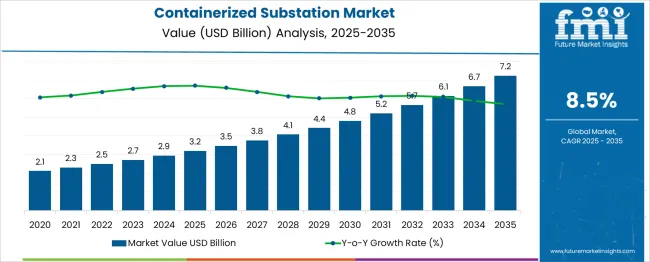

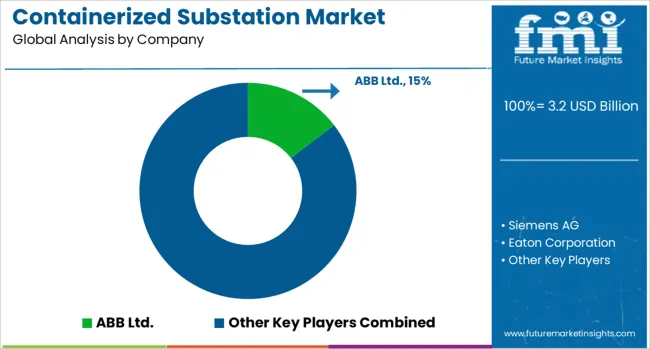

The Containerized Substation Market is estimated to be valued at USD 3.2 billion in 2025 and is projected to reach USD 7.2 billion by 2035, registering a compound annual growth rate (CAGR) of 8.5% over the forecast period. This sharp value increase reflects both rising global electricity demand and the growing need for rapid-deployment grid infrastructure in remote and industrializing zones.

From 2025 to 2030 alone, the market is set to reach approximately USD 4.8 billion, translating to a five-year absolute gain of USD 1.6 billion, or 40% of the total decade-long growth. This early acceleration is driven by widespread upgrades in distribution networks and the rising deployment of modular substations for renewable energy integration, especially in solar and wind parks. The appeal of containerized substations lies in their factory-assembled, plug-and-play design, reducing on-site labor, civil works, and commissioning time.

Utilities, data centers, mining operations, and oil & gas facilities increasingly rely on these systems for reliable, space-efficient power delivery. Additionally, developing markets in Asia, the Middle East, and Africa are prioritizing modular substations to overcome infrastructure deficits. As demand for decentralized and resilient power networks grows, the market's absolute dollar opportunity remains both substantial and time-sensitive.

| Metric | Value |

|---|---|

| Containerized Substation Market Estimated Value in (2025 E) | USD 3.2 billion |

| Containerized Substation Market Forecast Value in (2035 F) | USD 7.2 billion |

| Forecast CAGR (2025 to 2035) | 8.5% |

The Containerized Substation Market is segmented across several major parent sectors, each with distinct market shares contributing to overall demand. The renewable energy integration sector holds the largest share at approximately 32%, driven by the need to connect solar and wind power installations to existing electrical grids. This segment is growing steadily as more regions invest in cleaner energy sources. The mining industry accounts for about 23% of the market, where containerized substations offer mobility and fast deployment in off-grid and remote mining operations. The temporary power supply segment, which supports applications such as construction sites, public events, and military operations, contributes around 19% of the total market share. This segment is expanding with the rising need for fast, flexible energy setups. The disaster recovery sector makes up roughly 16%, focused on restoring power infrastructure in regions affected by floods, earthquakes, or hurricanes. The utilities and infrastructure segment represents the remaining 10%, where containerized substations support grid reinforcement, upgrades, and rural electrification. Together, these sectors underscore the market’s broad utility across both emergency and long-term applications. The overall market is expected to grow at a healthy annual pace, supported by increasing power demands, decentralized energy systems, and the need for mobile and scalable electrical solutions.

The containerized substation market is experiencing sustained growth as utilities and energy developers seek scalable and mobile power distribution solutions to meet dynamic load demands. These prefabricated substations offer significant advantages in terms of reduced on-site construction time, compact footprint, and ease of transportation, which have made them a preferred alternative to traditional substation setups.

The growing shift toward decentralized power generation, along with grid modernization initiatives, is accelerating the adoption of containerized substations across regions facing land scarcity and rapid urbanization. Their adaptability to diverse climatic and topographical conditions, coupled with advancements in switchgear integration and thermal management systems, has further strengthened their viability.

Regulatory support for electrification in off-grid and remote areas, particularly in emerging economies, is driving investments in portable substations. Moreover, the integration of smart grid components, IoT-based monitoring, and digital control systems is enhancing the performance, reliability, and remote operability of these systems, positioning them as a critical component of next-generation power distribution infrastructure.

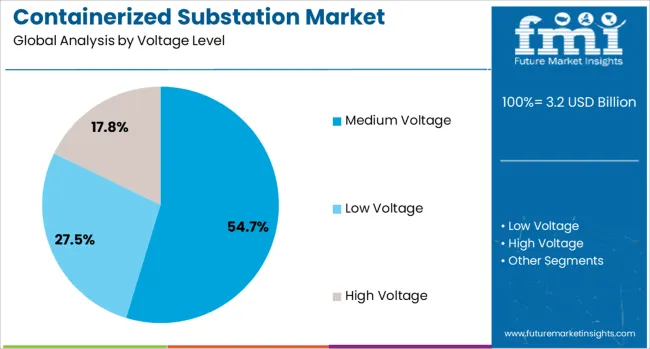

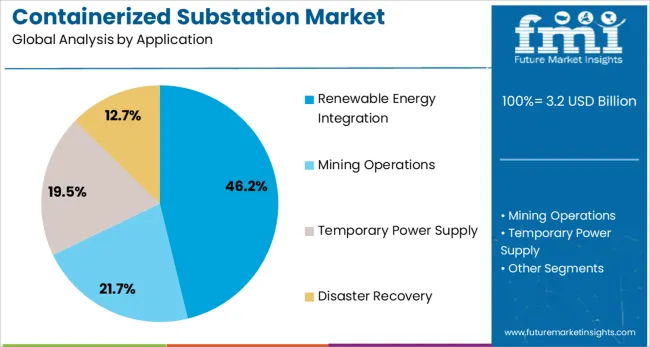

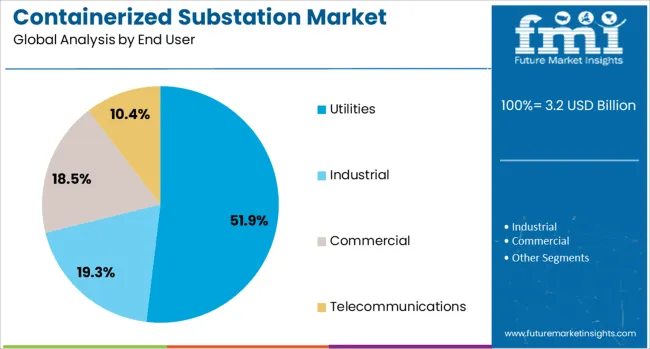

The containerized substation market is segmented by voltage level, application, end user, and component and geographic regions. The containerized substation market is divided by voltage level into Medium Voltage, Low Voltage, and High Voltage. The containerized substation market is classified into Renewable Energy Integration, Mining Operations, Temporary Power Supply, and Disaster Recovery. The end user of the containerized substation market is segmented into Utilities, Industrial, Commercial, and Telecommunications.

The containerized substation market is segmented by component into Switchgears, Transformers, Control Systems, and Protection Systems. Regionally, the containerized substation industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The medium voltage segment is projected to hold 54.7% of the containerized substation market revenue share in 2025, making it the leading voltage level. This dominance is being driven by the growing use of medium voltage distribution in industrial and commercial facilities, where safe, efficient, and space-saving power delivery is required.

The adaptability of medium voltage systems to varied deployment scenarios, including urban load centers and remote installations, has contributed to their strong preference among utilities and infrastructure developers. Medium voltage containerized substations offer superior performance in renewable energy parks, mining operations, and temporary power sites where agility and scalability are essential.

Enhanced compatibility with modular switchgear, digital protection relays, and transformer units has made this segment more resilient and operationally efficient. The ability to meet grid code requirements while maintaining a compact and mobile structure has further increased adoption across both permanent and temporary power distribution networks, reinforcing medium voltage’s pivotal role in the evolving substation landscape.

The renewable energy integration segment is expected to account for 46.2% of the total revenue share in the containerized substation market in 2025. This segment's growth is being supported by the global transition toward clean energy sources, where containerized substations are increasingly used to connect solar, wind, and hybrid energy farms to transmission networks.

Their ability to be rapidly deployed, relocated, and upgraded without major civil works aligns with the fluctuating development patterns of renewable projects. As renewable energy systems are often established in remote or geographically constrained locations, the modularity and mobility of containerized substations provide critical infrastructure support.

Enhanced grid balancing and reactive power management capabilities have enabled these substations to facilitate smooth grid integration and voltage regulation in variable generation environments. Furthermore, digital monitoring and predictive maintenance features have helped in optimizing asset performance, reducing downtime, and ensuring compliance with evolving grid codes, all of which have reinforced their value in renewable energy applications.

The utilities segment is projected to represent 51.9% of the containerized substation market revenue share in 2025, emerging as the dominant end user. This leading position is being supported by increasing grid expansion projects, aging substation infrastructure, and the need for fast-tracked deployments in developing and underserved regions. Utilities are increasingly leveraging containerized substations to accelerate electrification initiatives, particularly where conventional substations are impractical due to space, cost, or terrain constraints.

Their plug-and-play architecture allows utilities to rapidly deploy, energize, and integrate new grid assets with minimal disruption to existing operations. The integration of SCADA systems, real-time fault diagnostics, and load management solutions within these substations is enhancing operational visibility and reliability.

Additionally, the growing demand for peak shaving, load balancing, and contingency backup infrastructure has elevated their role in urban and rural power networks. As regulatory pressures for grid resilience and decarbonization intensify, containerized substations are becoming essential tools in utilities’ efforts to modernize and stabilize their transmission and distribution networks.

Demand is growing for compact and flexible power distribution systems that simplify deployment in remote or temporary energy sites, including renewable integration, mining operations, and emergency utility expansion.

Containerized substations are increasingly used where traditional brick‑and‑mortar installations are impractical—such as remote industrial zones, disaster recovery sites, or rapidly evolving renewable energy projects. These modular units enclose transformers, switchgear, and control systems within weatherproof and transport‑ready containers. Operators value standard product line designs that reduce on‑site assembly while ensuring consistent performance. Features such as pre‑tested plug‑and‑play electrical panels, skid‑mounted insulation, and built‑in safety controls deliver resilience in challenging environments. Electric utilities, micro‑grid developers, and EPC contractors use containerized substations to speed up power capacity upgrades and relieve stranded grid needs, especially in off‑grid or mobile contexts. Their mobility, safety, and scalability support accelerated deployment of distributed energy infrastructure without lengthy construction timelines.

Market growth is being fueled by providers offering containerized substation kits bundled with installation, commissioning and maintenance services. Business models based on equipment leasing or service contracts enable developers to avoid upfront infrastructure expenditure while accessing scalable grid capacity. Suppliers are collaborating with local manufacturers, engineering firms, and utilities to tailor designs to voltage classes, climatic conditions, and site-specific standards. Standardized container frames coupled with optional modules—like integrated battery storage, SCADA systems, or power quality panels—allow customization without extensive engineering. Regional assembly hubs near high-growth areas help minimize transport delays and manage regulatory approvals more effectively. Training programs for installation crews and remote support platforms improve deployment speed and reliability. These strategies enhance adoption in industrial, commercial, and developing market segments requiring flexible electricity distribution solutions.

Containerized substations are gaining rapid traction in solar parks and wind installations due to their compactness and ease of integration with renewable energy assets. These units support decentralized power generation by facilitating plug-and-play connectivity to grid systems and on-site storage. Project developers value their modular design, which allows deployment in under half the time required for traditional substations. Their sealed construction improves weather resistance and thermal efficiency, especially in desert and coastal energy zones. As renewables grow in capacity and complexity, containerized substations play a key role in managing intermittent loads and ensuring seamless transmission at utility-scale or hybrid power setups. Their prefabricated architecture supports quick relocation or expansion, aligning with fluctuating project timelines. This trend also reduces permitting delays and civil work costs, making it suitable for energy clusters with evolving regulatory and environmental conditions.

Containerized substations offer significant opportunity in remote and underserved regions where conventional power infrastructure is logistically or economically infeasible. Their skid-mounted or mobile configuration allows for direct transport to industrial mines, oil and gas fields, rural electrification zones, and emergency relief operations. Unlike traditional setups, these units require minimal site preparation, lowering the threshold for capital investment in isolated environments. Their compact form also facilitates airlifting or trailer mounting, accelerating electrification for remote operations. This application is particularly important for modular data centers, temporary construction hubs, and mobile hospitals, where reliable power is mission-critical but not permanently needed. Energy developers in emerging economies are using containerized substations to rapidly connect renewable microgrids to rural settlements or agricultural zones. Their self-contained design improves service continuity and eliminates the need for extensive utility buildouts, making them ideal for decentralized energy strategies and resilience planning in off-grid markets.

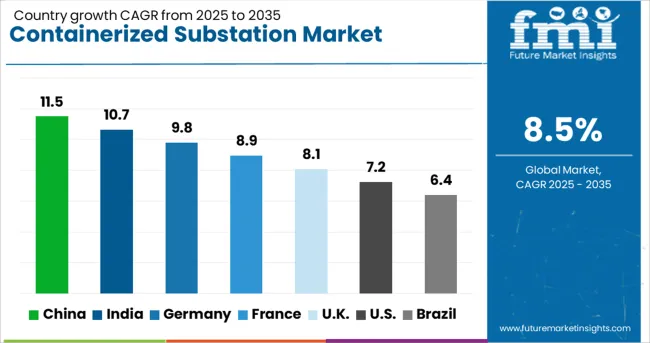

| Country | CAGR |

|---|---|

| China | 11.5% |

| India | 10.7% |

| Germany | 9.8% |

| France | 8.9% |

| UK | 8.1% |

| USA | 7.2% |

| Brazil | 6.4% |

China, a BRICS nation, is anticipated to grow at an 11.5% CAGR from 2025 to 2035, with strong momentum from industrial park electrification and rapid installations in grid extension projects across inland provinces. India, also part of BRICS, follows at 10.7%, supported by expanding rural electrification efforts and growing use of containerized units in mining, construction, and renewable energy zones. Within the OECD, Germany is advancing at 9.8%, with increasing demand across decentralized energy systems and fast-track industrial developments requiring modular power solutions. France, with 8.9% growth, is scaling adoption in rail electrification corridors and urban power reinforcement sites. The United Kingdom, projected at 8.1%, maintains growth through utility partnerships and deployment of mobile substations for temporary grid stabilization and emergency response. The report covers detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

China is leading the global containerized substation market with a robust CAGR of 11.5%. Rapid urbanization, large-scale industrialization, and renewable energy integration are key factors driving demand. Modular substations are being adopted in remote energy projects, smart grid developments, and utility-scale solar and wind farms. Domestic manufacturers are producing prefabricated units with integrated protection systems and remote monitoring capabilities. These substations are deployed for fast electrification in both rural and industrial zones. High-speed railway projects and infrastructure corridors are boosting the use of containerized systems due to their mobility and quick deployment. Chinese state utility companies are adopting standardized designs for nationwide grid upgrades. Export demand from Africa and Southeast Asia is also rising. Technological advancements in insulation, ventilation, and weatherproofing are improving system reliability in extreme environments.

India is experiencing a strong CAGR of 10.7% in the containerized substation market, supported by nationwide electrification and renewable integration efforts. These prefabricated solutions are being used in solar parks, metro systems, and industrial corridors where land and deployment speed are critical. Government programs like Saubhagya and Smart Cities Mission are accelerating demand. Indian manufacturers are building customizable, plug-and-play substations with fault protection and SCADA compatibility. Utilities and EPC contractors prefer these systems for their reduced installation time and modular scalability. Containerized substations are gaining traction in semi-urban and hilly regions where conventional infrastructure faces challenges. The oil and gas sector is also adopting mobile substations for temporary and remote operations. Cost efficiency and faster commissioning make them attractive for private energy developers across multiple states.

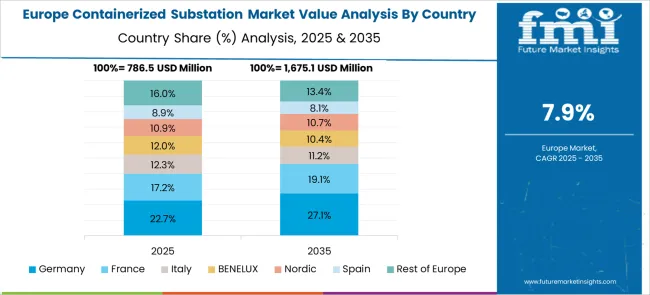

In Germany, containerized substation market is growing at a steady CAGR of 9.8 percent, driven by energy transition goals and decentralized grid infrastructure. Modular substations are being implemented in wind farms, data centers, and EV charging networks. German manufacturers are focusing on engineering compact, high-efficiency systems that meet EU standards for safety and environmental performance. Utilities prefer containerized units for rapid response in maintenance and emergency power restoration. Integration with digital monitoring platforms enables real-time diagnostics and predictive maintenance. Energy-intensive sectors are investing in these substations for load balancing and voltage control. Projects involving battery storage and hydrogen production also benefit from scalable substation designs. Emphasis on recyclable materials and smart automation is contributing to sustainability. These trends are expected to sustain demand across both domestic and export markets in Europe.

France is witnessing a 8.9% CAGR in the containerized substation market, influenced by renewable energy integration, urban grid modernization, and industrial electrification. Local utilities and grid operators are deploying prefabricated substations to speed up network upgrades and reduce site disruption. French engineering firms are producing compact substations with low-loss transformers, integrated switchgear, and digital control systems. These units are finding use in wind energy sites, rail electrification, and backup power installations. Their modularity makes them suitable for dense urban settings where conventional substations face spatial constraints. The French government’s emphasis on carbon neutrality is encouraging investment in infrastructure that supports smart grid applications. Export opportunities in Francophone Africa are also opening up for locally manufactured units. Enhanced safety features, anti-corrosion designs, and thermal management systems are boosting long-term performance.

The United Kingdom is registering 8.1% CAGR in the containerized substation market, supported by renewable power integration, EV charging infrastructure, and energy security concerns. These systems are favored for their portability, quick setup, and compliance with UK grid codes. Utility providers and contractors are using containerized substations in wind and solar projects across Scotland and Wales. Urban substations are being upgraded using prefabricated modules that reduce on-site civil work. British manufacturers are emphasizing weatherproofing, fire resistance, and remote diagnostics to meet local safety standards. Offshore wind projects are also adopting container substations for grid tie-ins. Demand is increasing in military and emergency response applications where power mobility is critical. Public-private energy initiatives are funding smart substation deployments to improve resiliency and peak load management across regions.

The containerized substation market features a competitive mix of global electrical giants and regionally focused power solution providers, segmented into Tier 1, Tier 2, and Tier 3 suppliers. ABB Ltd. stands out in the Tier 1 segment, known for delivering compact, turnkey substations engineered for rapid deployment across remote locations, industrial sites, and urban infrastructure projects.

Siemens AG, Eaton Corporation, and General Electric also hold significant Tier 1 positions, leveraging advanced modular power conversion technologies and integrated protection systems to meet the rigorous demands of modern grid and utility-scale applications. Tier 2 suppliers, including Toshiba Corporation, Larsen & Toubro, and Kirloskar Electric, specialize in robust, weather-resistant containerized substations designed for industrial zones and power distribution networks operating in challenging environments.

These companies focus on durability and customization to support localized power needs with flexible configurations that ensure reliability under harsh conditions. Meanwhile, Tier 3 players such as Crompton Greaves, IMESA S.p.A., and Elsewedy Electric Co S.A.E. emphasize regional and project-specific solutions, offering cost-effective, tailored containerized units adapted to unique grid specifications and space limitations. Their focus on affordability and adaptability enables deployment in diverse markets, especially in developing regions where infrastructure requirements vary widely.

Together, these suppliers drive innovation and scalability in the containerized substation market, responding to increasing demand for modular, efficient, and rapid power infrastructure deployment worldwide. The competitive landscape fosters continuous advancements in substation compactness, integration, and resilience, supporting evolving energy distribution challenges globally.

On August 8, 2023, Hartek Power secured a ₹250 million turnkey contract to deliver two 33/11 kV containerized substations to TPWODL, enabling rapid deployment, space efficiency, and improved grid resilience.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.2 Billion |

| Voltage Level | Medium Voltage, Low Voltage, and High Voltage |

| Application | Renewable Energy Integration, Mining Operations, Temporary Power Supply, and Disaster Recovery |

| End User | Utilities, Industrial, Commercial, and Telecommunications |

| Component | Switchgears, Transformers, Control Systems, and Protection Systems |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB Ltd., Siemens AG, Eaton Corporation, General Electric, Toshiba Corporation, Larsen&Toubro, Kirloskar Electric, Crompton Greaves, IMESA S.p.A., and Elsewedy Electric Co S.A.E. |

| Additional Attributes | Dollar sales by equipment type including transformers, switchgear, control and protection systems, by voltage classification such as low, medium, and high voltage, and by application in utilities, renewables, mining, and industrial sectors; demand driven by grid modernization, rapid deployment needs, rural electrification, and renewable energy integration; innovation in modular, smart‑grid enabled enclosures with digital twin validation; cost shaped by materials, lead time reduction, and mobility features. |

The global containerized substation market is estimated to be valued at USD 3.2 billion in 2025.

The market size for the containerized substation market is projected to reach USD 7.2 billion by 2035.

The containerized substation market is expected to grow at a 8.5% CAGR between 2025 and 2035.

The key product types in containerized substation market are medium voltage, low voltage and high voltage.

In terms of application, renewable energy integration segment to command 46.2% share in the containerized substation market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Substation Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Substations Market Size and Share Forecast Outlook 2025 to 2035

Substation Automation and Integration Market Size and Share Forecast Outlook 2025 to 2035

Substation Grounding System Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Substation Automation Market Growth - Trends & Forecast 2025 to 2035

Substation Testing Equipment Market

Mobile Substations Market Size and Share Forecast Outlook 2025 to 2035

Modular Substation Market Size and Share Forecast Outlook 2025 to 2035

Digital Substations Market - Size, Share, and Forecast 2025 to 2035

Electric Substation Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Substation Market Size and Share Forecast Outlook 2025 to 2035

Data Center Substation Market Size and Share Forecast Outlook 2025 to 2035

Transmission Substation Market Size and Share Forecast Outlook 2025 to 2035

Distribution Substation Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Substation Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Substation Market - Size, Share, and Forecast 2025 to 2035

Low Voltage Digital Substation Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Digital Substation Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Digital Substation Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA