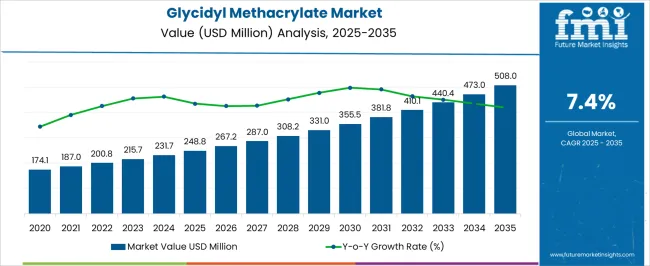

The Glycidyl Methacrylate Market is estimated to be valued at USD 248.8 million in 2025 and is projected to reach USD 508.0 million by 2035, registering a compound annual growth rate (CAGR) of 7.4% over the forecast period.

By 2030, the value reaches USD 267.2 billion, benefiting from expanding usage in advanced composites and functional polymers within electronics and automotive industries. From 2031 to 2035, the market shows accelerated momentum, rising from USD 287.0 billion to USD 381.8 billion, reflecting higher adoption in biomedical devices, paints, and packaging materials due to the compound’s compatibility and performance-enhancing attributes. This increase is driven by research-driven innovations, increasing demand for lightweight materials, and expansion of specialty chemicals in global manufacturing hubs. Enhanced product formulations, coupled with rising demand for high-performance resins and coatings, ensure that glycidyl methacrylate maintains its importance across diverse industrial verticals, establishing it as a critical enabler of growth in specialty chemical applications.

| Metric | Value |

|---|---|

| Glycidyl Methacrylate Market Estimated Value in (2025 E) | USD 248.8 million |

| Glycidyl Methacrylate Market Forecast Value in (2035 F) | USD 508.0 million |

| Forecast CAGR (2025 to 2035) | 7.4% |

The glycidyl methacrylate market is exhibiting strong growth, supported by its critical role in high-performance polymer synthesis and advanced material development. Increasing utilization of this monomer in industrial coatings, adhesives, and composite formulations has been influenced by its exceptional reactivity, adhesion enhancement capabilities, and weather resistance. Manufacturers are leveraging glycidyl methacrylate’s ability to introduce epoxy functionality into polymers, which significantly improves crosslinking, impact resistance, and chemical durability.

As regulatory frameworks continue to push for eco-friendly and high-solids formulations, its application in low-VOC and waterborne systems is gaining prominence. Expansion of end-use industries such as automotive, electronics, construction, and packaging, especially in Asia-Pacific economies, is further supporting market growth.

Strategic collaborations between chemical producers and resin manufacturers are also fostering product innovation, aligning with evolving application-specific performance requirements The future outlook remains positive as demand for engineered materials and performance-optimized coatings continues to rise across both established and emerging economies.

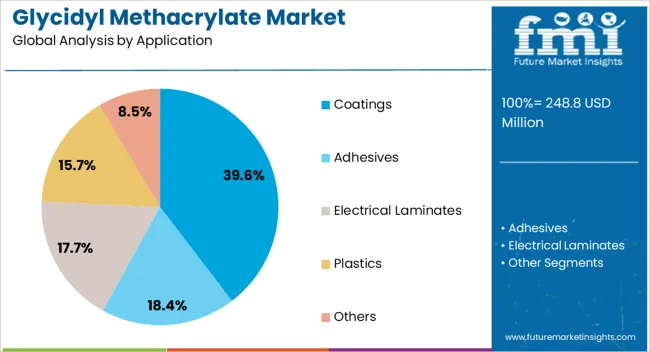

The glycidyl methacrylate market is segmented by application, and geographic regions. By application, glycidyl methacrylate market is divided into Coatings, Adhesives, Electrical Laminates, Plastics, and Others. Regionally, the glycidyl methacrylate industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The coatings segment is expected to account for 39.6% of the total revenue share in the glycidyl methacrylate market by 2025, making it the leading application area. This dominance is being driven by the increasing demand for durable, high-adhesion coatings across automotive, industrial, and protective surface applications.

Glycidyl methacrylate has been widely incorporated into coatings formulations due to its ability to enhance chemical resistance, UV stability, and mechanical strength through improved crosslink density. The growing shift toward high-performance waterborne and solvent-free systems has further increased the preference for reactive monomers such as glycidyl methacrylate in environmentally compliant coatings.

Its molecular structure enables strong interfacial adhesion on various substrates including metals, plastics, and composites, making it particularly suitable for use in corrosion-resistant and weather-durable applications Advancements in resin chemistry and polymer dispersion technologies have also played a key role in promoting the use of glycidyl methacrylate in next-generation coating solutions that require a balance of flexibility, hardness, and long-term stability.

Glycidyl methacrylate is gaining traction as a performance-driven additive across coatings, adhesives, polymers, healthcare, and electronics. Its versatility ensures long-term growth, making it a vital component in multiple industries.

Glycidyl methacrylate (GMA) has gained prominence in the coatings industry where its reactive functionality enhances adhesion, chemical resistance, and durability. It is widely applied in automotive, marine, and industrial coatings that demand long-term stability under harsh conditions. Manufacturers are incorporating GMA into epoxy-modified acrylics to achieve improved flexibility and crosslinking properties. The rise of waterborne and powder coatings has further increased its use as it supports performance without compromising environmental compliance. With infrastructure projects and industrial expansion fueling demand for durable surfaces, GMA is positioned as a preferred additive for premium formulations. This dynamic highlights its indispensable role in advancing coating performance across diverse end-use industries.

The adhesives and sealants sector is witnessing rising adoption of glycidyl methacrylate due to its ability to improve bond strength and resistance. Structural adhesives in automotive, construction, and packaging are increasingly incorporating GMA to enhance durability and long-term performance. Its epoxy functionality enables crosslinking with multiple substrates, creating strong and versatile bonds. Heat and chemical resistance provided by GMA-modified adhesives supports their use in challenging industrial environments. Flexible packaging and laminates also benefit from its superior adhesion properties. Market players are exploring GMA-based formulations for high-demand sectors where bonding reliability directly impacts safety and product life. This trend continues to make GMA a crucial raw material in advanced adhesive systems.

Glycidyl methacrylate plays a strategic role in polymer modification, offering improved toughness, flexibility, and compatibility in various plastics. It is utilized in impact modifiers, extrusion blends, and copolymers that demand superior performance characteristics. Packaging, electronics, and automotive components are major beneficiaries, where GMA helps improve transparency, impact resistance, and dimensional stability. Its ability to functionalize polyolefins and engineering resins allows for broader applications in industries that rely on customized polymer solutions. The growth of lightweight materials in automotive and packaging has amplified interest in GMA-based modified resins. By improving the mechanical and chemical profile of base polymers, GMA is enabling manufacturers to deliver advanced, application-specific solutions.

Healthcare and electronics sectors are increasingly adopting glycidyl methacrylate due to its functional versatility. In medical devices, GMA contributes to coatings, adhesives, and polymer blends that require biocompatibility and chemical resistance. Electronics manufacturers use GMA-based resins in encapsulation, printed circuit boards, and protective coatings for components, where long-term stability is essential. The demand for miniaturized, durable electronics has driven adoption of GMA-modified materials that ensure performance under stress. Pharmaceutical packaging and diagnostic tools also rely on its role in enhancing material integrity and resistance. With healthcare and electronics experiencing consistent innovation cycles, GMA stands out as a performance enabler that ensures reliability and quality in these critical applications.

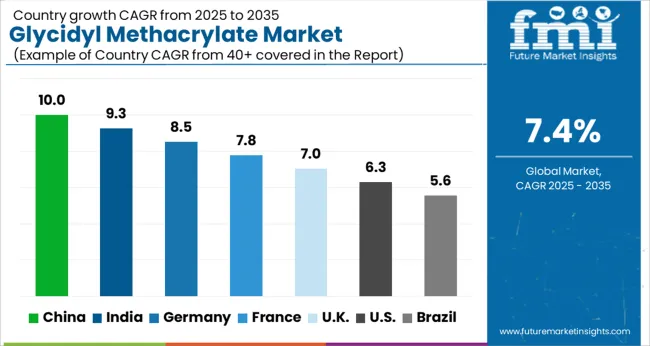

| Country | CAGR |

|---|---|

| China | 10.0% |

| India | 9.3% |

| Germany | 8.5% |

| France | 7.8% |

| UK | 7.0% |

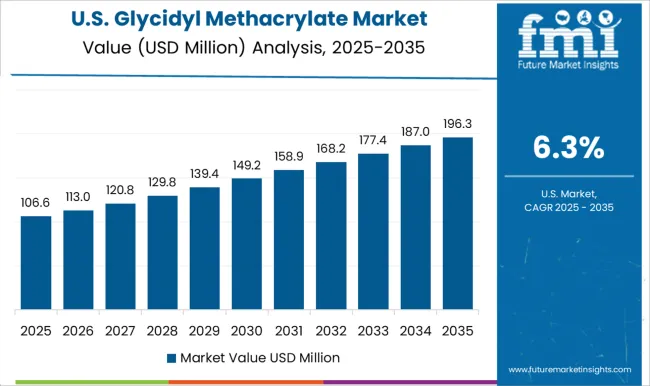

| USA | 6.3% |

| Brazil | 5.6% |

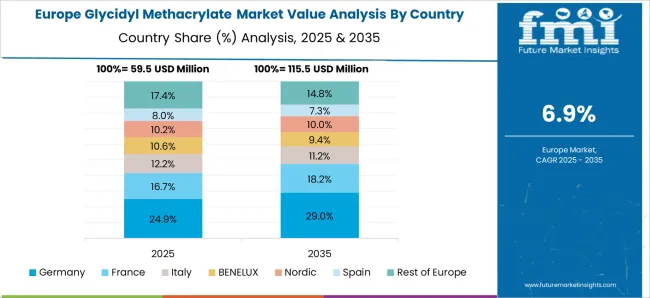

The glycidyl methacrylate (GMA) market is projected to expand globally at a CAGR of 7.4% from 2025 to 2035, driven by its rising use in coatings, adhesives, polymer modification, and electronics. China leads with a CAGR of 10.0%, supported by rapid industrial expansion, demand in automotive coatings, and strong electronics manufacturing. India follows at 9.3%, with growth fueled by construction, packaging, and rising demand for polymer blends in infrastructure and consumer goods. France grows at 7.8%, benefitting from pharmaceutical packaging, medical devices, and specialty polymer applications. The United Kingdom posts 7.0%, where electronics and healthcare applications are driving growth, while the United States records 6.3%, reflecting steady demand in adhesives, composites, and industrial resins in a mature but innovation-led market. This assessment highlights Asia-Pacific as the key growth hub for GMA, while Europe maintains a balanced role in specialty applications, and North America sustains demand through advanced industrial sectors.

China is projected to record a 10.0% CAGR during 2025–2035, rising from nearly 8.7% in 2020–2024, which positions it well above the global average of 7.4%. This progression is supported by rising demand from automotive coatings, adhesives, and electronics manufacturing. Strong government-backed investments in infrastructure and high-value polymers have stimulated large-scale adoption. Expansion of medical devices and packaging applications further supports demand, while domestic manufacturers are scaling up integrated production facilities. With export-driven growth in specialty chemicals, China has become a key hub for both volume and advanced applications of GMA. Regional players are collaborating with global chemical giants to expand production capacity and improve formulation versatility.

India is forecasted to post a 9.3% CAGR for 2025–2035, compared with about 8.1% during 2020–2024, maintaining a growth rate well above the global trajectory of 7.4%. The uplift is largely due to expanding construction, packaging, and automotive industries where GMA-modified resins and adhesives are in demand. With rising consumption of FMCG products and rapid infrastructure projects, applications of GMA in coatings and polymer blends have gained significant traction. Small and medium-scale manufacturers are collaborating with multinational chemical companies to bring cost-effective, application-specific GMA products into the domestic market. India’s strong pharmaceutical and medical packaging sector is further fueling adoption, ensuring continued demand growth across multiple industries.

France is projected to achieve a 7.8% CAGR during 2025–2035, up from approximately 6.6% in 2020–2024, keeping it just above the global average of 7.4%. The stronger trajectory is influenced by demand in pharmaceuticals, food packaging, and high-performance coatings. French specialty chemical companies are advancing GMA formulations tailored for aerospace, automotive refinishing, and medical devices. Growth in healthcare packaging has added to demand, as biocompatible and chemically resistant solutions are prioritized. Innovation in adhesive and polymer blends within French R&D hubs continues to contribute to the wider adoption of GMA. With strong regulatory compliance requirements, France remains a crucial European hub for high-value chemical applications.

The United Kingdom is projected at a 7.0% CAGR during 2025–2035, compared to nearly 5.9% between 2020–2024, aligning closely with the global 7.4% pace. The earlier lower CAGR reflected slower investment in chemical intermediates, while the recent uptick comes from stronger adoption in healthcare, electronics, and specialty adhesives. Growing demand for biocompatible polymers in medical devices and increased reliance on GMA-modified coatings for infrastructure maintenance have lifted market performance. SMEs are partnering with global suppliers to develop cost-effective, customized solutions, making GMA more accessible to niche industries. Broader utilization across e-mobility components and protective coatings is strengthening the long-term outlook for the UK market.

The United States is projected to grow at a 6.3% CAGR during 2025–2035, up from nearly 5.4% in 2020–2024, trailing the global average of 7.4% but sustaining steady demand. Growth has been reinforced by high-value applications in adhesives, composites, and specialty coatings. Aerospace, automotive, and construction industries continue to adopt GMA-modified materials for durability and performance. Expansion in electronics packaging and medical devices is also contributing to adoption. The USA chemical industry’s focus on high-margin specialty chemicals supports the steady integration of GMA into advanced product formulations. While growth is slower compared to Asia, consistent innovation and strong end-user industries ensure resilient demand.

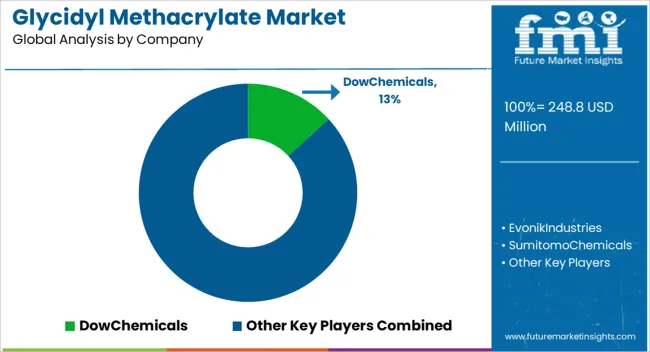

The glycidyl methacrylate (GMA) market features a diverse mix of global chemical giants and specialized regional producers, each competing on formulation quality, supply chain integration, and application-specific performance. Dow Chemicals leverages its extensive polymer and specialty chemical expertise to deliver high-purity GMA for coatings, adhesives, and advanced composites. Evonik Industries focuses on customized methacrylate solutions that enhance durability and adhesion in automotive, construction, and electronics sectors. Sumitomo Chemicals and Mitsubishi Gas Chemical Company maintain strong positions in Asia, offering GMA-based intermediates tailored for polymer modification and industrial coatings. Merck KGaA supplies specialty formulations with an emphasis on pharmaceutical and electronics applications, ensuring performance consistency.

Estron Chemical and Kowa American Corporation are recognized for niche formulations targeting resins and powder coatings. Zhonglan Industry, Haihang Industry Co. Ltd., and Jindun Chemical contribute significantly from China, supplying cost-competitive GMA for adhesives, plastics, and packaging industries. Hubei Xiansheng Biotechnology and Lianyungang Ningkang Chemical Co. Ltd. emphasize scaling production for broader industrial adoption. Wuhan Sincere-star Chemical Co. Ltd. and Oswal Udhyog expand market accessibility with regional distribution strength. Alfa Chemistry offers research-grade and specialty variants of GMA for lab and pilot-scale applications.

Competitive strategies across the market focus on expanding production capacity, improving purity grades, and enhancing compatibility with eco-compliant formulations. Partnerships with polymer manufacturers, regulatory compliance in packaging and medical devices, and targeted innovations in adhesives and coatings are driving competition. Market players are also prioritizing supply stability, technical service, and tailored GMA derivatives to meet the evolving needs of industries worldwide.

Dow Chemical

Evonik Industries

Sumitomo Chemicals

Mitsubishi Gas Chemical Company

Merck KGaA

Estron Chemical

Kowa American Corporation

Zhonglan Industry

Haihang Industry Co., Ltd.

Jindun Chemical

Hubei Xiansheng Biotechnology

Lianyungang Ningkang Chemical Co., Ltd.

Wuhan Sincere-star Chemical Co., Ltd.

Oswal Udhyog

Alfa Chemistry

| Item | Value |

|---|---|

| Quantitative Units | USD 248.8 Million |

| Application | Coatings, Adhesives, Electrical Laminates, Plastics, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Dow Chemical, Evonik Industries, Sumitomo Chemicals, Mitsubishi Gas Chemical Company, Merck KGaA, Estron Chemical, Kowa American Corporation, Zhonglan Industry, Haihang Industry Co., Ltd., Jindun Chemical, Hubei Xiansheng Biotechnology, Lianyungang Ningkang Chemical Co., Ltd., Wuhan Sincere-star Chemical Co., Ltd., Oswal Udhyog, Alfa Chemistry. |

| Additional Attributes | Dollar sales, share, regional demand patterns, end-use industries growth, competitor strategies, regulatory frameworks, supply chain risks, pricing trends, and R&D opportunities. |

The global glycidyl methacrylate market is estimated to be valued at USD 248.8 million in 2025.

The market size for the glycidyl methacrylate market is projected to reach USD 508.0 million by 2035.

The glycidyl methacrylate market is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types in glycidyl methacrylate market are coatings, adhesives, electrical laminates, plastics and others.

In terms of , segment to command 0.0% share in the glycidyl methacrylate market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Basic Methacrylate Copolymer Market Growth 2025 to 2035

Polymethyl Methacrylate (PMMA) Market Size and Share Forecast Outlook 2025 to 2035

Synthetic And Bio Based PMMA Polymethyl Methacrylate Size Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA