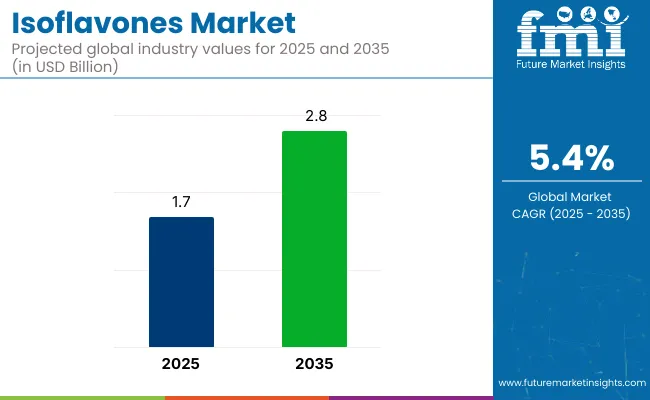

The global isoflavones market is valued at USD 1.7 billion in 2025 and is poised to reach USD 2.8 billion by 2035, reflecting a CAGR of 5.4%. Growth will be driven by increasing demand for plant-based bioactive compounds, rising health awareness, and preferences for clean-label functional food ingredients.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.7 billion |

| Market Value (2035) | USD 2.8 billion |

| CAGR (2025 to 2035) | 5.4% |

Technological advancements in extraction methods, such as supercritical CO2 extraction and enzymatic processing, are expected to enhance product quality and bioavailability. Additionally, government support promoting natural health solutions is contributing to the market's expansion.

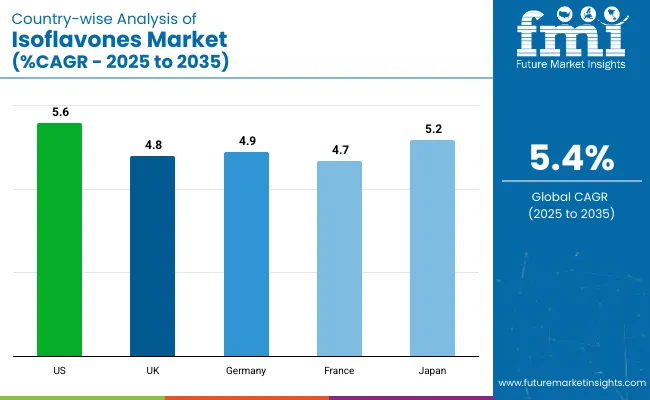

The USA holds the largest market share and is also expected to grow at the highest CAGR of 5.6% through 2035. Japan records a CAGR of 5.2%, driven by its traditional soy-based diet and functional beverage applications. In Europe, Germany is poised to grow at a CAGR of 4.9% through 2035, driven by increasing consumer awareness of isoflavones’ cardiovascular and hormonal health benefits.

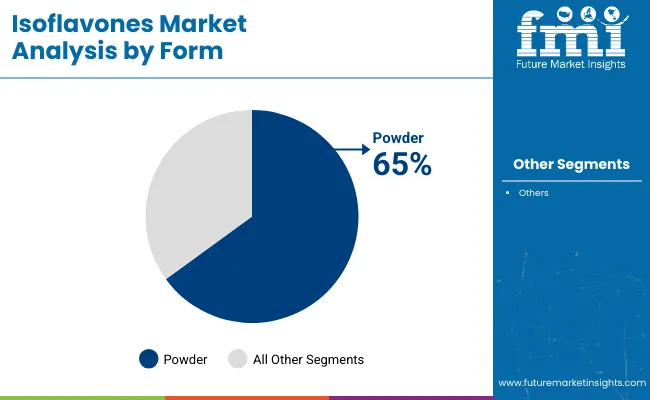

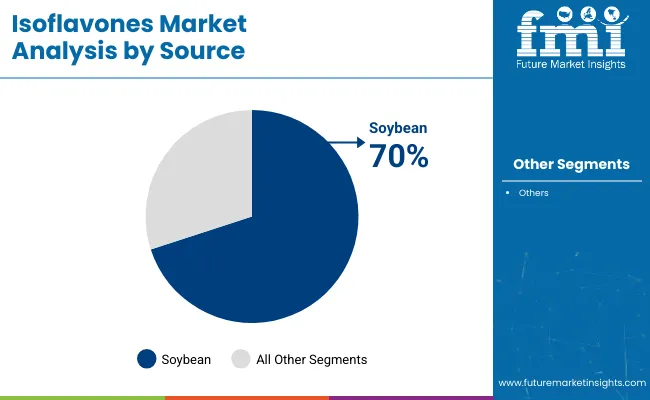

Soybean leads the source segment with a 70% share in 2025 due to its rich genistein and daidzein content. Powder dominates the form segment with a 65% share, offering better stability, shelf life, and easy use in supplements and functional foods for health-conscious consumers.

The market holds a small but significant share within its parent markets. It accounts for approximately 5-7% of the overall functional food ingredients market, given its specialized use as a phytoestrogen compound. Within the nutraceutical ingredients market, isoflavones contribute around 3-5%, mainly driven by their inclusion in dietary supplements targeting hormonal balance and cardiovascular health. In the broader plant-based bioactive compounds market, isoflavones represent about 2-4%, reflecting their niche yet growing demand.

The market is segmented by form, source, application, and region. By form, the market includes powder, liquid, and wax. Based on the source, it is segmented into soybean, peanut, chickpea, clover, and others (including fava beans, pistachios, alfalfa, and red clover extracts).

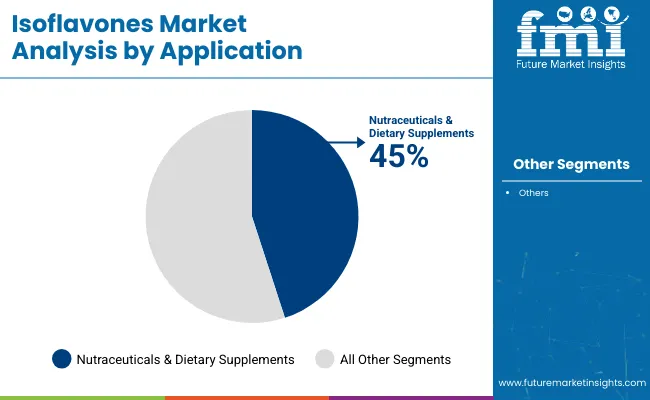

By application, the market includes food & beverages, nutraceuticals & dietary supplements, pharmaceuticals, cosmetics & personal care, and others (including animal nutrition and agricultural applications). Regionally, the market is segmented into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and the Middle East & Africa.

Powder is the most lucrative segment in the isoflavones market by form, holding a 65% share in 2025.

Soybean is the most lucrative segment in the isoflavones market by source, holding a 70% share in 2025.

Nutraceuticals & dietary supplements are the most lucrative segment in the isoflavones market by application, holding a 45% market share in 2025.

The global market is growing steadily, driven by rising consumer awareness of hormonal health, increasing demand for plant-based bioactive solutions, and advancements in functional food, beverage, and nutraceutical supplement formulations.

Recent Trends in the Isoflavones Market

Challenges in the Isoflavones Market

Among the top countries in the isoflavones market, the USA leads with the highest CAGR of 5.6% through 2035, driven by strong demand for non-GMO soybean extracts and advanced supplement formulations. Japan follows with a CAGR of 5.2%, supported by its traditional soy-based diet and functional beverage integration.

Germany records a CAGR of 4.9%, driven by health-conscious consumers preferring phytoestrogen-rich diets. The UK market grows at a CAGR of 4.8%, reflecting rising demand for menopause support products, while France shows a CAGR of 4.7%, driven by clean-label and plant-based hormonal health supplements. The USA remains the fastest-growing among these nations.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The USA isoflavones market is projected to grow at a CAGR of 5.6% through 2035. Major manufacturers focus on soy-based isoflavone extracts to cater to evolving dietary supplement trends.

Sales of isoflavone products in the UK are expected to grow at a CAGR of 4.8% through 2035. Increasing demand for natural menopause relief products and clean-label nutraceuticals supports market expansion.

Germany's isoflavone products revenue is forecasted to grow at a CAGR of 4.9% through 2035. Demand is driven by health-conscious consumers preferring phytoestrogen-rich diets and supplements.

Sales of isoflavone products in France are projected to grow at a CAGR of 4.7% through 2035. Growth is driven by rising consumer preference for natural, hormonal health supplements and clean-label food products.

The isoflavone products demand in Japan is expected to grow at a CAGR of 5.2% through 2035. Growth is supported by traditional dietary reliance on soy products and increasing integration of isoflavones in functional beverages, foods, and supplements.

The market is moderately consolidated, with tier 1 companies like Nutraceutical International Corporation, Solae LLC (DuPont), Herbalife Nutrition Ltd., Cargill, Incorporated, and Archer Daniels Midland Company (ADM) holding significant market shares. These industry leaders are actively investing in research and development to enhance extraction techniques and product formulations, aiming to meet the growing consumer demand for plant-based, clean-label, and sustainable isoflavone products.

Top companies are competing through strategic pricing, innovation, partnerships, and global expansion. For instance, Cargill has expanded its soy isoflavones manufacturing to increase supply in line with the rising demand in the dietary supplement market. Herbalife Nutrition Ltd. continues to incorporate isoflavones into its extensive product range, focusing on health supplements and functional food products. ADM, despite facing market challenges, maintains a strong position in the isoflavones market through its efforts in sustainable sourcing and quality production procedures.

Recent Isoflavones Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 1.7 billion |

| Projected Market Size (2035) | USD 2.8 billion |

| CAGR (2025 to 2035) | 5.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billion/Volume (Metric Tons) |

| By Form | Powder, Liquid, Wax |

| By Source | Soybean, Peanut, Chickpea, Clover, Others (Fava Beans, Pistachios, Alfalfa, and Red Clover Extracts) |

| By Application | Food & Beverages, Nutraceuticals & Dietary Supplements, Pharmaceuticals, Cosmetics & Personal Care, Others (Animal Nutrition and Feed Additives, Agricultural Applications (plant growth promoters), Research and Laboratory Use, and Industrial Applications (bioactive ingredient research, cosmetic ingredient testing)) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, South Korea, Mexico, China |

| Key Players | Nutraceutical International Corporation, Solae LLC (DuPont), Herbalife Nutrition Ltd., Cargill, ADM, Kemin Industries, DSM Nutritional Products, Indena S.p.A., Nattopharma ASA, Ginkgo BioWorks, Synlogic, Matsutake Biopharmaceutical Co. Ltd., BASF SE, International Flavors and Fragrances, NutraScience Labs, FUJIFILM Wako Pure Chemical Corporation, Frutarom Industries Ltd. |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis. |

As per form, the industry has been categorized into Powder, Liquid, and Wax.

As per species, the industry has been categorized into Soybean, Peanut, Chickpea, Clover, and Other Sources.

This segment is further categorized into Food & Beverages, Nutraceuticals & Dietary Supplements, Pharmaceuticals, Cosmetics & Personal Care, and Other Applications.

Industry analysis has been carried out in key countries of North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The market is valued at USD 1.7 billion in 2025.

The market is projected to reach USD 2.8 billion by 2035.

Soybean-based isoflavones lead with a 70% market share in 2025.

The market is expected to grow at a CAGR of 5.4%.

Nutraceuticals & dietary supplements hold the largest share with 45% in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Soy Isoflavones Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA