity, tack, or curing behavior based on regional application conditions whether humidity levels, temperature ranges, or substrate preferences. Such agility is especially valuable for packaging converters and electronics manufacturers working on fast-paced production lines. Offering customized resin packages or pre-formulated kits also improves convenience for smaller processors lacking in-house R&D. By working more closely with OEMs and regional supply chains, acrylate producers not only reduce shipping delays and quality issues but also strengthen long-term business relationships. This model supports stable demand growth, especially in emerging markets with expanding industrial bases.

Demand for acrylate systems that support faster production is steadily increasing across sectors. Whether in roll-to-roll packaging, automated electronics lines, or automotive refinishing, processors now prefer materials that cure rapidly, handle well at ambient conditions, and require minimal post-treatment. Acrylate-based products especially UV-curable grades are well suited for these needs due to their controlled viscosity, fast drying time, and reliable film formation. In high-throughput environments, delays caused by long open times, high-temperature curing, or inconsistent spreadability can impact both quality and output. Acrylates that eliminate intermediate steps, allow direct application, or reduce scrap rates help manufacturers maintain operational efficiency. Additionally, materials that integrate easily into screen-printing, spraying, or coating workflows are being prioritized over those needing custom equipment or narrow processing windows. This shift toward throughput-focused solutions favors acrylate producers that offer well-balanced, application-ready formulations that perform reliably under pressure.

Volatility in raw material availability and pricing continues to pose a significant restraint for the acrylate market. Key precursors such as acrylic acid, esters, and monomers are subject to fluctuations due to feedstock supply disruptions, refinery outages, and shifting global demand. Such variability can cause procurement delays, batch inconsistency, and cost increases all of which affect downstream users. For example, in adhesives and coatings, even minor compositional differences can result in altered tack, cure rate, or film integrity. This instability creates added pressure on quality control teams and forces processors to stockpile or rapidly qualify alternative materials. Smaller converters with limited storage or testing capacity are especially vulnerable. While some large manufacturers hedge risk through long-term supply contracts or backward integration, others face tighter margins or missed delivery windows. Continued market growth will depend in part on improving sourcing resilience and managing the downstream impact of feedstock unpredictability.

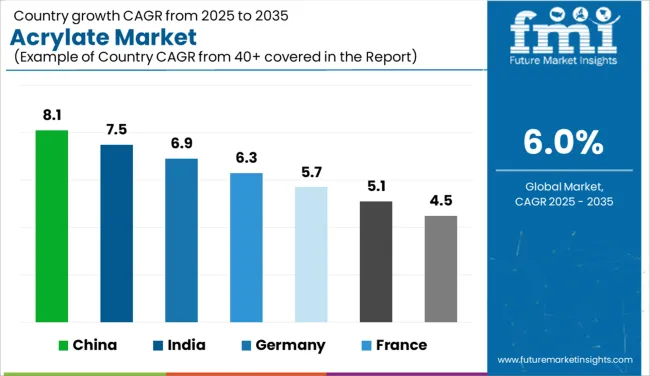

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

The global Acrylate Market is projected to grow at a CAGR of 6.0% through 2035, supported by demand in coatings, adhesives, textiles, and sealants. Among BRICS nations, China leads with 8.1% growth, driven by high-volume polymer production and domestic application in infrastructure and manufacturing. India follows at 7.5%, where market growth has been supported by packaging and construction materials sectors. In the OECD region, Germany reports 6.9% growth, aided by established chemical processing capabilities and industrial polymer use. France, growing at 6.3%, continues to support demand in paints, hygiene products, and specialty coatings. The United Kingdom, at 5.7%, reflects moderate gains through applications in automotive, printing, and healthcare products. Market trends have been shaped by chemical classification updates, raw material sourcing policies, and usage restrictions in end-user industries. This report includes insights on 40+ countries; the top five markets are shown here for reference.

In China, a CAGR of 8.1% has been recorded for acrylate materials, backed by sustained expansion in paints, adhesives, and textile applications. Large-scale industrial zones have contributed to wider use of water-based acrylate emulsions in interior and decorative coatings. Growth in automotive production has encouraged wider adoption of low-VOC acrylates for plastic bonding and trim finishing. Adhesive makers have utilized acrylate monomers in high-clarity, fast-setting formulations. Flexible packaging companies have sourced modified acrylates to support superior print adhesion and seal strength. Paint firms have favored emulsion-based options compatible with quick-drying applications. Exports of finished adhesive blends have risen, boosting domestic consumption of raw acrylate materials. Line expansions have been observed among contract manufacturers supplying specialty electronics-grade variants.

India has experienced a 7.5% CAGR in its acrylate market, with increased demand seen across decorative paints, hygiene adhesives, and coated papers. Semi-urban housing activity has encouraged use of acrylate emulsions for durable, fast-setting wall finishes. Manufacturers of diapers and personal hygiene products have applied butyl acrylates in high-tack adhesive systems. Cost-effective copolymers have been supplied to packaging players seeking flexible but firm sealing solutions. Paper coaters have favored acrylate dispersions that enhance print quality and gloss. Medium-sized producers have scaled operations in state industrial parks to meet the rising sector-specific demand. Distributors have broadened inventory lines to accommodate different viscosity and curing profiles. Demand from home décor and hygiene segments has continued to increase sourcing of acrylates with high bonding reliability.

Germany has maintained a 6.9% CAGR in the acrylate market, where coatings, medical products, and pressure-sensitive systems remain major consumers. High-grade acrylates have been supplied for UV-resistant automotive finishes and specialized medical adhesives. Construction sealant makers have formulated weather-resistant products using acrylate binders. Medical suppliers have employed acrylates in surgical tapes and flexible dressing adhesives. Pressure-sensitive applications in labeling and tapes have promoted the use of customized acrylate grades. Rheology modifiers and performance enhancers have been adopted to meet strict formulation targets in industrial coatings. Regional R&D centers have engaged in compliance-focused formulation adjustments. Adhesive manufacturers have tailored product lines to meet customer requirements for flexibility and durability. Niche applications have been explored in optics and engineered surfaces.

A steady CAGR of 6.3% has been observed in France’s acrylate market, with contributions from packaging films, consumer hygiene products, and paint systems. Coating formulators have applied acrylates in long-lasting exterior paints compatible with local environmental conditions. Flexible packaging companies have utilized UV-curable acrylates to enhance label clarity and resistance. Low-odor variants have been sourced by hygiene product manufacturers to suit sensitive-skin consumer goods. Acrylate copolymers have been preferred in surface coatings for improved flow and leveling. Regional suppliers have adjusted inventory to serve medium-sized converters across personal care and flexible film sectors. Market activity has also included adhesive grades for office and industrial labeling. Increased interest has emerged in low-shrinkage acrylates for specialty graphic films.

Across the United Kingdom, a 5.7% CAGR has been maintained in the acrylate market, with applications spanning industrial coatings, hygiene items, and label adhesives. Regional paint producers have adopted fast-drying acrylate systems for quick turnaround on residential and commercial projects. UV-reactive acrylates have been employed in high-resolution labeling films used in specialty food and retail packaging. Personal care brands have sourced low-irritant adhesive grades for sensitive-skin items like wound pads and children’s products. Distribution channels have been strengthened through overseas supplier partnerships to ensure stock continuity. Smaller converters have utilized customizable acrylate emulsions in coated paper and packaging films. Supply chains have included both polymer and monomer forms to fit diverse manufacturing scales. Focus has been placed on consistency in cure time and film integrity.

The acrylate market is dominated by leading chemical manufacturers offering a broad range of monomers and derivatives used extensively in adhesives, paints, coatings, textiles, and personal care products. BASF SE holds the largest market share, backed by a diverse acrylate portfolio and an expansive global manufacturing and supply network. Its products are widely used across construction, automotive, and hygiene sectors, known for quality, consistency, and reliable supply. Dow Inc., Arkema SA, and LG Chem Ltd. are also dominant players, each supplying high-performance acrylates tailored for UV resistance, flexibility, and chemical durability in end-use formulations. Evonik Industries AG and Mitsubishi Chemical Corporation operate as key suppliers offering specialized acrylate derivatives that support niche formulations, including high-performance coatings and functional adhesives. These companies maintain a strong presence in Asia and Europe, with integrated R&D and production facilities. Nippon Shokubai Co., Ltd. is a notable contributor in superabsorbent polymers, especially for hygiene applications, driven by its expertise in acrylic acid and derivatives. Tier 3 manufacturers such as Hexion Inc., SIBUR Holding PJSC, and Formosa Plastics Corporation primarily focus on supplying standard acrylates at competitive prices to regional industrial markets. These players are valued for their consistent volume output and support for bulk applications such as emulsion polymers and textile treatments. As demand continues across diverse sectors, suppliers are optimizing process efficiencies, expanding capacity in high-demand regions, and ensuring stable supply of acrylates that meet evolving performance requirements in global manufacturing environments.

Recent DevelopmentIn June 2025, BASF officially introduced its Rheovis® range with bio-based ethyl acrylate (up to 35% renewable content), validated by carbon‑14 testing, and achieving approximately 30% lower carbon footprint, without altering product performance.

| Item | Value |

|---|---|

| Quantitative Units | USD 13.5 Billion |

| Product Type | Butyl acrylate, Methyl acrylate, Ethyl acrylate, 2-ethylhexyl acrylate, and Others |

| Grade | Standard grade, Technical grade, Chemical grade, and Pharmaceutical grade |

| Application | Paints & coatings, Adhesives & sealants, Textiles, Plastics, Paper & paperboard, Personal care products, and Others |

| End Use | Paints & coatings, Construction, Automotive, Packaging, Textile, Adhesives & sealants, Personal care, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, Arkema SA, Dow Inc., Evonik Industries AG, Mitsubishi Chemical Corporation, LG Chem Ltd., Nippon Shokubai Co., Ltd., Hexion Inc., SIBUR Holding PJSC, and Formosa Plastics Corporation |

| Additional Attributes | Dollar sales by acrylate chemistry including butyl acrylate, ethyl acrylate, methyl acrylate, and 2‑ethylhexyl acrylate, by application in paints & coatings, adhesives & sealants, plastics, textiles, and paperboard, and by geographic region including North America, Europe, and Asia-Pacific; demand driven by rapid urbanization, construction expansion, and automotive growth; innovation in low‑VOC and bio‑based acrylates, UV-curable formulations, and high‑adhesion specialty monomers; costs influenced by acrylic acid feedstock volatility tied to crude oil prices and energy-intensive production; and emerging use cases in smart packaging, flexible electronics, eco-aware coatings, and advanced textile finishes. |

The global acrylate market is estimated to be valued at USD 13.5 billion in 2025.

The market size for the acrylate market is projected to reach USD 24.1 billion by 2035.

The acrylate market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in acrylate market are butyl acrylate, methyl acrylate, ethyl acrylate, 2-ethylhexyl acrylate and others.

In terms of grade, standard grade segment to command 42.3% share in the acrylate market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Acrylate Oligomer Market Growth - Trends & Forecast 2025 to 2035

Polyacrylate Rubber Market Analysis - Size, Share, and Forecast 2025 to 2035

Butyl Acrylate Market Size and Share Forecast Outlook 2025 to 2035

Alkyl Acrylate Market Size and Share Forecast Outlook 2025 to 2035

Isobornyl Acrylate Market Size and Share Forecast Outlook 2025 to 2035

Basic Methacrylate Copolymer Market Growth 2025 to 2035

Glycidyl Methacrylate Market Size and Share Forecast Outlook 2025 to 2035

Polymethyl Methacrylate (PMMA) Market Size and Share Forecast Outlook 2025 to 2035

1,6-Hexanediol Diacrylate Market Growth – Trends & Forecast 2024-2034

Synthetic And Bio Based PMMA Polymethyl Methacrylate Size Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA